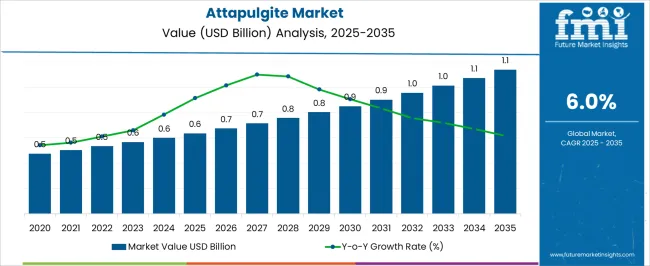

The attapulgite market is valued at USD 0.6 billion in 2025 and is projected to reach USD 1.1 billion by 2035, growing at a CAGR of 6.0%. A saturation point analysis highlights how market growth gradually approaches maturity as demand stabilizes across key applications. Between 2021 and 2025, the market increases from USD 0.5 billion to USD 0.6 billion, with incremental values surpassing USD 0.5 billion and USD 0.6 billion. Early gains are driven by rising utilization in drilling fluids, pet care, industrial absorbents, and construction materials, establishing a foundational market base.

From 2026 to 2030, the values increase from USD 0.6 billion to USD 0.9 billion, passing through USD 0.7 billion, USD 0.7 billion, USD 0.8 billion, and USD 0.8 billion. During this phase, the market exhibits moderate growth as adoption widens, supply chains stabilize, and product applications expand in the pharmaceutical, agricultural, and environmental remediation sectors. Between 2031 and 2035, the market is projected to progress from USD 0.9 billion to USD 1.1 billion, with intermediate values of USD 0.9 billion, USD 1.0 billion, and USD 1.1 billion.

| Metric | Value |

|---|---|

| Attapulgite Market Estimated Value in (2025 E) | USD 0.6 billion |

| Attapulgite Market Forecast Value in (2035 F) | USD 1.1 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The attapulgite market is driven by five parent markets that collectively shape its growth, applications, and demand across industrial, environmental, and specialty sectors. The drilling fluids and oilfield chemicals market contributes the largest share, about 28-32%, as attapulgite is used as a viscosifier and suspension agent in water-based and synthetic drilling fluids to enhance lubrication, thermal stability, and cuttings transport in oil and gas exploration. The agriculture and animal feed market adds approximately 20-24%, where attapulgite functions as an adsorbent, anti-caking agent, and mycotoxin binder in animal feed, improving livestock health and feed efficiency.

The wastewater treatment and environmental remediation market contributes around 15-18%, leveraging attapulgite’s high adsorption capacity for removing heavy metals, dyes, and organic contaminants from industrial effluents and contaminated water. The construction and building materials market accounts for roughly 12-15%, as attapulgite is used as a rheology modifier, thickener, and stabilizer in paints, coatings, sealants, and cementitious products. The specialty chemicals and pharmaceuticals market represents about 8-10%, utilizing attapulgite in drug formulations, cat litter, and other absorbent applications due to its high surface area and inert properties.

The attapulgite market is experiencing stable growth, supported by its diverse industrial applications and unique mineral properties such as high absorption capacity, colloidal stability, and chemical inertness. Reports from industrial minerals associations and manufacturer press releases have highlighted increased utilization in environmental, agricultural, and consumer product sectors.

Demand has been positively influenced by stricter environmental regulations, prompting industries to adopt attapulgite-based products for oil absorption, waste treatment, and filtration. In the consumer goods segment, the rising use of attapulgite in pet care, cosmetics, and pharmaceuticals has strengthened market penetration.

Mining expansions and improved processing technologies have increased supply consistency, meeting the growing needs of end-use industries. Future growth is anticipated with the development of higher-purity grades and enhanced surface-modified attapulgite for specialty applications. Market leadership is expected from colloidal-grade products due to their suitability in drilling muds, paints, and suspension agents, while cat litter absorbent applications continue to capture a significant share, driven by pet ownership trends.

The attapulgite market is segmented by product, application, and geographic regions. By product, attapulgite market is divided into Colloidal grade and Sorptive grade. In terms of application, attapulgite market is classified into Cat litter absorbent, Oil and gas, Agriculture, Paints and coatings, Medical and pharmaceutical, and Others. Regionally, the attapulgite industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

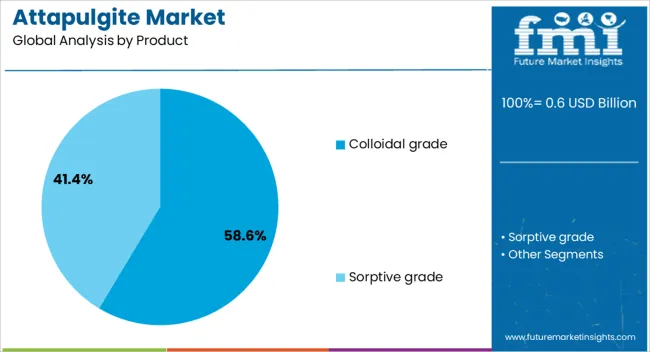

The colloidal grade segment is projected to account for 58.6% of the attapulgite market revenue in 2025, holding its position as the leading product type. Its dominance is attributed to its superior suspension and thickening properties, making it an essential additive in paints, drilling fluids, adhesives, and agricultural formulations.

Industrial users value colloidal-grade attapulgite for its ability to maintain viscosity stability under varying temperature and pH conditions. Technological advancements in processing have enhanced particle uniformity and purity, improving performance in high-value applications.

The segment’s growth is further supported by increased adoption in the oil and gas sector for drilling operations and in the construction industry for specialty coatings. Given its versatility and compatibility with a wide range of industrial processes, the colloidal grade is expected to remain the preferred choice for manufacturers seeking functional mineral additives.

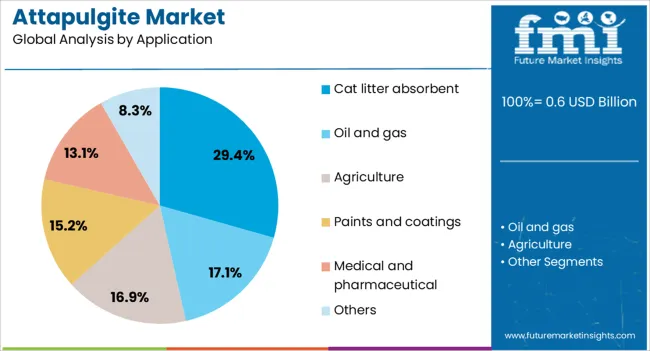

The cat litter absorbent segment is projected to represent 29.4% of the attapulgite market revenue in 2025, making it one of the most prominent application areas. Growth in this segment has been driven by attapulgite’s high absorption capacity, odor control properties, and natural composition, which appeal to environmentally conscious consumers.

The expanding global pet population, particularly in urban regions, has significantly increased demand for high-performance and cost-effective litter products. Manufacturers have incorporated attapulgite into premium cat litter formulations to improve clumping efficiency and enhance moisture retention.

Market trends indicate a shift toward natural and biodegradable pet care products, further boosting attapulgite usage in this application. As consumer awareness of sustainable pet care solutions grows, the cat litter absorbent segment is expected to sustain strong demand, supported by continuous product innovation and retail availability.

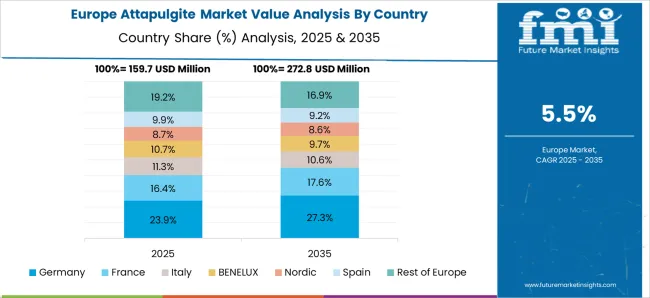

The attapulgite market is growing due to rising demand from drilling fluids, paints, coatings, pharmaceuticals, and personal care products. Its absorbent, thickening, and rheological properties make it valuable across industrial, healthcare, and construction sectors. Challenges include raw material price fluctuations, supply chain constraints, and regulatory compliance in mining and processing. Opportunities exist in specialized grades for drilling, coatings, and pharmaceutical applications. Manufacturers providing high-purity, application-ready, and technically supported attapulgite products are best positioned to capture market growth. Asia-Pacific, North America, and Europe are key regions, driven by industrialization, oil and gas exploration, and healthcare expansion.

The attapulgite market is expanding as industries increasingly adopt this clay mineral for its absorbent, rheological, and thickening properties. Applications in drilling fluids, paints, coatings, construction materials, and pharmaceuticals drive growth. Pharmaceutical and cosmetic industries use attapulgite as an excipient and adsorbent in tablets, creams, and personal care products. Demand is further supported by its use in wastewater treatment, agriculture, and animal feed as a binder and carrier. Manufacturers are focusing on high-quality, processed attapulgite with consistent particle size and purity. Growth in oil and gas exploration, industrial coatings, and healthcare sectors across Asia-Pacific, North America, and Europe reinforces market expansion. Companies providing technically supported, application-ready products are well-positioned to capture rising industrial and commercial demand globally.

Despite increasing demand, the attapulgite market faces challenges from raw material price fluctuations, energy-intensive processing, and supply chain limitations. Mining, grinding, and purification processes require specialized equipment and skilled labor, affecting production costs. Compliance with environmental regulations, occupational safety standards, and regional mining permits adds operational complexity. Variability in natural deposits can impact quality and performance in industrial applications. Buyers increasingly demand certified, consistent, and high-purity attapulgite suitable for pharmaceuticals, cosmetics, and drilling fluids. Manufacturers investing in process optimization, quality control, and logistics efficiency are better positioned to mitigate challenges. Ensuring reliable supply, product consistency, and regulatory compliance is crucial to meeting global industrial and pharmaceutical market requirements.

Growth opportunities in the attapulgite market are driven by expanding oil and gas drilling operations, industrial coatings, and pharmaceutical production. Drilling fluids require high-quality attapulgite for viscosity control and suspension properties. Paints and coatings adopt it for rheology control, anti-settling, and thickening performance. Pharmaceutical and personal care industries leverage its adsorbent and carrier characteristics in creams, gels, and medicinal formulations. Asia-Pacific, North America, and Europe represent key growth regions due to rising industrialization, healthcare demand, and construction projects. Manufacturers offering customized grades, technical support, and application expertise gain a competitive edge. Expanding applications in wastewater treatment, agriculture, and specialty chemicals further support long-term market growth globally.

Technological trends in the attapulgite market include processed and micronized products for enhanced dispersion, absorption, and rheology. Manufacturers are developing specialty grades with uniform particle size, reduced impurities, and improved thermal stability for pharmaceutical, cosmetic, and drilling applications. Integration with digital formulation tools allows manufacturers to optimize product performance in coatings, sealants, and industrial fluids. Collaborations with pharmaceutical and chemical companies enable the development of application-specific solutions. Increasing focus on high-performance, reliable, and consistent products drives product differentiation. Companies delivering technically supported, certified, and high-quality attapulgite products are well-positioned to meet evolving industrial and healthcare requirements, ensuring operational efficiency and enhanced product performance worldwide.

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The global alcoholic drinks packaging market is projected to grow at a CAGR of 6.1% from 2025 to 2035. China leads at 8.2%, followed by India at 7.6%, France at 6.4%, the UK at 5.8%, and the USA at 5.2%. Growth is driven by premiumization, urbanization, and expanding retail and e-commerce channels. Demand for high-quality glass bottles, cans, and multi-pack cartons is increasing across spirits, wine, and beer segments. Automation, digital labeling, and precision decoration enhance efficiency, design, and durability. Limited edition, gift, and functional packaging trends further boost consumer appeal and market adoption globally. The analysis includes over 40 countries, with the leading markets shown below.

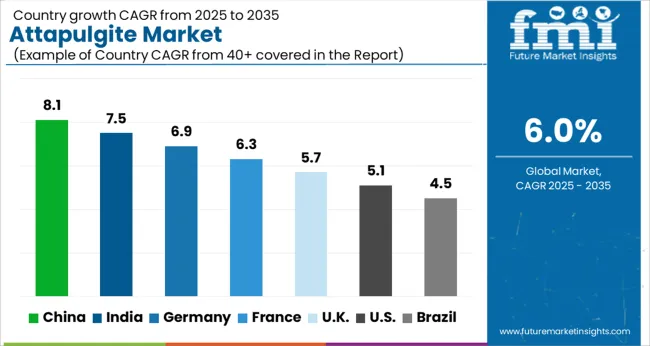

The attapulgite market in China is projected to grow at a CAGR of 8.1% from 2025 to 2035, driven by rising demand from the oil drilling, agriculture, and construction industries. The country’s expanding industrial base and increasing manufacturing activities fuel consumption of attapulgite-based products, such as drilling muds, absorbents, and construction additives. Manufacturers are focusing on high-purity attapulgite, optimized processing technologies, and specialized formulations to meet industrial requirements. Growth is further supported by rising chemical, paint, and rubber production, where attapulgite serves as a rheology modifier. Partnerships with end-use industries and investments in production capacity ensure competitive positioning.

The attapulgite market in India is expected to grow at a CAGR of 7.5% from 2025 to 2035, driven by growth in oilfield drilling, agriculture, and industrial applications. The rise of domestic chemical and paint production increases demand for attapulgite as a rheology modifier and absorbent. Manufacturers are focusing on enhancing purity, performance, and cost-effectiveness of attapulgite products. Expansion of drilling activities, industrial infrastructure, and urban construction further boosts demand. Integration with end-use sectors, collaborations with oilfield service providers, and innovation in specialty applications, such as pharmaceuticals and environmental remediation, enhance market growth.Growing awareness of attapulgite’s benefits in water treatment and absorbent solutions drives adoption in niche segments.

The attapulgite market in Germany is projected to expand at a CAGR of 6.9% from 2025 to 2035, supported by applications in paints, chemicals, construction, and specialized industrial uses. High demand for quality rheology modifiers, absorbents, and fillers drives adoption in both industrial and commercial sectors. Manufacturers focus on product innovation, high-purity grades, and consistent supply to meet stringent quality standards. Germany’s strong automotive, chemical, and construction industries increase consumption in adhesives, coatings, and oil-based products. Emerging applications in environmental management and pharmaceuticals further boost market potential. Strategic partnerships between local suppliers and end-users enhance penetration and technological adoption.

The UK attapulgite market is expected to grow at a CAGR of 5.7% from 2025 to 2035, supported by steady demand from chemical manufacturing, construction, and industrial sectors. Attapulgite is widely used as a rheology modifier in paints, coatings, and drilling fluids. Manufacturers focus on improving product consistency, purity, and functionality for niche industrial applications. Growth is enhanced by urban construction projects, oilfield services, and the specialty chemical sector. Strategic collaborations with distributors and end-use companies help expand market reach. Emerging applications in environmental remediation and water treatment create additional growth opportunities.

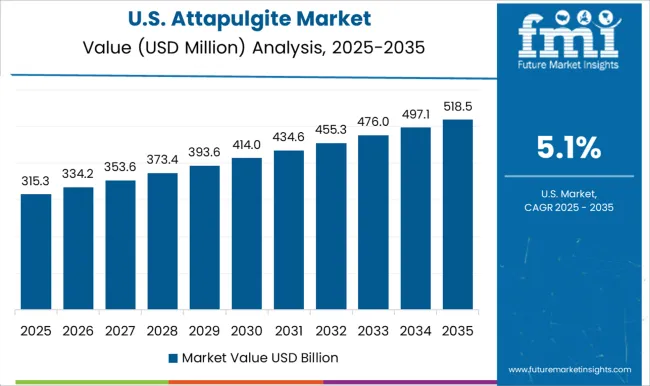

The USA attapulgite market is projected to grow at a CAGR of 5.1% from 2025 to 2035, driven by applications in oilfield drilling, chemical processing, paints, and industrial manufacturing. Rising demand for drilling muds, absorbents, and fillers boosts consumption. Manufacturers focus on enhancing product quality, developing specialized grades, and scaling production to meet end-use requirements. Growth is also supported by expanding industrial infrastructure, urban construction projects, and the increasing need for environmental management solutions. Strategic partnerships with chemical manufacturers and oilfield service providers improve supply reliability and adoption in key sectors. Innovation in specialty applications, including pharmaceuticals and wastewater treatment, continues to create market opportunities.

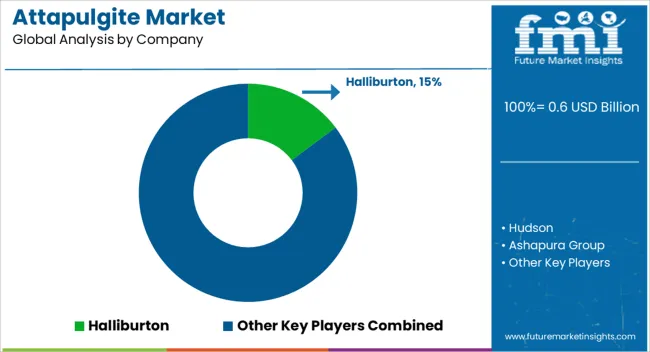

Competition in the attapulgite market is driven by quality, particle size consistency, and applications across oil drilling, filtration, and industrial sectors. Halliburton maintains a leading position through high-grade attapulgite used in drilling mud formulations, emphasizing rheological control and thermal stability for oil and gas operations. Hudson differentiates with specialty absorbents and filtration-grade attapulgite for chemical processing and environmental applications. Ashapura Group competes with large-scale production capacity, offering attapulgite for drilling, cat litter, and industrial absorbent markets, leveraging cost efficiency and supply reliability. Geohellas focuses on high-purity clays tailored for specialty applications, including paint, coatings, and wastewater treatment. KPL International provides attapulgite for pharmaceutical, personal care, and specialty industrial uses, emphasizing particle uniformity and chemical inertness. Oil-Dri Corporation of America delivers functional grades for oil absorption, industrial filtration, and environmental cleanup, targeting both domestic and export markets.

Jaxon Filtration integrates attapulgite in filtration systems and performance chemicals, highlighting performance consistency and compatibility with industrial processes. Russell Finex supplies attapulgite-based filtration media for powder and liquid separation applications, emphasizing equipment compatibility and product stability. Gujarat Minechem and Anhui Mingmei Minchem compete primarily on regional supply, offering bulk attapulgite for drilling muds, industrial absorbents, and clay-based formulations. Strategies across the market focus on expanding high-purity production, developing application-specific grades, and ensuring consistent particle size distribution for critical industrial processes. Product brochures highlight granular and powdered attapulgite, filtration-grade clays, absorbents for oil and chemical spills, drilling mud additives, rheology modifiers, and environmental remediation solutions. Collectively, these offerings demonstrate a market where quality, application versatility, and reliable supply chains define competitiveness, with investment in production technology and specialty product development crucial to meeting global demand across oilfield, industrial, and environmental segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.6 Billion |

| Product | Colloidal grade and Sorptive grade |

| Application | Cat litter absorbent, Oil and gas, Agriculture, Paints and coatings, Medical and pharmaceutical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Halliburton, Hudson, Ashapura Group, Geohellas, KPL International, Oil-Dri Corporation of America, Jaxon Filtration, Russell Finex, Gujarat Minechem, and Anhui Mingmei Minchem |

| Additional Attributes | Dollar sales by product type (powder, granules, processed grades), application (oilfield drilling, industrial filtration, animal feed, absorbents), and purity grade (technical, food, industrial). Demand is driven by oilfield expansion, industrial filtration needs, and environmental regulations. Regional trends show strong growth in North America, Europe, and Asia-Pacific, supported by the drilling industry, chemical manufacturing, and industrial absorbent consumption. |

The global attapulgite market is estimated to be valued at USD 0.6 billion in 2025.

The market size for the attapulgite market is projected to reach USD 1.1 billion by 2035.

The attapulgite market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in attapulgite market are colloidal grade and sorptive grade.

In terms of application, cat litter absorbent segment to command 29.4% share in the attapulgite market in 2025.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA