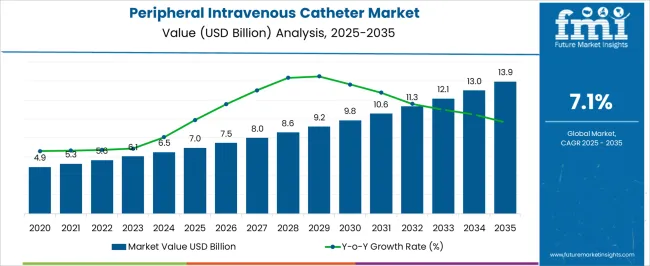

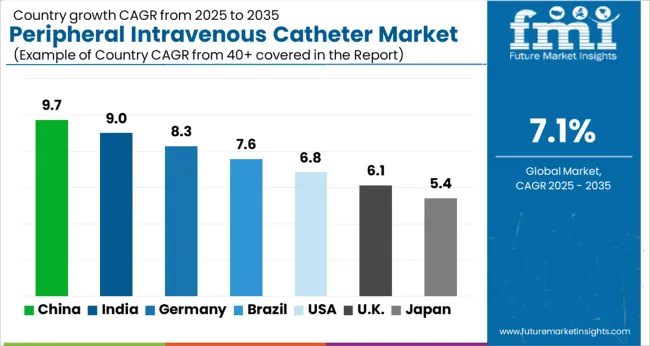

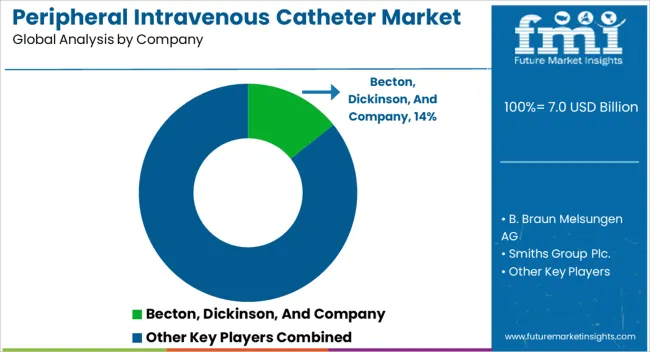

The Peripheral Intravenous Catheter Market is estimated to be valued at USD 7.0 billion in 2025 and is projected to reach USD 13.9 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period.

| Metric | Value |

|---|---|

| Peripheral Intravenous Catheter Market Estimated Value in (2025 E) | USD 7.0 billion |

| Peripheral Intravenous Catheter Market Forecast Value in (2035 F) | USD 13.9 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

The peripheral intravenous catheter (PIVC) market is expanding steadily, driven by rising hospitalization rates, increasing use of infusion therapies, and advancements in catheter safety technologies. Clinical reports and healthcare updates have highlighted a growing demand for reliable vascular access devices as chronic disease management, chemotherapy, and parenteral nutrition therapies become more prevalent. Hospitals and ambulatory care centers are focusing on reducing catheter-related bloodstream infections, prompting adoption of safety-engineered catheters.

Furthermore, innovations in materials and insertion techniques have improved patient comfort and reduced complications, supporting wider clinical use. Annual reports from healthcare providers and device manufacturers have emphasized investments in next-generation catheters, including those with antimicrobial coatings and closed system designs.

The market outlook remains positive, supported by government initiatives for patient safety, increased healthcare spending, and the expansion of advanced care infrastructure in emerging economies. Segmental leadership is expected from short peripheral IV catheters, safety PIVC technologies, and hospitals, reflecting both clinical practicality and widespread institutional adoption.

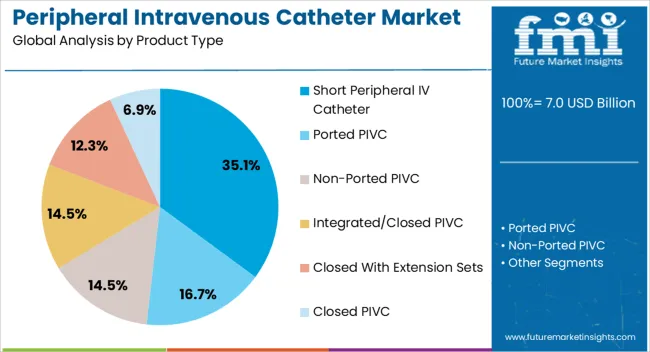

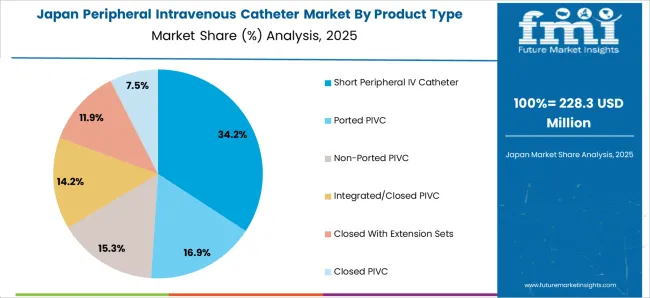

The Short Peripheral IV Catheter segment is projected to account for 35.1% of the market revenue in 2025, making it the leading product type. Growth of this segment has been supported by its widespread use for short-term fluid administration, medication delivery, and blood sampling. Clinical guidelines and hospital protocols have continued to prioritize short catheters due to their ease of insertion, cost-effectiveness, and reduced procedural time.

Additionally, improvements in design, such as flexible materials and advanced tip configurations, have enhanced patient comfort and reduced the incidence of phlebitis. Hospitals and outpatient facilities have maintained strong demand for short peripheral catheters, particularly in emergency and surgical settings where rapid vascular access is critical.

The segment’s established role in routine care and compatibility with a wide range of therapies is expected to sustain its dominant market position.

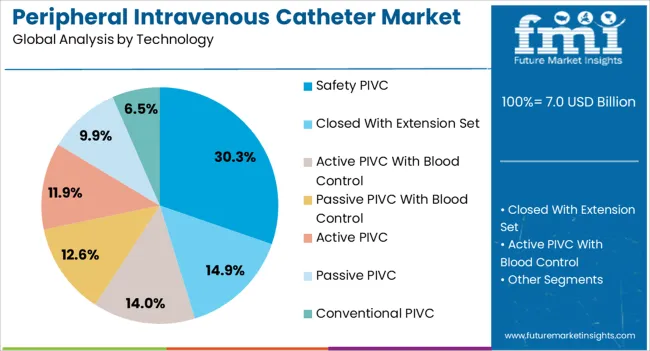

The Safety PIVC segment is projected to contribute 30.3% of the market revenue in 2025, reflecting growing adoption driven by infection control and needlestick injury prevention. Healthcare authorities and safety boards have issued mandates promoting safety-engineered devices, leading to wider institutional procurement of safety PIVCs.

These devices have been designed with retractable needles, safety shields, or passive safety features that reduce occupational risks for healthcare workers. Hospitals and clinics have increasingly adopted safety catheters to comply with patient safety regulations and accreditation standards.

Additionally, clinical evidence has shown that safety PIVCs reduce the likelihood of blood exposure and catheter-related complications, further strengthening their adoption. With a rising focus on infection prevention and workplace safety, the Safety PIVC segment is positioned for sustained growth as institutions prioritize compliance and long-term cost savings.

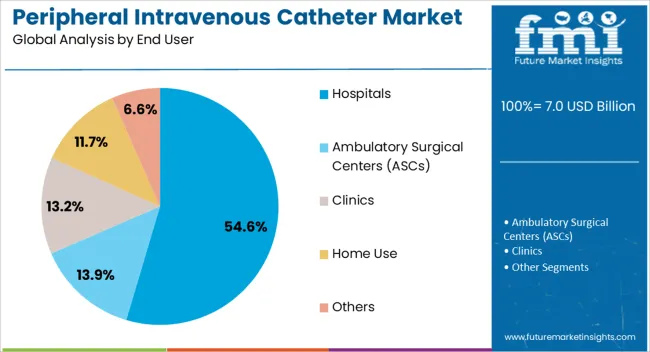

The Hospitals segment is projected to hold 54.6% of the market revenue in 2025, underscoring its leadership as the primary end user. Hospitals have been the largest consumers of PIVCs due to high patient volumes, complex treatment regimens, and frequent need for intravenous therapies. The prevalence of chronic illnesses, surgical procedures, and emergency admissions has reinforced hospital dependency on reliable catheter systems.

Hospital procurement strategies have increasingly emphasized devices that reduce insertion failures and improve clinical efficiency, driving adoption of advanced PIVCs. Moreover, continuous staff training programs and integration of safety devices into hospital protocols have further encouraged usage.

With expanding healthcare infrastructure and rising investments in acute care facilities globally, hospitals are expected to remain the dominant end-user segment, ensuring consistent demand for peripheral intravenous catheters.

Rise in the Number of Surgical Procedures Performed Worldwide

Surgical procedures often require the placement of an IV catheter to administer anesthesia, fluids, and medications during and after the surgery. With the increase in surgeries being conducted globally, the need for peripheral intravenous catheters has perceived an uptick.

Technological advancements in the design and materials used in peripheral intravenous catheters have significantly propelled the sector. The adoption of catheters that reduce the risk of infection, thrombosis, and phlebitis in healthcare facilities is on the rise. This progress in the healthcare sector is a testament to the industry's continuous evolution.

Plurality of Chronic Diseases

Cancer, diabetes, and cardiovascular disease cases have increased steadily, leading to a rise in the global peripheral intravenous catheter sector. Patients suffering from these conditions often require long-term hospitalization and frequent administration of medications or fluids through IV catheters. This has surged the peripheral intravenous catheter market expansion.

Among the restraining factors influencing the industry are

Ease of use, low cost, and high level of patient comfort make short PIVCs a prominent choice in the peripheral intravenous catheter market. These catheters are typically used for short-term intravenous therapy in hospitals and clinics. They are chosen over other types of catheters because they are smaller, making them less invasive and less painful for patients. The short peripheral IV catheter is backed up due to its many features, thus accounting for a flawless share of 35.10% in 2025.

| Attributes | Details |

|---|---|

| Product Type | Short Peripheral IV Catheter |

| Industry Share (2025) | 35.1% |

Demand for these catheters has surged due to the increasing prevalence of chronic diseases, coupled with the growing senior population. The rising need for efficient and effective medical devices in healthcare facilities is expected to surge the landscape for PIV catheters to continue to grow in the coming years.

Safety PIVC acquires the technological space of the peripheral intravenous catheter (PIVC) industry through its superior safety features and ease of use. Rising popularity of hospital-acquired infections (HAIs) and the need for safe and effective catheterization methods are increasing the adoption of this technology. With a share of 30.30% in 2025, safety PIVC technology tops the segment column in the peripheral intravenous catheter market.

| Attributes | Details |

|---|---|

| Technology | Safety PIVC |

| Industry Share (2025) | 30.3% |

Safety PIVCs prevent needlestick injuries to healthcare workers and reduce the risk of bloodstream infections in patients, thus making them picked choice among healthcare professionals. Its requirement is also attributed to the increasing use of PIVCs in various healthcare settings like hospitals, clinics, and home care.

Growing focus on patient safety and the need for cost-effective solutions in healthcare facilitates its success. The peripheral intravenous catheter market is catching the launch of innovative products with advanced safety features. Products like retractable needles, anti-reflux valves, and integrated needleless connectors are holding superior positions, making PIVCs a prominent player in the industry.

The peripheral intravenous catheter industry expansion has been observed in key Asian, European, and North American countries. With huge opportunities in Japan and Italy, setting a CAGR of 6.6% and 6.7%, respectively. The table shows the prominence of these countries in the industrial landscape, with India making its presence offering lucrative opportunities.

Increasing patient pool, expanding the healthcare industry, and favorable government support facilitate the development of healthcare sectors in India. Plus, rising prevalence of chronic diseases, increasing surgical procedures, and growing healthcare infrastructure also stand in a row for India’s industry expansion locally and internationally. This is accelerating the medical tourism sector. Indian landscape in this sector is estimated to surge a huge surplus, accounting for a CAGR of 7.5% through 2035, with an increase in local manufacturers selling goods at reduced prices.

Key players in the peripheral intravenous catheter market are Becton Dickinson and Company, B. Braun Melsungen AG, Teleflex Incorporated, and Smiths Medical. For instance, in a recent development, Becton Dickinson launched its Nexiva Closed IV Catheter System in India, offering advanced safety features and reducing the risk of needlestick injuries. Thus, companies are involved in addressing the growing need for safer and more efficient peripheral intravenous catheter solutions in India.

A sharp rise in the number of hospitalizations is playing a crucial role in pushing the demand for peripheral intravenous catheters in the United States. The trend is likely to continue during the forecast period. For instance, as per the 2024 AHA Annual Survey (FY 2024), total admissions in all USA hospitals reached 33,356,853. This pool of patients attracts the need for more medically equipped infrastructure. Thus, the peripheral intravenous catheter market increases.

Technological advancements like the development of advanced materials and improved catheter designs have enhanced the safety and efficacy of peripheral intravenous catheters. A CAGR of 7.5% through 2035 reflects the fast-paced development of the industry.

Ongoing mergers and acquisitions within the healthcare sector, coupled with an increasing number of surgeries and procedures, are spurring the peripheral intravenous catheter market in the United States. In addition, reimbursement practices for catheters, such as those offered by the Centers for Medicare and Medicaid in the USA, aid in sectoral expansion.

China is home to one of the largest populations in the world with more opportunities for healthcare professionals. Growing chronic diseases and the elderly population surge the demand for preventive measures against it.

Increasing healthcare spending, advancing medical technology, and accelerating growth of the medical tourism sector are subjects to the development of the Chinese peripheral intravenous catheter market. China is estimated to cover a CAGR of 7% from 2025 to 2035 with advanced technological development in the healthcare industry.

China also has one of the best laboratories and research centers, which fuels the healthcare sector's growth. The innovation and use of these PIVCs as a number of surgeries and trials are carried out on a daily basis, the scape is set to expand broadly in the foreseeable future.

Italy's strong healthcare infrastructure and government initiatives to improve healthcare services are soaring its growth. Italy’s influence on healthcare development globally is significant.

As it holds a strong position in advanced medical research and technology. Italy is also a big ground for the pharmaceutical industry. All these combine to advance and skyrocket the Italian lanscape expansion globally. Italy is seen to have a CAGR of 6.7% through 2035.

Major companies such as B. Braun Melsungen AG, Becton, Dickinson and Company, Smiths Medical, and others drove segment proliferation through product innovation and strategic collaborations.

Ascending preference among healthcare providers for peripheral intravenous catheters due to their ease of use and reduced risk of complications compared to traditional catheters fuels the industry.

Development of novel minimally invasive devices has improved patient comfort and safety, aiding in industrial success. The Japanese peripheral intravenous catheter market, with a CAGR of 6.6% from 2025 to 2035, widens its border in the healthcare sector.

Recent acquisitions by major players in the Japanese sector have spurred the sectorial arrow upside. For example, Terumo Corporation's acquisition of BD's soft tissue core needle biopsy product line has also contributed to market expansion, offering a wider range of high-quality products to healthcare facilities and providers.

Product launches, research, and mergers by major companies are guiding the competitiveness in the industry. Researchers are focused on more innovative and patient-centric developments and updating the peripheral intravenous catheter market.

With approval from the United States Food and Drug Administration (FDA) and the CE Mark in March 2025, Shockwave Medical, Inc. announced that the Shockwave M5+ peripheral IVL catheter is now commercially available throughout the world. The Shockwave M5+ catheter, whose launch has been restricted up to this point, is specially made to shorten IVL treatments, offer other access possibilities, and extend IVL therapy to patients with bigger vessel diameters

Recent Advancements

Based on product type, the industry is categorized into short peripheral IV catheter, ported PIVC, non-ported PIVC, integrated/closed PIVC, closed with extension sets, and closed PIVC.

When it comes to technology, the industry is classified into conventional PIVC, safety PIVC, closed with Extension Set, active PIVC with blood control, passive PIVC with blood control, active PIVC, passive PIVC

Key end users present in this industry are hospitals, ambulatory surgical centers (ASCs), clinics, home use, and others

The industry is scrutinized across key regions including North America, Latin America, Asia Pacific, Middle East and Africa (MEA), as well as Europe.

The global peripheral intravenous catheter market is estimated to be valued at USD 7.0 billion in 2025.

The market size for the peripheral intravenous catheter market is projected to reach USD 13.9 billion by 2035.

The peripheral intravenous catheter market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in peripheral intravenous catheter market are short peripheral iv catheter, ported pivc, non-ported pivc, integrated/closed pivc, closed with extension sets and closed pivc.

In terms of technology, safety pivc segment to command 30.3% share in the peripheral intravenous catheter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Peripheral T-Cell Lymphoma Treatment Market Size and Share Forecast Outlook 2025 to 2035

Peripheral Embolization Device Market Size and Share Forecast Outlook 2025 to 2035

Peripheral Vascular Devices Market Size and Share Forecast Outlook 2025 to 2035

Peripheral Vascular Stent Market Analysis - Size, Trends & Forecast 2025 to 2035

Peripheral Angioplasty Market Analysis - Share, Size, and Forecast 2025 to 2035

Peripheral Neuritis Treatment Market

Peripheral Micro Catheters Market Trends – Industry Forecast 2024-2034

Peripherally Inserted Central Catheter Analysis by Product Type by Indication and by End User through 2035

Computer Peripherals Market Size and Share Forecast Outlook 2025 to 2035

Continuous Peripheral Nerve Block Catheter Market Growth – Trends & Forecast 2025-2035

Intravenous Hydration Therapy Market Size and Share Forecast Outlook 2025 to 2035

Intravenous Solution Compounders Market Size and Share Forecast Outlook 2025 to 2035

Intravenous Line Connectors Market Size and Share Forecast Outlook 2025 to 2035

Intravenous Iron Drugs Market Size and Share Forecast Outlook 2025 to 2035

Intravenous Packaging Market Size and Share Forecast Outlook 2025 to 2035

Intravenous Pegloticase Market Insights - Growth, Demand & Forecast 2025 to 2035

Market Share Insights of Leading Intravenous Packaging Providers

Catheter Market Insights by Product, Indication, End-user, and Region 2025 to 2035

Catheter-Directed Thrombolysis Market Growth - Trends & Forecast 2025 to 2035

Catheter Tip Syringe Market Size, Share & Demand Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA