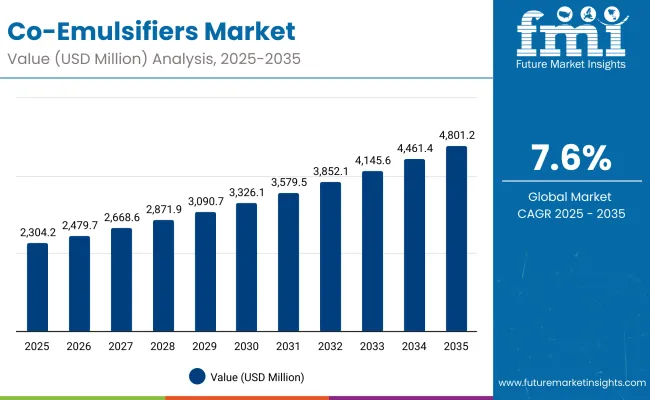

The Co-Emulsifiers Market is expected to record a valuation of USD 2,304.2 million in 2025 and USD 4,801.2 million in 2035, with an increase of USD 2,497.0 million, which equals a growth of 108% over the decade. The overall expansion represents a CAGR of 7.6% and a near 2.1X increase in market size.

Co-Emulsifiers Market Key Takeaways

| Metric | Value |

|---|---|

| Co-Emulsifiers Market Estimated Value in (2025E) | USD 2,304.2 million |

| Co-Emulsifiers Market Forecast Value in (2035F) | USD 4,801.2 million |

| Forecast CAGR (2025 to 2035) | 7.6% |

During the first five-year period from 2025 to 2030, the market increases from USD 2,304.2 million to USD 3,090.7 million, adding USD 786.5 million, which accounts for 31% of the total decade growth. This phase records steady adoption across skincare, sun care, and haircare formulations, with formulators prioritizing HLB balancing aids and polyglyceryl esters for stable and mild emulsions. Free-form grades dominate this period, catering to over 52% of application needs due to their versatility in cold- and hot-process systems.

The second half from 2030 to 2035 contributes USD 1,710.5 million, equal to 69% of total growth, as the market jumps from USD 3,090.7 million to USD 4,801.2 million. This acceleration is powered by premiumization in cosmetics, palm-free and PEG-free demand, and compliance with COSMOS/RSPO standards. Pre-blended bases and encapsulated co-emulsifiers gain wider adoption for high-performance dermocosmetic and pharmaceutical emulsions, while bio-based and multifunctional co-emulsifiers capture increasing share by 2035.

From 2020 to 2024, the Co-Emulsifiers Market steadily expanded, supported by growing demand for mild, multifunctional emulsifier systems in personal care, sun care, and dermocosmetic formulations. During this period, the competitive landscape was dominated by global suppliers focusing on polyglyceryl esters and co-emulsifying waxes, which together accounted for the majority of new product launches. Differentiation relied on sustainability credentials, clean-label positioning, and palm-free sourcing, while RSPO-certified and COSMOS-approved ingredients gained prominence.

Demand for Co-Emulsifiers will expand to USD 2,304.2 million in 2025, with revenue increasingly driven by bio-based, PEG-free, and pre-blended solutions. Traditional suppliers face rising competition from specialty players offering encapsulated delivery systems, multifunctional co-emulsifiers, and fermentation-derived alternatives. Major incumbents are pivoting toward value-added services such as formulation guidance, claim substantiation, and digital sample libraries to retain customer loyalty. The competitive advantage is shifting from commodity emulsifiers to integrated ingredient ecosystems, where compliance, sustainability, and scalability are as important as technical performance.

Global brands are reformulating emulsions with alkyl glucosides and polyglyceryl esters to meet clean-label, palm-free, and PEG-free claims. This shift is not just regulatory-driven but consumer-led, as beauty and personal care buyers increasingly associate “free-from” co-emulsifiers with safety and sustainability. Suppliers offering RSPO-certified, COSMOS-approved, and fermentation-derived grades are winning disproportionate share, fueling structural growth in premium and dermocosmetic product categories.

Formulators are moving from single-function ingredients to pre-blended, multifunctional co-emulsifier systems that deliver stability, viscosity control, and sensory enhancement in one package. This reduces R&D cycles and processing complexity, especially for cold-process emulsions and water-sensitive actives. Growth is strongest in skincare and suncare, where multifunctional co-emulsifiers support rapid product launches and improve cost efficiency, creating a clear competitive edge for suppliers with advanced blending capabilities.

The Co-Emulsifiers Market is segmented by functional role, chemistry type, delivery system, physical form, application, end use, and region. Functional roles include HLB balancing aids, viscosity and rheology assist, stability enhancers, and sensory modifiers, which underpin formulation performance.

By chemistry type, the market covers co-emulsifying waxes, polyglyceryl esters, sorbitan esters, and PEG-free alkyl glucosides, reflecting diverse clean-label and technical needs. Delivery formats range from free-form grades to pre-blended bases and encapsulated systems, while physical forms include flakes, liquid concentrates, and pellets/powders for flexible processing.

Applications span creams and lotions, serums, balms and sticks, and sunscreens, with end uses across skincare, sun care, haircare, and color cosmetics. Regionally, the market is analyzed across North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, with high-growth countries such as India, China, Japan, the USA, Germany, and the U.K. leading adoption.

| Functional Role | Value Share % 2025 |

|---|---|

| HLB balancing aids | 35.6% |

| Others | 64.4% |

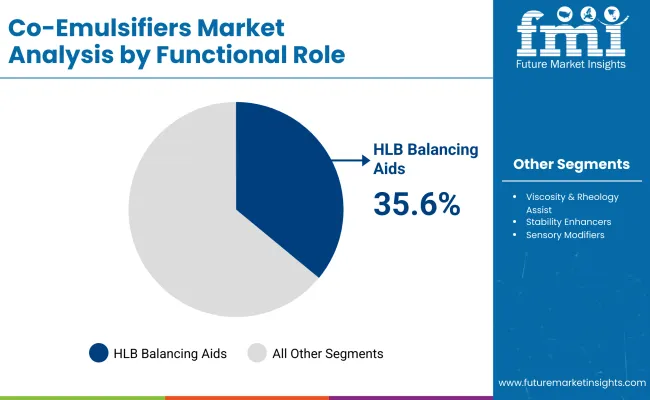

The HLB balancing aids segment is projected to contribute 35.6% of the Co-Emulsifiers Market revenue in 2025, maintaining its lead as the most influential functional role category. Growth is driven by the critical role of HLB adjusters in optimizing emulsion stability, enabling formulators to fine-tune oil/water compatibility across skincare, sun care, and haircare applications.

The segment’s expansion is further supported by clean-label reformulation trends, as brands increasingly rely on polyglyceryl esters and alkyl glucosides to achieve mildness and palm-free credentials. By offering versatility across both cold- and hot-process emulsions, HLB balancing aids are expected to remain a cornerstone in cosmetic and pharmaceutical formulations, supporting premium textures and enhanced stability.

| Chemistry Type | Value Share % 2025 |

|---|---|

| Polyglyceryl esters | 34.5% |

| Others | 65.5% |

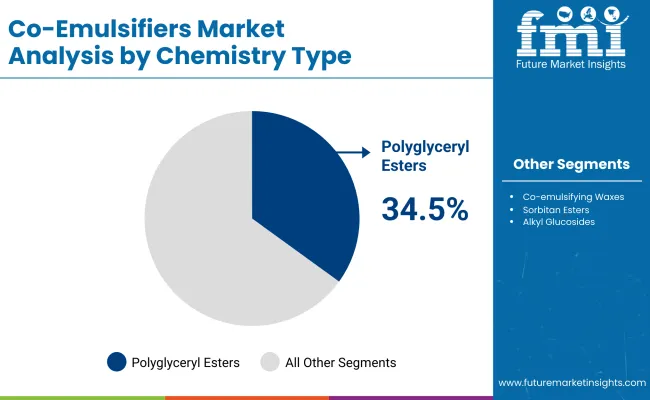

The polyglyceryl esters segment is forecasted to hold 34.5% of the market share in 2025, driven by its wide application in clean-label skincare, sun care, and baby care formulations. These esters are favored for their mildness, excellent emulsifying efficiency, and compatibility with natural oils, making them indispensable in products requiring both stability and sensory appeal. Their versatility in palm-free and PEG-free systems has further facilitated widespread adoption among global brands seeking sustainable and consumer-friendly solutions.

Growth is also bolstered by their ability to support cold-process emulsions and multifunctional roles such as moisturization and skin barrier reinforcement. As cosmetic and dermopharma markets increasingly prioritize eco-certified and bio-based emulsifiers, polyglyceryl esters are expected to continue their strong momentum over the forecast period.

| Delivery System | Value Share % 2025 |

|---|---|

| Free form | 52.2% |

| Others | 47.8% |

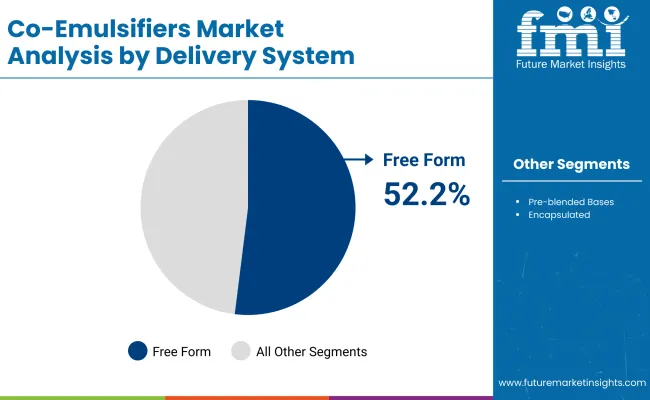

The free form delivery system segment is projected to account for 52.2% of the Co-Emulsifiers Market revenue in 2025, establishing it as the leading format. Free form grades are preferred by formulators for their flexibility in dosage adjustment, broad compatibility with oils and actives, and ease of incorporation into cold- and hot-process emulsions.

Their suitability across diverse formulations such as creams, lotions, and sunscreens has driven widespread adoption, particularly in skincare and sun care products. In addition, free form co-emulsifiers enable faster product development cycles by reducing the need for complex pre-processing steps. With demand rising for cost-effective yet multifunctional emulsifier systems, free form grades are expected to maintain their leadership over the forecast period.

Rising Demand for Clean-Label and PEG-Free Formulations

The Co-Emulsifiers Market is being propelled by the surge in demand for clean-label products, especially PEG-free, palm-free, and naturally derived ingredients. Brands are actively reformulating to comply with COSMOS, NATRUE, and RSPO certifications, which favor the use of polyglyceryl esters and alkyl glucosides as mild and sustainable alternatives.

This is reinforced by consumer preference for transparent ingredient lists and “free-from” claims in personal care and cosmetics. As regulatory bodies tighten restrictions on ethoxylated compounds, suppliers focusing on bio-based and eco-certified co-emulsifiers are capturing faster adoption across skincare and sun care portfolios.

Expansion of Premium and Multifunctional Cosmetic Products

Growth is strongly supported by the expansion of premium cosmetics and dermocosmetics requiring co-emulsifiers with multifunctional properties such as stability enhancement, sensory improvement, and moisturizing benefits. Pre-blended and encapsulated delivery systems allow formulators to shorten development cycles while offering performance in complex emulsions like sunscreens and color cosmetics.

Rising consumer willingness to pay for premium textures and high-performance formulations has created consistent demand for advanced co-emulsifiers. This shift benefits suppliers with strong R&D pipelines and the ability to combine multiple functionalities into a single ingredient system, improving both cost efficiency and product differentiation.

Volatility in Raw Material Sourcing and Compliance Costs

A key restraint for the Co-Emulsifiers Market is the volatility of raw material sourcing, particularly for fatty alcohols, palm derivatives, and specialty esters. Price fluctuations linked to palm oil supply, combined with sustainability pressures, have increased procurement costs for manufacturers.

Additionally, compliance with evolving standards such as REACH, Prop 65, and RSPO adds both operational complexity and certification expenses. Smaller players face challenges in scaling eco-certified supply chains, while global suppliers must continually invest in traceability and alternative feedstocks. These pressures limit margins and can slow adoption in cost-sensitive applications like mass-market personal care and home care.

Adoption of Pre-Blended and Encapsulated Co-Emulsifiers

A clear trend shaping the Co-Emulsifiers Market is the growing adoption of pre-blended and encapsulated formats. Unlike free-form ingredients, these systems offer improved emulsion stability, ease of incorporation, and compatibility with sensitive actives, making them ideal for high-performance dermocosmetics and pharmaceutical topicals.

Their use supports cold-process manufacturing, reducing energy costs and enabling faster formulation cycles. Encapsulation further enhances controlled release, texture, and sensory experience. As global brands seek efficiency and differentiation, suppliers providing turnkey pre-blended or encapsulated solutions are emerging as preferred partners, reshaping the competitive dynamics of the co-emulsifier landscape.

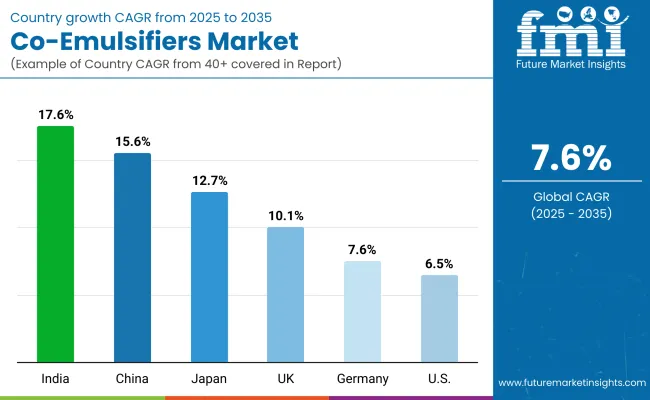

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 15.6% |

| USA | 6.5% |

| India | 17.6% |

| UK | 10.1% |

| Germany | 7.6% |

| Japan | 12.7% |

The global Co-Emulsifiers Market displays clear regional disparities in growth, largely influenced by consumer preferences, regulatory compliance, and the shift toward clean-label formulations. Asia-Pacific is the fastest-growing region, anchored by India (17.6% CAGR) and China (15.6% CAGR). India’s surge reflects the rapid expansion of mass skincare and suncare categories, with local brands adopting palm-free and bio-based co-emulsifiers to meet consumer and export demands. China, on the other hand, benefits from large-scale adoption of polyglyceryl esters and alkyl glucosides in premium skincare and color cosmetics, supported by strong domestic production and evolving safety standards.

Europe maintains steady growth, led by Germany (7.6% CAGR) and the UK (10.1% CAGR), underpinned by stringent EU compliance requirements and consumer demand for COSMOS- and RSPO-certified ingredients. Growth is further supported by the region’s leadership in dermocosmetics and high-end suncare, where multifunctional co-emulsifiers play a critical role. Japan (12.7% CAGR) also reflects rising demand for encapsulated and multifunctional systems, tied to its premium dermocosmetic innovation.

North America, with the USA at 6.5% CAGR, shows moderate expansion due to its mature market structure. Growth here is more service- and compliance-driven, with brands focusing on RSPO-certified sourcing, palm-free portfolios, and PEG-free claims, while premium skincare and baby care continue to be strong demand drivers.

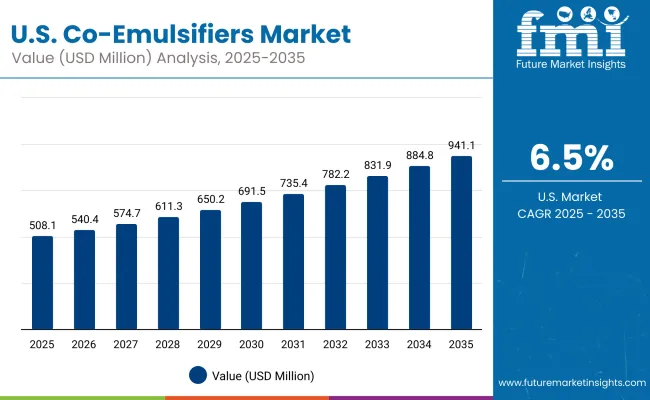

| Year | USA Market (USD Million) |

|---|---|

| 2025 | 508.13 |

| 2026 | 540.43 |

| 2027 | 574.79 |

| 2028 | 611.33 |

| 2029 | 650.20 |

| 2030 | 691.53 |

| 2031 | 735.49 |

| 2032 | 782.25 |

| 2033 | 831.98 |

| 2034 | 884.88 |

| 2035 | 941.13 |

The Co-Emulsifiers Market in the United States is projected to grow at a CAGR of 6.5%, led by rising adoption of PEG-free and palm-free co-emulsifiers in personal care and dermocosmetic formulations. Strong consumer preference for clean-label skincare, baby care, and sun care products is accelerating demand for polyglyceryl esters and co-emulsifying waxes.

Compliance with RSPO, COSMOS, and Prop 65 standards further strengthens the USA market as formulators shift portfolios toward eco-certified and safe emulsifier systems. Growth is also supported by pre-blended co-emulsifier systems, which simplify processing and shorten formulation timelines for local brands competing in fast-moving premium and mass-market segments.

The Co-Emulsifiers Market in the United Kingdom is expected to grow at a CAGR of 10.1% between 2025 and 2035, supported by strong adoption in premium skincare, sun care, and color cosmetics. Demand is driven by consumer preference for clean-label, RSPO-certified, and palm-free co-emulsifiers, with polyglyceryl esters and alkyl glucosides gaining traction as mild, multifunctional alternatives.

The market is also benefiting from growing investments in dermocosmetic R&D and a shift toward encapsulated and pre-blended emulsifier systems that reduce formulation timelines. Collaborative initiatives between academic institutions, formulators, and ingredient suppliers are further fostering innovation in sustainable and high-performance emulsifier technologies.

India is witnessing rapid expansion in the Co-Emulsifiers Market, projected to grow at a CAGR of 17.6% through 2035. The surge is driven by strong demand for affordable skincare and sun care products, alongside rising adoption of palm-free, PEG-free, and bio-based co-emulsifiers by local and regional brands.

Tier-2 and tier-3 cities are emerging growth hubs, as MSMEs and contract manufacturers increasingly adopt pre-blended co-emulsifier systems that lower production costs and simplify formulation. Government initiatives encouraging sustainable cosmetics and herbal-based innovation are further strengthening domestic adoption and export competitiveness.

The Co-Emulsifiers Market in China is expected to grow at a CAGR of 15.6%, the highest among leading economies. Growth momentum is driven by surging demand for premium skincare, sun care, and color cosmetics, combined with strong domestic production of polyglyceryl esters and alkyl glucosides.

Local manufacturers are rapidly scaling capacity for palm-free and PEG-free emulsifiers, making sustainable options more affordable and accessible. Government-backed initiatives promoting green chemistry and cosmetic safety compliance are further propelling adoption. With Chinese consumers increasingly favoring bio-based, multifunctional, and encapsulated co-emulsifiers, the market is positioned for sustained double-digit growth through 2035.

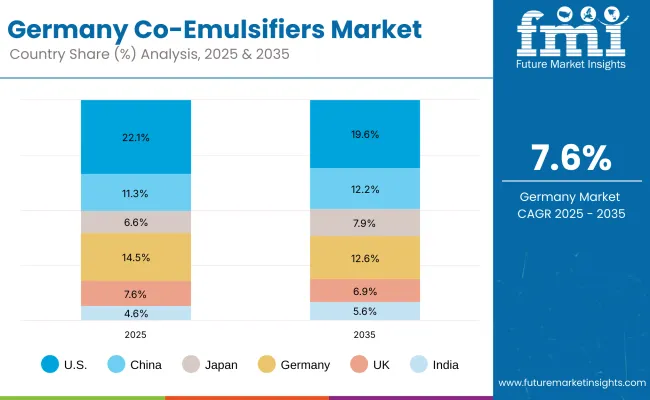

| Country | 2025 Share (%) |

|---|---|

| USA | 22.1% |

| China | 11.3% |

| Japan | 6.6% |

| Germany | 14.5% |

| UK | 7.6% |

| India | 4.6% |

| Country | 2035 Share (%) |

|---|---|

| USA | 19.6% |

| China | 12.2% |

| Japan | 7.9% |

| Germany | 12.6% |

| UK | 6.9% |

| India | 5.6% |

The Co-Emulsifiers Market in Germany is projected to grow at a CAGR of 7.6%, supported by the country’s position as a leader in high-quality personal care and dermocosmetic innovation. German formulators are actively incorporating COSMOS- and RSPO-certified co-emulsifiers to comply with stringent EU regulations on sustainability and ingredient safety.

Demand is particularly strong in skincare and suncare categories, where HLB balancing aids and polyglyceryl esters are critical for stable, mild, and multifunctional emulsions. Growth is also driven by premiumization trends, with pharmaceutical and dermo brands increasingly adopting pre-blended and encapsulated delivery systems to improve stability, processing efficiency, and product differentiation.

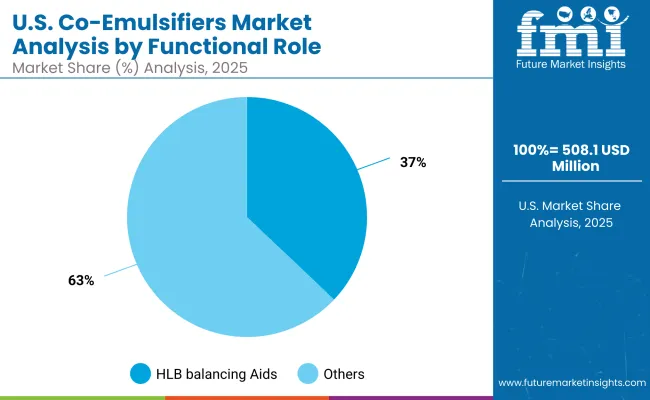

| USA By Functional Role | Value Share % 2025 |

|---|---|

| HLB balancing aids | 37.1% |

| Others | 62.9% |

The Co-Emulsifiers Market in the United States is projected to reach USD 508.1 million in 2025, growing at a CAGR of 6.5% through 2035. HLB balancing aids lead with 37.1% share, reflecting their critical role in stabilizing emulsions across skincare, suncare, and baby care applications.

Growth is increasingly driven by PEG-free and palm-free formulations, as USA consumers demand transparency and safer cosmetic ingredients. Suppliers are also seeing higher adoption of pre-blended bases, which simplify formulation, reduce R&D costs, and enable faster product launches.

The country’s regulatory landscape including Prop 65 compliance, RSPO certification, and FDA oversight for dermocosmetics further encourages innovation in bio-based, multifunctional, and eco-certified co-emulsifiers. Over the next decade, the USA market will continue to shift toward premium skincare, baby care, and clean-label categories, making sustainability and functionality the core growth levers.

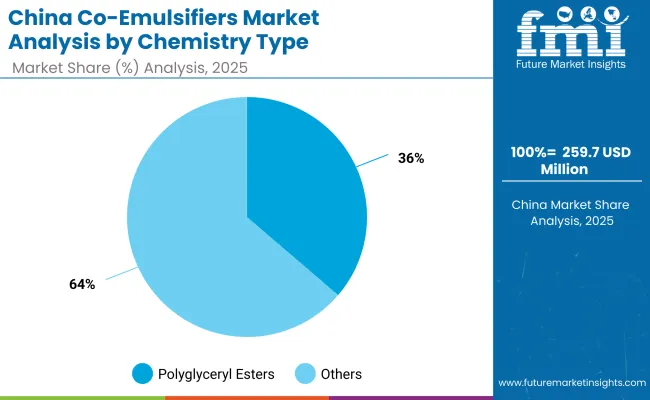

| China By Chemistry Type | Value Share % 2025 |

|---|---|

| Polyglyceryl esters | 36.3% |

| Others | 63.7% |

The Co-Emulsifiers Market in China is expected to expand rapidly, reaching USD 259.7 million in 2025 and growing at a CAGR of 15.6% through 2035. A key opportunity lies in the rising adoption of polyglyceryl esters, which already account for 36.3% of market share, as they align with clean-label and palm-free formulation trends. China’s strong domestic cosmetics and skincare ecosystem, combined with government support for green chemistry and regulatory compliance, is creating demand for eco-certified, multifunctional, and encapsulated co-emulsifiers.

China’s market opportunity is further amplified by local production advantages. Domestic suppliers are scaling palm-free and PEG-free alternatives at competitive prices, making sustainable co-emulsifiers accessible for both multinational and local brands. With rising consumer preference for premium skincare, color cosmetics, and multifunctional products, China is positioned to be a central hub for innovation and export-oriented supply in the global co-emulsifier landscape.

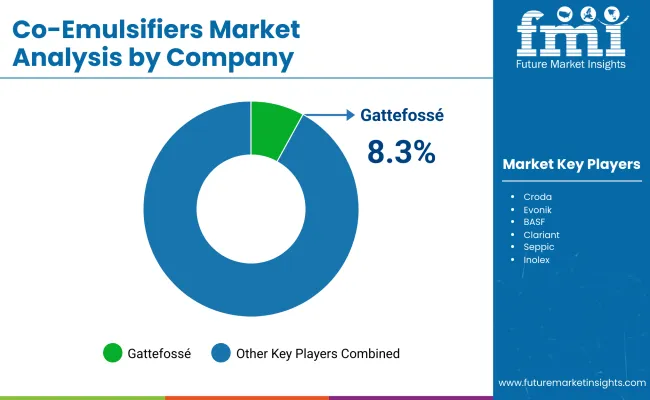

| Company | Global Value Share 2025 |

|---|---|

| Gattefossé | 8.3% |

| Others | 91.7% |

The Co-Emulsifiers Market is moderately fragmented, with a mix of global ingredient leaders, regional specialists, and niche-focused innovators competing across diverse formulation applications. Global leaders such as Croda, BASF, Evonik, Clariant, and Seppic hold significant positions, leveraging broad portfolios of polyglyceryl esters, co-emulsifying waxes, and alkyl glucosides. Their strategies emphasize clean-label innovation, RSPO-certified sourcing, and multifunctional delivery systems to align with regulatory and consumer demands.

Mid-sized innovators including Gattefossé, Inolex, and Ashland focus on pre-blended and encapsulated co-emulsifier systems that simplify formulation and accelerate time-to-market, particularly in dermocosmetics and premium skincare. Their ability to deliver tailored solutions and strong technical support makes them highly competitive in value-added segments.

Specialist providers such as KosterKeunen and Nouryon cater to application-specific needs with wax-based and bio-based co-emulsifiers, addressing niches in baby care, natural cosmetics, and pharmaceutical topicals. Their strength lies in sustainability credentials, custom blends, and regional adaptability rather than sheer scale.

Competitive differentiation is increasingly shifting away from commodity emulsifiers toward integrated ingredient ecosystems that combine compliance, sustainability, multifunctionality, and supplier-backed formulation services. Players able to combine bio-based innovation with scalable supply chains are expected to strengthen their leadership over the next decade.

Key Developments in Co-Emulsifiers Market

| Item | Value |

|---|---|

| Quantitative Units | USD 2,304.2 Million |

| Functional Role | HLB balancing aids, Viscosity & rheology assist, Stability enhancers, Sensory modifiers |

| Chemistry Type | Co-emulsifying waxes, Polyglyceryl esters, Sorbitan esters, Alkyl glucosides (PEG-free) |

| Delivery System | Free form, Pre-blended bases, Encapsulated |

| Physical Form | Flakes/pastilles, Liquid concentrate, Pellets/powder |

| Application | Creams & lotions, Serums, Balms & sticks, Sunscreens |

| End Use | Skincare, Sun care, Haircare, Color cosmetics |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Croda , Evonik , BASF, Gattefossé , Clariant , Seppic , Inolex , Ashland, Nouryon , Koster Keunen |

| Additional Attributes | Dollar sales by chemistry type and end use, HLB-band mix, delivery system split (free-form vs pre-blends), PEG-free/palm-free adoption, growth in skincare and suncare , RSPO/COSMOS compliance impact, APAC acceleration (China, India), shift to pre-blended/encapsulated systems, cold-process/energy-saving use, innovation in polyglyceryl esters and alkyl glucosides. |

The global Co-Emulsifiers Market is estimated to be valued at USD 2,304.2 million in 2025.

The market size for the Co-Emulsifiers Market is projected to reach USD 4,801.2 million by 2035.

The Co-Emulsifiers Market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key chemistry types in the Co-Emulsifiers Market are co-emulsifying waxes, polyglyceryl esters, sorbitan esters, and alkyl glucosides (PEG-free).

In terms of delivery systems, the free-form segment is set to command the significant share in 2025, accounting for 52.2% of market value.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA