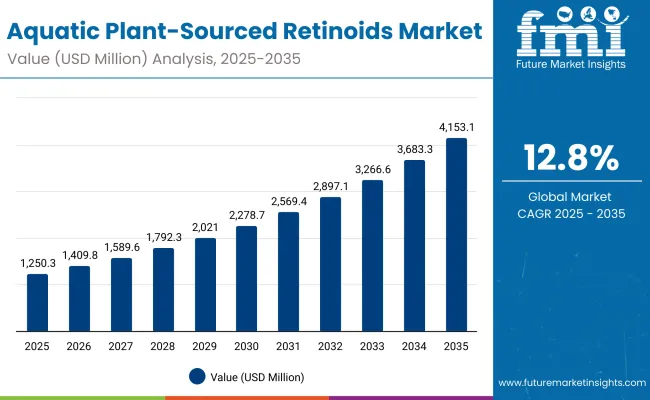

The global Aquatic Plant-Sourced Retinoids Market is expected to record a valuation of USD 1,250.3 million in 2025 and USD 4,153.1 million in 2035, with an increase of USD 2,902.8 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 12.8% and more than a 3X increase in market size.

Global Aquatic Plant-SourcedRetinoids Market Key Takeaways

| Metric | Value |

|---|---|

| Global Aquatic Plant-Sourced Retinoids Market Estimated Value in (2025E) | USD 1,250.3 million |

| Global Aquatic Plant-Sourced Retinoids Market Forecast Value in (2035F) | USD 4,153.1 million |

| Forecast CAGR (2025 to 2035) | 12.8% |

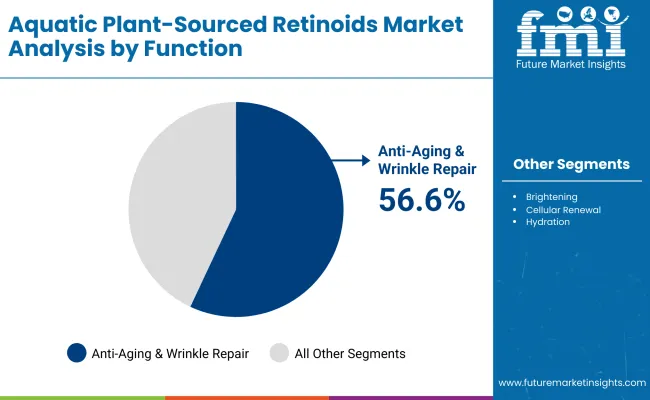

During the first five-year period from 2025 to 2030, the market increases from USD 1,250.3 million to USD 2,278.7 million, adding USD 1,028.4 million, which accounts for 35% of the total decade growth. This phase records steady adoption in premium skincare serums, dermocosmetic creams, and spa-based anti-aging formulations, driven by the need for marine-derived actives with higher efficacy and natural positioning. Anti-aging & wrinkle repair dominates this period as it caters to over 56% of consumers seeking functional retinoid alternatives sourced from marine and freshwater ecosystems.

The second half from 2030 to 2035 contributes USD 1,874.4 million, equal to 65% of total growth, as the market jumps from USD 2,278.7 million to USD 4,153.1 million. This acceleration is powered by biotech-driven marine retinoid innovations, vegan-certified formulations, and rapid expansion of e-commerce and spa dermatology clinics as trusted channels.

Brightening, hydration, and cellular renewal functions grow strongly in this period as consumers diversify their skincare needs beyond anti-aging. Marine biotech and clean-label claims expand to capture premium positioning, while microalgae-engineered retinoids attract biotech partnerships and scale-up investments.

From 2020 to 2024, the global Aquatic Plant-Sourced Retinoids Market grew from an estimated USD ~820 million to USD 1,200 million, driven by marine algae-derived retinoid launches and initial positioning in anti-aging skincare. During this period, the competitive landscape was dominated by ingredient manufacturers controlling nearly 80% of revenue, with leaders such as Algatech, Codif, and Marinova focusing on marine-sourced active extracts and retinoid-alternative molecules for anti-aging and brightening.

Competitive differentiation relied on purity levels, biotech innovation, and regulatory approvals for natural/organic positioning, while downstream skincare brands leveraged these inputs in premium lines. Direct-to-consumer distribution was minimal, with pharmacies and spas driving early traction.

Demand for aquatic plant-sourced retinoids will expand to USD 1,250.3 million in 2025, and the revenue mix will shift as vegan, clean-label, and marine biotech-certified claims grow to over 50% share. Traditional marine algae leaders face rising competition from microalgae biotech firms and synthetic biology players offering engineered retinoids with enhanced stability and potency.

Major global players such as BASF, Croda, and DSM-Firmenich are pivoting to bioengineered formulations, AI-driven molecule optimization, and marine fermentation platforms to retain relevance. Emerging entrants specializing in freshwater plant extraction, sustainability certifications, and AR/VR-enabled consumer engagement are gaining share. The competitive advantage is moving away from raw sourcing innovation alone to ecosystem strength, brand partnerships, and regulatory trust-building.

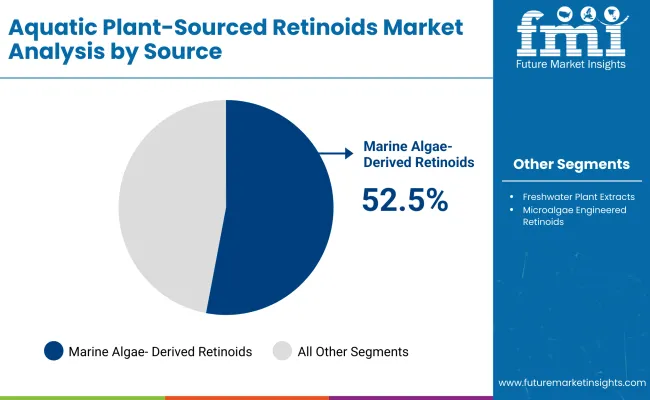

Advances in marine biotechnology and microalgae engineering have improved extraction efficiency and molecule stability, allowing for safer, natural alternatives to synthetic retinoids. Marine algae-derived retinoids dominate due to their high bioactivity and consumer trust in marine-origin actives. Anti-aging & wrinkle repair has gained popularity due to its scientifically validated efficacy in reducing fine lines and skin damage while offering a natural label.

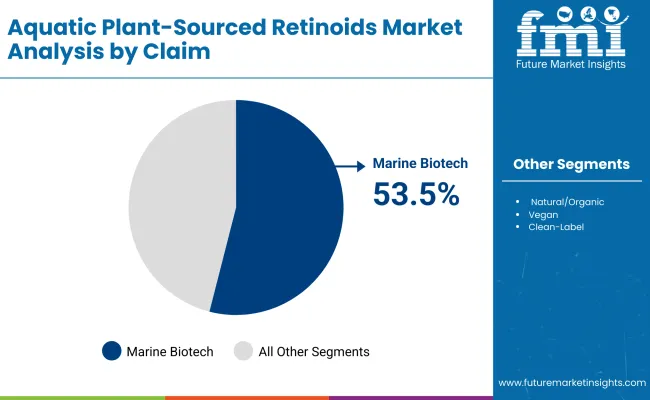

The rise of marine biotech-certified formulations has contributed to premium positioning and market acceleration, with consumers associating marine actives with luxury and purity. Industries such as skincare, dermocosmetics, and spa-based treatments are driving demand for aquatic retinoid solutions that can integrate seamlessly into serums, creams, and professional-grade ampoules.

Expansion of e-commerce platforms, clean-label consumer preferences, and vegan positioning has fueled market growth. Innovations in microalgae bioengineering and sustainable harvesting practices are expected to open new application areas. Segment growth is expected to be led by marine algae-derived retinoids in source, anti-aging in function, and serums in product type, due to their precision targeting, higher consumer trust, and adaptability across skincare routines.

The market is segmented by source, function, product type, channel, claim, and region. Sources include marine algae-derived retinoids, freshwater plant extracts, and microalgae engineered retinoids, highlighting the sustainability and biotech focus of product pipelines. Functions cover anti-aging & wrinkle repair, brightening, cellular renewal, and hydration, reflecting diverse skincare benefits.

Product types include serums, creams/lotions, masks, and ampoules, addressing different consumer preferences and professional use. Channels span e-commerce, pharmacies, specialty marine-based beauty retail, and premium spas/dermatology clinics. Claims emphasize marine biotech, natural/organic, vegan, and clean-label, aligning with consumer demand for transparency and certification.

| Function | Value Share % 2025 |

|---|---|

| Anti-aging & wrinkle repair | 56.6% |

| Others | 43.4% |

The anti-aging & wrinkle repair segment is projected to contribute USD 707.1 million of global market revenue in 2025, maintaining its lead as the dominant function. This is driven by the growing consumer demand for effective yet natural anti-aging solutions, especially among aging populations in North America, Europe, and Japan. The segment’s growth is also supported by clinical validation of marine retinoid actives, positioning them as natural substitutes to traditional retinoids without the harsh side effects.

| Source | Value Share % 2025 |

|---|---|

| Marine algae-derived retinoids | 52.5% |

| Others | 47.5% |

The marine algae-derived segment is forecasted to hold USD 656.6 million in 2025, led by its broad application in both mass-market and premium skincare ranges. These retinoids are favored for their stability, high bioavailability, and association with marine purity, making them ideal for luxury skincare and dermocosmetics. Their scalability and regulatory acceptance have facilitated widespread adoption across global beauty brands.

| Claim | Value Share % 2025 |

|---|---|

| Marine biotech | 53.5% |

| Others | 46.5% |

The marine biotech segment is projected to reach USD 669.7 million in 2025, establishing it as the leading claim type. Its dominance is supported by premium product positioning, biotech certification, and brand storytelling that resonates with conscious consumers. This segment benefits from collaborations between marine research institutes, biotech companies, and global cosmetics brands, which provide both credibility and innovation pipelines.

Rising Consumer Preference for Retinoid Alternatives with Lower Irritation Risk

One of the strongest growth drivers for the global aquatic plant-sourced retinoids market is the shift away from synthetic retinoids like retinol and tretinoin, which are widely associated with side effects such as skin peeling, redness, and increased sensitivity to sunlight. Consumers - especially those with sensitive skin or looking for preventative anti-aging products - are actively seeking natural, marine-derived alternatives that deliver the same benefits with fewer side effects.

Aquatic retinoids, derived from marine algae and microalgae bioengineering, are positioned as gentler yet effective solutions, which makes them attractive to the rapidly growing base of younger consumers (Millennials and Gen Z) who want preventive skincare but are wary of irritation risks. This consumer-driven safety perception is boosting adoption not only in direct-to-consumer skincare brands but also in dermatology clinics and premium spas, where professional-grade aquatic retinoid treatments are gaining ground.

Expansion of Biotech and Marine-Based Partnerships Driving Product Innovation

Another major driver is the increasing collaboration between biotech firms, marine research institutes, and global cosmetics manufacturers. Leading companies like Algatech, Codif, and Marinova are investing in microalgae bioengineering, fermentation processes, and sustainable harvesting practices to develop next-generation aquatic retinoids with enhanced stability, potency, and scalability.

These innovations are moving beyond simple extraction to engineered molecules that can provide multi-functional benefits such as anti-aging, brightening, and hydration. The involvement of global leaders such as BASF, Croda, and DSM-Firmenich ensures robust commercialization pathways and integration into established beauty portfolios. This synergy between biotech-driven innovation and established beauty brands accelerates market expansion and creates a pipeline of differentiated, science-backed ingredients that reinforce consumer trust.

High Cost of Production and Limited Yield of Aquatic Retinoids

Unlike synthetic retinoids, which can be mass-produced at relatively lower costs, the extraction and purification of aquatic plant-sourced retinoids remain capital- and technology-intensive. Cultivation of marine algae requires controlled environments, large-scale photobioreactors, or ocean-based aquaculture systems that demand high operational investments.

Even with advances in fermentation and microalgae engineering, yields remain limited compared to the scale of demand, pushing costs higher. This makes aquatic retinoids significantly more expensive, restricting their presence mostly to premium skincare lines and luxury retail channels. Unless production costs are reduced through scale or innovation, mass-market adoption could remain limited, thereby slowing growth in price-sensitive regions such as Latin America and parts of Asia-Pacific.

Regulatory and Standardization Gaps Across Global Markets

Another critical restraint is the lack of harmonized regulatory frameworks for aquatic-sourced cosmetic ingredients. While the European Union enforces stringent testing and labeling requirements, other regions like Asia-Pacific have inconsistent standards for marine-derived actives. In markets such as China, additional approvals for new marine-sourced ingredients can delay commercialization.

Furthermore, the absence of a global standard for marine biotech or clean-label certifications creates confusion among both manufacturers and consumers. Brands often struggle with multiple certifications, inconsistent labeling, and regulatory hurdles that slow product launches. These gaps not only increase compliance costs but also limit transparency, which could undermine consumer trust in the long run.

Rapid Growth of Marine Biotech-Certified Claims as a Premium Differentiator

One of the defining trends in this market is the rise of marine biotech certifications and sustainability storytelling. Brands are increasingly highlighting certifications such as marine biotech, vegan, and clean-label on packaging to signal transparency and ethical sourcing.

Consumers are willing to pay a premium for such products, especially in mature markets like the USA, Japan, and Europe, where eco-conscious beauty is evolving into a mainstream purchase driver. Marine biotech claims are not just marketing labels but are being backed by academic partnerships, lab-to-brand collaborations, and third-party validations, which help these products command higher margins and loyalty.

Shift Toward Microalgae-Engineered Retinoids for Scalable Innovation

Another emerging trend is the pivot from traditional algae harvesting to microalgae bioengineering and synthetic biology platforms. Companies are experimenting with engineered strains of microalgae that produce higher retinoid yields with more consistent bioactivity.

This approach not only reduces dependency on natural harvesting (which is seasonal and environmentally sensitive) but also enables customization of retinoid molecules for specific benefits such as anti-inflammatory properties or enhanced photostability. This trend is particularly visible in collaborations between biotech startups and ingredient giants (e.g., BASF, Croda, Seppic), aiming to bridge the gap between sustainability, cost efficiency, and innovation.

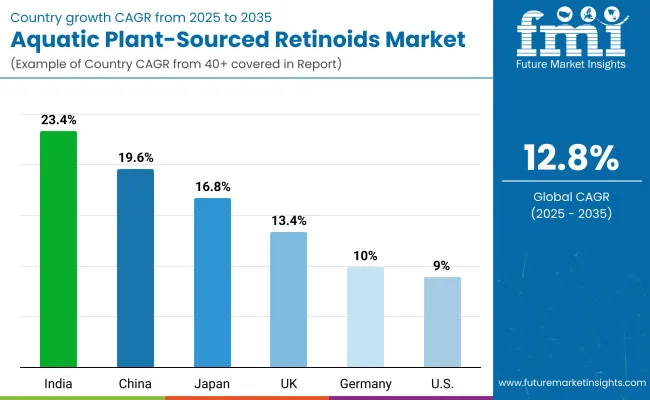

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 19.6% |

| USA | 9.0% |

| India | 23.4% |

| UK | 13.4% |

| Germany | 10.0% |

| Japan | 16.8% |

The global aquatic plant-sourced retinoids market shows highly uneven growth rates across key countries, reflecting differences in consumer adoption, regulatory frameworks, and retail channel maturity. India is expected to lead with a CAGR of 23.4%, driven by its fast-growing middle-class population, strong demand for natural and clean-label beauty products, and the rising influence of e-commerce platforms that provide access to premium international skincare brands.

China follows closely with a 19.6% CAGR, fueled by the popularity of marine biotech-certified formulations, the country’s large consumer base for anti-aging and brightening solutions, and government-led support for biotech and algae-based industries. Japan, with a 16.8% CAGR, is seeing strong traction due to its aging population, premium skincare culture, and established dermocosmetic industry, which actively adopts safer alternatives to synthetic retinoids.

By contrast, Western markets are growing at a steadier pace, reflecting market maturity and consumer awareness. The USA is projected to grow at 9.0% CAGR, with demand concentrated in anti-aging serums and professional spa-based treatments, while Germany at 10.0% CAGR and the UK at 13.4% CAGR show strong preference for clean-label, vegan, and organic claims, aligning with Europe’s strict regulatory frameworks and sustainability-driven consumer behavior.

These markets, though slower in growth compared to Asia, remain significant in absolute value because of their established premium skincare segments and high consumer purchasing power. Overall, the data suggests that Asia-Pacific will be the engine of future expansion, while the USA and Europe will anchor demand through premium positioning and regulatory-driven trust.

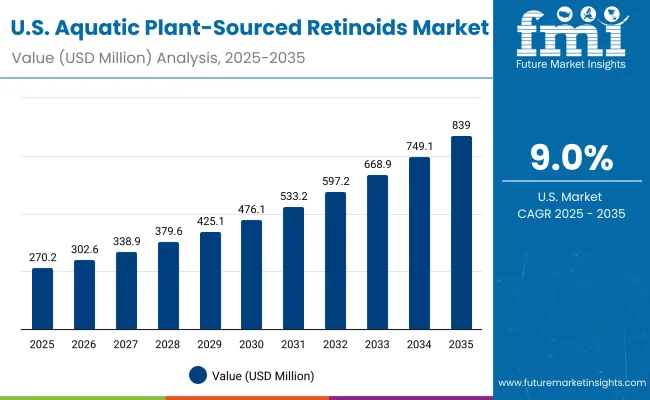

| Year | USA Aquatic Plant-Sourced Retinoids Market (USD Million) |

|---|---|

| 2025 | 270.23 |

| 2026 | 302.65 |

| 2027 | 338.96 |

| 2028 | 379.62 |

| 2029 | 425.16 |

| 2030 | 476.16 |

| 2031 | 533.28 |

| 2032 | 597.25 |

| 2033 | 668.90 |

| 2034 | 749.14 |

| 2035 | 839.01 |

The Aquatic Plant-Sourced Retinoids Market in the United States is projected to grow at a CAGR of 9.0%, led by strong consumer interest in anti-aging serums and clean-label skincare solutions. Professional dermatology clinics and premium spas are integrating marine algae-derived retinoids into advanced anti-aging treatments, driving early adoption in the professional channel.

Pharmacies and e-commerce platforms have also seen growth, with USA consumers showing increasing trust in marine biotech-certified ingredients. The anti-aging & wrinkle repair function holds the largest share, while vegan and clean-label claims are expected to gain traction in the second half of the forecast period.

The Aquatic Plant-Sourced Retinoids Market in the United Kingdom is expected to grow at a CAGR of 13.4%, supported by premium skincare adoption and sustainability-driven claims. U.K. consumers are among the most responsive to vegan and clean-label certifications, boosting demand for microalgae-engineered and freshwater-derived extracts.

Innovation is being accelerated by collaborations between marine biotech firms and European cosmetic houses, with the U.K. serving as a hub for clinical trials and retail launches. E-commerce platforms are integrating retinoid-rich marine formulations into beauty subscription boxes and premium skincare bundles, widening access to eco-conscious consumers.

India is witnessing rapid growth in the Aquatic Plant-Sourced Retinoids Market, which is forecast to expand at a CAGR of 23.4% through 2035. A sharp increase in adoption across tier-2 and tier-3 cities is being driven by price declines and rising consumer awareness of natural anti-aging products.

Domestic skincare brands are beginning to integrate marine biotech-certified and organic retinoid formulations, offering competitive price points for younger consumers. Educational campaigns, dermatology clinics, and Ayurveda-inspired beauty firms are collaborating to position aquatic retinoids as gentle yet effective alternatives to conventional chemical actives.

The Aquatic Plant-Sourced Retinoids Market in China is expected to grow at a CAGR of 19.6%, the highest among leading economies. This momentum is driven by the popularity of marine biotech-certified formulations, rising urban demand for anti-aging and brightening products, and large-scale integration into premium spa and dermatology clinics.

Cross-sector adoption is also visible: domestic e-commerce platforms are promoting vegan and clean-label formulations at competitive prices, while biotech partnerships with local manufacturers enhance supply. Municipal and academic partnerships are supporting algae cultivation research, accelerating scalability.

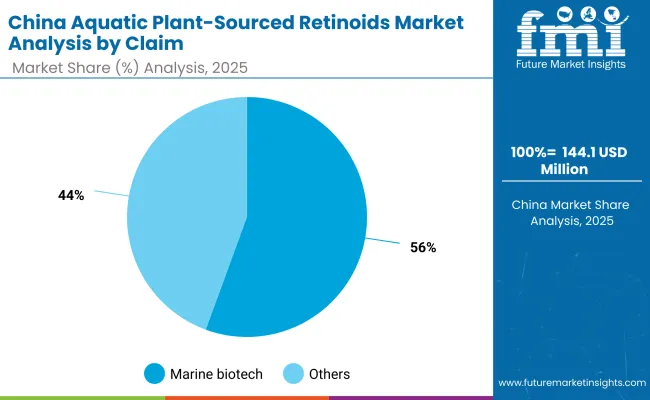

| China by Claim | Value Share % 2025 |

|---|---|

| Marine biotech | 55.6% |

| Others | 44.4% |

The Aquatic Plant-Sourced Retinoids Market in China is valued at USD 144.1 million in 2025, with marine biotech claims leading at 55.6%, followed by natural/organic, vegan, and clean-label categories. The dominance of marine biotech claims is a direct outcome of China’s premium skincare ecosystem, where consumers place high trust in scientifically validated marine actives. Anti-aging and brightening products enriched with marine-sourced retinoids are gaining strong traction across tier-1 and tier-2 cities, particularly among middle- and upper-income demographics.

The market’s strength lies in the integration of marine biotech certifications with e-commerce-driven beauty consumption, as platforms such as Tmall and JD.com highlight clean-label, biotech-derived innovations in premium beauty sections. Portability of marine biotech claims across multiple formulations (serums, creams, ampoules) further enhances their adoption, making them a cornerstone for luxury brands and indie labels alike. Vegan and clean-label alternatives are also gaining traction, but marine biotech maintains leadership due to heavy investment in R&D and brand storytelling around marine purity.

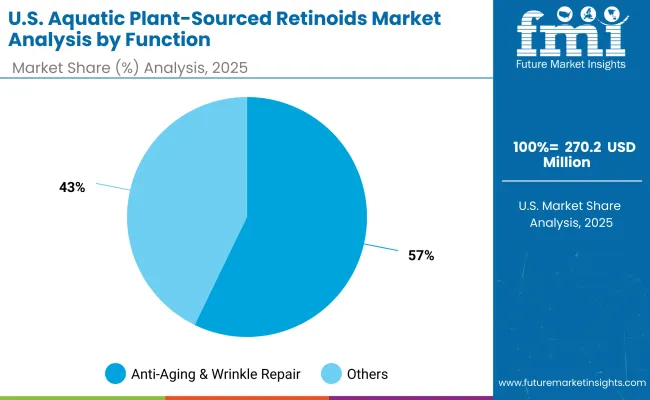

| USA by Function | Value Share % 2025 |

|---|---|

| Anti-aging & wrinkle repair | 57.2% |

| Others | 42.8% |

The Aquatic Plant-Sourced Retinoids Market in the United States is valued at USD 270.2 million in 2025, with anti-aging & wrinkle repair leading at 57.2%, followed by brightening, hydration, and cellular renewal. The dominance of anti-aging formulations is driven by the aging population and premium consumer spending on dermocosmetics, where retinoid-based anti-aging solutions are well-established. Unlike synthetic retinoids, marine-derived alternatives are gaining traction due to their lower irritation profile and strong alignment with clean-label and vegan trends.

The advantage of aquatic retinoids in the USA market lies in their integration into dermatology clinics, premium spas, and pharmacy-led retail channels, where professional endorsement reinforces consumer trust. At the same time, e-commerce channels and direct-to-consumer brands are scaling adoption among younger consumers looking for preventive anti-aging solutions. Over the forecast period, the USA market will see increasing demand for serums and ampoules, favored for their concentrated marine actives and compatibility with daily skincare regimens.

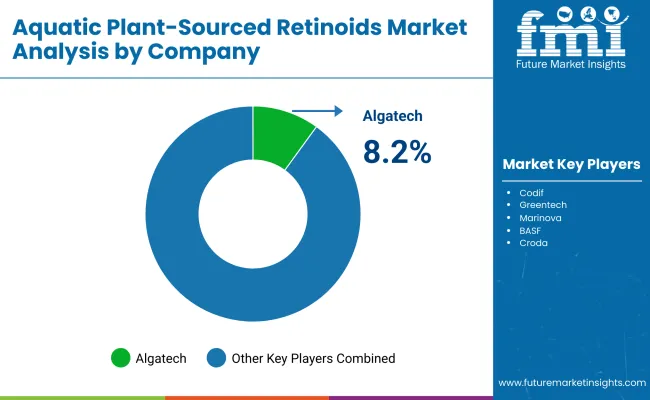

| Company | Global Value Share 2025 |

|---|---|

| Algatech | 8.2% |

| Others | 91.8% |

The global Aquatic Plant-Sourced Retinoids Market is moderately fragmented, with marine biotechnology leaders, cosmetic ingredient suppliers, and niche algae-focused innovators competing across multiple regions. Global leaders such as Algatech, BASF, Croda, DSM-Firmenich, and Givaudan hold significant influence, driven by advanced marine algae cultivation systems, microalgae bioengineering capabilities, and integration into multinational skincare portfolios. Their strategies increasingly emphasize biotech partnerships, marine fermentation platforms, and clean-label certifications to secure premium positioning.

Established marine-specialist players such as Codif, Greentech, and Marinova cater to niche demand for sustainably harvested marine actives. These companies accelerate adoption through collaborations with luxury skincare brands and professional-grade spa treatments, making them highly relevant in Europe and Asia-Pacific premium markets.

Other mid-sized innovators like Seppic and Ashland are focusing on hybrid ingredient platforms that combine marine-derived retinoids with multifunctional properties such as hydration and barrier repair. Their strength lies in custom formulations, clinical validation, and cross-functional ingredient positioning, which appeal to pharma-cosmetic and dermocosmetic applications.

Competitive differentiation is shifting away from sourcing exclusivity toward integrated ecosystems that include biotech scalability, regulatory compliance, consumer-facing certifications (vegan, clean-label, marine biotech), and cross-channel retail partnerships. Emerging entrants in Asia are rapidly adopting microalgae engineering and cost-competitive freshwater retinoid extraction, signaling intensified competition in the next decade.

Key Developments in Global Aquatic Plant-Sourced Retinoids Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,250.3 Million |

| Source | Marine algae-derived retinoids , Freshwater plant extracts, Microalgae engineered retinoids |

| Function | Anti-aging & wrinkle repair, Brightening, Cellular renewal, Hydration |

| Product Type | Serums, Creams/lotions, Masks, Ampoules |

| Channel | E-commerce, Pharmacies, Specialty marine-based beauty retail, Premium spas/dermatology clinics |

| Claim | Marine biotech, Natural/organic, Vegan, Clean-label |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Algatech , Codif , Greentech , Marinova , BASF, Croda , Seppic , Ashland, DSM- Firmenich , Givaudan |

| Additional Attributes | Dollar sales by source, function, claim, and product type; adoption trends across premium skincare, spa dermatology, and e-commerce; rising demand for marine biotech-certified formulations; sector-specific growth in anti-aging, brightening, and hydration; consumer-driven expansion of vegan and clean-label retinoids ; regional trends influenced by biotech investments, sustainability certifications, and digital-first retail strategies; innovations in microalgae bioengineering, marine fermentation, and clean-label extraction methods. |

The global Aquatic Plant-Sourced Retinoids Market is estimated to be valued at USD 1,250.3 million in 2025.

The market size for the global Aquatic Plant-Sourced Retinoids Market is projected to reach USD 4,153.1 million by 2035.

The global Aquatic Plant-Sourced Retinoids Market is expected to grow at a 12.8% CAGR between 2025 and 2035.

The key product types in the global Aquatic Plant-Sourced Retinoids Market are serums, creams/lotions, masks, and ampoules.

In terms of function, anti-aging & wrinkle repair is projected to command 56.6% share in the global Aquatic Plant-Sourced Retinoids Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA