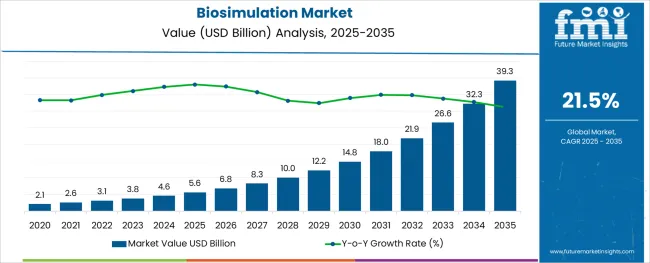

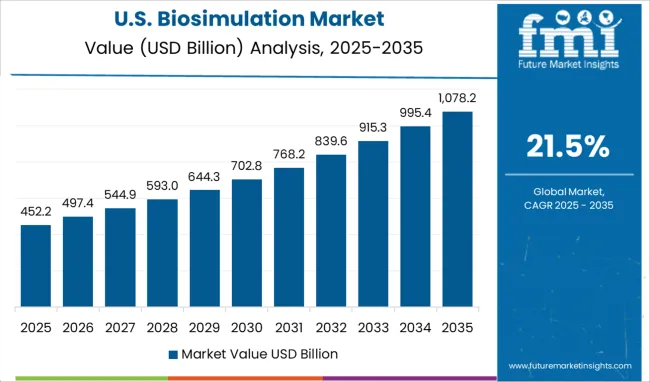

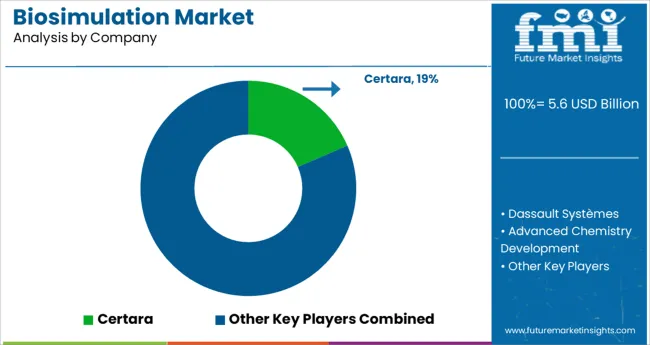

The Biosimulation Market is estimated to be valued at USD 5.6 billion in 2025 and is projected to reach USD 39.3 billion by 2035, registering a compound annual growth rate (CAGR) of 21.5% over the forecast period.

The biosimulation market is advancing as technological innovation, cost pressures in drug discovery, and regulatory expectations converge to redefine research and development strategies. Adoption is being driven by the ability of biosimulation tools to reduce experimental failures, shorten development timelines, and improve predictive accuracy in preclinical and clinical stages.

Increasing integration of computational models with experimental workflows has enhanced decision-making and optimized resource allocation in drug pipelines. Future growth is expected to benefit from rising demand for precision medicine, the expansion of biologics and advanced therapies, and the incorporation of artificial intelligence into simulation platforms.

Continuous enhancements in data analytics and cross-disciplinary collaboration between computational scientists and life science researchers are paving the way for deeper market penetration and broader applicability across therapeutic areas.

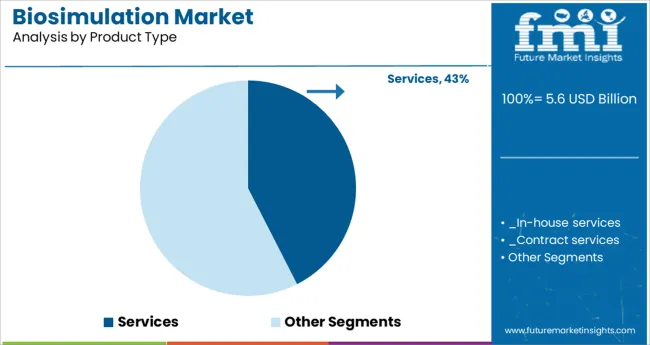

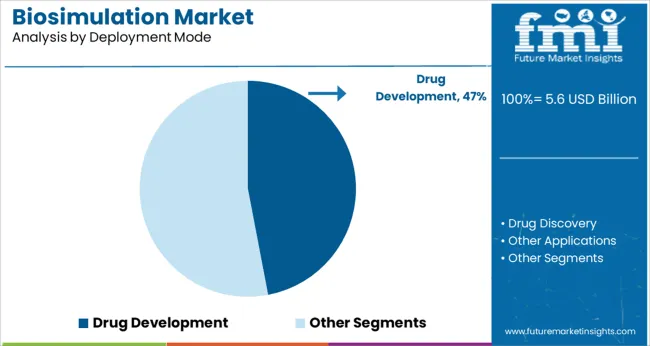

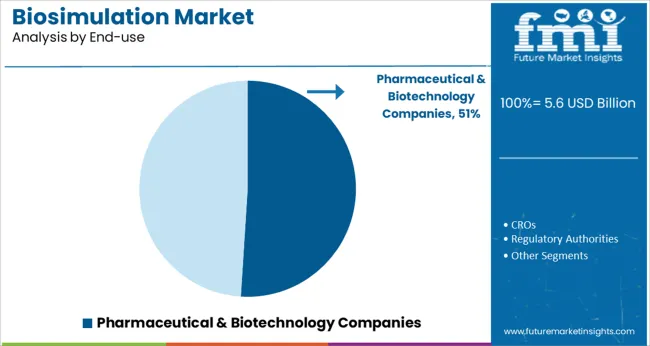

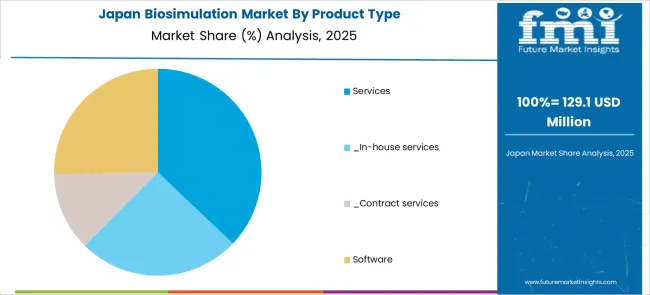

The market is segmented by Product Type, Deployment Mode, and End-use and region. By Product Type, the market is divided into Services and Software. In terms of Deployment Mode, the market is classified into Drug Development, Drug Discovery, and Other Applications. Based on End-use, the market is segmented into Pharmaceutical & Biotechnology Companies, CROs, Regulatory Authorities, and Academic Research Institutions. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product type the services segment is projected to hold 42.5% of the total market revenue in 2025 making it the leading product category. This leadership is being sustained by the increasing complexity of biosimulation applications which has led companies to rely on specialized service providers for expertise and scalability.

Outsourced services are enabling organizations to access advanced platforms and domain knowledge without incurring the full cost of in-house development. The flexibility offered by service models has allowed for customization of simulations to specific drug candidates and therapeutic areas enhancing efficiency and regulatory compliance.

Additionally the ability of service providers to integrate evolving regulatory guidelines and emerging methodologies into their offerings has strengthened their relevance and adoption across both small and large sponsors.

Segmented by deployment mode drug development is expected to account for 47.0% of the market revenue in 2025 maintaining its position as the dominant application area. This prominence is being reinforced by the role of biosimulation in addressing the high attrition rates and escalating costs associated with bringing new drugs to market.

Utilization of biosimulation in drug development is enabling more informed decisions in target validation dosing strategies and patient selection improving overall success rates of clinical trials. By allowing virtual testing of hypotheses and scenarios the technology has reduced reliance on costly and time-consuming wet lab experiments.

Companies are increasingly embedding biosimulation early in the development cycle to identify potential risks and optimize study designs which has further solidified its leadership in this segment.

When segmented by end use pharmaceutical and biotechnology companies are projected to capture 51.0% of the market revenue in 2025 securing their place as the foremost customer base. This dominance is being supported by their imperative to innovate under intense competitive and regulatory pressure while managing development costs

These organizations have been leveraging biosimulation to accelerate time to market enhance portfolio decision-making and demonstrate value to payers and regulators. Investment in internal capabilities as well as partnerships with specialized vendors has allowed them to integrate biosimulation into strategic planning across discovery preclinical and clinical phases.

The growing importance of precision medicine and complex biologics in their pipelines has further amplified the need for robust predictive modeling tools cementing their leadership in driving demand for biosimulation solutions.

The global market for Biosimulation registered a CAGR of 15.8% from 2020 to 2024. The market growth is projected to surge due to technological advancement in software for biosimulation. In 2024, the global market size of biosimulation was valued at USD 5.6 Billion and is estimated to increase to a valuation of USD 3.1 Billion in 2025.

Biosimulation is the use of computer-aided mathematical models to simulate biological processes. Biosimulation has various applications like developing new drugs and discovering new drugs. The drug discovery and development process is expensive, and the failure of a therapeutic molecule in the late stages of drug development results in a massive waste of time, money, and other resources. As a result, a predictive tool is required to aid in predicting the future results of drug development through simulation of the biological processes involved.

Biosimulation helps to simulate the effect of drugs on the body with the help of simulation. Pharmaceutical manufacturers are using biosimulation throughout the drug development process to identify the positive and negative effects of their drug can have on the people if the drug is used.

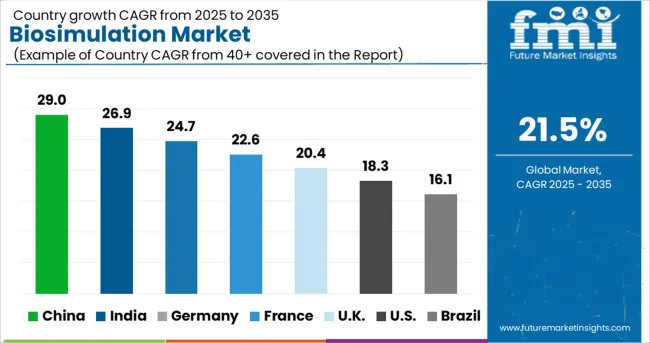

The global biosimulation market has predicted to surge ahead at a CAGR of 21.5% and record sales worth USD 39.3 Billion by the end of 2035. USA will continue to be the largest procurer of biosimulation throughout the analysis period accounting for over USD 7.5 Billion absolute dollar opportunity in the coming 10-year epoch.

Rising global healthcare spending will increase spending on developing drugs, which will drive revenue for biosimulation. Many drugs for mimic diseases are developed using biosimulation. Computers operating sickness simulations with the aid of biosimulation software can be used to conduct virtual clinical trials for new pharmaceutical treatments. Developing a new drug requires significant research and studies.

Every stage of drug development from clinical trials to the approval of the drug has a serious chance of failure. Biosimulation lowers these odds by predicting these failures in the development process. Also, it lowers the cost of pharmaceutical companies by lowering the number of clinical trials.

Biosimulation uses mathematical equations to depict a real-life process that occurs within the human body. Researchers may simulate a wide range of scenarios and examine the behavior of a human system in diverse settings since it can duplicate human biological elements and their interactions with medications when they are put into the system.

In order to obtain a better result, skilled expertise is required to perform the biosimulation software. The demand for skilled expertise is high in research laboratories and companies. In addition, this process is very complex and highly technical as they involve various laboratory documentation systems. In order to overcome this issue, researchers must receive proper training and assistance. These factors make biosimulation development time-consuming, thus limiting its adoption among researchers.

North America holds the largest market for biosimulation. The rising chronic disease among the population in the region and regulations implemented by the governments for patient safety and treatment standards is driving the demand for biosimulation in the region. In silico modeling is being used to boost the standard of patient care and safety. This is particularly true for the implementation of regulatory laws that have high standards for the safety and care of patients.

The encouraging government policies in the USA and the rising healthcare expenditure due to the dominance of chronic diseases are key factors that are rising drug development and discovery in the USA. The market for biosimulation in the USA has projected to reach a valuation of USD 39.3 Billion in 2035.

The government policies for developing quality pharmaceutical drugs and the Chinese government‘s commitment to develop and increase innovation in its healthcare system are driving the market for biosimulation in China. Chinese government’s plan to be a global leader in drug development is attracting drug development and pharmaceutical companies to China for the development of new drugs, which will further increase the demand for the biosimulation market over the years. The market for biosimulation in China is forecasted to reach a valuation of USD 1.7 Billion by 2035.

The market in the United Kingdom is projected to reach a valuation of USD 880 million by 2035. The market is expected to grow at a CAGR of 20.6% from 2025 to 2035 to gross an absolute dollar opportunity of USD 336 million.

The market for biosimulation in Japan is expected to reach USD 1.2 Billion by 2035. Growing at a CAGR of 25.1% during the forecast period, the market is likely to garner an absolute dollar opportunity of USD 1.1 Billion.

The market through the CROs segment is anticipated to grow at the fastest rate during the forecast period. The growing tendency of firms to cut total spending is expected to drive segment growth. Other factors like increased efficiency and the ability to focus on core areas for company development will also drive the use of biosimulation in CROs.

The key companies operating in the biosimulation market include Certara, Dassault Systemes, Advanced Chemistry Development, Simulation Plus Inc., Schrodinger, Inc., Chemical Computing Group, Physiomics Plc, Rosa & Co. LLC, BioSimulation Consulting Inc., Genedata AG, Instem Group of Companies, PPD, Inc., Insilico Biotechnology AG, Rhenovia Pharma, LeadInvent Technologies, Nuventra Pharma, and In Silico Biosciences.

Some of the recent developments by key providers of biosimulation are as follows:

Similarly, the team at Future Market Insights has tracked recent developments related to companies offering Biosimulation, which is available in the full report.

The global biosimulation market is estimated to be valued at USD 5.6 billion in 2025.

It is projected to reach USD 39.3 billion by 2035.

The market is expected to grow at a 21.5% CAGR between 2025 and 2035.

The key product types are services, _in-house services, _contract services and software.

drug development segment is expected to dominate with a 47.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA