The industry is anticipated to grow steadily, with a predicted revenue size of USD 2.06 billion in 2025 and is likely to grow to a valuation of USD 2.89 billion by 2035, with a CAGR of about 3.5%. Its growth is rooted in stable demand from the pharmaceuticals, agrochemicals, and specialty chemicals segments.The pharmaceutical sector remains a strong end user, where MCB is used for the production of anesthetics and antihistamine intermediates. As generic drug production and world pharmaceutical exports increase, demand for chlorinated intermediates continues to reflect modest but steady growth.

The agrochemical industry is another major force. MCB is utilized as an ingredient in crop protection chemicals, such as herbicides and fungicides. The industry is affected by government and environmental forces. MCB's toxicology profile and its characterization as a hazardous air pollutant (HAP) have generated strict emission standards and worker protection regulations in the USA and EU, which affect production economics.Trends towards greener chemical production and bio-based substitutes may restrict long-term MCB demand in some uses. Nevertheless, its chemical effectiveness and affordability continue to make it relevant in industrial processes where substitutes are still technically or economically unviable.

Asia Pacific, particularly China and India, remains on top in terms of production and consumption as they are powerful players in chemicals and pharma. Meanwhile, North America and Europe prioritize specialty-grade MCB as well as downstream applications with stronger environmental regulation.

Market Metrics - Monochlorobenzene Market

| Market Metrics | Value |

|---|---|

| Industry Size (2025E) | USD 2.06 billion |

| Industry Value (2035F) | USD 2.89 billion |

| CAGR (2025 to 2035) | 3.5% |

Monochlorobenzene (MCB) is a multifunctional chemical intermediate widely employed in the manufacturing of nitrochlorobenzenes, a class of precursors used in the production of dyes, pigments, rubber manufacturing chemicals, and agrochemicals. Its application as a solvent in the production of adhesives, paints, and pharmaceuticals also reflects its industrial importance.

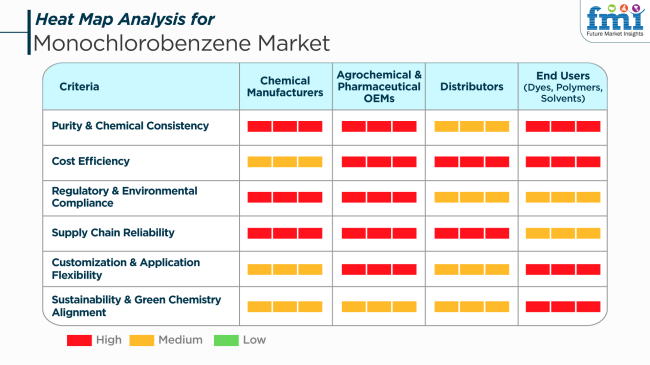

Agrochemical and Pharmaceutical Original Equipment Manufacturers place utmost value on cost savings and regulation compliance. MCB plays a central role in the production of different agrochemicals, as well as pharmaceutical chemicals, and requires conformity with environmental and safety regulations. Distributors highlight supply chain reliability and value for money in order to respond to the different needs of their customers. Distributors provide a critical link between consumers and producers, with prompt delivery and inventory availability of MCB products.

End Users, such as in dyes, polymers, and solvent industries, appreciate MCB due to its performance properties and eco-friendliness. In the dyes industry, MCB derivatives are employed to create bright and stable colors; in polymers, it is a solvent and intermediate of high-performance materials; and in solvents, it is a medium for a variety of chemical reactions.

Between 2020 and 2024, the MCB sales saw continuous growth owing to its use in industries such as chemicals, pharmaceuticals, and agrochemicals. The demand for MCB, especially in the manufacture of pesticides and pharmaceuticals and as a solvent in various manufacturing processes, was robust between 2020 and 2024. Notwithstanding the challenges that it experienced with the volatility in raw material costs and supply chain interruptions during the COVID-19 pandemic, the industry recovered with the resumption of global industrial activities.

Increased interest in its application in producing high-performance materials, including polymers, further stabilized the sector. Yet, stricter environmental laws governing the use of chlorinated compounds started to push manufacturers towards using safer and greener alternatives, though these moves were still in their infancy.

During 2025 to 2035, the industry will undergo drastic changes with rising sustainability concerns and environmental regulations. Demand for MCB in chemical production will continue to exist, yet there will be an increasing trend towards finding greener substitutes. The focus will be on minimizing the environmental footprint of production processes and finding greener substitutes that offer equivalent benefits in agrochemicals, pharmaceuticals, and polymers.

Furthermore, the Asia-Pacific region, which is one of the key consumers of MCB, will be growing, but with increasing regulation of its use and production. The industry will also be more focused on circular economy principles with innovations in waste management and recycling of chemicals, which have the potential to reframe how MCB will be used.

Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Sustained growth due to its application in chemicals, pharmaceuticals, and agrochemicals. | Progressive transition towards eco-friendly alternatives, led by tighter environmental legislation and sustainability aspirations. |

| Common practice in chemical production, pesticides, and pharmaceuticals. | Growing regulatory pressures and consumers' need for ecologically sustainable products are driving innovation in alternatives. |

| Limited innovation in environmentally friendly alternatives; efficiency in their production. | Increased focus on developing greener products and production processes to reduce the environmental footprint. |

| Increased demand in Asia-Pacific, growing adoption in North America and Europe. | Continued demand in Asia-Pacific but with tighter regulations and growing interest in green practices in North America and Europe. |

| Emerging phases of enviro nmental regulation . | Increased attention to sustainability, with tighter environmental regulations and a shift towards cleaner production technologies. |

| Limited diversification beyond traditional uses in chemicals and pharmaceuticals. | Creation of ecologically friendly alternatives and more sustainable manufacturing processes to meet environmental demands. |

Raw material costs of benzene and chlorine are constantly fluctuating. Instability in such input costs can sharply influence the cost of production, with manufacturers finding it difficult to sustain competitive pricing levels and impacting profit margins.

Strict environmental and safety regulations present significant threats to the industry. Adherence to various regional requirements requires ongoing tracking and adaptation. Failure to adapt can result in legal penalties and loss of brand reputation, which affects revenue share and customer trust.

Breakdowns within the supply chain, such as transport delays or political unrest, can interrupt the timely delivery of raw materials and finished goods. Such disruptions can cause production stops and unfulfilled customer demand, impacting sales and long-term business ties negatively.

There are challenges from growing competition and technological advancements. To stay ahead, businesses must invest in research and development and innovate and enhance product offerings continuously.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 3.9% |

| UK | 2.8% |

| France | 2.6% |

| Germany | 3.1% |

| Italy | 2.4% |

| South Korea | 4.2% |

| Japan | 3.5% |

| China | 5.7% |

| Australia | 2.9% |

| New Zealand | 2.1% |

The USA is also anticipated to grow steadily over the forecast period 2025 to 2035, primarily owing to the intense demand for chemical manufacturing and manufacturing of intermediates such as chlorinated solvents and nitrochlorobenzene derivatives. Having established agrochemical and pharmaceutical industries also plays a role in accelerating the revenue growth rate, facilitated by rigorous regulation protocols enabling managed use and safe handling processes.

Sophisticated technological advancements in synthesis process developments also hold the potential to benefit operational efficiency as well as the environment. Major players in the USA are those that have in-house chemical production lines and high-tech R&D centers, creating specialty chemicals through innovation. High demand for high-performance plastics and dyes, along with investment in environmentally friendly chemical processes, underpin the long-term growth story. Strategic alliances by key leaders will improve the competitive landscape.

The UK is expected to report moderate growth in the period between 2025 and 2035 on the back of pharma, agrochemicals, and dyestuff chlorinated intermediates demand. Increased focus on ecologically compatible production methods and advancement in catalytic chlorination technology is expected to drive growth. Increased government focus on environmentally friendly industrial processes is one aspect that shapes industry trends.

Leading UK producers are investing in the optimization of production and diversification of downstream applications to maintain competitive advantage. The trend towards greener alternatives is gradually altering supply chain dynamics, and niche end-use segment demand is offering new prospects. The UK's export-oriented chemical industry influences domestic trends and strategic direction.

France is anticipated to experience steady but modest growth during the 2025 to 2035 period through demand in chemical synthesis applications for rubber processing chemicals and dyes. Industry performance depends on adherence to EU chemical safety rules, as companies guarantee product purity and safety. Technological improvements in emission control and waste treatment improve environmental protection.

French manufacturers are focusing more on value-added intermediate chemicals and innovation. Multinational chemical companies and continuous investment in environmentally friendly production units ensure that the industry has long-term stability. Despite poor domestic demand, a strategic position in the European network of chemical trade ensures stability.

Germany will experience consistent growth in the MCB industry over the forecast period, aided by its strong industry base and highly advanced chemical production plants. High demand for MCB as a chemical intermediate for herbicides and rubber chemicals remains one of the fundamental growth drivers. Leadership in process automation and chemical innovations in the country enhances efficiency and sustainability.

Top German chemical companies are actively investing in plant modernization and adopting circular economy philosophies to improve operational sustainability. Diversified customer bases and advanced logistics infrastructure guarantee stable supply chains. Green chemistry innovation centers are likely to create future growth.

Italy’s MCB market is forecast to grow modestly between 2025 and 2035, led by demand from Italy's pigment and dye sector and tightly controlled consumption in the agrochemical sector. Italy is characterized by medium-sized production with an emphasis on regulatory and product quality factors.

Italian producers are making themselves more competitive through efficient operation and forays into the EU and nearby export industries. Cleaner technology and the efforts to reduce emissions are reshaping production trends. Industrial innovation and high-tech manufacturing investment on a selective basis will support growth.

South Korea will have a high CAGR in the MCB industry due to the advanced chemical industry and growing consumption of specialty chemicals and electronics. The growing use of MCB in manufacturing high-performance solvents and polymers is fueling momentum. Government support towards chemical research and sustainable operation is also driving long-term growth.

Major South Korean chemical firms are applying automation and digitalization to enhance plant efficiency and reduce environmental footprint. Strategic R&D expenditure and integration into worldwide supply chains also strengthen the industry position. The country's focus on specialty chemical diversification will be driving growth in the forecast period.

Japan will expand steadily from 2025 to 2035 as the demand for drugs, pesticides, and the manufacture of high-end materials increases. Safety in chemical manufacturing and regulatory stringency ensure good product quality and environmental concern. The stability of innovation in catalytic technology and waste reduction techniques also ensures efficiency in the industry.

Leading Japanese chemical firms continue to invest in next-generation technologies and customized chemical solutions. Collaborations with universities and cross-border partnerships underpin innovation pipelines. Domestic demand is relatively stable, yet export-oriented strategies provide additional growth opportunities, underpinning the strength of the sector.

China is projected to lead with the highest CAGR during the forecast period. Industrialization, huge chemical production, and high demand from the dye, pesticide, and rubber sectors are propelling aggressive growth. Government policies encouraging chemical industry modernization and environmental regulation are reshaping the production landscape.

Dominant Chinese chemical manufacturers are expanding capacity and incorporating backward processes to secure feedstock supplies. Investment in eco-friendly technologies and process improvements ensures production efficiency. China's position as the focal point of global supply chains and increasing demand for chemical intermediates are contributing factors for long-term growth.

Australia is expected to evolve moderately, supported primarily by chemical intermediates and specialty manufacturing applications. Although the domestic production base remains limited, imports are used to satisfy most of the demand. Emphasis on quality assurance and regulatory compliance continues to dominate purchasing and application trends.

Australia highlights the development of strong supply chains and regional alliances. Environmental technologies are embraced, and worldwide safety standards are met, thus gaining credibility within the industry. The country's industrial policy promotes investment to invest in specialty chemical capabilities with incremental growth.

New Zealand is expected to register the lowest CAGR among the nations being analyzed, with demand for MCB being limited primarily to niche industrial applications. The industry's small-scale nature and import dependency characterize the local industry. Health and environmental safety regulation emphasis dictates the handling and usage of the product.

Growth is likely to be driven by emerging applications in specialty chemicals and restricted applications in laboratory-scale processes. Strategic alliances with local vendors and improved logistics infrastructure are likely to facilitate reliable supply. Focus on sustainability and innovation in niche segments provides a model for sluggish market development.

By type, Nitrochlorobenzene is expected to account for approximately 46.5% of the entire marketplace, followed by p-dichlorobenzene, which would account for a share of 15.75%.

Nitrochlorobenzene captures the market in its role as an intermediate during the synthesis of aniline, which forms a fundamental basis for dyes, pesticides, and pharmaceuticals. Agriculture and healthcare show a high dependence on this chemical. For example, demand is demonstrated by BASF and Dow Chemical, the leading companies in the market worldwide, as they consume Nitrochlorobenzene to produce rubber chemicals and pharmaceuticals.

More agricultural chemicals like herbicides and insecticides boost the need for nitrochlorobenzene even more, especially in the growing economies of emerging markets with expanding agrarian industries. It is also gaining strength because of the pharmaceutical area, as Nitrochlorobenzene-containing drugs can be found in analgesics and antipyretics.

P-Dichlorobenzene is also one of the major contributors in the marketplace, and it is prominently featured in both household and industrial applications. For example, the production of disinfectants, deodorants, and pesticides, as well as the manufacture of polymer resins, relies on p-dichlorobenzene.

Olin Corporation and Eastman Chemical Company are two important players that use it in several consumer and industrial products, like air fresheners and insecticides. There are more applications of p-dichlorobenzene in mothballs and solvents, keeping it in demand for household and commercial use.

Hence, these two segments are always led by their crucial applications of importance and continuous demand for p-dichlorobenzene: the wide-ranging use of the chemical in various consumer goods and industrial processes and the strong presence of Nitrochlorobenzene for chemicals and pharmaceutical applications. This guarantees a solid demand in the market until even 2025 and beyond.

The estimated share for the industry is projected to be significantly influenced by the Chemicals sector, which is expected to capture 46.5%, closely followed by the Pharmaceutical industry, which is estimated at 12.60%.

Monochlorobenzene is a major chemical in the chemicals sector and accounts for a 46.5% share. It is indispensable in producing key chemical intermediates such as aniline, pesticides, and dyes. The intermediate is extensively used in the manufacture of rubber chemicals, agrochemicals, and polymeric materials, which have far-reaching applications in industry.

For example, chemical companies such as BASF and Dow Chemical process MCB into chemicals that find applications in various sectors such as construction, automotive, and consumer goods. MCB sales will continue to flourish alongside the growth of the global chemical industry.

The pharmaceutical industry is the second-largest end-user of monochlorobenzene, representing 12.60%. Monochlorobenzene is a key intermediate in the manufacture of APIs, especially those used in the synthesis of drugs treating pain, inflammation, and infections.

The demand for Monochlorobenzene-based intermediates will increase as the pharmaceutical domain continues to grow: the global demand for healthcare is on the rise, and patients are in aging populations requiring innovation. Drug manufacturers such as Pfizer and Novartis use Monochlorobenzene to produce therapeutic drugs, which maintains its sustained need within this industry.

It can, therefore, be assumed that global industrial growth and healthcare advancements will not falter in driving steady demand for Monochlorobenzene from the Chemicals and Pharmaceutical industries beyond 2025.

The industryhas regional trends driven by industrial applications, regulations, and downstream demand. Asia Pacific, and more specifically China and India, dominates with extensive use in dye intermediates, agrochemicals, and rubber process chemicals.

Industrialization and rising chemical output are the key drivers. North America has steady growth, with the impetus coming from pharmaceutical demand and specialty chemicals, with the USA having a robust manufacturing base.

Europe possesses stricter environmental legislation that moderates expansion somewhat, but there remains demand for chemical synthesis and solvent usage, especially in France and Germany.

Industry growth is driven by growing industrial infrastructure and foreign investments in chemical processing in the Middle East & Africa, as well as Latin America.

These areas are conducive to the expansion of capacity and export-led manufacturing. Regional growth, in general, depends on manufacturing density, environmental regulations standards, and proximity to large end-use industries such as dyes, adhesives, and drugs.

Integrated production chemical manufacturers dominate the industry. A monopoly is created by companies such as Arkema SA, Bayer AG, and Kureha Corporation, with strategically strong supply chains, very advanced chlorination technologies, and a wide-reaching distribution network. All of these advantages come from vertically integrated operations, which guarantee the filling of raw material columns and cheap ways of production.

Makera Huyan Mapiko and Jinhua Chemical Company, as well as Nanjing Chemical Industry Company, are other big players in Asia who enhance their manufacturing capacity and specialization to develop strategic alliances with end-user industries and thus consolidate the industry position. Therefore, they maintain cheaper ways of production and strong domestic industries for mono-chlorobenzene consumption in agros and dyes.

High-profile global companies such as PPG Industries Inc. and Solutia, Inc. are investing in product innovations and various sustainability measures to satisfy the world's growing need for environment-friendly solutions. Their drive toward improving production efficiency and regulatory compliance further sets them apart from smaller competitors.

An increased footprint of acquired production capability and regional acumen by companies like Tianjin Bohai Chemical Co., Ltd and Mahindra would also be sufficient for the companies to gain a place in the global arena. Strategic tie-ups for downstream chemical processing or industrial manufacturing can put the firms in a position to exploit forthcoming markets and diversify from domestic income streams.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Arkema SA | 18-22% |

| Bayer AG | 14-18% |

| Kureha Corporation | 12-16% |

| Henan Kaipu Chemical Co. Ltd. | 10-14% |

| PPG Industries Inc. | 8-12% |

| Others (combined) | 30-40% |

| Company Name | Key Offerings and Activities |

|---|---|

| Arkema SA | Specializes in high-purity monochlorobenzene for agrochemicals, polymers, and solvents. |

| Bayer AG | Leverages advanced chlorination processes for sustainable production of monochlorobenzene derivatives. |

| Kureha Corporation | Develops high-performance monochlorobenzene applications in specialty chemicals and dyes. |

| Henan Kaipu Chemical Co. Ltd. | Focuses on cost-effective bulk production for industrial and pharmaceutical applications. |

| PPG Industries Inc. | Innovates in high-purity formulations for coatings and specialty applications. |

Key Company Insights

Arkema SA (18-22%)

A key leader in monochlorobenzene production, leveraging integrated supply chains and advanced chlorination technologies.

Bayer AG (14-18%)

Strengthens its competitive edge by enhancing production efficiency and expanding sustainable chemical processes.

Kureha Corporation (12-16%)

Focuses on high-performance monochlorobenzene derivatives for applications in agrochemicals and dyes.

Henan Kaipu Chemical Co. Ltd. (10-14%)

Expand its global presence with cost-effective manufacturing and strategic industry collaborations.

PPG Industries Inc. (8-12%)

Develops high-purity monochlorobenzene solutions catering to specialty coatings and polymers.

Other Key Players

The segmentation is into p-Dichlorobenzene, o-Dichlorobenzene, m-Dichlorobenzene, Tetra chlorobenzenes, Nitrocholorobenzene, Trichlorobenzenes, Hexachlorobenzene, and Others.

The segmentation is into chemicals, pharmaceuticals, rubber, paints & coatings, agriculture, and others.

The segmentation is into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

The global monochlorobenzene market is estimated to be USD 2.06 billion in 2025.

Sales are projected to grow to USD 2.89 billion by 2035, driven by applications in industries like chemicals and manufacturing.

China is expected to grow at a 5.7% CAGR, supported by strong demand from its chemical manufacturing sector.

Nitrochlorobenzene is leading the trend and is primarily used in the production of agrochemicals, dyes, and pharmaceuticals.

Key players in the market include Arkema SA, Bayer AG, Kureha Corporation, Henan Kaipu Chemical Co. Ltd., PPG Industries Inc., Jinhua Chemical (Group) Corporation, Nanjing Chemical Industry Co. Ltd., Solutia, Inc., Tianjin Bohai Chemical Co. Ltd., and Mahindra.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End Use Industry, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End Use Industry, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End Use Industry, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End Use Industry, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End Use Industry, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End Use Industry, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End Use Industry, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End Use Industry, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA