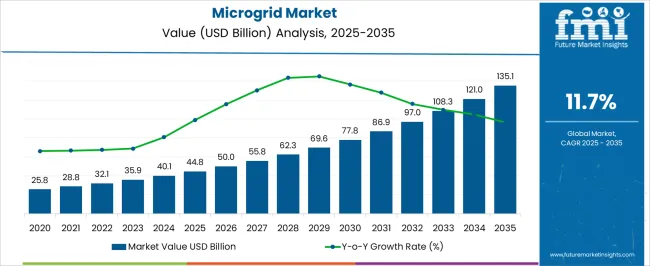

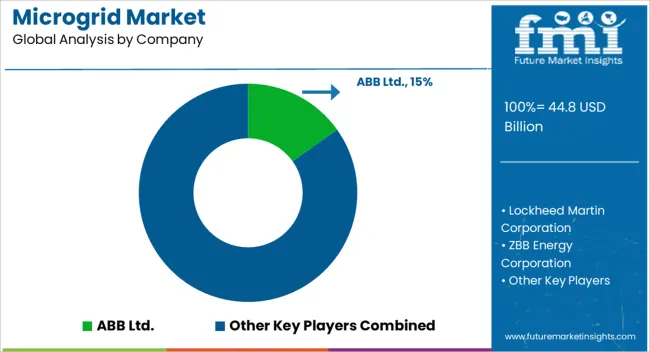

The Microgrid Market is estimated to be valued at USD 44.8 billion in 2025 and is projected to reach USD 135.1 billion by 2035, registering a compound annual growth rate (CAGR) of 11.7% over the forecast period.

| Metric | Value |

|---|---|

| Microgrid Market Estimated Value in (2025 E) | USD 44.8 billion |

| Microgrid Market Forecast Value in (2035 F) | USD 135.1 billion |

| Forecast CAGR (2025 to 2035) | 11.7% |

The microgrid market is experiencing significant growth driven by increasing demand for reliable and resilient energy systems, integration of renewable energy sources, and the need for decentralized power solutions. Current dynamics are characterized by rising investments in energy infrastructure, regulatory support for clean energy adoption, and technological advancements in control and energy storage systems.

Market expansion is also influenced by grid instability in certain regions and the growing emphasis on energy security and sustainability. The future outlook is shaped by urbanization, industrial electrification, and the transition toward low-carbon energy frameworks, which are expected to increase deployment of both on-grid and off-grid microgrid solutions.

Growth rationale is founded on the ability of microgrids to enhance energy efficiency, provide operational flexibility, and support critical infrastructure, while ongoing innovation in smart control systems and modular infrastructure is facilitating faster and more scalable adoption Strategic partnerships, government incentives, and integration of advanced hardware are expected to underpin sustained market growth and broader adoption across public and private sectors.

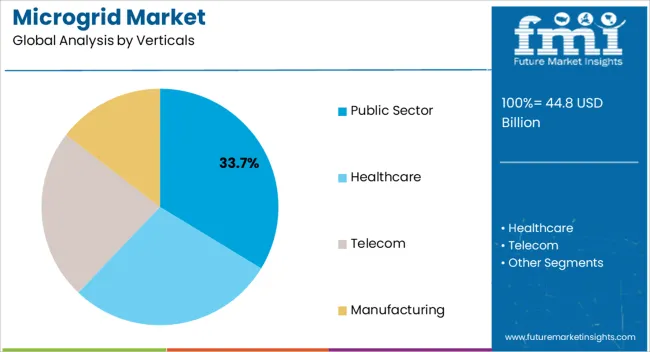

The public sector segment, representing 33.70% of the verticals category, has maintained a leading position due to its critical role in deploying microgrids for government facilities, military installations, and public institutions. Adoption has been driven by policy mandates for energy security, infrastructure modernization programs, and funding support for sustainable energy initiatives.

Operational reliability and resilience against grid disruptions have reinforced preference for microgrid deployment in public sector projects. Integration of smart monitoring and energy management technologies has enhanced system efficiency and predictive maintenance.

Procurement processes, compliance with regulatory standards, and scalability of infrastructure have contributed to sustained market confidence Ongoing investment in public energy infrastructure and strategic collaborations with technology providers are expected to further strengthen the segment’s market share and support long-term growth in critical applications.

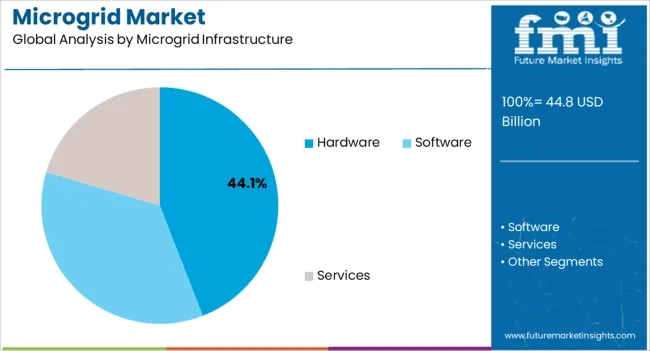

The hardware segment, holding 44.10% of the microgrid infrastructure category, has emerged as the leading segment due to its central role in enabling energy conversion, storage, and distribution. Adoption has been driven by improvements in power electronics, energy storage systems, and modular hardware components that enhance operational efficiency and reliability.

Market preference has been reinforced by increased performance, durability, and integration capabilities with renewable energy sources. Supply chain optimization, quality assurance, and technological innovation have further supported widespread acceptance.

Growth potential is underpinned by rising investments in smart grid infrastructure, increasing electrification of industrial and commercial facilities, and ongoing development of advanced hardware solutions that reduce downtime and improve energy management, ensuring continued dominance of this segment in the microgrid market.

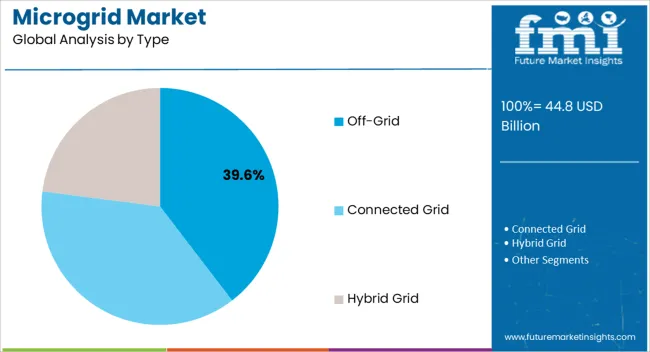

The off-grid segment, accounting for 39.60% of the type category, has maintained leadership due to its applicability in remote, underserved, and energy-insecure regions where traditional grid access is limited or unreliable. Adoption has been driven by increasing demand for autonomous energy solutions, integration with renewable energy sources, and deployment in critical facilities requiring uninterrupted power supply.

Operational reliability, ease of scalability, and modular design have reinforced market preference. Technological enhancements in energy storage, system control, and monitoring have improved performance and reduced maintenance requirements.

Strategic initiatives, government support, and project-based collaborations are expected to sustain segment share and encourage further deployment of off-grid microgrid solutions across both developing and mature markets.

Microgrid has recently emerged as an innovative force in the field of energy infrastructure. The microgrid market saw significant growth between 2020 and 2025, fueled by factors such as rising distributed energy systems resilience awareness, concerns about climate change, and technological improvements.

Energy industry business executives and entrepreneurs have been attentively watching this development.

The microgrid market is anticipated to experience growth from 2025 to 2035. Opportunities for fresh collaborations, investments, and models are in store for the future. Scalability, grid integration, and sustainability should be the main concerns for businesspeople in the market.

To successfully complete the journey, working with utilities, complying with regulations, and staying updated with technology developments will be essential.

Embracing the developing microgrid industry is not simply a choice but a strategic need for forward-thinking enterprises as the world moves toward cleaner and more reliable energy solutions.

Governments worldwide support microgrid programs more frequently as they know their potential to provide stable and adequate power supplies to various sectors. The affordability of microgrid technology is increasing its allure.

Governments are providing financial support for the microgrid programs. The development allows company executives to improve energy resilience and save operating expenses. These factors serve as a significant market opportunity for microgrid.

An uninterrupted power supply enhanced sustainability is assured, ultimately boosting their bottom line while aligning with changing government goals by looking into collaborations and investments in microgrid projects.

For companies looking for energy security and efficiency, staying informed and involved in the rapidly evolving microgrid landscape can be advantageous.

Innovations in renewable energy technology have the potential to completely transform the microgrid technology market. Microgrid systems incorporate more renewable energy into their operations, making solar-generated microgrid networks, etc. Renewable energy sources provide a green and sustainable option, generating less carbon while maximizing energy effectiveness and lowering the cost.

Leading microgrid manufacturers ought to be aware of the advancements because they promote increased energy resilience and independence. Leveraging hybrid microgrid taps into renewable energy reduces grid dependency, cuts environmental impact, and fosters sustainable business practices.

The high initial capital expenditures are one of the key obstacles for the microgrid technology market. Building a microgrid infrastructure, particularly in distant or underdeveloped locations, can be costly.

As microgrid expand, standardized components and systems are needed to ease scaling and save costs. A lack of standardization might cause compatibility concerns and hinder the market expansion of microgrid.

Obtaining funding may be difficult which inhibits the microgrid market. Investors may be cautious due to the technology's relative youth, uncertainties around revenue models, and the lengthy payback times connected.

Within the microgrid infrastructure category, the hardware segment dominates the microgrid solutions market as the primary demand generator. The crucial role that hardware components serve in the setup and operation of microgrid is linked to the upsurge in demand.

| Category | Microgrid Infrastructure |

|---|---|

| Leading Segment | Hardware |

| Segment Share | 41.0% |

The fundamental components of microgrid systems, including power converters, switches, generators, and control systems, are hardware.

The requirement for strong and dependable hardware solutions remains critical as the adoption of microgrid for various purposes, such as resilience, energy efficiency, and renewable integration, continues to increase, pushing the hardware segment to the pinnacle of the microgrid demand.

The off-grid category has the potential to take the lead in sales in the competitive microgrid market. Microgrids, including Off-grid, Connected Grid, and Hybrid Grid solutions, have revolutionized the energy market, according to manufacturers closely connected to the sector.

Off-grid power solutions, in particular, are attracting much interest and funding because of their capacity to offer independent power generation and distribution, frequently in isolated or neglected locations.

| Category | Connectivity |

|---|---|

| Leading Segment | Off Grid |

| Segment Share | 61.9% |

The off-grid segment has become critical due to its ability to provide dependable electricity in areas where standard grid infrastructure is unworkable or financially unviable. Due to its versatility, it has become a lucrative segment for investment, which has sparked interest from companies looking to address energy difficulties in off-grid power solutions.

Recognizing the dominant position of the off-grid segment may help companies sail the microgrid market, inform strategic choices, and make it easier to take advantage of the wealth of prospects in the promising industry.

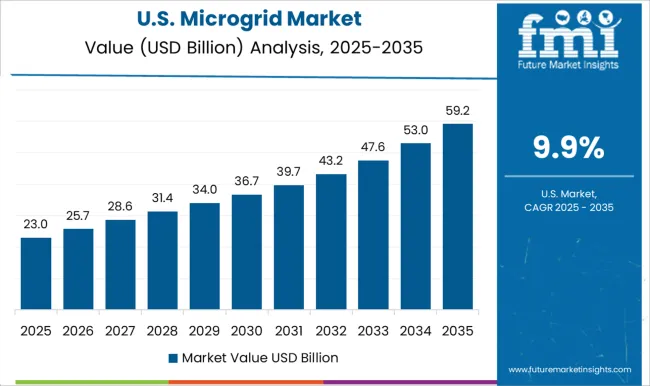

The North America microgrid market is booming, mainly owing to a greater emphasis on grid resilience and sustainability. Businesses understand the necessity of maintaining an uninterrupted power supply, especially during emergencies or extreme weather. As a result, investments in microgrid solutions have surged.

| Attributes | Details |

|---|---|

| United States Market CAGR | 17.6% |

| Canada Market CAGR | 8.3% |

For example, the Federal Microgrid Grant Program has provided a financial incentive. Collaborations between utilities and private firms have resulted in novel financing structures. Nonetheless, connecting microgrids with existing grid infrastructure remains problematic for enterprises in North America, as does navigating regulatory limitations.

The demand for microgrid in Europe is growing due to aggressive renewable energy goals and the need to cut carbon emissions. Microgrid manufacturers adopt microgrid to reduce environmental impact, improve energy security, and optimize energy consumption. The deployment of microgrid is aided by supportive policies like those described in the Clean Energy Package of the European Union.

| Attributes | Details |

|---|---|

| United Kingdom Market CAGR | 10.4% |

| France Market CAGR | 6.9% |

| Italy Market CAGR | 3.5% |

| Spain Market CAGR | 3.2% |

| Germany Market CAGR | 8.5% |

The growth of cross-border initiatives and energy communities reflects a pan-European commitment to sustainable energy solutions. Integrating microgrid within the complex web of national rules remains a problem for market growth for microgrid.

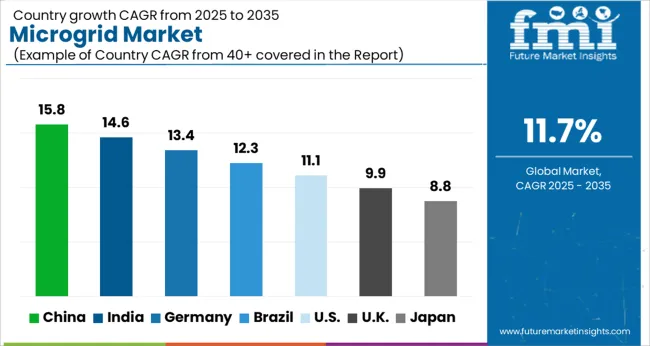

The Asia Pacific microgrid market is expanding rapidly, driven by rising energy consumption, grid reliability issues, and a growing emphasis on renewable energy sources. Countries like China and India invest heavily in microgrid to improve grid resilience and provide energy availability to remote areas.

| Attributes | Details |

|---|---|

| India Market CAGR | 8.5% |

| China Market CAGR | 9.1% |

| South Korea Market CAGR | 3.6% |

| Japan Market CAGR | 4.3% |

Government regulations, including feed-in tariffs and subsidies, are hastening the implementation of microgrid solutions. On the other hand, the market landscape is tremendously diversified, with varying levels of infrastructure development. This creates opportunities and challenges for microgrid manufacturers profiting from the growing demand for dependable, sustainable energy solutions.

Due to rising consumer demand for energy sustainability and resilience, the microgrid market is highly competitive. To provide scalable and economical solutions, the key players in microgrid innovate consistently. Entrepreneurs should concentrate on market trends in microgrid, regulation changes, and developing technology.

Strategic collaborations and investments in research and development are vital for competitive advantage. In microgrid market where flexibility and versatility are essential for advancement, seizing opportunities requires understanding customer expectations. In a dynamic environment, constant market evaluation and strategy modification is essential.

Noteworthy Milestone

| Company | Details |

|---|---|

| Caterpillar | Caterpillar acquired Tangent Energy Solutions in May 2025, allowing them to collaborate with utilities and energy suppliers directly to supply distributed energy systems. The in-house software developed by Tangent Energy is a DERMS platform that controls, monitors, and generates profits from onsite energy assets like microgrids, natural gas power, and renewable energy storage. |

| Siemens | Siemens created a grid software suite in May 2025 to manage the complexities of grid systems. It is an open, modular software suite developed by Siemens Smart Infrastructure. |

| Los Angeles Transportation Department | The Los Angeles Transportation Department started a USD 40.1 million microgrid project in November 2024 to electrify their fleet of EVs. The California Energy Commission will fund a 7.5 MW charging station for the microgrid. |

| LECO, Dimo, and DHYBRID GmbH | In June 2024, LECO, Dimo, and DHYBRID GmbH worked to build the first national grid-tied renewable energy microgrid for Sri Lanka at the University of Moratuwa. The Asian Development Bank (ADB) provided funding for it, and it constituted a radical change in Sri Lanka's distributed power generation system. |

The global microgrid market is estimated to be valued at USD 44.8 billion in 2025.

The market size for the microgrid market is projected to reach USD 135.1 billion by 2035.

The microgrid market is expected to grow at a 11.7% CAGR between 2025 and 2035.

The key product types in microgrid market are public sector, healthcare, telecom and manufacturing.

In terms of microgrid infrastructure, hardware segment to command 44.1% share in the microgrid market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Remote Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Military Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Remote DC Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Grid Connected Microgrid Market Size and Share Forecast Outlook 2025 to 2035

DC Grid Connected Microgrid Market Size and Share Forecast Outlook 2025 to 2035

AC Grid Connected Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA