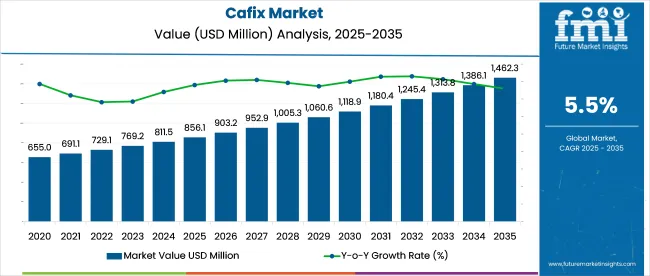

In 2025, the global cafix market is valued at USD 856.1 million and is likely to reach USD 1,462.4 million by 2035, expanding at a CAGR of 5.5%. This growth is fueled by increasing consumer preference for healthier, caffeine-free alternatives to traditional coffee.

| Attributes | Description |

|---|---|

| Estimated Market Size (2025E) | USD 856.1 million |

| Projected Market Value (2035F) | USD 1,462.4 million |

| Value-based CAGR (2025 to 2035) | 5.5% |

Made from roasted barley, chicory, and natural ingredients, cafix offers a rich flavor without artificial additives, aligning with the shift toward clean-label, plant-based beverages. The increasing preference for functional ingredients like prebiotic-rich chicory root further boosts its popularity.

The cafix market draws its strength from several overlapping sectors. The coffee substitutes market forms the largest base, contributing approximately 40-45%, as cafix directly competes with caffeine-free alternatives like chicory blends and roasted grain beverages. The health and wellness beverages segment accounts for around 25-30%, supported by consumer interest in non-stimulant, stomach-friendly drinks.

The natural and organic products market contributes roughly 10-12%, as cafix aligns with clean-label, non-GMO, and plant-based preferences. Around 8-10% comes from the functional foods and beverages category, where cafix is chosen for its perceived digestive and energy-balancing benefits. The remaining 5-7% stems from the dietary and lifestyle-specific segment, appealing to individuals on vegan, low-acid, or gluten-sensitive diets seeking coffee alternatives.

In April 2025, John Smith, CEO of Cafix, emphasized the company’s commitment to offering “high-quality, caffeine-free alternatives that don’t compromise on taste.” Speaking during the Global Wellness Beverages Summit, Smith framed Cafix’s mission as a response to growing global demand for healthier beverage options.

With its lineup of roasted barley-based drinks and natural herbal blends, cafix is positioned as a leading choice for consumers seeking satisfying coffee substitutes without the stimulant effects of caffeine. This strategy has bolstered cafix’s reach in the wellness market, contributing to a 13.2% year-over-year growth in the caffeine-free beverage segment across North America and Europe.

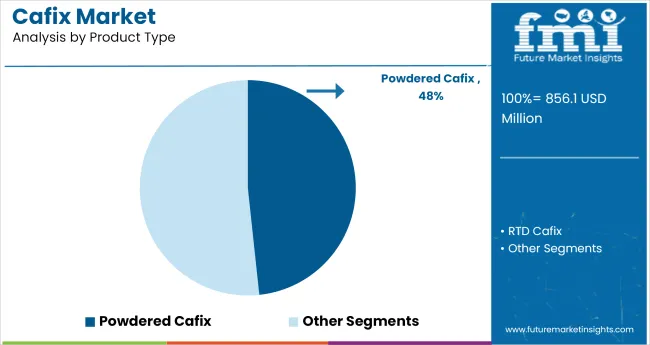

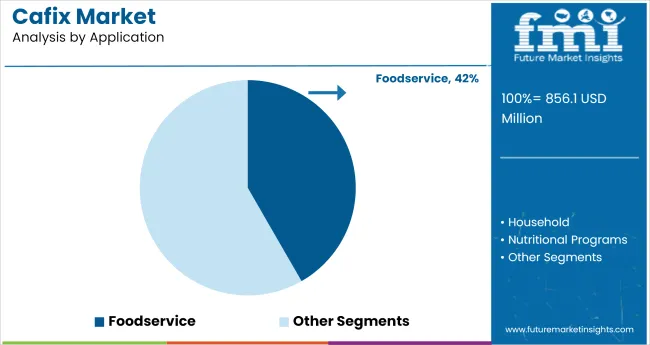

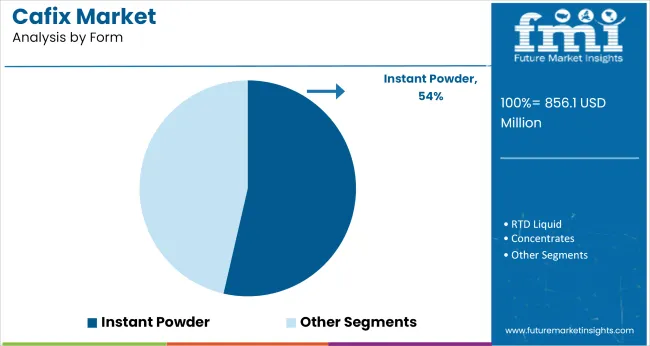

The cafix market in 2025 is led by powdered cafix (48.3%), foodservice applications (41.7%), and instant powder forms (53.6%). A surge in demand for caffeine-free alternatives and digestive wellness drinks is fueling growth across multiple verticals. Clean-label and organic claims further enhance consumer trust and brand loyalty across both retail and service sectors.

Powdered cafix holds the largest product share in 2025 at 48.3%, driven by its high solubility and preparation speed. Its dry format enables long shelf stability, making it ideal for bulk buyers and single-cup users alike. Used extensively in both household kitchens and foodservice settings, powdered cafix is popular for delivering a roasted flavor profile without caffeine. Key players such as Inka, Pero, and CaféCafix have optimized packaging and flavor variations to boost sales across global markets.

The foodservice segment is projected to lead in 2025, accounting for 41.7% of the cafix market due to high adoption in cafés, hotels, and corporate dining setups. Restaurants and quick-serve cafés incorporate cafix into caffeine-free espresso alternatives, contributing to higher menu differentiation. Brands such as Mount Hagen, Teeccino, and cafix Original are building strong B2B channels focused on product reliability and batch scalability.

Instant powder form captures the largest share by form at 53.6% in 2025. This segment benefits from user-friendly packaging, fast preparation, and broad accessibility across demographics. Whether for home use or institutional kitchens, instant cafix is chosen for its ease of storage and consistent quality. Brands like Carob Coffee, Cafix, and Pero Instant dominate this category with single-serve sachets and refill jars designed for regular consumption.

Digestive wellness accounts for an estimated 39.2% share of the cafix market in 2025, supported by growing consumer awareness of gut health and prebiotic-rich diets. Made from chicory, carob, and barley-known digestive aids-cafix products appeal to those seeking a functional, caffeine-free beverage. Companies such as Dandy Blend, Bueno Coffee Substitute, and Cafix Natural Blend focus their marketing on digestive support, targeting wellness-focused and older consumer groups.

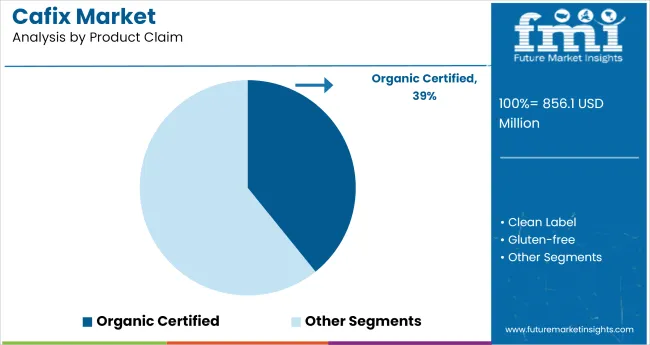

Organic certified leads the product claim segment with an estimated 36.5% market share in 2025. Consumers increasingly demand transparency and purity, pushing brands to prioritize USDA organic and EU Bio certifications. Companies like Whole Earth, Nature’s Path, and Teeccino leverage their organic identity to gain placement in premium stores and subscription health boxes.

Cafix is gaining ground due to rising interest in clean, caffeine-free drinks. Growth is driven by North American demand and e-commerce expansion, the manufacturers navigate cost instability, supply constraints, and low global awareness. Market success hinges on formulation agility, efficient logistics, and wider brand education in underpenetrated regions.

Data Trends Defining Cafix Growth

The market recorded a 6.3% rise in global revenue in 2024, reaching an estimated valuation of USD 98 million. North America contributed 42% of total sales, with the USA leading retail volume. E-commerce distribution grew by 18%, driven by a 23% increase in health-food category searches.

The 30-55 age group represented 64% of repeat purchases. Product variants labeled gluten-free or non-GMO saw 27% faster shelf turnover. Chicory and barley-based blends accounted for over 70% of all SKUs launched between Q1-Q2 2024, as consumers increasingly preferred clean-label profiles with functional ingredients.

Measurable Impacts on Production

Chicory prices surged 12% year-on-year due to inconsistent harvest yields in key European regions. Shipping delays extended average lead times from 21 to 34 days. Label compliance costs rose 9.5% due to stricter ingredient disclosures in the EU and USA A 15% increase in small-brand entries intensified competition in the caffeine-free category, driving promotional expenses up by 11%.

Only 28% of surveyed consumers in Asia-Pacific recognized cafix by brand name, underscoring a limited global footprint. Profit margins shrank by 4.2% across mid-size producers, largely tied to packaging cost hikes and reduced volume discounts on raw materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.5% |

| Germany | 5.3% |

| United Kingdom | 5.2% |

| Canada | 5.4% |

| Australia | 5.1% |

The Global industry is expected to expand at a 5.5% CAGR from 2025 to 2035. Among the featured countries, the United States matches the global rate at 5.5%, while Canada follows at 5.4%, Germany at 5.3%, the United Kingdom at 5.2%, and Australia at 5.1%. This translates to a 0% deviation for the USA, -2% for Canada, -4% for Germany, -5% for the UK, and -7% for Australia, compared to the global baseline.

These figures reflect steady demand for caffeine-free beverage alternatives across mature markets. As OECD members, these countries show consistent growth, shaped by shifts toward non-coffee hot drinks, expanding retail availability, and health-oriented product choices.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference

The cafix market in the United States is projected to expand at a 5.5% CAGR from 2025 to 2035. The market is driven by a growing consumer base seeking caffeine-free hot beverage alternatives. Primarily made from roasted barley, chicory, and sugar beet, appeals to health-conscious Americans moving away from conventional coffee. Increased demand for gut-friendly and low-acid drinks has created niche opportunities. E-commerce contributes over 52% of total sales as health brands optimize digital visibility.

The market in Germany is expanding at 5.3% CAGR, supported by consumers actively limiting caffeine intake. Brands offering heritage-rich blends made from rye, fig, and chicory are capturing attention in organic retail chains like Alnatura, Reformhaus, and Bio Company. In 2025, over 68% of drinkers identified as regular herbal tea or alternative brew consumers. The wellness community gravitates toward low-acid, caffeine-free formats for digestive comfort and daily ritual consistency.

At a 5.2% CAGR, the market in United Kingdom is seeing higher uptake among consumers shifting to caffeine-free digestion-friendly beverages. The product's positioning as a coffee alternative for post-lunch or evening use has gained traction. Retailers such as Holland & Barrett and Planet Organic are leading.

Demand is particularly pronounced among women aged 35-55 and individuals with acid sensitivity or caffeine intolerance. Local adaptations with oat or roasted dandelion root are becoming frequent in new product development. The product’s presence in subscription wellness boxes has also driven trial and brand familiarity.

The market in Canada is set to grow at 5.4% CAGR, driven by plant-based beverage trends and low-acid lifestyle adoption. Consumers are looking for warm drinks that replicate the aroma and roastiness of coffee without the side effects. Chicory, carob, and barley-based cafix variants are selling particularly well in Quebec and Ontario provinces. National chains like Whole Foods Canada and Nature’s Fare Markets are among the top distributors.

Australia is registering 5.1% CAGR in the industry, with major demand centered around caffeine-sensitive consumers in urban areas like Sydney and Melbourne. Interest in caffeine-free, low-acid hot beverages has paralleled the rise in plant-based and functional food consumption. Brands are leveraging roasted dandelion, carob, and chicory in blends to meet preferences for digestive comfort and herbal functionality.

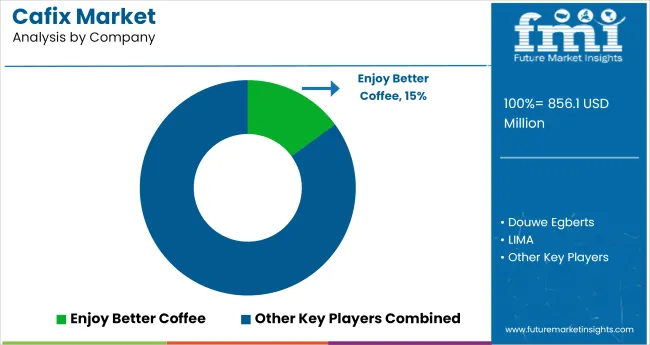

In 2025, The industry is witnessing rapid competitive growth due to rising demand for caffeine-free and health-driven beverages. Brands such as LIMA, Enjoy Better Coffee, and World Finer Foods are expanding globally through multi-channel distribution. The innovative entrants like DateSeedCoffee.com and Phi Drinks Inc. are targeting niche segments with clean-label, plant-based alternatives.

With a shift toward eco-conscious manufacturing and natural wellness ingredients, leading companies are refining product strategies to meet evolving consumer needs. The competition is intensifying, driven by digital marketing, retail partnerships, and functional health positioning.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 856.1 million |

| Projected Market Size (2035) | USD 1,462.4 million |

| CAGR (2025 to 2035) | 5.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Types Analyzed (Segment 1) | Organic White Rice Flour, Organic Brown Rice Flour |

| End Use Industries Analyzed (Segment 2) | Bakery, Sauces and Dressings, Baby Food, Snacks, Meat-Based Products, Processed Food, Food Service Industry, Household, Others |

| Distribution Channels Analyzed (Segment 3) | Supermarkets/Hypermarkets, Convenience Stores, Departmental Stores, Specialty Stores, Online Retail |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia & Belarus, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Chile, Germany, France, United Kingdom, Italy, Spain, Poland, Russia, Czech Republic, India, Indonesia, Australia, New Zealand, China, Japan, South Korea, Kazakhstan, Uzbekistan, Romania, Bulgaria, Lithuania, Latvia, Estonia, Belarus, South Africa, United Arab Emirates, Saudi Arabia, Egypt, Nigeria |

| Key Players | Enjoy Better Coffee, Douwe Egberts, LIMA, DateSeedCoffee.com, World Finer Foods, Unilever Plc., Rasa Inc., Som Sleep, MudWtr, Dandy Blend, Phi Drinks Inc., Clearspring |

| Additional Attributes | Dollar sales distribution by end use and channel; rising consumer preference for caffeine alternatives; demand concentrated in North America and Europe; growing adoption in household and food service sectors; organic segment gaining rapid traction |

The industry is expected to reach USD 1,462.4 million by 2035, up from USD 856.1 million in 2025.

The industry is projected to grow at a CAGR of 5.5% during the forecast period.

Powdered cafix dominates with a 48.3% market share due to its convenience, solubility, and shelf stability.

Organic certified cafix holds the top spot with 36.5% share, driven by demand for clean-label and non-GMO products.

The United States leads the market with a 5.5% CAGR and 52% of sales coming from e-commerce platforms.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA