The global alpha-lactalbumin market is projected to grow from USD 762.5 million in 2025 to USD 1,631.1 million by 2035, reflecting a CAGR of 7.9% over the forecast period. North American producers are focusing on sachet-based clinical nutrition and fortified drinks.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 762.5 million |

| Market Value (2035F) | USD 1,631.1 million |

| CAGR (2025 to 2035) | 7.9% |

Filtration upgrades have raised yield consistency, supporting concentrated protein fractions with intact bioactivity. These formats are gaining traction in hospitals and outpatient therapy settings.

In Western Europe, low-protein infant formulas are being enabled through alpha-lactalbumin-rich concentrates that meet regulatory amino acid thresholds. Energy-efficient dry-blend systems are being adopted to control formulation costs while preserving product stability.

East Asian producers are transitioning toward recombinant and animal-free variants, especially for halal, allergy-sensitive, and vegan-certified formulations. Local authorities are facilitating commercial fermentation hubs to supply next-gen infant and adult medical nutrition formats.

Product transparency is being enhanced through packaging-integrated traceability. Brands are embedding digital batch logs showing herd origin, antibiotic screening, thermal history, and plant compliance. Retailers in Asia and Europe report lower return volumes and higher parent trust linked to these verification tools.

Pricing remains consistent. Food-grade alpha-lactalbumin averages USD 31-86 per kg, with clinical and assay-grade formats priced higher. Margin protection has been achieved through high-efficiency fractionation and long-term whey sourcing agreements.

In 2025, the alpha-lactalbumin market represents a specialized yet steadily growing segment across several broader parent markets. Within the global whey protein market, it contributes approximately 3-5%, given its role as a high-purity protein fraction used in premium formulations. In the dairy ingredients market, its share is around 1-2%, due to its selective extraction from whey.

In the infant nutrition market, alpha-lactalbumin holds a more prominent share of 6-8%, as it closely mimics human milk proteins and supports infant development. Within the functional food ingredients market, it makes up about 2-3%, driven by applications in health beverages and protein-enriched snacks. In the nutraceuticals market, it contributes roughly 1-2%, favored for its amino acid profile and bioactive properties.

Innovation in protein isolation techniques, particularly membrane filtration and low-heat processing, is helping maintain native protein structure and bioactivity. With consumers shifting toward targeted nutrition and clean-label products, manufacturers are prioritizing traceability and transparency. This has led to increased R&D investments and partnerships across dairy producers and nutraceutical brands, helping position alpha-lactalbumin as a cornerstone ingredient in premium nutritional applications.

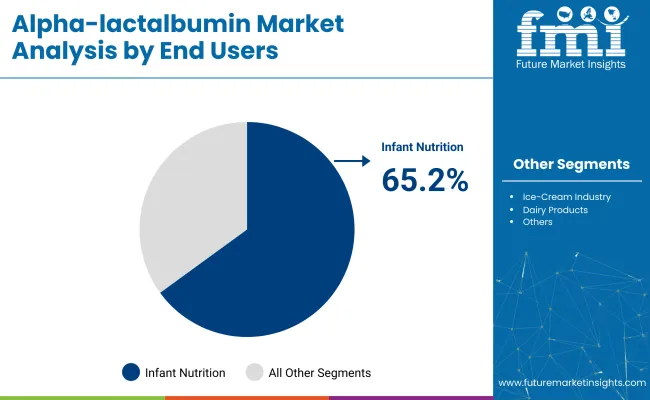

The alpha-lactalbumin market is segmented by end users into the food and beverage industry, infant nutrition, ice-cream industry, dairy products, pharmaceutical industry, and others such as the nutraceutical industry. Regionally, the market is distributed across North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

Infant nutrition is projected to dominate the application segment with a 65.2% market share by 2025, driven by increasing demand for premium protein ingredients in baby formula formulations.

Infant nutrition is expected to command 65.2% of the alpha-lactalbumin market share by 2025. Demand for infant nutrition is higher in the alpha-lactalbumin market because alpha-lactalbumin closely replicates the primary whey protein found in human breast milk. This resemblance makes it a preferred ingredient in infant formulas aimed at improving protein quality while supporting digestibility, immune function, and cognitive development in newborns.

Alpha-lactalbumin is used in infant formulas to replicate human milk protein composition, supporting brain development and sleep regulation. In sports and clinical nutrition, it enables muscle recovery, immune support, and dietary intervention in gastrointestinal disorders, cachexia, and metabolic diseases, with expanding applications in hospital nutrition protocols and post-operative care.

High Demand from Infant Formula and Early Life Nutrition

Alpha-lactalbumin demand remains concentrated in early-life formulations due to its biological similarity to human milk protein. Infant formula manufacturers are using it to improve amino acid profiles, reduce total protein load, and meet regulatory protein-quality thresholds.

Specialized formulas targeting low-birthweight and premature infants rely on alpha-lactalbumin to support neurodevelopment and gut health. Between 2020 and 2025, usage across hospital and retail infant formulas expanded by 31%, with neonatal units in Europe and East Asia reporting a shift toward formulations enriched with alpha-lactalbumin.

Tryptophan-rich blends have gained traction in sleep-regulating formulas for infants aged 0-6 months. Product registrations in over 40 countries now require compositional disclosure of alpha-lactalbumin content, reinforcing its role in premium newborn nutrition. Clinical buyers in neonatal care prefer formulas with 25-30% of total protein from alpha-lactalbumin to align with human milk benchmarks.

Growing Use in Sports Nutrition and Clinical Dietary Supplements

Alpha-lactalbumin is increasingly used in active and clinical nutrition formats for its digestibility and high leucine and tryptophan content. Sports nutrition brands have formulated recovery blends with alpha-lactalbumin for faster muscle repair and better amino acid uptake. Between 2021 and 2025, 18 new product SKUs featuring alpha-lactalbumin launched across the EU and North America targeting endurance athletes and post-operative recovery.

In clinical applications, it is preferred in low-lactose, hypoallergenic formulas for malnourished patients and those with gastrointestinal or metabolic conditions. Hospitals in Japan and Scandinavia have integrated alpha-lactalbumin-based drinks into nutrition protocols for cancer cachexia and inflammatory bowel disease. Liquid and powder formats with concentrated alpha-lactalbumin now represent a growing portion of therapeutic dietary product pipelines, with procurement volume rising in hospital nutrition tenders.

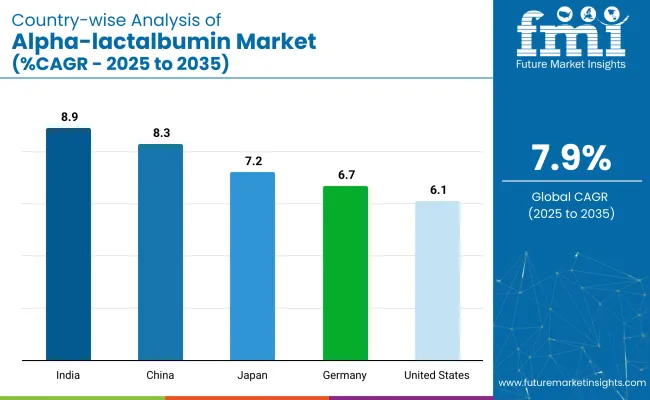

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.9% |

| China | 8.3% |

| Japan | 7.2% |

| Germany | 6.7% |

| United States | 6.1% |

Global alpha-lactalbumin demand is projected to rise at a 6.9% CAGR from 2025 to 2035. Of the five profiled markets out of 40 covered, India leads at 8.9%, followed by China at 8.3% and Japan at 7.2%, while Germany posts 6.7% and the United States records 6.1%.

These rates translate to a growth premium of +29% for India, +20% for China, and +4% for Japan versus the baseline, whereas Germany and the United States trail by -3% and -12%, respectively. Divergence reflects local catalysts: fortification mandates in India, sports-nutrition boom in China, clean-label reformulations in Japan, export-grade whey processing constraints in Germany, and saturated high-value isolate demand in the United States.

Demand for alpha-lactalbuminin India is projected to expand at 8.9% CAGR from 2025 to 2035, the fastest among leading economies. Growth is led by rising infant formula penetration and expanding nutraceutical brands targeting pediatric care. Local manufacturers are building whey isolation capacity to meet formula-grade protein standards. FSSAI-aligned purity norms are attracting partnerships with EU dairy processors for bioavailable protein enrichment.

The market in China is growing at 8.3% CAGR, driven by demand for traceable infant and elderly formulations. Post-COVID health prioritization has boosted use of alpha-lactalbumin in follow-on and medical formulas. Cross-border e-commerce platforms now account for 27% of sales, with imported European blends rich in alpha-lactalbumin favored by middle-income urban parents.

Japan is projected to grow at 7.2% CAGR, supported by its aging population and demand for allergen-free, digestible proteins. Over 41% of alpha-lactalbumin is used in nutrition products for seniors aged 65+. Local processors are investing in membrane microfiltration for high-purity dairy fractions. Regulatory norms require full amino acid disclosures on pediatric blends.

Germany is forecast to grow at 6.7% CAGR, supported by bio-certified infant formula and rising sports recovery applications. Alpha-lactalbumin-enriched products are now integrated into over 30% of Stage-1 and Stage-2 infant formulations sold through pharmacies. Domestic firms are aligning with EU Regulation 609/2013 on amino acid composition in formula-grade dairy proteins.

The USA market is expanding at a 6.1% CAGR, led by adoption in clinical-grade, clean-label, and performance-oriented nutrition products. Ultrafiltration and ion-exchange are used in producing whey isolates with high alpha-lactalbumin content for both sports recovery and pediatric care. Brands now offer targeted blends for gut health, muscle support, and immune resilience.

The market is moderately consolidated, with a combination of global dairy conglomerates and specialized biochemical firms driving innovation and supply. Arla Foods Ingredients and Fonterra Co-operative Group Limited lead the market with their extensive dairy processing infrastructure and commitment to high-quality whey protein production. Nestlé S.A. and Agropur Cooperative also play a significant role, leveraging their nutritional expertise to meet rising demand in infant formula and clinical nutrition segments.

Specialty ingredient suppliers such as Milk Specialties Global and Hilmar Ingredients Inc. provide tailored alpha-lactalbumin products to food and nutraceutical manufacturers. Meanwhile, companies like Abcam plc, Merck KGaA, and VWR International focus on high-purity variants for research and pharmaceutical applications. XuchangShangke Chemical Co., Ltd. supports the market with cost-effective alternatives in emerging economies, contributing to expanding global reach.

Recent Alpha-lactalbumin Industry News

In May 2023, Arla Foods Ingredients announced the launch of a new alpha-lactalbumin-enriched infant formula ingredient, enhancing amino acid profile and digestibility for newborns.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 762.5 million |

| Projected Market Size (2035) | USD 1,631.1 million |

| CAGR (2025 to 2035) | 7.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value |

| End Users Analyzed (Segment 1) | Food & Beverage Industry, Infant Nutrition, Ice Cream Industry, Dairy Products, Pharmaceuticals, Nutraceuticals |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players | Agropur Cooperative, Arla Foods Ingredients, Nestlé S.A., Abcam plc, Hilmar Ingredients Inc, Fonterra Co-operative Group Limited, Milk Specialties Global, VWR International, LLC, Xuchang Shangke Chemical Co., Ltd., Merck KGaA |

| Additional Attributes | Dollar sales by end user segments, rising uptake in infant nutrition and dairy applications, expanding use in nutraceuticals, and growth in global lactose-free and functional protein markets. |

The industry is segmented by end users into the food and beverage industry, infant nutrition, ice-cream industry, dairy products, pharmaceutical industry, and others such as the nutraceutical industry.

Regionally, the market is distributed across North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The market size is projected to be USD 762.5 million in 2025.

The global market is projected to reach USD 1,631.1 million by 2035.

The market is expected to grow at a CAGR of 7.9% during the forecast period.

Infant nutrition is the leading application, accounting for 65.2% of the market share in 2025.

India is forecast to grow at the highest CAGR of 8.9% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA