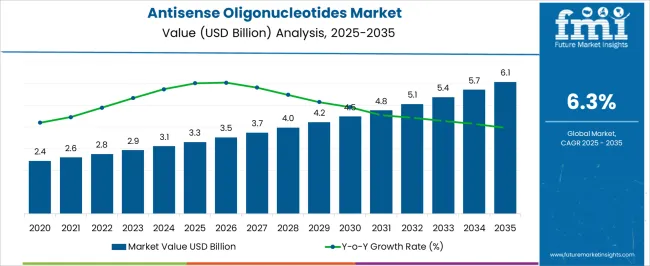

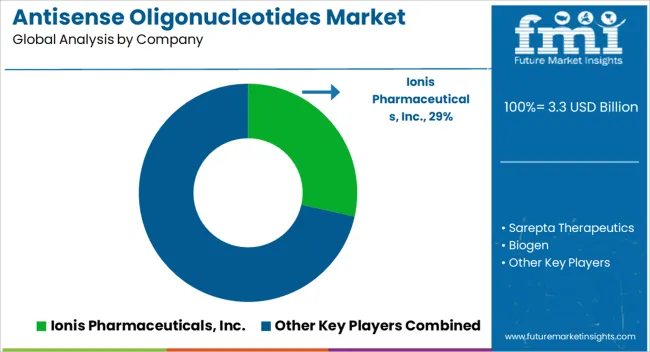

The Antisense Oligonucleotides Market is estimated to be valued at USD 3.3 billion in 2025 and is projected to reach USD 6.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

| Metric | Value |

|---|---|

| Antisense Oligonucleotides Market Estimated Value in (2025 E) | USD 3.3 billion |

| Antisense Oligonucleotides Market Forecast Value in (2035 F) | USD 6.1 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The Antisense Oligonucleotides market is experiencing steady growth due to its ability to specifically modulate gene expression, offering targeted therapeutic approaches for genetic and acquired diseases. The current market scenario reflects increasing adoption in ocular, neurological, and rare genetic disorders, with emphasis on precision medicine and personalized treatment regimens. The market is being shaped by the development of chemically modified oligonucleotides that enhance stability, reduce off-target effects, and improve cellular uptake.

Expanding investment in biotechnology research and rising awareness about gene-targeted therapies are further supporting the market's growth. The increasing prevalence of ocular diseases and genetic disorders is driving clinical and commercial interest in antisense therapeutics. Future growth opportunities are anticipated in applications beyond traditional therapeutic indications, including oncology, metabolic disorders, and research-focused applications.

The potential for improved patient outcomes through highly specific molecular interventions is positioning antisense oligonucleotides as a critical component in modern therapeutic pipelines Continuous innovation in delivery technologies and regulatory support for orphan drugs are expected to sustain growth over the next decade.

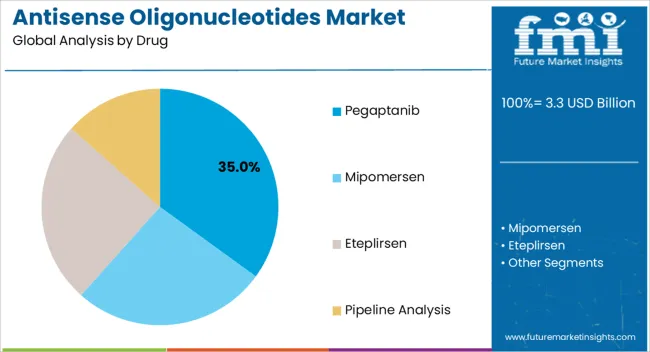

The Pegaptanib drug segment is projected to hold 35.00% of the Antisense Oligonucleotides market revenue in 2025, establishing it as the leading drug type. This prominence is attributed to its proven efficacy in treating ocular diseases through targeted inhibition of vascular endothelial growth factor pathways, reducing abnormal blood vessel growth and fluid accumulation.

The growth of this segment has been driven by increasing adoption in age-related macular degeneration treatment and other retinal disorders, supported by long-term clinical data demonstrating safety and effectiveness. The segment’s leading position is also facilitated by established manufacturing and distribution networks, which enable rapid access to patients globally.

Additionally, the ability to integrate Pegaptanib into broader therapeutic protocols without significant alteration of existing care pathways has contributed to widespread utilization As regulatory approvals expand and the patient population with ocular disorders continues to grow, the Pegaptanib segment is expected to maintain leadership, driven by its well-characterized pharmacological profile and clinical reliability.

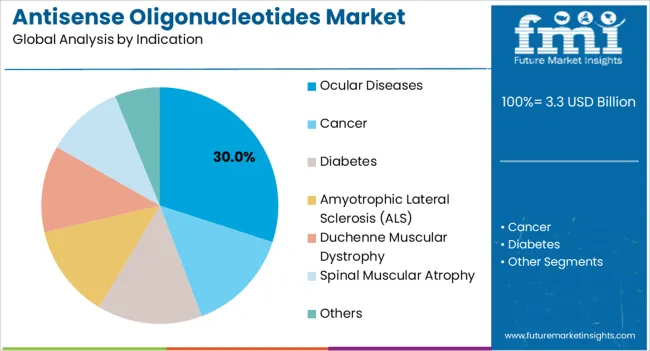

The ocular diseases indication segment is expected to account for 30.00% of the Antisense Oligonucleotides market revenue in 2025, making it the leading therapeutic application. The growth in this segment is being driven by increasing prevalence of conditions such as age-related macular degeneration, diabetic retinopathy, and retinal vascular disorders, which require targeted molecular therapies for effective management. The segment benefits from advancements in delivery systems that enhance retinal penetration and reduce systemic exposure.

Additionally, healthcare providers are increasingly prioritizing therapies that can provide sustained efficacy with minimal side effects, favoring antisense oligonucleotides. The availability of well-established clinical data supporting efficacy and safety has facilitated wider adoption among ophthalmologists.

Moreover, the rising aging population and growing awareness about vision preservation are contributing to sustained demand in this indication As research progresses and new antisense molecules targeting ocular diseases enter development pipelines, this segment is expected to continue leading the market due to its high clinical relevance and significant unmet medical needs.

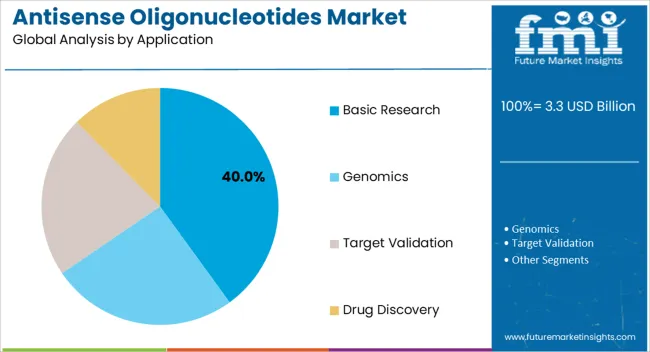

The basic research application segment is anticipated to hold 40.00% of the Antisense Oligonucleotides market revenue in 2025, reflecting its dominant role in scientific discovery and preclinical investigations. Growth in this segment is driven by the increasing use of antisense oligonucleotides as tools to selectively knock down gene expression, enabling functional genomics studies and mechanistic investigations. The flexibility of these molecules allows researchers to explore a wide range of gene targets across multiple disease areas, supporting innovation in therapeutic discovery.

Investment in biotechnology laboratories and academic research institutions has expanded demand for antisense oligonucleotides in experimental settings. Additionally, the availability of high-fidelity synthesis techniques and chemically modified oligonucleotides has enhanced reliability, reproducibility, and efficiency in basic research applications.

The segment also benefits from integration into broader molecular biology workflows, facilitating rapid adoption and consistent results As genomics and molecular biology research continue to grow, the basic research segment is expected to maintain its market leadership, providing foundational knowledge that drives subsequent clinical and therapeutic applications.

A strong pipeline of antisense oligonucleotides and increased focus on a large number of product approvals and commercialization are likely to expand the global antisense oligonucleotides sector size.

Moreover, significant advances in the field of antisense oligonucleotides at a therapeutic or clinical level are further contributing to the growth of the global market.

However, the global antisense oligonucleotides business is grappling with numerous challenges related to the diversity of oligonucleotides, delivery, and regulatory complexity.

Despite several advancements at clinical levels, the delivery of active oligonucleotides to the actual site within target cells is still one of the key challenges hindering the growth of the global antisense oligonucleotides sector. In addition to this, developing a new set of unique regulatory guidelines is also expected to hamper the market statistics.

| Countries | Market Share (2025) |

|---|---|

| United States | 58% |

| Germany | 3.3% |

| Japan | 2.9% |

North America clearly dominates the global antisense oligonucleotides industry due to a strong product pipeline and an increasing number of FDA approvals in the region, contributing to the region’s market share of 60.9% in 2025.

For instance, the international biotechnology company Biogen Inc.'s Nusinersen, sold as Spinraza, received FDA approval in the USA in 2020. Health infrastructures and an increase in the use of oligonucleotides in the development of innovative pharmacological therapies are additional factors driving market expansion.

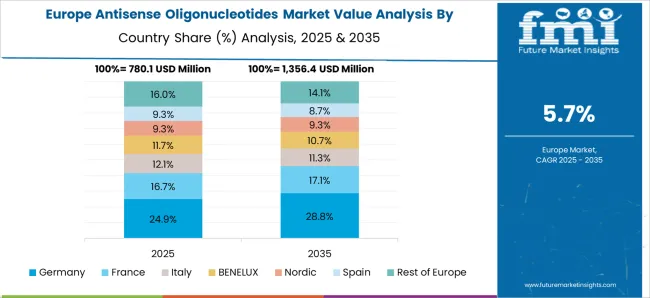

In 2025, the Europe antisense oligonucleotides sector captured a share of 14.3%. In order to improve their product portfolio for antisense oligonucleotides, key players in Europe are concentrating on strategic mergers and acquisitions, in turn spurring the market growth in Europe.

For instance, in 2014, the multinational pharmaceutical and biopharmaceutical company AstraZeneca Plc. merged with the pharmaceutical firm Ionis Pharmaceuticals. Additionally, it is anticipated that a strong pipeline of important companies aids the market growth to some level.

While many organizations are working on RNA-based treatments and vaccines, including well-known companies like Pfizer, BioNtech, Moderna, etc., a few biotech start-ups are also emerging, shaping the market trends.

Examples:

The company's tiny molecule medications bind to targets that were previously believed to be unreachable as well as those that were confirmed using genetic and pharmacological techniques.

These medications use multiple ways to either decrease RNA translation or splicing. Drugs for oncology, dyslipidemia, and uncommon disorders are in the startup's development.

The company's top therapeutic candidate for type 1 myotonic dystrophy is an anti-microRNA (DM1). The start-up's anti-miRs are shown to suppress microRNAs that repress MBNL1/2 genes in DM1 in muscle biopsies of patients.

The market for antisense oligonucleotides is fairly consolidated, with a few competitors gaining a significant growing share. The market participants for antisense oligonucleotides are heavily invested in research and development. These activities assist the participants in developing novel formulations that are advantageous to the user.

A couple of recent developments are:

The agreement improves MilliporeSigma's capacity to produce and develop mRNA for its clients' usage in Covid-19 and numerous other diseases-related vaccines, therapies, and diagnostics.

The global antisense oligonucleotides market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the antisense oligonucleotides market is projected to reach USD 6.1 billion by 2035.

The antisense oligonucleotides market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in antisense oligonucleotides market are pegaptanib, mipomersen, eteplirsen and pipeline analysis.

In terms of indication, ocular diseases segment to command 30.0% share in the antisense oligonucleotides market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA