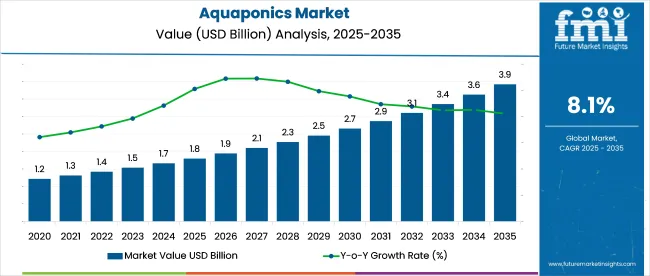

The aquaponics market is forecasted to reach USD 1.8 billion in 2025 and is projected to grow steadily to USD 3.9 billion by 2035, registering a CAGR of 8.1% over the assessment period. This expansion is being shaped by growing interest in chemical-free and locally grown produce, particularly in water-scarce zones.

| Attribute | Values |

|---|---|

| Estimated Industry Size (2025E) | USD 1.8 billion |

| Projected Industry Value (2035F) | USD 3.9 billion |

| CAGR (2025 to 2035) | 8.1% |

Government bodies, non-profits, and agriculture-focused research institutes have been encouraging aquaponic systems as part of broader food security strategies, especially in regions with limited arable land or water constraints.

Rising health consciousness, combined with a distrust of industrial agriculture practices, has further reinforced the appeal of closed-loop production systems that integrate fish farming with hydroponic plant cultivation. As supply chains face periodic disruptions and concerns mount over pesticide residues, the system offers both traceability and reduced environmental exposure, making it a viable choice for health-focused and environmentally-aware consumers.

The market registers a niche share across its parent industries in 2025, representing 1% of the global hydroponics market and about 2.4% of the broader aquaculture market. Within the controlled environment agriculture (CEA) space, they contributed roughly 5.6%, owing to its integrated nature, combining plant and fish production. Its share in the organic food market remains below 1%, constrained by certification complexities and scale limitations.

In agriculture technologies, this represents close to 4.2%, driven by its closed-loop water and nutrient efficiency appeal. Despite modest penetration, it continues to attract interest for its multi-yield potential and adaptability in land-constrained regions, positioning it as a growing subsegment across these overlapping parent markets.

The consumption of systems remained largely concentrated in experimental setups, niche organic communities, and research-driven initiatives from 2020 to 2025. Although awareness about the product increased during this period, particularly following the food supply shocks triggered by COVID-19, commercial-scale adoption remained limited.

The capital costs for system setup, lack of widespread technical expertise, and regulatory ambiguity in many countries acted as significant barriers. Adoption was strongest in regions with state-led incentive schemes or university-backed pilot projects.

Most systems during this period were small to medium-sized installations, often oriented around leafy greens, herbs, and home-grown fish, with limited reach into mainstream food retail or foodservice channels. Nonetheless, this early phase served to educate a segment of producers andfarmers, who began to exploreproductsas a supplement to traditional agriculture.

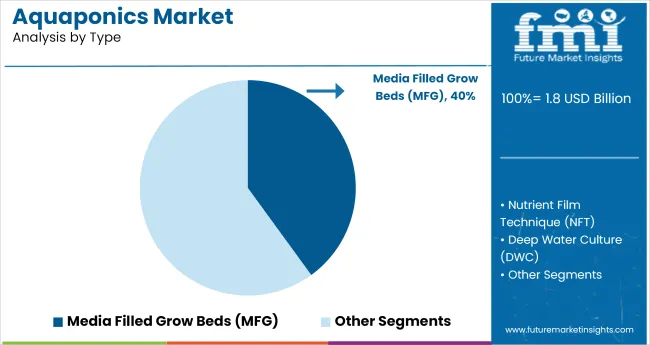

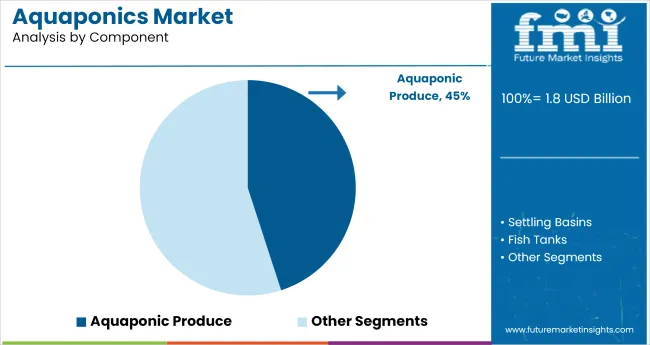

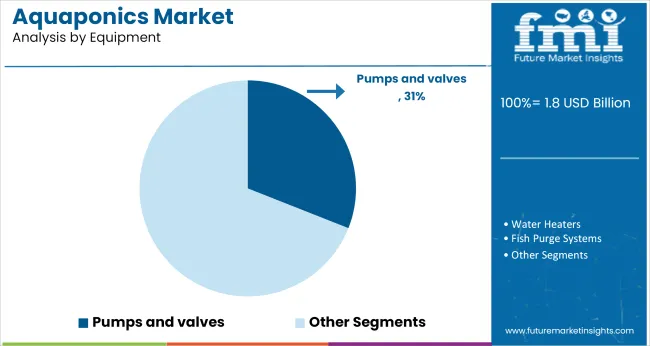

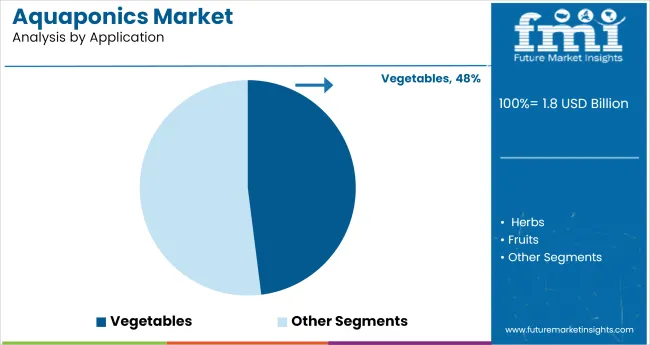

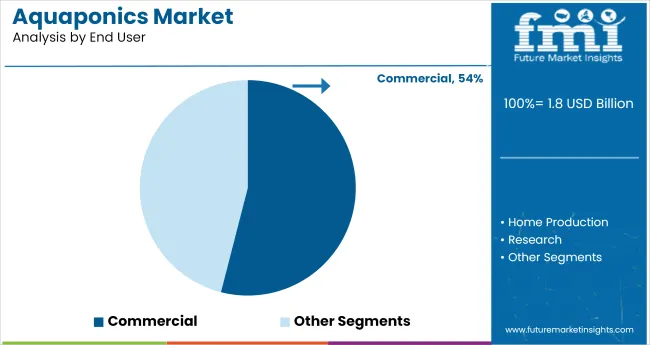

Media-filled grow beds, aquaponic produce, pumps and valves, vegetables, and commercial end users lead their respective segments in 2025 due to ease of use, reliable yields, essential system functions, and strong retail demand. Their dominance reflects scalability, consumer preference for pesticide-free food, and system efficiency across commercial setups.

Media-filled grow beds (MFG) have emerged as the leading segment within aquaponic systems, accounting for 40% of the market share in 2025. Their dominance is largely attributed to the simplicity of setup, low technical requirements, and versatility across both residential and commercial use cases.

Aquaponic produce holds the leading position among components, capturing 45% of the market share in 2025, driven by growing demand for chemical-free vegetables and fish.

Pumps and valves represent the leading equipment segment in the market, holding an estimated 31% share in 2025. Their dominance stems from their essential role in maintaining continuous water flow between fish tanks and plant grow beds, which is central to the closed-loop nature of aquaponic systems.

Vegetables account for the leading share in the market by application, estimated at 48% in 2025. This dominance is driven by the consistent demand for leafy greens like lettuce, spinach, and kale, which grow efficiently in aquaponic systems with minimal input.

The commercial segment holds the leading share in themarket by end user, accounting for 54% in 2025. This leadership is driven by the scalability and revenue potential of products in retail supply chains, foodservice, and institutional procurement.

Aquaponic farms are cutting costs through nutrient recycling, water-saving systems, and solid waste recovery. Retailers are improving off-take by aligning procurement with harvest cycles, reducing spoilage, and enhancing supply chain efficiency.

Closed-Loop Input Recovery Enhances Cost Control

Aquaponic farms have begun optimizing input loops to reduce dependence on external fertilizers and water replenishment. Commercial setups in Southeast Asia lowered input costs by 21% in 2024 by integrating mineralization tanks that recycle fish waste into bioavailable nutrients.

Recirculation system refinements in California helped decrease water usage per kg of lettuce by 36% compared to conventional hydroponics. Mid-size farms in Germany now use sedimentation cones to recover up to 74% of suspended solids for reuse, enabling longer filtration cycles.

Retail Alignment with Aquaponic Output Cycles Boosts Offtake

Retailers in high-density regions have begun adapting procurement calendars to match aquaponic farm harvest intervals. In South Korea, grocery chains added flexible sourcing contracts after trials showed 27% lower waste in aquaponic leafy greens due to shorter transport routes.

Midwestern USA meal-kit firms adjusted ingredient forecasting to mirror the harvest rhythms of tilapia and bok choy, reducing SKU mismatch by 19%. European foodservice buyers began favoring aquaponic produce after temperature-controlled delivery hubs cut spoilage incidents by 22% in 2024.

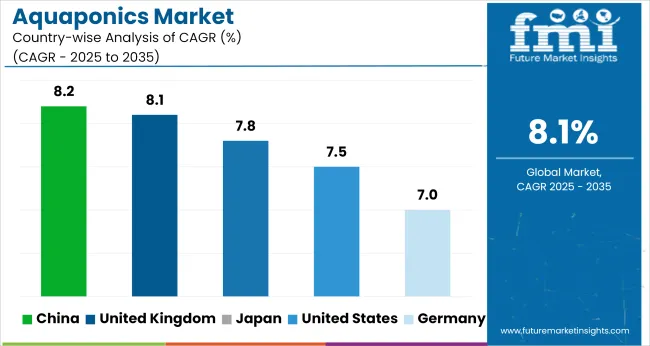

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 7.5% |

| United Kingdom | 8.1% |

| Japan | 7.8% |

| China | 8.2% |

| Germany | 7.0% |

The aquaponics industry is projected to grow at a global CAGR of 8.1% from 2025 to 2035, though regional growth trajectories show marked variation. India, representing BRICS, is advancing at 9.6%, powered by state-funded integrated farming programs and farm startups optimizing water use in zones. China follows at 9.1%, with high-tech greenhouse expansion in inland provinces supporting closed-loop vegetable and fish production.

ASEAN nations such as Malaysia and Thailand post CAGRs around 8.5%, as rooftop gains popularity in densely populated areas and SMEs respond to premium produce demand in domestic markets. OECD economies such as the United States and Germany register slower growth at 6.4% and 6.1% respectively, limited by energy costs, zoning regulations, and longer return-on-investment cycles. This divergence highlights how emerging economies are scaling products as a land and water-efficient solution, while mature markets focus on pilot-scale integration and policy alignment.

The report covers a detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

The USA aquaponics market is expected to grow at a 7.5% CAGR during the forecast period. Expansion is being led by commercial operators scaling modular systems to supply grocery chains and farm-to-fork restaurants. Federal nutrition assistance programs have begun sourcing aquaponic greens for school lunches and food banks, boosting institutional demand.

The farming zones in cities like Denver, Seattle, and Chicago have granted zoning flexibility for aquaponic structures, encouraging rooftop and indoor farm investments. Rising consumer demand for chemical-free produce in health-focused states such as California and Oregon has shifted procurement preferences of meal-kit services and CSAs toward aquaponic farms.

The China aquaponics market is projected to grow at 8.2% CAGR from 2025 to 2035. Deployment has expanded through government-backed research hubs and pilot farms in peri-districts, focusing on fish and leafy greens integration. Several tier-1 cities have been included in regional food safety strategies, prioritizing chemical-free produce to address contamination concerns.

Consumer shift toward clean-label vegetables, especially among middle-income households, has increased demand for traceable aquaponic crops in online grocery channels. Domestic tech firms are entering the segment with low-cost automation kits, enabling smallholders to retrofit aquaculture tanks for dual-purpose use.

The Japanese aquaponics market is anticipated to grow at a 7.8% CAGR between 2025 and 2035. Expansion has been supported by the government’s smart agriculture policy, which includes as a component in climate-resilient food production. Declining availability of farmland in mountainous and coastal areas has prompted investment in vertical aquaponic systems.

High-margin crops such as wasabi greens and shiso are being cultivated in fish-plant symbiotic systems to serve premium retail and gourmet outlets. Prefectures like Shizuoka and Nagano have launched incubation zones with funding for R&D in nutrient recovery and precision aquaculture.

The German aquaponics market is estimated to grow at 7.0% CAGR during the forecast period. Growth is being supported by integration into decentralized food systems targeting carbon-neutral distribution chains. Retail co-operatives in cities like Berlin and Hamburg are prioritizing locally sourced aquaponic lettuce and herbs as part of regional food resilience strategies.

Regulatory clarity on aquaponic fish production has opened investment from municipal food banks and educational institutions. Partnerships between aquaponic startups and organic certification bodies have helped overcome previous barriers in retail certification, allowing entry into mainstream supermarket shelves.

The United Kingdom aquaponics market is valued at an 8.1% CAGR through 2025 to 2035. Post-Brexit agricultural reform has created openings for controlled environment systems like aquaponics, which are less reliant on imported inputs. Regeneration projects in Greater London and Manchester have incorporated aquaponic farming units to address food access disparities.

Consumer awareness campaigns around nitrate-free greens and low-carbon fish have increased footfall at retailers offering aquaponic-certified produce. The UK’s indoor agriculture grants and local council incentives have enabled mid-sized growers to scale operations near distribution hubs, ensuring a fresh, locally sourced supply for major retailers.

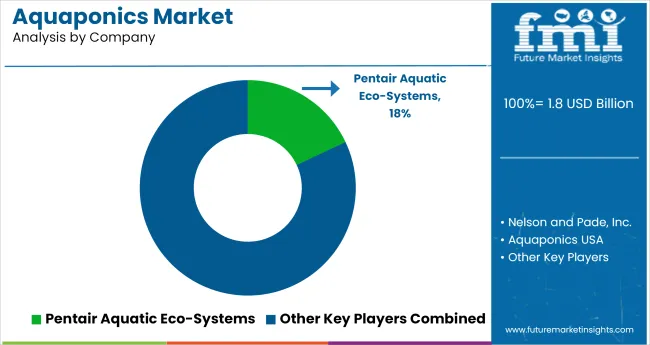

Leading players are advancing through system specialization, localized deployment, and hybrid distribution models in the market. Companies like Pentair Aquatic Eco-Systems, Nelson and Pade, Inc., and The Aquaponic Source are leveraging their engineering expertise to supply modular systems tailored to commercial farms and educational institutions.

Firms such as Aquaponics USA, Greenlife Aquaponics, and Endless Food Systems focus on residential kits and applications, often bundled with training or remote monitoring support. Regional players like Japan Aquaponics and Practical Aquaponics are driving adoption in Asia-Pacific through government-linked pilot projects and low-footprint installations.

Symbiotic Aquaponic and Stuppy Greenhouse are concentrating on school partnerships and semi-automated greenhouses in North America, where curriculum-aligned farming kits help boost STEM education. Competitive momentum is shaped by three factors: regional customization of system designs, integration with controlled environment agriculture (CEA) platforms, and tight coupling of plant-fish nutrient loops for traceability and yield stability.

Recent Aquaponics Industry News

In March 2025, Nelson and Pade, Inc. launched the new “Aquaponics 360” systems, which integrate IoT-enabled sensors and AI-driven management to optimize production and system monitoring.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.8 billion |

| Projected Market Size (2035) | USD 3.9 billion |

| CAGR (2025 to 2035) | 8.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and volume in metric tons |

| Type Analyzed (Segment 1) | Media Filled Grow Beds (MFG), Nutrient Film Technique (NFT), Deep Water Culture (DWC), and Others. |

| Component Analyzed (Segment 2) | Bio Filter, Settling Basins, Fish Tanks, Soil-Free Plant Bed, Rearing Tanks, and Aquaponic Produce. |

| Equipment Analyzed (Segment 3) | Pumps And Valves, Water Heaters, Fish Purge Systems, Aeration Systems, Water Quality Testing, and Others. |

| Application Analyzed (Segment 4) | Fish, Herbs, Fruits, and Vegetables. |

| End Use Analyzed (Segment 5) | Commercial, Home Production, and Research. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Pentair Aquatic Eco-Systems, Nelson and Pade, Inc., Aquaponics USA, Greenlife Aquaponics, The Aquaponic Source, Endless Food Systems, Japan Aquaponics, Stuppy Greenhouse, Symbiotic Aquaponics, and Practical Aquaponics. |

| Additional Attributes | Dollar sales, share by system type, equipment demand forecasts, regional adoption rates, consumer preferences for produce, cost benchmarks, and competitive positioning in commercial segments. |

The industry is segmented into media-filled grow beds (MFG), nutrient film technique (NFT), deep water culture (DWC), and others.

The industry is segmented into bio filters, settling basins, fish tanks, soil-free plant beds, rearing tanks, and aquaponic produce.

The industry includes pumps and valves, water heaters, fish purge systems, aeration systems, water quality testing, and others.

The industry is segmented into fish, herbs, fruits, and vegetables.

The industry is segmented into commercial, home production, and research.

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 1.8 billion in 2025.

It is forecasted to reach USD 3.9 billion by 2035.

The industry is anticipated to grow at a CAGR of 8.1% during this period.

Commercials are projected to lead the market with a 54% share in 2025.

Asia Pacific, particularly China, is expected to be the key growth region with a projected growth rate of 8.2%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA