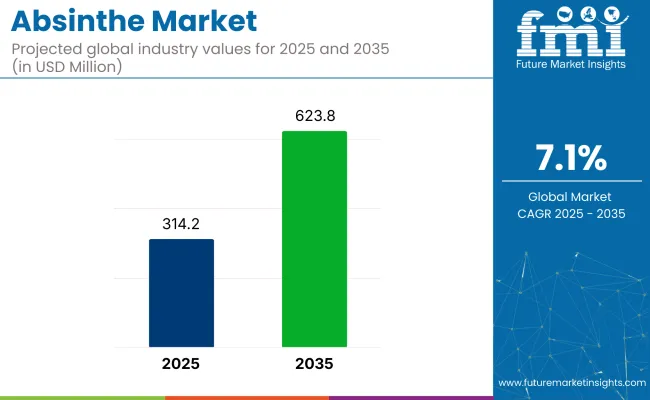

The absinthe market is valued at USD 314.2 million in 2025, with a CAGR of 7.1% the industry is projected to reach USD 623.8 million in 2035. The industry is steadily gaining momentum as consumers shift toward premium, unique alcoholic beverages.

| Attributes | Description |

|---|---|

| Estimated Size (2025E) | USD 314.2 million |

| Projected Value (2035F) | USD 623.8 million |

| Value-based CAGR (2025 to 2035) | 7.1% |

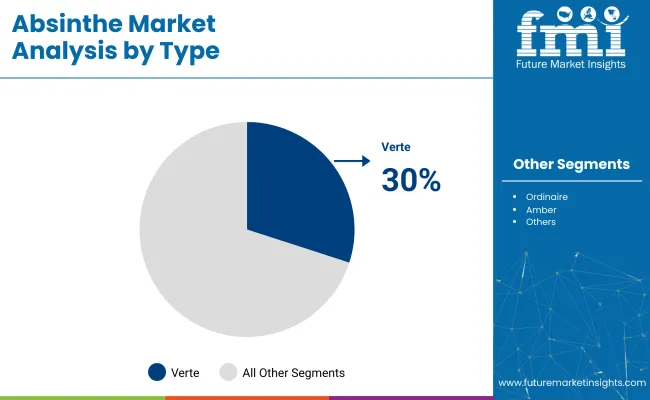

With a growing preference for artisanal and craft spirits, absinthe-especially Verte absinthe-continues to dominate due to its rich historical legacy and its strong presence in global industries. As consumers seek distinctive drinking experiences, absinthe is increasingly popular in upscale cocktails and flavored spirits, fueling growth in the food and beverage industry.

North America and Europe are expected to remain key industries, but emerging regions like China are also showing potential for growth. The industry’s expansion is being driven by a rising interest in both traditional and innovative spirits. This trend is expected to continue as absinthe garners more attention from millennials and connoisseurs looking for a unique drinking experience.

In a 2024 interview with The Guardian, Max Venning, co-owner of the London-based bar group Three Sheets, highlighted the growing popularity of absinthe, stating, “People are always looking for new things, and it’s great to see customers embracing the dry anise spirits-including absinthe, pastis and raki. The strong flavour can be a lot, but when used in the right quantities, it adds a great depth to drinks.”

The industry holds a niche yet distinctive share within its parent markets. In the broader spirits market, it accounts for approximately 1-2%, as it is a specialty spirit compared to more mainstream options like vodka and whiskey. Within the alcoholic beverages market, its share is even smaller, around 0.5%, reflecting its unique positioning and limited production in comparison to beer and wine.

In the premium alcohol market, absinthe's share is higher, contributing around 3-5%, particularly for high-end and aged varieties. In the craft alcohol market, absinthe has a growing presence, holding about 5-7%, driven by the rise of artisanal distilleries. In the herbal and botanical beverages market, it holds a niche share of about 2-3%, popular for its distinct herbal ingredients and flavor profile.

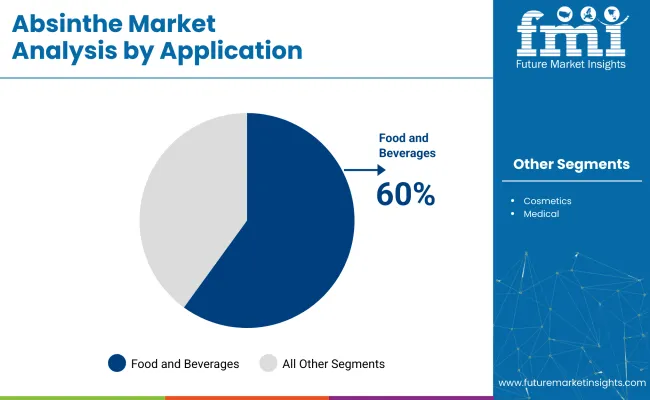

The industry is driven by Verte, projected to hold 30% of the industry share, and the food and beverages industry, which will lead the application segment with 60% industry share in 2025. These segments are key drivers of the industry's growth.

Verte is expected to hold the largest share of the industry, with a 30% share in 2025. Known for its distinctive green color and rich herbal flavors, Verte is the most popular type of Absinthe and is often associated with the traditional and iconic image of the spirit.

It is widely consumed in Europe and North America, where it is favored for its authenticity and complexity. As demand for premium and classic spirits continues to rise, Verte will maintain its strong position in the industry, especially among consumers who prefer its bold, aromatic profile.

The food and beverages industryis projected to dominate theindsutry, capturing 60% of the industry share in 2025. Absinthe is gaining popularity in the cocktail industry, especially in craft and artisanal cocktails, where its unique flavor profile is highly valued. Absinthe is increasingly being used in high-end bars and restaurants, which further drives its consumption.

As consumers continue to seek new and exciting drinking experiences, Absinthe’s role in the food and beverage industry will continue to expand, making it a staple in premium cocktail menus worldwide. The versatility of Absinthe in both classic and modern cocktail recipes plays a crucial role in its dominance in this segment.

The sector is being fueled by a rising consumer preference with craft and boutique alcoholic drinks, coupled with an expanding appetite for exclusive, top-tier spirits. Market challenges such as restrictive regulations and fierce rivalry from alternative spirit categories could constrain growth in particular markets.

Rising Consumer Demand for Premium and Artisanal Spirits

The industry is witnessing robust growth as discerning consumers increasingly gravitate toward premium and artisanal spirits. Absinthe, with its distinctive and complex flavor profile, is becoming a sought-after choice for individuals seeking unique drinking experiences.

As the craft cocktail culture expands, Absinthe is gaining a foothold in upscale bars, fine-dining establishments, and home mixology. Particularly in North America and Europe, where the premium spirits trend is thriving, consumers are willing to invest in quality and authenticity. This surge in interest for bespoke and high-quality liquors is set to drive Absinthe's prominence in the global spirits market.

Regulatory Challenges and Intense Competition from Mainstream Spirits

Despite the growing interest, the industry faces substantial barriers due to stringent regulatory frameworks in several key regions. In industries like the USA and parts of Europe, where Absinthe’s association with prohibition-era histories remains, regulatory hurdles limit its availability.

Absinthe must contend with formidable competition from mainstream spirits such as whiskey, vodka, and gin-beverages with broader consumer acceptance and larger industry shares. These factors, combined with regulatory complexities, could hinder Absinthe's growth, particularly in industries where established liquor categories dominate.

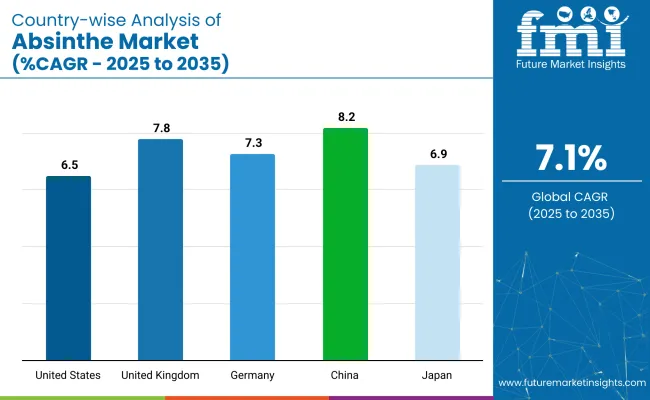

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.5% |

| United Kingdom | 7.8% |

| Germany | 7.3% |

| China | 8.2% |

| Japan | 6.9% |

The global craft spirits market is expected to grow at a CAGR of 7.1% from 2025 to 2035. In the OECD region, the United States shows steady growth with a CAGR of 6.5%, driven by rising demand for premium and craft spirits.

The United Kingdom follows with a slightly higher CAGR of 7.8%, benefitting from increasing consumer interest in artisanal and historical spirits, with absinthe becoming a notable segment. Germany, also within the OECD, experiences stable growth at 7.3%, fueled by a strong preference for traditional spirits and the growing cocktail culture.

Among the ASEAN countries, Japan shows moderate growth with a CAGR of 6.9%, supported by a growing trend for unique international spirits, driven by its sophisticated consumer base. Within BRICS, China leads the way with the highest growth rate of 8.2%, driven by the rising popularity of Western-style spirits and an expanding middle class. India, with its emerging middle class, is also expected to show robust growth, although specific projections for India are not provided here.

While the OECD countries show consistent growth, ASEAN and BRICS regions, especially China, emerge as the fastest-growing markets, reflecting the increasing role of emerging economies in shaping the global craft spirits industry. The report includes an in-depth analysis of over 40 countries, with a focus on the top-performing nations from the OECD, ASEAN, and BRICS regions.

The United States is projected to grow at a CAGR of 6.5% in the industry. Premium craft spirits are increasingly in demand, and Absinthe is benefiting from this trend as consumers look for distinctive, high-quality alcoholic beverages. The craft cocktail scene in the USA is booming, and Absinthe’s complex flavor profile is finding a place in sophisticated cocktail menus.

However, regulatory challenges regarding alcohol content and historical restrictions still influence industry dynamics. The USA continues to lead as one of the largest industries for Absinthe, with increasing retail and online sales platforms expanding its reach.

The United Kingdom is set to grow at a CAGR of 7.8% in the industry. As the spirit culture in the UK thrives, consumers are increasingly seeking unique, artisanal liquors like Absinthe, which offers a rich, herbal taste and an exciting experience in mixed drinks.

The premium liquor segment is expanding, with independent distilleries playing a crucial role in educating consumers about Absinthe’s history and complex flavors. The UK’s steady demand for distinctive, high-quality drinks further supports the industry’s growth, although competitive alcoholic beverages from vodka and gin continue to challenge its expansion.

Germany is expected to grow at a CAGR of 7.3% in the industry. German consumers are embracing premium spirits and unique liquors as part of the growing trend for higher-quality alcohol. Absinthe is gradually gaining acceptance, particularly in craft cocktail bars and specialty liquor stores.

The demand for unique alcoholic beverages, alongside Germany’s growing spirits culture, provides a strong foundation for Absinthe’s growth. The broader German preference for traditional drinks like beer and schnapps presents a challenge for Absinthe to carve out a larger industry share.

China is expected to grow at a CAGR of 8.2% in the industry. The increasing demand for premium spirits in China, is opening doors for unique alcohols like Absinthe. While wine and beer dominate, younger generations are experimenting with spirits, leading to higher consumption of niche options like Absinthe.

Despite the strong competition from local spirits, such as baijiu and vodka, Absinthe is seen as a premium alternative, especially among affluent consumers. E-commerce platforms are playing a key role in increasing Absinthe’s visibility and availability.

Japan is projected to grow at a CAGR of 6.9% in the industry. Japanese consumers’ growing appreciation for premium imported liquors and craft spirits has driven an increased interest in Absinthe, especially among connoisseurs and enthusiasts. Absinthe is often associated with high-end cocktails, which are increasingly popular in Tokyo’s luxury bars and restaurants.

However, traditional Japanese spirits such as sake and whisky continue to dominate the local industry. Absinthe’s growth potential will depend on how well it can appeal to Japanese consumers’ evolving tastes for premium, imported drinks and its increasing availability in specialty retail outlets and bars.

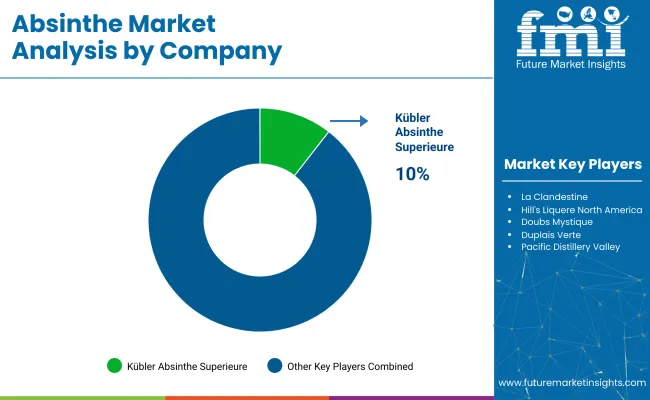

Theindustry features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as Kübler Absinthe Superieure, La Fée Absinthe, and Lucid Absinthe Supérieure lead the industry with extensive product portfolios, strong brand recognition, and robust distribution networks across North America and Europe.

Key players including La Clandestine, Hill's Liquere North America, and Doubs Mystique offer specialized absinthe products tailored to specific consumer preferences and regional industries. Emerging players, such as DuplaisVerte, Pacific Distillery, and Alandia GmbH & Co. KG, focus on innovative formulations and premium offerings, expanding their presence in the growing industry.

Recent Industry Developments

| Report Attributes | Details |

|---|---|

| Estimated Industry Size (2025E) | USD 314.2 million |

| Projected Industry Size (2035F) | USD 623.8 million |

| Value-based CAGR (2025 to 2035) | 7.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and million liters for volume |

| Application Segmentation | Food and Beverages Industry, Cosmetics Industry, Medical Industry |

| Type Segmentation | Blanche, Amber, Verte , Ordinaire , Reve Pastis, Bohemian, Liqueur, Premium |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players Influencing the Industry | La Fée Absinthe, Lucid Absinthe Supérieure , Kübler Absinthe Superieure , La Clandestine, Hill's Liquere North America, Doubs Mystique, Duplais Verte , Pacific Distillery, Alandia GmbH & Co. KG, Butterfly Absinthe, Jade Liqueurs LLC, Philadelphia Distilling Company, Teichenne S.A., Milan METELKA a.s , RUDOLF |

| Additional Attributes | Dollar sales by application type, product type, and region, growing interest in premium and artisanal absinthe products, regional trends in alcohol consumption, increasing adoption of absinthe in culinary and cocktail applications, e-commerce growth in spirits sales. |

The industry is segmented into blanche, amber, verte, ordinaire, reve pastis, bohemian, liqueur, and premium.

The industry is segmented into food and beverages industry, cosmetics industry, and medical industry.

The industry is segmented into North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, and the Middle East & Africa.

The industry size is estimated to be USD 314.2 million in 2025 and USD 623.8 million by 2035.

The expected CAGR is 7.1% from 2025 to 2035.

Kübler Absinthe Superieure is the leading company in the industry, holding a 10% industry share.

China has the highest CAGR in the industry at 8.2%.

The projected CAGR for the United States is 6.5% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA