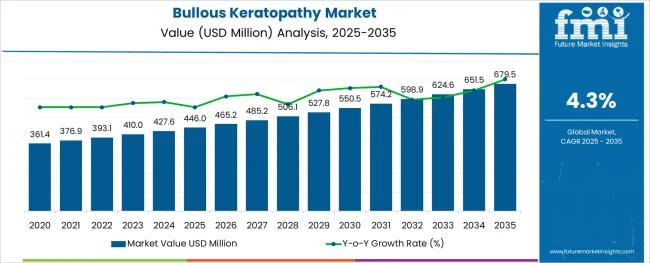

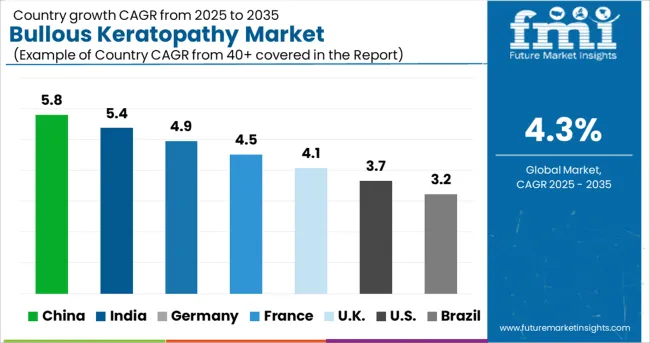

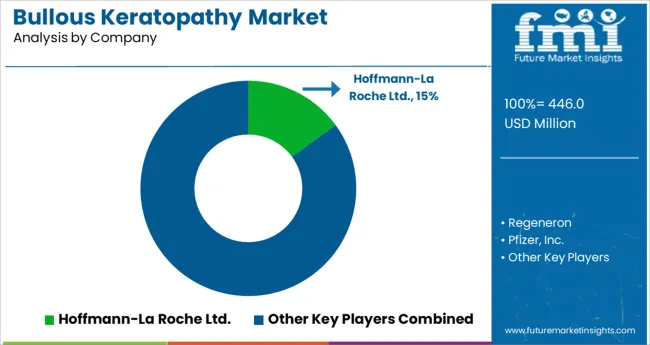

The Bullous Keratopathy Market is estimated to be valued at USD 446.0 million in 2025 and is projected to reach USD 679.5 million by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

The bullous keratopathy market is witnessing gradual yet significant progress as advances in surgical techniques and novel therapies converge with improved diagnostics and patient management protocols. Rising awareness among patients and practitioners about early intervention options and the growing availability of minimally invasive procedures are driving adoption across healthcare settings.

Medical institutions are increasingly prioritizing vision-restoring solutions to address corneal endothelial dysfunction, while innovation in regenerative therapies continues to expand the treatment landscape. The market outlook remains positive as research in cell-based therapies and bioengineered materials promises to improve clinical outcomes and reduce dependency on donor tissues.

Future opportunities are expected to arise from the integration of advanced imaging modalities, better postoperative care protocols, and cross-disciplinary collaborations, paving the way for more personalized and effective treatments.

The market is segmented by Medical Management, Surgical Management, Therapies, and End Users and region. By Medical Management, the market is divided into Lubricants, Steroids, Hyperosmotic Agents, Anti-Glaucoma Drugs, and Antibiotics. In terms of Surgical Management, the market is classified into Amniotic Membrane Grafting (AMG), Annular Keratotomy, and Anterior Stromal Puncture. Based on Therapies, the market is segmented into Emmecell and Cellusion. By End Users, the market is divided into Hospitals and Surgical Centers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Medical Management, Surgical Management, Therapies, and End Users and region. By Medical Management, the market is divided into Lubricants, Steroids, Hyperosmotic Agents, Anti-Glaucoma Drugs, and Antibiotics. In terms of Surgical Management, the market is classified into Amniotic Membrane Grafting (AMG), Annular Keratotomy, and Anterior Stromal Puncture. Based on Therapies, the market is segmented into Emmecell and Cellusion. By End Users, the market is divided into Hospitals and Surgical Centers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

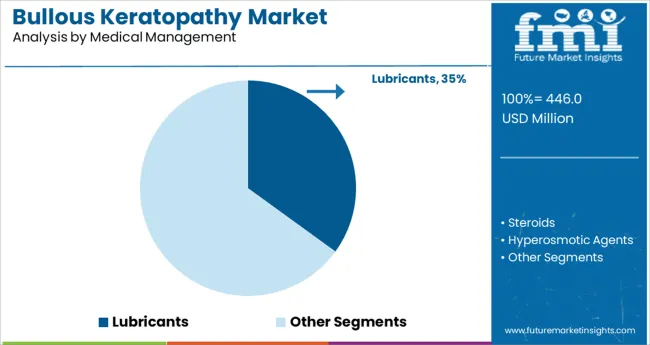

Within the medical management segment, lubricants are expected to hold a 35.0% share of the market revenue in 2025, making them the most prominent subsegment. This leadership has been reinforced by the continued reliance on lubricants as a primary supportive therapy for symptom relief in patients who are not immediate candidates for surgical intervention.

Their ability to reduce corneal epithelial stress, improve patient comfort, and maintain ocular surface integrity has made them a standard of care in initial disease stages. Accessibility, affordability, and ease of administration have further strengthened their position, particularly in settings where surgical resources are limited.

The persistence of a substantial patient base requiring non-invasive, symptomatic management has underpinned the lubricants subsegment’s sustained relevance in clinical practice.

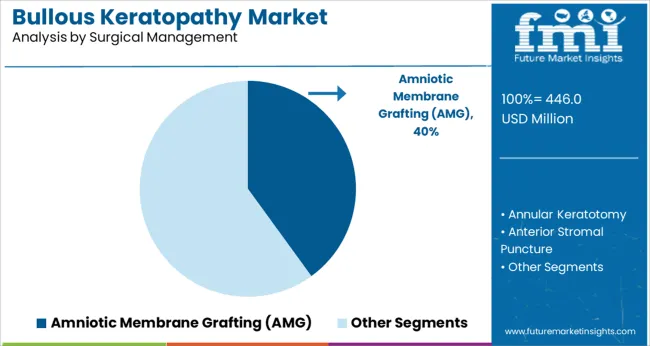

In the surgical management segment, amniotic membrane grafting is projected to capture 40.0% of the market revenue in 2025, establishing it as the leading subsegment. This dominance has been driven by the procedure’s dual ability to promote healing and provide symptomatic relief while offering an alternative to full corneal transplantation.

Its utility in stabilizing the ocular surface, reducing inflammation, and improving epithelialization has been widely recognized by ophthalmic surgeons. Additionally, the comparatively lower complexity and faster recovery associated with this technique have enhanced its adoption in both acute and chronic cases.

The growing preference for interventions that preserve vision and improve quality of life without immediate reliance on donor tissue has further reinforced the leading position of amniotic membrane grafting.

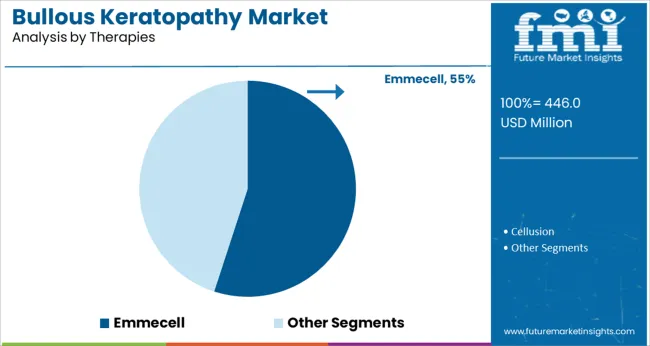

Within the therapies segment, Emmecell is anticipated to command a 55.0% share of the market revenue in 2025, positioning it as the foremost subsegment. This leadership has been shaped by its promise as an innovative regenerative therapy capable of restoring corneal endothelial function without traditional transplantation.

The cell-based approach of Emmecell has been recognized for its potential to address underlying endothelial cell loss, offering a disease-modifying solution rather than mere symptomatic relief. Its minimally invasive nature, combined with encouraging clinical outcomes in terms of corneal clarity and visual improvement, has accelerated its acceptance among ophthalmologists seeking advanced alternatives.

The growing momentum around regenerative medicine and the shift toward curative rather than palliative approaches have firmly anchored Emmecell at the forefront of therapeutic innovation in the bullous keratopathy market.

The bullous keratopathy market was valued at USD 446 Million in 2025 and expanded with a CAGR of 4.2% between 2020 and 2025. Rising cases of cataract surgeries and the advent of advanced technologies in corneal transplant and implant surgeries are proving to be game changers in market expansion. Considering these factors, the bullous Keratopathy market is expected to possess a valuation of USD 650 Million, growing with a CAGR of 4.3%.

Complications from Cataract Surgeries augmenting Market Growth

Rising complications from cataract surgeries and glaucoma surgeries and the growing prevalence of eye disorders are driving the market of bullous keratopathy. Furthermore, the adoption of surgical management options for bullous keratopathy including Amniotic membrane grafting (AMG), annular keratotomy, anterior stromal puncture, basement membrane polishing, etc. is boosting the growth of this market. Cataract surgery remained the leading cause of endothelial dysfunction/bullous keratopathy (39.9%), followed by combined surgery (23.0%) and FED (11.1%). FED, Fuchs’ endothelial dystrophy.

Increased risk factors of the surgery

Most people do well with bullous Keratopathy surgery. But complications can happen. Possible complications are Keratitis, perforation of the eye, extrusion of your ring, eye swelling, movement of your ring, night halos or glare, chronic eye pain, infections, etc. are expected to hamper the growth of the market during the forecast period. Furthermore, the high cost of ophthalmology devices and surgical procedures is anticipated to restrain the growth of this market during the forecast period.

Increase in risk of surgery failure

There is a risk that surgery might not correct the vision as much as expected. It might cause another vision problem like Astigmatism, where the curvature of the cornea becomes irregular. Some people who have corneal ring implantation may need an adjustment surgery to get a better outcome which will restrict the market growth.

Favorable Reimbursement policies driving the market

North America dominated the industry in 2024 and accounted for the largest share of around 59% of the overall revenue. Domicile of major market players, efficient reimbursement policies, and increasing Research and Development activities related to bullous Keratopathy are the factors expected to drive the region’s growth further.

North America's bullous keratopathy market was worth over USD 427.6 Million in 2024. This is credited to the rising geriatric population base and the greater susceptibility of aging people to several chronic ailments, such as diabetes. Diabetic people are more prone to develop eye diseases that lead to vision loss. National Eye Institute estimates suggest that over 30,000 Americans undergo corneal transplants to replace injured and diseased corneas, creating numerous growth opportunities for the bullous Keratopathy market.

Europe's bullous keratopathy market held over 19.1% business share in 2025 and is slated to record an appreciable target valuation by 2035. The regional industry is fuelled by the growing number of eye surgeries led by the prevalence of several eye disorders in Europe.

The increasing Research and Development investments and practices focused on developing advanced corneal implants will create favorable regional market statistics for the expansion of the bullous keratopathy market.

The hospital segment dominated the industry in 2024. The segment accounted for the largest revenue share of more than 58% with a revenue generation of USD 446 Million in 2025 and is expected to register a lucrative CAGR over the forecast period.

The presence of highly skilled surgeons, the rising number of patients, and access to transnational eye banks are the factors anticipated to drive the segment growth.

Amniotic membrane grafting segment accounts for the highest revenue share in the market. In this technique, first, the loose epithelium is removed with the help of a sponge or a blade. This results in a large epithelial defect, usually sparing the limbus. A required amniotic membrane is cut and placed over the cornea with the stromal side towards the cornea, which is sticky compared to the basement membrane. The AMG is then attached to the cornea with the help of interrupted stay sutures. If needed, a BCL can also be placed. Amniotic membrane transplantation is a successful adjunctive method in achieving corneal epithelization which will propel the growth of this segment during the forecast period.

These drugs are the most prevalent in primary medical management procedures. The drugs commonly employed are beta-blockers and alpha agonists-these work by reducing intraocular pressure, which reduces corneal edema and thickness in the postoperative period. Miotics and prostaglandins are avoided because they usually aggravate inflammation. Carbonic anhydrase inhibitors are also avoided as they are epitheliotoxic.

Key players in the Bullous Keratopathy market are- Hoffmann-La Roche Ltd, Regeneron, Pharmaceuticals, Inc., Pfizer, Inc., Bayer AG, Cellusion, CRSTEurope, Barraquer Eye Hospital, Planchard Eye & Laser Center, and Medscape. Some recent developments in the bullous keratopathy market are:

| Report Attribute | Details | |

|---|---|---|

| Market Value in 2025 |

|

|

| Market Value in 2035 | USD 679.5 million | |

| Growth Rate | CAGR of 4.3% from 2025 to 2035 | |

| Base Year for Estimation | 2025 | |

| Historical Data | 2020 to 2025 | |

| Forecast Period | 2025 to 2035 | |

| Quantitative Units | Revenue in million and CAGR from 2025 to 2035 | |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis | |

| Segments Covered | Therapies, Treatment, End Users, Region | |

| Regions Covered | North America; Latin America; Europe; South Asia & Pacific; East Asia; Middle East & Africa | |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Mexico, Germany, UK, France, Spain, Italy, India, Malaysia, Singapore, Thailand, China, Japan, South Korea, Australia, New Zealand, GCC countries, South Africa, Israel | |

| Key Companies Profiled | Hoffmann-La Roche Ltd; Regeneron Pharmaceuticals; Pfizer Inc.; Bayer AG; Cellusion; CRSTEurope; Barraquer Eye Hospital; Planchard Eye & Laser Center; Medscape | |

| Customization | Available Upon Request |

The global bullous keratopathy market is estimated to be valued at USD 446.0 million in 2025.

It is projected to reach USD 679.5 million by 2035.

The market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types are lubricants, steroids, hyperosmotic agents, anti-glaucoma drugs and antibiotics.

amniotic membrane grafting (amg) segment is expected to dominate with a 40.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA