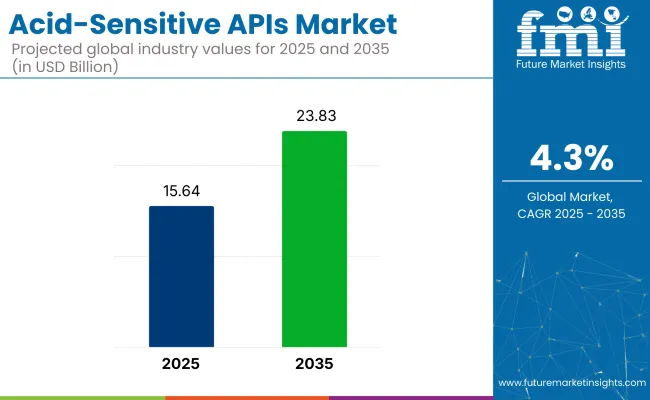

The acid-sensitive APIs market is expected to be valued at USD 15.64 billion in 2025 and USD 23.83 billion by 2035, with a projected CAGR of 4.3% during the forecast period. The growth of the market is being driven by the increasing demand for specialized drugs that require controlled release for the treatment of acid-related disorders and diseases.

Pharmaceutical technologies are continuously being advanced to develop drug formulations that enhance stability, solubility, and bioavailability, which are considered essential for effective treatment outcomes. The rising use of biopharmaceuticals and targeted therapies is expected to further contribute to market growth.

As highlighted by Kim Huynh-Ba in the Handbook of Stability Testing in Pharmaceutical Development, the importance of forced degradation studies (acid, base, and oxidative degradation) in stability programs is emphasized.

These studies are crucial in identifying degradation products, establishing degradation pathways, and validating the stability-indicating power of the analytical procedures used. The effects of stress testing are used to assess how acid-sensitive APIs behave under different environmental conditions, providing valuable insights into their intrinsic stability.

The adoption of acid-sensitive APIs is expected to increase, especially in the gastrointestinal and oncology sectors, where regulated treatments are in high demand. As regulations around drug safety tighten, the focus on targeted treatments is expected to be intensified. Technological innovations in drug delivery systems and drug formulations are expected to continue shaping the market through 2035, improving the efficacy and bioavailability of drugs, and enhancing overall patient outcomes in diverse therapeutic areas.

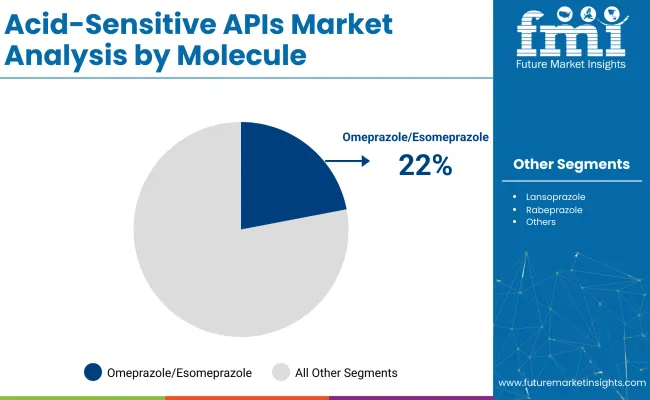

The acid-sensitive APIs market is segmented into various key investment areas. By molecule, the market includes erythromycin, omeprazole/esomeprazole, lansoprazole, pancrelipase, rabeprazole, didanosine, liraglutide, mesalamine, and others.

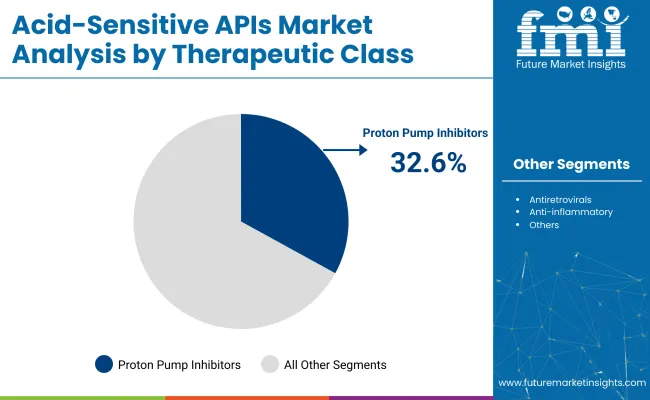

Therapeutically, the market covers antibiotics, immunosuppressants, proton pump inhibitors, enzyme replacement, antiretrovirals, GLP-1 receptor agonists, and anti-inflammatory drugs. The end-users of these APIs include pharmaceutical manufacturers, biopharmaceutical companies, and contract development and manufacturing organizations (CDMOs).

Geographically, the market spans across key regions, including North America, Western Europe, East Asia, and South Asia, with each region contributing to the market’s expansion and growth.

Omeprazole and esomeprazole are expected to capture 22% of the acid-sensitive APIs market share in 2025. These molecules are integral in treating conditions like gastroesophageal reflux disease (GERD), peptic ulcers, and Zollinger-Ellison syndrome. They work by reducing stomach acid production and are favored for their long-term effectiveness and safety profile.

Proton pump inhibitors (PPIs) are projected to hold 32.6% of the acid-sensitive APIs market in 2025. PPIs, including omeprazole, pantoprazole, and lansoprazole, are considered the first-line treatment for acid-related disorders such as GERD, ulcers, and dyspepsia. These medications work by blocking the proton pumps in the stomach, significantly reducing acid production.

Pharmaceutical manufacturers are anticipated to dominate the acid-sensitive APIs market, securing 45% of the market share by 2025. These manufacturers are responsible for the production of API formulations, which are essential in treating a wide range of gastrointestinal conditions.

The acid-sensitive active pharmaceutical ingredients (APIs) market is being driven by increasing demand for targeted therapies and advancements in drug delivery systems. However, formulation complexities and stability issues are limiting market expansion.

Increasing demand for targeted therapies and advancements in drug delivery systems are driving market growth.

The demand for acid-sensitive APIs is being significantly boosted by the growing prevalence of chronic diseases and the increasing need for targeted drug delivery. Advancements in drug delivery technologies, such as enteric coatings and controlled-release formulations, are enabling effective delivery of acid-sensitive APIs to specific sites in the gastrointestinal tract.

These innovations are enhancing the therapeutic efficacy of acid-sensitive drugs, leading to their greater adoption in treating conditions such as gastrointestinal disorders and certain cancers. Additionally, the growing focus on personalized medicine is further propelling demand for acid-sensitive APIs, allowing for more precise and effective treatment regimens.

Formulation complexities and stability issues are limiting market growth

Despite positive growth prospects, the acid-sensitive APIs market is being hindered by formulation complexities and stability issues. The instability of certain APIs in acidic environments requires the development of specialized formulations to protect the active ingredient until it reaches the targeted site of action.

These formulation challenges are necessitating significant investment in research and development, along with strict adherence to regulatory standards. Additionally, the high cost of producing acid-sensitive formulations is limiting accessibility, particularly in cost-sensitive markets. Overcoming these challenges is seen as essential for the continued growth and widespread adoption of acid-sensitive APIs in the pharmaceutical industry.

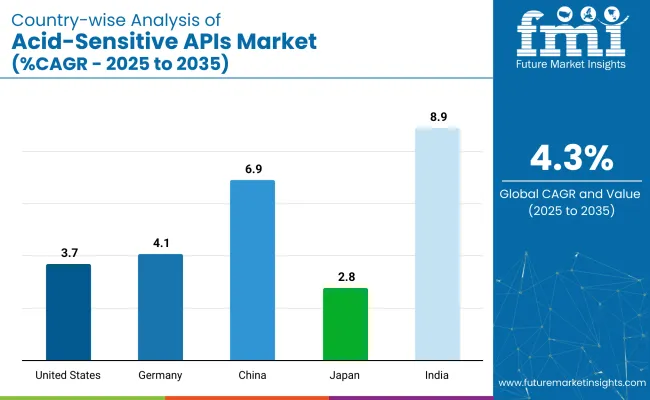

The acid-sensitive APIs market is expected to grow through 2035, driven by rising demand for controlled-release drugs. Industrialization in China and India is contributing to market growth, while advanced drug formulation technologies in the USA and Germany are also fueling expansion. Health awareness and specialized treatments are driving the market’s adoption.

| Countries | CAGR (%) |

|---|---|

| United States | 3.7% |

| Germany | 4.1% |

| China | 6.9% |

| Japan | 2.8% |

| India | 8.9% |

The United States acid-sensitive APIs market is expected to grow at a CAGR of 3.7% through 2035. Growth is driven by advancements in drug formulation technologies, with a focus on controlled-release formulations.

The Germany acid-sensitive APIs market is projected to grow at a CAGR of 4.1% through 2035. Growth is supported by increasing demand for high-quality pharmaceuticals and innovations in drug formulation.

Acid-sensitive APIs market in China is expected to grow at a CAGR of 6.9% through 2035. The market is being driven by rapid industrialization, increased pharmaceutical production, and the growing demand for safe drug packaging.

The acid-sensitive APIs market in India is projected to grow at a CAGR of 8.9% through 2035. Growth is driven by the expanding pharmaceutical industry, increasing generics production, and the demand for packaging solutions meeting international standards.

The acid-sensitive APIs market in Japan is projected to grow at a CAGR of 5.1% through 2035. Growth is supported by Japan’s advanced pharmaceutical sector and emphasis on drug safety and packaging quality.

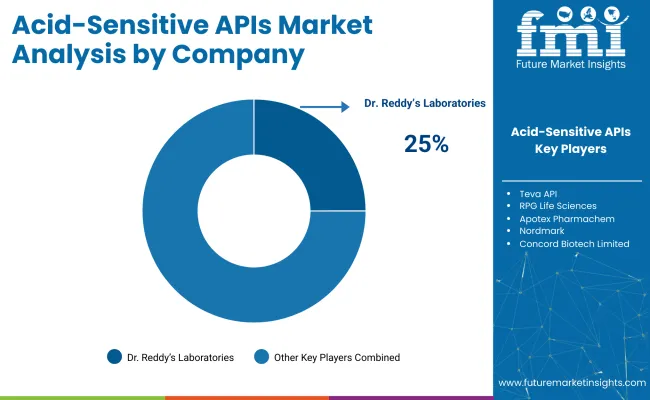

The acid-sensitive API market is characterized by a diverse range of suppliers. Key players like Lonza Group, BASF SE, Evonik Industries, and Fujifilm Diosynth Biotechnologies dominate the market due to their extensive product portfolios, technological advancements, and strong global presence in the pharmaceutical sector.

Other significant suppliers such as Cipla Limited, Dr. Reddy's Laboratories, and Aurobindo Pharma focus on specialized markets, offering innovative and sustainable solutions tailored to the unique requirements of acid-sensitive APIs. Emerging players like Hikal Ltd, Granules India Limited, and Suven Pharmaceuticals target regional markets with cost-effective and niche product offerings, catering to specific consumer needs and preferences.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 15.64 billion |

| Projected Market Size (2035) | USD 23.83 billion |

| CAGR (2025 to 2035) | 4.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and Metric Tons for volume |

| Molecules Analyzed (Segment 1) | Erythromycin; Omeprazole/Esomeprazole; Lansoprazole; Pancrelipase; Rabeprazole; Didanosine; Liraglutide; Mesalamine; Others |

| Therapeutic Classes Covered (Segment 2) | Antibiotics; Immunosuppressants; Proton pump inhibitors; Enzyme replacement; Antiretrovirals; GLP-1 receptor agonists; Anti-inflammatory; Others |

| End-Users Covered (Segment 3) | Pharmaceutical manufacturers, Biopharmaceutical companies, and CDMOs |

| Regions Covered | North America, Western Europe, East Asia, South Asia |

| Countries Covered | United States; Canada; Germany; United Kingdom; France; Italy; Spain; China; Japan; South Korea; India; Pakistan; Bangladesh |

| Key Players Influencing the Market | Dr. Reddy’s Laboratories; ChemWerth Inc.; Teva API; RPG Life Sciences; Apotex Pharmachem; Nordmark; Chunghwa Chemical Synthesis & Biotech Co., Ltd; Concord Biotech Limited |

| Additional Attributes | Dollar sales by molecule (erythromycin, omeprazole, others); Growth of proton pump inhibitors and GLP-1 receptor agonists; Regional trends in API manufacturing; Market demand for enzyme replacement and anti-inflammatory therapies |

The market is segmented into erythromycin, omeprazole/esomeprazole, lansoprazole, pancrelipase, rabeprazole, didanosine, liraglutide, mesalamine, and others.

The market covers antibiotics, immunosuppressants, proton pump inhibitors, enzyme replacement, antiretrovirals, GLP-1 receptor agonists, and anti-inflammatories.

The market is categorized into pharmaceutical manufacturers, biopharmaceutical companies, and CDMOs.

The market spans North America, Western Europe, East Asia, and South Asia.

The market is expected to reach USD 23.83 billion by 2035.

The market size is projected to be USD 15.64 billion in 2025.

The market is expected to grow at a CAGR of 4.3%.

India is the fastest growing country with a CAGR of 8.9%.

The United States holds the highest market share with a 3.7% CAGR.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA