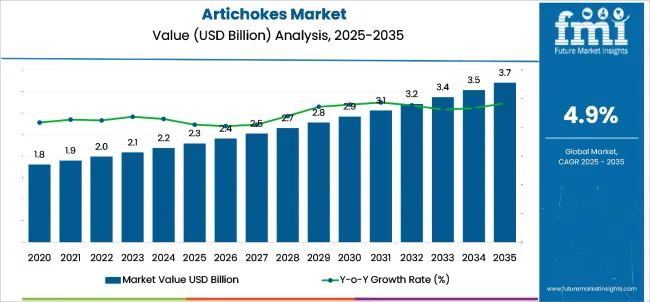

The artichokes market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 3.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period. The artichokes market is projected to add an absolute dollar opportunity of USD 1.4 billion over the forecast period. This reflects a 1.61 times growth at a compound annual growth rate of 4.9%.

| Metric | Value |

|---|---|

| Artichokes Market Estimated Value in (2025E) | USD 2.3 billion |

| Artichokes Market Forecast Value in (2035F) | USD 3.7 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The market's evolution is expected to be shaped by rising demand for functional foods, Mediterranean cuisine popularity, and health-conscious consumer behavior, particularly where antioxidant-rich vegetables and premium culinary ingredients are prioritized.

By 2030, the market is likely to reach approximately USD 2.9 billion, accounting for USD 600 million in incremental value over the first half of the decade. The remaining USD 800 million is expected during the second half, suggesting a moderately back-loaded growth pattern. Product diversification for processed foods and value-added artichoke preparations is gaining traction due to artichokes' favorable nutritional profile and versatile culinary applications.

Companies such as Ocean Mist Farms and Green Globe Artichokes are advancing their competitive positions through investment in sustainable farming technologies and value-added processing capabilities. Premium positioning and organic certification are supporting expansion into gourmet food markets, specialty retail channels, and international export opportunities. Market performance will remain anchored in quality standards, supply chain efficiency, and consumer education about artichokes' health benefits.

The artichokes market holds approximately 28% of the specialty vegetables market, driven by its premium positioning, nutritional benefits, and culinary versatility in Mediterranean and gourmet cuisines. It accounts for around 15% of the functional foods vegetables market, supported by its high antioxidant content and potential health benefits including liver support and digestive wellness.

The market contributes nearly 18% to the processed vegetables market, particularly for canned, frozen, and marinated artichoke products used in foodservice and retail applications. It holds close to 12% of the organic specialty produce market, where sustainably grown artichokes command premium pricing among health-conscious consumers.

The share in the gourmet food ingredients market reaches about 22%, reflecting its preference among upscale restaurants, specialty food manufacturers, and culinary enthusiasts seeking authentic Mediterranean flavors.

The market is undergoing structural change driven by rising demand for functional and nutrient-dense vegetables. Advanced cultivation methods using precision agriculture and sustainable farming practices have enhanced yield consistency, product quality, and shelf life, making artichokes more accessible to mainstream consumers beyond traditional Mediterranean markets.

Processors are introducing value-added products including artichoke hearts, spreads, and ready-to-eat preparations tailored for convenience-oriented consumers, expanding applications beyond fresh produce. Strategic partnerships between growers and food manufacturers have accelerated adoption in packaged foods, restaurant chains, and international markets.

Online retail platforms and specialty food distributors have widened access and awareness, reshaping traditional supply chains and encouraging artichoke consumption in non-traditional markets.

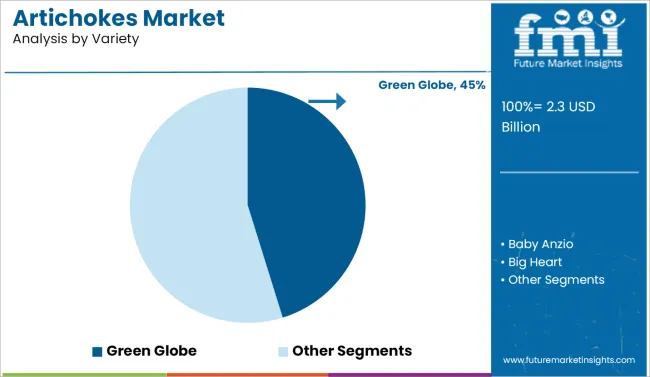

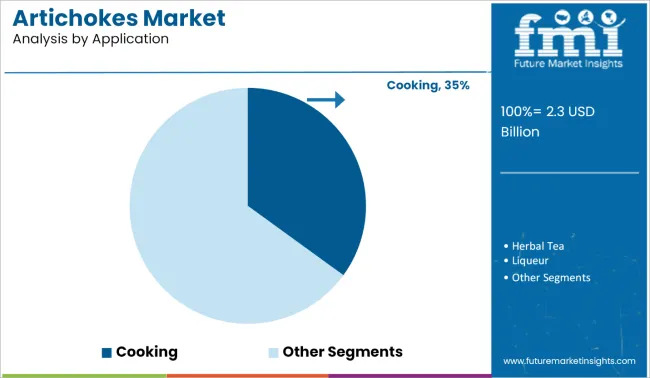

The market is segmented by origin, variety, application, and region. Based on origin, the market is bifurcated into organic artichokes and conventional artichokes. By variety, it includes Baby Anzio, Big Heart, Green Globe, Siena, Mercury, Omaha, Fiesole, Chianti, King. In terms of applications, the market is classified into cooking, herbal tea, liqueur, medical research, genome. Regionally, the market is analyzed across North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa.

The Green Globe variety leads the artichokes market with a 45% share in the variety category, owing to its strong commercial appeal, consistent quality, and wide consumer acceptance across global markets. Known for its uniform size, tender texture, and mild flavor, Green Globe artichokes are favored in both traditional dishes and modern culinary applications.

The variety offers superior storage stability and shipping resilience, making it suitable for long-distance distribution and extended retail shelf life. Its dominance is further supported by established cultivation practices, dependable yields, and strong market recognition among growers and end-users.

Producers are increasingly investing in organic farming and value-added formats such as pre-trimmed hearts and marinated products to serve retail and foodservice demand. With tightening quality standards and growing international trade, the Green Globe variety is expected to maintain its leadership position in the artichokes market.

The cooking segment holds a substantial 35% share in the application category, driven by the widespread use of artichokes in home kitchens and culinary preparations across diverse cuisines. Artichokes are valued for their rich flavor, nutrient content, and versatility in dishes such as pastas, salads, pizzas, stews, and appetizers.

The segment benefits from increasing consumer interest in Mediterranean and plant-forward diets, where artichokes are commonly featured. Fresh, canned, and frozen formats are widely used for both everyday meals and gourmet cooking, supporting steady household and foodservice demand.

Growing awareness of artichokes’ health benefits, including digestive support and antioxidant properties, further enhances their appeal in home-cooked meals. As global culinary trends continue to prioritize clean ingredients and vegetable-based recipes, the cooking segment is expected to retain a strong position within the artichokes market.

Artichokes' reputation as a superfood with high antioxidant content, fiber, and potential liver health benefits makes them an attractive choice for health-conscious consumers seeking functional foods with proven nutritional advantages.

Growing awareness of Mediterranean diet benefits and the globalization of culinary preferences are further propelling adoption, especially in urban markets where consumers are experimenting with diverse, authentic ingredients. Rising disposable income in emerging markets, along with improved cold chain logistics, enables broader distribution of fresh and processed artichoke products.

As foodservice establishments and specialty food manufacturers prioritize premium, health-focused ingredients, artichokes are well-positioned to expand across various culinary applications. With consumers and food professionals emphasizing natural nutrition, authentic flavors, and culinary sophistication, artichokes offer compelling value propositions for both fresh consumption and processed food applications.

In 2024, global artichoke production grew by 8.2% year-on-year, with Mediterranean regions maintaining a 67% cultivation share. Applications include gourmet culinary preparations, functional food ingredients, and nutraceutical supplements. Producers are introducing organic cultivation methods and value-added processing techniques that deliver superior flavor retention and extended shelf life.

Sustainable farming practices and controlled atmosphere storage now support year-round availability. Food manufacturers increasingly source premium artichoke ingredients with certified quality standards and traceability documentation to meet foodservice and retail demands.

Health and Wellness Trends Support Artichoke Market Growth

Consumers and nutritionists are choosing artichoke products to access proven antioxidant benefits, digestive support, and liver health properties documented in clinical research. Laboratory studies demonstrate that artichoke leaf extracts contain up to 15% cynarin and silymarin compounds, providing measurable antioxidant activity and potential cholesterol management benefits.

Products featuring artichoke-derived ingredients maintain bioactive compound stability for up to 18 months under proper storage conditions. Premium artichoke supplements and functional foods are now standardized for active compound content, increasing adoption in wellness-focused consumer segments. These attributes help explain why health-conscious purchasing behavior drove 23% growth in organic artichoke sales during 2024 across North America and Western Europe.

Supply Chain Complexity and Seasonal Availability Restrict Market Expansion

Growth faces constraints due to artichokes' limited growing seasons, specialized cultivation requirements, and perishability challenges. Fresh artichokes maintain optimal quality for only 7-10 days under refrigerated conditions, impacting distribution efficiency and leading to retail shrinkage rates of up to 12% in conventional supply chains.

Seasonal production patterns create price volatility, with peak season prices 40-60% lower than off-season imports. Limited processing infrastructure for value-added products restricts market development in emerging regions. Specialized knowledge requirements for proper preparation and cooking methods create adoption barriers among unfamiliar consumer segments. These constraints make scaling difficult in new markets despite growing consumer interest in healthy, functional vegetables.

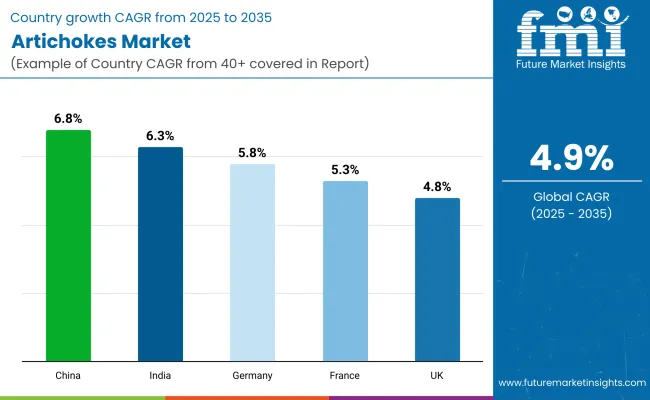

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

The global artichokes market is projected to grow at a CAGR of 4.9% from 2025 to 2035. China leads with 6.8%, growing 1.9 percentage points above the global rate due to expanding health-conscious urban populations and increasing Mediterranean cuisine adoption.

India follows at 6.3%, marking a 1.4-point advantage supported by growing disposable income and exposure to international culinary trends. Germany stands at 5.8%, slightly higher by 0.9 points, while France records 5.3%, showing a 0.4-point edge. The UK trails slightly below average at 4.8%, reflecting mature market dynamics. Consumer education, distribution infrastructure, and culinary integration are key drivers behind growth variations.

The report covers an in-depth analysis of 40+ countries; five top performing OECD countries are highlighted below.

China artichokes market is projected to grow at a CAGR of 6.8% from 2025 to 2035, outperforming the global average by 1.9%. The growth is linked to expanding urban middle class interest in premium vegetables and international cuisine adoption. Specialty imported artichokes are widely adopted in upscale restaurants and gourmet food retail channels.

Domestic cultivation experiments have been launched in temperate regions with technical support from Mediterranean agricultural consultants. Health-focused consumers are increasingly purchasing artichoke supplements and functional food products. More than half of consumption is concentrated in tier-1 cities, with growing penetration in tier-2 urban centers among affluent consumers seeking nutritional diversity.

Artichokes market in India is forecast to grow at a CAGR of 6.3% from 2025 to 2035, ahead of the global average by 1.4%. Urban metros, particularly Mumbai, Delhi, and Bangalore, have expanded availability of imported fresh and processed artichokes for affluent consumer segments. Hotel and restaurant chains are incorporating artichokes into continental and Mediterranean menu offerings.

Specialty food importers have established cold chain distribution networks for premium vegetable segments. Health supplement manufacturers are introducing artichoke-based digestive and liver support products for wellness-conscious consumers. Import dependence remains high, as domestic cultivation is limited to experimental plots in hill station regions.

Germany is expected to grow at a CAGR of 5.8% from 2025 to 2035, exceeding the global rate by 0.9%. Growth is centered on organic food retail, health-focused consumers, and Mediterranean cuisine popularity in urban areas such as Berlin, Munich, and Hamburg. Fresh artichokes are being specified in gourmet supermarkets, organic food chains, and specialty delicatessens.

Import volumes from Spain, Italy, and France have increased, particularly during peak European growing seasons. Premium processed products with clean-label formulations are favored under EU organic certification standards. Most adoption is driven by health-conscious consumers and culinary enthusiasts, with limited penetration in conventional mainstream grocery channels.

France is expected to grow at 5.3%, driven by traditional Mediterranean cuisine appreciation and premium food retail expansion in Paris, Lyon, and Marseille. Demand is shifting toward organic and locally-sourced artichokes from domestic production regions in Brittany and southern France. Custom culinary preparations and artisan food products lead in unit sales.

Domestic distribution networks have strengthened, with increased availability in both specialty shops and mainstream supermarkets. While France maintains strong domestic production, specialty varieties and year-round availability drive some import activity. French culinary tradition supports consistent artichoke consumption across both traditional and contemporary food preparation methods.

The UK artichokes market is expected to grow at 4.8% from 2025 to 2035, matching the regional average. Demand is driven by health-conscious consumers and expanding Mediterranean cuisine popularity in London, Manchester, and Edinburgh. Artichokes are gaining momentum in premium grocery chains, organic food retailers, and specialty delicatessens. Local restaurants and gastropubs have increased artichoke menu offerings, particularly in urban areas with affluent demographics.

However, higher import costs due to post-Brexit trade adjustments and limited domestic production capacity impact price competitiveness. Market share is shifting toward pre-processed and value-added artichoke products, especially marinated hearts and convenience preparations. Direct-to-consumer specialty food delivery services have helped reduce supply chain complexity.

The artichokes market is moderately fragmented, featuring a mix of regional agricultural producers and specialty food distributors with varying degrees of vertical integration and premium positioning. Master Fruit SRL and Hijos De Joaquín Rodríguez SL lead the European production segment, supplying premium fresh artichokes for both domestic and export markets. Their strength lies in sustainable farming practices, quality certification, and established relationships with premium food retailers.

Jawhara Foods and Sirri Ustundag differentiate through processed artichoke products, including marinated hearts, frozen preparations, and value-added culinary ingredients that cater to foodservice and retail applications. Danda Global Trade and Caprichos Del Paladar focus on specialty distribution and import/export operations, addressing the growing demand for authentic Mediterranean ingredients in non-traditional markets.

Regional players such as Agro T18 Italia S.R.L. and Olive Gardens dominate cultivation and primary processing in Mediterranean production regions, ensuring cost efficiency and quality control for premium fresh and processed artichoke supply chains. These companies emphasize organic certification, traceability, and sustainable production methods.

Entry barriers remain moderate, driven by specialized agricultural knowledge, quality certification requirements, and established distribution relationships across multiple geographic regions. Competitiveness increasingly depends on organic certification capabilities, product innovation in processing and packaging, and market development in emerging consumer segments seeking functional and gourmet food products.

Key Developments in the Artichokes Market

Producers are advancing sustainable cultivation practices and organic certification to meet growing consumer demand for environmentally responsible agriculture, while developing value-added processing techniques for marinated, frozen, and ready-to-eat artichoke products.

Global players are investing in cold chain logistics and packaging innovations for extended shelf life, while regional producers scale operations for both domestic consumption and international export opportunities. Integration of quality traceability, GAP certification, and clean-label positioning is becoming standard, driven by food safety regulations and premium market positioning. Partnerships with specialty food distributors and restaurant chains are accelerating adoption in non-traditional markets and international cuisine segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 Billion |

| Variety | Green Globe, Purple of Romagna, Violetto di Toscana, and Others |

| Application | Culinary, Herbal Tea, Dietary Supplements, Liqueur, and Others |

| End-user | Retail Consumers, Foodservice, Food Processing, and Nutraceuticals |

| Distribution Channel | Online Retail and Offline Retail |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Master Fruit SRL, Hijos De Joaquín Rodríguez SL, Jawhara Foods, Sirri Ustundag, Danda Global Trade, Caprichos Del Paladar, Agro T18 Italia S.R.L., and Olive Gardens |

| Additional Attributes | Dollar sales by variety and application, growing usage in gourmet cooking and functional foods for premium consumer segments, stable demand in traditional Mediterranean markets and expanding adoption in health-conscious demographics, innovations in sustainable farming and value-added processing improve quality, shelf life, and market accessibility |

The global artichokes market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the artichokes market is projected to reach USD 3.7 billion by 2035.

The artichokes market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The Green Globe variety is projected to lead in the artichokes market with 45% market share in 2025.

In terms of application, the cooking segment is expected to command 35% share in the artichokes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA