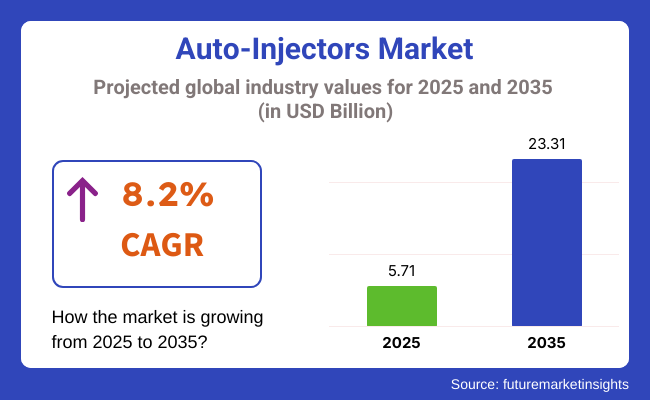

The auto-injectors market is forecast to reach a value of USD 5.71 billion in 2025 and is expected to expand to USD 23.31 billion by 2035, growing at a steady compound annualgrowth rate of 8.2% over the period. The market has gained considerable momentum with rising global incidences of chronic illnesses that require routine, precise drug delivery.

As healthcare systems evolve to accommodate more personalized and decentralized care models, these injectors have become central to this shift, offering patients greater autonomy and ease in managing long-term therapies.

The market continues to be shaped by growing patient demand for self-administration solutions that reduce hospital dependency. As public health campaigns increase awareness and governments push for home-based care options, these serve as a bridge between clinical-grade treatment and personal convenience.

Many patients with conditions like multiple sclerosis, rheumatoid arthritis, or severe allergic reactions are choosing to manage their treatment from home using reliable, user-friendly injectors. This behavioral shift is also driven by cost pressures and limited availability of healthcare professionals in remote regions.

A major factor propelling this market is the rapid development and acceptance of biologics and biosimilar drugs, which often require consistent subcutaneous injection. Pharmaceutical companies are pairing these drugs with auto-injector technologies to improve adherence, reduce anxiety, and ensure dose accuracy. Additionally, innovations in digital health, such as smart injectors with adherence tracking features, are helping physicians monitor patient compliance remotely.

Together, these forces are transforming these injectors from basic mechanical tools into advanced healthcare delivery systems tailored for a tech-forward patient population.

Government regulations surrounding products are focused on ensuring product safety, accuracy, and accessibility for patients managing chronic and acute conditions at home. Regulatory bodies such as the USA Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have introduced stricter guidelines for device approval, particularly emphasizing features like needle safety, dose precision,and usability

The market is segmented by product into prefilled auto-injectors and fillable auto-injectors. By indication, the market is categorized into anaphylaxis, multiple sclerosis, rheumatoid arthritis, and others (migraines, hormonal disorders, oncology treatments, osteoporosis, psoriasis, and fertility therapies).

Based on the distribution channel, it includes hospital pharmacies, retail pharmacies, online pharmacies, and drug stores. Regionally, the market is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

Prefilled auto-injectors are the fastest-growing product segment in the global market, projected to expand at a CAGR of 8.8% from 2025 to 2035. Their growth is driven by user-friendly designs, reduced dosing errors, and increasing use in emergency care and chronic disease management. These devices come pre-loaded with medication, offering added convenience and better compliance for patients requiring frequent injections. Prefilled designs appeal to patients managing chronic illnesses like rheumatoid arthritis or multiple sclerosis, where routine dosing is essential.

The rise in demand is also tied to manufacturers partnering with pharmaceutical companies to launch combination products that integrate a drug and delivery device, streamlining treatment and enhancing adherence.

Fillable auto-injectors, while not expanding as rapidly, maintain relevance in specialized care settings. These devices offer flexibility for drugs that require reconstitution or tailored doses before use. Healthcare professionals typically rely on fillable formats for treatments that do not yet have prefilled equivalents or for clinical trials testing new medications.

Though they require more handling, fillable injectors provide cost advantages and are being increasingly used in hormone therapies, oncology, and hospital-based applications where trained personnel are available to prepare and administer doses.

| Product | CAGR (2025 to 2035) |

|---|---|

| Prefilled Auto-Injectors | 8.8% |

Anaphylaxis is the fastest-growing indication in the market, expected to expand at a CAGR of 9.1% from 2025 to 2035. The rising prevalence of severe allergic reactions from food, medications, and insect stings has significantly increased the demand for epinephrine auto-injectors. These devices are widely recommended for emergency use, especially among children and adults with life-threatening allergies.

Efforts by governments and healthcare providers to make epinephrine injectors more accessible, along with over-the-counter approvals in some regions, have further fueled adoption. Additionally, innovations such as needle-free or voice-assisted injectors are improving ease of use, particularly for first-time users.

Other indications, like multiple sclerosis and rheumatoid arthritis, also contribute steadily to market growth. Products help patients manage chronic inflammatory conditions by enabling regular, self-administered doses of disease-modifying drugs at home. In multiple sclerosis, interferon therapy often requires frequent subcutaneous injections, making products essential for minimizing discomfort and improving compliance. Rheumatoid arthritis patients benefit from easy-to-handle devices that reduce injection-site pain and simplify complex dosing regimens.

The “others” category includes indications such as migraine, hormonal therapies, and oncology, where self-injection is becoming increasingly common, especially as biologics and biosimilars gain broader use.

| Indication | CAGR (2025 to 2035) |

|---|---|

| Anaphylaxis | 9.1% |

Online pharmacies represent the fastest-growing distribution channel for products, projected to expand at a CAGR of 9.4% from 2025 to 2035, primarily due to the convenience of doorstep delivery, rising health awareness, and the increasing number of patients managing chronic conditions at home. These platforms offer greater price transparency and access to a wider range of brands, making them especially appealing for tech-savvy consumers and those in remote areas.

Subscription-based delivery models and digital prescription uploads are also simplifying the repeat purchase of self-injectable therapies, contributing to their rapid expansion in both developed and emerging markets.

Hospital pharmacies remain a foundational channel, particularly for newly prescribed biologic therapies or acute treatment scenarios. Patients often receive their first dose under medical supervision in hospital settings before transitioning to at-home administration.

This ensures proper instruction and monitoring, especially for complex conditions like multiple sclerosis or oncology-related therapies. These pharmacies are trusted by clinicians and patients alike for their controlled handling of temperature-sensitive products and real-time access to healthcare professionals for guidance.

Retail pharmacies and drug stores continue to play a vital role in broadening access to products, especially for established users refilling prescriptions. Retail chains provide personalized interaction and pharmacist counseling, enhancing patient confidence in self-use. In many regions, these stores are the first point of contact for individuals seeking emergency injectors like epinephrine.

Drug stores, particularly in smaller towns and rural areas, act as community healthcare hubs where over-the-counter access to select injectables is possible, extending reach to underserved populations and supporting ongoing treatment adherence.

| Distribution Channel | CAGR (2025 to 2035) |

|---|---|

| Online Pharmacies | 9.4% |

Surging Incidence of Chronic Diseases to Fuel Product Adoption

The primary driver for the market is the rising prevalence of chronic and life-threatening conditions such as anaphylaxis, multiple sclerosis, rheumatoid arthritis, and diabetes. These diseases require frequent administration of medication, which makes products a preferred option due to their ease of use and patient-controlled application.

The growth of biologics and biosimilars has further increased demand for accurate and efficient drug delivery systems. Patients are shifting toward self-management, and the convenience offered by these injectors supports this trend. Healthcare providers and insurance systems are also encouraging home-based care models to reduce hospital loads, further boosting market adoption.

Innovations such as Bluetooth-enabled injectors and needle-safety features continue to attract more users and drive long-term usage.

Steep Product Cost May Impede Demand

High product costs remain a significant barrier in many regions, particularly where healthcare reimbursement systems are underdeveloped or absent. The integration of advanced features like digital dose tracking and smart connectivity adds to manufacturing costs, making these devices less accessible to price-sensitive consumers.

Regulatory hurdles also slow down the introduction of new devices, especially when digital features are involved. Limited awareness and training in lower-income countries inhibit the adoption of self-injectors. Additionally, patients with needle anxiety or concerns about incorrect administration are hesitant to transition from clinician-administered injections to self-use.

Combined, these financial, regulatory, and psychological barriers create challenges to faster and more widespread market penetration, particularly in emerging markets.

Opportunities Due to the Development of Eco-friendly Products

The market is witnessing new opportunities through the development of eco-friendly and reusable products aimed at reducing environmental waste and long-term healthcare costs. Digital health integration is unlocking new use cases, including remote treatment monitoring and personalized dosing support.

Partnerships between pharmaceutical companies and digital health platforms are leading to connected devices that improve treatment adherence through real-time data analytics. Growth in the biosimilar space also presents a major opportunity, as more affordable versions of biologics reach the market. Emerging economies with improving healthcare infrastructure and policy support are opening untapped patient populations to auto-injector solutions.

Government initiatives promoting home healthcare and chronic disease management are expected to further elevate demand in the coming years.

Threats Due to Alternatives

The market faces competitive threats from alternative drug delivery methods such as transdermal patches, oral biologics, and inhalable medications that continue to advance in efficacy and convenience. Supply chain disruptions, including shortages of medical-grade plastics and electronics, may hinder the timely production and delivery of devices. Intellectual property disputes and regulatory recalls could impact the credibility and sales of branded devices. Inconsistent global regulatory standards also create bottlenecks in multi-country product launches.

Additionally, cybersecurity concerns around connected injectors pose risks to patient data integrity, which may lead to hesitancy in adopting smart devices. If not addressed, these risks could stall technological progress and erode consumer trust in advanced auto-injector platforms.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.7% |

| United Kingdom | 6.3% |

| Japan | 6.1% |

| Germany | 5.9% |

| France | 6.0% |

The USA auto-injectors market is estimated to grow at a 5.7% CAGR during the study period, driven by a high prevalence of chronic illnesses such as multiple sclerosis, rheumatoid arthritis, and anaphylaxis. The country’s mature healthcare ecosystem supports widespread access to biologics and self-injection devices. With rising demand for at-home care and pressure to reduce hospital visits, many patients are adopting these injectors to manage long-term treatments conveniently and safely.

Insurance coverage for self-administered medications further supports affordability and access. Moreover, the country has experienced an uptick in severe allergy cases, especially among children, prompting greater use of epinephrine products injectors across schools and public facilities. Innovation is also a key growth enabler, with companies introducing Bluetooth-connected injectors and digital adherence tracking tools. These smart systems are aligned with the shift toward value-based care and digital health.

Regulatory support for such innovations, along with strong domestic production capabilities and strategic collaborations between pharma and device manufacturers, are reinforcing the USA leadership in advanced drug delivery models. This positions the country as one of the most attractive markets globally for auto-injector deployment.

The UK auto-injectors market is estimated to grow at a 6.3% CAGR during the study period. The United Kingdom is witnessing a solid rise in demand for products, underpinned by a strong public healthcare system and government-driven health campaigns that promote early intervention and at-home treatment for chronic diseases.

The National Health Service (NHS) provides access to self-injectable therapies for conditions like rheumatoid arthritis, multiple sclerosis, and severe allergic reactions, increasing patient familiarity with these devices. Epinephrine auto-injectors are particularly common, distributed widely to schools, offices, and public spaces due to regulations mandating emergency preparedness for anaphylaxis. Recent digital health initiatives and MedTech collaborations are driving the development and pilot testing of smart injectors with adherence-monitoring features.

These technologies are aligned with the UK’s focus on digital-first healthcare solutions and data-driven patient outcomes. Moreover, biosimilar adoption is accelerating, making therapies more affordable and expanding the user base for injectable drugs. As part of its broader healthcare digitization plan, the UK government continues to support remote patient management tools, which complement the growing use of connected injectors in both urban and rural populations.

The Japan auto-injectors market is estimated to grow at a 6.1% CAGR during the study period. Chronic conditions such as diabetes, osteoporosis, and rheumatoid arthritis are increasingly common, and patients are seeking more convenient, less invasive ways to manage these conditions. Products offer a compelling solution, enabling elderly and mobility-impaired users to self-administer medications accurately without assistance.

Japanese manufacturers are renowned for producing compact, ergonomic devices that emphasize user comfort, precision, and reliability. Local regulatory authorities support patient-centered care and have paved the way for innovations in drug delivery technologies, including injectors with voice-guided features and minimal injection-site pain. There is also growing interest in using digital health platforms that integrate with smart injectors, providing both physicians and caregivers with adherence data. Government initiatives focused on expanding home healthcare services, along with rising adoption of biologics and hormone therapies, further drive market growth.

Japan’s emphasis on medical device quality, patient safety, and user-friendly design reinforces its position as a technologically advanced and patient-aware market.

The German auto-injectors market is estimated to grow at a 5.9% CAGR during the study period, supported by one of the world’s most efficient healthcare systems and a strong pharmaceutical manufacturing base. The country is experiencing a rise in chronic diseases such as rheumatoid arthritis, Crohn’s disease, and allergies, all of which often require injectable therapies. German patients and healthcare providers favor products due to their safety, dosing precision, and ability to facilitate home care while reducing the healthcare system's burden.

The reimbursement framework in Germany is favorable for biologics and biosimilars, which are frequently administered via auto-injectors, making treatment more accessible. The government promotes innovation in medical devices, and domestic manufacturers are active in advancing design improvements such as hidden needles, one-touch activation, and reusable formats.

Furthermore, physician-led outpatient programs encourage training patients on self-injection techniques, leading to higher adoption across multiple therapeutic areas. With ongoing support from insurance providers and medical societies, Germany continues to see consistent investment in next-generation auto-injector platforms that meet both clinical and patient usability standards.

The French auto-injectors market is estimated to grow at a 6.0% CAGR during the study period, driven by its efforts to decentralize chronic disease care and increase patient autonomy. The country’s healthcare system offers broad coverage for self-injectable biologics used in multiple sclerosis, hormonal conditions, and autoimmune diseases. Public health policies also support early access to emergency products like epinephrine through school and workplace programs. French regulators have established clear pathways for approving new self-administration devices, encouraging both domestic and international manufacturers to bring innovations to market. Design enhancements that simplify injection, reduce discomfort, and ensure correct usage are seeing increased demand.

Biosimilars are gaining market share, and with them, the compatible use of cost-effective products is expanding rapidly. In addition, the country’s emphasis on sustainable healthcare solutions is prompting interest in reusable and recyclable injector formats.

Collaborative projects between pharmaceutical companies and technology startups are accelerating the development of connected injectors, giving France a foothold in the growing digital therapeutics landscape. Together, these factors create a robust growth environment for the auto-injector industry.

Leading companies in the market are focusing on innovation, strategic collaborations, and expanding patient access to drive growth in a competitive environment. Many are investing heavily in research and development to design user-friendly, ergonomic devices that support ease of administration and compliance.

Integration of smart features such as dose tracking, Bluetooth connectivity, and safety mechanisms like hidden needles is a key area of focus. In parallel, partnerships with biotech firms and digital health platforms are being used to co-develop drug-device combinations tailored to specific therapeutic areas. Companies are also targeting biosimilar integration, ensuring compatibility of new injectors with more affordable biologics. Sustainability is gaining attention, prompting the development of reusable or recyclable products to meet growing environmental expectations.

Becton, Dickinson and Company remains a dominant player with a strong portfolio of prefilled auto-injector systems and next-gen platforms supporting biologic therapies. Sanofi, a leader in immunology and diabetes care, continues to roll out device-enhanced treatments with a focus on accessibility.

Janssen Global Services, under Johnson & Johnson, emphasizes personalized self-injection solutions for oncology and immunology patients. Pfizer, with widely used therapies like Enbrel and Xeljanz, supports its dominance by offering integrated auto-injector options. Mylan N.V., now part of Viatris, is widely known for EpiPen and remains a key provider in the anaphylaxis segment.

Amgen Inc. and Eli Lilly and Company focus on biologic delivery in autoimmune and endocrine conditions, advancing smart injector models for better patient experiences. Novartis AG and Bayer AG are active in expanding their reach through innovation in injector design and treatment integration.

These firms are leveraging scale, regulatory expertise, and therapy-specific injector customization to maintain leadership while addressing evolving patient needs in chronic care and emergency medicine. Their combined efforts continue to shape the global trajectory of the market.

Recent Auto-Injectors Industry News

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 5.71 billion |

| Projected Market Size (2035) | USD 23.31 billion |

| CAGR (2025 to 2035) | 8.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion |

| By Product Type | Prefilled Auto-Injectors and Fillable Auto-Injectors |

| By Indication | Anaphylaxis, Multiple Sclerosis, Rheumatoid Arthritis, and Others ( Migraines, Hormonal Disorders, Oncology Treatments, Osteoporosis, Psoriasis, And Fertility Therapies) |

| By Distribution Channels | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, and Drug Stores |

| Regions Covered | North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan |

| Key Players | Becton, Dickinson and Company , Sanofi , Janssen Global Services, LLC , Pfizer, Inc. , Mylan N.V. , Amgen Inc. , Eli Lilly and Company , Novartis AG , and Bayer AG |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The global market is projected to reach USD 23.31 billion by 2035, growing from USD 5.71 billion in 2025.

The market is expected to grow at a CAGR of 8.2% during the forecast period from 2025 to 2035.

Online pharmacies are the fastest-growing channel, projected to expand at a CAGR of 9.4% from 2025 to 2035.

Key players include Becton, Dickinson and Company, Sanofi, Pfizer, Mylan N.V., Janssen, Amgen, Eli Lilly, Novartis, and Bayer.

Rising chronic disease prevalence, growth of biologics, patient preference for home-based care, and innovation in self-injection technology are driving demand.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Indication, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Indication, 2023 to 2033

Figure 23: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Indication, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Product, 2023 to 2033

Figure 46: North America Market Attractiveness by Indication, 2023 to 2033

Figure 47: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Indication, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Indication, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Indication, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Indication, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Indication, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Indication, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Indication, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Indication, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Indication, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Indication, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Indication, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Indication, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA