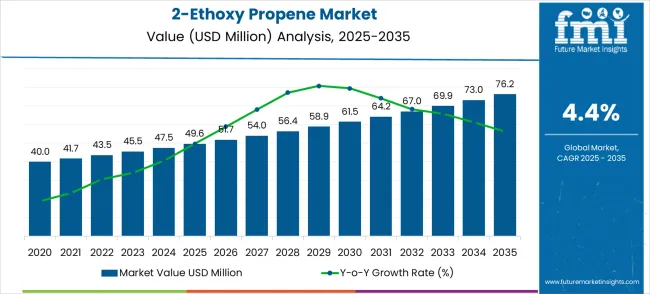

The 2-ethoxy propene market is valued at USD 49.6 million in 2025 and is projected to reach USD 76.2 million by 2035, with a CAGR of 4.4%. Between 2021 and 2025, the market is expected to grow from USD 40.0 million to USD 49.6 million, with incremental values of USD 9.6 million, USD 3.5 million, USD 5.5 million, and USD 7.5 million, respectively. During this period, demand is driven by its use as a solvent and intermediate in the production of specialty chemicals, including adhesives, coatings, and plasticizers. Industrial sectors, particularly those in chemicals and paints, drive steady growth, as 2-ethoxypropene is increasingly used in formulations requiring high purity and low toxicity.

From 2026 to 2030, the market is expected to continue expanding, growing from USD 49.6 million to USD 61.5 million, with intermediate values of USD 51.7 million, USD 54.0 million, USD 56.4 million, and USD 58.9 million. This growth is largely supported by increased adoption in agrochemicals, such as herbicides and pesticides, and continued demand in paints, coatings, and resins. The trend toward environmentally friendly chemicals further accelerates market expansion.

Between 2031 and 2035, the market is projected to progress from USD 61.5 million to USD 76.2 million, passing through USD 64.2 million, USD 67.0 million, USD 69.9 million, and USD 73.0 million. Innovations in formulations and the expansion of industrial usage contribute to the market's long-term growth, positioning 2-ethoxypropene as a key player in the global solvent industry.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 49.6 million |

| Forecast Value in (2035F) | USD 76.2 million |

| Forecast CAGR (2025 to 2035) | 4.4% |

The chemical manufacturing market contributes about 30-35%, as 2-Ethoxy Propene is commonly used as an intermediate in the production of various chemicals, including solvents and polymers. The agriculture and pesticides market adds roughly 20-25%, as the compound is used in the synthesis of herbicides, insecticides, and fungicides, playing a key role in crop protection. The pharmaceuticals market contributes approximately 15-18%, with 2-Ethoxy Propene being utilized in the synthesis of bioactive compounds and pharmaceutical intermediates. The coatings and paints market accounts for about 10-12%, where it is used as a solvent and additive to improve the properties of paints and coatings, particularly for industrial and automotive applications. Finally, the plastics and polymers market supplies about 8-10%, with 2-Ethoxy Propene being used in the production of various polymeric materials, contributing to the development of plastics with improved durability and chemical resistance.

Market expansion is being supported by the increasing global demand for pharmaceutical intermediates and the corresponding need for high-purity chemical compounds that can maintain quality standards and reaction efficiency while enabling complex organic synthesis applications. Modern pharmaceutical manufacturers are increasingly focused on implementing chemical solutions that can reduce synthesis steps, improve reaction yields, and provide consistent quality in drug development and production processes. 2-ethoxy propene's proven ability to deliver synthetic versatility, high purity levels, and efficient reaction capabilities make it an essential intermediate for contemporary pharmaceutical research and specialty chemical manufacturing.

The growing emphasis on drug development and pharmaceutical innovation is driving demand for 2-ethoxy propene that can support complex synthetic pathways, reduce production costs, and enable the development of novel therapeutic compounds. Chemical processors' preference for intermediates that combine synthetic efficiency with quality consistency and cost-effectiveness is creating opportunities for innovative 2-ethoxy propene implementations. The rising influence of precision medicine and personalized therapeutic approaches is also contributing to increased adoption of high-purity chemical intermediates that can provide reliable synthetic building blocks for advanced pharmaceutical applications.

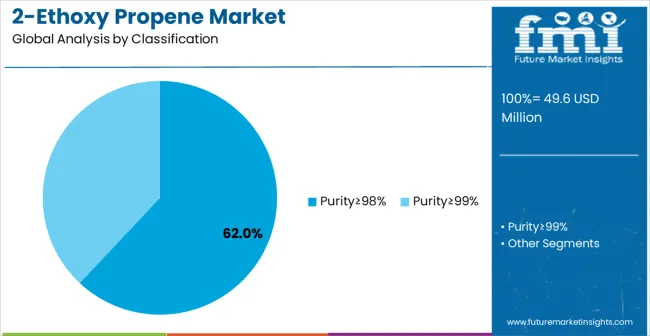

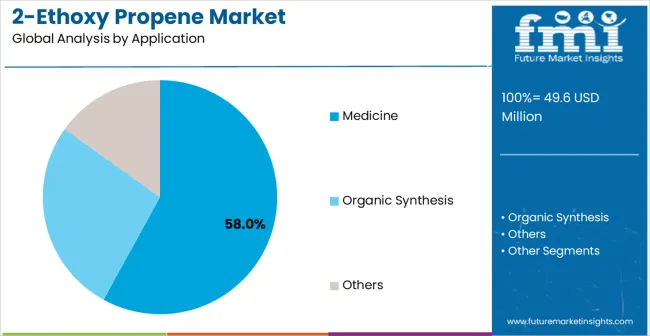

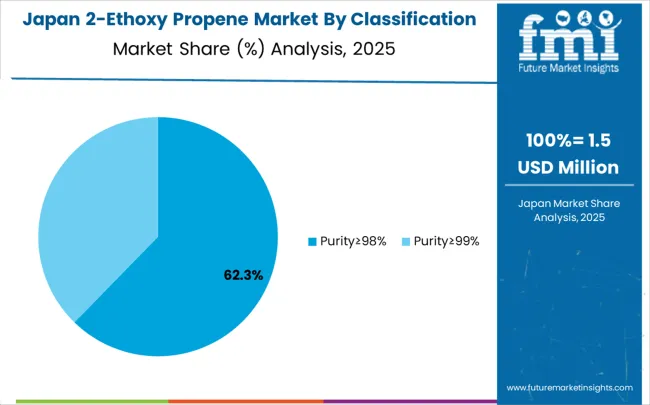

The market is segmented by purity level, application, and region. By purity level, the market is divided into purity≥98%, purity≥99%, and others. Based on application, the market is categorized into medicine and organic synthesis. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The purity≥98% segment is projected to account for 62.0% of the 2-ethoxy propene market in 2025, reaffirming its position as the leading purity category. Pharmaceutical manufacturers increasingly utilize high-purity 2-ethoxy propene for its superior synthetic reliability, consistent reaction performance, and compliance with pharmaceutical manufacturing standards across drug development, intermediate synthesis, and specialty chemical applications. High-purity 2-ethoxy propene technology's advanced processing capabilities and consistent quality output directly address the industrial requirements for reliable synthetic performance and regulatory compliance in pharmaceutical and specialty chemical production.

This purity segment forms the foundation of modern pharmaceutical manufacturing operations, as it represents the grade with the greatest reliability and established market demand across multiple therapeutic categories and synthetic applications. Manufacturer investments in enhanced purification technologies and quality control systems continue to strengthen adoption among pharmaceutical companies. With drug developers prioritizing consistent synthetic outcomes and regulatory compliance, purity≥98% 2-ethoxy propene aligns with both operational efficiency objectives and quality standards, making it the central component of comprehensive pharmaceutical intermediate strategies.

Medicine applications are projected to represent 58.0% of 2-ethoxy propene demand in 2025, underscoring their critical role as the primary industrial consumers of high-purity chemical intermediates for pharmaceutical development and production. Pharmaceutical companies prefer 2-ethoxy propene for its synthetic versatility, reaction efficiency, and ability to enhance drug development processes while reducing synthesis complexity and improving yield consistency. Positioned as essential intermediates for modern pharmaceutical manufacturing, 2-ethoxy propene offers both synthetic advantages and quality benefits.

The segment is supported by continuous innovation in drug development and the growing availability of specialized synthesis technologies that enable premium pharmaceutical production with enhanced therapeutic efficacy. Pharmaceutical manufacturers are investing in supply chain optimization to support high-quality intermediate procurement and regulatory compliance. As personalized medicine demand becomes more prevalent and pharmaceutical innovation requirements increase, medicine applications will continue to dominate the end-user market while supporting advanced synthetic utilization and drug development strategies.

The 2-ethoxy propene market is primarily driven by the rising demand for advanced synthetic intermediates across pharmaceuticals, agrochemicals, and specialty chemical applications. Its role as a reactive intermediate enhances the efficiency of complex organic syntheses, making it highly valuable in drug discovery and fine chemical manufacturing. Increasing investment in pharmaceutical R&D, particularly in the development of high-performance intermediates, is accelerating adoption. Industries are favoring 2-ethoxy propene due to its ability to improve reaction selectivity and consistency, supporting the production of high-purity compounds. The growth of advanced synthesis platforms further underpins market expansion.

Despite strong growth potential, the 2-ethoxy propene market faces significant restraints. Stringent regulatory frameworks surrounding the handling, storage, and application of reactive intermediates create compliance challenges for manufacturers and suppliers. Quality standardization across different regions and suppliers also remains a concern, particularly in pharmaceutical and high-value chemical markets where consistency is non-negotiable. The requirement for advanced purification equipment and specialized infrastructure increases operational costs, limiting participation from smaller producers. Fluctuations in raw material availability and price volatility further add uncertainty, while environmental and safety concerns create additional compliance and investment burdens.

The market is being reshaped by innovation in synthesis and processing technologies. A notable trend is the adoption of advanced purification systems, enabling production of high-purity 2-ethoxy propene with consistent quality performance, which is crucial for pharmaceutical applications. Parallelly, producers are integrating automated production lines and real-time quality monitoring systems to enhance efficiency, reduce waste, and improve supply chain reliability. This digitalization of production processes supports custom synthesis services and premium product positioning. The shift toward green manufacturing practices and tailored intermediates for specialized applications is expected to further strengthen market opportunities.

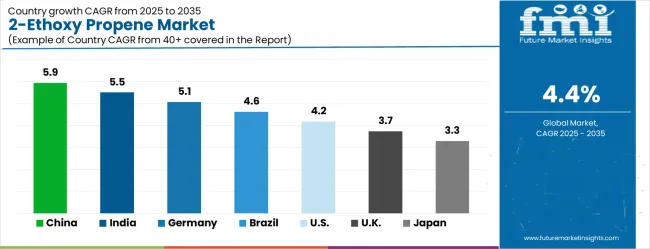

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| Brazil | 4.6% |

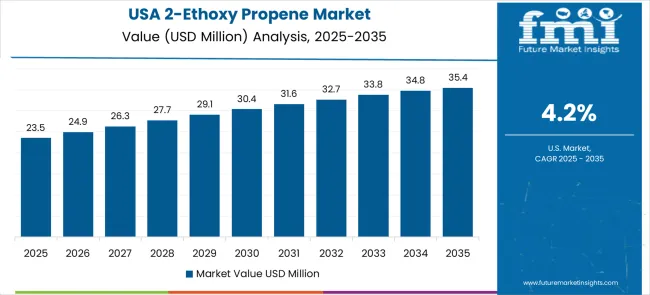

| USA | 4.2% |

| UK | 3.7% |

| Japan | 3.3% |

The 2-ethoxy propene market is experiencing steady growth globally, with China leading at a 5.9% CAGR through 2035, driven by the expanding pharmaceutical manufacturing industry, growing chemical processing capabilities, and significant investment in specialty chemical production infrastructure development. India follows at 5.5%, supported by large-scale pharmaceutical production, advanced chemical manufacturing facilities, and growing domestic demand for pharmaceutical intermediates. Germany shows growth at 5.1%, emphasizing technological innovation and high-purity product development. Brazil records 4.6%, focusing on pharmaceutical industry expansion and specialty chemical market development. The USA demonstrates 4.2% growth, prioritizing pharmaceutical research and premium chemical intermediate supply. The UK exhibits 3.7% growth, emphasizing specialized pharmaceutical applications and European market supply. Japan shows 3.3% growth, supported by advanced pharmaceutical research and synthetic chemistry innovation.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

China leads the global 2-ethoxy propene market, expanding at a robust CAGR of 5.9% through 2035. Growth is fueled by the country’s large-scale pharmaceutical manufacturing sector, expanding specialty chemical production, and increasing investment in advanced synthesis technologies. Government-backed initiatives to modernize the chemical industry are fostering rapid adoption of high-purity intermediates to meet both domestic and export-oriented demand. China’s abundant production capacity and strong cost competitiveness are attracting multinational pharmaceutical and chemical players to establish joint ventures and expand local operations. With the rise of biologics, generics, and specialty pharma, demand for high-performance intermediates like 2-ethoxy propene is increasing. Domestic manufacturers are scaling up advanced purification technologies to achieve consistent product quality, positioning themselves as reliable suppliers in regulated markets such as Europe and North America. Growing environmental and safety regulations are also pushing companies to invest in automated systems and greener production processes. Overall, China’s combination of infrastructure development, strong pharmaceutical demand, and government support is making it the leading global growth hub for 2-ethoxy propene production and consumption.

India is experiencing strong growth in the 2-ethoxy propene market, with revenue projected to expand at a 5.5% CAGR through 2035. The country’s large-scale pharmaceutical industry, particularly its dominance in generics and bulk drug manufacturing, is driving demand for advanced chemical intermediates. India’s extensive supply chain for active pharmaceutical ingredients (APIs) and intermediates ensures steady consumption of 2-ethoxy propene in both domestic and export-oriented drug production. Advanced chemical processing facilities are being established to improve synthesis efficiency, supported by collaborations with international technology providers. The government’s push for pharmaceutical self-sufficiency under “Make in India” and incentives for chemical industry modernization are encouraging local producers to adopt advanced purification and automated synthesis systems. India’s rising domestic demand for high-quality drugs, combined with increasing exports to regulated markets, is spurring demand for high-purity intermediates. Regional pharmaceutical hubs such as Hyderabad, Gujarat, and Maharashtra are emerging as focal points for adoption. With global contract research and manufacturing services (CRAMS) expanding in India, 2-ethoxy propene’s role as a reliable and efficient intermediate is becoming more critical. These dynamics position India as a fast-growing market with strong global competitiveness in the supply of high-quality chemical intermediates.

Germany is emerging as a technological leader in the 2-ethoxy propene market, forecast to grow at a CAGR of 5.1% through 2035. The country’s advanced pharmaceutical and chemical industries are driving strong demand for high-purity intermediates to support innovation and regulatory compliance. Germany’s reputation for precision and quality in chemical production is pushing manufacturers to adopt advanced purification methods and automated production systems. Pharmaceutical companies are emphasizing innovation-driven drug development, which requires intermediates that can deliver efficiency, consistency, and reliability. The nation’s strong research infrastructure, supported by collaborations between academia and industry, is further boosting adoption of high-performance intermediates. Stringent regulatory frameworks within Germany and the broader EU are raising the quality benchmarks for pharmaceutical synthesis, driving investments in high-purity chemical intermediates like 2-ethoxy propene. Companies are increasingly focusing on export competitiveness, targeting high-regulation markets across Europe and North America. S

Green chemistry is gaining traction in Germany, prompting chemical producers to integrate eco-friendly and energy-efficient technologies into synthesis processes. These dynamics make Germany a center of innovation, setting high standards for purity, performance, and regulatory compliance in the global 2-ethoxy propene market.

Brazil is emerging as a key growth market for 2-ethoxy propene, with a forecast CAGR of 4.6% through 2035. Expansion in the pharmaceutical sector, particularly generic drug production, is fueling demand for high-performance intermediates. Brazil’s specialty chemical industry is also gaining traction, supported by growing investments in modern chemical manufacturing infrastructure. Increasing domestic demand for pharmaceuticals, coupled with a strengthening export base to Latin America, is driving adoption of 2-ethoxy propene in synthesis applications. Manufacturers are exploring advanced purification technologies to ensure compliance with international quality standards, enabling greater participation in global supply chains. Government incentives to strengthen healthcare access and pharmaceutical production are encouraging local manufacturers to invest in chemical synthesis capabilities. While regulatory complexity and infrastructure gaps remain challenges, multinational companies are establishing partnerships with Brazilian firms to expand local capabilities. Overall, Brazil is leveraging its strong pharmaceutical base and rising specialty chemical industry to increase adoption of advanced intermediates like 2-ethoxy propene, positioning itself as a regional hub in Latin America.

The United States market for 2-ethoxy propene is set to grow steadily at a 4.2% CAGR through 2035, driven by a robust pharmaceutical research ecosystem and demand for premium intermediates in drug discovery and specialty applications. The country’s advanced biotechnology and pharmaceutical industries require high-purity chemical inputs, making 2-ethoxy propene a vital synthesis component. USA companies are heavily investing in automated production systems and advanced purification technologies to achieve regulatory compliance and maintain consistency in high-value markets. Demand is further supported by the expansion of contract research and manufacturing services (CRAMS), which rely on efficient intermediates to serve both domestic and international clients. The emphasis on innovation in drug development and the rise of biologics and targeted therapies are creating opportunities for advanced intermediates. Strong intellectual property protections and high R&D investment levels support adoption. Environmental and safety regulations encourage producers to adopt cleaner and more efficient synthesis processes, raising the technological benchmark for the industry. The USA remains a premium market, prioritizing reliability, consistency, and innovation in 2-ethoxy propene production and supply.

The United Kingdom’s 2-ethoxy propene market is projected to expand at a 3.7% CAGR through 2035, supported by its advanced pharmaceutical sector and strong focus on specialized applications. The UK emphasizes niche pharmaceutical and research-driven applications, where high-purity intermediates are essential. Demand is also shaped by the nation’s role as a supplier to the broader European pharmaceutical market, requiring consistent quality and regulatory alignment with EU standards. Growth is supported by investments in research institutions and collaborations between pharmaceutical companies and academia to develop innovative synthesis methods. The UK’s contract manufacturing sector is also contributing to demand, as companies seek intermediates that enhance efficiency and scalability. However, challenges such as Brexit-related supply chain adjustments and regulatory divergence could impact supply consistency. Despite these hurdles, emphasis on precision, compliance, and research-driven adoption positions the UK as a stable but specialized market. Long-term opportunities lie in expanding its role in advanced drug synthesis and high-value specialty chemicals.

The 2-ethoxy propene market in Japan is forecast to grow at a steady CAGR of 3.3% through 2035, reflecting the nation’s focus on advanced pharmaceutical research and innovation in synthetic chemistry. Japan’s pharmaceutical sector emphasizes high-precision drug development and specialty formulations, where consistent and high-purity intermediates are critical. Growth is also supported by strong investments in R&D and collaborations between pharmaceutical companies and universities. Japan’s chemical industry is known for innovation in synthetic methods, and adoption of advanced intermediates like 2-ethoxy propene aligns with the country’s high standards for product quality. While overall market growth is more moderate compared to emerging Asian economies, Japan’s demand is characterized by sophistication and premium positioning. Companies are adopting automated synthesis systems and green chemistry practices to improve efficiency and align with goals. The aging population and rising healthcare needs are expanding pharmaceutical demand, indirectly supporting greater adoption of chemical intermediates.

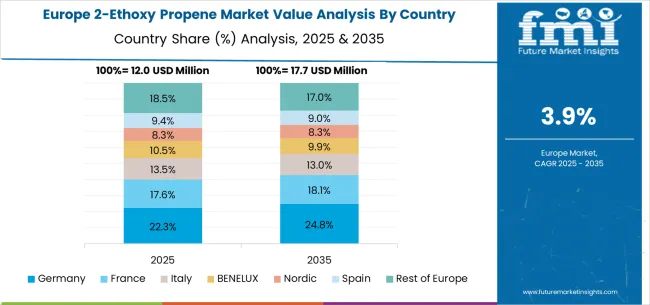

The 2-ethoxy propene market in Europe is projected to grow from USD 12.4 million in 2025 to USD 19.1 million by 2035, registering a CAGR of 4.4% over the forecast period. Germany is expected to maintain its leadership position with a 28.0% market share in 2025, slightly increasing to 28.5% by 2035, supported by its strong pharmaceutical industry, advanced chemical processing facilities, and comprehensive specialty chemical supply network serving major European markets.

United Kingdom follows with a 22.0% share in 2025, projected to reach 22.2% by 2035, driven by robust demand for pharmaceutical intermediates in drug development, specialty chemical production, and research applications, combined with established pharmaceutical research capabilities incorporating high-purity chemical intermediates. France holds a 18.0% share in 2025, expected to increase to 18.3% by 2035, supported by strong pharmaceutical demand but facing competitive pressures from other European suppliers. Italy commands a 15.0% share in 2025, projected to reach 15.2% by 2035, while Spain accounts for 8.0% in 2025, expected to reach 8.1% by 2035. Switzerland maintains a 4.5% share in 2025, growing to 4.6% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Netherlands, Belgium, and Austria, is anticipated to maintain momentum, keeping its collective share stable from 4.5% to 4.1% by 2035, attributed to steady pharmaceutical activities in Nordic countries and growing chemical processing activities across Eastern European markets implementing modernization programs.

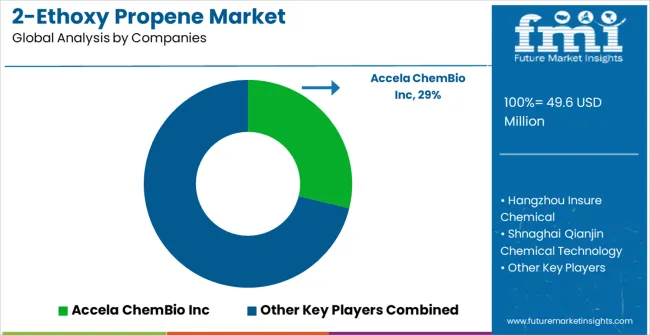

The 2-ethoxy propene market is characterized by competition among established chemical manufacturers, specialized pharmaceutical intermediate suppliers, and integrated synthesis technology providers. Companies are investing in advanced purification technology research, supply chain optimization, quality control systems, and comprehensive product portfolios to deliver consistent, high-quality, and cost-effective 2-ethoxy propene solutions. Innovation in synthesis processes, purification technologies, and custom manufacturing services is central to strengthening market position and competitive advantage.

Accela ChemBio Inc leads the market with a strong market share, offering comprehensive chemical intermediate solutions with a focus on pharmaceutical applications and research supply. Hangzhou Insure Chemical provides specialized synthesis capabilities with an emphasis on high-purity production and quality assurance. Shanghai Qianjin Chemical Technology delivers innovative chemical intermediate solutions with a focus on pharmaceutical applications and synthetic versatility. Kaiyue Chemical specializes in specialty chemical production and pharmaceutical intermediate supply. Hubei Xinkang Pharmaceutical Chemical focuses on pharmaceutical-grade chemical intermediates and integrated quality systems. Ruiya Shengwu offers specialized chemical products with emphasis on pharmaceutical applications and synthetic chemistry. Wuhan Fortuna Chemical provides comprehensive chemical intermediate solutions with focus on pharmaceutical and specialty chemical markets.

The 2-ethoxy propene market underpins pharmaceutical R&D, specialty chemical synthesis, and advanced manufacturing processes. With rising regulatory scrutiny, demand for high-purity intermediates, and increasing integration of automation, the sector faces pressure to deliver consistent quality, supply reliability, and compliance with environmental responsibility requirements. Coordinated engagement from governments, industry bodies, technology providers, suppliers, and investors is essential to accelerate innovation, strengthen quality assurance, and ensure eco-conscious growth across global markets.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 49.6 Million |

| Purity Level | Purity≥98%, Purity≥99%, Others |

| Application | Medicine, Organic Synthesis |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, India, Brazil, and 40+ countries |

| Key Companies Profiled | Accela ChemBio Inc, Hangzhou Insure Chemical, Shanghai Qianjin Chemical Technology, Kaiyue Chemical, Hubei Xinkang Pharmaceutical Chemical, Ruiya Shengwu, and Wuhan Fortuna Chemical |

| Additional Attributes | Dollar sales by purity level and application category, regional demand trends, competitive landscape, technological advancements in synthesis systems, purification innovation, pharmaceutical applications development, and supply chain optimization |

North America

Europe

Asia Pacific

Latin America

Middle East & Africa

The global 2-ethoxy propene market is estimated to be valued at USD 49.6 million in 2025.

The market size for the 2-ethoxy propene market is projected to reach USD 76.2 million by 2035.

The 2-ethoxy propene market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in 2-ethoxy propene market are purity≥98% and purity≥99%.

In terms of application, medicine segment to command 58.0% share in the 2-ethoxy propene market in 2025.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA