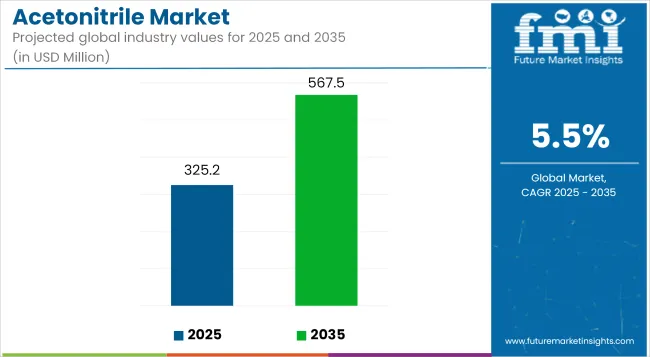

The global acetonitrile market is estimated to reach USD 325.2 million in 2025 and expand to USD 567.5 million by 2035, registering a CAGR of 5.5% during the forecast period. Growth is being driven by consistent demand from pharmaceutical, agrochemical, analytical, and energy storage industries.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 325.2 million |

| Industry Value (2035F) | USD 567.5 million |

| CAGR (2025 to 2035) | 5.5% |

Acetonitrile is being widely utilized as a polar aprotic solvent due to its high solvency power, low viscosity, and chemical stability. Its use in high-performance liquid chromatography (HPLC) is supporting extensive pharmaceutical research and drug quality testing. As drug synthesis, formulation, and regulatory testing increase globally, the consumption of HPLC-grade solvents such as acetonitrile is being accelerated.

In the pharmaceutical sector, acetonitrile is being applied during the manufacture of Active Pharmaceutical Ingredients (APIs) and intermediates. Its compatibility with advanced analytical techniques and bioassay systems is reinforcing its position as a preferred solvent in pharmaceutical laboratories and manufacturing facilities.

In agrochemical production, acetonitrile is being incorporated into pesticide and herbicide formulation processes. The compound is playing a role in purification and crystallization during downstream processing. With rising agricultural output targets and increasing regulatory focus on precise formulation quality, demand for high-purity solvents is increasing across agrochemical manufacturing hubs.

In the electronics sector, acetonitrile is being adopted in lithium-ion battery production. It is serving as a solvent component in electrolyte formulations, where its dielectric properties and low moisture content contribute to improved battery performance. The expansion of electric vehicle manufacturing and grid-scale energy storage systems is contributing to higher usage of battery-grade acetonitrile.

Production innovations are focusing on reducing environmental impact by developing bio-based routes to acetonitrile and implementing sustainable solvent recovery systems. Emerging green chemistry protocols are influencing procurement and refining processes in response to global chemical safety directives.

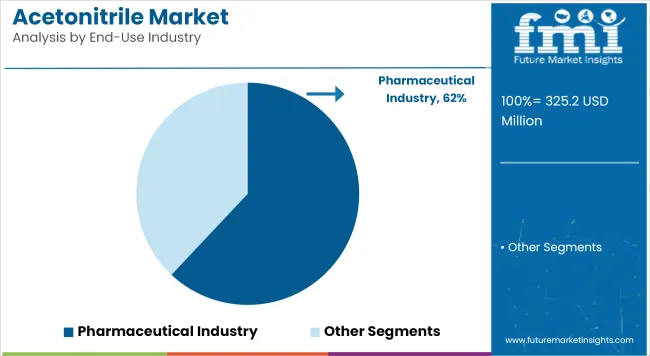

The pharmaceutical segment is estimated to account for approximately 62% of the global acetonitrile market share in 2025 and is projected to grow at a CAGR of 5.6% through 2035. Acetonitrile is widely used in the production of active pharmaceutical ingredients (APIs), serving as a critical solvent for reaction processes, crystallization, and HPLC analysis.

Its low viscosity, high elution strength, and miscibility with water and organic solvents make it indispensable in pharmaceutical purification and separation. As global drug production scales up-especially for generic drugs, oncology treatments, and vaccines-demand for high-purity acetonitrile is growing across manufacturing hubs in Asia-Pacific and North America. Manufacturers are also expanding capacity to meet rising requirements for cGMP-compliant solvents in regulated markets.

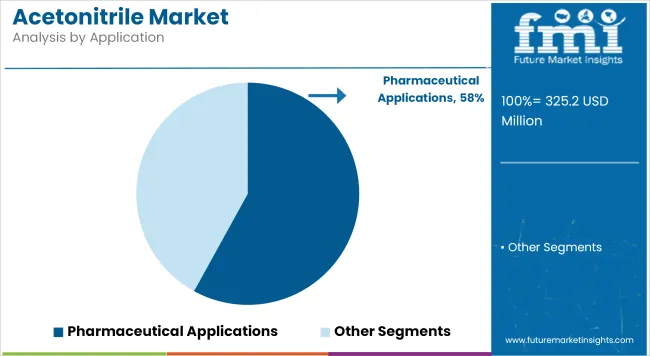

Pharmaceutical applications are projected to hold approximately 58% of the global acetonitrile market share in 2025 and are expected to grow at a CAGR of 5.7% through 2035. Acetonitrile is used throughout drug discovery, formulation development, and quality control processes, particularly in high-performance liquid chromatography (HPLC) systems.

Its ability to dissolve a wide range of compounds and deliver precise analytical performance supports its extensive use in pharmaceutical laboratories and quality assurance programs. In addition to large-scale synthesis, acetonitrile plays a central role in clinical trial material validation and bioanalytical assays. With increasing regulatory scrutiny on solvent residues and analytical accuracy, demand for pharmaceutical-grade acetonitrile continues to rise in tandem with global drug development activity.

Raw Material Availability & Price Volatility

Acetonitrile is made as the by-product of acrylonitrile production, which makes the availability of acetonitrile directly dependent on the market for acrylonitrile. Thus, fluctuations in production capacity and feedstock availability have caused supply crunch and price fluctuation. Furthermore, geopolitical issues, residual trade restrictions, and supply chain disruptions have also impacted uninterrupted availability of acetonitrile for end-use industries.

Environmental & Safety Regulations

Greater regulatory pressure on the chemical industry to reduce solvent emissions and implement green practices. As a VOC you have to treat acetonitrile and it has to be treated and the environment is sucked out of the regulations. Compliance to emission control and above all, the development of Alternative Solvents are the issues burning question for the market players.

Health & Safety Risks

Acetonitrile is also toxic and flammable, posing an acute health & safety risk. This drives additional safety measure need and operational, cost to industrials and end-users. Stricter workplace safety standards also could further restrict acetonitrile use in some applications and boost demand for safer substitutes.

Rising Demand from Pharmaceutical & Biotechnology Industries

Acetonitrile is primarily consumed by the pharmaceutical industry, especially as a solvent in high-performance liquid chromatography (HPLC), drug formulation, and drug synthesis. Growing investments in drug discovery, biopharmaceuticals, and clinical research is likely to sustain the demand for high-purity acetonitrile. The increase of biotech hubs and government backing for pharmaceutical R&D will further accelerate the market.

Expansion of Lithium-Ion Battery & Semiconductor Applications

The shift toward electric vehicles and renewable energy has driven exponential demand for lithium-ion batteries. One such important solvent, acetonitrile, permits the enhancement of electrolyte and battery technology. Acetonitrile is one of the leading candidates, because it features in both the chemical plant and the pharmaceutical factories (the electronics industry uses ultra-pure acetonitrile to clean and etch processes) and is also a front-line next-generation electronics.

Development of Sustainable & Bio-Based Alternatives

Acetonitrile producers come up under mounting regulator and brand pressure to lower their environmental footprint, driving a trend towards bio-based & sustainable production routes for this unique chemical platform.

Green approaches (e.g. how to use new solvents) are emerging and can encourage reporting of less toxic and/or environmentally friendly acetonitriles (or derivatives) with relatively less environmental footprint. Companies investing in sustainable production processes are likely to gain a competitive edge in the evolving market landscape.

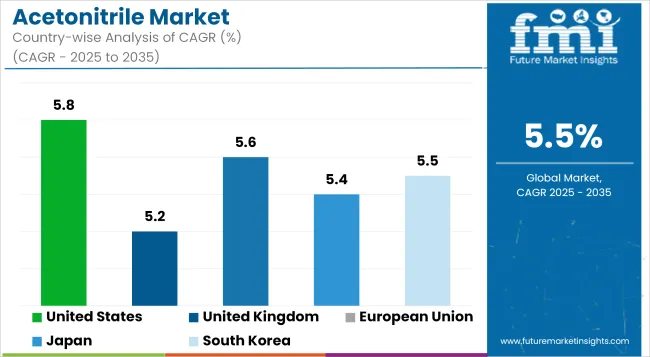

Furthermore, the acetonitrile market in the United States is growing because of the booming pharmaceutical and biotechnology sector, that are some end-users of high-purity acetonitrile. Market growth is primarily driven by the increasing demand by the analytical-grade solvent for high-performance liquid chromatography (HPLC) and DNA synthesis purposes.

Furthermore, demand is also being driven by improvements in agrochemicals and chemical synthesis processes. The strong market growth can be attributed to the large number of established chemical manufacturers and strict regulatory frameworks governing solvent purity and environmental safety. Further growth will be fueled by increased R&D spending in synthetic chemistry and biopharmaceuticals. Increasing R&D in synthetic chemistry and biopharmaceuticals will continue to support growth in the coming years.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.8% |

The acetonitrile market in the UK is also growing and is mostly attributed to the growing use of acetonitrile in pharmaceuticals and chemicals in the country. A growing emphasis on analytical applications - chromatography, for instance, as well as spectroscopy - is also helping drive demand for high-purity acetonitrile.

Moreover, government policies favoring sustainable chemical production and strict regulatory guidelines on solvent safety are contributing to market trends. The green chemistry and bio-based solvents movement is also driving development of acetonitrile recycling and recovery technologies. The UK market is set for steady growth in light of ongoing investments into pharmaceutical R&D, and biotechnological breakthroughs.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.2% |

The acetonitrile market in the European Union (EU) is increasing on account of the [Pharmaceutical, Childcare and Research factors in the region. Under REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulatory policies, laboratory and industrial applications of high-purity acetonitrile are increasing.

Demand for analytical-grade solvents is also increasing in clinical research, biotechnology and environmental testing. In addition, investments in green chemistry and sustainable solvent recovery technologies are shaping the market trends. Because Europe remains at the forefront of precision medicine and novel drug formulations, the demand for high-performance acetonitrile is anticipated to see healthy growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.6% |

Japan is the leading acetonitrile market in Asia followed by China, India, and other countries. Market growth is being driven by rising demand for ultra-high-purity acetonitrile used in precision medicine as well as semiconductor processing and specialty chemicals. Japan’s strong R&D and innovation in green chemistry is, moreover, driving the development of sustainable solvent alternatives.

Acetonitrile of high purity is highly consumed in Japan with a strong focus on quality control and high-performance analytical applications for laboratory and industrial use. Tools like AI for drug development or the emergence of advanced materials science will further help the market in the country to grow.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.4% |

Acetonitrile market in South Korea is expanding rapidly, primarily driven by its pharmaceutical, chemical, and electronics sectors. High-purity acetonitrile demand is also being propelled by the country’s focus on high-tech manufacturing and R&D-based chemical innovations.

Analytical and industrial demand for solvents is also rising as South Korea’s biopharmaceutical and semiconductor production growth continues to gather pace. Another factor that influences market dynamics is government support for sustainable chemical processing and investment in green solvent technologies. With periodic developments in biotechnology, high and fine materials, and special chemicals, South Korea is forecasted to show steady acetonitrile market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.5% |

The acetonitrile market is competitive, with key players focusing on improving production processes to meet the increasing demand from industries such as pharmaceuticals, agribusiness, and electronics. As the demand for acetonitrile grows, especially in the production of active pharmaceutical ingredients and analytical applications, manufacturers are investing in more efficient, cost-effective production methods. With rising environmental concerns, companies are also exploring greener alternatives and sustainable production practices to minimize the environmental footprint of acetonitrile production.

The market is estimated to reach a value of USD 325.2 million by the end of 2025.

The market is projected to exhibit a CAGR of 5.5% over the assessment period.

The market is expected to clock revenue of USD 567.5 million by end of 2035.

Key companies in the Acetonitrile market include INEOS AG, Asahi Kasei Corporation, Formosa Plastics Corporation

On the basis on Industrial Grade and Pharmaceutical to command significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA