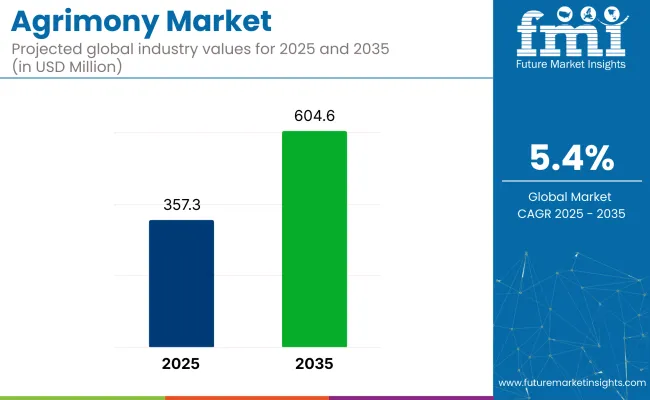

The global agrimony market is projected to grow from USD 357.3 million in 2025 to USD 604.6 million by 2035, at a CAGR of 5.4%.The market growth is driven by the rising consumer preference for natural and alternative health solutions, as well as the growing focus on organic and sustainable farming practices.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 357.3 million |

| Projected Market Size in 2035 | USD 604.6 million |

| CAGR (2025 to 2035) | 5.4% |

The demand for agrimony is particularly high in herbal remedies, where it is used for its therapeutic benefits, and in natural skincare formulations due to its anti-inflammatory and antioxidant properties. The agrimony market has a small yet significant share in its parent industries.

In the herbal supplements market, agrimony holds a share of around 1-2%, as it is one of many herbal remedies used for various health conditions. In the pharmaceuticals market, agrimony accounts for approximately 0.5-1%, as it is utilized in niche therapeutic applications.

The cosmetics and personal care sector also shows a growing interest, with agrimony representing around 2-3% of the market, driven by its inclusion in natural skincare products. In the functional foods market, agrimony's share stands at 1-2%, where it is added to specialized health products aimed at improving well-being.

Recent developments in agrimony-based products have focused on improving production efficiency and ensuring product quality. Manufacturers like Gaia Herbs and Nature’s Way are prioritizing third-party testing and supply chain transparency to enhance consumer trust.

Additionally, companies are incorporating advanced extraction technologies to standardize the concentration of active compounds, ensuring consistency across product batches. Strategic partnerships, such as DhanukaAgritech's agreement with Kimitec, are also advancing the development of natural, bio-based products that align with sustainable agricultural practices.

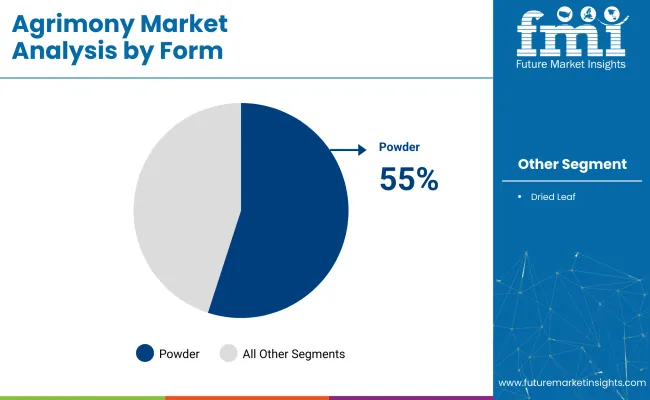

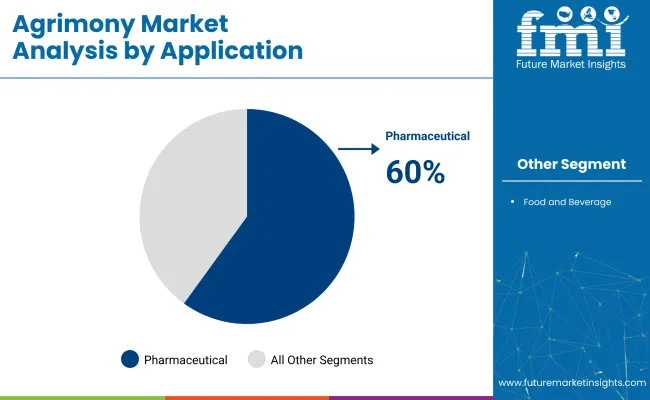

The market is segmented by form into powder and dried leaf form; by application into pharmaceuticals and food & beverages; by distribution channel into store-based retail, specialty stores, online retail, supermarkets, and hypermarkets.

The market is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic countries, Russia and Belarus, and the Middle East & Africa.

Agrimony powder is expected to hold 55% of the agrimony market share by 2025. Its popularity is growing due to its extensive use in herbal remedies and natural supplements, which are gaining traction among health-conscious consumers.

Agrimony powder is widely appreciated for its potential health benefits, including its anti-inflammatory and antioxidant properties. Companies like Swanson Health Products, Nature’s Way, and Herbalife are focusing on expanding agrimony powder-based products in the market. The demand for natural ingredients in pharmaceuticals and wellness products is expected to further drive the growth of this segment.

Pharmaceutical applications of agrimony are projected to hold a dominant 60% share of the market by 2025. Agrimony is widely used in traditional medicine for treating conditions such as digestive issues, skin problems, and respiratory disorders.

With rising consumer preference for natural treatments, agrimony’s pharmaceutical applications are increasingly adopted in products aimed at digestive health, anti-inflammatory treatments, and immune support. Companies like Herbalife, NOW Foods, and Gaia Herbs are incorporating agrimony into their product lines, with growth driven by increasing consumer awareness about plant-based remedies.

Store-based retail is expected to account for 35% of the agrimony market share by 2025. Physical retail stores, including health food stores, pharmacies, and supermarkets, play a critical role in the distribution of agrimony products. The rise in consumer demand for health supplements and natural remedies is expected to boost sales through brick-and-mortar retail channels.

Leading retail chains like Walmart, CVS Health, and Boots are expanding their product offerings to include agrimony-based products. This trend is further supported by the growing number of health-conscious consumers seeking natural solutions.

The agrimony market is growing due to the increasing demand for natural remedies and functional foods. Agrimony is becoming more popular for its medicinal properties, and its inclusion in various products is expected to drive further market growth.

Preference for herbal and natural products boosts agrimony demand.

Consumers are increasingly shifting toward bio-based and holistic health solutions, pushing the demand for agrimony, especially for its antimicrobial, antioxidant, and anti-inflammatory properties. Agrimony’s versatility in use across functional foods, beverages, dietary supplements, and skincare products is also contributing to its market growth.

As more consumers seek alternatives to synthetic chemicals, agrimony-based products are expected to see wider adoption across different sectors. Additionally, increasing government support for the use of herbal remedies in consumer products is fueling demand for agrimony.

High production costs limit affordability for consumers.

Despite its increasing demand, the agrimony market faces challenges related to high production costs, especially for organic and sustainably sourced agrimony. The cost of cultivation, harvesting, and processing organic agrimony can limit its affordability.

Additionally, regulatory challenges regarding the approval of health claims associated with agrimony in supplements and food products pose significant hurdles. Limited scientific research on the full therapeutic benefits of agrimony also affects consumer confidence. Market fragmentation, with many small producers, leads to inconsistencies in quality and supply chain complexities, making it difficult for larger companies to scale up operations.

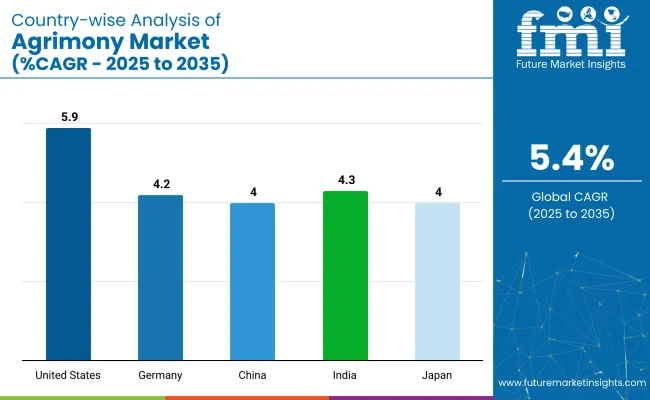

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.9% |

| Germany | 4.2% |

| China | 4.0% |

| India | 4.3% |

| Japan | 4.0% |

The agrimony marketshows steady growth across both OECD and BRICS countries. Among the OECD countries, the United States is expected to lead with a CAGR of 5.9% from 2020 to 2035. Growth in the USA is driven by increasing consumer interest in herbal and natural remedies, as well as expanding demand for functional foods. Germany, with a CAGR of 4.2%, benefits from its well-established health-conscious population and the increasing preference for plant-based products.

In China and India, the market shows moderate growth, with CAGRs of 4.0% and 4.3%, respectively. These markets are benefiting from the rising interest in traditional herbal medicine and the growing demand for natural ingredients in wellness products. Japan also experiences steady growth at 4.0%, with a focus on herbal supplements and traditional remedies driving demand for agrimony.

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

Demand for agrimony in the United States is expected to grow at a CAGR of 5.9% through 2035. The increasing demand for herbal remedies, wellness products, and natural solutions is driving market expansion. Agrimony, a popular herb used in teas and supplements, has seen rising adoption due to its perceived health benefits.

With a growing focus on plant-based health products, the USA continues to lead in the market for herbal ingredients. Key trends include technological advancements in product formulations, along with a shift toward natural and organic wellness products.

Germany is projected to grow at a CAGR of 4.2% through 2035 in the agrimony market. The country’s strong preference for organic, natural products and healthy living fuels the demand for agrimony in functional foods and wellness products. Agrimony’s medicinal properties, particularly for digestive health, are well recognized, driving adoption in herbal remedies.

Increased awareness of plant-based products and clean-label ingredients contributes to the market’s growth. Germany’s robust regulatory framework and eco-conscious population support agrimony’s integration into the consumer wellness segment.

Sales of agrimony in China is expected to grow at a CAGR of 4% through 2035. The rising interest in traditional Chinese medicine (TCM) and natural ingredients is driving the demand for agrimony. As consumers increasingly adopt herbal remedies for various health benefits, agrimony’s use in supplements, teas, and medicinal products is growing.

Government policies promoting the use of herbal ingredients also support market growth. Agrimony’s role in promoting digestive health, along with its natural properties, is gaining attention among consumers seeking natural alternatives.

The agrimony marketin India is expected to grow at a CAGR of 4.3% through 2035. As health consciousness grows in the country, agrimony’s demand as a natural remedy for digestive health is increasing. The herb is gaining popularity in the form of herbal teas, supplements, and health tonics. Agrimony’s use in alternative medicine and growing consumer awareness of its benefits are driving adoption. India’s expanding middle class, along with a shift toward plant-based and organic products, is expected to propel agrimony market growth.

Demand for agrimony in Japan is likely to grow at a CAGR of 4% through 2035. The aging population, alongside the increasing demand for natural health products, is driving agrimony’s adoption. Japanese consumers are turning to herbal remedies like agrimony to manage digestive health and promote wellness.

As the demand for plant-based and natural products rises, agrimony is becoming an important ingredient in supplements, teas, and functional foods. The country’s strong affinity for traditional and herbal medicine supports the growing popularity of agrimony.

The agrimony market, is driven by a diverse range of suppliers, including seed companies, herbal product manufacturers, and specialty retailers. Key players such as Sheffield's Seed Company, Em's Herbals, and Strictly Medicinal Seeds are recognized for their extensive portfolios, including seeds and dried herbs for medicinal use.

These companies focus on product innovation, sustainability, and expanding distribution networks to meet growing demand for natural, organic herbal products. Emerging players like Gracie Deola's Natural Wellness Remedies, Sacred Plant Co, and Mountain Rose Herbs add to the market's dynamism. Significant companies such as Best Agrolife Ltd., Crystal Crop Protection Limited, BASF SE, Bayer AG, Syngenta AG, and CortevaAgriscience leverage their global presence and innovation to capture a share of the market.

Recent Agrimony Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 357.3 million |

| Market Size (2035) | USD 604.6 million |

| CAGR (2025 to 2035) | 5.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and tons for volume |

| Forms Analyzed (Segment 1) | Powder, Dried Leaf |

| Applications Analyzed (Segment 2) | Pharmaceutical, Food & Beverage |

| Distribution Channels Analyzed (Segment 3) | Store-Based Retail, Specialty Stores, Online Retail, Supermarkets, Hypermarkets |

| Regions Covered | Global |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Best Agrolife Ltd., Crystal Crop Protection Limited, Dhanuka Agritech , BASF SE, Bayer AG, UPL Limited, Syngenta AG, Corteva Agriscience |

| Additional Attributes | Dollar sales, share by form and application, growing demand in pharmaceutical use, rising interest in herbal remedies, regional shifts in food & beverage applications, trends in sustainable agrimony production |

The market is segmented into powder and dried leaf form.

Agrimony is applied in the pharmaceutical and food & beverage industries.

The market is segmented by distribution channels including store-based retail, specialty stores, online retail, supermarkets, and hypermarkets.

The market is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and The Middle East & Africa.

The industry is expected to reach USD 604.6 million by 2035.

The industry is projected to grow at a CAGR of 5.4% from 2025 to 2035.

The agrimony powder segment is expected to lead with a 55% share in 2025.

South Asia, particularly India, is expected to grow at a 4.3% CAGR.

Sheffield's Seed Company leads the industry with a 12% market share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA