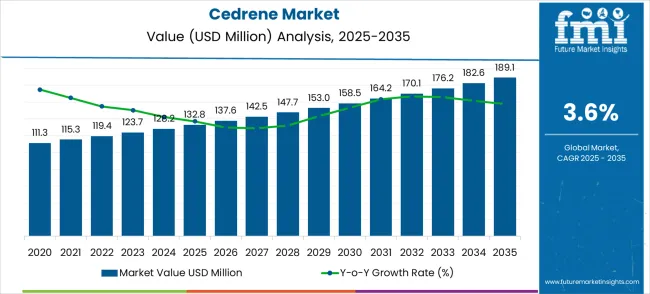

The cedrene market is anticipated to witness steady growth from USD 132.8 million in 2025 to USD 189.1 million by 2035, reflecting a compound annual growth rate (CAGR) of 3.6%. The growth of this market can be attributed to the increasing demand for cedrene, which is widely used in the fragrance, food, and cosmetics industries due to its pleasant woody aroma and natural origins.

As consumers lean more towards natural and plant-based ingredients, cedrene is becoming a preferred choice for formulating perfumes and other personal care products. This shift towards natural and sustainable products, particularly in the fragrance industry, is expected to drive the continued adoption of cedrene in various applications. With expanding markets for essential oils, fragrances, and natural ingredients, cedrene’s market presence is set to grow steadily in the coming decade.

Despite facing moderate growth rates, the cedrene market is expected to remain resilient in its niche, buoyed by demand from high-end perfumes, aromatherapy, and wellness-focused product segments. Over the next decade, the market's growth is anticipated to remain relatively stable, with an annual increase in market size reflecting an ongoing, yet steady, shift towards natural fragrances. This ongoing trend in consumer preferences for natural ingredients will likely continue to fuel market expansion, especially as new applications for cedrene are discovered in the food and beverage industry as a flavoring agent. The increasing awareness about the advantages of natural products over synthetic alternatives further strengthens the long-term growth outlook for the cedrene market, ensuring that it remains an integral part of the broader essential oils and natural ingredient sectors.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 132.8 million |

| Market Forecast Value (2035) | USD 189.1 million |

| Forecast CAGR (2025-2035) | 3.6% |

The cedrene market holds a notable share in the essential oils market, contributing around 5%, as it is widely used in aromatic and therapeutic oils. In the fragrance ingredients market, cedrene accounts for approximately 7%, given its importance as a key component in perfume formulations. Within the flavor and fragrance industry, it captures about 6%, as it adds a woody, balsamic note to fragrance blends. The natural aromatic chemicals market sees a 4% share, driven by increasing demand for naturally sourced compounds. Finally, in the broader chemical compounds market, cedrene holds around 3%, reflecting its role in the production of various chemical products. This distribution illustrates cedrene’s key function across multiple industries reliant on natural and aromatic substances.

Market expansion is being supported by the increasing consumer preference for natural and organic fragrance ingredients across premium cosmetic and perfumery sectors. Modern fragrance applications require distinctive and authentic scent profiles to differentiate products in competitive luxury markets, creating demand for unique natural ingredients like cedrene. The superior woody and cedar-like olfactory characteristics of cedrene make it an essential component in sophisticated perfume compositions where complexity and naturalness are valued by discerning consumers.

The growing emphasis on sustainable sourcing and natural ingredient authenticity is driving demand for high-purity cedrene from certified suppliers with proven track records of quality and environmental responsibility. Perfume houses and cosmetic manufacturers are increasingly investing in premium natural ingredients that offer superior scent longevity and enhanced olfactory complexity while meeting consumer expectations for natural product formulations. Industry regulations and certification standards are establishing quality benchmarks that favor sustainably sourced cedrene with consistent purity levels and verified natural origin.

The luxury fragrance industry's focus on artisanal and niche perfumery is creating substantial demand for distinctive natural ingredients capable of creating unique scent signatures in premium product segments. Consumer awareness of ingredient quality and natural sourcing practices continues to drive innovation in cedrene applications while maintaining cost-effectiveness, leading to development of specialized extraction and purification technologies that enhance cedrene's olfactory properties and market appeal.

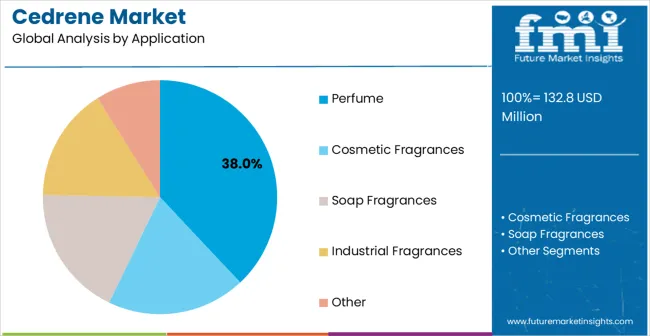

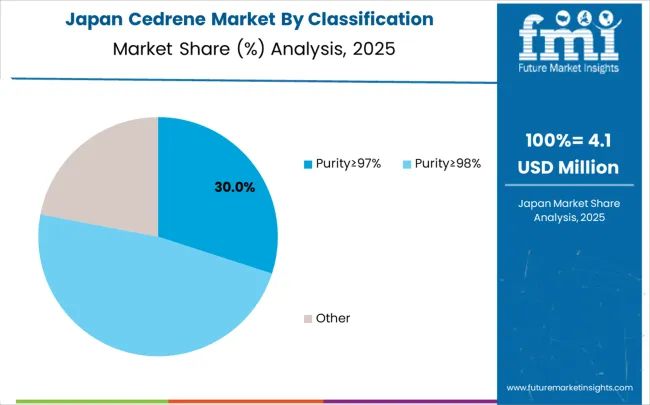

The market is segmented by purity level, application, and region. By purity level, the market is divided into Purity≥97%, Purity≥98%, and other configurations. Based on application, the market is categorized into perfume, cosmetic fragrances, soap fragrances, industrial fragrances, and other applications. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Purity≥98% configurations are projected to account for 48% of the cedrene market in 2025. This leading share is supported by the increasing demand for ultra-pure cedrene in luxury perfumery applications and growing quality requirements in premium cosmetic formulations. High-purity cedrene provides superior olfactory performance and enhanced scent stability, making it the preferred choice for expensive perfumes, artisanal fragrances, and high-end cosmetic products. The segment benefits from advanced extraction and purification technologies that have improved cedrene purity levels while maintaining natural origin authenticity.

Modern Purity≥98% cedrene incorporates sophisticated distillation processes and enhanced purification techniques that maximize olfactory clarity while ensuring consistent quality across production batches. These innovations have significantly improved fragrance application performance while reducing impurity-related scent variations that can affect final product quality. The luxury perfumery sector particularly drives demand for ultra-pure solutions, as these applications require absolute scent authenticity and superior olfactory characteristics to justify premium pricing and brand positioning.

Additionally, the niche fragrance market increasingly adopts Purity≥98% cedrene to create distinctive scent profiles and enhance product differentiation in competitive luxury segments. The growing emphasis on artisanal perfumery creates opportunities for specialized high-purity cedrene formulations designed for exclusive and limited-edition fragrance collections.

Perfume applications are expected to represent 38% of cedrene demand in 2025. This dominant share reflects the critical role of cedrene in creating sophisticated woody base notes and enhancing scent complexity in premium fragrance compositions. Perfume manufacturers require high-quality cedrene capable of providing distinctive cedar-like characteristics while maintaining excellent blending properties with other fragrance ingredients. The segment benefits from continuous innovation in perfume formulation techniques that maximize cedrene's olfactory contribution to complex scent structures.

The luxury perfume industry drives significant demand for premium-grade cedrene that provides exceptional scent longevity and enhanced olfactory depth in high-end fragrance products. These applications require cedrene with superior purity levels and consistent olfactory characteristics to ensure reproducible fragrance quality and brand consistency. The segment benefits from growing consumer appreciation for natural woody notes and increasing demand for sophisticated fragrance compositions that showcase cedrene's unique olfactory properties.

Artisanal and niche perfumery segments contribute substantially to market growth as independent perfumers implement cedrene in exclusive fragrance creations and limited-edition collections. The growing adoption of natural fragrance ingredients creates opportunities for specialized cedrene applications designed for eco-conscious and sustainability-focused perfume brands. Additionally, the trend toward personalized and custom fragrances drives demand for distinctive ingredients like cedrene that enable unique scent signature development.

The cedrene market is advancing steadily due to increasing natural fragrance ingredient demand and growing recognition of cedrene's unique olfactory properties across luxury fragrance applications. However, the market faces challenges including seasonal supply variations, need for specialized extraction expertise, and varying quality requirements across different fragrance applications. Sustainability certifications and quality standards continue to influence sourcing practices and market development patterns.

The growing adoption of sophisticated steam distillation processes and enhanced separation techniques is enabling significant purity improvements while maintaining natural origin authenticity in cedrene production. Advanced extraction methods provide better yield efficiency and superior olfactory quality, enabling consistent product characteristics and enhanced fragrance application performance. These technologies are particularly valuable for luxury perfumery applications that require maximum olfactory clarity and natural ingredient authenticity.

Modern cedrene suppliers are implementing comprehensive sustainability programs and traceability systems that ensure responsible sourcing while maintaining superior product quality and environmental compliance. Advanced quality control processes enable precise monitoring of purity levels and olfactory characteristics while supporting certification requirements for organic and natural product standards. These systems are essential for meeting luxury fragrance industry expectations for ingredient transparency and environmental responsibility.

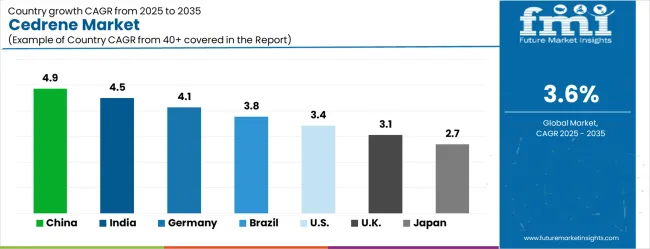

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.9% |

| India | 4.5% |

| Germany | 4.1% |

| Brazil | 3.8% |

| United States | 3.4% |

| United Kingdom | 3.1% |

| Japan | 2.7% |

The cedrene market is growing steadily, with China leading at a 4.9% CAGR through 2035, driven by expanding natural fragrance ingredient production capabilities and growing domestic luxury cosmetic market development. India follows at 4.5%, supported by traditional aromatic extraction expertise and increasing export-oriented fragrance ingredient manufacturing. Germany records strong growth at 4.1%, emphasizing premium fragrance industry development and advanced purification technologies. Brazil grows moderately at 3.8%, leveraging natural resource advantages and expanding fragrance ingredient processing capabilities. The United States shows solid growth at 3.4%, focusing on luxury perfumery market expansion and natural ingredient demand. The United Kingdom maintains steady expansion at 3.1%, supported by premium fragrance brand development. Japan demonstrates stable growth at 2.7%, emphasizing quality excellence and sophisticated fragrance applications.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

The cedrene market in China is projected to exhibit the highest growth rate with a CAGR of 4.9% through 2035, driven by the country's expanding natural fragrance ingredient production capabilities and rapidly growing domestic luxury cosmetic market. The extensive aromatic extraction infrastructure and increasing investment in advanced purification technologies are creating substantial opportunities for high-quality cedrene production. Major fragrance ingredient manufacturers are establishing comprehensive production facilities to support both domestic demand and international export markets while meeting global quality standards.

Natural fragrance ingredient production expansion and luxury cosmetic market development are supporting widespread adoption of advanced cedrene extraction technologies across commercial production operations, driving demand for sophisticated processing equipment and quality assurance systems. Export market development and international quality certification programs are creating significant opportunities for Chinese cedrene producers in global luxury fragrance supply chains requiring consistent quality and competitive pricing.

The cedrene market in India is expanding at a CAGR of 4.5%, supported by the country's traditional expertise in aromatic extraction and increasing focus on export-oriented fragrance ingredient manufacturing. The established essential oil industry infrastructure and growing investment in modern extraction technologies are driving substantial cedrene production capabilities. Manufacturing facilities are leveraging traditional knowledge while adopting contemporary purification methods to meet international quality requirements and market demands.

Traditional aromatic extraction expertise and export market development are creating opportunities for high-quality cedrene production across diverse fragrance ingredient categories requiring authentic natural sourcing and superior olfactory characteristics. International market expansion and quality certification achievements are driving investments in advanced extraction technologies for cedrene applications throughout major aromatic production regions and processing facilities.

The cedrene market in Germany is projected to grow at a CAGR of 4.1%, supported by the country's leadership in premium fragrance industry development and advanced purification technology applications. German fragrance companies are implementing sophisticated cedrene processing systems that meet stringent quality standards and luxury market requirements. The market is characterized by focus on innovation, advanced extraction technologies, and compliance with comprehensive fragrance industry quality regulations.

Premium fragrance industry investments are prioritizing advanced cedrene processing technologies that demonstrate superior purity levels and olfactory excellence while meeting German fragrance quality and sustainability standards for luxury perfumery applications. Innovation programs and technology development initiatives are driving adoption of precision-engineered extraction systems that support optimal cedrene quality and enhanced fragrance application performance.

The cedrene market in Brazil is growing at a CAGR of 3.8%, driven by the country's natural resource advantages and expanding fragrance ingredient processing capabilities across aromatic production sectors. The abundant natural aromatic resources and growing investment in modern extraction infrastructure are creating opportunities for sustainable cedrene production. Processing facilities are adopting advanced technologies to support growing domestic and export market requirements while maintaining environmental sustainability standards.

Natural resource utilization and fragrance ingredient processing expansion are facilitating development of cost-effective cedrene production systems capable of meeting diverse quality requirements and market specifications across international fragrance applications. Regional processing capability enhancement and export market development are creating demand for standardized cedrene products that meet international fragrance industry specifications and quality requirements.

The cedrene market in the United States is expanding at a CAGR of 3.4%, driven by the country's luxury perfumery market expansion and increasing consumer demand for natural fragrance ingredients. The sophisticated fragrance industry ecosystem and focus on premium product development create consistent demand for high-quality cedrene solutions. The market benefits from artisanal perfumery growth and niche fragrance brand development across multiple luxury segments.

Luxury perfumery market expansion and natural ingredient demand growth are driving adoption of premium cedrene solutions that offer superior olfactory characteristics and authenticity verification for high-end fragrance applications. Artisanal fragrance development and niche market growth are supporting demand for specialized cedrene formulations that meet stringent quality requirements and natural sourcing expectations.

The cedrene market in the United Kingdom is projected to grow at a CAGR of 3.1%, supported by ongoing premium fragrance brand development and increasing emphasis on natural ingredient authenticity in luxury perfumery. Fragrance companies are investing in high-quality cedrene solutions that provide distinctive olfactory characteristics and meet consumer expectations for natural product formulations. The market is characterized by focus on brand differentiation, ingredient quality, and regulatory compliance across premium fragrance applications.

Premium fragrance brand development and natural ingredient authentication programs are supporting adoption of verified cedrene solutions that meet contemporary quality and sustainability standards for luxury perfumery applications. Brand differentiation initiatives and quality enhancement programs are creating demand for specialized cedrene applications that provide distinctive olfactory characteristics and natural sourcing verification.

The cedrene market in Japan is expanding at a CAGR of 2.7%, driven by the country's emphasis on quality excellence and sophisticated fragrance application development. Japanese fragrance companies are developing advanced cedrene formulations that incorporate precision blending and quality optimization principles. The market benefits from focus on olfactory sophistication, ingredient purity, and continuous improvement in fragrance composition techniques.

Quality excellence programs and sophisticated fragrance development initiatives are driving advancement of premium cedrene applications that demonstrate superior olfactory characteristics and composition reliability. Fragrance sophistication programs and ingredient quality advancement are supporting adoption of precision-formulated cedrene solutions that optimize olfactory performance and ensure consistent fragrance quality in demanding applications.

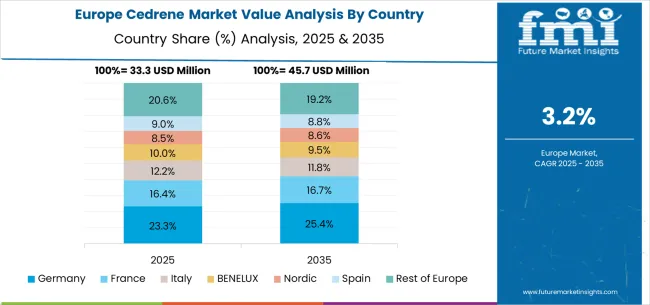

The cedrene market in Europe is projected to grow from USD 41.8 million in 2025 to USD 58.2 million by 2035, registering a CAGR of 3.3% over the forecast period. Germany is expected to maintain its leadership with a 31.2% share in 2025, supported by its advanced fragrance industry and premium perfumery market development. The United Kingdom follows with 20.4% market share, driven by luxury fragrance brand development and natural ingredient demand growth. France holds 19.8% of the European market, benefiting from traditional perfumery expertise and luxury cosmetic industry expansion. Italy and Spain collectively represent 16.7% of regional demand, with growing focus on artisanal fragrance development and natural ingredient applications. The Rest of Europe region accounts for 11.9% of the market, supported by emerging fragrance markets in Eastern European countries and Nordic luxury cosmetic development.

The cedrene market is defined by competition among established fragrance ingredient suppliers, specialized natural extract manufacturers, and aromatic processing companies. Companies are investing in advanced extraction technologies, product innovation, quality assurance systems, and sustainable sourcing capabilities to deliver reliable, pure, and cost-effective cedrene solutions. Strategic partnerships, technological advancement, and geographic expansion are central to strengthening product portfolios and market presence.

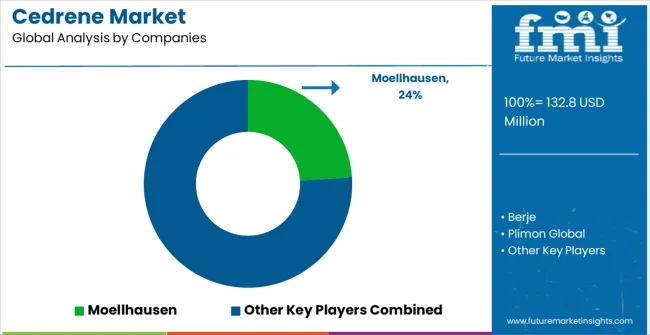

Moellhausen, operating globally, offers comprehensive cedrene solutions with focus on premium quality, natural authenticity, and technical support services. Berje, multinational, provides advanced natural fragrance ingredients with emphasis on purity consistency and application-specific formulations. Plimon Global delivers specialized cedrene products with focus on luxury perfumery applications and quality optimization. Jiangxi Baolin Natural Flavor offers comprehensive natural ingredient solutions with standardized procedures and regional manufacturing support.

Jiangxi Linyuan Spices provides advanced cedrene extraction capabilities with emphasis on sustainable sourcing and technical expertise. Yibin Chuanhui Perfumery delivers specialized aromatic extraction services with focus on quality excellence and customer applications. Join In-Jiangxi Yuanshangcao Flavor offers comprehensive natural ingredient processing with regional manufacturing and quality capabilities. Jiangxi Global Natural Spice provides advanced cedrene solutions with specialized extraction technologies and market expertise. These companies offer specialized cedrene expertise, regional production capabilities, and technical support across global and regional fragrance industry networks.

The cedrene market underpins luxury fragrance development, natural cosmetic formulation, sustainable ingredient sourcing, and olfactory innovation excellence. With growing natural ingredient demand, luxury perfumery expansion, and sustainable sourcing requirements, the sector faces pressure to balance quality authenticity, supply chain reliability, and environmental compliance. Coordinated contributions from governments, industry bodies, OEMs/technology integrators, suppliers, and investors will accelerate the transition toward sustainable, high-quality, and application-optimized cedrene solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 132.8 million |

| Purity Level Type | Purity≥97%, Purity≥98%, Other |

| Application | Perfume, Cosmetic Fragrances, Soap Fragrances, Industrial Fragrances, Other |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and other 40+ countries |

| Key Companies Profiled | Moellhausen, Berje, Plimon Global, Jiangxi Baolin Natural Flavor, Jiangxi Linyuan Spices, Yibin Chuanhui Perfumery, Join In-Jiangxi Yuanshangcao Flavor, Jiangxi Global Natural Spice |

The global cedrene market is estimated to be valued at USD 132.8 million in 2025.

The market size for the cedrene market is projected to reach USD 189.1 million by 2035.

The cedrene market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in cedrene market are purity≥97%, purity≥98% and other.

In terms of application, perfume segment to command 38.0% share in the cedrene market in 2025.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA