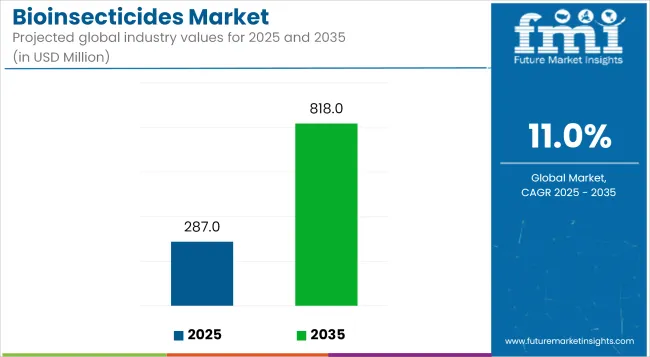

The global bioinsecticides market is projected to grow from USD 287 million in 2025 to approximately USD 818 million by 2035, advancing at a compound annual growth rate (CAGR) of 11.0%. Growth is being driven by mounting regulatory pressure to phase out high-toxicity synthetic pesticides and by increasing reliance on biological alternatives to meet global food safety and environmental standards.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 287 million |

| Projected Market Size in 2035 | USD 818 million |

| CAGR (2025 to 2035) | 11.0% |

Bioinsecticides, derived from naturally occurring microorganisms such as Bacillus thuringiensis (Bt), Beauveria bassiana, and neem extracts, are being adopted across crop protection systems where reduced environmental impact and residue-free yields are prioritized. These products are playing an increasingly central role in integrated pest management (IPM) programs, especially in fruit, vegetable, and specialty crop cultivation.

Stricter residue level regulations by authorities such as the European Food Safety Authority (EFSA), Codex Alimentarius, and the USA Environmental Protection Agency (EPA) are prompting global producers to adopt pest control strategies that avoid chemical build-up and preserve biodiversity. Bioinsecticides provide a targeted approach that limits non-target toxicity, which is essential in ecosystems that support pollination and natural predator populations.

Technological advancements in microbial fermentation, nanoencapsulation, and formulation science are improving the efficacy, field stability, and shelf life of bioinsecticides. These innovations are enabling producers to meet industrial-scale demand while aligning with global environmental mandates. For instance, RNA interference (RNAi) platforms and entomopathogenic virus-based biocontrols are being developed to counter pest resistance and extend control duration across growing cycles.

Global demand is also being shaped by rising consumer preference for chemical-free food, expansion of certified organic farmland, and trade-related phytosanitary requirements. Food processors and export markets are placing increasing emphasis on traceability and sustainability, incentivizing the agricultural sector to adopt biological inputs that comply with transparent sourcing and environmental safety benchmarks.

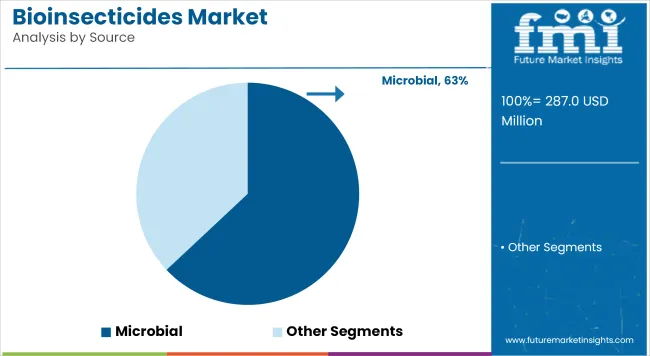

The microbial segment is projected to account for approximately 63% of the global bioinsecticide market share in 2025 and is forecast to grow at a CAGR of 11.2% through 2035. These bioinsecticides are derived from bacteria, fungi, viruses, and protozoa, with Bacillus thuringiensis (Bt) being among the most extensively used strains.

Their selectivity and low toxicity to non-target species make them suitable for integrated pest management (IPM) systems. Regulatory bodies and environmental agencies across Europe and North America are increasingly promoting microbial solutions due to their biodegradability and lower ecological impact compared to synthetic alternatives. Advancements in formulation and spore stability are supporting their broader adoption in both open-field and greenhouse applications.

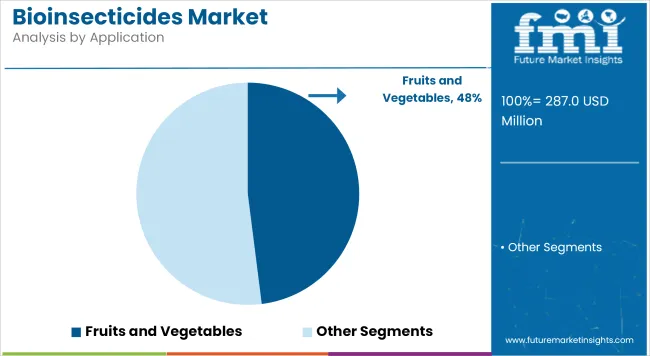

The fruits and vegetables segment is estimated to hold approximately 48% of the global bioinsecticide market share in 2025 and is projected to grow at a CAGR of 11.4% through 2035. Producers of high-value crops such as tomatoes, cucumbers, grapes, and berries are prioritizing bio-based pest control to meet residue limits, particularly in markets governed by strict food safety regulations.

Bioinsecticides offer advantages in pre-harvest intervals, re-entry periods, and resistance management. Growth is also supported by rising organic farming acreage and retail demand for clean-label produce. As horticultural exporters invest in sustainable crop protection strategies, bioinsecticides continue to gain relevance in protecting yield quality and regulatory compliance.

| Drivers | Restraints |

|---|---|

| Increasing Demand for Organic Farming: Growing consumer awareness about health and environmental sustainability is boosting the adoption of organic farming practices, thereby increasing the demand for Bioinsecticides as natural pest control solutions. | High Production Costs: The production of Bioinsecticides often involves complex processes, leading to higher costs compared to synthetic pesticides, which can deter adoption among cost-sensitive farmers. |

| Environmental and Health Concerns: The adverse effects of chemical pesticides on ecosystems and human health are prompting a shift towards eco-friendly alternatives like bio insecticides. | Limited Shelf Life and Stability: Bioinsecticides may have shorter shelf lives and require specific storage conditions, posing logistical challenges in distribution and storage. |

| Regulatory Support: Governments worldwide are implementing stringent regulations to reduce chemical pesticide usage, promoting the use of Bioinsecticides as safer alternatives. | Variable Efficacy: The effectiveness of Bioinsecticides can vary based on environmental conditions and pest species, leading to inconsistent results compared to chemical pesticides. |

| Advancements in Biotechnology: Innovations in microbial and plant-based bio insecticide formulations are enhancing their efficacy and expanding their application range. | Lack of Awareness and Education: Many farmers are not fully informed about the benefits and application methods of bio insecticides, hindering their widespread adoption. |

Impact Assessment

| Drivers | Impact |

|---|---|

| Increasing Demand for Organic Farming | High |

| Environmental and Health Concerns | High |

| Regulatory Support | High |

| Advancements in Biotechnology | Medium |

Impact Assessment of Bioinsecticides Market Restraints

| Restraints | Impact |

|---|---|

| High Production Costs | High |

| Limited Shelf Life and Stability | Medium |

| Variable Efficacy | Medium |

| Lack of Awareness and Education | High |

The Bioinsecticides industry has seen significant growth across various regions, with North America leading the way. In 2025, North America dominated the global Bioinsecticides market, capturing a share of 36.59%. This leadership is primarily due to the increasing demand for sustainable and eco-friendly pest management solutions in the region.

Europe also plays a crucial role in the Bioinsecticides market. The region is characterized by stringent environmental policies and a strong emphasis on organic farming practices. Countries such as Germany, France, and Italy are key contributors to the market's expansion in this region.

In the Asia-Pacific region, Japan and South Korea are witnessing a growing interest in bio insecticides. This trend is driven by a rising awareness of environmental sustainability and the benefits of organic farming practices.

While specific market share percentages for the United Kingdom, Germany, France, Italy, Japan, and South Korea are not readily available, these countries are recognized as significant players in the global Bioinsecticides market. Their contributions are essential to the overall growth and adoption of Bioinsecticides worldwide.

Overall, the global Bioinsecticides market is on an upward trajectory, with various countries adopting eco-friendly pest management solutions to meet the increasing demand for organic and sustainably produced food.

The shift towards bioinsecticides is being supported by collaboration among various stakeholders in the agricultural value chain. Research institutions, agrochemical companies, and growers are working together on field trials and lifecycle assessments to evaluate environmental benefits and practical feasibility. As the emphasis on reducing the environmental impact of agriculture increases, bioinsecticides are likely to play an important role in future crop protection strategies.

Consumer and regulator demand for safer, environmentally sustainable alternatives to chemical pesticides is further propelling the referral market for bio insecticides.

Some of the major challenges include limited shelf life, high production costs and a slower killing effect against pests compared to synthetic pesticides.

Companies are also creating new biotech and microbial products as well as Precision Application techniques to facilitate better efficacy and longevity.

These trends are being majorly driven by North America and Europe; meanwhile Asia-Pacific is fast catching up with the rising trends of organic farming.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA