Changing lifestyle of consumers towards urbanization coupled with rising demand for modern-based kitchen appliances are expected to propel the growth of global built-in hobs market. Designed to blend in seamlessly with cabinetry, built-in hobs are a popular choice among households looking for a combination of convenience and aesthetics, as they take up minimal space and usually come as a combined with integrated features.

And with the increased number of residential and commercial construction projects and the emergence of the middle class in developing markets, the demand for built-in kitchen solutions is sky-high. Built-in hobs also bring together additional technological advancements such as smart connectivity, energy efficiency, and touch controls.

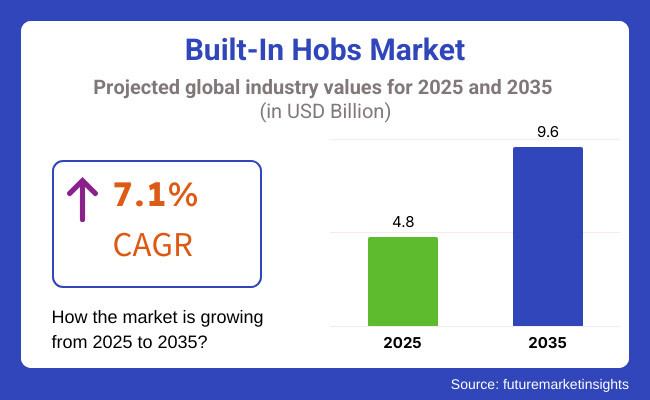

As homeowners seek both function and style, built-in hobs are becoming a default option for contemporary kitchens, contributing to market growth through 2035. The built hobs market in 2025 is expected to register around USD 4.8 Billion, primarily due to the growing consumer inclination towards new kitchen appliances and increased interest in pleasing, integrated design kitchen functionality. The market is projected to grow USD 9.6 Billion by 2035, at a compound annual growth rate (CAGR) of 7.1% during the forecast period.

The prime market for built-in hobs is North America, attributed to an established home appliance market and the increasing adoption of open-plan kitchens. In the Americas, consumers are turning to built-in kitchen options to optimize the space and aesthetic appeal of their homes. The growing disposable income and a strong renovation culture have also spurred the acceptance of advanced built-in hobs with features including touch controls, induction heating, and enhanced connectivity.

Built-in hobs have also found a significant market in Europe, where there is a high demand for premium kitchen appliances with energy-efficient solutions. Countries such as Germany, Italy and France have been at the forefront of the shift, given their mature appliance manufacturing industries and consumers’ tendency to favor sleek, minimalist kitchen layouts. With sustainability rapidly centering in Europe, the manufacturers are launching energy-efficient models to comply with innovative energy standards, thus driving the growth of the market.

The Asia-Pacific region is poised to be the fastest-growing market for built-in hobs, driven by rapid urbanization, increasing disposable income levels, and growing housing construction. The consumer awareness of built-in kitchen solutions is increasing due to rising number of consumers preferring appliances that combines convenience and style in countries China, India, and Japan.

Moreover, the increasing penetration of smart home systems and the expansion of modular kitchen trends in the region are positively influencing the demand for smart built-in hobs. With the continuous expansion of Asia-Pacific’s middle class and a growing leisure-time construction project, the built-in hob market will usher in vigorous growth.

Challenges

High Installation Costs, Limited Consumer Awareness, and Regional Regulatory Standards

Challenges in the built-in hobs market include high installation costs and customized kitchen countertops. In contrast to standalone gas or electric stoves that can be standalone, built-in hobs require professional installation, increasing upfront costs and making adoption less viable in cost-sensitive markets. And in some areas where traditional stoves are more commonly used, consumer awareness is also still low.

Another obstacle is different regional regulatory requirements for gas safety, electrical wiring, and energy efficiency, making it difficult for manufacturers to standardize their product offerings across multiple markets.

Opportunities

Growth in Smart Kitchen Appliances, Energy-Efficient Induction Technology, and Premium Home Upgrades

However, there are challenges that the built-in hobs market will have to overcome, which includes, but is not limited to, changing consumer preferences and increased competition from alternative cooking solutions. Smart kitchen appliances with touch controls, AI-based temperature control, and IoT connectivity are boosting the functionality and effectiveness of built-in hobs.

The demand for induction is also being driven by new technology and induction hobs are much faster, consume less power and are safer. Additionally, the increasing focus on culinary leisure, along with the rising demand for premium home improvements, is standards for market expansion in luxury kitchen reconstruction and high-income homes, particularly in metropolitan areas.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with gas safety, electrical efficiency, and environmental impact regulations. |

| Consumer Trends | Rising preference for sleek, space-saving, and high-tech cooking solutions. |

| Industry Adoption | Adoption of induction, gas, and hybrid built-in hobs in urban kitchens. |

| Supply Chain and Sourcing | Dependence on traditional stainless steel and tempered glass materials. |

| Market Competition | Dominated by premium home appliance brands and kitchenware manufacturers. |

| Market Growth Drivers | Growth fueled by modern kitchen aesthetics, growing urbanization, and demand for energy efficiency. |

| Sustainability and Environmental Impact | Moderate focus on energy-efficient induction hobs and gas safety measures. |

| Integration of Smart Technologies | Early-stage use of touchscreen panels, app connectivity, and temperature sensors. |

| Advancements in Cooking Efficiency | Development of multi-burner induction hobs and hybrid cooking surfaces. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of eco-friendly kitchen standards, stricter energy efficiency mandates, and smart appliance regulations. |

| Consumer Trends | Increased demand for AI-integrated smart hobs, voice-controlled cooking, and self-cleaning surfaces. |

| Industry Adoption | Widespread use of IoT-enabled, touchless operation, and AI-powered heat control systems. |

| Supply Chain and Sourcing | Shift toward nanocoated, anti-scratch surfaces, and recyclable eco-friendly hob materials. |

| Market Competition | Entry of AI-driven smart kitchen startups, eco-friendly appliance firms, and energy-efficient product developers. |

| Market Growth Drivers | Accelerated by sustainable cooking technology, automated kitchen systems, and luxury home kitchen remodeling. |

| Sustainability and Environmental Impact | Large-scale shift to zero-emission kitchen appliances, fully recyclable materials, and minimal energy wastage designs. |

| Integration of Smart Technologies | Expansion into AI-driven recipe recommendations, automatic cooking adjustments, and real-time performance analytics. |

| Advancements in Cooking Efficiency | Evolution toward wireless energy transfer cooking, intelligent flame control, and fully automated meal preparation. |

The Built-In Hobs market in USA is witnessing a steady growth owing to increasing adoption of modern kitchen appliances and integration with smart home systems. Consumers are drawing keen toward aesthetic space-saving cooking solutions that enhance overall kitchen aesthetics and functionality. Further growth of the market is attributed to increasing acceptance of energy-saving and induction-based built-in hobs, as well as advancements in technology such as touch controls and IoT-enabled capabilities.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

The built-in hobs industry in the United Kingdom is growing at a time when urban households are increasingly adopting modular kitchens and advanced kitchen appliances. The increasing trend of open kitchen designs and high-end home renovation is also helping the built-in hob demand. Moreover, growing awareness among consumers regarding energy efficient as well as eco-friendly cooking solutions is expected to further fuel the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.0% |

The growth of the built-in hobs market in Europe can be attributed to the increasing adoption of smart kitchen appliances among consumers in the region. However, to meet the demand for high-end hobs, manufacturers are putting emphasis on advanced features such as precise temperature control, improved safety features, and integration with home automation systems, as consumers prefer induction and ceramic hobs. Further, a rising demand for sustainable and high-performance appliances is expected to act as another factor providing a thrust to the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.1% |

Japan's built-in hobs market is experiencing steady growth, driven by the country's adoption of modern kitchen appliances and smart home technologies. Trends in the market are being defined by compact, multipurpose built-in hobs, especially in urban apartments. The market is also expanding due to developments in energy-saving gas and induction hobs.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.0% |

Urbanization, increasing disposable income, and a high-end kitchen design preference are all contributing to the growth of the built-in hobs market over South Korea. The latest trend of the integrated induction hob with touch control function, device connected to each other and high safety system are all the rage. Market expand is bolstered due to government campaigns promoting energy-efficient equipment.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.2% |

The trend towards sleek, space-saving hobs is driving much of this growth in kitchen hobs market. Growing demand for premium built-in hobs is driven by the rising adoption of modular kitchens, smart home integration, and energy-efficient cooking technologies. It covers Market Segments by Product Type (Electric Hob, Permanent, Others-Induction, Gas) and Burner Type (2 Burner, 3 Burner, 5 Burner, Others).

Ceramic hobs account for the majority in the Built-In Hobs Market, because of its aesthetic appeal, easy to maintain, and energy efficient heating. Ceramic hobs are different in that they utilize infrared heating elements positioned under a smooth glass-ceramic surface for even heat distribution and cooking times. These kinds of hobs are left as the most well-known decision at the present time in high and cutting-edge kitchens where they can add a touch of style for your kitchen.

Moreover, the consumer preference for smart kitchen appliances is positively influencing the uptake of advanced ceramic hobs featuring touch control, automated temperature control and child lock. As energy efficiency standards become more stringent and consumers become more interested in eco-friendly kitchen appliances, ceramic built-in hobs are becoming increasingly popular.

Other than that, induction and gas hobs is housed under the others category which attracts a wider consumer base. Induction hobs are carving out market share particularly because of their fast heating, precise temperature control, and energy efficiency. While smart touch-controlled induction hobs have been favored by practitioners, it is expected to grow steadily as other homeowners capture their potential. Though gas hobs are conventional, they are still prevalent, especially in regions where gas is a part of the cultural cooking experience or where the electric tariff is high.

Largest market share of 4-burner built-in hobs as they offer flexibility, effectiveness, and steadiness for contemporary households and commercial kitchens. These hobs enable users to prepare multiple meals at the same time, perfect for big families, home cooks, and commercial kitchens. Moreover, manufacturers are adding smart features like flame control, auto-ignition, and heat sensors to improve user experience and maintain safety.

3-burner built-in hobs becoming increasingly widespread, especially in urban apartments and smaller kitchens. Giving context here, these hobs are perfect for small to mid-sized families that are looking for modern looking cooking appliances that are energy-efficient as well as functional but space-efficient. As real estate trends are evolving towards compact housing, smart kitchens, spaces between built-in hobs, the demand for multi-functional, space-optimized hobs is booming.

The global built-in hobs market is witnessing growth owing to the increasing preference for modern kitchen appliances that also save space and are energy efficient. As a result, firms are targeting AI-driven smart cooking tech, automation with gooder and safer features, and elaborate appearance designs to lead more convenient user’s ways of restricting carbon emissions as well as more incorporated with home kitchens.

In this space, the market consists of three different types of manufacturers: home appliance manufacturers, luxury kitchen brands, and smart home technology providers all playing their part in building increasingly sophisticated technology for built-in gas, induction and hybrid hobs, AI-driven temperature control, and IoT-enabled smart cooking.

Market Share Analysis by Key Players & Built-In Hob Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| BSH Hausgeräte GmbH (Bosch, Siemens, Neff, Gaggenau) | 18-22% |

| Whirlpool Corporation (KitchenAid, Whirlpool, Hotpoint, Indesit) | 12-16% |

| Electrolux AB (AEG, Electrolux, Zanussi) | 10-14% |

| Elica S.p.A. | 8-12% |

| Miele & Cie. KG | 5-9% |

| Other Kitchen Appliance Brands (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| BSH Hausgeräte GmbH (Bosch, Siemens, Neff, Gaggenau) | Develops AI-driven smart hobs, flex-induction cooking zones, and sensor-controlled flame regulation. |

| Whirlpool Corporation (KitchenAid, Whirlpool, Hotpoint, Indesit) | Specializes in energy-efficient built-in hobs, smart IoT connectivity, and automatic safety shutoff technology. |

| Electrolux AB (AEG, Electrolux, Zanussi) | Provides premium built-in induction and hybrid hobs, AI-powered heat distribution, and automatic cookware detection. |

| Elica S.p.A. | Focuses on luxury kitchen integration, built-in gas and induction hobs with downdraft ventilation, and smart touch controls. |

| Miele & Cie. KG | Offers high-end built-in hobs with precise temperature control, AI-assisted cooking modes, and premium glass-ceramic finishes. |

Key Market Insights

BSH Hausgeräte GmbH (18-22%)

BSH dominates the market for built-in hobs, with high-efficiency induction and gas hobs, AI powered flame and heat regulation and premium smart home integration.

Whirlpool Corporation (12-16%)

Whirlpool is focused on hob technologies that embrace energy efficiency, with smart temperature control, AI-assisted cooking presets, and safety-based design.

Electrolux AB (10-14%)

Provides top-of-the-line induction hobs that have the latest in AI-assisted automatic heating adjustment and seamless kitchen built designs.

Elica S.p.A. (8-12%)

Elica specializes in high-end kitchen appliance integration, incorporating downdraft ventilation tech, smart touch controls, and luxury aesthetic finishes.

Miele & Cie. KG (5-9%)

AI-controlled cooking aids have developed precision-focused built-in hobs with luxurious ceramic and glass finishes, and smart temperature sensors from Miele.

Other Key Players (30-40% Combined)

Several home appliance manufacturers, kitchen technology brands, and built-in hob specialists contribute to next-generation built-in hob innovations, AI-powered temperature control, and smart kitchen connectivity solutions. These include:

The overall market size for built-in hobs market was USD 4.8 Billion in 2025.

Built-in hobs market is expected to reach USD 9.6 Billion in 2035.

The demand for Built-in Hobs is expected to rise due to increasing urbanization, growing adoption of modular kitchens, and rising consumer preference for space-saving and aesthetically appealing kitchen appliances.

The top 5 countries which drives the development of built-in hobs market are USA, UK, Europe Union, Japan and South Korea.

Ceramic Hobs and 4-Burner Configurations to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 2: Global Market Volume (‘000 Units) Forecast by Product Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast, By Burner Type, 2018 to 2033

Table 4: Global Market Volume (‘000 Units) Forecast, By Burner Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 6: Global Market Volume (‘000 Units) Forecast, By Sales Channel, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 8: Global Market Volume (‘000 Units) Forecast by Region, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (‘000 Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (‘000 Units) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast, By Burner Type, 2018 to 2033

Table 14: North America Market Volume (‘000 Units) Forecast, By Burner Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 16: North America Market Volume (‘000 Units) Forecast, By Sales Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (‘000 Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (‘000 Units) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast, By Burner Type, 2018 to 2033

Table 22: Latin America Market Volume (‘000 Units) Forecast, By Burner Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 24: Latin America Market Volume (‘000 Units) Forecast, By Sales Channel, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (‘000 Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Europe Market Volume (‘000 Units) Forecast by Product Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast, By Burner Type, 2018 to 2033

Table 30: Europe Market Volume (‘000 Units) Forecast, By Burner Type, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 32: Europe Market Volume (‘000 Units) Forecast, By Sales Channel, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: East Asia Market Volume (‘000 Units) Forecast by Country, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: East Asia Market Volume (‘000 Units) Forecast by Product Type, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast, By Burner Type, 2018 to 2033

Table 38: East Asia Market Volume (‘000 Units) Forecast, By Burner Type, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 40: East Asia Market Volume (‘000 Units) Forecast, By Sales Channel, 2018 to 2033

Table 41: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia Market Volume (‘000 Units) Forecast by Country, 2018 to 2033

Table 43: South Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia Market Volume (‘000 Units) Forecast by Product Type, 2018 to 2033

Table 45: South Asia Market Value (US$ Million) Forecast, By Burner Type, 2018 to 2033

Table 46: South Asia Market Volume (‘000 Units) Forecast, By Burner Type, 2018 to 2033

Table 47: South Asia Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 48: South Asia Market Volume (‘000 Units) Forecast, By Sales Channel, 2018 to 2033

Table 49: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Oceania Market Volume (‘000 Units) Forecast by Country, 2018 to 2033

Table 51: Oceania Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: Oceania Market Volume (‘000 Units) Forecast by Product Type, 2018 to 2033

Table 53: Oceania Market Value (US$ Million) Forecast, By Burner Type, 2018 to 2033

Table 54: Oceania Market Volume (‘000 Units) Forecast, By Burner Type, 2018 to 2033

Table 55: Oceania Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 56: Oceania Market Volume (‘000 Units) Forecast, By Sales Channel, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: MEA Market Volume (‘000 Units) Forecast by Country, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: MEA Market Volume (‘000 Units) Forecast by Product Type, 2018 to 2033

Table 61: MEA Market Value (US$ Million) Forecast, By Burner Type, 2018 to 2033

Table 62: MEA Market Volume (‘000 Units) Forecast, By Burner Type, 2018 to 2033

Table 63: MEA Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 64: MEA Market Volume (‘000 Units) Forecast, By Sales Channel, 2018 to 2033

Figure 01: Global Market Value (US$ Million) Analysis by Burner Type, 2018 to 2033

Figure 02: Global Market Volume (‘000 Units) Analysis by Burner Type, 2018 to 2033

Figure 03: Global Market Y-o-Y Growth (%) Projections, By Burner Type, 2023 to 2033

Figure 04: Global Market Attractiveness by Burner Type, 2023 to 2033

Figure 05: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 06: Global Market Volume (‘000 Units) Analysis by Sales Channel, 2018 to 2033

Figure 07: Global Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 08: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 09: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 10: Global Market Volume (‘000 Units) Analysis by Region, 2018 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections, By Region, 2023 to 2033

Figure 12: Global Market Attractiveness by Region, 2023 to 2033

Figure 13: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 14: North America Market Volume (‘000 Units) Analysis by Country, 2018 to 2033

Figure 15: North America Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 16: North America Market Attractiveness by Country, 2023 to 2033

Figure 17: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 18: North America Market Volume (‘000 Units) Analysis by Product Type, 2018 to 2033

Figure 19: North America Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 20: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 21: North America Market Value (US$ Million) Analysis by Burner Type, 2018 to 2033

Figure 22: North America Market Volume (‘000 Units) Analysis by Burner Type, 2018 to 2033

Figure 23: North America Market Y-o-Y Growth (%) Projections, By Burner Type, 2023 to 2033

Figure 24: North America Market Attractiveness by Burner Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 26: North America Market Volume (‘000 Units) Analysis by Sales Channel, 2018 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 28: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 29: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: Latin America Market Volume (‘000 Units) Analysis by Country, 2018 to 2033

Figure 31: Latin America Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 32: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: Latin America Market Volume (‘000 Units) Analysis by Product Type, 2018 to 2033

Figure 35: Latin America Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 36: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Burner Type, 2018 to 2033

Figure 38: Latin America Market Volume (‘000 Units) Analysis by Burner Type, 2018 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections, By Burner Type, 2023 to 2033

Figure 40: Latin America Market Attractiveness by Burner Type, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 42: Latin America Market Volume (‘000 Units) Analysis by Sales Channel, 2018 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 45: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Europe Market Volume (‘000 Units) Analysis by Country, 2018 to 2033

Figure 47: Europe Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 48: Europe Market Attractiveness by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 50: Europe Market Volume (‘000 Units) Analysis by Product Type, 2018 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 52: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Europe Market Value (US$ Million) Analysis by Burner Type, 2018 to 2033

Figure 54: Europe Market Volume (‘000 Units) Analysis by Burner Type, 2018 to 2033

Figure 55: Europe Market Y-o-Y Growth (%) Projections, By Burner Type, 2023 to 2033

Figure 56: Europe Market Attractiveness by Burner Type, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 58: Europe Market Volume (‘000 Units) Analysis by Sales Channel, 2018 to 2033

Figure 59: Europe Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 60: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 61: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 62: East Asia Market Volume (‘000 Units) Analysis by Country, 2018 to 2033

Figure 63: East Asia Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 64: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 65: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 66: East Asia Market Volume (‘000 Units) Analysis by Product Type, 2018 to 2033

Figure 67: East Asia Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 68: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 69: East Asia Market Value (US$ Million) Analysis by Burner Type, 2018 to 2033

Figure 70: East Asia Market Volume (‘000 Units) Analysis by Burner Type, 2018 to 2033

Figure 71: East Asia Market Y-o-Y Growth (%) Projections, By Burner Type, 2023 to 2033

Figure 72: East Asia Market Attractiveness by Burner Type, 2023 to 2033

Figure 73: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 74: East Asia Market Volume (‘000 Units) Analysis by Sales Channel, 2018 to 2033

Figure 75: East Asia Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 76: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 77: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: South Asia Market Volume (‘000 Units) Analysis by Country, 2018 to 2033

Figure 79: South Asia Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 80: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: South Asia Market Volume (‘000 Units) Analysis by Product Type, 2018 to 2033

Figure 83: South Asia Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 84: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Burner Type, 2018 to 2033

Figure 86: South Asia Market Volume (‘000 Units) Analysis by Burner Type, 2018 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections, By Burner Type, 2023 to 2033

Figure 88: South Asia Market Attractiveness by Burner Type, 2023 to 2033

Figure 89: South Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 90: South Asia Market Volume (‘000 Units) Analysis by Sales Channel, 2018 to 2033

Figure 91: South Asia Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 92: South Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 93: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 94: Oceania Market Volume (‘000 Units) Analysis by Country, 2018 to 2033

Figure 95: Oceania Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 96: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 97: Oceania Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 98: Oceania Market Volume (‘000 Units) Analysis by Product Type, 2018 to 2033

Figure 99: Oceania Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 100: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 101: Oceania Market Value (US$ Million) Analysis by Burner Type, 2018 to 2033

Figure 102: Oceania Market Volume (‘000 Units) Analysis by Burner Type, 2018 to 2033

Figure 103: Oceania Market Y-o-Y Growth (%) Projections, By Burner Type, 2023 to 2033

Figure 104: Oceania Market Attractiveness by Burner Type, 2023 to 2033

Figure 105: Oceania Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 106: Oceania Market Volume (‘000 Units) Analysis by Sales Channel, 2018 to 2033

Figure 107: Oceania Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 108: Oceania Market Attractiveness by Sales Channel, 2023 to 2033

Figure 109: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: MEA Market Volume (‘000 Units) Analysis by Country, 2018 to 2033

Figure 111: MEA Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 112: MEA Market Attractiveness by Country, 2023 to 2033

Figure 113: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 114: MEA Market Volume (‘000 Units) Analysis by Product Type, 2018 to 2033

Figure 115: MEA Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 116: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 117: MEA Market Value (US$ Million) Analysis by Burner Type, 2018 to 2033

Figure 118: MEA Market Volume (‘000 Units) Analysis by Burner Type, 2018 to 2033

Figure 119: MEA Market Y-o-Y Growth (%) Projections, By Burner Type, 2023 to 2033

Figure 120: MEA Market Attractiveness by Burner Type, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 122: MEA Market Volume (‘000 Units) Analysis by Sales Channel, 2018 to 2033

Figure 123: MEA Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 124: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Hobs Market Analysis - Trends, Growth & Forecast 2025 to 2035

Portable Induction Hobs Market Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA