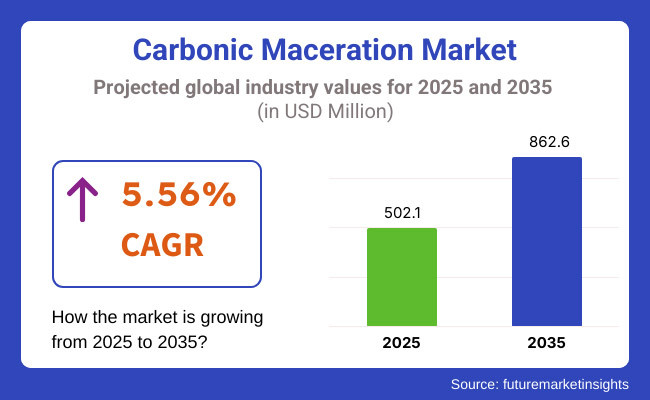

The carbonic maceration market is anticipated to be valued at USD 502.1 million in 2025. It is expected to grow at a CAGR of 5.56% during the forecast period and reach a value of USD 862.6 million in 2035.

The carbonic maceration market is changing as producers increasingly apply this method to produce low-tannin, fruit-forward wines. Traditional maceration still exists, but new trends, such as fermentation monitoring fermentation and the use of automated machinery, are spearheading growth.

Wineries also emphasize sustainability with the use of energy-efficient fermenting vessels and reduced chemical intervention levels to respond to consumer demands for natural and organic wines. Emerging wine regions, particularly in Asia-Pacific and Latin America, where interest in low-intervention wines is growing.

In 2024, growth remained steady due to shifting consumer preferences toward fresh, aromatic wines. In Europe and North America, winemakers refined maceration processes to enhance aromatic complexity while preserving natural fermentation. The popularity of organic and biodynamic wines encouraged more vineyards to follow this method.

The growing consumption of wine in Asia-Pacific, especially China and Japan, created a demand for fruit-forward and low-tannin wines, promoting new trade. Sustainability trends were further encouraged with biodegradable fermentation equipment and low-energy processing methods.

In the future, in 2025 and beyond, there will be more innovation and personalization. AI-monitored fermentation and cloud-controlled extraction will enable accurate flavor creation. Expansion in Asia-Pacific and Latin America will persist, while robust, energy-saving maceration tanks and accurate fermentation equipment will draw both artisanal and commercial wineries, providing sustained growth.

Recent research by Future Market Insights (FMI) involving the key stakeholders in the wine industry has provided insight into market trends, challenges, and future opportunities. Winemakers, vineyard owners, oenologists, and fermentation technology providers, among others, brought various perspectives upon the evolution of this industry.

Over 70% of respondents predicted greater market acceptance of new fermentation methods within the next decade, driven by consumer demand for fruit-forward, low-tannin wines and the growing trend of natural winemaking.

Technological innovation still drives the business, and some 60% of winemakers are seeking automated fermentation control systems for quality and best extraction. The technology in greatest demand is AI-governed fermentation control, cloud-based analysis, and real-time temperature control. Sustainability is still key, with over 50% of vineyard proprietors exploring low-energy fermentation vats and bio-degradable options to reduce their carbon footprint.

Nevertheless, challenges, particularly regarding cost and scalability, still lurk. The high initial investment cost for setting up modern fermentation systems was highlighted as a barrier by around 40% of smaller wineries. At the same time, climate variations in the region play a role in some of the fermentation going awry, especially in warmer areas.

However, in spite of such difficulties, 65% of commercial wineries are planning to push the production of fruit-forward wines in five years, especially in the premium and organic segments. Stakeholders feel that advances in fermentation control and personalized techniques will help winemakers create a wide spectrum of flavors to attract more palates around the globe.

| 2020 to 2024 (Historical Analysis) | 2025 to 2035 (Future Outlook) |

|---|---|

| Moderate growth is driven by the increasing adoption of specialized fermentation techniques in premium and natural wine production. | Stronger growth is expected due to technological advancements and rising global demand for natural and artisanal wines. |

| There is a growing interest in fruit-forward, low-tannin wines, particularly among young consumers. | Demand for sustainable, organic, and low-intervention wines will drive market expansion. |

| Minimal automation; traditional fermentation techniques remained dominant. | Increased use of AI, IoT-enabled fermentation monitoring, and ultrasound maceration for better efficiency. |

| Europe remained the largest market, with growth in North America and Australia. | Asia-Pacific and Latin America are expected to witness significant growth due to rising wine consumption. |

| Presence of established winemakers and small craft producers experimenting with maceration techniques. | New entrants and investments in research-driven wine production will intensify competition. |

| Early adoption of eco-friendly practices, such as reduced sulfur use and natural fermentation. | Enhanced focus on carbon footprint reduction, use of biodegradable materials, and energy-efficient maceration methods. |

| Supply chain disruptions and climate change effects on grape production. | Potential regulatory changes and adaptation to climate-driven shifts in grape quality and availability. |

Red wine continues to dominate, accounting for the largest market share. This process is widely used for the production of light and fruit-forward red wines such as Beaujolais Nouveau. The most aromatic red wines benefit from very specific fermentation regimes that gain aroma profiles, reduce tannins, and give a softer mouthfeel.

These wines are also in demand in European countries such as France, Italy, and Spain, where winemakers are in search of new methods for creating unique, high-quality vintages. The growing preference for natural, minimally processed wines among Millennials and Gen Z is a key market driver.

Ultrasound maceration is becoming the fastest-growing area within the market. Breaking down grape cell walls is accelerated using ultrasonic waves, greatly enhancing the extraction of phenolic compounds, aromas, and flavors from that grape skin in a very short period. Although adopted by wineries around the globe, ultrasound maceration offers the potential for making high-quality wine with efficient energy consumption and improved output.

The sustainability benefits associated with ultrasound maceration make it even more appealing for ecologically prudent producers, including less water usage and shorter fermentation time. Regions like North America and Australia are further paving the way for ultrasound maceration, in which technical advancements in winemaking are eagerly embraced.

The USA is growing as consumers favor natural, low-intervention wines. California, Oregon, and Washington lead adoption, with millennials and Gen Z preferring fruit-forward wines with lower tannins. Regulatory transparency by the Alcohol and Tobacco Tax and Trade Bureau (TTB) has encouraged wineries to highlight fermentation methods as a selling point.

In 2024, boutique wineries in Oregon and Napa Valley expanded operations, catering to organic wine demand. Smart fermentation tools and AI-driven analytics are optimizing production. As sustainability gains traction, durable, energy-efficient maceration tanks are expected to shape future market growth.

The UK market has seen rising imports from France, Italy, and Spain, driven by growing demand for fruit-forward wines. While domestic production is limited, English vineyards in Sussex and Kent are experimenting with new fermentation techniques for lighter, aromatic wines.

Retailers and online platforms have made these wines more accessible, with gastropubs and fine dining establishments featuring them prominently in 2024. Strict alcohol labeling laws have raised consumer awareness, and e-commerce growth and subscription services will likely continue expanding accessibility.

France remains a global leader in winemaking, with Beaujolais dominating production. The Loire and Rhône Valleys have expanded their offerings to meet the rising demand for softer, fruitier reds.

In 2024, organic certifications increased due to EU sustainability regulations, strengthening exports to Asia and North America. Innovation in blends and fermentation techniques is helping French wineries differentiate themselves in a competitive global market.

Germany’s carbonic maceration market is in its early stages but expanding in Baden and Pfalz, where winemakers are crafting lighter Spätburgunder and Dornfelder wines. Temperature-regulated fermentation tanks and organic viticulture are shaping the sector.

In 2024, exports to Nordic countries increased, signaling future growth potential. Regulatory support from EU wine laws and sustainability initiatives is fostering development, though domestic consumption remains niche.

Italy is experimenting with carbonic maceration in Tuscany, Piedmont, and Veneto, producing lighter versions of Sangiovese, Barbera, and Nebbiolo. While DOC and DOCG regulations set winemaking standards, natural wine producers are driving adoption.

In 2024, exports surged, especially to Japan and the USA, as global demand for fruit-forward Italian wines increased. Continued experimentation and sustainability efforts will likely drive further growth.

South Korea’s wine market is expanding, with imports of fruit-forward wines from France and Italy rising 18% in 2024. Seoul’s young consumers favor natural, organic wines, boosting demand in specialty bars and fine-dining restaurants. E-commerce and wine subscription services are expected to drive future growth, making these wines an everyday choice among South Korean consumers.

Japan’s market values balanced, delicate wines, making fruit-forward varieties a popular choice. Imports from France, Italy, and Australia have surged, with sommeliers pairing them with traditional cuisine.

In 2024, Beaujolais Nouveau sales remained strong while premium natural wines gained traction. Domestic wineries, particularly in Yamanashi, are adopting innovative fermentation techniques, with sustainability trends shaping future production.

China’s premium wine segment is expanding, with younger consumers in Beijing, Shanghai, and Guangzhou preferring aromatic, light wines. In 2024, imports of fruit-forward wines rose 25%, led by demand for French and Italian varieties.

Domestic wineries in Ningxia and Shandong are beginning to experiment with new fermentation techniques. With e-commerce dominating wine sales, platforms like JD.com and Tmall are expected to drive adoption further.

Regulation by the government is an important supplement to the evolution of the market. It transforms production standards and labeling requirements as well as sustainsmanship practices. Many countries involved in wine production have adopted strict measures for quality assurance, thus ensuring authenticity, environmental compliance, and consumer protection. Major themes of regulation include organic certification, fermentation additives, geographical indication (GI) protection, and sustainability mandates.

In conventional cases, for instance, the EU Organic Wine Regulation (203/2012) encourages low-intervention winemaking, while other initiatives in favor of an organic producer will be using sustainable fermentation practices. Apart from AOC laws restricting certain fermentation methods in France, Italy and Spain adhere to their import standards of fermentation with the Denominazione di Origine Controllata (DOC) and Denominación de Origen (DO) requirements, respectively.

The government of North America has, through the USA Alcohol and Tobacco Tax and Trade Bureau (TTB), offered comprehensive provisions on wine labeling and production while setting mandates on such declarations concerning the methods employed in fermentation.

California's Sustainable Winegrowing Program (SWP) motivates wineries to utilize energy-low fermentation methods that are in line with sustainability trends. Stringent certification standards have also been adopted by Canada's Vintners Quality Alliance (VQA) to ensure credibility and regional identity.

In Asia-Pacific, governments are creating a conducive environment for juice quality standards that new markets in the industry have put forth. China's National Food Safety Standards demand more stringent fermentation records for wines from a winery.

In contrast, Australia has instituted the Label Integrity Program (LIP) to provide transparency in the whole winemaking process. Competition today seems to be stewing among emerging wine-producing countries such as India, which are already starting to concatenate stipulations on fermentation checks within a country to enable wine quality and viability in exports.

| Countries/Regions | Regulation & Impact |

|---|---|

| European Union | EU Organic Wine Regulation (203/2012) supports low-intervention winemaking, encouraging natural fermentation methods. |

| France | AOC laws regulate fermentation techniques, limiting artificial additives in wine production. |

| Italy & Spain | DOC & DO standards enforce strict labeling and production controls for regional authenticity. |

| United States | TTB mandates fermentation disclosures; California's SWP encourages sustainable maceration practices. |

| Canada | VQA certification imposes stricter quality control on carbonic maceration wines. |

| China | National Food Safety Standards require detailed documentation of fermentation methods. |

| Australia | LIP mandates transparent winemaking process disclosures to maintain market trust. |

| India | Emerging fermentation monitoring regulations aim to improve wine quality and export compliance. |

Growth Opportunities

Expansion in Emerging Markets

The increasing popularity of wine in Asia-Pacific (China, Japan, South Korea) and Latin America presents significant growth opportunities. Rising disposable incomes, evolving consumer preferences, and increasing interest in premium and natural wines will drive demand for carbonic maceration techniques.

Technological Advancements

The adoption of AI-driven fermentation monitoring, IoT-enabled temperature control, and ultrasound maceration can improve efficiency and quality. Wineries investing in automation and smart fermentation solutions will gain a competitive edge.

Sustainability & Organic Wine Trends

Consumers are becoming increasingly conscious of eco-friendly wine production, leading to greater demand for organic, biodynamic, and low-intervention wines. Implementing sustainable vineyard management and carbon-reduction strategies will attract environmentally conscious consumers.

Strategic Recommendations

Invest in R&D

Wineries should focus on refining maceration techniques, optimizing fermentation conditions, and leveraging data-driven winemaking to improve product quality.

Enhance Distribution Networks

Expanding into e-commerce, direct-to-consumer (DTC) sales and online wine platforms will ensure better market reach.

Compliance & Regulatory Adaptation

Companies should closely monitor evolving regulations on sustainable wine production and ensure compliance with regional policies to avoid market disruptions.

The carbonic maceration industry falls within the broader wine production and fermentation technology industry, which is part of the global food and beverage sector. It intersects with agriculture (viticulture), manufacturing, and technology, making it highly sensitive to macroeconomic factors such as disposable income, trade policies, climate change, and technological advancements.

Between 2020 and 2024, the market experienced steady growth due to rising demand for natural and artisanal wines, particularly in North America and Europe. The premiumization trend in the wine industry has led to increased interest in innovative fermentation techniques that enhance flavor complexity and reduce tannins, making wines more appealing to younger consumers.

However, challenges such as supply chain disruptions, fluctuating grape yields due to climate change, and inflationary pressures on wine production cost slightly impacted growth. Looking ahead to 2025 to 2035, macroeconomic factors such as rising middle-class income in emerging economies, increased wine consumption in Asia-Pacific, and advancements in fermentation technology are expected to drive market expansion.

Additionally, sustainability regulations, government incentives for eco-friendly wine production, and trade agreements affecting wine exports will shape the industry. Investment in automation, AI-driven fermentation monitoring, and sustainable viticulture practices will be key to maintaining competitiveness in this evolving market.

The carbonic maceration market is characterized by the presence of established wineries, fermentation technology providers, and specialized winemaking firms that focus on low-intervention and fruit-forward wines. Market share distribution is highly fragmented, with leading companies controlling a moderate share. At the same time, smaller artisanal winemakers continue to gain traction due to the rising demand for natural and organic wines.

Laffort (10-12%)

A leader in oenological solutions, Laffort continues to dominate the fermentation space by supplying specialized fermentation aids and yeast solutions that optimize intracellular fermentation.

Oenobrands (8-10%)

Known for its advanced fermentation enhancers, Oenobrands has expanded its portfolio to include customized enzyme solutions, giving it a competitive edge.

IMAWAVE (7-9%)

A key player in innovative fermentation techniques, IMAWAVE has gained market share due to its AI-driven fermentation control systems, allowing winemakers to fine-tune their processes.

Vincor International (5-7%)

This multinational winery group has invested heavily in low-tannin wine production, capturing a growing segment of younger consumers who prefer fruit-forward wines.

Vinadeis (5-6%)

France’s largest cooperative winery has strengthened its presence in organic and biodynamic wine markets, leveraging specialized fermentation methods for premium-quality production.

Akitu, Bergström, Domaine de la Côte, Black Canvas (collectively 15-18%)

These artisanal wineries hold a significant share of the market by capitalizing on the demand for terroir-driven wines that highlight regional characteristics.

Key Developments

The market is segmented by type of wine into red wine, white wine, rose wine, sparkling wine, dessert wine, and fortified wine.

Based on the production method, the market is segmented into classic maceration, microwave maceration, ultrasound maceration, thermo maceration, and cryo maceration.

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Carbonic maceration is a fermentation technique that enhances fruitiness, reduces tannins, and creates lighter, aromatic wines by fermenting whole grape clusters in a carbon dioxide-rich environment.

Red wines like Gamay (Beaujolais) benefit the most, but the technique is also being explored for rosé and white wines to enhance fruit-forward flavors.

Innovations include ultrasound-assisted maceration, AI-driven fermentation monitoring, and IoT-enabled temperature control for improved efficiency and precision.

Wineries are adopting organic viticulture, biodegradable materials, and energy-efficient processes to align with eco-conscious production trends.

France (Beaujolais) remains the leader, but adoption is growing in North America, Australia, and parts of Asia as winemakers experiment with new applications.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type of Wine, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Type of Wine, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Production Method, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Production Method, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type of Wine, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Type of Wine, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Production Method, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Production Method, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type of Wine, 2018 to 2033

Table 16: Latin America Market Volume (MT) Forecast by Type of Wine, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Production Method, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Production Method, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Type of Wine, 2018 to 2033

Table 22: Europe Market Volume (MT) Forecast by Type of Wine, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Production Method, 2018 to 2033

Table 24: Europe Market Volume (MT) Forecast by Production Method, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Type of Wine, 2018 to 2033

Table 28: East Asia Market Volume (MT) Forecast by Type of Wine, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by Production Method, 2018 to 2033

Table 30: East Asia Market Volume (MT) Forecast by Production Method, 2018 to 2033

Table 31: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: South Asia Market Value (US$ Million) Forecast by Type of Wine, 2018 to 2033

Table 34: South Asia Market Volume (MT) Forecast by Type of Wine, 2018 to 2033

Table 35: South Asia Market Value (US$ Million) Forecast by Production Method, 2018 to 2033

Table 36: South Asia Market Volume (MT) Forecast by Production Method, 2018 to 2033

Table 37: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 39: Oceania Market Value (US$ Million) Forecast by Type of Wine, 2018 to 2033

Table 40: Oceania Market Volume (MT) Forecast by Type of Wine, 2018 to 2033

Table 41: Oceania Market Value (US$ Million) Forecast by Production Method, 2018 to 2033

Table 42: Oceania Market Volume (MT) Forecast by Production Method, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Type of Wine, 2018 to 2033

Table 46: MEA Market Volume (MT) Forecast by Type of Wine, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Production Method, 2018 to 2033

Table 48: MEA Market Volume (MT) Forecast by Production Method, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type of Wine, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Production Method, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type of Wine, 2018 to 2033

Figure 9: Global Market Volume (MT) Analysis by Type of Wine, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type of Wine, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type of Wine, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Production Method, 2018 to 2033

Figure 13: Global Market Volume (MT) Analysis by Production Method, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Production Method, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Production Method, 2023 to 2033

Figure 16: Global Market Attractiveness by Type of Wine, 2023 to 2033

Figure 17: Global Market Attractiveness by Production Method, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type of Wine, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Production Method, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type of Wine, 2018 to 2033

Figure 27: North America Market Volume (MT) Analysis by Type of Wine, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type of Wine, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type of Wine, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Production Method, 2018 to 2033

Figure 31: North America Market Volume (MT) Analysis by Production Method, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Production Method, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Production Method, 2023 to 2033

Figure 34: North America Market Attractiveness by Type of Wine, 2023 to 2033

Figure 35: North America Market Attractiveness by Production Method, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type of Wine, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Production Method, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type of Wine, 2018 to 2033

Figure 45: Latin America Market Volume (MT) Analysis by Type of Wine, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type of Wine, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type of Wine, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Production Method, 2018 to 2033

Figure 49: Latin America Market Volume (MT) Analysis by Production Method, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Production Method, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Production Method, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type of Wine, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Production Method, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Type of Wine, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Production Method, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Type of Wine, 2018 to 2033

Figure 63: Europe Market Volume (MT) Analysis by Type of Wine, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Type of Wine, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Type of Wine, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Production Method, 2018 to 2033

Figure 67: Europe Market Volume (MT) Analysis by Production Method, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Production Method, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Production Method, 2023 to 2033

Figure 70: Europe Market Attractiveness by Type of Wine, 2023 to 2033

Figure 71: Europe Market Attractiveness by Production Method, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: East Asia Market Value (US$ Million) by Type of Wine, 2023 to 2033

Figure 74: East Asia Market Value (US$ Million) by Production Method, 2023 to 2033

Figure 75: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 78: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: East Asia Market Value (US$ Million) Analysis by Type of Wine, 2018 to 2033

Figure 81: East Asia Market Volume (MT) Analysis by Type of Wine, 2018 to 2033

Figure 82: East Asia Market Value Share (%) and BPS Analysis by Type of Wine, 2023 to 2033

Figure 83: East Asia Market Y-o-Y Growth (%) Projections by Type of Wine, 2023 to 2033

Figure 84: East Asia Market Value (US$ Million) Analysis by Production Method, 2018 to 2033

Figure 85: East Asia Market Volume (MT) Analysis by Production Method, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Production Method, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Production Method, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Type of Wine, 2023 to 2033

Figure 89: East Asia Market Attractiveness by Production Method, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) by Type of Wine, 2023 to 2033

Figure 92: South Asia Market Value (US$ Million) by Production Method, 2023 to 2033

Figure 93: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 96: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia Market Value (US$ Million) Analysis by Type of Wine, 2018 to 2033

Figure 99: South Asia Market Volume (MT) Analysis by Type of Wine, 2018 to 2033

Figure 100: South Asia Market Value Share (%) and BPS Analysis by Type of Wine, 2023 to 2033

Figure 101: South Asia Market Y-o-Y Growth (%) Projections by Type of Wine, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) Analysis by Production Method, 2018 to 2033

Figure 103: South Asia Market Volume (MT) Analysis by Production Method, 2018 to 2033

Figure 104: South Asia Market Value Share (%) and BPS Analysis by Production Method, 2023 to 2033

Figure 105: South Asia Market Y-o-Y Growth (%) Projections by Production Method, 2023 to 2033

Figure 106: South Asia Market Attractiveness by Type of Wine, 2023 to 2033

Figure 107: South Asia Market Attractiveness by Production Method, 2023 to 2033

Figure 108: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 109: Oceania Market Value (US$ Million) by Type of Wine, 2023 to 2033

Figure 110: Oceania Market Value (US$ Million) by Production Method, 2023 to 2033

Figure 111: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 114: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Oceania Market Value (US$ Million) Analysis by Type of Wine, 2018 to 2033

Figure 117: Oceania Market Volume (MT) Analysis by Type of Wine, 2018 to 2033

Figure 118: Oceania Market Value Share (%) and BPS Analysis by Type of Wine, 2023 to 2033

Figure 119: Oceania Market Y-o-Y Growth (%) Projections by Type of Wine, 2023 to 2033

Figure 120: Oceania Market Value (US$ Million) Analysis by Production Method, 2018 to 2033

Figure 121: Oceania Market Volume (MT) Analysis by Production Method, 2018 to 2033

Figure 122: Oceania Market Value Share (%) and BPS Analysis by Production Method, 2023 to 2033

Figure 123: Oceania Market Y-o-Y Growth (%) Projections by Production Method, 2023 to 2033

Figure 124: Oceania Market Attractiveness by Type of Wine, 2023 to 2033

Figure 125: Oceania Market Attractiveness by Production Method, 2023 to 2033

Figure 126: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 127: MEA Market Value (US$ Million) by Type of Wine, 2023 to 2033

Figure 128: MEA Market Value (US$ Million) by Production Method, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 132: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: MEA Market Value (US$ Million) Analysis by Type of Wine, 2018 to 2033

Figure 135: MEA Market Volume (MT) Analysis by Type of Wine, 2018 to 2033

Figure 136: MEA Market Value Share (%) and BPS Analysis by Type of Wine, 2023 to 2033

Figure 137: MEA Market Y-o-Y Growth (%) Projections by Type of Wine, 2023 to 2033

Figure 138: MEA Market Value (US$ Million) Analysis by Production Method, 2018 to 2033

Figure 139: MEA Market Volume (MT) Analysis by Production Method, 2018 to 2033

Figure 140: MEA Market Value Share (%) and BPS Analysis by Production Method, 2023 to 2033

Figure 141: MEA Market Y-o-Y Growth (%) Projections by Production Method, 2023 to 2033

Figure 142: MEA Market Attractiveness by Type of Wine, 2023 to 2033

Figure 143: MEA Market Attractiveness by Production Method, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA