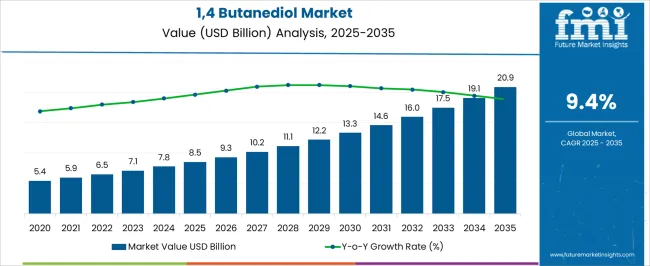

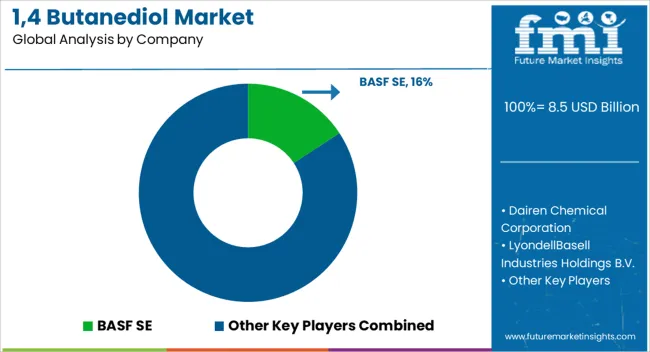

The 1,4 butanediol (BDO) market is expected to grow from USD 8.5 billion in 2025 to USD 20.9 billion by 2035, registering a 9.4% CAGR and generating an absolute dollar opportunity of USD 12.4 billion. Growth is driven by increasing demand for BDO in the production of polyurethanes, elastic fibers, plastics, and solvents. Rising consumption in the automotive, construction, textiles, and electronics industries, along with the expansion of chemical manufacturing capacity in the Asia Pacific and North America, supports market expansion.

Peak-to-trough analysis illustrates the market’s cyclical behavior, highlighting periods of high and low growth momentum over the forecast period. From 2025 to 2027, the market reaches an initial peak as North America and Europe witness steady industrial demand and BDO adoption in downstream applications such as spandex fibers and thermoplastic polyurethanes. Between 2028 and 2031, the market experiences a moderate trough, influenced by supply chain constraints, fluctuations in raw material prices, and regional economic slowdowns that temporarily temper growth. From 2032 to 2035, the market accelerates toward a secondary peak, driven by increased production capacity in the Asia Pacific, heightened construction and automotive activity, and rising consumption of downstream polymers.

The USD 12.4 billion opportunity reflects a market that balances peaks of rapid adoption with troughs of moderated growth, providing a clear understanding of cyclical trends, regional contributions, and the global 1,4 butanediol market trajectory between 2025 and 2035.

| Metric | Value |

|---|---|

| 1,4 Butanediol Market Estimated Value in (2025 E) | USD 8.5 billion |

| 1,4 Butanediol Market Forecast Value in (2035 F) | USD 20.9 billion |

| Forecast CAGR (2025 to 2035) | 9.4% |

The 1,4 butanediol market is driven by five primary parent markets with specific shares. Polyurethanes lead with 40%, as 1,4 butanediol is a key feedstock for spandex fibers, elastomers, and foams. Solvents and chemical intermediates contribute 25%, supporting the production of tetrahydrofuran (THF) and gamma-butyrolactone (GBL). Polybutylene terephthalate (PBT) accounts for 15%, used in engineering plastics and automotive components. Coatings, adhesives, and sealants represent 10%, leveraging 1,4 butanediol for improved performance. Pharmaceuticals and specialty chemicals hold 10%, where it functions as a precursor for active compounds. These sectors collectively shape global demand and drive production innovation.

Recent developments in the 1,4 butanediol market focus on sustainability, efficiency, and alternative feedstocks. Manufacturers are advancing bio-based production methods using renewable raw materials to reduce their carbon footprint. Process optimization and catalytic innovations are improving yields, reducing energy consumption, and lowering costs. Growth in polyurethane applications, including textiles, foams, and elastomers, is driving demand. Expansion in the automotive, electronics, and construction sectors is increasing the use of PBT and specialty chemicals.

The 1,4 butanediol market is experiencing sustained growth, driven by its vital role as a chemical intermediate in the production of high-performance polymers, solvents, and elastic fibers. Increased demand across automotive, electronics, and textile sectors has solidified its position as a core industrial chemical.

As global supply chains stabilize and manufacturing activity rebounds, the market is witnessing renewed interest from downstream industries seeking reliable and high-purity feedstock materials. Environmental pressures and the transition toward bio-based alternatives are also encouraging investments in sustainable production technologies.

Future market expansion is expected to be underpinned by innovation in application development and the growing use of spandex fibers and engineered plastics. With performance efficiency and process integration becoming key priorities across industries, 1,4 butanediol’s flexibility and adaptability in chemical synthesis make it a critical enabler of modern industrial formulations

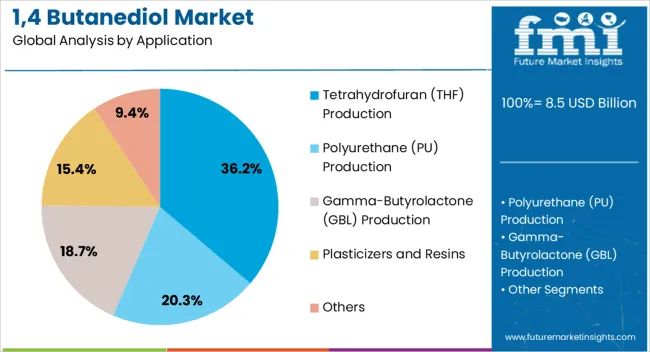

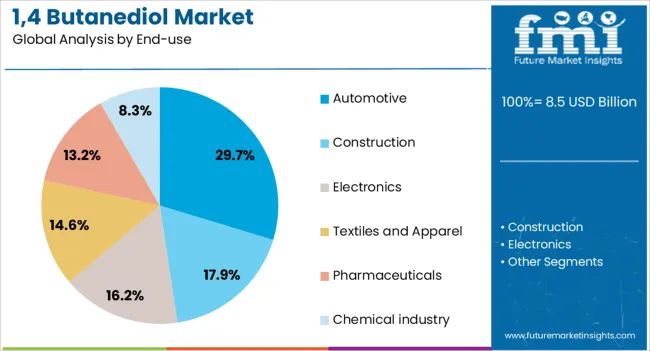

The 1,4 butanediol market is segmented by application, end-use, and geographic regions. By application, 1,4 butanediol market is divided into Tetrahydrofuran (THF) Production, Polyurethane (PU) Production, Gamma-Butyrolactone (GBL) Production, Plasticizers and Resins, and Others. In terms of end-use, 1,4 butanediol market is classified into Automotive, Construction, Electronics, Textiles and Apparel, Pharmaceuticals, and Chemical industry. Regionally, the 1,4 butanediol industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The tetrahydrofuran (THF) production segment accounts for 36% of the 1,4 butanediol market, making it the most prominent application category. THF is widely utilized as a precursor for spandex fibers and other performance elastomers, driven by growing demand in apparel, automotive interiors, and industrial coatings.

The synthesis of THF via 1,4 butanediol is highly efficient, making it a preferred method in large-scale production processes. Rising adoption of flexible polyurethane materials and coatings across various sectors is further supporting segment growth.

Additionally, the increasing focus on high-strength, lightweight components in end-use industries is reinforcing THF’s relevance as a critical intermediate. Continuous investments in THF plant capacity expansion and technology upgrades are expected to maintain strong demand for 1,4 butanediol in this application segment

The automotive segment leads the end-use category with a 30% share, driven by the increasing incorporation of high-performance plastics, coatings, and sealants derived from 1,4-butanediol-based intermediates. The industry’s focus on vehicle lightweighting, fuel efficiency, and durability has increased reliance on engineered polymers such as thermoplastic polyurethanes and polybutylene terephthalate, both of which utilize 1,4 butanediol in their synthesis.

Additionally, interior components, under-the-hood applications, and exterior coatings benefit from the chemical’s properties of strength, flexibility, and chemical resistance. As automotive manufacturers continue to invest in electric vehicles and advanced materials, demand for 1,4 butanediol in this segment is expected to grow further.

Regulatory shifts favoring sustainable and high-performance materials will likely enhance their long-term role in the automotive value chain.

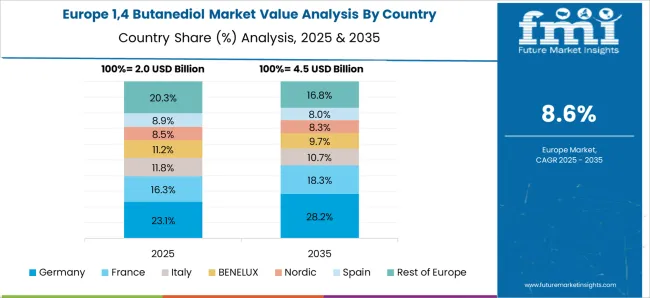

The global 1,4 butanediol (BDO) market is expanding due to growing demand from plastics, solvents, polyurethane, and fiber applications. Asia Pacific accounts for over 45% of global production, driven by chemical manufacturing, textile, and automotive sectors. North America and Europe focus on high-purity BDO for polyurethanes, tetrahydrofuran, and elastic fiber production. Technological advances in bio-based BDO and energy-efficient production methods are increasing yield and reducing costs. Rising demand for spandex fibers, high-performance plastics, and solvents, combined with industrial growth in emerging markets, is supporting global market expansion.

The 1,4 butanediol market is primarily driven by demand in polyurethane, spandex fiber, solvent, and plastic industries. Polyurethane production consumes nearly 40–45% of global BDO, used in foams, elastomers, and coatings. Spandex fiber manufacturing utilizes BDO for elasticity and durability, accounting for 20–25% of total consumption. Automotive and electronics sectors rely on BDO-based polyurethanes for lightweight components, insulation, and adhesives. Rising industrialization in Asia Pacific, Latin America, and Middle East is increasing demand for polyester polyols and tetrahydrofuran, produced from BDO. Technological improvements in continuous production and purification have increased global yield by 10–12%, improving cost efficiency and driving adoption across industrial, commercial, and textile applications worldwide.

Opportunities in the BDO market arise from bio-based production methods using sugar, corn, or lignocellulosic feedstocks. Bio-BDO offers 20–25% lower carbon emissions compared to fossil-based processes, appealing to manufacturers of sustainable plastics, polyurethanes, and fibers. Specialty applications such as high-performance elastomers, solvent blends, and tetrahydrofuran derivatives create growth avenues in pharmaceuticals, coatings, and adhesives. Expansion of textile industries in China, India, and Southeast Asia increases spandex demand, creating measurable BDO consumption opportunities. Manufacturers investing in advanced fermentation and catalytic processes achieve higher conversion rates, lower energy consumption, and reduced production costs, positioning bio-BDO as a key growth driver in environmentally conscious markets globally.

Key trends in the BDO market include adoption of bio-based production, continuous processing, and integrated chemical manufacturing. Fermentation and catalytic hydrogenation methods allow production of high-purity BDO with yields exceeding 90%, reducing energy usage by 10–15%. Asia Pacific dominates due to large-scale industrial clusters and proximity to raw materials. North America and Europe are focusing on low-emission, energy-efficient plants and specialty BDO derivatives. Integration with downstream production of tetrahydrofuran, polyurethanes, and elastic fibers improves cost-efficiency. Companies are adopting digital process monitoring, predictive maintenance, and automated distillation systems to optimize production. Use of BDO in new polymer applications, adhesives, and high-performance coatings reflects a trend toward functional and sustainable industrial growth.

The 1,4 butanediol market faces challenges from volatile feedstock prices, energy-intensive production, and high capital investment requirements. Fossil-derived BDO production relies on acetylene, butadiene, or formaldehyde, exposing manufacturers to raw material price fluctuations up to 15–20%. Bio-based production requires significant upfront investment in fermentation and catalytic processing infrastructure. Regulatory compliance for emissions and chemical safety in Europe and North America increases operational costs. Supply chain constraints in emerging markets can lead to delays and inconsistent quality. Manufacturers must focus on process optimization, energy efficiency, and feedstock diversification to maintain cost-effectiveness, production reliability, and regulatory compliance while supporting global demand growth.

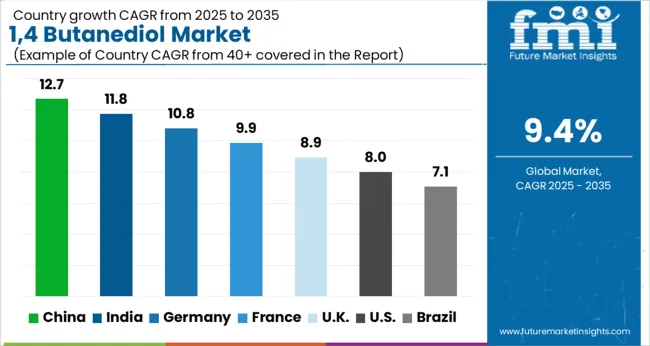

| Country | CAGR |

|---|---|

| China | 12.7% |

| India | 11.8% |

| Germany | 10.8% |

| France | 9.9% |

| UK | 8.9% |

| USA | 8.0% |

| Brazil | 7.1% |

The global 1,4 butanediol market is expected to grow at a CAGR of 9.4% through 2035, fueled by increasing use in polyurethanes, solvents, and chemical intermediates across industrial manufacturing. China leads with a 12.7% growth rate, 1.35× the global average, driven by BRICS-focused chemical production, industrial capacity expansion, and strong export demand. India follows at 11.8%, a 1.25× multiple, reflecting rising domestic chemical manufacturing, industrial adoption, and growing demand for intermediates. Germany records 10.8%, 1.15× the global benchmark, supported by OECD-backed innovation in high-performance chemicals and efficiency-oriented industrial processes. The United Kingdom posts 8.9%, 0.95× the global CAGR, with adoption concentrated in specialty chemicals and industrial applications. The United States stands at 8.0%, 0.85× the benchmark, driven by steady demand in industrial solvents, polyurethanes, and chemical intermediates. BRICS nations contribute the largest market volume, OECD countries focus on advanced production technologies, and ASEAN markets support growth through expanding chemical manufacturing and industrial activity. This report includes insights on 40+ countries; the top markets are shown here for reference.

The 1,4 butanediol market in China is projected to grow at a CAGR of 12.7%, driven by increasing demand from polyurethanes, solvents, and biodegradable plastics. Leading manufacturers such as BASF, LyondellBasell, and local Chinese producers are scaling production using bio-based and petrochemical processes. Adoption is concentrated in industrial chemicals, textiles, automotive, and electronics applications. Technological trends focus on process efficiency, cost reduction, and integration with bio-refinery operations. Government policies supporting industrial modernization, chemical manufacturing, and environmental compliance reinforce market growth. Rising demand for high-performance and sustainable materials accelerates adoption in China.

The 1,4 butanediol market in India is expected to expand at a CAGR of 11.8%, supported by growth in polyurethanes, fibers, solvents, and biodegradable plastic production. Key suppliers such as Reliance Industries, BASF India, and LyondellBasell provide 1,4 butanediol using both petrochemical and bio-based methods. Adoption is concentrated in textiles, automotive components, industrial chemicals, and packaging materials. Technological developments focus on improving yield, process efficiency, and sustainability. Government initiatives promoting industrial modernization, chemical manufacturing, and environmental compliance reinforce market growth. Rising demand for high-performance chemical intermediates accelerates adoption across India.

The 1,4 butanediol market in Germany is projected to grow at a CAGR of 10.8%, supported by demand from polyurethanes, industrial chemicals, and solvents. Leading companies such as BASF, LyondellBasell, and Covestro supply 1,4-butanediol for automotive, textile, and industrial applications. Adoption is concentrated in chemical plants, industrial polymers, and specialty materials. Technological trends focus on bio-based production, process efficiency, and low-emission operations. Government incentives promoting sustainable chemical production, energy efficiency, and environmental compliance reinforce market growth. The increasing demand for high-quality intermediates and eco-friendly materials is accelerating adoption in Germany.

The 1,4 butanediol market in the United Kingdom is projected to grow at a CAGR of 8.9%, driven by demand in polyurethanes, solvents, and industrial chemicals. Key suppliers such as INEOS, BASF, and LyondellBasell provide both petrochemical and bio-based 1,4 butanediol for chemical intermediates, fibers, and packaging applications. Adoption is concentrated in automotive, textiles, and industrial polymers. Technological trends include bio-based production, yield optimization, and low-emission processes. Government policies promoting industrial modernization, chemical safety, and sustainability reinforce market growth. Rising demand for durable and environmentally friendly chemical intermediates supports adoption in the United Kingdom.

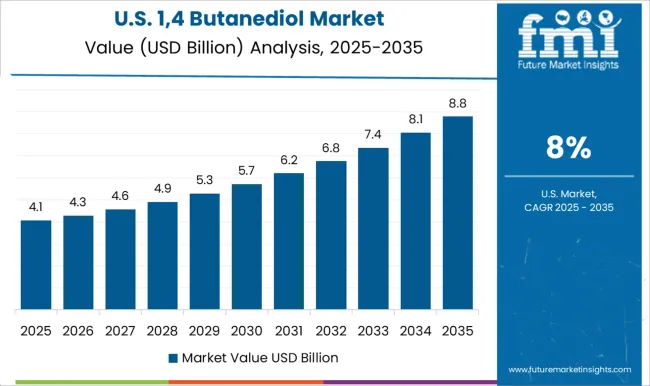

The 1,4 butanediol market in the United States is expected to grow at a CAGR of 8.0%, supported by industrial chemicals, polyurethanes, and solvent applications. Leading manufacturers such as BASF, LyondellBasell, and Arkema supply 1,4 butanediol for automotive, textiles, and industrial polymer applications. Adoption is concentrated in chemical plants, industrial coatings, and specialty materials. Technological trends emphasize bio-based production, process optimization, and emission control. Government initiatives supporting chemical safety, sustainability, and industrial modernization reinforce market adoption. Rising demand for high-performance intermediates supports steady growth in the United States.

Competition in the 1,4 butanediol sector is being driven by high demand across polyurethane, solvent, and plasticizer applications, with companies focusing on product quality, scalability, and process efficiency. BASF SE and Dairen Chemical Corporation are being advanced with high-purity BDO solutions designed for consistent performance in industrial intermediates and polymer production. LyondellBasell Industries Holdings B.V. and Mitsubishi Chemical Corporation are positioned to leverage large-scale production capabilities, offering flexibility in feedstock utilization and process optimization.

Invista and Sipchem are being highlighted with formulations that support polyurethane fiber, solvent, and chemical intermediate applications, ensuring reliability and process efficiency. Nanjing Bluestar Co., Ltd. and The Dow Chemical Company are utilizing innovative manufacturing technologies that enhance purity, reduce energy consumption, and improve process stability. Ashland Global Holdings Inc., Oxea GmbH, and BASF-YPC Company Limited are showcasing specialty grades tailored for industrial coatings, adhesives, and plastics. TCC Group, Formosa Plastics Corporation, International Specialty Products (ISP), and Marubeni Corporation are advancing with customizable solutions to meet diverse regional and industrial demands.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.5 Billion |

| Application | Tetrahydrofuran (THF) Production, Polyurethane (PU) Production, Gamma-Butyrolactone (GBL) Production, Plasticizers and Resins, and Others |

| End-use | Automotive, Construction, Electronics, Textiles and Apparel, Pharmaceuticals, and Chemical industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Dairen Chemical Corporation, LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Corporation, Invista, Sipchem, Nanjing Bluestar Co., Ltd., The Dow Chemical Company, Ashland Global Holdings Inc., Oxea GmbH, BASF-YPC Company Limited, TCC Group, Formosa Plastics Corporation, International Specialty Products (ISP), and Marubeni Corporation |

| Additional Attributes | Dollar sales by product type and end use, demand dynamics across plastics, solvents, and fibers, regional trends in chemical and polymer production, innovation in bio-based and sustainable processes, environmental impact of petrochemical use and waste, and emerging use cases in biodegradable polymers, elastic fibers, and specialty chemicals. |

The global 1,4 butanediol market is estimated to be valued at USD 8.5 billion in 2025.

The market size for the 1,4 butanediol market is projected to reach USD 20.9 billion by 2035.

The 1,4 butanediol market is expected to grow at a 9.4% CAGR between 2025 and 2035.

The key product types in 1,4 butanediol market are tetrahydrofuran (thf) production, polyurethane (pu) production, gamma-butyrolactone (gbl) production, plasticizers and resins and others.

In terms of end-use, automotive segment to command 29.7% share in the 1,4 butanediol market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

MET ex14 Skipping Treatment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA