The Antacids Market is valued at USD 7.67 billion in 2025. As per FMI's analysis, the Antacids Industry will grow at a CAGR of 4.9% and reach USD 12.33 billion by 2035.

In 2024, the industry experienced steady growth driven by an increase in the prevalence of gastroesophageal reflux disease (GERD) and a rising aging population more prone to digestive disorders. Over-the-counter (OTC) antacid sales saw a notable uptick, especially in urban regions, as consumers sought immediate relief without prescriptions.

E-commerce channels also played a key role, with several brands reporting double-digit growth in online antacid purchases. However, the industry also saw a growing consumer preference for natural and herbal remedies, which slightly impacted the sales of traditional antacids. Regional trends showed that North America and parts of Asia Pacific witnessed higher growth rates compared to Europe, driven by dietary changes and increased consumption of processed foods.

Looking ahead into 2025 and beyond, the industry is expected to benefit from continued innovations in antacid formulations, including sugar-free and chewable options catering to consumer preferences. Pharmaceutical companies are also expected to focus more on pediatric and geriatric-friendly variants. Expansion in emerging economies, supported by increasing healthcare awareness and improving distribution channels, is likely to further accelerate growth in the coming decade.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 7.67 billion |

| Industry Value (2035F) | USD 12.33 billion |

| CAGR (2025 to 2035) | 4.9% |

The Antacids Industry is on a steady growth path, driven primarily by rising cases of acidity and digestive disorders across age groups. Increased self-medication and greater access to OTC products are fueling demand. Pharmaceutical companies and retail drugstores stand to benefit, while traditional prescription-based treatments may face slower growth.

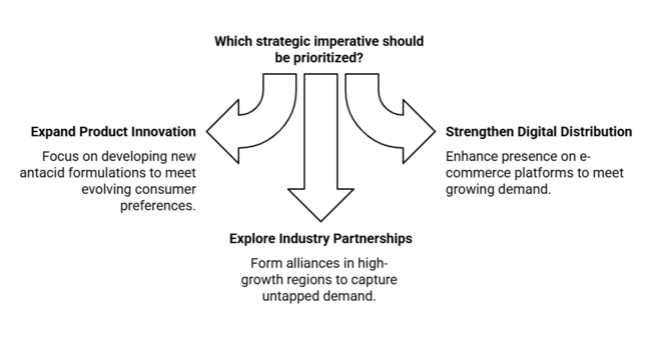

Expand Product Innovation Pipeline

Invest in developing new antacid formulations such as fast-dissolving tablets, natural/herbal alternatives, and sugar-free options to cater to evolving consumer preferences.

Strengthen Digital and OTC Distribution

Enhance presence across e-commerce platforms and modern retail channels to meet the growing demand for convenient, over-the-counter antacid purchases.

Explore Emerging Industry Partnerships

Form strategic alliances and distribution partnerships in high-growth regions like Asia-Pacific and Latin America to capture untapped demand and build long-term industry presence.

| Risk | Assessment (Probability - Impact) |

|---|---|

| Rise in preference for natural or home remedies over traditional antacids | Medium - High |

| Regulatory changes affecting OTC drug classifications | Low - High |

| Supply chain disruptions in raw materials or packaging | Medium - Mediu m |

1-year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Product Differentiation | Conduct consumer surveys to identify demand for natural and sugar-free antacid variants |

| Digital Channel Expansion | Launch targeted market ing and sales campaigns across leading e-commerce platforms |

| Emerging Industry Penetration | Identify and onboard regional distribution partners in high-growth APAC and LATAM regions |

To stay ahead, companies must shift from a one-size-fits-all approach to a more segmented, consumer-driven antacid product strategy. With rising self-medication trends and growing demand for natural alternatives, stakeholders should prioritize innovation pipelines that cater to specific health preferences and age groups.

Simultaneously, expanding digital reach and deepening presence in emerging industries will be critical to unlocking the next phase of growth. This intelligence signals a need to recalibrate the roadmap-balancing rapid-response product development with strategic investments in e-commerce, localized partnerships, and supply chain resilience to ensure long-term competitiveness.

The global industry for Proton Pump Inhibitors (PPI) is witnessing a steady rise with a leading CAGR of 5.4%, making it the fastest-growing segment in the drug class category. As the most commonly prescribed treatment for conditions like gastroesophageal reflux disease (GERD) and peptic ulcers, PPIs are highly effective in reducing stomach acid.

The ongoing preference for these drugs among patients, coupled with their ability to treat multiple gastrointestinal disorders, solidifies their dominance in the industry. Innovations in formulation and expanding clinical applications are likely to further drive this growth, making PPIs an essential therapeutic choice in the global antacids industry.

Liquid dosage forms in the antacids industry are projected to grow at the highest CAGR of 5.8%. This is due to the growing preference for liquids over tablets and capsules, particularly among patients with difficulty swallowing pills, such as the elderly and pediatric populations.

Liquid formulations are also favoured for their faster absorption rates, making them ideal for immediate relief from conditions like heartburn and GERD. As manufacturers continue to develop more convenient and effective liquid antacid options, the demand for this dosage form will continue to increase, supporting its position as a highly lucrative segment in the industry.

The GERD segment leads the industry with a CAGR of 5.3%, reflecting the widespread prevalence of this condition and the growing demand for effective treatments. GERD has become a major health concern due to lifestyle changes, poor dietary habits, and increased stress levels.

As a result, the treatment landscape for GERD is rapidly evolving, with both prescription and over-the-counter antacids showing strong growth. Additionally, ongoing advancements in therapeutic approaches and the development of targeted drugs for GERD will contribute significantly to the expansion of this segment, making it a vital area for investment and innovation in the coming years.

Online pharmacies represent the fastest-growing distribution channel for antacids, with a remarkable CAGR of 7.5%. The rise in e-commerce, accelerated by the COVID-19 pandemic, has led to a surge in demand for online pharmaceutical services. Consumers increasingly prefer the convenience of ordering medications online, often at discounted prices.

With a growing number of patients opting for home delivery services for antacids and other medications, the online pharmacy segment is expected to continue its rapid expansion. This trend reflects broader shifts in consumer behaviour, especially among tech-savvy and convenience-oriented customers, making online pharmacies a promising avenue for future growth.

The oral segment is projected to experience the highest CAGR of 5.2% in this segment. This growth is attributed to the widespread consumer preference for oral formulations like tablets, chewable, and liquids, which offer convenience, easy administration, and fast relief from acid-related issues such as heartburn and indigestion.

Oral antacids are commonly available over-the-counter, making them accessible for a large population, including in emerging industries. Additionally, increased awareness about gastrointestinal health and the convenience of at-home treatment are further fueling the growth of this segment. The preference for oral dosage forms ensures their dominance in the industry.

Sales in the United States are anticipated to grow at a CAGR of 4.8% from 2025 to 2035. This growth is driven by a well-established healthcare infrastructure, high prevalence of gastrointestinal disorders like GERD, and widespread availability of over-the-counter antacid products.

he USA industry benefits from a large consumer base with easy access to healthcare services and a variety of antacid formulations, including tablets, liquids, and chewable. Additionally, the presence of major pharmaceutical companies and continuous product innovations contribute to the industry's expansion. The trend towards self-medication and the convenience of OTC products further bolsters the demand for antacids in the country.

Antacids industry in the United Kingdom is anticipated to grow at a CAGR of 4.3% from 2025 to 2035. The UK's antacids industry is supported by a robust healthcare system and high consumer awareness regarding digestive health. The increasing prevalence of lifestyle-related gastrointestinal issues, such as acid reflux and indigestion, drives the demand for antacid products.

The industry is characterized by the availability of a wide range of OTC antacids and a growing preference for self-care solutions. Furthermore, the UK's regulatory environment ensures the safety and efficacy of antacid products, fostering consumer trust and industry growth.

France sales are anticipated to grow at a CAGR of 4.2% from 2025 to 2035. The French antacids industry benefits from a strong pharmaceutical industry and a health-conscious population. The demand for antacids is driven by the prevalence of digestive disorders and the increasing adoption of OTC medications for self-treatment.

French consumers show a preference for natural and herbal antacid formulations, aligning with the country's inclination towards holistic health approaches. The industry is also influenced by the availability of innovative products and the emphasis on preventive healthcare measures.

The industry in Germany is anticipated to grow at a CAGR of 4.5% from 2025 to 2035. Germany's antacids industry is bolstered by a robust pharmaceutical sector and a high level of healthcare expenditure. The country's aging population and the increasing incidence of gastrointestinal ailments contribute to the steady demand for antacid products.

German consumers value high-quality and effective medications, leading to a preference for well-established brands and formulations. The industry also benefits from a strong distribution network, including pharmacies and online platforms, ensuring wide accessibility of antacid products.

In Italy the sales are anticipated to grow at a CAGR of 4.0% from 2025 to 2035. The Italian antacids industry is influenced by dietary habits and a high prevalence of digestive issues among the population.

The demand for antacid products is supported by the availability of various OTC options and the cultural acceptance of self-medication practices. Italian consumers show interest in both traditional and innovative antacid formulations, including natural and herbal options. The industry growth is further facilitated by the presence of local pharmaceutical companies and a well-established pharmacy network.

The industry in South Korea is anticipated to grow at a CAGR of 4.3% from 2025 to 2035. South Korea's antacids industry is driven by a combination of dietary patterns, stress-related digestive issues, and a tech-savvy population. The increasing awareness of gastrointestinal health and the availability of advanced antacid formulations contribute to industry growth.

South Korean consumers are inclined towards innovative and convenient antacid products, including chewable tablets and effervescent powders. The industry also benefits from the integration of digital health platforms and e-commerce channels, enhancing product accessibility.

In Japan the sector is anticipated to grow at a CAGR of 4.8% from 2025 to 2035. Japan's antacids industry is characterized by a high level of consumer awareness and a preference for high-quality, domestically produced medications. The aging population and the prevalence of digestive disorders drive the demand for effective antacid products.

Japanese consumers Favor innovative formulations, such as effervescent tablets and chewable options, that offer convenience and rapid relief. The industry is also supported by stringent regulatory standards ensuring product safety and efficacy, fostering consumer confidence.

Sales in China are anticipated to grow at a CAGR of 5.5% from 2025 to 2035. China's antacids industry experiences rapid growth due to rising disposable incomes, increasing health awareness, and changing dietary habits. The large population base and the growing prevalence of gastrointestinal disorders contribute to the expanding demand for antacid products.

Chinese consumers are increasingly adopting OTC medications for self-care, and there is a notable interest in both Western and traditional Chinese medicine formulations. The sector is further propelled by the expansion of e-commerce platforms, enhancing product accessibility across the country.

In Australia and New Zealand the sector is anticipated to grow at a CAGR of 4.4% from 2025 to 2035. The antacids sector in these countries is supported by high healthcare standards, widespread availability of OTC medications, and a health-conscious population.

The demand for antacid products is driven by the prevalence of digestive issues and the preference for self-medication practices. Consumers in Australia and New Zealand show interest in natural and herbal antacid formulations, aligning with the regional emphasis on holistic health approaches. The industry also benefits from strong regulatory frameworks ensuring product quality and safety.

The antacids industry is moderately fragmented, featuring a mix of multinational corporations and regional players. Major companies like Johnson & Johnson, Haleon, Sanofi, Bayer AG, and Sun Pharmaceuticals Ltd. dominate the landscape, while numerous smaller firms contribute to a competitive environment.

Top companies are competing through strategies such as competitive pricing, product innovation, strategic partnerships, and geographic expansion. They focus on developing novel formulations, including natural and organic options, to cater to evolving consumer preferences. Collaborations with digital health firms and expansion into emerging industries are also key tactics to enhance industry presence and drive growth.

In June 2024, Akums Drugs & Pharmaceuticals Ltd. introduced an advanced anti-reflux chewable tablet formulated with sodium alginate and potassium bicarbonate. Approved by the Drugs Controller General of India (DCGI), the product aims to provide rapid relief from acid reflux and heartburn in a convenient chewable format, marking a significant development in India's gastrointestinal therapeutics space.

In July 2024, Dr. Reddy's Laboratories entered into a strategic partnership with Takeda Pharmaceuticals to bring the novel antacid vonoprazan to the Indian market. Branded as VONO, this collaboration represents a move to offer next-generation acid-suppressing treatments that provide faster and more sustained relief compared to traditional proton pump inhibitors.

Earlier in March 2024, ENO, now under the umbrella of Haleon (formerly GSK Consumer Healthcare), launched “ENO Chewy Bites,” a new line of flavored chewable antacids. Available in Tangy Lemon and Zesty Orange variants, the product aims to meet consumer demand for on-the-go relief from indigestion while expanding the brand’s presence in the chewable antacid category.

Johnson & Johnson leads the global antacids industry with a 15.3% market share, anchored by its strong brand portfolio-including Pepcid-and a robust distribution network across North America and Europe. Its strategic focus on over-the-counter (OTC) digestive health products and collaborative healthcare partnerships continues to reinforce its dominant position.

Sanofi S.A. follows closely with a 12.8% share, benefiting from its well-established antacid brands and expanding footprint in emerging markets. The company’s diversified digestive health portfolio and solid market presence across Europe and Asia have been key drivers of its sustained performance.

Bayer AG holds an 11.5% market share, largely attributed to consumer trust in its heritage brands like Rennie and Alka-Seltzer. Its extensive global retail penetration and consistent positioning in gastrointestinal care solidify its rank among the top players.

GlaxoSmithKline (GSK) captures a 9.7% share, primarily due to its flagship antacid brand, Gaviscon, which enjoys strong popularity in both the USA and European markets. GSK’s physician-backed recommendations and comprehensive marketing strategies help maintain steady consumer demand.

Reckitt Benckiser commands an 8.4% share with key products such as Mylanta and Eno. The company’s dominance in the USA and UK, combined with fast-acting formulations and aggressive advertising, continues to boost its market standing.

Pfizer holds a 6.2% share, leveraging its pharmaceutical credibility and strategic acquisitions to maintain a stable role in the antacids sector. Its consumer health division plays a critical role in ensuring continued relevance and market penetration.

Procter & Gamble (P&G) holds a 5.9% share, thanks to its well-known brand Pepto-Bismol. High brand loyalty and strong retail distribution, especially in North America, contribute significantly to its market position.

Sun Pharmaceuticals accounts for 4.6% of the market, with a rapidly growing presence across India and other Asian regions. Its cost-effective manufacturing and expanding OTC antacid offerings are fueling its rise in global rankings.

AstraZeneca secures a 3.8% share, focusing primarily on prescription-based antacid therapies and their OTC extensions. Its clinical reputation lends credibility to its digestive health products, supporting continued demand.

Dr. Reddy’s Laboratories holds a 3.5% share, driven by its extensive portfolio of generic antacids and growing presence in both USA and emerging markets. Its affordability and strategic expansion efforts are key to its upward trajectory.

The industry is segmented into proton pump inhibitors, H2 antagonist, acid neutralizers, pro-motility agents, anti-h.pyrolicdrugs, prostaglandin analogous and others

The industry is divided into tablet, capsules, powder, liquid and others

The industry is segmented into oral and injectable

The industry is divided into gastroesophageal reflux disease, heartburn, peptic ulcer and others

The industry is divided into retail pharmacies, hospital pharmacies and online pharmacies

The industry is studied across North America, Latin America, Europe, South Asia, East Asia, Oceania and The Middle East and Africa (MEA)

The antacids industry is valued at USD 7.67 billion in 2025

The industry is expected to grow at a CAGR of 4.9% from 2025 to 2035.

Rising GERD cases, aging population, and increased OTC usage are key growth drivers.

E-commerce and modern retail channels are seeing rapid growth in antacid sales.

Innovation, digital expansion, and emerging industry partnerships are top imperatives.

Table 01: Global Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Drug Class

Table 02: Global Market Volume (Units) Analysis and Forecast 2017 to 2033, by Drug Class

Table 03: Global Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Route of Administration

Table 04: Global Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Dosage Form

Table 05: Global Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Indication

Table 06: Global Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Distribution Channel

Table 07: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 08: North America Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Drug Class

Table 09: North America Market Volume (Units) Analysis and Forecast 2017 to 2033, by Drug Class

Table 10: North America Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Route of Administration

Table 11: North America Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Dosage Form

Table 12: North America Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Indication

Table 13: North America Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Distribution Channel

Table 14: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 15: Latin America Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Drug Class

Table 16: Latin America Market Volume (Units) Analysis and Forecast 2017 to 2033, by Drug Class

Table 17: Latin America Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Route of Administration

Table 18: Latin America Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Dosage Form

Table 19: Latin America Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Indication

Table 20: Latin America Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Distribution Channel

Table 21: Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 22: Europe Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Drug Class

Table 23: Europe Market Volume (Units) Analysis and Forecast 2017 to 2033, by Drug Class

Table 24: Europe Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Route of Administration

Table 25: Europe Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Dosage Form

Table 26: Europe Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Indication

Table 27: Europe Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Distribution Channel

Table 28: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 29: South Asia Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Drug Class

Table 30: South Asia Market Volume (Units) Analysis and Forecast 2017 to 2033, by Drug Class

Table 31: South Asia Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Route of Administration

Table 32: South Asia Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Dosage Form

Table 33: South Asia Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Indication

Table 34: South Asia Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Distribution Channel

Table 35: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 36: East Asia Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Drug Class

Table 37: East Asia Market Volume (Units) Analysis and Forecast 2017 to 2033, by Drug Class

Table 38: East Asia Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Route of Administration

Table 39: East Asia Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Dosage Form

Table 40: East Asia Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Indication

Table 41: East Asia Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Distribution Channel

Table 42: Oceania Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 43: Oceania Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Drug Class

Table 44: Oceania Market Volume (Units) Analysis and Forecast 2017 to 2033, by Drug Class

Table 45: Oceania Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Route of Administration

Table 46: Oceania Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Dosage Form

Table 47: Oceania Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Indication

Table 48: Oceania Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Distribution Channel

Table 49: Middle East & Africa Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 50: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Drug Class

Table 51: Middle East & Africa Market Volume (Units) Analysis and Forecast 2017 to 2033, by Drug Class

Table 52: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Route of Administration

Table 53: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Dosage Form

Table 54: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Indication

Table 55: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2017 to 2033, by Distribution Channel

Figure 01: Global Market Volume (Units), 2017 to 2022

Figure 02: Global Market Volume (Units) & Y-o-Y Growth (%) Analysis, 2023 to 2033

Figure 03: Pricing Analysis per unit (US$), in 2023

Figure 04: Pricing Forecast per unit (US$), in 2033

Figure 05: Global Market Value (US$ Million) Analysis, 2017 to 2022

Figure 06: Global Market Forecast & Y-o-Y Growth, 2023 to 2033

Figure 07: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2023 to 2033

Figure 08: Global Market Value Share (%) Analysis 2023 and 2033, by Drug Class

Figure 09: Global Market Y-o-Y Growth (%) Analysis 2023-2033, by Drug Class

Figure 10: Global Market Attractiveness Analysis 2023 to 2033, by Drug Class

Figure 11: Global Market Value Share (%) Analysis 2023 and 2033, by Route of Administration

Figure 12: Global Market Y-o-Y Growth (%) Analysis 2023-2033, by Route of Administration

Figure 13: Global Market Attractiveness Analysis 2023 to 2033, by Route of Administration

Figure 14: Global Market Value Share (%) Analysis 2023 and 2033, by Dosage Form

Figure 15: Global Market Y-o-Y Growth (%) Analysis 2023-2033, by Dosage Form

Figure 16: Global Market Attractiveness Analysis 2023 to 2033, by Dosage Form

Figure 17: Global Market Value Share (%) Analysis 2023 and 2033, by Indication

Figure 18: Global Market Y-o-Y Growth (%) Analysis 2023-2033, by Indication

Figure 19: Global Market Attractiveness Analysis 2023 to 2033, by Indication

Figure 20: Global Market Value Share (%) Analysis 2023 and 2033, by Distribution Channel

Figure 21: Global Market Y-o-Y Growth (%) Analysis 2023-2033, by Distribution Channel

Figure 22: Global Market Attractiveness Analysis 2023 to 2033, by Distribution Channel

Figure 23: Global Market Value Share (%) Analysis 2023 and 2033, by Region

Figure 24: Global Market Y-o-Y Growth (%) Analysis 2023-2033, by Region

Figure 25: Global Market Attractiveness Analysis 2023 to 2033, by Region

Figure 26: North America Market Value (US$ Million) Analysis, 2017 to 2022

Figure 27: North America Market Value (US$ Million) Forecast, 2023-2033

Figure 28: North America Market Value Share, by Drug Class (2023 E)

Figure 29: North America Market Value Share, by Route of Administration (2023 E)

Figure 30: North America Market Value Share, by Dosage Form (2023 E)

Figure 31: North America Market Value Share, by Indication (2023 E)

Figure 32: North America Market Value Share, by Distribution Channel (2023 E)

Figure 33: North America Market Value Share, by Country (2023 E)

Figure 34: North America Market Attractiveness Analysis by Drug Class, 2023 to 2033

Figure 35: North America Market Attractiveness Analysis by Route of Administration, 2023 to 2033

Figure 36: North America Market Attractiveness Analysis by Dosage Form, 2023 to 2033

Figure 37: North America Market Attractiveness Analysis by Indication, 2023 to 2033

Figure 38: North America Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 39: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 40: USA Market Value Proportion Analysis, 2022

Figure 41: Global Vs. USA Growth Comparison, 2022 to 2033

Figure 42: USA Market Share Analysis (%) by Drug Class, 2022 to 2033

Figure 43: USA Market Share Analysis (%) by Route of Administration, 2022 to 2033

Figure 44: USA Market Share Analysis (%) by Dosage Form, 2022 to 2033

Figure 45: USA Market Share Analysis (%) by Indication, 2022 to 2033

Figure 46: USA Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 47: Canada Market Value Proportion Analysis, 2022

Figure 48: Global Vs. Canada. Growth Comparison, 2022 to 2033

Figure 49: Canada Market Share Analysis (%) by Drug Class, 2022 to 2033

Figure 50: Canada Market Share Analysis (%) by Route of Administration, 2022 to 2033

Figure 51: Canada Market Share Analysis (%) by Dosage Form, 2022 to 2033

Figure 52: Canada Market Share Analysis (%) by Indication, 2022 to 2033

Figure 53: Canada Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis, 2017 to 2022

Figure 55: Latin America Market Value (US$ Million) Forecast, 2023-2033

Figure 56: Latin America Market Value Share, by Drug Class (2023 E)

Figure 57: Latin America Market Value Share, by Route of Administration (2023 E)

Figure 58: Latin America Market Value Share, by Dosage Form (2023 E)

Figure 59: Latin America Market Value Share, by Indication (2023 E)

Figure 60: Latin America Market Value Share, by Distribution Channel (2023 E)

Figure 61: Latin America Market Value Share, by Country (2023 E)

Figure 62: Latin America Market Attractiveness Analysis by Drug Class, 2023 to 2033

Figure 63: Latin America Market Attractiveness Analysis by Route of Administration, 2023 to 2033

Figure 64: Latin America Market Attractiveness Analysis by Dosage Form, 2023 to 2033

Figure 65: Latin America Market Attractiveness Analysis by Indication, 2023 to 2033

Figure 66: Latin America Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 67: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 68: Mexico Market Value Proportion Analysis, 2022

Figure 69: Global Vs Mexico Growth Comparison, 2022 to 2033

Figure 70: Mexico Market Share Analysis (%) by Drug Class, 2022 to 2033

Figure 71: Mexico Market Share Analysis (%) by Route of Administration, 2022 to 2033

Figure 72: Mexico Market Share Analysis (%) by Dosage Form, 2022 to 2033

Figure 73: Mexico Market Share Analysis (%) by Indication, 2022 to 2033

Figure 74: Mexico Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 75: Brazil Market Value Proportion Analysis, 2022

Figure 76: Global Vs. Brazil. Growth Comparison, 2022 to 2033

Figure 77: Brazil Market Share Analysis (%) by Drug Class, 2022 to 2033

Figure 78: Brazil Market Share Analysis (%) by Route of Administration, 2022 to 2033

Figure 79: Brazil Market Share Analysis (%) by Dosage Form, 2022 to 2033

Figure 80: Brazil Market Share Analysis (%) by Indication, 2022 to 2033

Figure 81: Brazil Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 82: Argentina Market Value Proportion Analysis, 2022

Figure 83: Global Vs Argentina Growth Comparison, 2022 to 2033

Figure 84: Argentina Market Share Analysis (%) by Drug Class, 2022 to 2033

Figure 85: Argentina Market Share Analysis (%) by Route of Administration, 2022 to 2033

Figure 86: Argentina Market Share Analysis (%) by Dosage Form, 2022 to 2033

Figure 87: Argentina Market Share Analysis (%) by Indication, 2022 to 2033

Figure 88: Argentina Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis, 2017 to 2022

Figure 90: Europe Market Value (US$ Million) Forecast, 2023-2033

Figure 91: Europe Market Value Share, by Drug Class (2023 E)

Figure 92: Europe Market Value Share, by Route of Administration (2023 E)

Figure 93: Europe Market Value Share, by Dosage Form (2023 E)

Figure 94: Europe Market Value Share, by Indication (2023 E)

Figure 95: Europe Market Value Share, by Distribution Channel (2023 E)

Figure 96: Europe Market Value Share, by Country (2023 E)

Figure 97: Europe Market Attractiveness Analysis by Drug Class, 2022 to 2033

Figure 98: Europe Market Attractiveness Analysis by Route of Administration, 2022 to 2033

Figure 99: Europe Market Attractiveness Analysis by Dosage Form, 2022 to 2033

Figure 100: Europe Market Attractiveness Analysis by Indication, 2022 to 2033

Figure 101: Europe Market Attractiveness Analysis by Distribution Channel, 2022 to 2033

Figure 102: Europe Market Attractiveness Analysis by Country, 2022 to 2033

Figure 103: UK Market Value Proportion Analysis, 2022

Figure 104: Global Vs. UK Growth Comparison, 2022 to 2033

Figure 105: UK Market Share Analysis (%) by Drug Class, 2022 to 2033

Figure 106: UK Market Share Analysis (%) by Route of Administration, 2022 to 2033

Figure 107: UK Market Share Analysis (%) by Dosage Form, 2022 to 2033

Figure 108: UK Market Share Analysis (%) by Indication, 2022 to 2033

Figure 109: UK Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 110: Germany Market Value Proportion Analysis, 2022

Figure 111: Global Vs. Germany Growth Comparison, 2022 to 2033

Figure 112: Germany Market Share Analysis (%) by Drug Class, 2022 to 2033

Figure 113: Germany Market Share Analysis (%) by Route of Administration, 2022 to 2033

Figure 114: Germany Market Share Analysis (%) by Dosage Form, 2022 to 2033

Figure 115: Germany Market Share Analysis (%) by Indication, 2022 to 2033

Figure 116: Germany Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 117: Italy Market Value Proportion Analysis, 2022

Figure 118: Global Vs. Italy Growth Comparison, 2022 to 2033

Figure 119: Italy Market Share Analysis (%) by Drug Class, 2022 to 2033

Figure 120: Italy Market Share Analysis (%) by Route of Administration, 2022 to 2033

Figure 121: Italy Market Share Analysis (%) by Dosage Form, 2022 to 2033

Figure 122: Italy Market Share Analysis (%) by Indication, 2022 to 2033

Figure 123: Italy Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 124: France Market Value Proportion Analysis, 2022

Figure 125: Global Vs France Growth Comparison, 2022 to 2033

Figure 126: France Market Share Analysis (%) by Drug Class, 2022 to 2033

Figure 127: France Market Share Analysis (%) by Route of Administration, 2022 to 2033

Figure 128: France Market Share Analysis (%) by Dosage Form, 2022 to 2033

Figure 129: France Market Share Analysis (%) by Indication, 2022 to 2033

Figure 130: France Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 131: Spain Market Value Proportion Analysis, 2022

Figure 132: Global Vs Spain Growth Comparison, 2022 to 2033

Figure 133: Spain Market Share Analysis (%) by Drug Class, 2022 to 2033

Figure 134: Spain Market Share Analysis (%) by Route of Administration, 2022 to 2033

Figure 135: Spain Market Share Analysis (%) by Dosage Form, 2022 to 2033

Figure 136: Spain Market Share Analysis (%) by Indication, 2022 to 2033

Figure 137: Spain Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 138: Russia Market Value Proportion Analysis, 2022

Figure 139: Global Vs Russia Growth Comparison, 2022 to 2033

Figure 140: Russia Market Share Analysis (%) by Drug Class, 2022 to 2033

Figure 141: Russia Market Share Analysis (%) by Route of Administration, 2022 to 2033

Figure 142: Russia Market Share Analysis (%) by Dosage Form, 2022 to 2033

Figure 143: Russia Market Share Analysis (%) by Indication, 2022 to 2033

Figure 144: Russia Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 145: BENELUX Market Value Proportion Analysis, 2022

Figure 146: Global Vs BENELUX Growth Comparison, 2022 to 2033

Figure 147: BENELUX Market Share Analysis (%) by Drug Class, 2022 to 2033

Figure 148: BENELUX Market Share Analysis (%) by Route of Administration, 2022 to 2033

Figure 149: BENELUX Market Share Analysis (%) by Dosage Form, 2022 to 2033

Figure 150: BENELUX Market Share Analysis (%) by Indication, 2022 to 2033

Figure 151: BENELUX Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 152: East Asia Market Value (US$ Million) Analysis, 2017 to 2022

Figure 153: East Asia Market Value (US$ Million) Forecast, 2023-2033

Figure 154: East Asia Market Value Share, by Drug Class (2023 E)

Figure 155: East Asia Market Value Share, by Route of Administration (2023 E)

Figure 156: East Asia Market Value Share, by Dosage Form (2023 E)

Figure 157: East Asia Market Value Share, by Indication (2023 E)

Figure 158: East Asia Market Value Share, by Distribution Channel (2023 E)

Figure 159: East Asia Market Value Share, by Country (2023 E)

Figure 160: East Asia Market Attractiveness Analysis by Drug Class, 2023 to 2033

Figure 161: East Asia Market Attractiveness Analysis by Route of Administration, 2023 to 2033

Figure 162: East Asia Market Attractiveness Analysis by Dosage Form, 2023 to 2033

Figure 163: East Asia Market Attractiveness Analysis by Indication, 2023 to 2033

Figure 164: East Asia Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 165: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 166: China Market Value Proportion Analysis, 2022

Figure 167: Global Vs. China Growth Comparison, 2022 to 2033

Figure 168: China Market Share Analysis (%) by Drug Class, 2022 to 2033

Figure 169: China Market Share Analysis (%) by Route of Administration, 2022 to 2033

Figure 170: China Market Share Analysis (%) by Dosage Form, 2022 to 2033

Figure 171: China Market Share Analysis (%) by Indication, 2022 to 2033

Figure 172: China Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 173: Japan Market Value Proportion Analysis, 2022

Figure 174: Global Vs. Japan Growth Comparison, 2022 to 2033

Figure 175: Japan Market Share Analysis (%) by Drug Class, 2022 to 2033

Figure 176: Japan Market Share Analysis (%) by Route of Administration, 2022 to 2033

Figure 177: Japan Market Share Analysis (%) by Dosage Form, 2022 to 2033

Figure 178: Japan Market Share Analysis (%) by Indication, 2022 to 2033

Figure 179: Japan Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 180: South Korea Market Value Proportion Analysis, 2022

Figure 181: Global Vs South Korea Growth Comparison, 2022 to 2033

Figure 182: South Korea Market Share Analysis (%) by Drug Class, 2022 to 2033

Figure 183: South Korea Market Share Analysis (%) by Route of Administration, 2022 to 2033

Figure 184: South Korea Market Share Analysis (%) by Dosage Form, 2022 to 2033

Figure 185: South Korea Market Share Analysis (%) by Indication, 2022 to 2033

Figure 186: South Korea Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 187: South Asia Market Value (US$ Million) Analysis, 2017 to 2022

Figure 188: South Asia Market Value (US$ Million) Forecast, 2023-2033

Figure 189: South Asia Market Value Share, by Drug Class (2023 E)

Figure 190: South Asia Market Value Share, by Route of Administration (2023 E)

Figure 191: South Asia Market Value Share, by Dosage Form (2023 E)

Figure 192: South Asia Market Value Share, by Indication (2023 E)

Figure 193: South Asia Market Value Share, by Distribution Channel (2023 E)

Figure 194: South Asia Market Value Share, by Country (2023 E)

Figure 195: South Asia Market Attractiveness Analysis by Drug Class, 2023 to 2033

Figure 196: South Asia Market Attractiveness Analysis by Route of Administration, 2023 to 2033

Figure 197: South Asia Market Attractiveness Analysis by Dosage Form, 2023 to 2033

Figure 198: South Asia Market Attractiveness Analysis by Indication, 2023 to 2033

Figure 199: South Asia Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 200: South Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 201: India Market Value Proportion Analysis, 2022

Figure 202: Global Vs. India Growth Comparison, 2022 to 2033

Figure 203: India Market Share Analysis (%) by Drug Class, 2022 to 2033

Figure 204: India Market Share Analysis (%) by Route of Administration, 2022 to 2033

Figure 205: India Market Share Analysis (%) by Dosage Form, 2022 to 2033

Figure 206: India Market Share Analysis (%) by Indication, 2022 to 2033

Figure 207: India Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 208: Indonesia Market Value Proportion Analysis, 2022

Figure 209: Global Vs. Indonesia Growth Comparison, 2022 to 2033

Figure 210: Indonesia Market Share Analysis (%) by Drug Class, 2022 to 2033

Figure 211: Indonesia Market Share Analysis (%) by Route of Administration, 2022 to 2033

Figure 212: Indonesia Market Share Analysis (%) by Dosage Form, 2022 to 2033

Figure 213: Indonesia Market Share Analysis (%) by Indication, 2022 to 2033

Figure 214: Indonesia Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 215: Malaysia Market Value Proportion Analysis, 2022

Figure 216: Global Vs. Malaysia Growth Comparison, 2022 to 2033

Figure 217: Malaysia Market Share Analysis (%) by Drug Class, 2022 to 2033

Figure 218: Malaysia Market Share Analysis (%) by Route of Administration, 2022 to 2033

Figure 219: Malaysia Market Share Analysis (%) by Dosage Form, 2022 to 2033

Figure 220: Malaysia Market Share Analysis (%) by Indication, 2022 to 2033

Figure 221: Malaysia Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 222: Thailand Market Value Proportion Analysis, 2022

Figure 223: Global Vs. Thailand Growth Comparison, 2022 to 2033

Figure 224: Thailand Market Share Analysis (%) by Drug Class, 2022 to 2033

Figure 225: Thailand Market Share Analysis (%) by Route of Administration, 2022 to 2033

Figure 226: Thailand Market Share Analysis (%) by Dosage Form, 2022 to 2033

Figure 227: Thailand Market Share Analysis (%) by Indication, 2022 to 2033

Figure 228: Thailand Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 229: Oceania Market Value (US$ Million) Analysis, 2017 to 2022

Figure 230: Oceania Market Value (US$ Million) Forecast, 2022-2033

Figure 231: Oceania Market Value Share, by Drug Class (2023 E)

Figure 232: Oceania Market Value Share, by Route of Administration (2023 E)

Figure 233: Oceania Market Value Share, by Dosage Form (2023 E)

Figure 234: Oceania Market Value Share, by Indication (2023 E)

Figure 235: Oceania Market Value Share, by Distribution Channel (2023 E)

Figure 236: Oceania Market Value Share, by Country (2023 E)

Figure 237: Oceania Market Attractiveness Analysis by Drug Class, 2022 to 2033

Figure 238: Oceania Market Attractiveness Analysis by Route of Administration, 2022 to 2033

Figure 239: Oceania Market Attractiveness Analysis by Dosage Form, 2022 to 2033

Figure 240: Oceania Market Attractiveness Analysis by Indication, 2022 to 2033

Figure 241: Oceania Market Attractiveness Analysis by Distribution Channel, 2022 to 2033

Figure 242: Oceania Market Attractiveness Analysis by Country, 2022 to 2033

Figure 243: Australia Market Value Proportion Analysis, 2022

Figure 244: Global Vs. Australia Growth Comparison, 2022 to 2033

Figure 245: Australia Market Share Analysis (%) by Drug Class, 2022 to 2033

Figure 246: Australia Market Share Analysis (%) by Route of Administration, 2022 to 2033

Figure 247: Australia Market Share Analysis (%) by Dosage Form, 2022 to 2033

Figure 248: Australia Market Share Analysis (%) by Indication, 2022 to 2033

Figure 249: Australia Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 250: New Zealand Market Value Proportion Analysis, 2022

Figure 251: Global Vs New Zealand Growth Comparison, 2022 to 2033

Figure 252: New Zealand Market Share Analysis (%) by Drug Class, 2022 to 2033

Figure 253: New Zealand Market Share Analysis (%) by Route of Administration, 2022 to 2033

Figure 254: New Zealand Market Share Analysis (%) by Dosage Form, 2022 to 2033

Figure 255: New Zealand Market Share Analysis (%) by Indication, 2022 to 2033

Figure 256: New Zealand Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 257: Middle East & Africa Market Value (US$ Million) Analysis, 2017 to 2022

Figure 258: Middle East & Africa Market Value (US$ Million) Forecast, 2022-2033

Figure 259: Middle East & Africa Market Value Share, by Drug Class (2023 E)

Figure 260: Middle East & Africa Market Value Share, by Route of Administration (2023 E)

Figure 261: Middle East & Africa Market Value Share, by Dosage Form (2023 E)

Figure 262: Middle East & Africa Market Value Share, by Indication (2023 E)

Figure 263: Middle East & Africa Market Value Share, by Distribution Channel (2023 E)

Figure 264: Middle East & Africa Market Value Share, by Country (2023 E)

Figure 265: Middle East & Africa Market Attractiveness Analysis by Drug Class, 2022 to 2033

Figure 266: Middle East & Africa Market Attractiveness Analysis by Route of Administration, 2022 to 2033

Figure 267: Middle East & Africa Market Attractiveness Analysis by Dosage Form, 2022 to 2033

Figure 268: Middle East & Africa Market Attractiveness Analysis by Indication, 2022 to 2033

Figure 269: Middle East & Africa Market Attractiveness Analysis by Distribution Channel, 2022 to 2033

Figure 270: Middle East & Africa Market Attractiveness Analysis by Country, 2022 to 2033

Figure 271: GCC Countries Market Value Proportion Analysis, 2022

Figure 272: Global Vs GCC Countries Growth Comparison, 2022 to 2033

Figure 273: GCC Countries Market Share Analysis (%) by Drug Class, 2022 to 2033

Figure 274: GCC Countries Market Share Analysis (%) by Route of Administration, 2022 to 2033

Figure 275: GCC Countries Market Share Analysis (%) by Dosage Form, 2022 to 2033

Figure 276: GCC Countries Market Share Analysis (%) by Indication, 2022 to 2033

Figure 277: GCC Countries Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 278: Türkiye Market Value Proportion Analysis, 2022

Figure 279: Global Vs. Türkiye Growth Comparison, 2022 to 2033

Figure 280: Türkiye Market Share Analysis (%) by Drug Class, 2022 to 2033

Figure 281: Türkiye Market Share Analysis (%) by Route of Administration, 2022 to 2033

Figure 282: Türkiye Market Share Analysis (%) by Dosage Form, 2022 to 2033

Figure 283: Türkiye Market Share Analysis (%) by Indication, 2022 to 2033

Figure 284: Türkiye Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 285: South Africa Market Value Proportion Analysis, 2022

Figure 286: Global Vs. South Africa Growth Comparison, 2022 to 2033

Figure 287: South Africa Market Share Analysis (%) by Drug Class, 2022 to 2033

Figure 288: South Africa Market Share Analysis (%) by Route of Administration, 2022 to 2033

Figure 289: South Africa Market Share Analysis (%) by Dosage Form, 2022 to 2033

Figure 290: South Africa Market Share Analysis (%) by Indication, 2022 to 2033

Figure 291: South Africa Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Figure 292: North Africa Market Value Proportion Analysis, 2022

Figure 293: Global Vs North Africa Growth Comparison, 2022 to 2033

Figure 294: North Africa Market Share Analysis (%) by Drug Class, 2022 to 2033

Figure 295: North Africa Market Share Analysis (%) by Route of Administration, 2022 to 2033

Figure 296: North Africa Market Share Analysis (%) by Dosage Form, 2022 to 2033

Figure 297: North Africa Market Share Analysis (%) by Indication, 2022 to 2033

Figure 298: North Africa Market Share Analysis (%) by Distribution Channel, 2022 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA