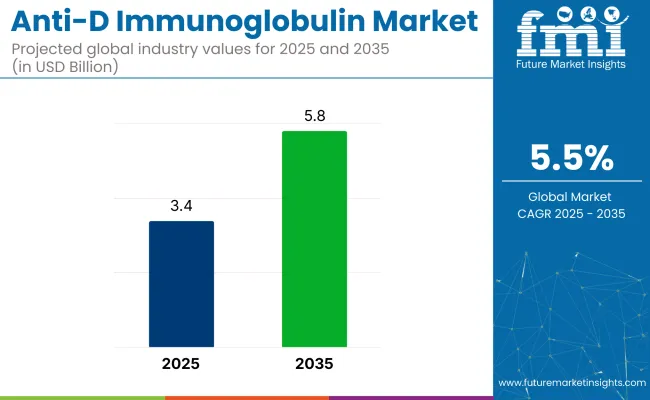

The global anti-D immunoglobulin market is forecasted to grow from USD 3.42 billion in 2025 to USD 5.85 billion by 2035, expanding at a CAGR of 5.53%.

The industry is being shaped by a rising number of Rh-negative pregnancies, growing awareness of hemolytic disease of the fetus and newborn (HDFN), and routine implementation of Rh immunoprophylaxis in prenatal care. Healthcare systems across developed and emerging economies are reinforcing preventive measures to minimize alloimmunization-related complications, thereby boosting anti-D product demand.

In a recent statement, Amir London, CEO of Kamada Pharmaceuticals, highlighted the company's plans to expand its hyperimmune plasma collection capacity, saying, “We plan to significantly expand our hyperimmune plasma collection capacity by investing in B&PR’s center at Beaumont, Texas, and leveraging its FDA license to open additional centers in the USA” This strategic move aims to strengthen Kamada's position in the industry by enhancing plasma collection capabilities.

The industry holds a specialized share within its parent markets. Within the immunoglobulin market, it accounts for approximately 10-12%, as Anti-D is one of the key types of immunoglobulin used in specific medical treatments, such as preventing Rh incompatibility. In the biopharmaceuticals market, the share is around 1-2%, given that it is a niche product in the broader pharmaceutical industry.

Within the vaccines and immunotherapy market, its share is minimal, around 0.5%, as it is focused on a specific immunotherapy for Rh-negative pregnancies. In the blood products and plasma derivatives market, the medicine contributes about 5-7%, as it is derived from plasma but is less common compared to other blood products. In the healthcare and hospital supplies market, its share is around 3-4%, being used primarily in hospitals for maternal care.

The medicine plays a critical role in preventing Rh sensitization in Rh-negative mothers exposed to Rh-positive fetal red blood cells. Increasing clinical adherence to antenatal and postnatal prophylaxis protocols is bolstering product usage in hospitals and maternity clinics.

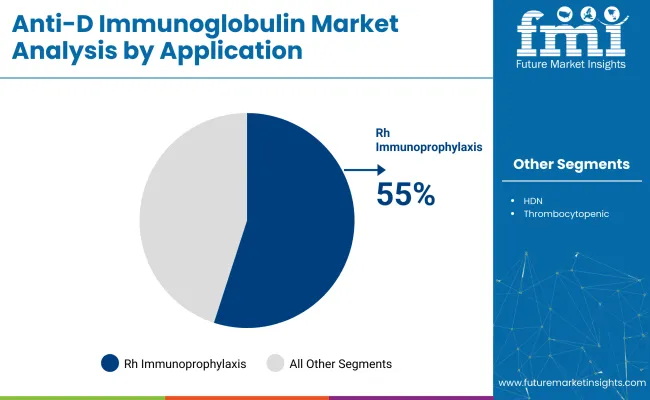

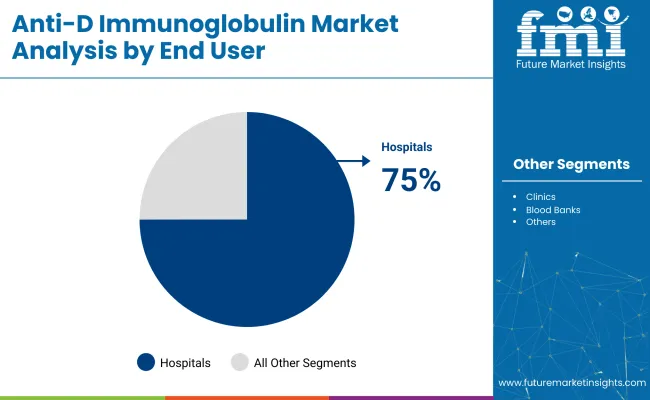

The global industry is projected to grow, with key segments including Rh immunoprophylaxis during pregnancy, intravenous anti-D immunoglobulin, and hospitals as the primary end-users. By 2025, Rh immunoprophylaxis is expected to capture 55%, hospitals will hold 75%, and intravenous formulations will lead the product type segment with 60%.

The Rh immunoprophylaxis during pregnancy application segment is expected to account for 55% of the industry share in 2025. This growth is driven by the widespread adoption of prophylactic anti-D programs, particularly for Rh-negative women. The routine administration of the medicine at 28 weeks of gestation and postpartum is standard practice in developed regions.

Awareness campaigns in emerging industries are increasing maternal screening rates and promoting Rh immunoprophylaxis as a core intervention for perinatal safety. Anti-D products such as Rhophylac by CSL Behring and RhoGAM by Kedrion Biopharma are widely used to prevent maternal alloimmunization and fetal complications.

The hospital segment is projected to account for 75% of the industry by 2025. Hospitals are the primary setting for administering the medicine, particularly through antenatal clinics, labor wards, and emergency obstetric care units. Hospital-based systems are investing in integrated maternal health records and staff training to ensure adherence to Rh immunoprophylaxis protocols.

Manufacturers like BPL, Grifols, and Octapharma are providing intramuscular and intravenous formulations designed for immediate postnatal care. With centralized inventory management and regulatory oversight, hospitals remain the most trusted and reliable channel for safe and efficient anti-D immunoglobulin administration.

Intravenous anti-D immunoglobulin is expected to capture 60% of the industry share in 2025, driven by its fast-acting and effective delivery, especially for postnatal care in hospital settings. This method’s ability to deliver immediate results makes it the preferred choice for preventing Rh incompatibility complications.

Leading manufacturers such as Grifols, CSL Behring, and Octapharma offer intravenous products administered immediately after delivery to reduce maternal alloimmunization. The rapid absorption and efficacy of intravenous anti-D immunoglobulin further contribute to its dominance in the industry.

Liquid formulations of the medicine are expected to dominate the dosage form segment, capturing 50% of the industry share in 2025. These ready-to-use formulations require no reconstitution, making them highly convenient for healthcare providers, especially in urgent care situations such as childbirth.

Liquid formulations also reduce preparation time, enhancing operational efficiency in hospital settings. Major manufacturers like Grifols and BPL have focused on developing liquid formulations to meet the growing demand for fast and reliable interventions in perinatal care.

The industry is growing due to increased prenatal screening and awareness of Rh incompatibility, improving maternal care and reducing HDN incidence. However, supply constraints, high production costs, and regulatory challenges hinder scaling, limiting access, especially in developing regions.

Growing Prenatal Screening and Rh Incompatibility Awareness Drive Anti-D Usage

The growing demand for the medicine is largely driven by expanding prenatal screening programs and increasing awareness of Rh incompatibility. Non-invasive fetal RhD genotyping allows for targeted administration, helping conserve scarce Anti-D supplies by only treating at-risk pregnancies.

Countries such as Denmark, Switzerland, and the Netherlands have adopted this practice, improving efficiency. In the Asia-Pacific region, where Rh-negative pregnancies are more common, public health campaigns and maternal health initiatives are fostering broader acceptance of Anti-D use, reducing the incidence of Hemolytic Disease of the Newborn (HDN) and positioning Anti-D as a key component of prenatal care.

Supply Constraints, Production Costs, and Regulatory Oversight Limit Scaling

Despite rising demand, the industry faces challenges related to supply constraints, high production costs, and regulatory hurdles. The production of Anti-D relies on rare Rh-negative plasma donors and complex plasma fractionation, resulting in supply shortages and elevated prices. In the USA, the FDA and ACOG have issued shortage warnings as a few manufacturers struggle to meet demand.

Additionally, the high complexity of manufacturing, including viral inactivation and purification, limits capacity expansion. Strict regulations around biologics safety and donor screening, along with trade barriers, are further slowing the growth of newer recombinant or monoclonal Anti-D products.

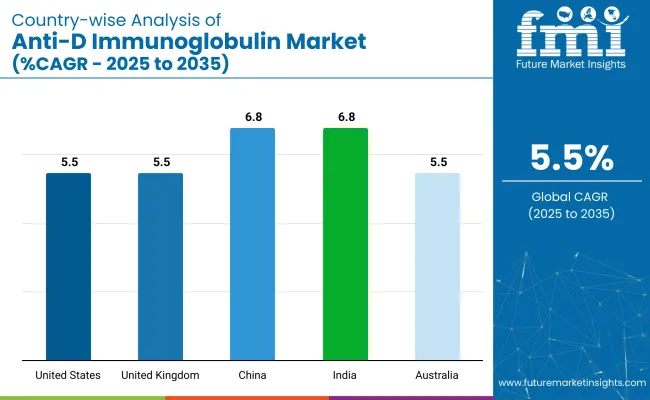

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5.5% |

| United Kingdom | 5.5% |

| China | 6.8% |

| India | 6.8% |

| Australia | 5.5% |

The global industry is projected to grow at a CAGR of 5.5% from 2025 to 2035. The United States, United Kingdom, and Australia, all with a CAGR of 5.5%, show steady growth, driven by increasing awareness and demand for the medicine, particularly in the treatment and prevention of Rh immunization during pregnancy. These developed industries benefit from well-established healthcare systems and a strong focus on maternal and child health.

In contrast, China and India, both with a CAGR of 6.8%, exhibit faster growth, fueled by rising healthcare access, improving medical infrastructure, and a growing awareness of maternal health needs. The demand for the medicine is expected to increase significantly in these emerging industries, driven by urbanization, rising income levels, and the expansion of healthcare services.

While developed industries show stable growth, China and India stand out as the fastest-growing industries, indicating the growing role of emerging economies in shaping the future of the industry.

The report covers in-depth analysis of 40+ countries; five top-performing OECD and BRICS countries are highlighted below.

Sales of the medicine in the United States are set to record a CAGR of 5.5% through 2035. Demand has been anchored by near-universal Rh blood-group screening and mature obstetric protocols. RhoGAM, WinRho SDF, and HyperRHO are administered across hospital labor wards and outpatient maternal-fetal clinics.

CDC guidelines mandating prophylaxis at 28 weeks and postpartum have been rigorously followed. Medicare and commercial insurers have reimbursed prophylaxis without prior authorization, preserving high compliance. Refrigerated logistics routed through group-purchasing organizations have secured product integrity across states. The USA continues to command the largest revenue share in Rh(D) immune-globulin administration.

Sales of the medicine in the United Kingdom are projected to grow at a CAGR of 5.5% through 2035. NHS-funded antenatal prophylaxis and unified guidelines from NICE and RCOG have driven strong compliance. Rhophylac has been supplied through the National Blood Service, enabling direct clinical access.

Midwife-led protocols at 28 and 34 weeks have standardised usage across public hospitals. Centralised procurement has kept NHS costs predictable amid rising patient volume. Strong integration with electronic maternity records has supported real-time flagging of Rh-negative patients, reducing missed doses. The UK remains a benchmark for Rh immunoprophylaxis delivery within nationalised health systems.

Demand in China is estimated to grow at a CAGR of 6.8% through 2035. Demographic shifts from two-child and three-child policies have enlarged the Rh-negative pregnancy cohort. Provincial hospitals have made Rh typing routine in the first trimester, accelerating early immunoprophylaxis.

Domestic manufacturers like Hualan Biological have expanded production under fast-track NMPA approval. Government price tenders have driven volume while capping retail pricing. Cold-chain logistics investments have extended reliable prophylaxis to inland regions. China has positioned itself as a major buyer and increasingly self-sufficient producer of Rh immune-globulin.

The industry in India is set to record a CAGR of 6.8% through 2035. Institutional deliveries have risen due to Janani Suraksha Yojana and Ayushman Bharat, placing anti-D within routine antenatal care. Bharat Serums, Biological E, and Intas have expanded vial production and regional distribution.

Rh screening has been promoted through state public-health missions, even in tier-3 districts. Cold-chain integrity has improved through WHO-backed child and maternal logistics investments. Clinical training under FOGSI and targeted education campaigns have built awareness among practitioners. India is being repositioned as both a price-sensitive demand hub and emerging manufacturing base.

Sales of the medicine in Australia are forecasted to grow at a CAGR of 5.5% through 2035. The National Blood Authority has centralized purchasing and contracts with CSL Behring, supplying Rh(D) immunoglobulin-VF to public hospitals. Medicare covers administration at 28 and 34 weeks, driving consistent prophylaxis across all regions.

Compliance rates remain high due to professional training, guideline enforcement, and reliable transport. Regional health services follow uniform cold-chain protocols monitored via digital audits. Product wastage is low, and adherence to postpartum dosing remains stable. Australia has continued to exhibit a mature, high-coverage profile in Rh prophylaxis.

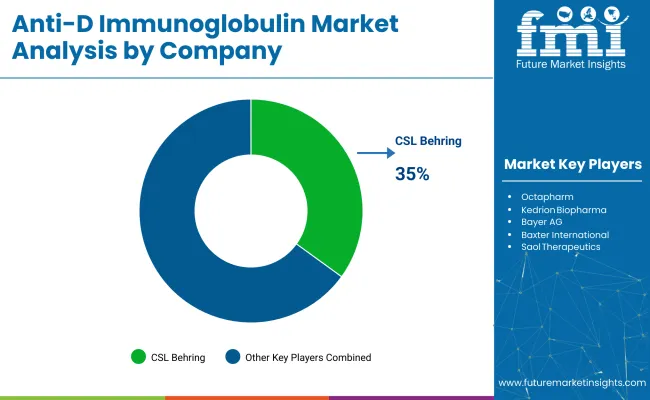

The global industry features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as CSL Behring, Grifols, and Octapharma lead the industry with extensive product portfolios, strong R&D capabilities, and robust distribution networks across maternal and neonatal healthcare sectors.

Key players including Kedrion Biopharma, Bayer, and Bio Products Laboratory offer specialized formulations tailored to specific applications and regional industries. Emerging players, such as Saol Therapeutics, China Biologic Products, and BDI Pharma, focus on innovative technologies and cost-effective solutions, expanding their presence in the global industry.

Recent Anti-D Immunoglobulin Industry News

| Report Attributes | Details |

|---|---|

| Industry Size in 2025 | USD 3.4 billion |

| Industry Size in 2035 | USD 5.8 billion |

| CAGR (2025 to 2035) | 5.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Product Type Segmentation | Intramuscular Anti-D Immunoglobulin, Intravenous Anti-D Immunoglobulin |

| Application Segmentation | Hemolytic Disease of the Newborn (HDN), Rh Immunoprophylaxis During Pregnancy, Management of Thrombocytopenic Patients |

| Route of Administration Segmentation | Parenteral Administration, Intravenous Administration, Subcutaneous Administration |

| End-User Segmentation | Hospitals, Clinics, Blood Banks, Research Laboratories |

| Dosage Form Segmentation | Liquid Formulation, Lyophilized Powder Formulation, Ready-to-Use Formulation |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players Influencing the Industry | Grifols, CSL Behring, Octapharma, Kedrion Biopharma, Bayer AG, Baxter International, Saol Therapeutics, Bio Products Laboratory, China Biologic Products, BDI Pharma |

| Additional Attributes | Dollar sales by product type, application, and route of administration, increasing demand for immunoglobulin in Rh prophylaxis, growing adoption in neonatal care and immunization, regional variations in healthcare infrastructure for immunoglobulin distribution. |

The industry is segmented by product type into intramuscular anti-D immunoglobulin and intravenous anti-D immunoglobulin.

Based on application, the industry includes hemolytic disease of the newborn (HDN), Rh immunoprophylaxis during pregnancy, and management of thrombocytopenic patients.

By route of administration, the industry is segmented into parenteral administration, intravenous administration, and subcutaneous administration.

In terms of end users, the industry includes hospitals, clinics, blood banks, and research laboratories.

Based on dosage form, the industry is categorized into liquid formulation, lyophilized powder formulation, and ready-to-use formulation.

Geographically, the industry is analyzed across North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

The industry is projected to grow from USD 3.42 billion in 2025 to USD 5.85 billion by 2035, at a CAGR of 5.53% through 2035.

Rh immunoprophylaxis during pregnancy leads the industry with a 55% share in 2025.

Hospitals dominate the end-user segment with a 75% industry share in 2025.

China and India are the fastest-growing industries with a 6.8% CAGR.

CSL Behring is a leading player with 35% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Immunoglobulin (IgG) Replacement Therapy Market Analysis - Size, Share & Forecast 2025 to 2035

Antidiabetics Market Overview - Growth, Demand & Forecast 2024 to 2034

Antiviral Immunoglobulin Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA