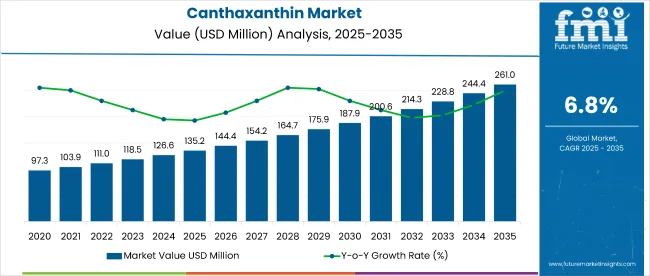

The global canthaxanthin market is worth USD 135.2 million in 2025 and is expected to reach USD 261 million by 2035, reflecting a CAGR of 6.8%. Factors driving this growth include increasing demand for natural colorants in food and beverages, rising applications in animal feed and cosmetics, and growing awareness about the compound’s antioxidant properties.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 135.2 million |

| Projected Value (2035F) | USD 261 million |

| CAGR (2025 to 2035) | 6.8% |

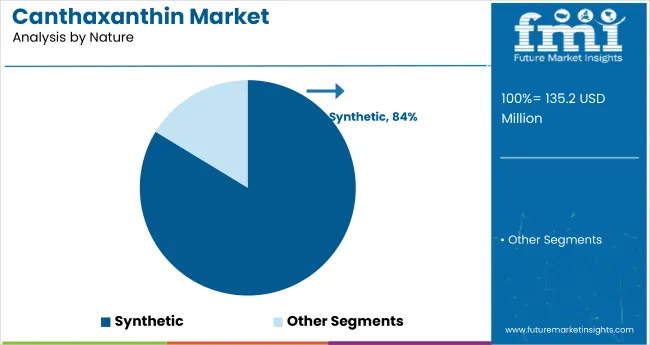

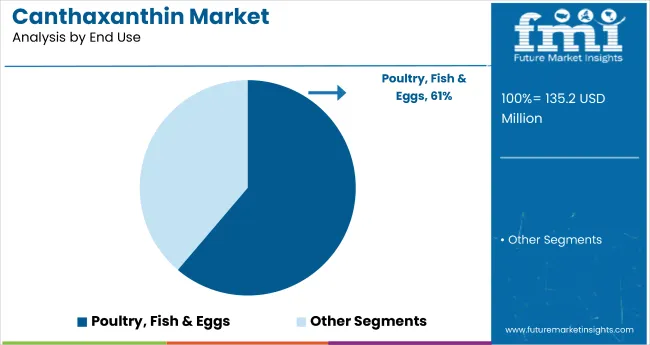

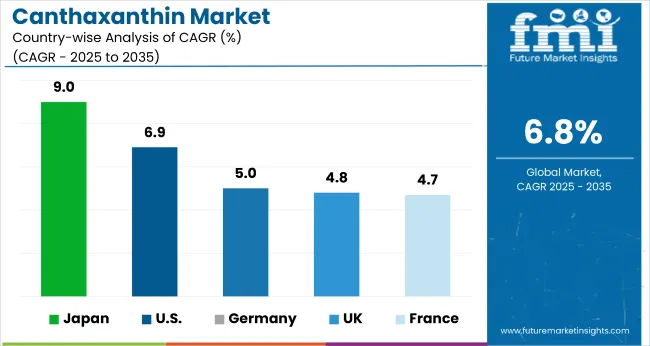

Canthaxanthin has gained attention for its functional benefits, such as eye health support and protection against oxidative stress. Japan is anticipated to register the fastest growth with a significant CAGR of 9%. Meanwhile, the USA is expected to account for the largest share in the global market by 2035, expected to expand at a CAGR of 6.9%, followed by Germany at a 5% CAGR. Synthetic canthaxanthin is expected to remain the dominant product type, capturing 84% of the market share. Among end users, poultry, fish & eggs will lead with 61% of the market share, due to the demand rising from seafood consumption.

Themarket holds a niche but impactful position across several broader markets. It accounts for 3.2% of the global carotenoids market, primarily due to its strong use in poultry, aquaculture, and dietary supplements. Within the natural food colors market, it represents around 1.5%, given its selective application in beverages and bakery.

In the animal feed additives market, canthaxanthin contributes nearly 2.8%, largely from poultry and shrimp feed. It holds a 1% share in both the nutraceutical ingredients and cosmetic ingredients markets, reflecting its emerging role in skin health and antioxidant products.

Going forward, investments in sustainable sourcing and advanced purification systems are expected to shape the market. Regulatory support, such as the FDA’s GRAS recognition of canthaxanthin-based additives, is encouraging further innovation.

Technologies enabling improved bioavailability and formulation stability are likely to enhance product applications in pharmaceuticals and nutraceuticals, supporting steady market expansion through 2035.The expansion of the processed food sector and increasing investments in clean-label ingredients are expected to boost the market throughout the forecast period.

The market is segmented into nature, end use and region. By nature, the market is divided into natural and synthetic. Based on end-use, the market includes beverage (alcoholic beverages, carbonates (carbonated soft drinks) & energy drinks, juice-based drinks, milk drinks & milk alternatives, sports drinks, and flavored, enhanced, & sparkling waters), bakery (snacks & cereal, breakfast cereal, bread, cakes & pastries, cookies & biscuits, and crackers & savory snacks), candy/confectionery, dairy, poultry, fish & eggs, sauces, soups & dressings, seasonings, dietary supplements, pharmaceuticals, and pet food. Regionally, the market is classified into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

Synthetic canthaxanthin remains the most lucrative segment under the nature segment, projected to hold an 84% market share by 2035. Its dominance can be attributed to cost-effectiveness, consistent pigment quality, and ease of large-scale production. Synthetic variants also offer a reliable supply chain, free from seasonal fluctuations, making them ideal for use in the food and feed industries. Natural alternatives are gaining traction but remain constrained by higher costs and limited availability.

Poultry, fish & eggs lead the end-use segment, accounting for a 61% market share by 2035. Canthaxanthin plays a crucial role in improving product appearance and meeting quality grading standards. Its use is expanding in both developed and emerging economies due to the growth of protein consumption and aquaculture. As global demand for seafood grows, fish feed remains the largest application in this segment.

Recent Trends in the Canthaxanthin Market

Challenges in the Canthaxanthin Market

Among the top-performing countries in the global market, Japan leads with the highest projected CAGR of 9% between 2025 to 2035. This growth is primarily driven by the increasing use of canthaxanthin in aquaculture feed, particularly for salmonids, and the expanding nutraceutical sector. The United States follows with a CAGR of 6.9%, supported by the shift toward clean-label food coloring, strong dietary supplement sales, and its mature cosmetic ingredient market.

Germany is expected to record a 5% CAGR, driven by high consumption in processed meats, pet foods, and functional animal feed. France and the UK are projected to grow at 4.7% and 4.8%, respectively, owing to innovation in cosmeceuticals, pharmaceutical pigments, and commitments to natural and sustainable sourcing. Other emerging contributors include China, India, and Brazil, where rising aquaculture output and pigment fortification in food/feed are accelerating demand.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

Canthaxanthin revenue in the USA is projected to expand at a CAGR of 6.9% from 2025 to 2035. Between 2020 and 2024, demand was driven primarily by the food and beverage industry's rapid clean-label transition, especially in flavored dairy and fortified juices.

Going forward, dietary supplements and poultry feed applications are gaining momentum due to increased awareness of antioxidant benefits and pigmentation standards. With major players like DSM and Novus International based in the USA, innovation and FDA approvals are accelerating domestic adoption across sectors.

The canthaxanthin market in the UK is anticipated to grow at a CAGR of 4.8% from 2025 to 2035. From 2020 to 2024, regulatory oversight by the Food Standards Agency led to stable yet cautious adoption in food and pharmaceutical formulations. However, the period from 2025 onward is likely to see broader use in cosmetics and dietary supplements, driven by consumer demand for natural, sustainable ingredients. The UK’s robust policy framework is pushing companies to invest in eco-certified and safety-compliant formulations.

Sales of canthaxanthin in Germany are expected to flourish at a CAGR of 5% from 2025 to 2035. From 2020 to 2024, the country experienced strong uptake in meat processing and dairy-based applications due to its dominant food manufacturing industry. Looking ahead, increased demand is expected from the pet food and aquaculture segments, as Germans continue to invest in premium pet nutrition and sustainable seafood. Innovation in formulation technologies is helping manufacturers offer higher pigment stability and better bioavailability.

The French canthaxanthinrevenueis slated to rise at a CAGR of 4.7% from 2025 to 2035. Between 2020 and 2024, demand was moderate, with applications concentrated in sauces, baked goods, and confectionery. From 2025 onward, the surge in cosmetic and dermatological supplement usage is likely to drive market expansion. French consumers' strong preference for visually appealing, natural-origin products is accelerating innovation in clean-label solutions.

The canthaxanthin market in Japan is predicted to grow at a CAGR of 9% from 2025 to 2035, the fastest among the top five countries. From 2020 to 2024, demand was largely driven by fish feed applications to meet aquaculture quality standards. As Japan continues to promote functional beverages and health supplements, demand from the nutraceutical and pharmaceutical sectors is forecast to surge. Japanese consumers show strong trust in scientifically validated, functional ingredients, making it a ripe market for canthaxanthin innovation.

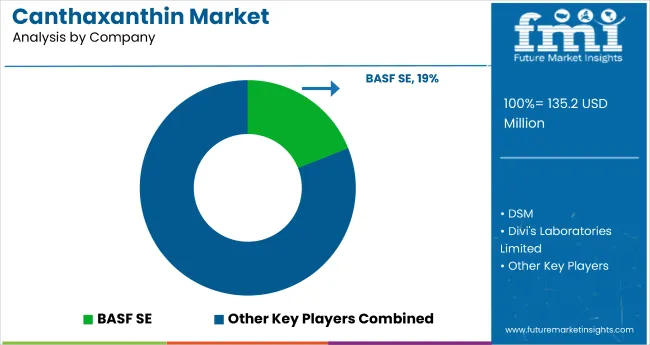

The global market is moderately fragmented, with several key players operating across global and regional levels. Leading companies such as Allied Biotech Corporation, BASF SE, DSM, ROHA, and Divi’s Laboratories dominate due to their advanced manufacturing capabilities and regulatory approvals. These companies are competing based on pigment purity, formulation flexibility, and industry-specific customization, particularly in food, cosmetics, and animal nutrition segments. Innovation in microencapsulation, natural extraction, and feed-grade formats continues to define the competitive edge in this space.

Company strategies are centered on expanding production capacities, strengthening regulatory compliance (especially with EFSA and FDA), and targeting high-growth regions like East Asia and North America. Strategic partnerships and acquisitions are being pursued to secure raw material access and regional distribution networks. BASF and DSM are also investing heavily in clean-label and synthetic biology advancements to serve the rising demand for sustainable and high-performance colorants in aquaculture, dietary supplements, and cosmetics.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 135.2 million |

| Projected Market Size (2035) |

USD 261 million |

| CAGR (2025 to 2035) | 6.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD million/Volume in kilotons |

| By Nature | Natural and Synthetic |

| By End Use | Beverages (Alcoholic Beverages, Carbonates (Carbonated Soft Drinks) & Energy Drinks, Juice-Based Drinks, Milk Drinks & Milk Alternatives, Sports Drinks, and Flavored, Enhanced, & Sparkling Waters), Bakery (Snacks & Cereal, Breakfast Cereal, Bread, Cakes & Pastries, Cookies & Biscuits, Crackers & Savory Snacks) Candy/ Confectionery, Dairy, Poultry/Fish/Eggs, Sauces & Dressings, Seasonings, Dietary Supplements, Pharmaceuticals, Pet Food |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Players | Mezzoni Foods, Allied Biotech Corporation, BASF SE, DSM, ROHA (A JJT Group Company), Sensient Colors LLC., Divi's Laboratories Limited, Zhejiang NHU Company Ltd, Zmc Gmbh, NOVUS INTERNATIONAL, Healtheway Xi‘an Biotechnology Co. Ltd, Guangzhou Juyuan Bio- Chem Co., Ltd., Lemillionaceae Fermentation Inc, Biosynth, Emd Millipore Corporation, FOODCHEM, INDOFINE CHEMICAL COMPANY MS, POLIFAR GROUP LIMITED, and HSF Biotech |

| Additional Attributes | Dollar sales by value, market share analysis by segments, and country-wise analysis |

The global canthaxanthin market is estimated to be valued at USD 135.2 billion in 2025.

The market size for the canthaxanthin market is projected to reach USD 253.7 billion by 2035.

The canthaxanthin market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in canthaxanthin market are natural and synthetic.

In terms of end use, beverage segment to command 41.8% share in the canthaxanthin market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA