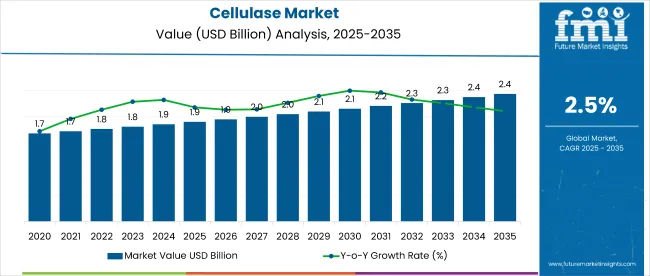

The global cellulase market is valued at USD 1.9 billion in 2025 and is expected to reach USD 2.4 billion by 2035, registering a CAGR of 9.2%. Market expansion is driven by increasing adoption of biofuels, rising demand from the textile and food industries, and extensive use in agricultural soil improvement and fruit juice processing. In addition, the enzyme's ability to replace antibiotics in certain medical applications is contributing to its popularity.

| Attribute | Value |

|---|---|

| 2025 Market Size | USD 1.9 Billion |

| 2035 Market Size | USD 2.4 billion |

| CAGR (2025 to 2035) | 9.2% |

The market holds approximately 12-15%, driven by its broad industrial applications. Within industrial biotechnology, cellulase represents around 10% of the market due to its critical role in biomass conversion and biofuel production. In the biofuel market, cellulase enzymes contribute roughly 8-10%, supporting sustainable energy initiatives.

The textile chemicals market sees a cellulase share near 7%, primarily for fabric processing. In food and beverage ingredients, cellulase holds about 5%, used in juice clarification and brewing. Its presence in agricultural chemicals and pharmaceutical enzymes is smaller but growing steadily.

Government regulations impacting the amrket focus on strict environmental policies aimed at reducing carbon emissions and promoting sustainable industrial practices have encouraged the adoption of cellulase enzymes, especially in biofuel production and textile processing.

Regulatory frameworks supporting renewable energy mandates and bioethanol blending targets have further boosted demand in key regions such as North America and Europe. However, compliance with stringent safety and quality standards for enzyme manufacturing and usage can increase operational costs for producers.

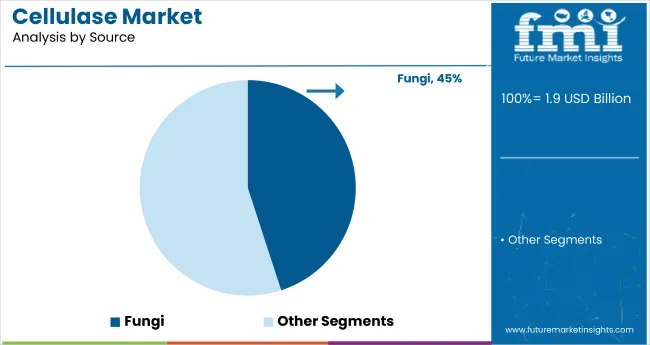

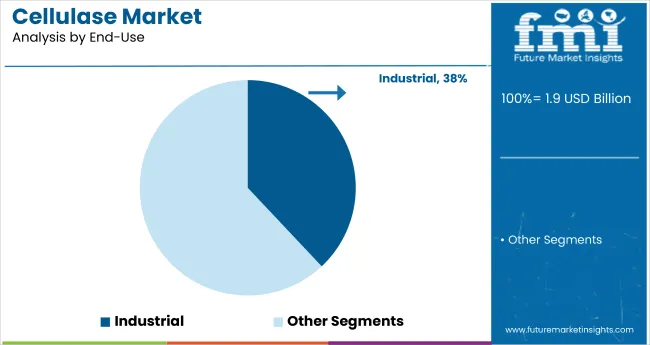

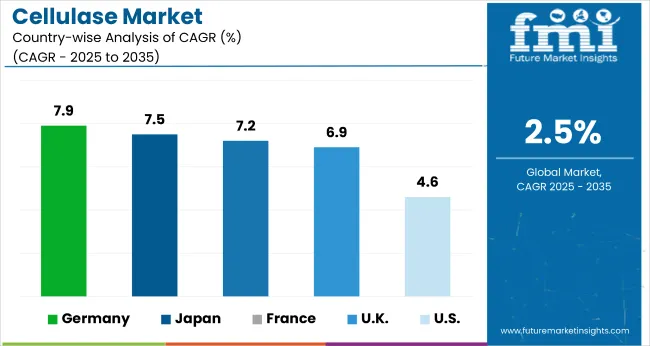

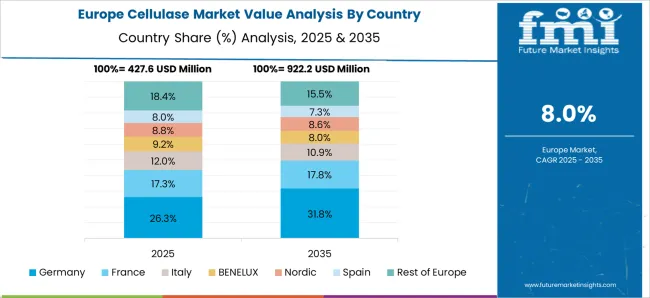

Germany is projected to be the fastest-growing market, expanding at a CAGR of 7.9% from 2025 to 2035, driven by rising demand across textiles, food, and sustainable manufacturing sectors. Fungi will lead the source segment with a 45% share in 2025, while industrial applications will dominate the end-use segment, accounting for 38% of global demand amid increasing investments in renewable energy. The USA and France markets are also expected to grow at 4.6% and 7.2% CAGR, respectively.

The cellulase marketis segmented into source, end-use, and region. By source, the market includes fungi, bacteria, actinomycetes, plants, and animals. Based on end use, the market is categorized into healthcare, industrial, food and beverages, textile, and pulp and paper. Regionally, the market is dividedclassified into North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa.

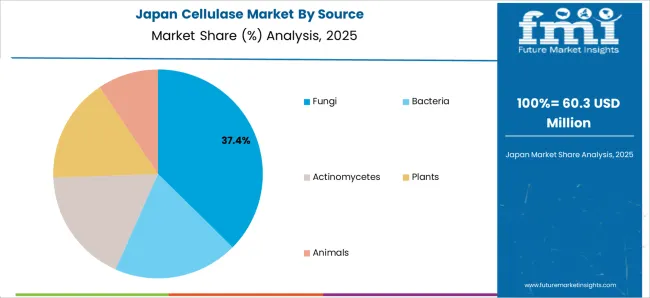

Fungi is projected to lead the source segment, accounting for approximately 45% of the market share in 2025. This is attributed to their high enzyme yield, stability, and ease of cultivation. Fungal cellulases, especially from species like Trichoderma reesei, are widely used in biofuels, textiles, and food processing due to their efficiency in breaking down cellulose.

The industrial segment is expected to dominate the end-use segment, accounting for approximately 38% of the market share in 2025. Its dominance is driven by high demand for cellulase in biofuel production, biomass conversion, and eco-friendly detergent formulations. Cellulase is vital in breaking down plant material into fermentable sugars, a key step in second-generation ethanol production.

The cellulase market is growing steadily, driven by increasing demand for bio-based industrial solutions, rising adoption in biofuel production, and expanding applications across food processing and textile industries. The shift towards environmentally sustainable processes and clean-label products is further accelerating market adoption, especially in developed regions. Additionally, technological advancements in enzyme engineering and fermentation techniques are enabling improved yield, enhanced stability, and reduced production costs.

Recent Trends in the Cellulase Market

Key Challenges in the Cellulase Market

Germany leads the cellulase market, driven by its strong industrial base and green chemistry initiatives.

The USA follows with a 4.6% CAGR, supported by robust biofuel and enzyme production infrastructure. Japan is projected to grow at 7.5%, led by innovations in industrial biotech and healthcare. France shows steady growth at 7.2%, fueled by demand in agriculture and pharmaceuticals, while the UK registers a 6.9% CAGR, reflecting growing interest in sustainable textiles and clean-label food processing.

The report covers an in-depth analysis of 40+ countries; with the five top-performing OECD nations highlighted below.

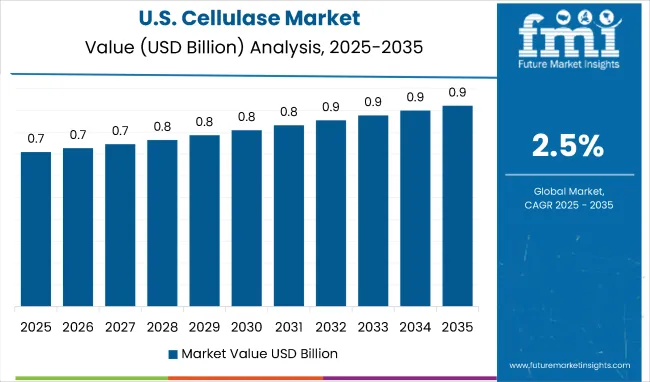

The USA cellulase market is projected to grow at a CAGR of 4.6% from 2025 to 2035, driven by strong demand from the biofuel, textile, and food processing sectors. The presence of major enzyme manufacturers and robust R&D infrastructure supports the country's leadership in both domestic use and global enzyme supply chains.

The sales of cellulase revenue in the UK are expanding at a CAGR of 6.9% from 2025 to 2035, supported by the growing shift toward sustainable textile and food processing technologies. Cellulase is increasingly being integrated into circular economy initiatives and clean-label production standards across the country.

The demand for cellulase products in Germany is expected to grow at a CAGR of 7.9% from 2025 to 2035, fueled by industrial innovation and sustainable manufacturing policies. The country remains a leader in enzyme utilization in textile finishing, pulp and paper, and industrial biotechnology sectors.

The cellulase market in France is projected to grow at a CAGR of 7.2% from 2025 to 2035, with increasing adoption across the pharmaceutical, food, and agricultural sectors. Emphasis on reducing chemical inputs in farming and processing is encouraging cellulase demand.

The cellulase market is projected to grow at a CAGR of 7.5% during the forecast period, driven by advancements in industrial biotechnology and the rising need for sustainable consumer goods. The country continues to invest in enzyme applications for precision manufacturing and aging population healthcare needs.

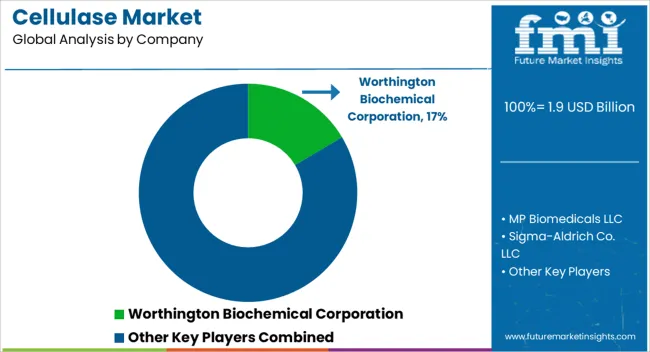

The cellulase market is moderately fragmented, with a mix of established multinational players and region-specific enzyme manufacturers competing across industrial, pharmaceutical, and food-grade enzyme segments. Key players focus on pricing efficiency, enzyme innovation, production scalability, and strategic partnerships to strengthen their market position.

Top companies such as Amano Enzyme Inc., MP Biomedicals, Sigma-Aldrich Co. LLC (a part of Merck), and Creative Enzymes are heavily investing in research and expanding their portfolios to meet rising demand in biofuels, food processing, and textile applications. These players prioritize enzyme performance, thermostability, and yield improvements to offer tailored solutions across end-use sectors.

Recent Cellulase Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.9 billion |

| Projected Market Size (2035) | USD 2.4 billion |

| CAGR (2025 to 2035) | 9.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in kilotons |

| By Source | Fungi, Bacteria, Actinomycetes, Plants, and Animals |

| By End-Use | Industrial, Food & Beverages, Healthcare, Textile, and Pulp & Paper |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, and +40 countries |

| Key Players | Worthington Biochemical Corporation, MP Biomedicals LLC, Sigma-Aldrich Co. LLC, Prozmix LLC, Creative Enzymes, World, Amano Enzyme USA, Amano Enzyme Inc., Zhongbei Bio-Chem Industry Co. Ltd., Hunan Hong Ying Biotech Co. Ltd. |

| Additional Attributes | Dollar sales by product type, share by functionality, regional demand growth, regulatory influence, clean-label trends, competitive benchmarking |

The global cellulase market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the cellulase market is projected to reach USD 4.4 billion by 2035.

The cellulase market is expected to grow at a 8.7% CAGR between 2025 and 2035.

The key product types in cellulase market are fungi, bacteria, actinomycetes, plants and animals.

In terms of end use, healthcare segment to command 36.4% share in the cellulase market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA