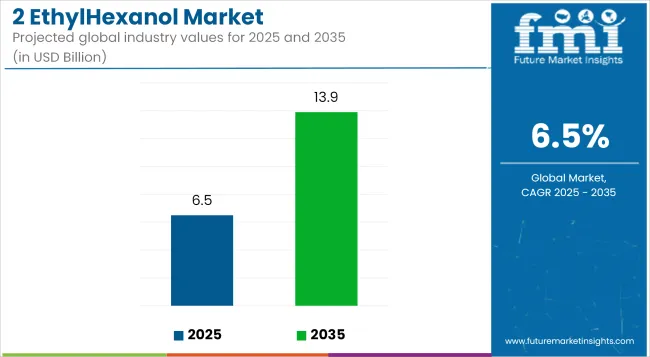

The global 2-ethylhexanol (2-EH) market is projected to grow from USD 6.5 billion in 2025 to USD 13.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5%. Growth is supported by continued demand for 2-EH as a key intermediate in the production of plasticizers, coatings, adhesives, and synthetic lubricants.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 6.5 Billion |

| Market Size (2035) | USD 13.9 Billion |

| Compound Annual Growth Rate (CAGR) | 6.5% |

2-EH serves as an essential raw material in the production of di(2-ethylhexyl) phthalate (DEHP) and other plasticizers used in polyvinyl chloride (PVC) applications. These plasticizers are widely applied in construction materials, automotive components, and wire and cable insulation. Expanding infrastructure development and rapid urbanization across Asia-Pacific and the Middle East are increasing consumption of flexible PVC and associated 2-EH derivatives.

The automotive industry is contributing to steady demand, with 2-EH-based plasticizers being used in interiors, seals, and underbody protection materials. Lightweight, durable, and weather-resistant components produced with 2-EH additives are being adopted to meet evolving design and performance standards. In the building sector, 2-EH is used in flooring systems, wall coverings, and construction sealants, where flexibility and thermal stability are critical.

In the coatings and adhesives segments, 2-EH is incorporated into acrylates and other monomers for high-performance architectural and industrial coatings. These applications benefit from 2-EH's role in enhancing gloss, durability, and flow characteristics. Demand for environmentally compliant coatings has led to a shift toward water-based and low-VOC formulations, where 2-EH remains relevant due to its compatibility with green chemistry frameworks.

Technological advancements are improving downstream formulation efficiency, and research efforts are being directed toward producing 2-EH using bio-based feedstocks. Early-stage initiatives focused on biomass conversion and microbial fermentation are being explored to reduce dependency on fossil-derived n-butyraldehyde.

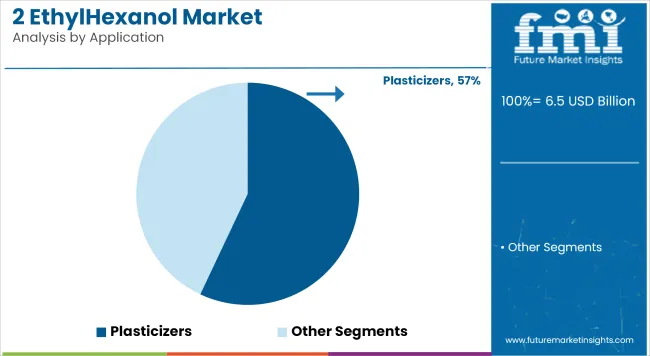

The plasticizers segment is projected to account for approximately 57% of the global 2-ethylhexanol (2-EH) market share in 2025 and is expected to grow at a CAGR of 6.4% through 2035. 2-EH is a key precursor in the synthesis of phthalate and non-phthalate plasticizers such as dioctyl phthalate (DOP) and dioctyl terephthalate (DOTP), which are used to impart flexibility and durability to polyvinyl chloride (PVC) products.

These plasticizers are widely applied in cables, flooring, wall coverings, and synthetic leather. As construction and automotive sectors expand across emerging markets, and manufacturers transition to safer, high-performance formulations, the demand for 2-EH in plasticizer production continues to rise steadily.

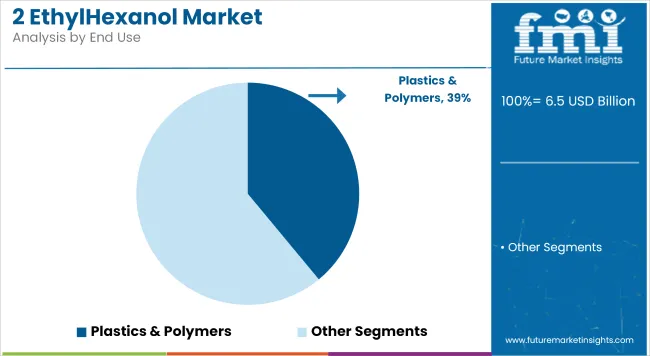

The plastics and polymers segment is estimated to hold approximately 39% of the global 2-ethylhexanol market share in 2025 and is forecast to grow at a CAGR of 6.6% through 2035. 2-EH is used as an intermediate in producing plasticizer-enhanced compounds and acrylic esters that improve flexibility, impact resistance, and processing characteristics of thermoplastics.

It supports the production of film-grade resins, synthetic rubbers, and specialty coatings. The growing use of modified polymer blends in construction materials, consumer goods, and automotive components reinforces steady consumption. With sustainability and material performance becoming central to product development, 2-EH’s role in advanced polymer systems continues to be critical across global value chains.

Raw Material Price Volatility: Fluctuations in the cost of propylene and synthesis gas can really mess with your bottom line; making it difficult to sustain relatively stable prices or margins

Stringent Regulations: Current environmental regulations and the demand for safety mean that costs will rise as technology must capitulate; parts of production could be replaced with transporting still others halfway around town instead.

Emerging Market Potential: Rapid industrialisation along the East China Sea as well as in Latin America offer fresh market opportunities of all kinds for construction and automotive use.

Technological Advancements: More efficient manufacturing processes coupled with bio-derived feed stocks types now promise easier and cheaper production of 2-EH, as well as sustainability.

USA 2-EH market is rising moderately behind the expanding end-use demand for 2-EH plasticizers, improved application possibilities in fuel additives, and the robust expansion in motor vehicle and construction uses.

Building activities such as infrastructure construction and the building of residences are significant drivers of demand for multi-purpose PVC products such as cabling, flooring, and pipes based on 2-EH plasticizers. ExxonMobil, Eastman Chemical, and OQ Chemicals are increasing production to produce 2-EH as they attempt to meet the growing demand in the region.

In addition to the motor vehicle industry, which includes General Motors, Ford, and Tesla, 2-EH-based coatings, adhesives, and lubricants are being used more and more to increase car performance and lifespan. Lightness and electric vehicle (EV) boom stimulate production of high-performance 2-EH-based products.

The market for fuel additives is also growing with ongoing applications of 2-EH-based 2-ethylhexyl nitrate (2-EHN) as a cetane diesel fuel additive to attain optimal engine performance and fuel economy.

With growing use in plasticizers & coatings, growing use as fuel additives, and other automobile & construction applications, USA market for 2-EH will grow incrementally.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.1% |

UK 2-EH market is rising moderately due to the move towards non-phthalate plasticizers, rising demand for environmental coatings and growing use in specialty chemicals.

Britain's tough environmental regulations, especially under REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals), are forcing industries to switch towards green plasticizers from 2-EH alternatives. Building and packaging industries are leading the demand for low-VOC plasticizers and flexible PVC products, which is driving 2-EH consumption.

The automobile industry, some of whose representatives include Jaguar, Land Rover and Aston Martin, is embracing technology-intensive coatings and lubricants with the use of 2-EH formulation that promote the efficiency and the durability of the car.

Apart from this, the increasing development of specialty chemicals, such as industrial cleaning chemicals, coatings, and performance solvents, is driving the market demand correspondingly.

Since non-phthalate plasticizers are attracting more investment, growing in the coatings industry, and growing in specialty chemical uses, the UK 2-EH market will grow steadily.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.0% |

The market of the European Union 2-Ethylhexanol (2-EH) is growing modestly due to increased plasticizer demand, increased application in the area of coatings and adhesives, and increasing application in the construction and automotive sectors.

2-EH is one of the raw materials with greatest application in the production of dioctyl phthalate (DOP) plasticizers, 2-EH acrylate, and 2-EH nitrate, all which find widespread applications in the polyvinyl chloride (PVC) processing industry, paints, and fuel additives.

EU emphasis upon greenery and strict environment regulation within the scenario of greenification problems through virtue of REACH is also becoming prevalent within the market under the veil of greener reduction of emissions trend fuel and plasticizer trend. 2-EH manufacturing from natural raw material is also taking shape in the form of a line of the future considering regulator pressure for carbon footprint avoidance and fossil fuel burn avoidance.

Moreover, Germany, France, and Italy's construction and automotive industries are boosting 2-EH-based adhesives, coatings, and lubricants demand. The EU green energy transition also supports the adoption of 2-EH nitrates for diesel fuel additives to increase efficiency and decrease emissions.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.3% |

The Japanese 2-EH market is expanding steadily due to increasing high-performance coatings, increased automobile industry demand, and increasing use of green plasticizers.

The Japanese automobile industry, led by Toyota, Honda, and Nissan, is finding 2-EH-based coatings and resins to a larger extent in response to contributing lightweight, corrosion protection, and durability applications. Fuel-efficient car demand growth and also EVs similarly drive demand for performance-enhancing coatings and adhesives.

The coatings and paint industry, dominated by companies like Kansai Paint and Nippon Paint, is significantly utilizing 2-EH-based resins to industrial and protection coatings. Soaring demand from sustainable formulation markets, smart-coatings markets, and scratch resistant coating markets is driving the acceptability of the market.

Apart from that, Japan's emphasis on sustainability is encouraging investment in bio-based plasticizers and non-phthalate plasticizers as alternatives to 2-EH to decrease the reliance on traditional plasticizers.

Since demand for motor vehicle coatings, application of biodegradable plasticizers, and heavy investment in specialty chemicals is increasing, the Japanese market for 2-EH will grow steadily.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

The South Korean 2-EH market is growing well on the back of increasing application in high-performance lubricants & coatings, growing EV battery manufacturing, and growing applications in adhesives & resins.

South Korean electronics and automotive sector, led by Samsung, LG, and Hyundai, are driving the application of 2-EH-based products in protective coatings, lubricants, and adhesives. The use of resins from 2-EH is also being increasingly utilized to create foldable mobile phones, OLED display panels, and motor parts that are lighter.

SK Innovation and LG Energy Solution are leading the EV battery market to implement 2-EH-based performance chemicals and coatings for improving battery insulation and lifespan.

In addition, the construction and packaging industries in South Korea are increasingly consuming 2-EH-based sealants and plasticizers, fuelling applications in the marketplace.

South Korean 2-EH will also exhibit a healthy growth rate, spurred by increasing EV battery coatings demand, increasing investment in lubricants & adhesives, and increasing application of specialty chemicals.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

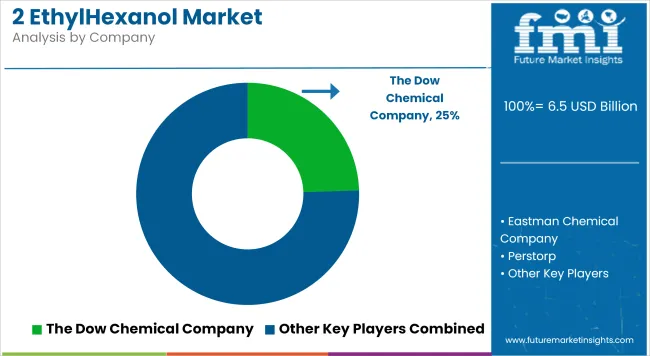

The 2-EH market remains competitive, with regional production concentrated in countries housing integrated petrochemical complexes, including China, Germany, South Korea, and the United States. Supply chain security and fluctuations in raw material pricing are shaping procurement strategies, prompting producers to increasingly focus on backward integration and strategic partnerships.

These efforts aim to ensure a steady supply of key feedstock chemicals like propylene and butyraldehyde. The market outlook for 2-EH remains positive, driven by its versatility and essential role in high-growth downstream industries, positioning it as a critical component in various sectors.

The overall market size for 2-EH Market was USD 6.5 Billion in 2025.

The 2-EH Market is expected to reach USD 13.9 Billion in 2035.

The demand for the 2-Ethylhexanol (2-EH) market will be driven by its increasing use in plasticizers, coatings, and lubricants, especially in the construction and automotive industries. Growing demand for flexible PVC, industrial solvents, and rising infrastructure projects will further propel market growth.

The top 5 countries which drives the development of 2-EH Market are USA, UK, Europe Union, Japan and South Korea.

Phthalate and 2-EH Acrylate Drive Market to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA