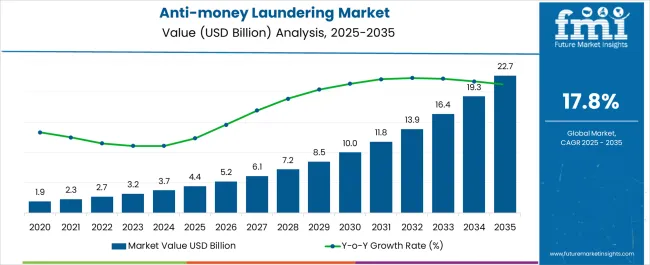

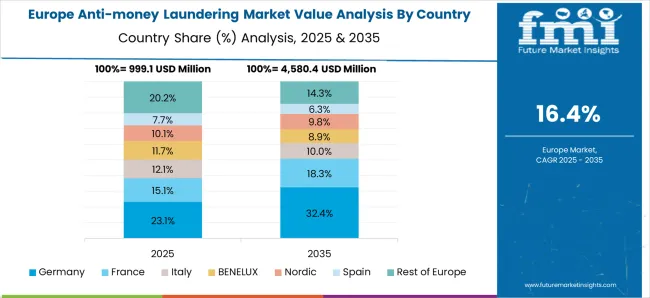

The anti-money laundering market is estimated to be valued at USD 4.4 billion in 2025 and is projected to reach USD 22.7 billion by 2035, registering a compound annual growth rate (CAGR) of 17.8% over the forecast period.

The market represents a critical segment within the global financial technology and compliance industry, characterized by exceptional growth potential driven by increasingly stringent regulatory requirements, expanding digital financial services, and evolving financial crime sophistication worldwide. Unlike discretionary technology investments that organizations may defer during economic uncertainty, AML compliance represents mandatory regulatory expenditure that financial institutions, fintech companies, and other regulated entities must maintain to operate legally in any jurisdiction.

Market dynamics in this sector reveal unique operational characteristics where demand is primarily driven by regulatory mandate rather than competitive advantage, creating consistent growth patterns that are largely insulated from economic cycles and business discretionary spending decisions. Regulatory bodies including FATF, FinCEN, EU financial authorities, and national banking supervisors continuously expand AML requirements to address emerging threats including cryptocurrency transactions, cross-border payments, digital assets, and sophisticated layering techniques employed by criminal organizations. Technical requirements encompass real-time transaction monitoring, beneficial ownership verification, sanctions screening, politically exposed person identification, and suspicious activity reporting that must process millions of transactions daily while maintaining acceptable false positive rates.

The technological landscape encompasses diverse solution categories including transaction monitoring systems, customer due diligence platforms, sanctions screening tools, case management software, regulatory reporting systems, and artificial intelligence-powered analytics that can identify previously undetected money laundering patterns. Platform providers must integrate with existing core banking systems, payment processors, and regulatory reporting infrastructure while maintaining data security standards and audit trail capabilities required for regulatory examinations. These technical integration requirements create operational complexity where AML systems must accommodate diverse data formats, processing speeds, and regulatory reporting standards across different jurisdictions and financial service types.

The competitive landscape operates under different parameters compared to traditional technology markets due to the regulatory validation requirements, audit trail documentation, and proven effectiveness standards that AML solutions must demonstrate to gain acceptance among regulated financial institutions. Success depends not only on technical capabilities and cost competitiveness but also on regulatory expertise, implementation track records, and the ability to demonstrate measurable improvements in money laundering detection while reducing operational burden. Market differentiation requires sophisticated understanding of evolving money laundering techniques, regulatory interpretation guidance, and financial crime investigation methodologies that extend beyond conventional software development capabilities.

| Metric | Value |

|---|---|

| Anti-money Laundering Market Estimated Value in (2025 E) | USD 4.4 billion |

| Anti-money Laundering Market Forecast Value in (2035 F) | USD 22.7 billion |

| Forecast CAGR (2025 to 2035) | 17.8% |

The anti money laundering market is expanding due to stricter regulatory frameworks, heightened financial crime risks, and the growing need for secure digital transaction monitoring. Financial institutions and enterprises are increasingly investing in advanced compliance solutions to prevent fraudulent activities and meet global regulatory standards.

The rise of digital banking, cross border payments, and online transactions has intensified the demand for robust systems that can identify suspicious behavior and mitigate risks in real time. Integration of artificial intelligence, machine learning, and big data analytics is enhancing detection accuracy and reducing false positives, strengthening trust in AML frameworks.

The outlook for the market remains positive as regulatory pressure, reputational risk management, and technological adoption continue to drive the transition toward more sophisticated compliance infrastructure.

The customer identity management solution segment is projected to hold 38.60% of market revenue by 2025, making it the leading solution category. Its dominance is attributed to the growing necessity for accurate identity verification, customer due diligence, and real time onboarding processes in financial institutions.

Increasing digital transactions and the prevalence of remote banking have amplified the need for advanced identity management tools that ensure compliance and safeguard against fraudulent accounts. Furthermore, global regulatory frameworks emphasizing know your customer protocols have reinforced adoption.

The ability to integrate biometric authentication, risk scoring, and continuous monitoring has strengthened the role of this segment as a critical component in AML strategies.

The professional service segment is expected to account for 57.20% of total revenue within the service category by 2025, establishing itself as the dominant area. This leadership is driven by the reliance of enterprises on expert consultancy, system integration, and regulatory advisory services to effectively deploy AML frameworks.

Continuous regulatory updates and the complexity of compliance across jurisdictions have created a strong demand for specialized professional services. Additionally, organizations are leveraging external expertise to customize AML systems, optimize workflows, and train staff for efficient use.

This segment’s growth is further reinforced by its ability to reduce implementation risks and ensure alignment with international compliance standards.

The on premise deployment model is projected to represent 46.30% of market revenue by 2025, making it the most significant deployment preference. Its prominence stems from the need for greater data security, control, and customization capabilities among large financial institutions.

Sensitive nature of customer data and regulatory requirements in highly regulated markets have reinforced the preference for on premise solutions. Enterprises with established IT infrastructure find this model advantageous for integration with legacy systems and tailoring to specific compliance needs.

Although cloud adoption is increasing, concerns around data privacy and control ensure that on premise deployment continues to dominate in critical financial environments.

The growing use of big data analytics by businesses enables them to conduct analyses that can identify trends and draw important conclusions from big data sets. It is predicted that using big data analytics may increase demand for anti-money laundering software.

For instance, Coinfirm and Sanction Scanner collaborated in November 2025 to offer compliance expertise and benefits in the blockchain with traditional finance ecosystems. Through this agreement, clients are likely to be able to track and inspect transactions handled by their businesses for both fiat currency and cryptocurrency.

Big Data analytics is the best tool for AML compliance because it can be tailored to enhance and automate numerous AML compliance processes. Big Data analytics also aids in risk reduction, fraud pattern detection, and the detection of data quality concerns that result in false positives.

Financial organizations can study the details of existing regulatory laws with the help of big data analytics tools. It aids in the analysis of client onboarding, transactional data, and the completion of regulatory authority obligations. Real-time risk or problem detection also aids in avoiding potential rule violations in front of supervisory authorities.

Demand for anti-money laundering (AML) is anticipated to rise at a phenomenal CAGR of 17.8% from 2025 to 2035.

Growing Emphasis on Real-time Monitoring and Regulatory Technology is Providing the Market with Lucrative Prospects

To obtain a comprehensive overview of a customer's activities in real-time, real-time transaction monitoring examines client transactions and behavior by looking at both past and present customer data and interactions. Organizations can identify financial crimes early on or before they happen, thanks to the transaction monitoring feature of anti-money laundering software.

Financial institutions can identify possible instances of financial crime and take action to intervene and stop it from happening at that same moment by implementing real-time transaction monitoring in anti-money laundering.

RegTech (Regulatory Technology) provides banks and other financial institutions with access to sophisticated tools and procedures that automate data gathering, processing, and visualization. RegTech helps banks onboard consumers quickly, efficiently, and with less engagement from the customer.

In the upcoming years, there is likely to be a boom in demand for anti-money laundering software due to the advent of AI RegTech solutions in the financial sector.

Several financial institutions frequently utilize AML solutions. There are a few external forces that have an impact on financial services. In order to identify the most significant issues relating to client identity or transactions, the solutions mix AI, machine learning, and big data.

This enables authorities to take the necessary action. Several sizable corporations provide banking institutions with AML solutions. Through the analysis of process modifications and the identification of any enhancements that may be required, these solutions are made to solve transaction monitoring, compliance management, and other issues to maintain smooth financial operations.

During the forecast period, these variables are expected to assist the segment's revenue growth.

BFSI companies are among the most frequent users of AML solutions, which use affordable ML and AI methods to combat illegal activity. The risk of fraudulent financial operations has increased as a result of digitalization, automation, and online transactions. In 2024, there were 1.9 billion users of internet banking services globally.

Additionally, it is anticipated that during the projection period, demand for AML solutions and services is estimated to increase due to the growing requirement to detect and prevent illegal activities. Additionally, throughout the forecast period, revenue growth in the market is anticipated to be fueled by increased governance and internal control to comply with domestic and international statutory AML rules.

As a result of numerous institutions in the region, anti-money laundering solutions are also anticipated to see considerable adoption in the future years. Additionally, it is projected that inorganic tactics to incorporate artificial intelligence among anti-money laundering providers may evolve, which is likely to accelerate the growth of the anti-money laundering sector in the area.

Specific anti-money laundering regulations set by the United States Congress under the Anti-Money Laundering Act of 2024 stimulate national preference for anti-money laundering, which is anticipated to boost regional market growth.

As a result of numerous institutions in the region, anti-money laundering solutions are also anticipated to see considerable adoption in the future years. Additionally, it is projected that inorganic tactics to incorporate artificial intelligence among anti-money laundering providers may evolve, which is likely to accelerate the growth of the anti-money laundering sector in the area.

Specific anti-money laundering regulations set by the United States Congress under the Anti-money Laundering Act of 2024 stimulate national preference for anti-money laundering, which is anticipated to boost the regional market growth.

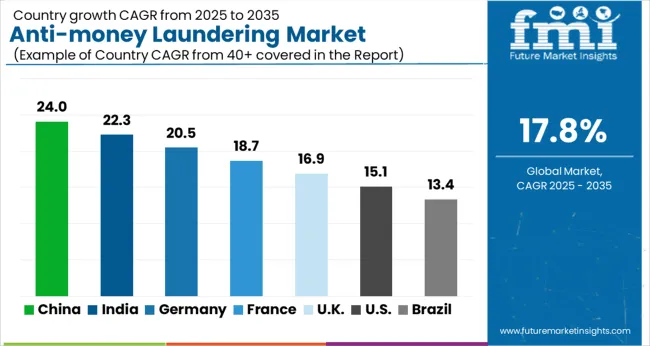

Asia Pacific market's prominent revenue growth rate is linked to the region's expanding adoption of digital payment platforms in nations like China and India. The industry is anticipated to grow in revenue as a result of increased government support and regulations, such as those set forth by the intergovernmental Financial Action Task Force (FATF) to tighten anti-money laundering procedures.

For instance, the Prevention of Money Laundering Act, 2002 (PMLA) in India forbids money laundering and is anticipated to spur development in market income in the near future.

To accelerate market growth, businesses in the region are significantly incorporating technologies like AI, ML, and automation in their AML solutions. For instance, in March 2024, 3i Infotech Limited unveiled AMLOCK Analytics, a cutting-edge AML system outfitted with machine language and artificial intelligence (AI) (ML).

AMLOCK Analytics creates analyses and forecasts based on institution-specific historical data using a variety of statistical techniques and machine learning algorithms.

Due to the presence of numerous solution providers worldwide, including SAS Institute, NICE Ltd., Experian, BAE Systems, FICO, Refinitiv, and many others, the anti-money laundering (AML) market's competitive environment is moderately fragmented.

Additionally, several small and medium-sized businesses are entering the market and generating money, which is anticipated to support them in developing novel solutions. To increase their market position, the current market participants are also developing strategic alliances and collaborations.

The Anti-Money Laundering (AML) Market is expanding rapidly as financial institutions, fintech companies, and regulatory bodies strengthen compliance frameworks to combat illicit financial activities. Rising incidences of online fraud, cross-border money laundering, and digital payment risks are driving the need for advanced AML software integrated with AI, machine learning, and big data analytics. Leading solution providers such as ACI Worldwide Inc., FICO (Fair Isaac Corporation), and SAS Institute Inc. are at the forefront of this transformation, offering end-to-end AML suites that include transaction monitoring, sanctions screening, and real-time risk scoring.

BAE Systems plc, Nice Systems Ltd., and Featurespace Ltd. specialize in behavioral analytics and adaptive machine learning to detect complex fraud patterns across payment ecosystems. Fiserv Inc., Temenos AG, and Wolters Kluwer N.V. are embedding AML functionalities within core banking and risk management platforms, enhancing compliance efficiency for financial institutions of all sizes.

LexisNexis Risk Solutions, TransUnion LLC, and CaseWare RCM Inc. are advancing global data intelligence solutions, leveraging extensive identity verification networks and public records to improve customer due diligence (CDD) and Know Your Customer (KYC) processes. Emerging players such as Feedzai Inc., Dixtior, and Finacus Solutions Pvt. Ltd. are introducing cloud-native and AI-driven AML systems tailored for digital banks, neobanks, and payment service providers. Nelito Systems Pvt. Ltd. and Comarch SA contribute by developing modular AML compliance software for regional banks and cooperative financial institutions, emphasizing automation and cost efficiency.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 17.8% from 2025 to 2035 |

| Base Year of Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion and Volume in Units and F-CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, growth factors, Trends, and Pricing Analysis |

| Key Segments Covered | Component, Deployment Model, Organization Size, Application, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; The Middle East & Africa; Oceania |

| Key Countries Profiled | Unite States, Canada, Brazil, Mexico, Germany, Italy, France, United Kingdom, Spain, Russia, China, Japan, India, GCC Countries, Australia |

| Key Companies Profiled | ACI Worldwide Inc., BAE Systems plc, Nice Systems Ltd., FICO (Fair Isaac Corporation), SAS Institute Inc., Fiserv Inc., Dixtior, LexisNexis Risk Solutions, TransUnion LLC, Wolters Kluwer N.V., Temenos AG, Nelito Systems Pvt. Ltd., Tata Consultancy Services Ltd., Featurespace Ltd., Feedzai Inc., Finacus Solutions Pvt. Ltd., CaseWare RCM Inc., Comarch SA |

| Customization & Pricing | Available upon Request |

The global anti-money laundering market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the anti-money laundering market is projected to reach USD 22.7 billion by 2035.

The anti-money laundering market is expected to grow at a 17.8% CAGR between 2025 and 2035.

The key product types in anti-money laundering market are customer identity management, compliance management, currency transaction reporting and transaction monitoring.

In terms of service, professional service segment to command 57.2% share in the anti-money laundering market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anti-Money Laundering (AML) Software Solution Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA