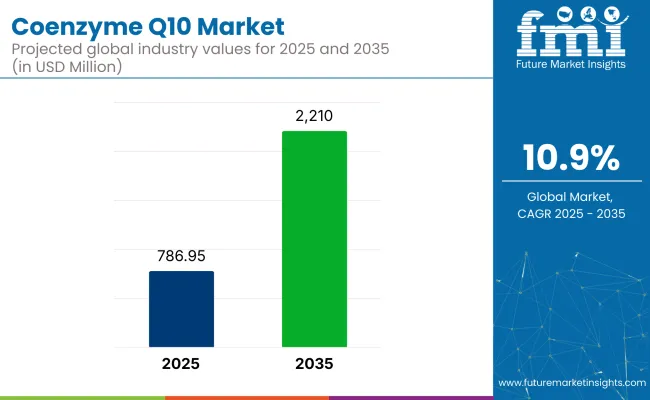

The Coenzyme Q10 market is expected to see significant growth, driven by rising consumer awareness of its health benefits, particularly in energy production, heart health, and anti-aging. The industry is expected to grow from USD 786.95 million in 2025 to USD 2,210 million by 2035, reflecting a CAGR of 10.9%.

In a recent interview, Duke Pitts, President of Healthy Extracts, emphasized the importance of Coenzyme Q10 for those on statin therapy, stating, “If you take a statin, our new STAT10 is a must-have addition to your daily health regime.” This highlights the growing recognition of CoQ10’s role in supporting heart health and its critical contribution to individuals managing statin-induced nutrient depletion, thus promoting overall wellness.

The coenzyme Q10 market holds varying shares within its parent markets. Within the nutraceuticals market, Coenzyme Q10 accounts for approximately 5-7%, driven by its widespread use in supplements for heart health and energy. In the vitamins and supplements market, its share is around 3-5%, as it competes with other popular supplements like vitamins C and D.

Within the pharmaceuticals market, Coenzyme Q10 represents a smaller share of about 1-2%, mainly used in specialized treatments for cardiovascular diseases and as an adjunct therapy for other conditions. In the cosmetics and personal care market, its share is approximately 2-3%, due to its inclusion in anti-aging products. In the functional foods and beverages market, Coenzyme Q10 holds around 1-2%, added to energy drinks and health-boosting foods.

Key players such as Kaneka Corporation, DSM, and Doctor’s Best are enhancing their portfolios through innovations in formulations and advanced delivery systems. As demand for natural health supplements continues to rise, CoQ10’s role in energy production, anti-aging, and cardiovascular health is driving its strong growth globally, particularly in regions like North America, Europe, and Asia-Pacific.

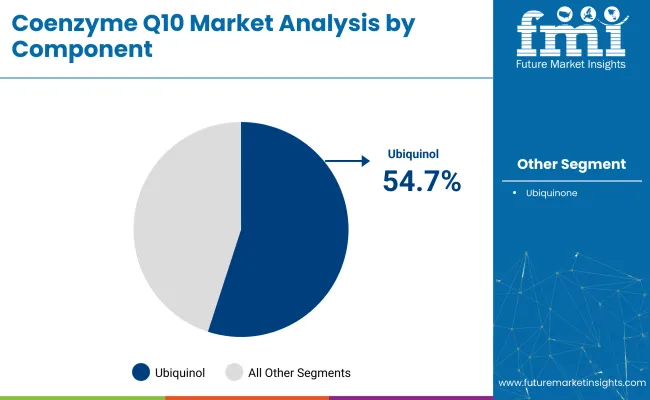

The Coenzyme Q10 market is expected to grow, driven by key segments including Ubiquinol, pharmaceutical-grade products, dietary supplements, and distribution channels like supermarkets. Ubiquinol and pharmaceutical-grade CoQ10 will continue leading, with strong demand for functional and effective supplements.

Ubiquinol is projected to dominate the CoQ10 product segment in 2025, capturing 54.7% of the industry share. Known for its higher bioavailability than ubiquinone (oxidized form), ubiquinol is widely used in dietary supplements and functional foods.

Leading manufacturers such as Kaneka Corporation and DSM continue to focus on improving ubiquinol’s formulation efficiency to meet consumer demand for natural and effective supplements. Ubiquinol’s superior absorption makes it a preferred choice for consumers seeking energy, anti-aging, and cardiovascular health benefits.

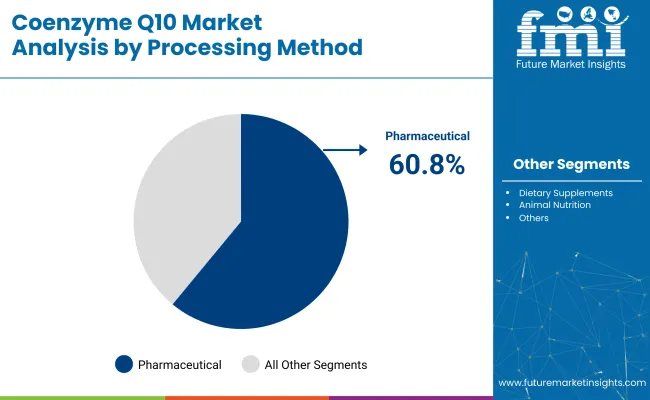

Pharmaceutical-grade CoQ10 is expected to hold a 60.8% share of the industry by 2025. This form of CoQ10 is extensively used in medical applications, particularly for heart health treatments and clinical supplements. Pharmaceutical-grade CoQ10 is essential in prescription medications and is highly valued for its efficacy in managing cardiovascular health.

Key companies like Kaneka Corporation and Pharma Nord are heavily investing in R&D to meet the growing demand for effective, high-quality CoQ10 products. The segment is projected to continue growing, driven by increasing awareness of its health benefits.

Powder and crystalline CoQ10 formulations are set to dominate the industry with a 26.5% share in 2025. These formulations are preferred for their versatility and ease of incorporation into dietary supplements, functional foods, and energy drinks. Companies like Jarrow Formulas and DSM focus on enhancing the absorption of powder-based CoQ10 to increase product effectiveness.

The growing demand for energy-boosting and heart health supplements ensures powder and crystalline CoQ10 forms remain a leading choice. These forms are seen as both affordable and efficient solutions for consumers seeking daily health maintenance.

Dietary supplements are expected to capture 42.1% of the CoQ10 industry in 2025. The rising consumer focus on health and wellness, particularly in areas such as cardiovascular health, anti-aging, and energy-boosting benefits, is driving demand for CoQ10 in various forms like softgels, chewables, and powders.

Leading brands such as Doctor’s Best and GNC Holdings, Inc. are expanding their CoQ10 product offerings in line with consumer preferences. The dietary supplements segment is expected to lead industry growth, particularly in North America and Europe, as awareness of CoQ10’s benefits increases.

Retail pharmacies and drug stores are expected to account for 20.3% of the CoQ10 industry in 2025. These channels are preferred for their accessibility and consumer trust in established pharmacies for health products. Companies like GNC Holdings and Vitamin Shoppe are expanding their retail networks, providing easier access to CoQ10 supplements.

The offline retail environment remains important, as it allows consumers to examine product labels, receive professional guidance, and take advantage of in-store promotions. This trust and convenience continue to strengthen retail pharmacies and drug stores as a key distribution channel.

The coenzyme Q10 market is growing due to increasing demand for natural supplements that support heart health, energy production, and anti-aging. However, regulatory challenges and raw material sourcing issues hinder growth, prompting companies to focus on improving efficiency and compliance.

Rising Demand for Natural Health Supplements Driving Market Growth

The coenzyme Q10 (CoQ10) industry is expanding, largely driven by increasing consumer demand for natural health supplements. As more individuals seek to enhance heart health, boost energy levels, and slow the effects of aging, the popularity of CoQ10 in dietary supplements and functional foods is growing.

CoQ10’s well-documented benefits in supporting cellular energy production are fueling its adoption, particularly in the wellness and anti-aging sectors. As consumer awareness continues to rise, CoQ10’s role in holistic health management is significantly strengthening industry demand.

Regulatory Challenges and Raw Material Sourcing Pose Challenges

Despite strong demand, the CoQ10 industry faces significant hurdles due to regulatory compliance and raw material sourcing issues. Stringent regulations, particularly in the pharmaceutical and food industries, complicate product approvals in several key industries. Additionally, the extraction of CoQ10 from natural sources remains costly, affecting both production timelines and cost-efficiency.

To address these obstacles, companies are focusing on enhancing production efficiency, exploring synthetic alternatives, and ensuring compliance with global standards to mitigate risks and reduce operational costs, thereby maintaining steady industry growth.

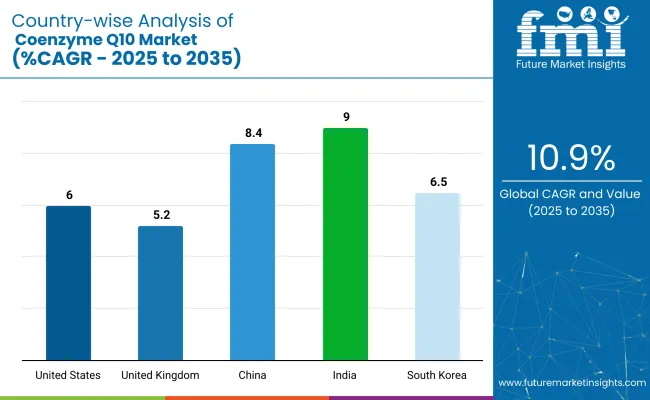

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 6% |

| United Kingdom | 5.2% |

| China | 8.4% |

| India | 9% |

| South Korea | 6.5% |

The global Coenzyme Q10 Market is projected to grow at a CAGR of 10.9% from 2025 to 2035. The United States, with a CAGR of 6%, shows steady growth, supported by strong demand for CoQ10 in dietary supplements and its growing application in the pharmaceutical and cosmetic industries. The United Kingdom, at 5.2%, demonstrates more modest growth, driven by the increasing popularity of natural health supplements and awareness of CoQ10’s benefits for energy production and anti-aging.

China, with a CAGR of 8.4%, reflects stronger growth as the demand for health supplements rises among the growing middle class and with an increasing focus on wellness and aging. India, at 9%, shows significant growth, driven by expanding health-conscious consumer segments and increasing adoption of CoQ10 for wellness and longevity.

South Korea, at 6.5%, sees steady growth due to the rising demand for CoQ10 in functional foods and cosmetics. While OECD countries experience moderate growth, India and China stand out with their faster-paced growth, marking them as key players in shaping the future of the global industry.

The report covers in-depth analysis of 40+ countries; five top-performing OECD and BRICS countries are highlighted below.

The CoQ10 industry in the United States is expected to grow at a steady CAGR of 6% from 2025 to 2035. This growth is fueled by a health-conscious population, an aging demographic, and a high prevalence of cardiovascular and neurodegenerative diseases.

Advanced distribution networks, regulatory clarity, and ongoing product innovation-such as clean-label and combination supplements-are further strengthening industry growth. Manufacturers are also focusing on transparency and clinically backed formulations to meet consumer expectations.

With a projected CAGR of 5.2% through 2035, the market in United Kingdom is supported by growing health awareness and a national focus on preventive wellness. NHS and private practitioners are increasingly recommending CoQ10 for heart health and statin side effects. The industry is also witnessing a surge in demand for vegan and allergen-free CoQ10, while e-commerce and pharmacy chains have made supplements more accessible to consumers nationwide.

Growing at a CAGR of 9% from 2025 to 2035, the Coenzyme Q10 industry in India is set to be the fastest expanding globally. This growth is driven by increasing awareness of lifestyle diseases, a rapidly expanding middle class, and rising healthcare expenditure. CoQ10 is gaining popularity in cardiac care, diabetes management, and fertility treatments.

Affordable, locally produced supplements and the surge in e-commerce are making CoQ10 accessible to a broader population, while domestic pharmaceutical companies are introducing cost-effective formulations to cater to price-sensitive consumers.

The industry in China is projected to grow at a robust CAGR of 8.4% between 2025 and 2035, making it one of the fastest-growing industries worldwide. CoQ10 is popular for its anti-aging, energy, and cardiovascular benefits, appealing to both older adults and younger fitness enthusiasts. The country’s strong domestic production supports both local and export industries, while government initiatives promoting healthy aging further accelerate adoption.

The industry in South Korea is projected to grow at a CAGR of 6.5% from 2025 to 2035, driven by a sophisticated consumer base and a strong culture of preventive health. CoQ10 is widely used in cosmeceuticals and functional foods, in addition to traditional supplements. Innovative delivery forms and premium, science-backed products are in high demand, supported by dynamic promotion and a robust online retail ecosystem.

The global industry features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as Kaneka Corporation, DSM, and SourceOne Global Partners, LLC lead the industry with extensive product portfolios, strong R&D capabilities, and robust distribution networks across dietary supplements, pharmaceuticals, and cosmetics sectors.

Key players including Healthy Origins, Vitamin Shoppe, Inc., and Pharmavite LLC offer specialized formulations tailored to specific applications and regional markets. Emerging players, such as Xiamen Kingdomway Group, Kyowa Hakko USA Inc., and Tishcon Corporation, focus on innovative extraction technologies and cost-effective solutions, expanding their presence in the global industry.

Recent Industry News

In April 2024, Beiersdorf announced the launch of the NIVEA Q10 Dual Action Serum, following nearly a decade of research on skin glycation and its impact on aging and wrinkles. The serum combines GLYCOSTOP™, a patented active ingredient that targets sugar-induced skin aging, with Coenzyme Q10 (Q10). GLYCOSTOP™ helps prevent the formation of advanced glycation end-products (AGEs) by neutralizing sugar molecules, which can weaken collagen and accelerate aging. The formula is designed to visibly reduce wrinkles in just two weeks. The product is eco-friendly, free from silicones and mineral oils, and packaged in recycled glass for sustainability.

| Report Attributes | Details |

|---|---|

| Estimated Industry Size (2025) | USD 786.95 million |

| Projected Industry Size (2035) | USD 2,210 million |

| CAGR (2025 to 2035) | 10.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and thousand units for volume |

| Product Types Analyzed (Segment 1) | Ubiquinone (oxidized form), Ubiquinol (reduced form) |

| Grade Segmentation (Segment 2) | Pharmaceutical grade, Food grade, Cosmetic grade |

| Formulation Segmentation (Segment 3) | Powder & crystalline forms, Oil suspensions & solutions, Softgel capsules, Hard capsules, Tablets & chewables, Advanced delivery systems, Liposomal & micellar formulations, Nanoparticle-based systems, Other advanced formulations, Other formulations |

| Application Segmentation (Segment 4) | Dietary supplements, Pharmaceuticals, Cosmetics & personal care, Functional foods & beverages, Animal nutrition, Other applications |

| Distribution Channel Segmentation (Segment 5) | Retail pharmacies & drug stores, Supermarkets & hypermarkets, Specialty health stores, Online retail, E-commerce platforms, Direct-to-consumer websites, Subscription services, Healthcare practitioners, Other distribution channels |

| Regions Covered | North America, Latin America, Europe, Asia-Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ (Australia & New Zealand), GCC Countries, South Africa |

| Key Players Influencing the Industry | Country Life, LLC, Doctor’s Best, DSM, GNC Holdings, Inc., Healthy Origins, Jarrow Formulas, Kaneka Corporation, Natural Organics, NBTY, Inc., Nordic Naturals, Inc., NOW Foods, Pharma Nord, Inc., Pharmavite LLC, QUTEN Research Institute LLC, SourceOne Global Partners, LLC, Tishcon Corp., Vitamin Shoppe, Inc., Xiamen Kingdomway Group |

| Additional Attributes | Dollar sales by product type, grade, and formulation, growing consumer demand for anti-aging and energy supplements, increasing incorporation of CoQ10 in functional foods and beverages, regional trends in CoQ10 supplementation for heart health, growth of e-commerce platforms in supplement distribution. |

The industry is segmented into ubiquinone (oxidized form) and ubiquinol (reduced form).

The industry is segmented into pharmaceutical grade, food grade, and cosmetic grade.

The industry is segmented into powder & crystalline forms, oil suspensions & solutions, softgel capsules, hard capsules, tablets & chewables, advanced delivery systems, liposomal & micellar formulations, nanoparticle-based systems, and other advanced formulations.

The industry is segmented into dietary supplements, pharmaceuticals, cosmetics & personal care, functional foods & beverages, animal nutrition, and other applications.

The industry is segmented into retail pharmacies & drug stores, supermarkets & hypermarkets, specialty health stores, online retail, e-commerce platforms, direct-to-consumer websites, subscription services, healthcare practitioners, and other distribution channels.

The industry is segmented into North America, Latin America, Europe, Asia-Pacific, and Middle East & Africa.

The global industry is expected to reach USD 2,210 million by 2035.

In 2025, the industry is valued at USD 786.95 million.

Ubiquinol (the reduced form) is expected to dominate the industry in 2025 with 54.7% industry share.

Dietary supplements will hold the largest industry share in 2025, accounting for 42.1%.

Retail pharmacies & drug stores are expected to be the leading distribution channel in 2025 with 20.3% industry share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

CoQ10 Gummies Market Analysis by Source, Distribution Channels, and Key Regions Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA