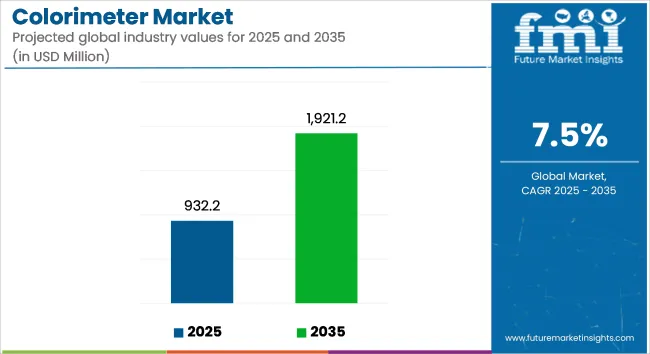

The global colorimeter market is projected to expand from USD 932.18 million in 2025 to USD 1,921.2 million by 2035. A compound annual growth rate (CAGR) of 7.5% is expected to be registered during this period. This growth is being propelled by the increasing emphasis on color accuracy and consistency across critical end-use industries. Applications in food and beverage processing, plastics manufacturing, textiles, automotive coatings, and consumer packaging are demanding greater uniformity in appearance, prompting widespread adoption of advanced color measurement systems.

Colorimeters are being adopted due to their ability to ensure compliance with brand specifications and reduce variability across production lines. As color precision becomes a standardized performance parameter, industries have increasingly shifted toward digital, easy-to-calibrate, and field-deployable devices. This demand has led to notable patent activity and product innovation, particularly from Chinese technology manufacturers.

In 2024, Shenzhen 3nh Technology Co., Ltd. was awarded patent CN218330255U for a newly engineered colorimeter featuring improved measurement sensitivity and ergonomic form. The instrument was designed for enhanced portability and is being optimized for use across production environments. Also in 2024, Shenzhen Wave Optoelectronics Co., Ltd. was granted patent CN221037681U for a digital colorimeter that integrates advanced optical components and an intuitive interface. This system is intended to streamline operations in high-throughput, accuracy-critical workflows.

These developments reflect the intensification of R&D investments by regional manufacturers and signal a transition from conventional benchtop colorimeters to next-generation systems tailored for diverse use cases. The momentum displayed by Chinese players indicates their growing influence in setting benchmarks for industrial color measurement innovation.

A notable trend has emerged wherein application-specific and portable colorimeters are increasingly being preferred over legacy systems. This shift is being enabled by embedded optical enhancements, real-time data acquisition, wireless connectivity, and touchscreen functionality. Devices are no longer limited to quality control labs; they are now being embedded into inline production environments to support operational agility and reduce downtime. As these solutions continue to be scaled, their adoption is expected to contribute significantly to the global colorimeter market’s growth trajectory through 2035.

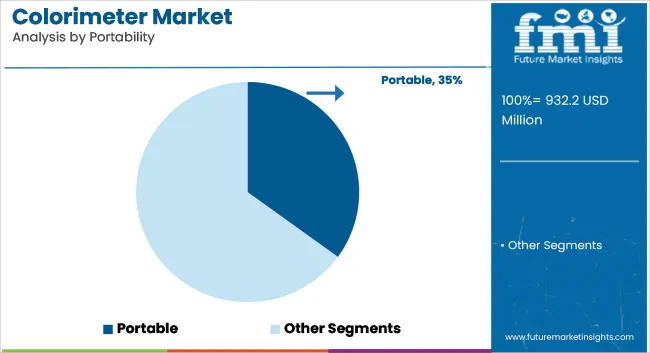

By 2035, portable colorimeters are projected to occupy nearly 35% of the global colorimeter market. Over the forecast period from 2025 to 2035, this segment is expected to register a compound annual growth rate (CAGR) of 6.7%. Growth has been driven by rising demand for real-time, on-site color analysis across industries such as food processing, textiles, construction materials, and automotive coatings.

The flexibility and ease of deployment offered by portable colorimeters have led to their growing preference in production environments, where laboratory testing may not be feasible. These devices are being adopted for their ability to deliver fast, accurate readings with minimal operator training. Additionally, manufacturers are integrating features such as touchscreen interfaces, wireless connectivity, and data storage into compact designs, making them suitable for field audits and quality checks.

Recent innovations by manufacturers in Asia and Europe have focused on improving sensor calibration, battery life, and ergonomic handling. As quality control continues to move closer to the point of production, portable colorimeters are expected to become an essential tool for ensuring color consistency in dynamic operating conditions.

The demand for colorimeters in the water utilities sector is projected to reach a 25% share of the global market by 2035. A compound annual growth rate (CAGR) of 7.1% is expected to be recorded over the forecast period. This growth is being driven by the increasing focus on water quality monitoring, stricter environmental compliance standards, and the rising need for rapid on-site testing in municipal and industrial water systems.

Colorimeters are being used to measure residual chlorine, turbidity, and other chemical concentrations that directly impact water safety and treatment efficiency. Their ability to provide precise, real-time colorimetric analysis has positioned them as critical tools in both portable test kits and laboratory-based workflows.

As global water infrastructure expands and legacy systems are upgraded, demand for digital, user-friendly colorimeters is expected to rise. Manufacturers have responded by introducing compact instruments with enhanced calibration stability, digital reporting, and automated data logging. These features are enabling faster response times and improved traceability-capabilities that are increasingly prioritized in modern water utility operations. The sector’s ongoing modernization is expected to sustain demand through 2035.

North America is a key region for the growth of colorimeters, throughout which established end-user industries, including paints and coatings and food processing are anticipated to drive colorimeters demand. More stringent quality control and compliance in the United States creates a high demand for the use of advanced colorimetric technologies for the promotion of their products. High demand for the portable and digital colorimeters in the region along with high focus on innovation in the region contribute to solid growth.

Europe is also an important market, with strict regulations and high-quality manufacturing and major industries most notably in textiles, chemicals and cosmetics. Countries like Germany, France, and the UK have leading roles in the use of color measurement technologies, in order to deliver products per strict quality requirements. Europe also drives demand for efficient and accurate colorimeters due to the region’s well-established infrastructure and focus on sustainability.

the Asia-Pacific region represents the fastest growing market for colorimeters. China, Japan, and the Indian are the major shells for color measurement, a rise in the demand for color measurement in the textile, food and beverage, and consumer electronics. With the region increasingly paying attention to quality control, aesthetics, and international standards, the number of colorimeters is expected to increase significantly in the near future.

Challenge

High Equipment Costs, Calibration Issues, and Competition from Advanced Spectrophotometry

The Colorimeter goes through major challenges such as high equipment costs for high accuracy colour measurements instruments such as industrial, pharmaceutical, food & beverage and environmental testing. Although low-cost colorimeters can be used for limited color analysis, but the low precision of a colorimeter especially for a specific color and the limited wavelength range makes high precision applications such as color measurement in textile, coatings, and paints difficult to access.

Moreover, their calibration needs to be frequent, this impacts the operational efficiency particularly in quality control laboratories where color consistency is of utmost importance. Sadly, they also face competition from spectrophotometers and digital imaging based colour analysis systems which tend to have higher sensitivity, wider spectral analysis and better data processing capabilities.

Opportunities

Growth in Quality Control, Digital Integration, and Portable Colorimeters

The ever-evolving landscape of market dynamics continues to unfold, with the colorimeter market being no exception to this ongoing transformation. AI is enabling improved storage and sharing of color data, and having digital color analysis built into professional, AI-driven image recognition is improving color management efficiency.

Furthermore, the development of portable, hand-held colorimeters for on-field testing, agricultural soil testing, and water quality measurement is establishing new market segments. These devices are also benefitting from advances in IoT and smartphone-integrated colorimeters, which will facilitate real-time color measurement capabilities.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with ISO color measurement standards and food safety regulations. |

| Consumer Trends | Increasing demand for portable and cost-effective color measurement solutions. |

| Industry Adoption | Use in food safety, textiles, printing, and industrial coatings. |

| Supply Chain and Sourcing | Dependence on high-precision optical sensors and LED light sources. |

| Market Competition | Dominated by traditional colorimeter manufacturers and laboratory equipment suppliers. |

| Market Growth Drivers | Growth fueled by quality control in food processing, pharmaceuticals, and industrial applications. |

| Sustainability and Environmental Impact | Moderate adoption of low-energy LED-based colorimeters and eco-friendly materials. |

| Integration of Smart Technologies | Early-stage development of Bluetooth-enabled portable colorimeters. |

| Advancements in Optical Technology | Development of enhanced multi-wavelength LED colorimeters for improved accuracy. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter traceability requirements, digital reporting mandates, and AI-powered color validation systems. |

| Consumer Trends | Growth in AI-assisted, cloud-connected, and automated color analysis devices. |

| Industry Adoption | Expansion into personalized color formulation, digital color fingerprinting, and precision medicine applications. |

| Supply Chain and Sourcing | Shift toward AI-driven calibration, digital color-matching algorithms, and cloud-based spectral databases. |

| Market Competition | Entry of AI-driven imaging firms, smartphone-based color analysis apps, and multi-spectral sensing companies. |

| Market Growth Drivers | Accelerated by smart color sensors, automation in quality inspection, and digital color intelligence platforms. |

| Sustainability and Environmental Impact | Large-scale adoption of low-waste digital color calibration systems, eco-friendly coatings, and AI-driven defect detection. |

| Integration of Smart Technologies | Expansion into real-time AI-powered color grading, smartphone-integrated lab-on-a-chip solutions, and IoT-based color tracking. |

| Advancements in Optical Technology | Evolution toward AI-driven hyperspectral color sensors, self-calibrating smart colorimeters, and nanophotonic-based color detection systems. |

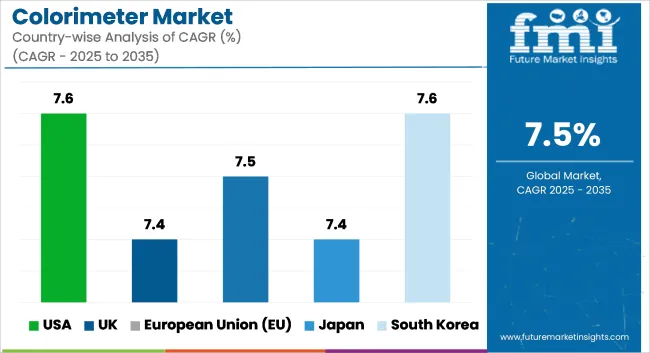

The Colorimeter market in the USA is expected to witness steady growth over the next few years, owing to the rise in usage across different verticals including environmental studies, food and beverage testing, and clinical diagnostics. Growing investment in the development of high-precision color measurement instruments in pharmaceutical, water quality testing, and chemical analysis industries is driving the market growth.

Moreover, the increasing need for the ultra-precision of color measurements in different application over the globe have led portable and digital colorimeter devices to be introduced in the market providing ease of use and adopting by various calculated industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.6% |

The colorimeter market is also growing in the United Kingdom, where businesses are investing in color measurement for quality assurance in food production, textile, and laboratory processes. Market demand is also being driven by increasing focus on environmental regulations and the growing need for accurate and representative water quality assessment. Moreover, the developing industries of smart and automatic colorimeter commercialization are driving industrial growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.4% |

The colorimeter market in Europe is expanding steadily, with increasing applications for those units in industrial quality control, pharmaceutical testing, and agricultural research. Strict regulations on food safety, water testing and chemical analysis are driving demand for precise color measurement devices. The further proliferation of digital and AI-enabled colorimeters is accelerating market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.5% |

Japan's market for colorimeter is growing at a moderate pace, owing to the Japanese country being a stronghold of advanced manufacturing, electronics and laboratory instrumentation. The market is associated with the growing use of colorimeters in the pharmaceutical and clinical research applications. Moreover, advancements in portable and handheld type colorimeter devices are fueling up the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.4% |

The colorimeter market in South Korea is growing owing to rising applications in water testing, electronics industry, and cosmetic quality control. This industry has been booming since there is a high demand for field based, accurate colorimeters from the environmental monitoring and industrial market. Moreover, the launch of several government programs that promote advanced analytical tools in R&D sectors further propels the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.6% |

Factors such as a rise in demand from pharmacy companies and laboratories, along with color analysis in the food and beverage industries are driving the growth of the colorimeter market. To improve its accuracy, efficiency, and real-time color-matching capabilities, businesses are working on AI-driven spectral analysis, advanced optical sensor technology, and portable calorimetry solutions.

As colour makers, scientific tools, and industrial colour measurement companies continue to drive technological innovation around colorimetric examination, AI-driven calibration frameworks, and high-accuracy colour recognition, this sort of ecosystem is terribly basic to the market.

Market Share Analysis by Key Players & Colorimeter Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Konica Minolta, Inc. | 18-22% |

| X-Rite, Inc. (A Danaher Company) | 12-16% |

| Hach Company (A Danaher Company) | 10-14% |

| Thermo Fisher Scientific Inc. | 8-12% |

| LaMotte Company | 5-9% |

| Other Scientific Instrument Providers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Konica Minolta, Inc. | Develops AI-driven portable colorimeters, industrial color measurement devices, and high-precision optical sensor technology. |

| X-Rite, Inc. (Danaher Corporation) | Specializes in digital color matching systems, AI-powered spectral analysis, and software-integrated colorimetry. |

| Hach Company (Danaher Corporation) | Provides laboratory and field colorimeters for water quality testing, AI-enhanced chemical analysis, and environmental monitoring. |

| Thermo Fisher Scientific Inc. | Focuses on biomedical and industrial colorimeters with AI-assisted calibration, real-time spectral analysis, and lab automation integration. |

| LaMotte Company | Offers portable and benchtop colorimeters for food safety, water quality, and industrial applications with AI-powered accuracy control. |

Key Market Insights

Konica Minolta, Inc. (18-22%)

Its rich offering portfolio includes spectral colour measurement device, AI-enabled colour calibration solution, portable company colorimeters, leading-edge and advanced spectral colorimeters to serve the needs of the marketKonica Minolta is a leading player in this segment.

X-Rite, Inc. (12-16%)

AI-SPECTRO instruments from X-Rite is robust in terms of spectral matching on the go with precision colors and validated consistency readout for digital imaging.

Hach Company (10-14%)

Optical-based chemistry analysis is a particular focus area for Hach is, providing colorimetric testing instruments built for the efficiency and accuracy requirements of water and environmental application, optimizing with AI-powered chemical analysis, real-time water testing, and lab-based testing.

Thermo Fisher Scientific Inc. (8-12%)

Thermo Fisher designs biomedical and industrial colorimeters, with integration of AI-assisted calibration systems, real-time color analysis and high-precision optical filters.

LaMotte Company (5-9%)

The company primarily focused on both field and laboratory colorimeters while emphasizing portable testing capabilities, AI driven chemical concentration detection, and assays that find applications across various industries.

Other Key Players (30-40% Combined)

Several laboratory instrument manufacturers, color measurement firms, and scientific technology providers contribute to next-generation colorimeter innovations, AI-powered spectral analysis, and high-precision optical measurement solutions. These include:

The overall market size for colorimeter market was USD 932.18 Million in 2025.

Colorimeter market is expected to reach USD 1,921.2 Million in 2035.

The demand for colorimeters is expected to rise due to increasing applications in environmental monitoring, food and beverage quality control, and healthcare diagnostics, along with advancements in color measurement technologies.

The top 5 countries which drives the development of colorimeter market are USA, UK, Europe Union, Japan and South Korea.

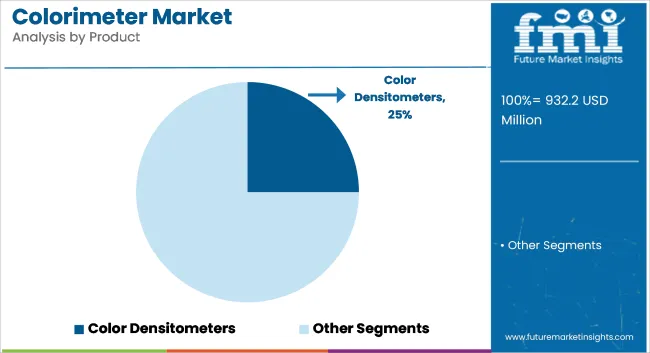

Color Photometers and Portable Colorimeters to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Portability, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Portability, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Portability, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Portability, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Portability, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Portability, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Portability, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Portability, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Portability, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Portability, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Portability, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Portability, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Portability, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Portability, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Portability, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Portability, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Portability, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Portability, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Portability, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Portability, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Portability, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Portability, 2023 to 2033

Figure 23: Global Market Attractiveness by End User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Portability, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Portability, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Portability, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Portability, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Portability, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 45: North America Market Attractiveness by Product, 2023 to 2033

Figure 46: North America Market Attractiveness by Portability, 2023 to 2033

Figure 47: North America Market Attractiveness by End User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Portability, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Portability, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Portability, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Portability, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Portability, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Portability, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Portability, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Portability, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Portability, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Portability, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Portability, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Portability, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Portability, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Portability, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Portability, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Portability, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Portability, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Portability, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Portability, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Portability, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Portability, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Portability, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Portability, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Portability, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Portability, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Portability, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Portability, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Portability, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Portability, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Portability, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Portability, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Portability, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Portability, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Portability, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Portability, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Portability, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA