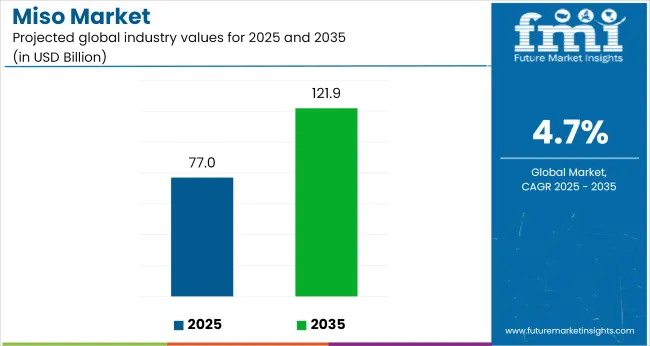

The miso market is valued at USD 77.0 billion in 2025 and is projected to grow to USD 121.9 billion by 2035, at a CAGR of 4.7%. Growth is being driven by the rising global appetite for fermented soy-based condiments, health-promoting probiotics, and clean-label umami ingredients.

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 77.0 billion |

| Market Size (2035) | USD 121.9 billion |

| CAGR (2025 to 2035) | 4.7% |

Paste formulations are being preferred for versatility in soups, marinades, and dressings, while powdered and organic variants are being spotlighted by premium chefs and natural-food brands. It is argued that manufacturers investing in flavored blends, non-GMO sourcing, and functional wellness claims will outperform commodity-grade competitors.

However, it is suggested that regional regulatory barriers and fermentation consistency challenges may hinder rapid expansion. Industry concentration is being observed around Japanese powerhouses like Marukome and Hikari, although newer players are being cited for disrupting traditional supply chains.

The industry holds a specialized share within its parent markets. In the fermented food market, it accounts for approximately 4-6%, as miso is one of the popular fermented products, but not as widespread as others like yogurt or pickles. Within the condiments and sauces market, the share is around 3-5%, driven by miso’s use as a seasoning and flavoring agent in various cuisines.

In the health and wellness food market, its share is about 2-3%, due to the increasing demand for fermented foods with probiotic benefits. In the organic food market, miso represents around 5-7%, as organic variants gain popularity. In the plant-based foods market, its share is approximately 4-6%, appealing to those seeking plant-based dietary options.

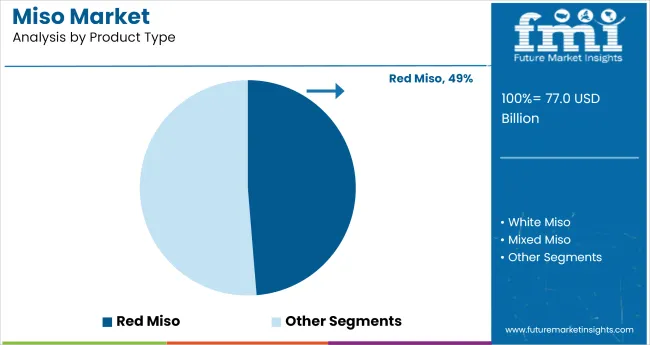

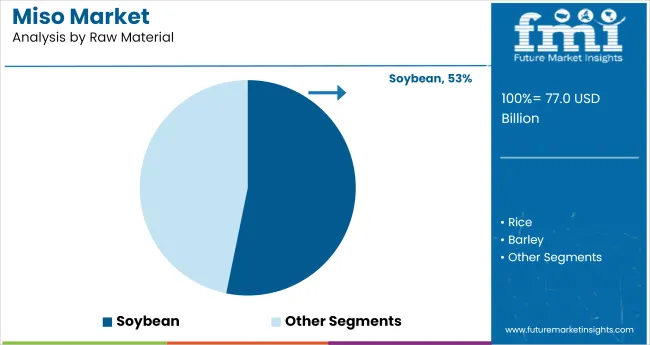

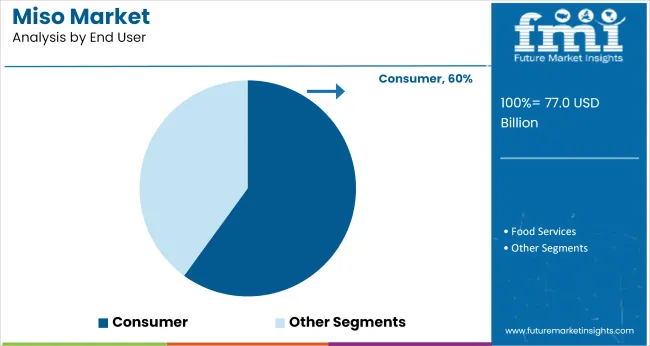

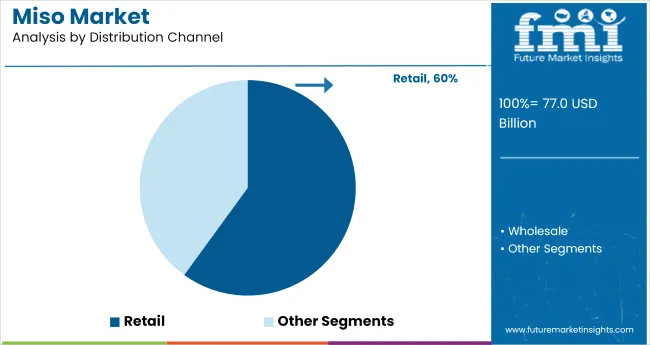

The industry in 2025 will see red miso leading the product type segment with 48.7% industry share. Soybean will dominate the raw material segment at 53.2%, while the consumer end-user segment will hold 60% of the industry share, and retail will be the primary distribution channel, also with 60%.

Red miso is projected to capture 48.7% of the industry share in 2025, making it the dominant product type. Known for its rich flavor and deep umami taste, red miso is preferred in traditional Japanese cuisine and increasingly in global cooking applications.

The fermentation process used to create red miso results in a stronger, saltier flavor compared to white miso, which is why it is often used in more robust dishes such as soups, marinades, and sauces. Its popularity in both authentic and fusion culinary applications ensures its continued dominance in the industry.

Soybean is expected to hold 53.2% of the industry share in the raw material segment by 2025. Soybeans are the primary ingredient used in miso production due to their high protein content and versatility. The fermentation of soybeans with specific bacteria yields the desired texture and flavor profile in miso, making it the preferred raw material. As global demand for plant-based proteins increases, soybeans continue to be the key raw material not only for miso but also for other fermented foods, further solidifying its dominant position in the industry.

The consumer segment is expected to capture 60% of the industry share in 2025, driven by the rising popularity of miso as a healthful, flavorful food product in households worldwide. Miso’s versatility as an ingredient in soups, sauces, dressings, and even smoothies has led to its increased use in daily meals.

The growing consumer preference for fermented foods, due to their health benefits such as improved gut health, supports the continued growth of the consumer segment. Convenience, availability, and the shift toward natural, clean-label products further contribute to miso’s industry dominance.

Retail is projected to hold 60% of the industry share in 2025 as the primary distribution channel. Supermarkets and grocery stores are the main points of sale for miso, offering a variety of miso products, including red, white, and organic options, to consumers.

The increasing availability of miso in both traditional and modern retail outlets has made it accessible to a broader audience. Retailers are also capitalizing on the growing consumer demand for plant-based, fermented foods by expanding their miso product offerings.

The industry is expanding due to the rising global interest in fermented foods and their health benefits. However, limited awareness in non-Asian industries and miso's strong flavor profile are hindering broader adoption. Educating consumers about its versatility and nutritional value is crucial for growth.

Increasing Popularity of Fermented Foods in Global Diets

The industry is experiencing growth driven by a global shift towards incorporating fermented foods into daily diets. Consumers are increasingly aware of the health benefits of fermented foods, such as improved gut health and enhanced immune function. Miso, with its rich probiotic content, is gaining attention not only in traditional Japanese cuisine but also in mainstream food cultures. The rising interest in healthy, natural food options is propelling the demand for miso, particularly in Western industries where demand for fermented foods continues to grow.

Challenges in Expanding Miso Awareness in New Industries

Despite increasing demand for miso, its adoption in non-Asian industries is constrained by limited awareness. Many consumers are unfamiliar with miso’s flavor and potential health benefits, which limits its appeal in some regions. Its strong taste may not align with local flavor preferences, causing hesitations in its widespread use. Efforts to educate consumers about miso’s versatility in cooking, along with highlighting its nutritional benefits, are essential to drive broader acceptance and integration into diverse culinary traditions.

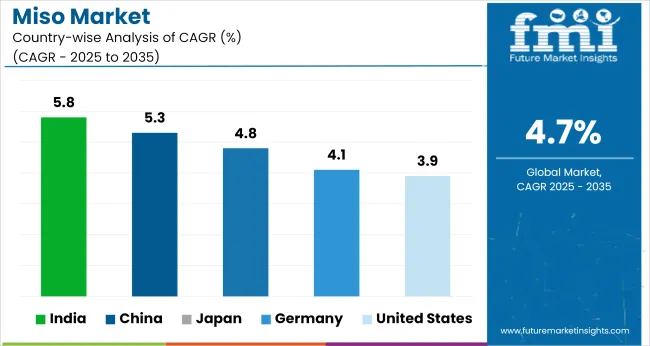

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 3.9% |

| Germany | 4.1% |

| China | 5.3% |

| Japan | 4.8% |

| India | 5.8% |

Global industry demand is projected to rise at a 4.7% CAGR from 2025 to 2035. Of the five profiled countries out of 40 covered, India leads at 5.8%, followed by China at 5.3%, and Japan at 4.8%, while Germany records 4.1% and the United States posts 3.9%. These rates translate to a growth premium of +23% for India, +13% for China, and +2% for Japan versus the baseline, while the United States and Germany show slower growth.

Divergence reflects local catalysts: growing demand for plant-based, protein-rich foods in India and China, while more mature industries like the United States and Germany exhibit slower growth due to industry saturation and established consumption habits.

Sales of miso in the United States are expected to grow at a 3.9% CAGR between 2025 and 2035. Interest in fermented food products has transitioned from niche to mainstream, pushing miso into new formats beyond traditional soup bases. Retailers are incorporating miso into dips, spreads, and marinades, appealing to flexitarian and plant-forward shoppers.

Distribution through natural food chains and refrigerated condiments aisles has increased. Innovations include freeze-dried miso cubes, blended sauces, and portable pouches. While consumption remains higher in coastal regions, Midwest markets are also opening up through wellness-focused grocers and meal kit integrations targeting clean-label consumers.

Germany’s industry is forecast to grow at a 4.1% CAGR through 2035. Consumers seeking fermented, additive-free foods have embraced miso across organic and vegan channels. White and mixed miso varieties dominate sales due to their milder flavor and versatility. Bio-specialty stores and farm-to-shelf cooperatives are expanding shelf space for miso pastes and miso-based ready meals.

Producers are introducing German-language labeling, pairing ideas, and storage guidance to improve household penetration. Nutritional awareness around salt alternatives and gut microbiota is driving trial among non-traditional users, including older demographics and home cooks looking to diversify flavor profiles without relying on processed enhancers.

Demand for miso in China is projected to rise at a CAGR of 5.3% from 2025 to 2035. Growth is supported by increasing household experimentation with East Asian cuisines, including Japanese-inspired condiments. Imported miso brands see traction in top-tier cities like Shanghai and Shenzhen, while domestic firms experiment with soy-rice fermentation hybrids.

Miso is being promoted in simplified Chinese, with QR-code access to recipes and health claims. Food delivery platforms are enabling adoption through ramen kits and bento box add-ons. The industry benefits from cross-category synergies, where fermented ingredients are viewed as both flavor enhancers and digestive aids.

Japan’s industry is forecast to grow at a 4.8% CAGR from 2025 to 2035. While overall soup consumption remains consistent, diversification into dressings, snacks, and ready-to-drink miso beverages is gaining momentum. Consumer preferences are shifting toward lighter, blended miso types with reduced sodium.

Regional miso variants such as Shinshu and Sendai are finding wider distribution through e-commerce and tourism-driven sampling campaigns. Schools and retirement homes remain major institutional buyers, ensuring baseline demand. Industry saturation has prompted large manufacturers to innovate through packaging, convenience, and flavor variants aimed at solo households and mobile professionals.

India’s industry is projected to expand at a 5.8% CAGR from 2025 to 2035. Awareness is growing in health-focused metros, where miso is positioned as a gut-friendly, umami-rich ingredient. Importers are targeting upper-income groups through gourmet stores and premium digital platforms. Homegrown startups are exploring adaptations using local pulses and millets as fermentation bases.

Wellness cafes are pairing miso with traditional grains in wraps and smoothies. Interest is driven by Ayurveda-compatible interpretations and probiotic narratives. Recipe-sharing communities and culinary workshops are demystifying miso preparation, with influencers promoting it as an immune-boosting pantry staple.

Leading Company - Marukome Co., Ltd.Industry Share - 13%

The global industry is led by Marukome Co., Ltd., which holds a significant share of approximately 13%. Founded in 1854 and headquartered in Nagano, Japan, Marukome is one of the top producers among the 2,500 miso manufacturers in the country.

The company has expanded its presence internationally, with a USA headquarters and factory established in Irvine, California, in 2007. Marukome's product offerings include traditional miso paste, instant miso soup, and seasonings, catering to a wide range of consumer preferences. The company's commitment to quality and innovation has solidified its leadership position in the industry.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025E) | USD 77.0 billion |

| Industry Value (2035F) | USD 121.9 billion |

| CAGR (2025 to 2035) | 4.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and tons for volume |

| Product Type Segmentation | Red Miso, White Miso, Mixed Miso |

| Raw Material Segmentation | Soybean, Rice, Barley, Others |

| End-User Segmentation | Consumer, Food Services |

| Distribution Channel Segmentation | Wholesale, Retail |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia & Belarus, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Leading Brands | Iyasaka Jozo Co., Marukome, Source Foods, Saikyo -Miso Co., Miyako Oriental Foods Inc., Hikari Miso Co. Ltd., Yamato Soysauce & Miso Co., Clearspring Ltd., Ohsawa Japan, Muso Co., Ltd. |

| Additional Attributes | Dollar sales by product type, raw material, and end-user, growing demand for miso in plant-based diets, increasing adoption of miso-based products in food services, regional preferences for miso flavors, expanding distribution channels through retail and e-commerce. |

Product type segmentation includes red miso, white miso, and mixed miso.

Raw materials include soybean, rice, barley, and others.

End-user categories comprise consumer and food services.

Distribution is segmented into wholesale and retail.

Regional analysis covers North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic countries, Russia and Belarus, and the Middle East & Africa.

The estimated size of the global miso industry in 2025 is USD 77.0 billion.

The projected value of the global miso industry in 2035 is USD 121.9 billion, with a CAGR of 4.7%.

Soybean dominates the raw material segment of the industry with a 53.2% industry share.

India will see the fastest growth in the industry with a CAGR of 5.8% from 2025 to 2035.

The leading company in the industry is Marukome Co., Ltd., with a 13% industry share.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.