Table of Content

1. Executive Summary | Mass Finishing Consumables Market

1.1. Global Market Outlook

1.2. Market Overview

1.3. Demand Side Trends

1.4. Supply Side Trends

1.5. Analysis and Recommendations

2. Market Introduction

2.1. Market Taxonomy

2.2. Market Definition

3. Key Market Trends

4. Key Success Factors

5. Global Market Demand Analysis 2014 to 2018 and Forecast, 2019 to 2029

5.1. Historical Market Volume (TONS) Analysis, 2014 to 2018

5.2. Current and Future Market Volume (TONS) Projections, 2019 to 2029

5.3. Y-o-Y Growth Trend Analysis

6. Global Market - Pricing Analysis

6.1. Regional Pricing Analysis By Region

6.2. Pricing Break-up

6.2.1. Manufacturer-Level Pricing

6.3. Global Average Pricing Analysis Benchmark

7. Global Market Demand (in Value or Size in US$ Million) Analysis 2014 to 2018 and Forecast, 2019 to 2029

7.1. Historical Market Value (US$ Million) Analysis, 2014 to 2018

7.2. Current and Future Market Value (US$ Million) Projections, 2019 to 2029

7.2.1. Y-o-Y Growth Trend Analysis

7.2.2. Absolute $ Opportunity Analysis

8. Market Viewpoint

8.1. Global Economic Outlook

8.2. Regional Economic Outlook

8.3. Macro-economic Factors Overview:

8.3.1. Global Automotive Industry Outlook

8.3.2. Global Aerospace Industry Outlook

8.3.3. Global Industry Value Added

8.3.4. Global Manufacturing Value Added

8.3.5. Global Healthcare Expenditure Outlook

8.4. Porter’s Five Analysis

8.5. Forecast Factors: Relevance and Impact

8.6. Value Chain

8.7. Market Dynamics

8.7.1. Drivers

8.7.2. Restraints

8.7.3. Opportunity

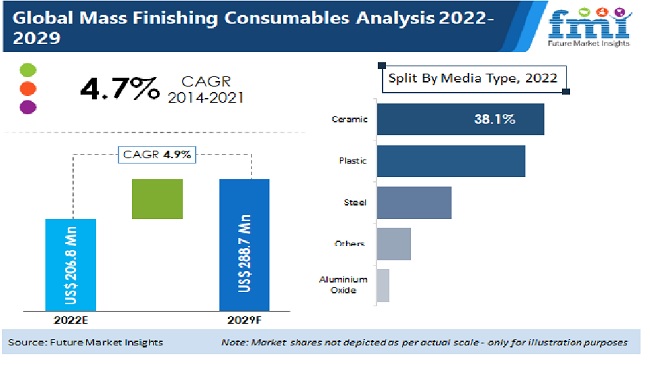

9. Global Market Analysis 2014 to 2018 and Forecast 2019 to 2029 By Media Type

9.1. Introduction / Key Findings

9.2. Historical Market Size (US$ Million) and Volume (TONS) Analysis By Media Type, 2014 to 2018

9.3. Current Market Size (US$ Million) and Volume (TONS) Forecast By Media Type, 2019 to 2029

9.3.1. Ceramic

9.3.2. Plastic

9.3.3. Steel

9.3.4. Aluminium Oxide

9.3.5. Others

9.4. Market Attractiveness Analysis By Media Type

9.5. Market Absolute $ Opportunity Analysis by Media Type

10. Global Market Analysis 2014 to 2018 and Forecast 2019 to 2029 By Application

10.1. Introduction / Key Findings

10.2. Historical Market Size (US$ Million) and Volume (TONS) Analysis By Application, 2014 to 2018

10.3. Current Market Size (US$ Million) and Volume (TONS) Forecast By Application, 2019 to 2029

10.3.1. Deburring

10.3.2. Pressure Deburring

10.3.3. Grinding

10.3.4. Polishing

10.3.5. Cleaning & Degreasing

10.3.6. Descaling, Corrosion & Rust Removal

10.3.7. Ball Furnishing

10.3.8. Surface Finish & refinement

10.4. Market Attractiveness Analysis By Application

10.5. Market Absolute $ Opportunity Analysis by Application

11. Global Market Analysis 2014 to 2018 and Forecast 2019 to 2029 By End-Use Industry

11.1. Introduction / Key Findings

11.2. Historical Market Size (US$ Million) and Volume (TONS) Analysis By End Use Industry, 2014 to 2018

11.3. Current Market Size (US$ Million) and Volume (TONS) Forecast By End Use Industry, 2019 to 2029

11.3.1. Automotive

11.3.2. Aerospace

11.3.3. Construction

11.3.4. Machine Tooling

11.3.5. General Manufacturing

11.3.6. Jewelry and Accessories

11.3.7. Healthcare

11.4. Market Attractiveness Analysis By End Use Industry

11.5. Market Absolute $ Opportunity Analysis by End-Use Industry

12. Global Market Analysis 2014 to 2018 and Forecast 2019 to 2029 By Region

12.1. Introduction / Key Findings

12.2. Historical Market Size (US$ Million) and Volume (TONS) Analysis By Region, 2014 to 2018

12.3. Current Market Size (US$ Million) and Volume (TONS) Forecast By Region, 2019 to 2029

12.3.1. North America

12.3.2. Latin America

12.3.3. Europe

12.3.4. South Asia

12.3.5. East Asia

12.3.6. Oceania

12.3.7. Middle East and Africa

12.4. Market Attractiveness Analysis By Region

12.5. Market Absolute $ Opportunity Analysis by Region

13. North America Market Analysis 2014 to 2018 and Forecast 2019 to 2029

13.1. Introduction

13.2. Pricing Analysis By Country

13.3. Historical Market Size (US$ Million) and Volume Trend Analysis By Market Taxonomy, 2014 to 2018

13.4. Market Size (US$ Million) and Volume Forecast By Market Taxonomy, 2019 to 2029

13.4.1. By Country

13.4.1.1. USA

13.4.1.2. Canada

13.4.2. By Media Type

13.4.3. By Application

13.4.4. By End Use Industry

13.5. Market Attractiveness Analysis

13.5.1. By Country

13.5.2. By Media Type

13.5.3. By Application

13.5.4. By End Use Industry

13.6. Drivers and Restraints - Impact Analysis

14. Latin America Market Analysis 2014 to 2018 and Forecast 2019 to 2029

14.1. Introduction

14.2. Pricing Analysis

14.3. Historical Market Size (US$ Million) and Volume Trend Analysis By Market Taxonomy, 2014 to 2018

14.4. Market Size (US$ Million) and Volume Forecast By Market Taxonomy, 2019 to 2029

14.4.1. By Country

14.4.1.1. Brazil

14.4.1.2. Mexico

14.4.1.3. Rest of Latin America

14.4.2. By Media Type

14.4.3. By Application

14.4.4. By End Use Industry

14.5. Market Attractiveness Analysis

14.5.1. By Country

14.5.2. By Media Type

14.5.3. By Application

14.5.4. By End Use Industry

14.6. Drivers and Restraints - Impact Analysis

15. Europe Market Analysis 2014 to 2018 and Forecast 2019 to 2029

15.1. Introduction

15.2. Pricing Analysis

15.3. Historical Market Size (US$ Million) and Volume Trend Analysis By Market Taxonomy, 2014 to 2018

15.4. Market Size (US$ Million) and Volume Forecast By Market Taxonomy, 2019 to 2029

15.4.1. By Country

15.4.1.1. Germany

15.4.1.2. France

15.4.1.3. United Kingdom

15.4.1.4. Spain

15.4.1.5. Benelux

15.4.1.6. Russia

15.4.1.7. Rest of Europe

15.4.2. By Media Type

15.4.3. By Application

15.4.4. By End Use Industry

15.5. Market Attractiveness Analysis

15.5.1. By Country

15.5.2. By Media Type

15.5.3. By Application

15.5.4. By End Use Industry

15.6. Drivers and Restraints - Impact Analysis

16. South Asia Market Analysis 2014 to 2018 and Forecast 2019 to 2029

16.1. Introduction

16.2. Pricing Analysis

16.3. Historical Market Size (US$ Million) and Volume Trend Analysis By Market Taxonomy, 2014 to 2018

16.4. Market Size (US$ Million) and Volume Forecast By Market Taxonomy, 2019 to 2029

16.4.1. By Country

16.4.1.1. India

16.4.1.2. Malaysia

16.4.1.3. Indonesia

16.4.1.4. Thailand

16.4.1.5. Rest of South Asia

16.4.2. By Media Type

16.4.3. By Application

16.4.4. By End Use Industry

16.5. Market Attractiveness Analysis

16.5.1. By Country

16.5.2. By Media Type

16.5.3. By Application

16.5.4. By End Use Industry

16.6. Drivers and Restraints - Impact Analysis

17. East Asia Market Analysis 2014 to 2018 and Forecast 2019 to 2029

17.1. Introduction

17.2. Pricing Analysis

17.3. Historical Market Size (US$ Million) and Volume Trend Analysis By Market Taxonomy, 2014 to 2018

17.4. Market Size (US$ Million) and Volume Forecast By Market Taxonomy, 2019 to 2029

17.4.1. By Country

17.4.1.1. China

17.4.1.2. Japan

17.4.1.3. South Korea

17.4.2. By Media Type

17.4.3. By Application

17.4.4. By End Use Industry

17.5. Market Attractiveness Analysis

17.5.1. By Country

17.5.2. By Media Type

17.5.3. By Application

17.5.4. By End Use Industry

17.6. Drivers and Restraints - Impact Analysis

18. Oceania Market Analysis 2014 to 2018 and Forecast 2019 to 2029

18.1. Introduction

18.2. Pricing Analysis

18.3. Historical Market Size (US$ Million) and Volume Trend Analysis By Market Taxonomy, 2014 to 2018

18.4. Market Size (US$ Million) and Volume Forecast By Market Taxonomy, 2019 to 2029

18.4.1. By Country

18.4.1.1. Australia

18.4.1.2. New Zealand

18.4.2. By Media Type

18.4.3. By Application

18.4.4. By End Use Industry

18.5. Market Attractiveness Analysis

18.5.1. By Country

18.5.2. By Media Type

18.5.3. By Application

18.5.4. By End Use Industry

18.6. Drivers and Restraints - Impact Analysis

19. Middle East and Africa Market Analysis 2014 to 2018 and Forecast 2019 to 2029

19.1. Introduction

19.2. Pricing Analysis

19.3. Historical Market Size (US$ Million) and Volume Trend Analysis By Market Taxonomy, 2014 to 2018

19.4. Market Size (US$ Million) and Volume Forecast By Market Taxonomy, 2019 to 2029

19.4.1. By Country

19.4.1.1. GCC Countries

19.4.1.2. North Africa

19.4.1.3. South Africa

19.4.1.4. Rest of Middle East and Africa(MEA)

19.4.2. By Media Type

19.4.3. By Application

19.4.4. By End Use Industry

19.5. Market Attractiveness Analysis

19.5.1. By Country

19.5.2. By Media Type

19.5.3. By Application

19.5.4. By End Use Industry

19.6. Drivers and Restraints - Impact Analysis

20. Emerging Countries Market Analysis 2014 to 2018 and Forecast 2019 to 2029

20.1. Introduction

20.1.1. Market Value Proportion Analysis, By Key Countries

20.1.2. Global Vs. Country Growth Comparison

20.2. China Market Analysis

20.2.1. Pricing Analysis

20.2.2. PEST Analysis

20.2.3. Market Value Proportion Analysis by Market Taxonomy

20.2.4. Market Volume (TONS) and Value (US$ Million) Analysis and Forecast by Market Taxonomy

20.2.4.1. By Media Type

20.2.4.2. By Application

20.2.4.3. By End Use Industry

20.3. India Market Analysis

20.3.1. Pricing Analysis

20.3.2. PEST Analysis

20.3.3. Market Value Proportion Analysis by Market Taxonomy

20.3.4. Market Volume (TONS) and Value (US$ Million) Analysis and Forecast by Market Taxonomy

20.3.4.1. By Media Type

20.3.4.2. By Application

20.3.4.3. By End Use Industry

20.4. Mexico Market Analysis

20.4.1. Pricing Analysis

20.4.2. PEST Analysis

20.4.3. Market Value Proportion Analysis by Market Taxonomy

20.4.4. Market Volume (TONS) and Value (US$ Million) Analysis and Forecast by Market Taxonomy

20.4.4.1. By Media Type

20.4.4.2. By Application

20.4.4.3. By End Use Industry

21. Market Structure Analysis

21.1. Market Structure

21.2. Tier Structure Analysis

21.3. Market Concentration

21.4. Market Concentration by Top Players

21.5. Key Players – Market Footprint

21.6. Regional Tier Structure Analysis

21.7. Competition Dashboard

22. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments)

22.1. Rösler Oberflächentechnik GmbH

22.1.1. Overview

22.1.2. Financials

22.1.3. Strategy

22.1.4. Recent Developments

22.2. Kramar Industries Inc.

22.2.1. Overview

22.2.2. Financials

22.2.3. Strategy

22.2.4. Recent Developments

22.3. Norican Group

22.3.1. Overview

22.3.2. Financials

22.3.3. Strategy

22.3.4. Recent Developments

22.4. Sintokogio, Ltd.

22.4.1. Overview

22.4.2. Financials

22.4.3. Strategy

22.4.4. Recent Developments

22.5. OTEC Präzisionsfinish GMBH

22.5.1. Overview

22.5.2. Financials

22.5.3. Strategy

22.5.4. Recent Developments

22.6. Abrasive Finishing Inc (Fortune)

22.6.1. Overview

22.6.2. Financials

22.6.3. Strategy

22.6.4. Recent Developments

22.7. UM abrasives

22.7.1. Overview

22.7.2. Financials

22.7.3. Strategy

22.7.4. Recent Developments

22.8. Vibra Finish Company

22.8.1. Overview

22.8.2. Financials

22.8.3. Strategy

22.8.4. Recent Developments

22.9. Washington Mills

22.9.1. Overview

22.9.2. Financials

22.9.3. Strategy

22.9.4. Recent Developments

22.10. Walther Trowal, LLC

22.10.1. Overview

22.10.2. Financials

22.10.3. Strategy

22.10.4. Recent Developments

22.11. Advanced Finishing Technologies

22.11.1. Overview

22.11.2. Financials

22.11.3. Strategy

22.11.4. Recent Developments

22.12. Tipton Corp.

22.12.1. Overview

22.12.2. Financials

22.12.3. Strategy

22.12.4. Recent Developments

22.13. Rotomex S.A. de C.V.

22.13.1. Overview

22.13.2. Financials

22.13.3. Strategy

22.13.4. Recent Developments

22.14. Spaleck Oberflächentechnik GmbH & Co. KG

22.14.1. Overview

22.14.2. Financials

22.14.3. Strategy

22.14.4. Recent Developments

23. Assumptions & Acronyms

24. Research Methodology

List of Tables

Table 01: Global Market Size (US$ Million) and Volume (Tons) Forecast by Media Type, 2014 to 2029

Table 02: Global Market Size (US$ Million) and Volume (Tons) Forecast by Application, 2014 to 2029

Table 03: Global Market Size (US$ Million) and Volume (Tons) Forecast by End Use Industry, 2014 to 2029

Table 04: Global Market Size (US$ Million) and Volume (Tons) Forecast by Region, 2014 to 2029

Table 05: North America Market Size (US$ Million) and Volume (Tons) Forecast by Country, 2014 to 2029

Table 06: North America Market Size (US$ Million) and Volume (Tons) Forecast by Media Type, 2014 to 2029

Table 07: North America Market Size (US$ Million) and Volume (Tons) Forecast by Application, 2014 to 2029

Table 08: North America Market Size (US$ Million) and Volume (Tons) Forecast by End Use Industry, 2014 to 2029

Table 09: Latin America Market Size (US$ Million) and Volume (Tons) Forecast by Country, 2014 to 2029

Table 10: Latin America Market Size (US$ Million) and Volume (Tons) Forecast by Media Type, 2014 to 2029

Table 11: Latin America Market Size (US$ Million) and Volume (Tons) Forecast by Application, 2014 to 2029

Table 12: Latin America Market Size (US$ Million) and Volume (Tons) Forecast by End Use Industry, 2014 to 2029

Table 13: Europe Market Size (US$ Million) and Volume (Tons) Forecast by Country, 2014 to 2029

Table 14: Europe Market Size (US$ Million) and Volume (Tons) Forecast by Media Type, 2014 to 2029

Table 15: Europe Market Size (US$ Million) and Volume (Tons) Forecast by Application, 2014 to 2029

Table 16: Europe Market Size (US$ Million) and Volume (Tons) Forecast by End Use Industry, 2014 to 2029

Table 17: South Asia Market Size (US$ Million) and Volume (Tons) Forecast by Country, 2014 to 2029

Table 18: South Asia Market Size (US$ Million) and Volume (Tons) Forecast by Media Type, 2014 to 2029

Table 19: South Asia Market Size (US$ Million) and Volume (Tons) Forecast by Application, 2014 to 2029

Table 20: South Asia Market Size (US$ Million) and Volume (Tons) Forecast by End Use Industry, 2014 to 2029

Table 21: East Asia Market Size (US$ Million) and Volume (Tons) Forecast by Country, 2014 to 2029

Table 22: East Asia Market Size (US$ Million) and Volume (Tons) Forecast by Media Type, 2014 to 2029

Table 23: East Asia Market Size (US$ Million) and Volume (Tons) Forecast by Application, 2014 to 2029

Table 24: East Asia Market Size (US$ Million) and Volume (Tons) Forecast by End Use Industry, 2014 to 2029

Table 25: Oceania Market Size (US$ Million) and Volume (Tons) Forecast by Country, 2014 to 2029

Table 26: Oceania Market Size (US$ Million) and Volume (Tons) Forecast by Media Type, 2014 to 2029

Table 27: Oceania Market Size (US$ Million) and Volume (Tons) Forecast by Application, 2014 to 2029

Table 28: Oceania Market Size (US$ Million) and Volume (Tons) Forecast by End Use Industry, 2014 to 2029

Table 29: Middle East & Africa Market Size (US$ Million) and Volume (Tons) Forecast by Country, 2014 to 2029

Table 30: Middle East & Africa Market Size (US$ Million) and Volume (Tons) Forecast by Media Type, 2014 to 2029

Table 31: Middle East & Africa Market Size (US$ Million) and Volume (Tons) Forecast by Application, 2014 to 2029

Table 32: Middle East & Africa Market Size (US$ Million) and Volume (Tons) Forecast by End Use Industry, 2014 to 2029

Table 33: China Market Size (US$ Million) and Volume (Tons) Forecast by Media Type, 2014 to 2029

Table 34: China Market Size (US$ Million) and Volume (Tons) Forecast by Application, 2014 to 2029

Table 35: China Market Size (US$ Million) and Volume (Tons) Forecast by End Use Industry, 2014 to 2029

Table 36: India Market Size (US$ Million) and Volume (Tons) Forecast by Media Type, 2014 to 2029

Table 37: India Market Size (US$ Million) and Volume (Tons) Forecast by Application, 2014 to 2029

Table 38: India Market Size (US$ Million) and Volume (Tons) Forecast by End Use Industry, 2014 to 2029

Table 39: Mexico Market Size (US$ Million) and Volume (Tons) Forecast by Media Type, 2014 to 2029

Table 40: Mexico Market Size (US$ Million) and Volume (Tons) Forecast by Application, 2014 to 2029

Table 41: Mexico Market Size (US$ Million) and Volume (Tons) Forecast by End Use Industry, 2014 to 2029

List of Charts

Figure 01: Global Historical Market Volume (Tons) Analysis, 2014 to 2018

Figure 02: Global Current and Future Market Volume (Tons) Analysis, 2019 to 2029

Figure 03: Global Market Historical Value (US$ Million) Analysis, 2014 to 2018

Figure 04: Global Current & Future Market Value (US$ Million) Analysis, 2019 to 2029

Figure 04: Aircraft Production by Type

Figure 05: Global Market Absolute $ Opportunity, 2019 to 2029

Figure 06: Global Market Share and BPS Analysis by Media Type, 2019 & 2029

Figure 07: Global Market Attractiveness Analysis by Media Type, 2019 to 2029

Figure 08: Global Market Y-o-Y Growth by Media Type, 2019 to 2029

Figure 09: Global Market Absolute $ Opportunity by Ceramic Segment, 2019 to 2029

Figure 10: Global Market Absolute $ Opportunity by Plastic Segment, 2019 to 2029

Figure 11: Global Market Absolute $ Opportunity by Steel Segment, 2019 to 2029

Figure 12: Global Market Absolute $ Opportunity by Aluminium Oxide Segment, 2019 to 2029

Figure 13: Global Market Absolute $ Opportunity by Others Segment, 2019 to 2029

Figure 14: Global Market Share and BPS Analysis by Application, 2019 & 2029

Figure 15: Global Market Attractiveness Analysis by Application, 2019 to 2029

Figure 16: Global Market Y-o-Y Growth by Application, 2019 to 2029

Figure 17: Global Market Absolute $ Opportunity by Deburring Segment, 2019 to 2029

Figure 18: Global Market Absolute $ Opportunity by Pressure Deburring Segment, 2019 to 2029

Figure 19: Global Market Absolute $ Opportunity by Grinding Segment, 2019 to 2029

Figure 20: Global Market Absolute $ Opportunity by Polishing Segment, 2019 to 2029

Figure 21: Global Market Absolute $ Opportunity by Cleaning & Degreasing Segment, 2019 to 2029

Figure 22: Global Market Absolute $ Opportunity by Descaling, Corrosion & Rust Removal Segment, 2019 to 2029

Figure 23: Global Market Absolute $ Opportunity by Ball Furnishing Segment, 2019 to 2029

Figure 24: Global Market Absolute $ Opportunity by Surface Finish & Refinement Segment, 2019 to 2029

Figure 25: Global Market Share and BPS Analysis by End Use Industry, 2019 & 2029

Figure 26: Global Market Attractiveness Analysis by End Use Industry, 2019 to 2029

Figure 27: Global Market Y-o-Y Growth by End Use Industry, 2019 to 2029

Figure 28: Global Market Absolute $ Opportunity by Automotive Segment, 2019 to 2029

Figure 29: Global Market Absolute $ Opportunity by Aerospace Segment, 2019 to 2029

Figure 30: Global Market Absolute $ Opportunity by Construction Segment, 2019 to 2029

Figure 31: Global Market Absolute $ Opportunity by Machine Tooling Segment, 2019 to 2029

Figure 32: Global Market Absolute $ Opportunity by General Manufacturing Segment, 2019 to 2029

Figure 33: Global Market Absolute $ Opportunity by Jewelry and Accessories Segment, 2019 to 2029

Figure 34: Global Market Absolute $ Opportunity by Healthcare Segment, 2019 to 2029

Figure 35: Global Market Share and BPS Analysis by Region, 2019 & 2029

Figure 36: Global Market Attractiveness Analysis by Region, 2019 to 2029

Figure 37: Global Market Y-o-Y Growth by Region, 2019 to 2029

Figure 38: Global Market Absolute $ Opportunity by North America, 2019 to 2029

Figure 39: Global Market Absolute $ Opportunity by Latin America, 2019 to 2029

Figure 40: Global Market Absolute $ Opportunity by Europe, 2019 to 2029

Figure 41: Global Market Absolute $ Opportunity by South Asia, 2019 to 2029

Figure 42: Global Market Absolute $ Opportunity by East Asia, 2019 to 2029

Figure 43: Global Market Absolute $ Opportunity by Oceania, 2019 to 2029

Figure 44: Global Market Absolute $ Opportunity by MEA, 2019 to 2029

Figure 45: North America Market Share and BPS Analysis by Country, 2019 & 2029

Figure 46: North America Market Attractiveness Analysis by Country, 2019 to 2029

Figure 47: North America Market Y-o-Y Growth by Country, 2019 to 2029

Figure 48: North America Market Absolute $ Opportunity by the US, 2019 to 2029

Figure 49: North America Market Absolute $ Opportunity by Canada, 2019 to 2029

Figure 50: North America Market Share and BPS Analysis by Media Type, 2019 & 2029

Figure 51: North America Market Attractiveness Analysis by Media Type, 2019 to 2029

Figure 52: North America Market Y-o-Y Growth by Media Type, 2019 to 2029

Figure 53: North America Market Share and BPS Analysis by Application, 2019 & 2029

Figure 54: North America Market Attractiveness Analysis by Application, 2019 to 2029

Figure 55: North America Market Y-o-Y Growth by Application, 2019 to 2029

Figure 56: North America Market Share and BPS Analysis by End Use Industry, 2019 & 2029

Figure 57: North America Market Attractiveness Analysis by End Use Industry, 2019 to 2029

Figure 58: North America Market Y-o-Y Growth by End Use Industry, 2019 to 2029

Figure 59: Latin America Market Share and BPS Analysis by Country, 2019 & 2029

Figure 60: Latin America Market Attractiveness Analysis by Country, 2019 to 2029

Figure 61: Latin America Market Y-o-Y Growth by Country, 2019 to 2029

Figure 62: Latin America Market Absolute $ Opportunity by Brazil, 2019 to 2029

Figure 63: Latin America Market Absolute $ Opportunity by Mexico, 2019 to 2029

Figure 64: Latin America Market Absolute $ Opportunity by Rest of Latin America, 2019 to 2029

Figure 65: Latin America Market Share and BPS Analysis by Media Type, 2019 & 2029

Figure 66: Latin America Market Attractiveness Analysis by Media Type, 2019 to 2029

Figure 67: Latin America Market Y-o-Y Growth by Media Type, 2019 to 2029

Figure 68: Latin America Market Share and BPS Analysis by Application, 2019 & 2029

Figure 69: Latin America Market Attractiveness Analysis by Application, 2019 to 2029

Figure 70: Latin America Market Y-o-Y Growth by Application, 2019 to 2029

Figure 71: Latin America Market Share and BPS Analysis by End Use Industry, 2019 & 2029

Figure 72: Latin America Market Attractiveness Analysis by End Use Industry, 2019 to 2029

Figure 73: Latin America Market Y-o-Y Growth by End Use Industry, 2019 to 2029

Figure 74: Europe Market Share and BPS Analysis by Country, 2019 & 2029

Figure 75: Europe Market Attractiveness Analysis by Country, 2019 to 2029

Figure 76: Europe Market Y-o-Y Growth by Country, 2019 to 2029

Figure 77: Europe Market Absolute $ Opportunity by Germany, 2019 to 2029

Figure 78: Europe Market Absolute $ Opportunity by France, 2019 to 2029

Figure 79: Europe Market Absolute $ Opportunity by UK, 2019 to 2029

Figure 80: Europe Market Absolute $ Opportunity by Spain, 2019 to 2029

Figure 81: Europe Market Absolute $ Opportunity by Benelux, 2019 to 2029

Figure 82: Europe Market Absolute $ Opportunity by Russia, 2019 to 2029

Figure 83: Europe Market Absolute $ Opportunity by Rest of Europe, 2019 to 2029

Figure 84: Europe Market Share and BPS Analysis by Media Type, 2019 & 2029

Figure 85: Europe Market Attractiveness Analysis by Media Type, 2019 to 2029

Figure 86: Europe Market Y-o-Y Growth by Media Type, 2019 to 2029

Figure 87: Europe Market Share and BPS Analysis by Application, 2019 & 2029

Figure 88: Europe Market Attractiveness Analysis by Application, 2019 to 2029

Figure 89: Europe Market Y-o-Y Growth by Application, 2019 to 2029

Figure 90: Europe Market Share and BPS Analysis by End Use Industry, 2019 & 2029

Figure 91: Europe Market Attractiveness Analysis by End Use Industry, 2019 to 2029

Figure 92: Europe Market Y-o-Y Growth by End Use Industry, 2019 to 2029

Figure 93: South Asia Market Share and BPS Analysis by Country, 2019 & 2029

Figure 94: South Asia Market Attractiveness Analysis by Country, 2019 to 2029

Figure 95: South Asia Market Y-o-Y Growth by Country, 2019 to 2029

Figure 96: South Asia Market Absolute $ Opportunity by India, 2019 to 2029

Figure 97: South Asia Market Absolute $ Opportunity by Malaysia, 2019 to 2029

Figure 98: South Asia Market Absolute $ Opportunity by Indonesia, 2019 to 2029

Figure 99: South Asia Market Absolute $ Opportunity by Thailand, 2019 to 2029

Figure 100: South Asia Market Absolute $ Opportunity by Rest of South Asia, 2019 to 2029

Figure 101: South Asia Market Share and BPS Analysis by Media Type, 2019 & 2029

Figure 102: South Asia Market Attractiveness Analysis by Media Type, 2019 to 2029

Figure 103: South Asia Market Y-o-Y Growth by Media Type, 2019 to 2029

Figure 104: South Asia Market Share and BPS Analysis by Application, 2019 & 2029

Figure 105: South Asia Market Attractiveness Analysis by Application, 2019 to 2029

Figure 106: South Asia Market Y-o-Y Growth by Application, 2019 to 2029

Figure 107: South Asia Market Share and BPS Analysis by End Use Industry, 2019 & 2029

Figure 108: South Asia Market Attractiveness Analysis by End Use Industry, 2019 to 2029

Figure 109: South Asia Market Y-o-Y Growth by End Use Industry, 2019 to 2029

Figure 110: East Asia Market Share and BPS Analysis by Country, 2019 & 2029

Figure 111: East Asia Market Attractiveness Analysis by Country, 2019 to 2029

Figure 112: East Asia Market Y-o-Y Growth by Country, 2019 to 2029

Figure 113: East Asia Market Absolute $ Opportunity by China, 2019 to 2029

Figure 114: East Asia Market Absolute $ Opportunity by South Korea, 2019 to 2029

Figure 115: East Asia Market Absolute $ Opportunity by Japan, 2019 to 2029

Figure 116: East Asia Market Share and BPS Analysis by Media Type, 2019 & 2029

Figure 117: East Asia Market Attractiveness Analysis by Media Type, 2019 to 2029

Figure 118: East Asia Market Y-o-Y Growth by Media Type, 2019 to 2029

Figure 119: East Asia Market Share and BPS Analysis by Application, 2019 & 2029

Figure 120: East Asia Market Attractiveness Analysis by Application, 2019 to 2029

Figure 121: East Asia Market Y-o-Y Growth by Application, 2019 to 2029

Figure 122: East Asia Market Share and BPS Analysis by End Use Industry, 2019 & 2029

Figure 123: East Asia Market Attractiveness Analysis by End Use Industry, 2019 to 2029

Figure 124: East Asia Market Y-o-Y Growth by End Use Industry, 2019 to 2029

Figure 125: Oceania Market Share and BPS Analysis by Country, 2019 & 2029

Figure 126: Oceania Market Attractiveness Analysis by Country, 2019 to 2029

Figure 127: Oceania Market Y-o-Y Growth by Country, 2019 to 2029

Figure 128: Oceania Market Absolute $ Opportunity by Australia, 2019 to 2029

Figure 129: Oceania Market Absolute $ Opportunity by New Zealand, 2019 to 2029

Figure 130: Oceania Market Share and BPS Analysis by Media Type, 2019 & 2029

Figure 131: Oceania Market Attractiveness Analysis by Media Type, 2019 to 2029

Figure 132: Oceania Market Y-o-Y Growth by Media Type, 2019 to 2029

Figure 133: Oceania Market Share and BPS Analysis by Application, 2019 & 2029

Figure 134: Oceania Market Attractiveness Analysis by Application, 2019 to 2029

Figure 135: Oceania Market Y-o-Y Growth by Application, 2019 to 2029

Figure 136: Oceania Market Share and BPS Analysis by End Use Industry, 2019 & 2029

Figure 137: Oceania Market Attractiveness Analysis by End Use Industry, 2019 to 2029

Figure 138: Oceania Market Y-o-Y Growth by End Use Industry, 2019 to 2029

Figure 139: Middle East & Africa Market Share and BPS Analysis by Country, 2019 & 2029

Figure 140: Middle East & Africa Market Attractiveness Analysis by Country, 2019 to 2029

Figure 141: Middle East & Africa Market Y-o-Y Growth by Country, 2019 to 2029

Figure 142: Middle East & Africa Market Absolute $ Opportunity by GCC Countries, 2019 to 2029

Figure 143: Middle East & Africa Market Absolute $ Opportunity by South Africa, 2019 to 2029

Figure 144: Middle East & Africa Market Absolute $ Opportunity by North Africa, 2019 to 2029

Figure 145: Middle East & Africa Market Absolute $ Opportunity by Rest of MEA, 2019 to 2029

Figure 146: Middle East & Africa Market Share and BPS Analysis by Media Type, 2019 & 2029

Figure 147: Middle East & Africa Market Attractiveness Analysis by Media Type, 2019 to 2029

Figure 148: Middle East & Africa Market Y-o-Y Growth by Media Type, 2019 to 2029

Figure 149: Middle East & Africa Market Share and BPS Analysis by Application, 2019 & 2029

Figure 150: Middle East & Africa Market Attractiveness Analysis by Application, 2019 to 2029

Figure 151: Middle East & Africa Market Y-o-Y Growth by Application, 2019 to 2029

Figure 152: Middle East & Africa Market Share and BPS Analysis by End Use Industry, 2019 & 2029

Figure 153: Middle East & Africa Market Attractiveness Analysis by End Use Industry, 2019 to 2029

Figure 154: Middle East & Africa Market Y-o-Y Growth by End Use Industry, 2019 to 2029

Figure 155: Global & Emerging Countries Market Share and BPS Analysis – 2018 & 2028

Figure 156: Global & Emerging Countries Market Y-o-Y Growth Projections, 2019 to 2029

Figure 157: China Market Share and BPS Analysis by Media Type, 2019 & 2029

Figure 158: China Market Attractiveness Analysis by Media Type, 2019 to 2029

Figure 159: China Market Y-o-Y Growth by Media Type, 2019 to 2029

Figure 160: China Market Share and BPS Analysis by Application, 2019 & 2029

Figure 161: China Market Attractiveness Analysis by Application, 2019 to 2029

Figure 162: China Market Y-o-Y Growth by Application, 2019 to 2029

Figure 163: China Market Share and BPS Analysis by End Use Industry, 2019 & 2029

Figure 164: China Market Attractiveness Analysis by End Use Industry, 2019 to 2029

Figure 165: China Market Y-o-Y Growth by End Use Industry, 2019 to 2029

Figure 166: India Market Share and BPS Analysis by Media Type, 2019 & 2029

Figure 167: India Market Attractiveness Analysis by Media Type, 2019 to 2029

Figure 168: India Market Y-o-Y Growth by Media Type, 2019 to 2029

Figure 169: India Market Share and BPS Analysis by Application, 2019 & 2029

Figure 170: India Market Attractiveness Analysis by Application, 2019 to 2029

Figure 171: India Market Y-o-Y Growth by Application, 2019 to 2029

Figure 172: India Market Share and BPS Analysis by End Use Industry, 2019 & 2029

Figure 173: India Market Attractiveness Analysis by End Use Industry, 2019 to 2029

Figure 174: India Market Y-o-Y Growth by End Use Industry, 2019 to 2029

Figure 175: Mexico Market Share and BPS Analysis by Media Type, 2019 & 2029

Figure 176: Mexico Market Attractiveness Analysis by Media Type, 2019 to 2029

Figure 177: Mexico Market Y-o-Y Growth by Media Type, 2019 to 2029

Figure 178: Mexico Market Share and BPS Analysis by Application, 2019 & 2029

Figure 179: Mexico Market Attractiveness Analysis by Application, 2019 to 2029

Figure 180: Mexico Market Y-o-Y Growth by Application, 2019 to 2029

Figure 181: Mexico Market Share and BPS Analysis by End Use Industry, 2019 & 2029

Figure 182: Mexico Market Attractiveness Analysis by End Use Industry, 2019 to 2029

Figure 183: Mexico Market Y-o-Y Growth by End Use Industry, 2019 to 2029