Ammunition Market Size and Share Forecast Outlook (2025 to 2035)

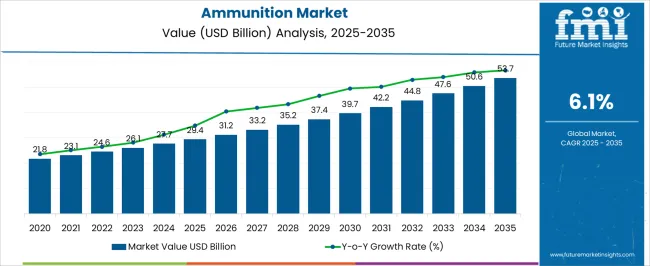

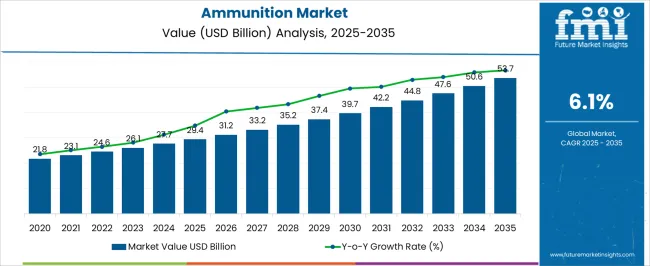

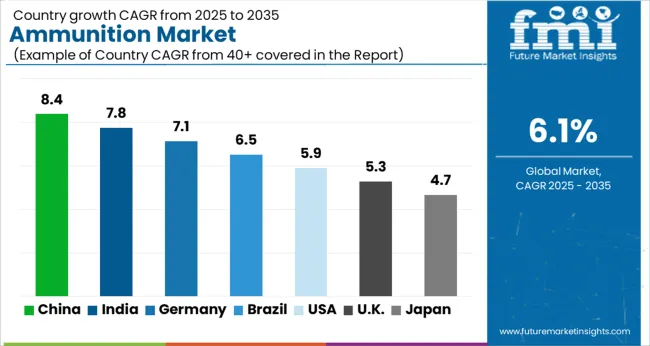

The Ammunition Market is estimated to be valued at USD 29.4 billion in 2025 and is projected to reach USD 53.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

Quick Stats for Ammunition Market

- Ammunition Market Industry Value (2025): USD 29.4 billion

- Ammunition Market Forecast Value (2035): USD 53.7 billion

- Ammunition Market Forecast CAGR: 6.1%

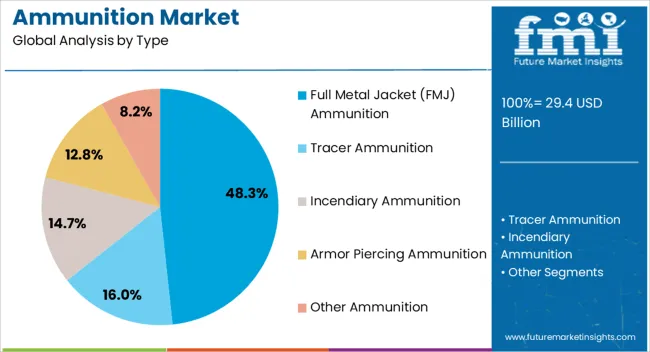

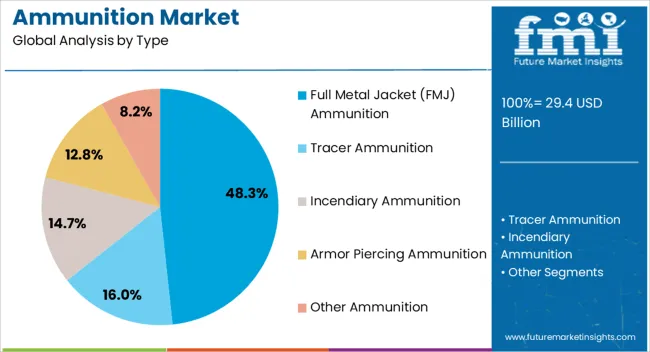

- Leading Segment in Ammunition Market in 2025: Full Metal Jacket (FMJ) Ammunition (48.3%)

- Key Growth Region in Ammunition Market: North America, Asia-Pacific, Europe

- Top Key Players in Ammunition Market: Northrop Grumman Corporation, FN Herstal, Olin Corporation, General Dynamics Corporation, BAE Systems, Inc., Rheinmetall Defense, Nexter KNDS Group, Hanwha Corporation, ST Engineering, Remington Arms Company LLC, Vista Outdoor Operations LLC

| Metric |

Value |

| Ammunition Market Estimated Value in (2025 E) |

USD 29.4 billion |

| Ammunition Market Forecast Value in (2035 F) |

USD 53.7 billion |

| Forecast CAGR (2025 to 2035) |

6.1% |

Rationale for Segmental Growth in the Ammunition Market

The ammunition market is witnessing consistent growth, supported by rising defense budgets, modernization of armed forces, and heightened geopolitical tensions that are driving procurement activities worldwide. Increased participation in recreational shooting sports and rising civilian ownership of firearms in certain regions have further contributed to demand.

The market benefits from ongoing technological advancements in ballistic performance, manufacturing efficiency, and compatibility with modern weapon platforms. Current growth trends reflect a dual reliance on defense procurement and commercial use, with military contracts forming a significant revenue base.

Sustainability considerations are gradually influencing manufacturing, with growing interest in lead-free and environmentally safer alternatives. Looking forward, expansion is expected to be sustained by modernization of military stockpiles, continued demand for small-caliber ammunition, and the introduction of advanced materials that enhance durability and penetration performance.

Segmental Analysis

Insights into the Full Metal Jacket (FMJ) Ammunition Segment

The full metal jacket (FMJ) segment dominates the type category with approximately 48.3% share, owing to its extensive use in training, target practice, and combat scenarios. Its design, characterized by a soft core encased in a harder metal shell, ensures durability, reliable feeding, and reduced barrel fouling, enhancing firearm longevity.

The cost-effectiveness and availability of FMJ ammunition make it a preferred choice for both military and civilian applications. Growth is further reinforced by its suitability for semi-automatic and automatic firearms, ensuring compatibility across multiple platforms.

With strong utilization in military training programs and recreational shooting activities, FMJ ammunition is expected to sustain its market leadership over the forecast period.

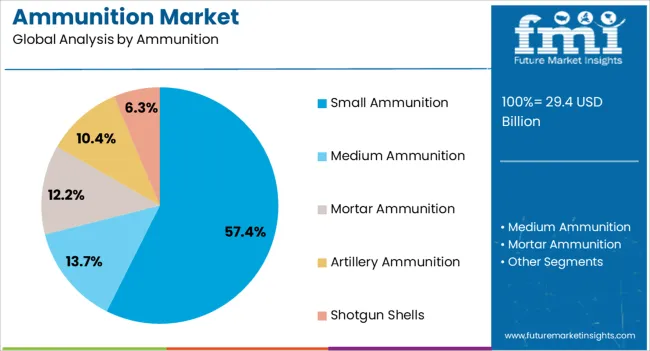

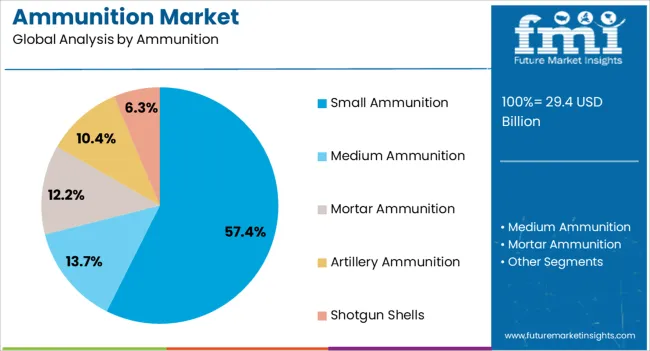

Insights into the Small Ammunition Segment:

The small ammunition segment holds approximately 57.4% share of the ammunition category, reflecting its widespread use in military, law enforcement, and civilian markets. This segment’s dominance is supported by its application in rifles, pistols, and light machine guns, which remain the most commonly deployed firearms globally.

High consumption levels are linked to training, active military operations, and growing civilian sports shooting participation. Manufacturing scale, standardized calibers, and established distribution networks have further supported this segment’s growth.

With military organizations prioritizing reliable and cost-efficient munitions for training and combat readiness, small ammunition is expected to retain its significant share in the long term.

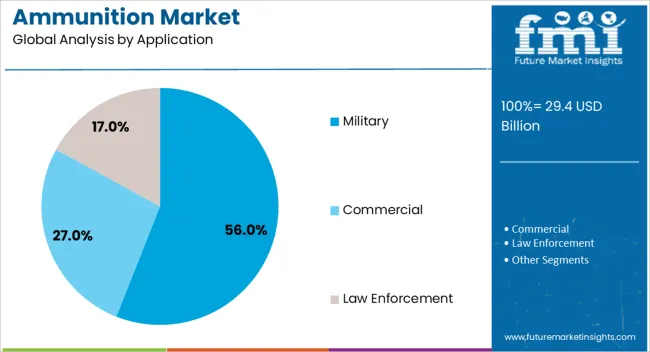

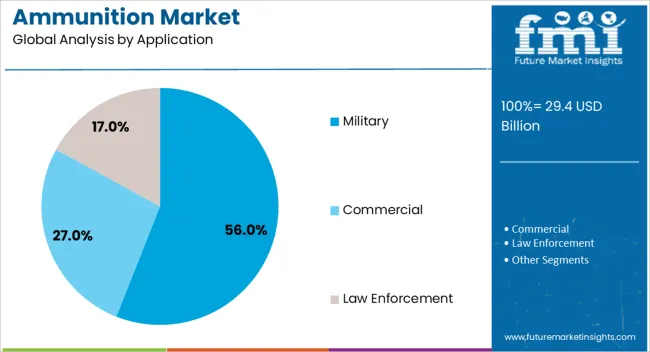

Insights into the Military Segment:

The military segment accounts for approximately 56.0% share of the application category, driven by large-scale procurement programs and sustained ammunition consumption in defense operations. Continuous modernization of armed forces and increasing participation in multinational defense collaborations have reinforced military demand.

The segment benefits from stockpiling strategies, periodic replenishment, and training requirements that ensure consistent usage levels. Additionally, technological improvements in ammunition designed for precision and lethality have further supported adoption in military applications.

With global defense expenditure continuing its upward trajectory, the military segment is projected to remain the dominant consumer group in the ammunition market.

Consumption Trends in the Global Ammunition Sector

- The ammunition market is experiencing growth owing to the rising demand fueled by geopolitical tensions, military modernization, and increasing defense budgets across the globe.

- Governments and defense forces prefer technologically advanced and precision-guided ammunition, leading manufacturers to develop and market innovative ammunition solutions.

- Advanced ammunition is gaining popularity among military and law enforcement agencies as they recognize the significance of staying technologically abreast for effective defense and security.

- The popularity of specialized ammunition, such as smart munitions and precision-guided systems, is increasing due to their enhanced accuracy and efficiency in addressing modern security challenges.

- The ammunition market is experiencing sustained growth, driven by global conflicts, counter-terrorism measures, and territorial disputes.

- Sales and adoption of ammunition with advanced features and capabilities are increasing, influencing procurement decisions and leading to widespread adoption across different regions.

- Ongoing military alliances and collaborative efforts contribute to exchanging ammunition technologies and strategies among nations, amplifying the market's popularity.

Key Restraints Impacting Ammunition Market Growth

The ammunition market is anticipated to surpass a valuation of USD 53.7 billion by 2035, expanding at a 6.2% CAGR. While the ammunition market is experiencing growth, several factors can adversely affect its development and expansion.

- Strict national and international regulations on arms trade and ammunition procurement can create barriers, limiting market access and affecting sales.

- Economic uncertainties and downturns can lead to defense budget cuts, impacting nations' purchasing power and ammunition market dynamics.

- International efforts towards disarmament and arms reduction treaties may decrease demand for ammunition, affecting market growth.

- Low utility in the prices of raw materials, such as metals and fuels, can increase production costs, putting pressure on profit margins for ammunition manufacturers.

- Growing awareness of ammunition's environmental impact may lead to restrictions on certain types, pushing for more eco-friendly alternatives.

- Rapid advancements in defense technologies may render certain conventional ammunition obsolete, requiring manufacturers to innovate and adapt constantly.

- The growing emphasis on security measures may divert resources from traditional defense spending, impacting the ammunition market.

- Public sentiments against armed conflicts and war can influence government decisions, potentially resulting in decreased defense budgets and ammunition procurement.

Ammunition Industry Analysis by Top Investment Segments

Versatility, Cost-effectiveness, and Compliance with International Regulations Drive Demand for Full Metal Jacket (FMJ) Ammunition

| Attributes |

Details |

| Top Type |

Full Metal Jacket |

| CAGR (2025 to 2035) |

23.4% |

Based on the type, full metal jacket (FMJ) ammunition dominates the global ammunition market, expanding at a 6.0% CAGR through 2035. This rising popularity is attributed to the following reasons:

- Full metal jacket ammunition features a lead core encapsulated in a metal jacket, which minimizes lead exposure and barrel fouling and enhances firearm reliability.

- Full metal jacket (FMJ) ammunition rounds are also known for their stability in flight, consistent accuracy, and reliable feeding in various firearms. This makes them a preferred choice for mass production and consumption in the ammunition market.

- While specialized ammunition exists for specific purposes, FMJ's versatility and compliance with regulations make it a go-to option for law enforcement, military, and civilian firearm enthusiasts.

Civilian, Military, and Law Enforcement Usage of Small Ammunition

| Attributes |

Details |

| Top Ammunition |

Small Ammunition |

| CAGR (2025 to 2035) |

5.8% |

Based on ammunition, small ammunition dominates the market, expanding at a 5.8% CAGR. This rising popularity is attributed to the following reasons:

- Small ammunition is extensively used for civilian purposes such as recreational shooting, hunting, and personal defense. This popularity contributes significantly to the demand for small ammunition because of its affordability and accessibility.

- Small ammunition is a staple in military and law enforcement operations due to the standardization of NATO caliber rounds and the prevalence of rifles and handguns chambered for these calibers.

- Moreover, the adaptability of small-caliber ammunition to various operational scenarios makes it the primary ammunition type used by armed forces.

Analysis of Top Countries Manufacturing and Exporting Ammunition

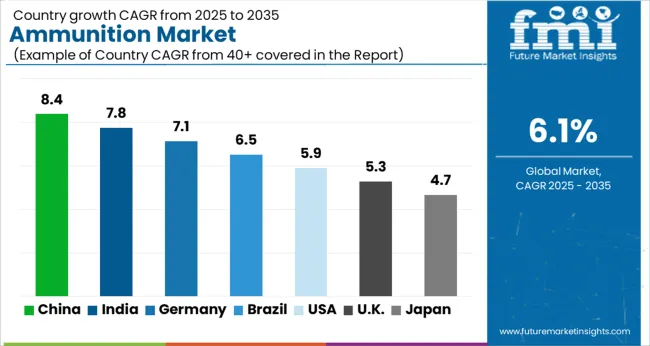

The section analyzes the ammunition market by country, including the United States, the United Kingdom, China, Japan, and South Korea. The table highlights the CAGR for each country, indicating the expected market growth in that country through 2035.

Technologically Advanced Defense Sector Production in South Korea

South Korea is the leading Asian country in the ammunition market. The Korean ammunition market is expected to rise at a CAGR of 7.2% until 2035.

- South Korea's presence in the ammunition market is characterized by its defense industry, which manufactures a range of small arms, ammunition, and artillery rounds, making it a prominent player in the global market.

- South Korea's strategic position in East Asia and active participation in international peacekeeping efforts further contribute to its dominance in the ammunition market.

Japan's Focus on Precision Engineering and Strong Defense Commitment

Japan is another Asian country leading in the global ammunition market. The Japanese market is anticipated to register a CAGR of 6.9% through 2035.

- Japanese defense industries produce high-quality small arms and ammunition, contributing to the global supply chain.

- Japan’s strategic location in the Asia-Pacific region also positions it as a key player in the regional ammunition market.

Significant Military Spending in the United States Defense Industry

The United States dominates the ammunition market in the North American region. It is expected to exhibit an annual growth rate of 6.3% until 2035.

- The United States’s advanced defense technologies and diverse product offerings make it a leader in the global ammunition market. It is also a major exporter of ammunition, supplying both domestic and international markets.

The United Kingdom’s Strong Defense Capabilities, Advanced Military Technologies, and Strategic Alliances

The United Kingdom ammunition market is predicted to register a CAGR of 6.8% through 2035.

- As a key member of NATO, the United Kingdom plays a crucial role in standardization efforts, and its defense industry produces a variety of ammunition types.

- The country's commitment to international security and peacekeeping operations further enhances its stand in the global ammunition market.

China’s Continuous Modernization Efforts and Strong Presence in the Global Arms Trade

China is another Asian country in the global ammunition market, which is anticipated to register a CAGR of 6.6% through 2035.

- Chinese defense industries manufacture a wide range of ammunition, including small arms and artillery rounds, making it one of the world's leading ammunition producers.

- China's expanding influence in international geopolitics also adds to its market dominance, as it caters to various nations seeking reliable and cost-effective ammunition.

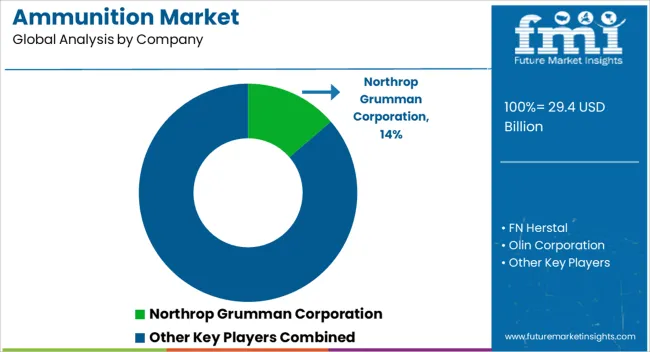

Competitive Landscape of the Ammunition Market

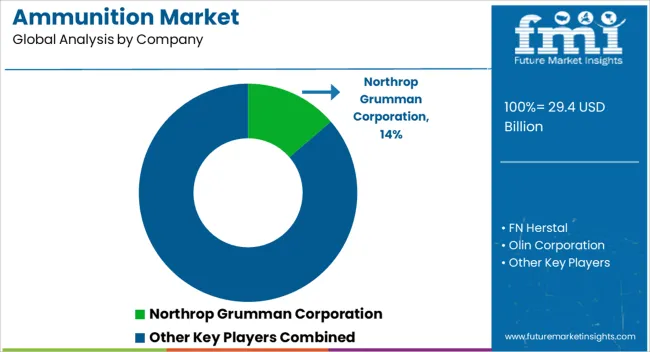

Key companies like Northrop Grumman Corporation, FN Herstal, Olin Corporation, General Dynamics Corporation, BAE Systems, Inc., and Rheinmetall Defense are implementing various strategies to expand their market presence and meet customers' evolving demands in the ammunition market. Companies are investing in R&D to introduce innovative technologies in ammunition manufacturing.

Leading ammunition manufacturers are actively pursuing opportunities in the global market. Companies engage in strategic mergers and acquisitions to strengthen their market position. Some companies are incorporating environmentally friendly practices in ammunition manufacturing.

Recent Developments

- On January 23, 2025, NATO signed a 1.1-billion-euro contract to procure 155mm artillery ammunition, reinforcing the alliance's commitment to bolstering military capabilities and ensuring strategic preparedness.

- On December 10, the United States accelerated ammunition sales to Israel, bypassing congressional review. The expedited shipment, reported by The New York Times, highlights the limited congressional oversight in this transaction.

- On October 11, 2025, South Korea's leading arms manufacturer, Hanwha Aerospace, aims to enter the United States market after a significant arms deal with Poland. Eager to expand globally, they target supplying the United States military.

Leading Companies in the Global Ammunition Industry

- Northrop Grumman Corporation

- FN Herstal

- Olin Corporation

- General Dynamics Corporation

- BAE Systems, Inc.

- Rheinmetall Defense

- Nexter KNDS Group

- Hanwha Corporation

- ST Engineering

- Remington Arms Company LLC

- Vista Outdoor Operations LLC

Top Segments Studied in the Ammunition Market Report

By Type:

- Full Metal Jacket (FMJ) Ammunition

- Tracer Ammunition

- Incendiary Ammunition

- Armor Piercing Ammunition

- Other Ammunition

By Ammunition:

- Small Ammunition

- Medium Ammunition

- Mortar Ammunition

- Artillery Ammunition

- Shotgun Shells

By Application:

- Commercial

- Military

- Law Enforcement

By Region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- Latin America

Frequently Asked Questions

How big is the ammunition market in 2025?

The global ammunition market is estimated to be valued at USD 29.4 billion in 2025.

What will be the size of ammunition market in 2035?

The market size for the ammunition market is projected to reach USD 53.7 billion by 2035.

How much will be the ammunition market growth between 2025 and 2035?

The ammunition market is expected to grow at a 6.1% CAGR between 2025 and 2035.

What are the key product types in the ammunition market?

The key product types in ammunition market are full metal jacket (fmj) ammunition, tracer ammunition, incendiary ammunition, armor piercing ammunition and other ammunition.

Which ammunition segment to contribute significant share in the ammunition market in 2025?

In terms of ammunition, small ammunition segment to command 57.4% share in the ammunition market in 2025.