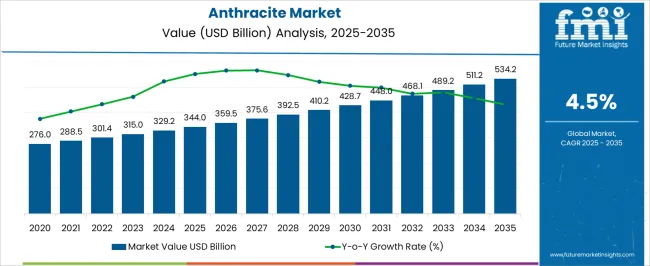

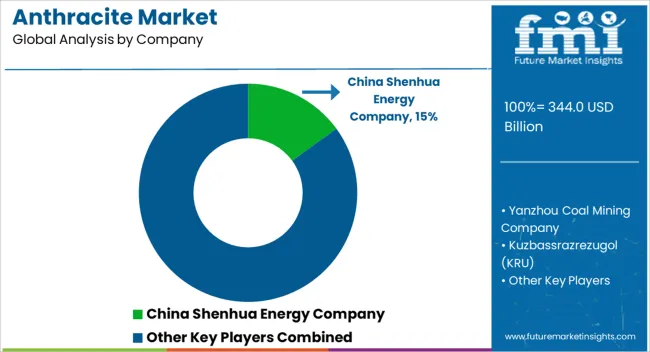

The anthracite market, estimated at USD 344.0 billion in 2025 and forecasted to reach USD 534.2 billion by 2035 at a CAGR of 4.5%, is significantly influenced by regulatory frameworks that govern mining, environmental compliance, and energy utilization. Government policies on coal extraction, emission standards, and carbon reporting impose direct operational constraints on mining companies, affecting production volumes and associated costs.

Stricter air quality regulations and limits on sulfur dioxide and particulate matter emissions necessitate investments in cleaner combustion technologies and emission control systems, which influence overall market economics. Trade regulations and import-export duties further impact regional supply dynamics, particularly in major anthracite-producing and consuming countries, shaping pricing structures and competitive positioning. Subsidies for alternative energy sources and penalties on high-carbon fuels also redirect industrial demand patterns, gradually affecting the adoption of anthracite in power generation, metallurgy, and industrial heating applications.

Compliance with occupational safety and environmental impact assessment protocols imposes additional administrative and capital requirements, thereby influencing project timelines and market entry strategies. Over the forecast period, incremental market growth from USD 344.0 billion in 2025 to USD 428.7 billion by 2030 reflects regulatory-driven adjustments in production and consumption practices. By 2035, the market is projected to be at USD 534.2 billion, indicating that regulatory oversight, while constraining operational flexibility, simultaneously encourages efficiency improvements, sustainable mining practices, and technology adoption that support long-term market stability and predictable growth trajectories.

| Metric | Value |

|---|---|

| Anthracite Market Estimated Value in (2025 E) | USD 344.0 billion |

| Anthracite Market Forecast Value in (2035 F) | USD 534.2 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The anthracite market represents a specialized segment within the global coal and energy minerals industry, emphasizing high-carbon content, low impurities, and superior heating efficiency. Within the broader coal and solid fuel market, it accounts for about 6.1%, driven by demand from power generation, metallurgical, and industrial applications. In the steel production and foundry sector, it holds nearly 5.2%, reflecting its use in coke blending, carbon additives, and high-temperature processes.

Across the water filtration and purification industry, the market captures 4.3%, supporting activated carbon and filtration media applications. Within the chemical and carbon-based material sector, it represents 3.7%, highlighting its relevance in specialty carbon products. In the industrial energy solutions and boiler fuel segment, it secures 3.4%, emphasizing efficiency, low emissions, and reliability in thermal energy generation. Recent developments in this market have focused on quality enhancement, process efficiency, and environmental compliance.

Innovations include beneficiation and washing techniques to reduce ash content and improve calorific value. Key players are collaborating with steel producers, power utilities, and water treatment companies to optimize supply and improve product performance. Adoption of sustainable mining practices, mechanized extraction, and logistics optimization is gaining traction for cost efficiency and reduced environmental impact. The packaging and transport innovations are being deployed to improve handling and minimize losses.

The anthracite market is witnessing steady expansion driven by its critical role as a high-carbon, low-impurity fuel source across multiple industries. Demand is primarily influenced by its superior energy content and combustion efficiency, which support environmentally conscious industrial operations. Increasing investments in steel manufacturing and power generation, especially in emerging economies, are creating significant growth opportunities.

Technological advancements in processing and refining have improved the quality and consistency of anthracite products, further enhancing their attractiveness. The market outlook remains positive as industries seek to optimize fuel efficiency and reduce emissions, positioning anthracite as a preferred choice.

Additionally, the rising need for cleaner fuel alternatives in metallurgical processes and energy production supports sustained demand growth. As infrastructure development and industrialization continue globally, anthracite consumption is expected to increase steadily in the foreseeable future.

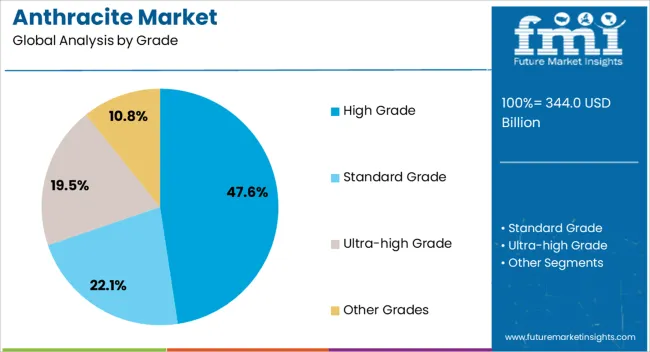

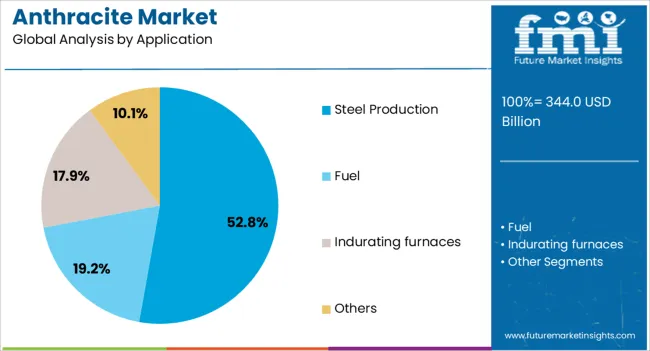

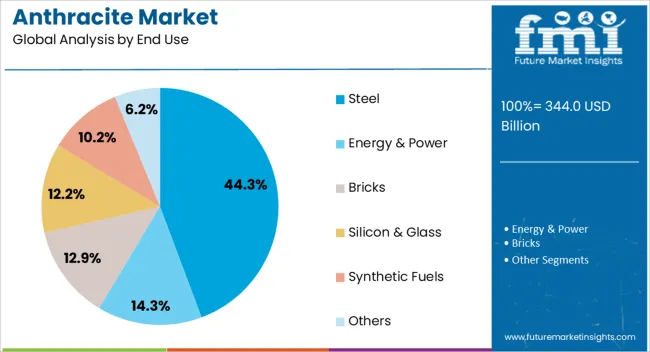

The anthracite market is segmented by grade, application, end use, mining, and geographic regions. By grade, anthracite market is divided into High Grade, Standard Grade, Ultra-high Grade, and Other Grades. In terms of application, anthracite market is classified into Steel Production, Fuel, Indurating furnaces, and Others. Based on end use, anthracite market is segmented into Steel, Energy & Power, Bricks, Silicon & Glass, Synthetic Fuels, and Others.

By mining, anthracite market is segmented into Underground and Surface. Regionally, the anthracite industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The High Grade segment is projected to hold 47.6% of the Anthracite market revenue share in 2025, marking it as the dominant grade. This position is largely attributed to the segment’s elevated carbon content and minimal impurities, which translate into higher energy efficiency and lower emissions during combustion.

High grade anthracite is preferred in applications requiring consistent heat output and cleaner fuel performance. The segment has benefited from technological improvements in mining and beneficiation processes that enhance product quality and availability.

Its adoption is widespread across industries prioritizing sustainability and regulatory compliance. The ability to deliver prolonged and efficient combustion makes high-grade anthracite the favored choice for critical industrial uses, thereby supporting its leading market share.

The Steel Production application segment accounts for 52.8% of the overall Anthracite market revenue in 2025, establishing it as the leading application. This dominance is due to anthracite’s essential role as a carbon source in steelmaking processes, where its high fixed carbon and low volatile matter contribute to improved furnace efficiency and product quality.

The steel industry’s growth, driven by infrastructure development and manufacturing expansion, has propelled anthracite consumption in this segment. Additionally, the segment benefits from ongoing modernization efforts in steel plants aiming to optimize fuel use and reduce environmental impact.

The capability of anthracite to maintain consistent performance in blast furnaces and electric arc furnaces solidifies its importance in steel production, reinforcing the segment’s strong revenue contribution.

The Steel end-use industry segment is anticipated to hold 44.3% of the Anthracite market revenue in 2025, making it the largest end-use sector. This leadership is driven by the extensive use of anthracite in steel manufacturing processes, where it serves as a vital raw material and energy source.

The segment’s growth is supported by the expanding demand for steel in construction, automotive, and machinery industries worldwide. Increased industrialization and urbanization have further stimulated the need for efficient steel production, thereby enhancing anthracite consumption.

The integration of anthracite into steelmaking workflows contributes to operational efficiency and product quality, aligning with industry objectives to improve sustainability and reduce emissions. As steel remains a cornerstone of industrial development, the commercial reliance on anthracite is expected to maintain its prominence.

The market has grown as industries increasingly seek high carbon, low impurity coal for energy generation, metallurgical applications, and filtration purposes. Anthracite, valued for its high calorific content, hardness, and minimal volatile matter, is widely used in power plants, steel production, and water treatment processes. Industrial demand has been influenced by the shift toward cleaner coal alternatives and efficiency in energy utilization. Technological improvements in mining, sorting, and beneficiation have enhanced product quality and operational efficiency. Global supply chains, particularly from major producing regions, have adapted to meet rising energy and industrial consumption.

Anthracite coal is widely adopted in thermal power plants due to its high calorific value and low emissions profile compared to other coal types. Industrial users, such as steel and foundry operations, utilize anthracite for reducing agents, carbon sources, and thermal processes. Its hardness and low volatile content make it ideal for efficient combustion and consistent energy output. Increasing energy requirements, expansion of manufacturing activities, and the preference for cleaner fuel alternatives have strengthened its adoption. Specialized applications, including metallurgical processes and high temperature furnaces, continue to drive stable demand. End users increasingly prefer standardized anthracite grades to ensure consistent performance in energy generation and industrial operations.

Advancements in mining and processing technologies have improved the quality and efficiency of anthracite production. Modern beneficiation processes, including gravity separation, flotation, and washing, have enhanced carbon content while reducing ash and sulfur levels. Automated mining equipment, conveyor systems, and real time monitoring have increased operational safety and productivity. Transportation and storage technologies ensure minimal contamination and maintain calorific value during logistics. These technological improvements have strengthened supply reliability and enabled producers to meet stringent industrial specifications. Continuous innovation has made anthracite a preferred choice for energy and industrial sectors seeking consistent quality and performance, reinforcing its competitiveness relative to alternative fuels.

Beyond energy and metallurgy, anthracite is increasingly used in water treatment and environmental management applications. Its high density, porosity, and chemical stability make it suitable for the filtration of drinking water, wastewater, and industrial effluents. Municipal and industrial water treatment facilities utilize anthracite to remove suspended solids, organic matter, and impurities efficiently. Demand for cleaner water and regulatory compliance in many countries has expanded this segment. The anthracite is being explored in soil remediation and air filtration systems due to its adsorption properties. Environmental and filtration applications are projected to become significant contributors to overall anthracite market growth, complementing traditional energy and industrial uses.

Despite robust demand, the anthracite market faces challenges from limited high quality reserves, price fluctuations, and logistical constraints. Major producing regions experience variable output due to geological and operational factors. Transportation costs, export restrictions, and international trade dynamics affect supply stability. Price volatility can impact procurement budgets for energy and industrial users, creating planning uncertainties. The competition from alternative energy sources, such as natural gas and renewable energy, has exerted pressure on long term demand. To mitigate these challenges, industry participants are focusing on efficient mining techniques, strategic sourcing, and diversification of applications to maintain market resilience.

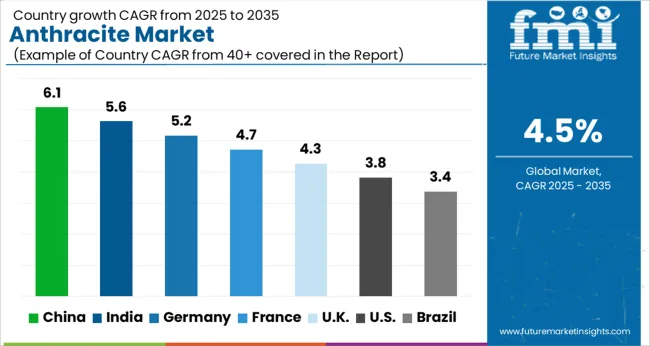

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

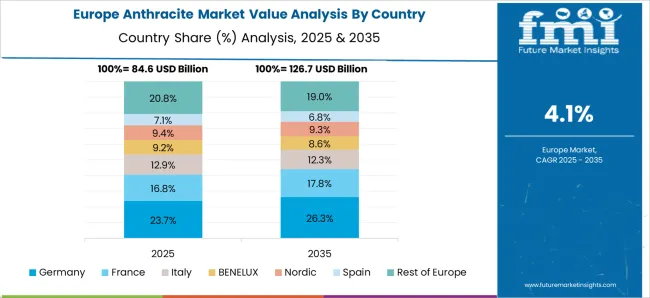

The market is projected to grow at a CAGR of 4.5% from 2025 to 2035, reflecting steady demand in industrial applications and energy production. Germany at 5.2 and the UK at 4.3 are expanding moderately, driven by energy efficiency initiatives and coal-based industrial processes. China leads with 6.1, supported by large-scale energy consumption and metallurgical applications. India at 5.6 shows consistent growth due to power generation and steel manufacturing requirements, while the USA at 3.8 records gradual expansion influenced by alternative energy integration. Together, these countries form a diverse landscape of production, scaling, and technological integration in the global anthracite market. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to grow at a CAGR of 6.1%, supported by rising demand from steel production, water treatment, and energy applications. Adoption has been reinforced by domestic industries requiring high carbon content coal with low impurities. Mining companies focus on efficiency, high yield production, and compliance with environmental regulations. China continues to lead globally in anthracite mining and consumption, catering to both domestic industrial needs and export markets. Technological improvements in coal washing and processing have enhanced product quality and usability. The market outlook remains strong as industrial demand and energy production continue to create consistent anthracite requirements.

India is expected to record a CAGR of 5.6%, driven by consumption in steel, metallurgy, and water filtration industries. Adoption has been reinforced by the availability of high grade anthracite reserves in the eastern regions and investment in coal beneficiation plants. Domestic mining and processing focus on enhancing calorific value and reducing impurities to meet industrial standards. Market growth is supported by infrastructure expansion, energy production, and increasing demand from urban and industrial projects. India continues to invest in modern mining technologies to increase output and maintain consistent supply for key sectors.

Germany is projected to expand at a CAGR of 5.2%, influenced by use in steel production, industrial heating, and water treatment. Adoption has been promoted by demand for high purity anthracite suitable for metallurgical processes and filtration applications. German companies focus on sourcing quality coal from domestic and import sources while emphasizing environmental compliance. Technological advancements in coal processing and handling have improved efficiency and product quality. Market growth remains moderate as anthracite is primarily used in specialized industrial sectors with strict quality requirements.

The United Kingdom market is expected to grow at a CAGR of 4.3%, supported by demand in industrial and filtration applications. Adoption has been encouraged by energy generation, water treatment, and metallurgical sectors requiring high carbon content anthracite. Domestic and imported sources supply the majority of the market, with emphasis on quality and compliance with environmental standards. The outlook indicates steady growth as industrial users continue to rely on anthracite for consistent output and high performance in specialized applications across the U K.

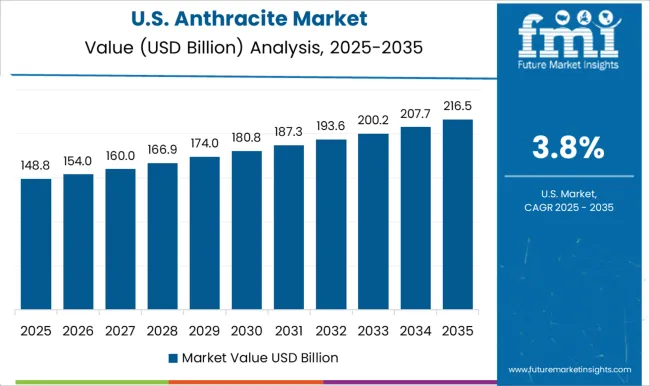

The United States market is projected to expand at a CAGR of 3.8%, driven by limited domestic production and demand from steel, filtration, and energy sectors. Adoption has been supported by industrial usage in high efficiency boilers and water purification systems. U S manufacturers rely on imports to supplement domestic supply and meet quality requirements. Market growth remains modest as demand is concentrated in specialized applications, with environmental regulations influencing coal usage and production.

The market is characterized by a mix of large multinational mining corporations, regional coal producers, and emerging players focusing on high-grade carbon products. Leading global players such as China Shenhua Energy Company, Yanzhou Coal Mining Company, and Glencore PLC dominate production volumes, leveraging integrated mining operations, extensive logistics networks, and strong export capabilities. Kuzbassrazrezugol (KRU), Mechel PAO, and Siberian Anthracite serve key industrial and metallurgical sectors in Russia and neighboring markets, emphasizing high-quality, low-impurity anthracite for steel and energy applications. North American companies like Reading Anthracite Company, Blaschak Coal Corporation, and Xcoal Energy & Resources focus on supplying energy, industrial, and specialty markets with premium anthracite products, benefiting from established distribution infrastructure and long-term customer contracts. European and Asian players, including OKD (a.s.) and Vinacomin, maintain strategic positions in local markets while exploring export opportunities.

Market competition is driven by product quality, calorific value, carbon content, and compliance with environmental regulations. Companies are increasingly investing in mechanized mining technologies, coal beneficiation processes, and sustainable practices to improve efficiency and reduce environmental impact. Strategic partnerships, long-term supply agreements, and geographic diversification remain key approaches to maintain market share and strengthen global presence. Emerging entrants often focus on niche applications and localized supply to compete against established multinational producers.

| Item | Value |

|---|---|

| Quantitative Units | USD 344.0 Billion |

| Grade | High Grade, Standard Grade, Ultra-high Grade, and Other Grades |

| Application | Steel Production, Fuel, Indurating furnaces, and Others |

| End Use | Steel, Energy & Power, Bricks, Silicon & Glass, Synthetic Fuels, and Others |

| Mining | Underground and Surface |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | China Shenhua Energy Company, Yanzhou Coal Mining Company, Kuzbassrazrezugol (KRU), Mechel PAO, Siberian Anthracite, Reading Anthracite Company, Blaschak Coal Corporation, Atlantic Coal Plc, Lehigh Anthracite, Jeddo Coal Company, Vinacomin - Vietnam National Coal and Mineral Industries Group, DTEK, Sadovaya Group, Xcoal Energy & Resources, Yitai Coal Co., Ltd, VostokCoal, OKD (OKD, a.s.), Coal India Limited, Glencore PLC, and Murray Energy Corporation |

| Additional Attributes | Dollar sales by coal grade and application, demand dynamics across power generation, steel production, and industrial sectors, regional trends in anthracite adoption, innovation in combustion efficiency, processing, and blending, environmental impact of mining and carbon emissions, and emerging use cases in high-grade energy applications, water filtration, and specialty carbon products. |

The global anthracite market is estimated to be valued at USD 344.0 billion in 2025.

The market size for the anthracite market is projected to reach USD 534.2 billion by 2035.

The anthracite market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in anthracite market are high grade, standard grade, ultra-high grade and other grades.

In terms of application, steel production segment to command 52.8% share in the anthracite market in 2025.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA