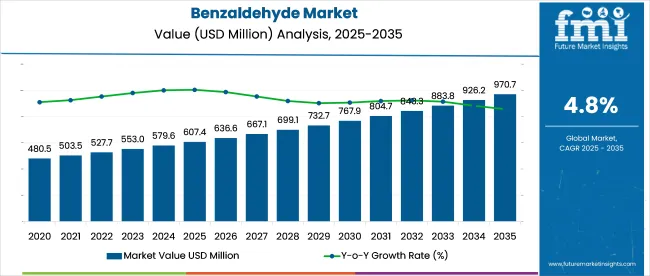

The benzaldehyde market is anticipated to expand from USD 607.4 million in 2025 to USD 969.8 million by 2035, registering a CAGR of 4.8% during the forecast period. Market growth is being sustained by its rising application in aroma chemicals, pharmaceuticals, and agrochemicals, particularly as a precursor for cinnamic acid and other derivatives used in flavors and fragrances.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025E) | USD 607.4 million |

| Projected Industry Value (2035F) | USD 969.8 million |

| Value-based CAGR (2025 to 2035) | 4.8% |

In Asia-Pacific, over 50,000 tons were processed in 2023, with China contributing nearly 45,000 tons due to its dominance in agrochemical intermediates and synthetic flavor production. India’s growing pharmaceutical sector is also boosting domestic benzaldehyde demand. In Europe, Germany alone processed around 8,000 tons, driven by strict purity requirements in cosmetics and personal care formulations.

North America’s usage is concentrated in USP-grade applications for food and pharma sectors, where compliance and consistency are critical. Manufacturers are increasingly adopting catalytic and green synthesis routes to meet tightening environmental standards, especially in OECD regions. Across the chain, demand visibility is improving due to long-term contracts with end users in dyes, fragrances, and veterinary products. This vertical alignment is improving throughput efficiency and allowing for better cost pass-through across regions.

As of 2025, the benzaldehyde market is being recognized as a key segment within its broader parent industries. Approximately 4-6% of the aromatic chemicals market is contributed by benzaldehyde, driven by its importance in perfumery and solvent applications.

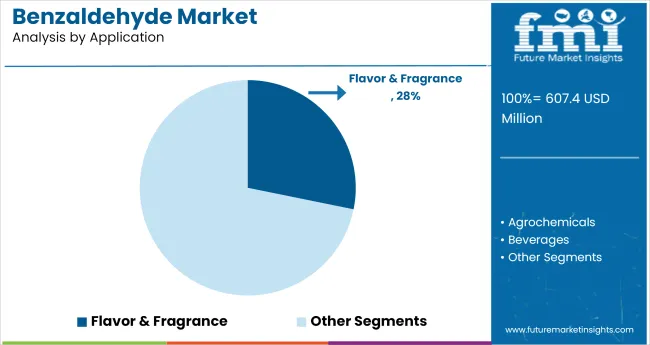

In the flavor and fragrance ingredients market, a share of nearly 8-10% is maintained as benzaldehyde continues to be used in almond, cherry, and marzipan formulations. Around 3-4% of the pharmaceutical intermediates market is represented by benzaldehyde due to its use in active ingredient synthesis. Its share in the agrochemical ingredients market is estimated at 2-3%, while in the specialty chemicals space, the contribution reaches around 5-6% as it supports dye and resin production.

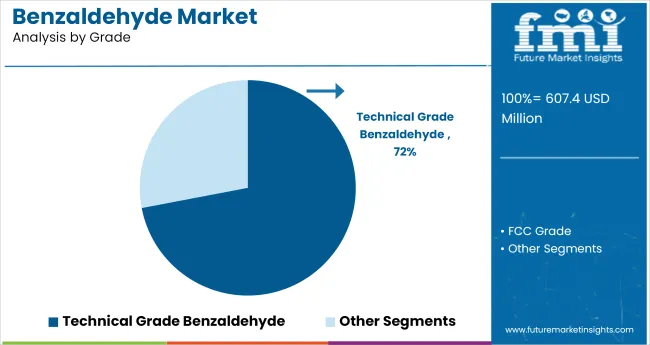

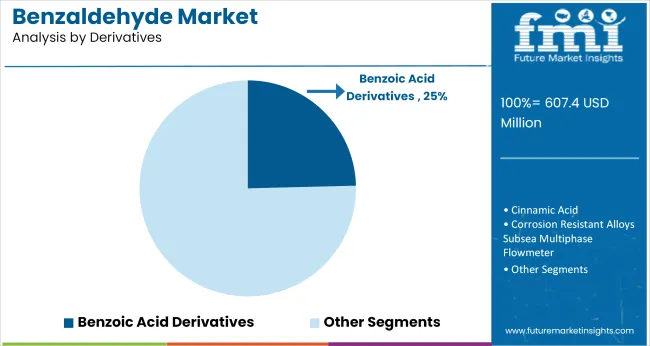

The market is expanding steadily, fueled by its widespread use in technical-grade production, flavor and fragrance formulation, and benzoic acid derivatives. Growth is supported by rising demand in personal care, food preservation, and industrial coatings applications.

Technical grade benzaldehyde is projected to account for 72% of total market share by 2025. It is widely favored in chemical manufacturing due to its affordability and consistent quality. Its use in agrochemicals, dyes, and pharmaceuticals drives large-scale demand across industrial economies.

Flavor and fragrance applications are expected to hold 28.2% of the total market by 2025. Benzaldehyde’s almond-like aroma makes it a key additive in food, beverages, and perfumes. Demand is supported by rising consumption of natural flavoring agents and expanding personal care markets.

Benzoic acid, derived from benzaldehyde, is projected to secure a 24.6% market share in 2025. It plays a crucial role in preservatives, coatings, and alkyd resins. Its antimicrobial properties and chemical resilience ensure widespread adoption across food processing and chemical coatings.

The market is growing steadily due to its widespread use in aroma chemicals, agrochemicals, and pharmaceutical intermediates. In 2024, global consumption crossed 105,000 metric tons, with Asia Pacific accounting for over 48% of total demand.

High Demand from Aroma Chemicals, Dyes, and Agrochemicals

Benzaldehyde is widely used in the synthesis of cinnamic acid, benzyl alcohol, and acridine dyes. In India and China, over 65% of benzaldehyde produced is consumed in agrochemical and dye sectors. In the EU, flavor-grade benzaldehyde is regulated under FEMA and EFFA standards, making it essential in almond, cherry, and nut flavor formulations.

Technological Advancements Enhancing Purity and Processing Efficiency

Manufacturers are investing in catalytic oxidation and continuous distillation to improve purity (>99.5%) and reduce by-products. In 2024, over 40% of global benzaldehyde plants adopted vapor-phase oxidation to increase yield and reduce carbon emissions. Advanced separation units are helping in fine chemical production where purity is critical.

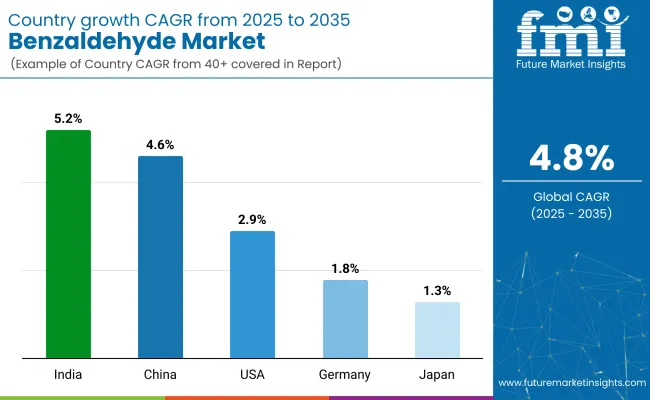

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.2% |

| China | 4.6% |

| USA | 2.9% |

| Germany | 1.8% |

| Japan | 1.3% |

The global market is forecast to expand at a 4.8% CAGR from 2025 to 2035, yet significant variation exists across BRICS and OECD economies. India leads with a 5.2% CAGR, slightly outperforming the global average due to rapid downstream expansion in the agrochemical and aroma sectors. Gujarat-based chemical clusters are driving capacity additions, with over 40% of new investments targeting benzoate esters and cinnamic acid production.

China follows at 4.6%, just below the global mark, where demand from perfumery, pharmaceuticals, and dyes supports continued growth, though regulatory tightening under its dual-carbon policy is slowing new plant approvals. In contrast, OECD countries underperform.

The USA posts a 2.9% CAGR, limited by volatile toluene pricing and decelerating growth in legacy perfumery applications. Germany (1.8%) and Japan (1.3%) reflect structural stagnation, with weak R&D in benzaldehyde derivatives and tighter environmental thresholds disincentivizing scale-ups. ASEAN markets are emerging but remain underrepresented in capacity and trade volumes.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

India is forecast to grow at a CAGR of 5.2% from 2025 to 2035. Growth is being supported by rising demand across agrochemicals, pharmaceuticals, and fragrance applications. Benzaldehyde is used as an intermediate in pesticides and plant growth regulators, which are widely produced in Gujarat and Maharashtra.

The country’s strong domestic chemical manufacturing base is helping meet internal consumption while also exporting derivatives. Additionally, the fragrance sector is expanding due to higher demand for incense sticks, soaps, and household care products that use benzaldehyde-based compounds.

China is expected to post a CAGR of 4.6% through 2035, driven by its large-scale manufacturing ecosystem and high consumption of resins and herbicide precursors. Benzaldehyde is widely used in southern provinces for coating resins and in agrochemical synthesis.

The country has ramped up local production with greater emphasis on process efficiency and pollution control. Domestic consumption is being bolstered by downstream demand in polymer, food additive, and personal care industries. Chinese exporters are also expanding their reach into Southeast Asia and the Middle East.

The United States is projected to grow at a CAGR of 2.9% from 2025 to 2035. This growth is led by demand in food flavoring, pharmaceutical synthesis, and personal care sectors. Benzaldehyde is used to manufacture artificial almond flavor, high-purity solvents, and active pharmaceutical ingredients. Industrial users prioritize quality and regulatory compliance, which gives domestic producers an advantage. In addition, the trend toward natural and bio-based benzaldehyde is gaining momentum as clean-label formulations gain market share.

Germany is estimated to grow at a CAGR of 1.8% between 2025 and 2035. The country has a stable but specialized demand for benzaldehyde in fragrance, fine chemicals, and pharmaceutical applications. Imports dominate the supply chain, and most buyers prefer high-purity grades that meet strict EU safety regulations. The country’s chemical industry places strong emphasis on sustainability and traceability, making eco-friendly production methods more attractive. Custom synthesis services are also rising as users demand tailored derivatives.

Japan is forecast to expand at a CAGR of 1.3% from 2025 to 2035. Demand is mainly driven by its well-established cosmetics, food flavoring, and fine chemicals sectors. Local manufacturers focus on precision synthesis, requiring high-quality benzaldehyde inputs for specialized uses. Imports make up the majority of supply, with the United States and China being key suppliers. Benzaldehyde is used in skin-care formulations, fragrance compounds, and food essences. Consumer preferences for high-performance and clean-label products are influencing future procurement patterns.

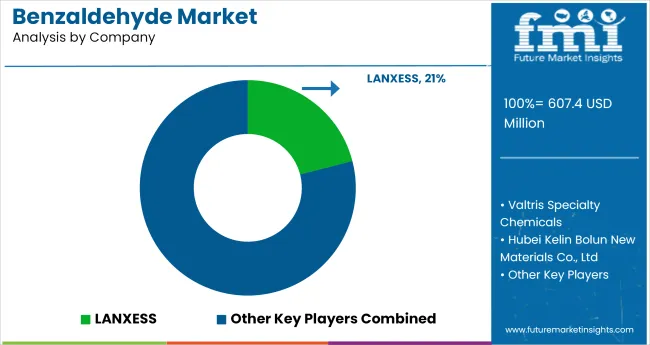

The industry is moderately consolidated, with key players specializing in either synthetic or natural-grade production. LANXESS holds a dominant global share, supplying high-purity benzaldehyde for agrochemicals and aroma chemicals, supported by backward integration and robust European infrastructure. Valtris Specialty Chemicals leverages strong USA manufacturing to serve the coatings and plastics sector.

India’s Shimmer Chemicals and KLJ Group cater to both domestic and Asian markets, offering cost-effective variants for dye and flavor applications. Kadillac Chemicals focuses on fine chemical intermediates, targeting pharmaceutical clients. In China, Lihai Chemical and Hubei Kelin Bolun lead with bulk exports, driven by low-cost synthesis methods. Axxence Aromatic GmbH serves premium natural benzaldehyde markets across Europe, emphasizing traceability and food-grade compliance.

Recent Benzaldehyde Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 607.4 million |

| Projected Market Size (2035) | USD 969.8 million |

| CAGR (2025 to 2035) | 4.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value |

| Grades Analyzed (Segment 1) | FCC Grade, Technical Grade |

| Applications Analyzed (Segment 2) | Agrochemicals (Crop Protection), Beverages (Alcoholic Beverages <15% ABV, Carbonated Soft Drinks, Fruit Juices, Other Soft Drinks), Dyes & Coatings, Flavor & Fragrance, Food (Bakery Goods, Confectionery & Chewing Gum, Ice Creams, Gelatins, Puddings), Pharmaceuticals & Intermediates, Others |

| Derivatives Analyzed (Segment 3) | Cinnamic Acid, Benzoic Acid, Sodium Benzoate, Benzyl Alcohol, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players | LANXESS, Valtris Specialty Chemicals, Hubei Kelin Bolun New Materials Co., Ltd, Lihai Chemical Industry Co., Ltd, Gujarat Alkalies & Chemicals Ltd, KLJ Group, Kadillac Chemicals Pvt. Ltd, Wuhan Dico Chemical Co., Ltd, Axxence Aromatic GmbH, Shimmer Chemicals Pvt. Ltd, Elan Chemical Co Inc., Other Players |

| Additional Attributes | Dollar sales by grade and application, increased use in food and fragrance formulations, growing demand for derivatives like cinnamic acid and benzoic acid, and expanding production capacity across Asia and Europe. |

In this segment, the industry has been categorized into FCC Grade and Technical Grade.

By application, the market is segmented into Agrochemicals (Crop Protection), Beverages (Alcoholic Beverages <15% ABV, Carbonated Soft Drinks, Fruit Juices and Other Soft Drinks), Dye and Coatings, Flavor and Fragrance, Food (Bakery Goods, Confectionery and Chewing Gum, Ice Creams, Gelatins, Puddings), Pharmaceutical and Intermediates, and Others.

Key derivatives include Cinnamic Acid, Benzoic Acid, Sodium Benzoate, Benzyl Alcohol, and Others.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is expected to reach USD 969.8 million by 2035.

The market is projected to expand at a CAGR of 4.8% from 2025 to 2035.

Flavor and fragrance leads with a 28.2% share in 2025.

Benzoic acid dominates with a 24.6% share in 2025.

India is forecast to grow at the fastest rate, with a CAGR of 5.2% during the period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA