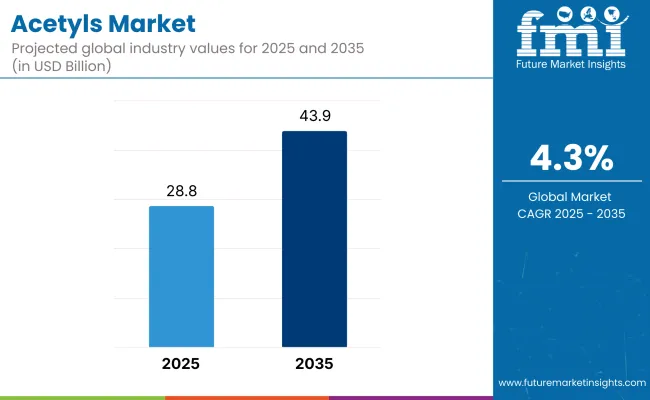

The acetyls market is set for substantial growth between 2025 and 2035, with its value reaching USD 28.8 billion in 2025 and be worth USD 43.9 billion by 2035. This shows a steady CAGR of 4.3% during the study period. Acetyl compounds such as acetic acid, acetic anhydride, and vinyl acetate monomer (VAM) play a crucial role as intermediates in the chemical industry.

These chemicals are essential in various product formulations, especially in industries that require high-performance materials and specialized chemical components. Their versatility and broad range of applications make them indispensable in numerous manufacturing processes.

The primary driver of this market expansion is the growing usage of acetyl derivatives across multiple end-use sectors. In the pharmaceutical industry, acetyl compounds are extensively used in the production of active pharmaceutical ingredients (APIs) and other medicinal products, which are critical for drug formulation and efficacy.

Additionally, in the food and beverage sector, acetyl derivatives serve as preservatives, helping to extend shelf life and maintain food safety standards. Industrial sectors such as adhesives and coatings also rely heavily on acetyls to enhance product durability, performance, and functionality. The diverse applications across these sectors demonstrate the integral role acetyl compounds play in modern production and industrial processes.

Moreover, advancements in technology and the growth of end-user industries are expected to further stimulate market growth. Innovations in chemical processing techniques are enabling manufacturers to produce acetyls more efficiently, with a greater focus on sustainability and cost-effectiveness. Industrialization in emerging economies is also driving demand, as these regions increase their production capacities and usage of chemical products.

Leading companies such as Saudi International Petrochemical Company (Sipchem), Sasol Limited, Chang Chun Group, and Shanghai Wujing Chemical Co., Ltd. are instrumental in meeting global demand through strategic expansions and the adoption of advanced manufacturing methods. These combined factors create a favorable environment for continued growth in the acetyls market over the next few years.

The acetyls market is segmented by product type, including acetic acid, acetic anhydride, vinyl acetate, formaldehyde, ethylene acetate, and others (acetyl chloride, acetylated cellulose, acetylated wood, and acetylsalicylic acid (aspirin). By end-use industry, the market covers sectors such as food & beverages, oil & gas, pharmaceutical, paints, inks, and waxes & coatings, furniture, and others (textiles, agriculture, and specialty chemicals). Regionally, the market is analyzed across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East and Africa.

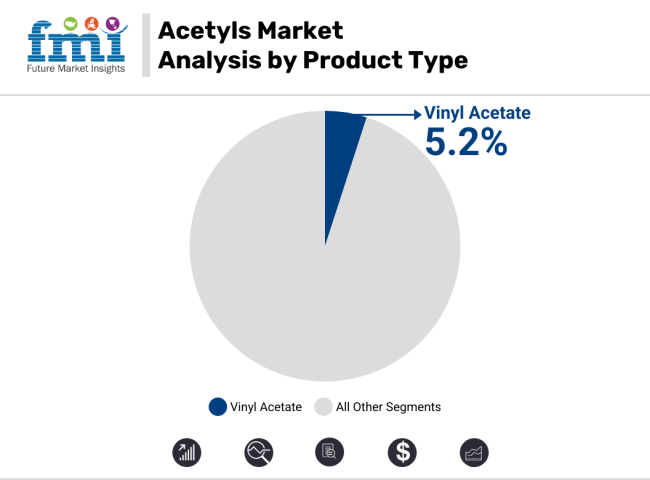

Vinyl acetate is the fastest-growing segment in the acetyls market, expected to grow at a CAGR of approximately 5.2% between 2025 and 2035. This strong growth is fueled by its extensive use in manufacturing adhesives, paints, coatings, and packaging films. Vinyl acetate's excellent properties, such as strong adhesion, flexibility, and resistance to environmental factors, make it highly sought after in construction, automotive, and packaging industries. The rising demand for pressure-sensitive adhesives, which are essential in labeling and packaging, further boosts their market potential.

Additionally, the increasing emphasis on eco-friendly packaging solutions is driving the adoption of vinyl acetate-based polymers, as these materials often offer lower volatile organic compound (VOC) emissions compared to traditional solvents. This aligns well with global sustainability trends and regulatory policies aiming to reduce environmental impact.

Acetic acid is the largest segment by volume and value, serving as a fundamental chemical intermediate. It is extensively used in the production of polymers, synthetic fibers, and food additives. Its role in pharmaceuticals, especially in drug manufacturing and food preservation, reinforces its dominant market position. The growing demand for biodegradable plastics and solvents is also contributing to steady expansion in this segment.

Acetic anhydride is crucial for producing cellulose acetate, which is used in photographic films, textiles, and cigarette filters. Additionally, it plays an important role in pharmaceutical synthesis, particularly in acetylation reactions for producing active pharmaceutical ingredients (APIs). The expanding pharmaceutical industry and increased demand for specialty chemicals support growth in this segment.

Formaldehyde is used mainly in producing resins, adhesives, and coatings, especially in the wood and furniture industries. Its role in manufacturing molding compounds, laminates, and textiles adds to steady demand. The rising construction and furniture manufacturing sectors in emerging economies help sustain growth in formaldehyde consumption.

Ethylene acetate is utilized primarily as a solvent and in producing certain polymers and resins. It has niche applications in coatings, adhesives, and chemical intermediates. While smaller compared to other segments, ethylene acetate is important for specialized industrial uses, including flexible packaging and electronics.

Others include various acetyl derivatives used in niche applications such as pharmaceuticals, agriculture, and specialty chemicals. These products support innovation and diversification within the acetyls market, contributing to overall market resilience and growth.

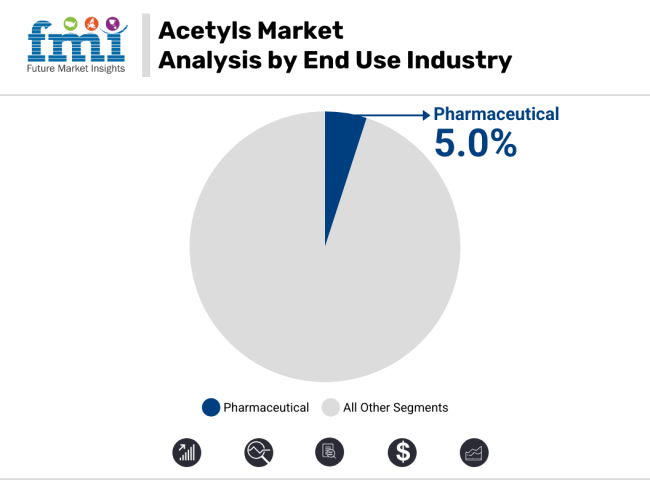

The pharmaceutical segment is the fastest-growing end-use industry in the acetyls market. This segment is expected to expand at a CAGR of approximately 5.0% from 2025 to 2035. This strong growth is largely driven by the critical role acetyl derivatives play in drug development and manufacturing.

Acetyl compounds like acetic anhydride and acetic acid are essential in synthesizing active pharmaceutical ingredients (APIs) and various medicinal formulations. As global healthcare demands increase due to aging populations, rising chronic diseases, and greater access to medical care in emerging economies, the pharmaceutical industry’s reliance on acetyls continues to intensify.

Moreover, ongoing advancements in pharmaceutical technologies and stricter regulatory standards for drug safety and efficacy are encouraging the use of high-purity acetyl intermediates. The growth of generic drugs and biosimilars also boosts demand for acetyl-based chemicals. Additionally, acetyls are used in the production of vaccines, antibiotics, and other critical medications, further anchoring their importance in healthcare.

Other end-use segments also contribute significantly to the acetyls market. The food & beverages industry relies on acetyl compounds for food preservation and additives, supporting steady demand due to rising consumer focus on food safety and shelf life extension. The oil & gas sector uses acetyl derivatives in refining and chemical processes, although its growth is comparatively moderate. Paints, inks, waxes & coatings represent a large segment where acetyls improve product durability, appearance, and environmental compliance, especially with the rise of eco-friendly coatings.

The furniture industry consumes acetyl-based resins and adhesives for manufacturing durable wood products. The other category includes various industrial applications such as textiles, agriculture, and specialty chemicals, which collectively maintain stable demand and contribute to overall market growth.

Fluctuating Raw Material Prices and Supply Chain Disruptions

Not only does the acetyls market have to deal with the volatility of raw material prices like methanol and carbon monoxide, but these raw materials are also the main ones. That is primarily due to the variable prices of crude oil and natural gas. The global supply chain interruptions, which are instigated by the geopolitical tensions, the lack of transportation, and trade barriers, also affect the production cost and the availability.

These price swings impose profitability issues on the production facilities, but the ones that export are the most affected. Also, relying on petroleum-based feedstocks makes the industry vulnerable to longer-term sustainability issues, which is a drive for the companies to search the alternative bio-based production methods.

Stringent Environmental Regulations and Sustainability Pressures

The tightening of environmental laws regarding volatile organic compounds (VOCs), carbon emissions, and hazardous waste disposal across crucial markets, including North America and Europe, continues the trend. Sustainability initiatives are now mandated by the government, which requires manufacturers to cut their carbon footprint and practice greener production.

The adherence to these policy changes demands substantial investments in clean technologies, which leads to a rise in the operational costs. The transition to bio-based acetyls is also a difficult task due to the issues of scalability, raw material sourcing, and production efficiency, which make it hard for the traditional acetyl manufacturers linked to petroleum-based supply chains.

Growth in Bio-Based Acetyls and Green Chemistry Innovations

With environmental concerns at the forefront, the market for bio based acetyl derivatives moves upwards. The combination of the innovation in acetic acid production technologies as well as the introduction of renewable feedstock’s has made this route to acetyls greener than petroleum ones.

The green chemistry solutions are being invested by more and more manufacturers in both the European and North American markets due to the supporting policies, which has led to the opening of channels for the production of sustainable products. The companies which take low-carbon and sustainable steps reshaping the acetyl production process will be greatly benefited because they will be attracting the eco-conscious pharmaceuticals, food packaging, and coatings sectors.

Expanding Applications in High-Growth Industries

The increasing demand for acetyls in pharmaceuticals, food preservatives, and adhesives presents a lucrative opportunity for market expansion. Pharmaceutical industry, especially in the Asian-Pacific and Latin American regions, is developing significantly with increased healthcare spending. Also, urbanization and development of infrastructure are generating demand for VAM-based sealants, adhesives, and coatings for the automotive and construction industries.

Growth in the consumption of packaged food and beverages is also pushing demand for acetic acid. These increasing end-use sectors develop high growth potential for the producers of acetyl, particularly in developing nations with changing industrial trends.

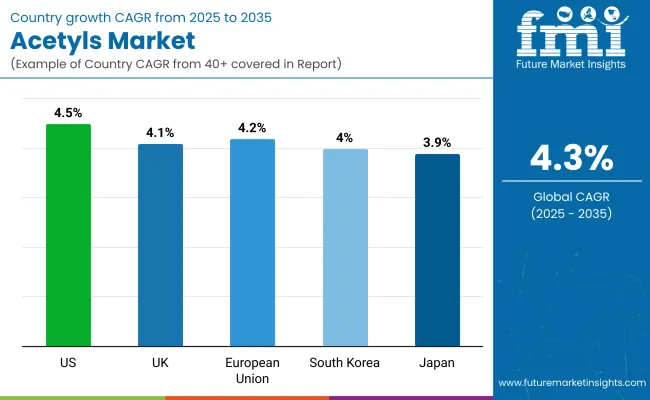

The acetyls market in the USA is about to grow steadily throughout the years with the increasing demand in areas such as pharmaceuticals, adhesives, and coatings industries. Acetic acid, vinyl acetate monomer (VAM), and ethyl acetate are extensively used in industrial applications, particularly in packaging and automotive sectors. Investors are directing funds toward the research and development of bio-based acetyls while the boost in market growth caused by the global sustainable development initiatives.

Due to the acetyls demand in drug formulations, the pharmaceutical industry, in turn, is directly affected by the higher consumption brought about by the rising population and the increase in the number of R&D activities. Furthermore, the aforementioned regulations like the EPA's guidelines on volatile organic compounds (VOCs) are driving the manufacturers for the production of environmentally friendly alternatives.

The chemical sector's growth, along with the rise in the production of coatings and resins, further endorses the market development.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.5% |

The UK acetyls market is propelled by strict environmental regulations and the demand for green chemicals that is rising. The growing emphasis on decreasing carbon emissions has led to an increase of bio based acetyl derivatives in coatings, adhesives, and pharmaceuticals. The battery materials production in EV sector is an additional driver for demand of acetyl-based materials in battery components and lightweight vehicle manufacturing.

The pharmaceutical sector is the key customer especially for acetyl in painkillers, antibiotics, and other drug formulations. Other than that, the country’s research and innovation ecosystem are strongholds for the development of advanced acetyl applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.1% |

The EU acetyls market is growing due to the specific region’s orientation towards sustainable chemical production and the circular economy. The strict REACH regulations are a big factor in the turnout of new low-VOC and bio based acetyl products. The automotive and construction industries come along as the biggest demand generators for acetyls, which are used in adhesives, coatings, and resins for the fabrication of lightweight and durable materials.

Besides, the pharmaceutical industry in countries like Germany and France is still the main customer. The rise in green manufacturing practices, combined with a strong government promotion of innovation in specialty chemicals, is creating a fertile market breakthrough. On the other hand, the transition to electric vehicles is causing a demand for acetyl-based materials in the battery components and electronic coatings.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.2% |

The acetyls market in Japan is on the rise mainly due to the country's highly developed manufacturing sectors and tough environmental standards. The chemical industry in Japan is more and more orientated towards producing high-purity acetyl derivatives which have use in electronics, pharmaceuticals, and as automotive parts. With being at the forefront of electric vehicle technology, the materials derived from acetyl are being more and more used in battery technologies and in coatings for interiors of vehicles.

The pharmaceutical sector is even now a major growing field the use of acetyl compounds for drug manufacturing supports this. On the other hand, the country’s focus on energy efficiency and green production means it is turning to the use of bio-based and low-carbon acetyl products more and more. The market is likely to further grow due to the large chemical companies carrying out research and coming up with new ideas.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

The acetyl formate market in South Korea is flourishing at a rapid pace led by the advanced electronics, automotive, and pharmaceutical industries of the country. Demand surges for these high-performance acetyl-based coatings and adhesives, thanks to the semiconductor and display manufacturers we have in the country. The electric vehicle segment, driven by governmental incentives, plays an important role in the use of acetyls for lightweight materials and battery manufacturing.

Furthermore, the country’s solid pharmaceutical sector, serving local and international clients, is another key contributor to the consumption of acetyl in drug manufacturing. The country’s emphasis on being green and using safe chemicals also boosts the demand for the bio-based form of acetyl products. The regulatory systems, being designed according to global standards, are another factor in the industry moving towards the implementation of safe and sustainable alternatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.0% |

The Acetyls market is healthily moving forward due to the increased demand from sectors like pharmaceuticals, adhesives, paints and coatings, food and beverage, and textiles. Acetyls, which consist of important derivatives including acetic acid, acetic anhydride, and vinyl acetate monomer (VAM), are essential for many different kinds of industrial applications.

The market is seeing plentiful funds in production capacity expansion, sustainability projects, and technological improvements in order to satisfy both the rising global demand and the environmental regulations.

The city growth and industrial development, especially in developing countries, have played a major role in market growth. The enterprises are emphasizing the way in which they improve their supply chain networks, production efficiency, and environment friendly green Chemistry practices.

Celanese Corporation

Celanese Corporation is the global champion in the Acetyls market with a solid foothold in the production of acetic acid, acetic anhydride, and VAM. The company is devoting a lot of efforts to the sustainability of its product and to the energy-efficient processes and innovative product development.

Celanese's growth continues to be based on investments in the expansion of applied capacity and on the strategic partnerships that it is concluding to keep its advantageous position in the market. The company is leading the way with the production of bio-based acetyl chemicals that comply with the new environmental regulations and are sought by the public.

Eastman Chemical Company

Eastman Chemical Company is a leading company in high-purity acetyls, with its most important uses in pharmaceuticals, food and beverage, and personal care products. The primary goal of the company is to focus on quality, regulated compliance, and efficiency so that it can provide the world with as much as it needs. Eastman has expanded its manufacturing facilities recently and has developed a more flexible and reliable logistics system in the supply chain that functions well under unstable market conditions.

LyondellBasell Industries Holdings B.V.

LyondellBasell is a significant supplier of acetyl intermediates with a wide product range that covers many sectors. The company has been increasing its production capacity and at the same time pushing towards a greener and better operating model. Investment in new technologies that improve energy performance and reduce emissions are the recent achievements of the company.

INEOS Group

INEOS Group is the provider of a broad spectrum of acetyl chemicals and also the one that applies the latest production methods that save the environment and money. The company's commitment to improving efficiency and sustainability reinforces its position in the world market. INEOS is looking for alternative feedstock and activities for waste valorization to cut the carbon footprint of acetyl production.

Daicel Corporation

Daicel Corporation is a company that manufactures acetyl chemicals of very high quality that are used in specialized areas such as in producing advanced pharmaceuticals and specialty coatings. The pursuit of innovation through R&D has been the driving force behind the growth of its product range and the market. Daicel is also working on the biodegradation of materials and is involved in making more sustainable packaging products, using its experience in acetyl chemistry.

Several mid-sized and emerging companies are playing a vital role in advancing acetyls market. These companies focus on specialized processes, cost-effective solutions, and expanding their presence in emerging markets. Their contributions help diversify product offerings and enhance accessibility to innovative testing solutions across various healthcare settings. Notable players include

The Acetyls Market can be segmented based on:

North America is likely to lead the acetyls industry.

The market is expected to reach USD 28.8 billion in 2025.

The acetyls industry is likely to secure a CAGR of 4.3% through 2035.

The market is projected to reach USD 43.9 billion by 2035.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Litres) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Litres) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 6: Global Market Volume (Litres) Forecast by End-Use Industry, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Litres) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Litres) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 12: North America Market Volume (Litres) Forecast by End-Use Industry, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Litres) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Litres) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 18: Latin America Market Volume (Litres) Forecast by End-Use Industry, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Litres) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Western Europe Market Volume (Litres) Forecast by Product Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 24: Western Europe Market Volume (Litres) Forecast by End-Use Industry, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Litres) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Litres) Forecast by Product Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 30: Eastern Europe Market Volume (Litres) Forecast by End-Use Industry, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Litres) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Litres) Forecast by Product Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Litres) Forecast by End-Use Industry, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Litres) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: East Asia Market Volume (Litres) Forecast by Product Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 42: East Asia Market Volume (Litres) Forecast by End-Use Industry, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Litres) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Litres) Forecast by Product Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Litres) Forecast by End-Use Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Litres) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Litres) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 13: Global Market Volume (Litres) Analysis by End-Use Industry, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Litres) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Litres) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 31: North America Market Volume (Litres) Analysis by End-Use Industry, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Litres) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Litres) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 49: Latin America Market Volume (Litres) Analysis by End-Use Industry, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Litres) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Litres) Analysis by Product Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 67: Western Europe Market Volume (Litres) Analysis by End-Use Industry, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Litres) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Litres) Analysis by Product Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Litres) Analysis by End-Use Industry, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Litres) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Litres) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Litres) Analysis by End-Use Industry, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Litres) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 117: East Asia Market Volume (Litres) Analysis by Product Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 121: East Asia Market Volume (Litres) Analysis by End-Use Industry, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Litres) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Litres) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Litres) Analysis by End-Use Industry, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA