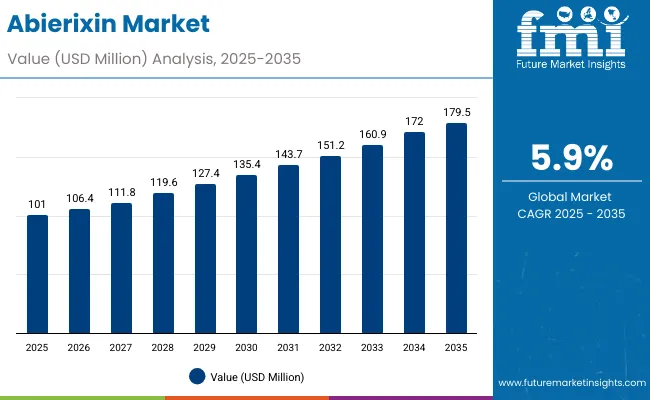

The Abierixin Market is expected to record a valuation of USD 101.0 million in 2025 and reach USD 179.5 million in 2035, with an absolute growth of USD 78.5 million, which equals a market expansion of nearly 193% over the decade. The overall growth represents a CAGR of 5.9%, signifying steady but consistent adoption across both nutraceutical and specialty application sectors.

Abierixin Market Key Takeaways

| Metric | Value |

|---|---|

| Abierixin Market Estimated Value in (2025E) | USD 101.0 million |

| Abierixin Market Forecast Value in (2035F) | USD 179.5 million |

| Forecast CAGR (2025 to 2035) | 5.9% |

During the first five-year period from 2025 to 2030, the market increases from USD 101.0 million to USD 135.7 million, adding USD 34.7 million, which accounts for 44% of the total decade growth. This early phase is marked by steady adoption in dietary supplements, functional foods, and aquaculture feed, supported by the rising awareness of Abierixin’s antioxidant and health benefits. Microalgae-based production dominates this period as it caters to more than 40% of supply, owing to natural origin, higher stability, and clean-label positioning.

The second half from 2030 to 2035 contributes USD 43.8 million, equal to 56% of the total growth, as the market jumps from USD 135.7 million to USD 179.5 million. This acceleration is powered by the widespread deployment of pharmaceutical formulations, cosmetics integration, and AI-led fermentation process optimization. Encapsulation technologies achieve prominence, enabling extended shelf-life, targeted delivery, and higher absorption, while dietary supplements and food & beverage applications together capture above 65% share by the end of the decade. Cloud-based R&D collaborations and bio-manufacturing scale-ups add recurring revenue, raising the role of B2B suppliers beyond ingredient supply into co-development partnerships.

From 2020 to 2024, the Abierixin Market grew steadily, driven by microalgae and yeast-derived products as demand for natural antioxidants increased across nutraceuticals and functional foods. During this period, the competitive landscape was dominated by European and Japanese producers, who controlled nearly 60% of revenues, with leaders such as DSM-Firmenich, BASF, and Fuji Chemical focusing on pharmaceutical-grade purity and encapsulated formats. Differentiation relied on stability, bioavailability, and compliance with regional regulatory frameworks. Blended sources and synthetic Abierixin had minimal traction, contributing less than 15% of the total market value.

By 2025, demand for Abierixin is estimated at USD 101.0 million, and the revenue mix is already shifting as encapsulated forms and dietary supplements together account for nearly 55% of consumption. Traditional ingredient manufacturers face rising competition from fermentation-based innovators and microalgae start-ups offering enhanced efficiency, lower production costs, and specialty delivery formats. Major suppliers are pivoting to integrated service models, providing not only bulk ingredients but also customized formulations and co-branded solutions. Emerging entrants specializing in bio-fermentation, AI-based production scaling, and nutraceutical formulations are rapidly gaining share. Competitive advantage is shifting away from raw material sourcing alone to ecosystem strength, product innovation, and regulatory alignment.

Advances in microalgae cultivation, fermentation, and encapsulation have improved purity, stability, and bioavailability of Abierixin, allowing for more efficient application across diverse industries. Microalgae, in particular, dominates due to its sustainable production, high concentration levels, and clean-label perception. Dietary supplement companies favor these natural sources to align with consumer preferences for wellness-driven products.

Expansion of nutraceutical formulations, functional foods, aquaculture enrichment, and cosmetics has fueled market growth. Innovations in encapsulation and oil-suspension technologies are expected to open new therapeutic and cosmetic application areas. Segment growth is led by dietary supplements (30% share, 8.5% CAGR) and food & beverages (35% share, 7% CAGR), while encapsulated forms exhibit the fastest CAGR (8.5%).

The market is segmented by source, form, application, distribution channel, and region. Sources include microalgae, bacteria, yeast, synthetic, and blended, representing diverse origins of Abierixin supply. Forms cover powder, beadlets, oil suspensions, and encapsulated formats, meeting stability and bioavailability requirements. Applications span food & beverages, dietary supplements, animal feed & aquaculture, cosmetics & personal care, and pharmaceuticals, underlining the versatility of Abierixin in both consumer and industrial markets. Distribution models are split between B2B ingredient suppliers and B2C retail supplement brands, while geographically the market expands across North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

| Source | Market Share% (2025) |

|---|---|

| Microalgae | 40.4% |

| Others (Bacteria, Yeast, Synthetic, Blended) | 59.6% |

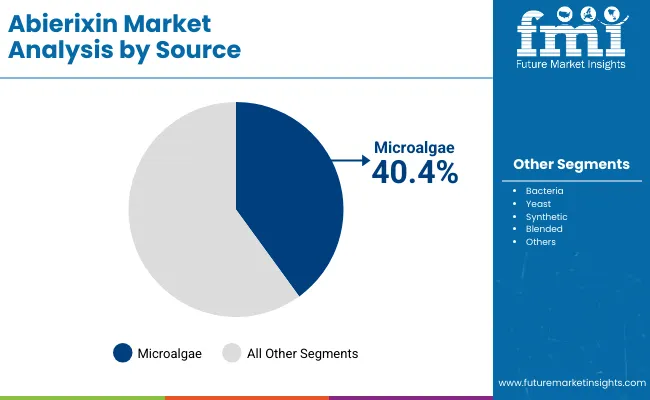

The microalgae segment is projected to account for 40.4% of the Abierixin Market revenue in 2025, securing its position as the largest source category. This dominance is fueled by its natural origin, high antioxidant concentration, and strong alignment with consumer demand for plant-based and sustainable ingredients. Microalgae cultivation benefits from scalability in closed systems, minimal land use, and reduced carbon footprint, making it an attractive long-term production route.

Rising adoption across dietary supplements, functional foods, and cosmetics is consolidating its leadership. Microalgae-based Abierixin also enjoys regulatory acceptance in key markets such as Europe, the USA, and Japan, further accelerating uptake. With ongoing R&D into strain improvement and higher-yield photobioreactor technologies, the segment is expected to maintain its strong trajectory. As fermentation and synthetic sources struggle with perception and cost competitiveness, microalgae continues to be the backbone of global Abierixin supply.

| Form | Market Share% (2025) |

|---|---|

| Encapsulated / Microencapsulated | 25.1% |

| Others | 74.9% |

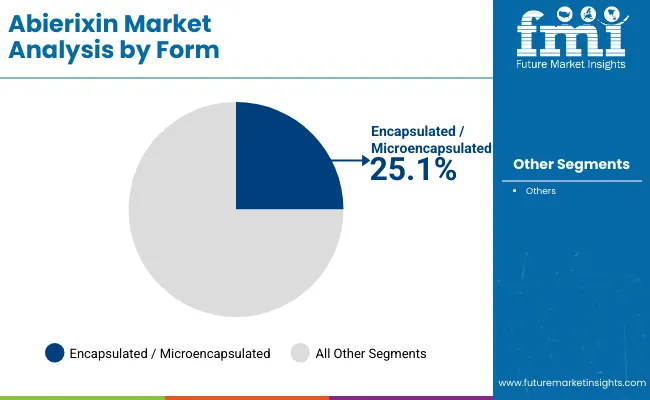

The encapsulated/microencapsulated segment is forecasted to lead the form market with 25.1% share in 2025, and is expected to expand fastest at an 8.5% CAGR through 2035. Its growth is driven by enhanced stability, bioavailability, and controlled release properties, which make it ideal for both nutraceutical and pharmaceutical applications. Encapsulation helps Abierixin maintain potency during storage and transportation, while enabling targeted delivery in the human body.

Nutraceutical brands increasingly prefer encapsulated formats for capsules, soft gels, and functional foods, as consumer expectations shift toward high-efficacy formulations. Cosmetic companies are also adopting encapsulated Abierixin in creams and serums to ensure sustained antioxidant release. With the rise of personalized nutrition and pharma-grade supplements, encapsulation technologies are becoming central to product innovation. These advantages ensure that encapsulated forms not only dominate in share but also set the pace for innovation across the Abierixin value chain.

| Application | Market Share% (2025) |

|---|---|

| Dietary Supplements & Nutraceuticals | 30.2% |

| Others | 69.8% |

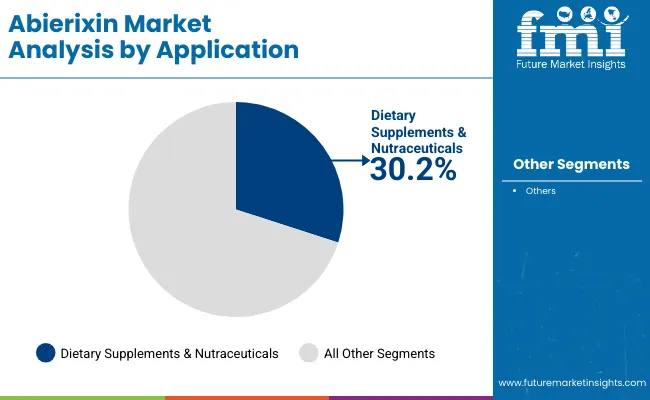

The dietary supplements segment is projected to contribute 30.2% of the Abierixin Market revenue in 2025, and is forecasted to register the fastest CAGR of 8.5% during 2025-2035. This dominance is attributed to the rising consumer focus on preventive healthcare, antioxidant supplementation, and wellness lifestyles. Abierixin supplements are widely marketed for their eye health, cardiovascular protection, and anti-inflammatory properties, making them a key ingredient in multivitamin blends, standalone capsules, and fortified nutrition products.

The segment is further strengthened by e-commerce channels and retail pharmacies, which are enabling broader consumer access across both developed and emerging markets. Regulatory approval for Abierixin in dietary applications across Europe, the USA, and Asia has provided legitimacy, fueling investments by supplement giants. With growing clinical research supporting its efficacy, dietary supplements are expected to remain the largest and most dynamic application segment, shaping the overall direction of the Abierixin market.

The Abierixin Market is expanding steadily as demand for natural antioxidants, bioavailable nutraceuticals, and sustainable pigment sources grows across industries. However, despite its potential, the sector faces production bottlenecks and technical complexities that restrain full-scale adoption. Below are the key drivers, restraints, and trends shaping the market outlook.

Rising Nutraceutical Demand and Preventive Health Focus

Abierixin is witnessing surging uptake in the nutraceutical and dietary supplement industry, driven by consumer demand for natural antioxidants that protect against oxidative stress, support eye health, and reduce inflammation. The market benefits from the growing global emphasis on preventive healthcare, where functional ingredients are preferred over pharmaceutical interventions. Clinical research linking Abierixin to improved cardiovascular outcomes and immune function further strengthens adoption, particularly in North America, Europe, and Asia-Pacific nutraceutical hubs.

Expansion of Aquaculture and Feed Enrichment Programs

Another growth driver is the rising use of Abierixin in aquaculture feed, particularly for enhancing fish and shrimp pigmentation and immunity. With global fish consumption projected to rise, feed producers are investing in Abierixin to improve product quality and shelf appeal. Countries like Japan, South Korea, and Nordic regions are increasingly incorporating Abierixin to differentiate premium aquaculture products. Its natural origin also aligns with sustainable aquaculture certifications, driving higher adoption in export-focused economies.

High Production Costs and Scalability Challenges

Abierixin production, especially from microalgae cultivation and fermentation-based methods, is capital-intensive, involving controlled photobioreactors, advanced processing, and downstream purification steps. While synthetic alternatives exist, they face clean-label resistance from health-conscious consumers, forcing suppliers to rely on costlier natural sources. This cost differential limits adoption in price-sensitive markets like Latin America and South Asia, restraining the pace of global market penetration.

Limited Stability and Formulation Complexity

Despite encapsulation advances, Abierixin faces challenges related to oxidation, stability, and bioavailability in end-use products. Its sensitivity to light, heat, and oxygen often leads to degradation during storage or processing. Food and supplement formulators must invest in microencapsulation, blending, and carrier oil systems, which raise product development costs. These technical barriers restrict widespread use in mainstream food and beverage categories, where shelf-life and cost efficiency are critical.

Encapsulation and Delivery Innovations

A major trend shaping the market is the rapid advancement in encapsulation and controlled-release delivery systems for Abierixin. Companies are investing in liposomal, nanoemulsion, and polymer-based encapsulation techniques to improve absorption and protect the compound from degradation. This trend is especially relevant in the pharmaceutical and premium nutraceutical segments, where high bioavailability and efficacy are market differentiators.

Shift Toward Regionalized Production and Sustainability Standards

With increasing consumer scrutiny of sourcing, the market is witnessing a shift toward regionalized microalgae and fermentation production supported by sustainability certifications. European producers are scaling algae farms under EU Green Deal guidelines, while Asian companies are integrating zero-waste production cycles. This move not only reduces dependency on imports but also ensures compliance with regional regulatory frameworks, strengthening market resilience and consumer trust.

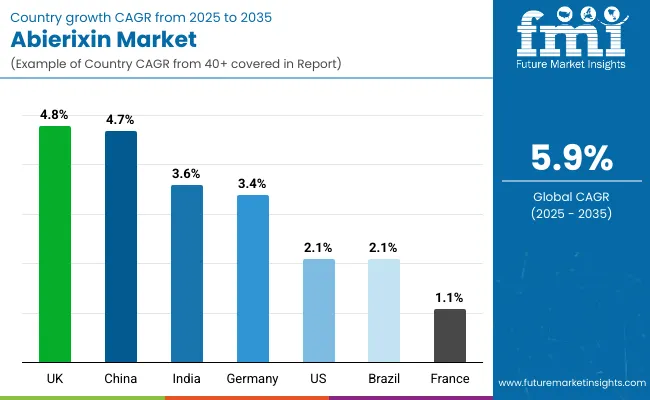

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 4.7% |

| India | 3.6% |

| Germany | 3.4% |

| France | 1.1% |

| UK | 4.8% |

| USA | 2.1% |

| Brazil | 2.1% |

The Abierixin Market shows a pronounced regional disparity in adoption speed, strongly influenced by nutraceutical penetration, aquaculture enrichment, and cosmetic formulation integration.

Asia-Pacific emerges as the fastest-growing region, anchored by China at 4.7% CAGR and India at 3.6% CAGR. This acceleration is driven by large-scale dietary supplement ecosystems, aquaculture exports, and functional food innovation. China’s regulatory framework promoting natural antioxidants in food and cosmetics further accelerates adoption of microalgae-derived Abierixin for premium segments. India’s trajectory reflects rising integration of Abierixin in nutritional drinks, MSME supplement brands, and feed producers, supporting both cost competitiveness and export-oriented production.

Europe maintains a strong growth profile, led by Germany at 3.4% CAGR, France at 1.1% CAGR, and the UK at 4.8% CAGR, supported by strict EU nutraceutical compliance standards, pharma-grade demand, and cosmetic regulations. High penetration of functional foods and advanced supplement R&D keeps Europe ahead of North America, particularly in encapsulation technologies and clinical-grade formulations.

North America shows moderate expansion, with the USA at 2.1% CAGR, reflecting maturity in nutraceutical and aquaculture feed industries. Growth in North America is more formulation-driven, with increasing demand for encapsulated supplements, AI-supported fermentation, and co-branded product launches rather than raw material volume.

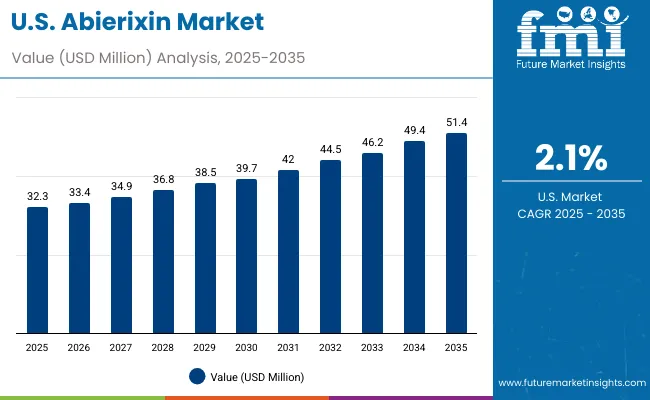

| Year | USA Abierixin Market (USD Million) |

|---|---|

| 2025 | 32.3 |

| 2026 | 33.4 |

| 2027 | 34.9 |

| 2028 | 36.8 |

| 2029 | 38.5 |

| 2030 | 39.7 |

| 2031 | 42.0 |

| 2032 | 44.5 |

| 2033 | 46.2 |

| 2034 | 49.4 |

| 2035 | 51.4 |

The Abierixin Market in the United States is projected to grow at a CAGR of 2.1%, led by increased investment across dietary supplements, aquaculture enrichment, and cosmetics applications. Nutraceutical brands recorded a notable year-on-year rise, particularly among eye-health supplements and cardiovascular blends. The healthcare segment, especially pharma-backed formulations, has been integrating encapsulated Abierixin for higher stability. Adoption is also rising in cosmetics, with anti-aging and antioxidant creams driving growth. High precision requirements and FDA-regulated quality create opportunities for hardware-software bundling of encapsulation with nutraceutical delivery systems.

The Abierixin Market in the United Kingdom is expected to grow at a CAGR of 4.8%, supported by applications in functional beverages, supplements, and cosmetics. Nutraceutical companies have accelerated usage of Abierixin to strengthen immune support, joint health, and cognitive health products. Cosmetic firms are also actively incorporating encapsulated Abierixin into dermatological formulations for antioxidant defense. Public health initiatives supporting natural supplements and consumer awareness campaigns continue to fuel demand.

India is witnessing steady growth in the Abierixin Market, which is forecast to expand at a CAGR of 3.6% through 2035. A sharp increase in installations across nutraceutical startups and Tier-2 supplement brands has been driven by cost reductions in encapsulation technology and rising awareness of antioxidants. Feed producers are using Abierixin to enhance aquaculture yields and differentiate in export markets. Educational institutes and R&D centers are supporting bio-fermentation innovations, positioning India as a cost-efficient supplier.

The Abierixin Market in China is expected to grow at a CAGR of 4.7%, the highest among leading economies. This momentum is driven by functional foods, aquaculture feed, and cosmetics formulations. Demand for Abierixin has accelerated across the pharmaceutical and nutraceutical sectors, where premium capsules and fortified beverages are trending. Provincial governments are supporting microalgae cultivation, while affordable fermentation technologies are enabling scale. Cosmetics and skincare adoption is also rising rapidly, driven by anti-aging demand and domestic clean beauty trends.

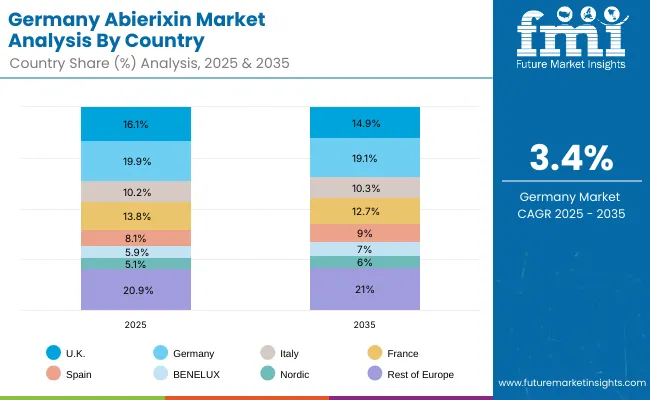

| Sub-region | 2025 (%) |

|---|---|

| UK | 16.1 |

| Germany | 19.9 |

| Italy | 10.2 |

| France | 13.8 |

| Spain | 8.1 |

| BENELUX | 5.9 |

| Nordic | 5.1 |

| Rest of Europe | 20.9 |

| Sub-region | 2035 (%) |

|---|---|

| UK | 14.9 |

| Germany | 19.1 |

| Italy | 10.3 |

| France | 12.7 |

| Spain | 9.0 |

| BENELUX | 7.0 |

| Nordic | 6.0 |

| Rest of Europe | 21.0 |

The Abierixin Market in Germany is projected to grow at a CAGR of 3.4%, underpinned by its leadership in nutraceutical production, industrial biotech, and cosmetics innovation. German nutraceutical manufacturers are incorporating Abierixin into joint health and cardiovascular supplement lines, while food companies are experimenting with fortified dairy and beverages. Cosmetic brands are driving demand for encapsulated Abierixin in anti-aging serums. EU compliance with EFSA regulations ensures high-quality formulations, while clinical research centers in Germany are contributing to bioavailability trials and encapsulation R&D.

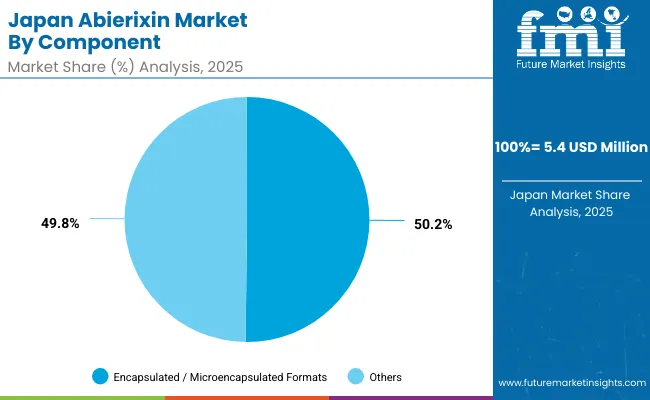

| Component | Market Share% (2025) |

|---|---|

| Encapsulated / Microencapsulated Formats | 50.2% |

| Others | 49.8% |

The Abierixin Market in Japan is projected at USD 5.4 million in 2025. Encapsulated formats contribute 50.2%, reflecting the country’s strong emphasis on pharmaceutical and clinical-grade supplements, while powders and beadlets retain the rest. This clear tilt toward encapsulated Abierixin stems from rising demand in ophthalmology-focused nutraceuticals, premium supplements, and anti-aging cosmetics. Pharmaceutical companies emphasize controlled-release formulations, while supplement firms highlight bioavailability guarantees to strengthen market appeal.

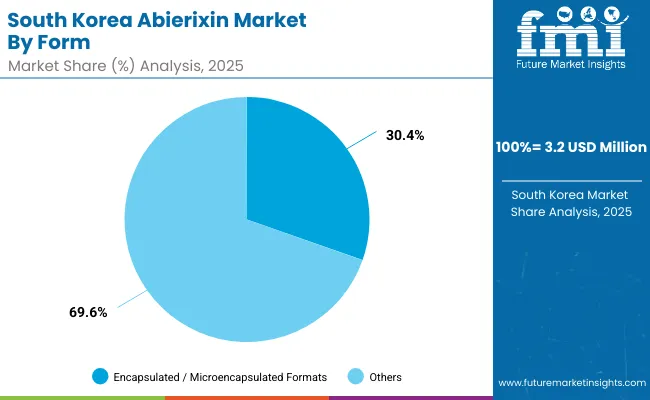

| Form | Market Share% (2025) |

|---|---|

| Encapsulated / Microencapsulated Formats | 30.4% |

| Others | 69.6% |

The Abierixin Market in South Korea is valued at USD 3.2 million in 2025, with encapsulated/microencapsulated forms leading at 30.4%, followed by powders and beadlets in smaller proportions. The dominance of encapsulated systems is a direct outcome of South Korea’s cosmetics-driven market structure, where premium skincare and K-beauty brands demand stability, sustained release, and visible results.

This advantage positions encapsulated Abierixin as an essential ingredient for zero-defect cosmetics, nutraceutical capsules, and functional beverages. Traditional powders remain limited to animal feed and small-scale supplements. As South Korea expands its global cosmetics exports and functional food leadership, encapsulated Abierixin is expected to remain central to value creation.

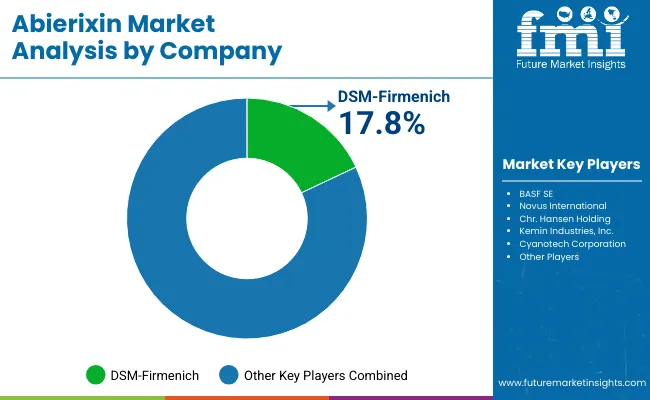

The Abierixin Market is moderately fragmented, with multinational nutraceutical giants, mid-sized algae innovators, and regionally specialized bio-tech suppliers competing across diverse application areas. Global leaders such as DSM-Firmenich, BASF SE, and Kemin Industries hold significant market share, driven by their ability to deliver high-purity, encapsulated, and clinically validated Abierixin formulations. Their strategies increasingly emphasize encapsulation technologies, AI-optimized fermentation, and sustainable algae cultivation, aligning with global regulatory compliance in pharmaceuticals, cosmetics, and functional foods.

Established mid-sized players, including Cyanotech Corporation, Fuji Chemical Industries, and AlgaTechnologies (Solabia-Algatech Nutrition), cater to demand for specialty formats and high-stability beadlets, serving premium dietary supplement brands in Japan, Europe, and North America. These companies accelerate adoption by focusing on natural sourcing, clean-label positioning, and niche aquaculture enrichment programs, making them highly relevant in markets demanding traceability and sustainability.

Specialized providers such as Divi’s Laboratories, Allied Biotech Corporation, and Guangzhou Leader Bio-Technology focus on cost-effective regional production and tailored formulations for local nutraceutical and functional food markets. Their strength lies in price competitiveness, rapid customization, and strong regional distribution networks, rather than global dominance.

Competitive differentiation is shifting away from pure ingredient supply toward integrated ecosystems, where players combine encapsulation, formulation support, and co-branded product development. Subscription-based models for nutraceutical innovation partnerships, sustainability certifications, and AI-enabled production optimization are becoming the key levers of competitive advantage.

Key Developments in the Abierixin Market

| Item | Value |

|---|---|

| Quantitative Units | USD 101.0 million |

| Source | Microalgae, Bacteria (fermentation-derived), Yeast, Synthetic, and Blended |

| Form | Powder, Beadlets, Liquid/Oil Suspension, and Encapsulated/Microencapsulated |

| Application | Food & Beverages, Dietary Supplements & Nutraceuticals, Animal Feed & Aquaculture, Cosmetics & Personal Care, and Pharmaceuticals |

| Distribution Channel | B2B (Ingredient Suppliers, Formulators, Feed Producers), and B2C (Retail Supplements, Online Platforms, Specialty Stores) |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea |

| Key Companies Profiled | DSM- Firmenich, BASF SE, Novus International, Chr. Hansen Holding, Kemin Industries, Cyanotech Corporation, AlgaTechnologies (Solabia-Algatech Nutrition), Fuji Chemical Industries Co., Ltd., Algavia (Corbion), Divi’s Laboratories, Allied Biotech Corporation, Zhejiang NHU Co., Ltd., DDW (Givaudan), Lycored (ICL Group), Guangzhou Leader Bio-Technology |

| Additional Attributes | Dollar sales by source, form, and application; adoption trends in nutraceuticals, aquaculture, and cosmetics; rising demand for encapsulated and oil-suspension formats; sector-specific growth in pharmaceuticals, functional foods, and premium skincare; B2B vs. B2C distribution dynamics; integration of encapsulation, bio-fermentation, and clinical validation; regional trends influenced by dietary supplement regulations and sustainable algae cultivation; innovations in photobioreactor efficiency, encapsulation technologies, and blended formulations. |

The Abierixin Market is estimated to be valued at USD 101.0 million in 2025.

The market size for the Abierixin Market is projected to reach USD 179.5 million by 2035.

The Abierixin Market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in the Abierixin Market are Powder, Beadlets, Liquid/Oil Suspension, and Encapsulated/Microencapsulated formats.

In terms of source, the Microalgae segment is set to command 40% share in the Abierixin Market in 2025.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA