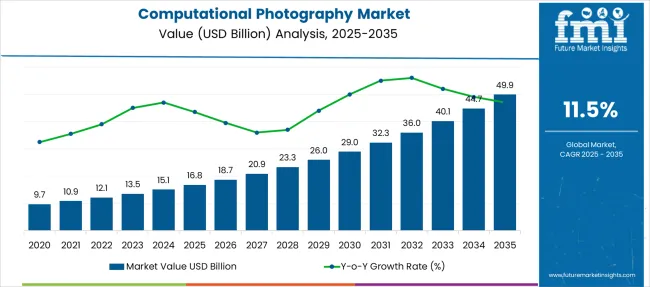

The Computational Photography Market is estimated to be valued at USD 16.8 billion in 2025 and is projected to reach USD 49.9 billion by 2035, registering a compound annual growth rate (CAGR) of 11.5% over the forecast period.

| Metric | Value |

|---|---|

| Computational Photography Market Estimated Value in (2025E) | USD 16.8 billion |

| Computational Photography Market Forecast Value in (2035F) | USD 49.9 billion |

| Forecast CAGR (2025 to 2035) | 11.5% |

The computational photography market is expanding rapidly as consumer electronics evolve to deliver high quality imaging through software driven enhancements rather than relying solely on traditional optical hardware. Advancements in artificial intelligence machine learning and image signal processing have enabled devices to produce clearer more detailed and low light optimized images.

The growing integration of multiple camera sensors in smartphones and the demand for features like portrait mode night mode and augmented reality imaging are accelerating adoption. Hardware limitations are being offset by real time software corrections and scene analysis capabilities that enhance photo quality across varying lighting and movement conditions.

The market outlook is highly positive with manufacturers focusing on chip level image processing neural network acceleration and depth mapping to push boundaries in imaging innovation particularly in mobile and consumer device ecosystems.

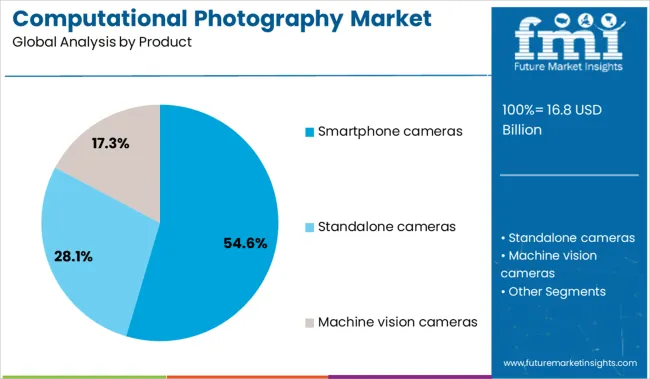

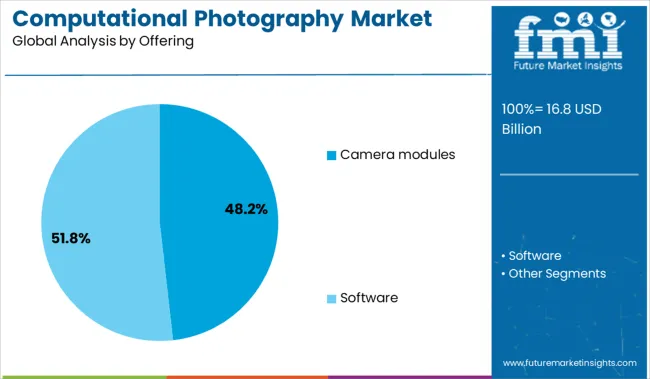

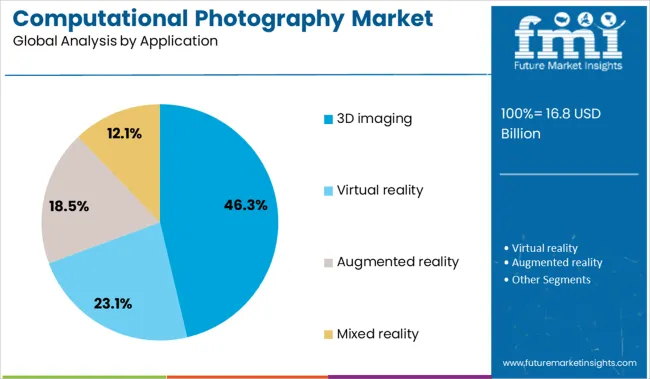

The computational photography market is segmented by product, offering, and application and geographic regions. The computational photography market is divided into Smartphone cameras, Standalone cameras, and Machine vision cameras. In terms of providing for the computational photography market, it is classified into Camera modules and Software. Based on the application of the computational photography market, it is segmented into 3D imaging, Virtual reality, augmented reality, and Mixed reality. Regionally, the computational photography industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The smartphone cameras segment is expected to account for 54.60 percent of total revenue by 2025 within the product category making it the leading contributor. This growth is being fueled by rising consumer demand for high resolution photography in mobile devices and the evolution of mobile imaging as a central factor in purchasing decisions.

Innovations such as multi lens configurations software based bokeh effects and enhanced digital zoom have positioned smartphones as powerful imaging tools. Additionally integration of computational techniques like HDR stacking real time scene recognition and super resolution algorithms have significantly enhanced image quality.

As smartphone manufacturers continue to prioritize camera capabilities for competitive differentiation smartphone cameras remain the most influential segment in driving the growth of computational photography.

The camera modules segment is projected to hold 48.20 percent of total market revenue by 2025 within the offering category driven by rapid technological advancements in miniaturization sensor quality and integration flexibility. These modules form the hardware foundation upon which computational photography techniques operate enabling features such as optical image stabilization depth sensing and ultra wide field imaging.

Demand for slimmer devices with superior camera performance has pushed manufacturers to adopt advanced sensor stacks lens systems and integrated image processors within compact camera modules.

As the line between hardware and software continues to blur in imaging innovation camera modules remain a core focus for delivering performance enhancements through computational methods across various consumer electronics.

The 3D imaging segment is projected to contribute 46.30 percent of total revenue by 2025 in the application category making it one of the most dynamic areas of growth. This surge is being driven by increased adoption in augmented reality facial recognition and spatial imaging applications particularly within smartphones wearable devices and automotive systems.

Computational photography enables accurate depth mapping and multi angle capture capabilities without bulky hardware thereby expanding 3D imaging into more compact and mobile platforms. Industries such as ecommerce healthcare and gaming are also leveraging 3D imaging to enhance user interaction and visualization.

The versatility and future readiness of 3D imaging position it as a critical application area within computational photography enabling immersive experiences and precise spatial analysis across diverse use cases.

Demand for computational photography is accelerating as smartphone OEMs, AR/VR developers, and automotive firms adopt AI-driven imaging systems. Sales of multi-frame fusion, depth-mapping, and low-light enhancement solutions are expanding with the need for compact, high-performance camera modules.

Demand for computational photography solutions in mobile devices grew 24% in 2025, driven by flagship launches from Apple, Xiaomi, and Vivo. Multi-frame HDR, AI-powered denoising, and per-pixel depth fusion are now standard in mid-range and premium phones. In India and LATAM, where selfie cameras influence >65% of buying decisions, vendors prioritized real-time facial enhancement algorithms. ISPs with neural processing units (NPUs) increased throughput by 33%, enabling native 4K cinematic effects. Night mode usage rose 40% YoY, fueled by ultra-wide low-light algorithms. Smartphone brands integrated open-source imaging pipelines to reduce SoC customization costs, accelerating the rollout of advanced features across models below USD 400.

Sales of computational photography solutions outside mobile—particularly in AR/VR and automotive—rose 29% in 2025. AR headset makers adopted real-time SLAM (simultaneous localization and mapping) using stereo disparity fusion, improving latency metrics by 18%. Lidar-based depth-mapping was scaled in ADAS systems for lane tracking and pedestrian recognition in low-visibility zones. In Europe, premium EVs incorporated fused RGB+IR sensors to enhance object detection during fog and dusk conditions. Gaming console cameras began supporting depth-augmented input, increasing user engagement by 22%. These cross-industry applications are broadening the scope of computational imaging beyond consumer electronics into spatial computing and autonomous navigation.

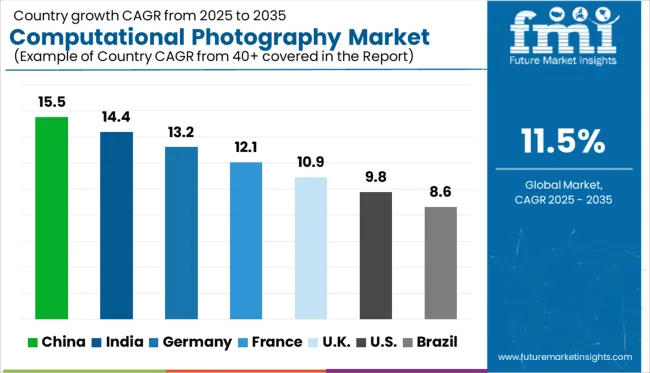

| Country | CAGR |

|---|---|

| China | 15.5% |

| India | 14.4% |

| Germany | 13.2% |

| France | 12.1% |

| UK | 10.9% |

| USA | 9.8% |

| Brazil | 8.6% |

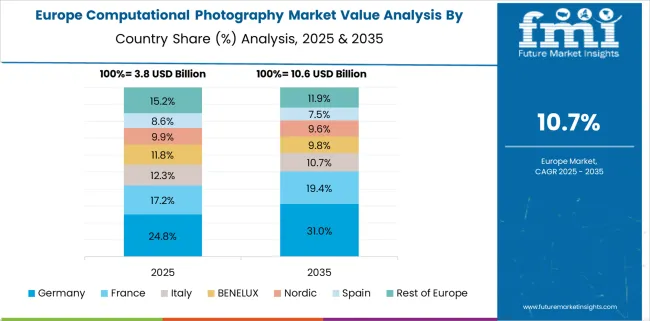

The global computational photography market is set to expand at a CAGR of 11.5% between 2025 and 2035. China (BRICS) takes the lead with a CAGR of 15.5%, outperforming the global average by 4.0 percentage points, backed by aggressive R&D in AI-based imaging and rapid innovation in smartphone camera modules. India (BRICS) follows at 14.4% (+2.9 pp), driven by rising smartphone penetration across Tier II and III cities and expanding adoption of budget devices with advanced photo-processing capabilities.

Germany (OECD) posts a CAGR of 13.2% (+1.7 pp), where the growth is fueled by advancements in automotive imaging systems and professional camera integration in industrial robotics. The UK records a CAGR of 10.9% (–0.6 pp), with steady uptake in creative tech and content creation platforms. The United States lags at 9.8% (–1.7 pp), as market saturation and regulatory constraints on AI-driven facial recognition temper growth. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China’s computational photography market is projected to grow at a CAGR of 15.5% from 2025 to 2035, fueled by rising smartphone shipments and local innovation in image signal processing. Between 2020 and 2024, growth was led by flagship models integrating basic AI-driven image correction. The coming decade will see widespread integration of neural processing units (NPUs) in mid-range and budget segments.

India is expected to register a CAGR of 14.4% between 2025 and 2035, driven by a booming mobile photography culture and demand for enhanced low-light capabilities. During 2020–2024, mid-tier smartphone models adopted basic multi-frame processing. From 2025, mass adoption of AI-enhanced sensors is anticipated across entry-level segments.

Germany’s market is forecast to grow at a CAGR of 13.2% through 2035, supported by demand for DSLR and mirrorless camera enhancements in automotive, healthcare, and industrial imaging. From 2020 to 2024, adoption was largely focused on professional camera modules. The upcoming period will see rapid deployment of ML-based vision systems in industrial robotics.

The UK market is poised to grow at a CAGR of 10.9% from 2025 to 2035, reflecting expanding consumer demand for visual storytelling tools and digital content creation. During 2020–2024, growth stemmed from smartphone vendors targeting creator-centric features. Now, the ecosystem is shifting toward computational enhancements for metaverse, AR, and social commerce.

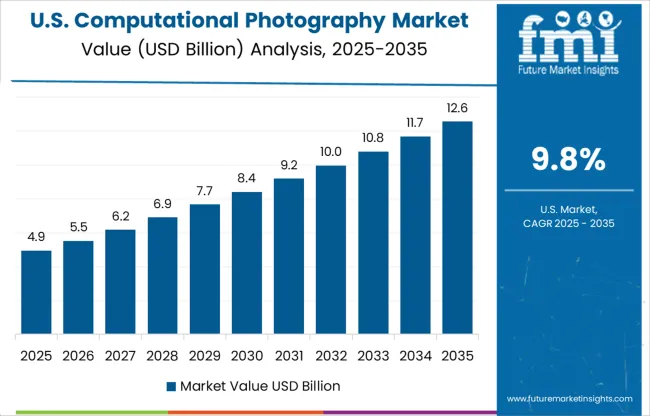

The USA is expected to grow at a CAGR of 9.8% from 2025 to 2035, led by demand for advanced imaging in consumer tech, security, and health diagnostics. Between 2020 and 2024, computational photography evolved from basic HDR to real-time facial recognition and motion tracking in high-end devices. Broader integration across smart home, automotive, and fitness applications is on the horizon.

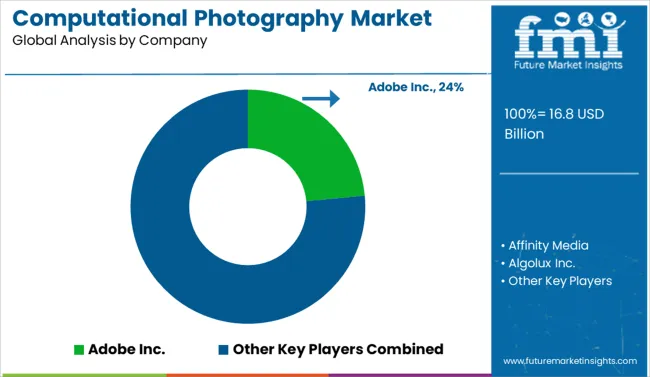

Sales of computational photography solutions are accelerating in 2025, propelled by AI-enabled imaging across smartphones, AR/VR, automotive vision, and security systems. Adobe Inc. leads with a significant market share, driven by its integrated AI-powered editing suite within Creative Cloud. Apple, Samsung, and Google (Alphabet Inc.) continue to embed neural imaging pipelines into flagship devices, redefining mobile camera performance. Sony and Canon are enhancing lens-edge clarity and depth computation in professional gear. Nvidia and Qualcomm are integrating real-time computer vision into chipsets, strengthening embedded photography. Startups like Algolux and Light Labs are pushing innovations in autonomous vision. Meanwhile, CEVA, ON Semiconductor, and Pelican Imaging are scaling low-power IP cores and depth sensors for OEM integration. Demand for computational imaging is poised to intensify across industries.

In June 2025, Adobe released Project Indigo, a computational photography app for iPhones that merges burst images into DSLR-quality photos with noise reduction and high dynamic range. The free app supports manual controls and runs on iPhone 12 Pro and newer.

| Item | Value |

|---|---|

| Quantitative Units | USD 16.8 Billion |

| Product | Smartphone cameras, Standalone cameras, and Machine vision cameras |

| Offering | Camera modules and Software |

| Application | 3D imaging, Virtual reality, Augmented reality, and Mixed reality |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Adobe Inc., Affinity Media, Algolux Inc., Almalence Inc., Alphabet Inc., Apple Inc., Canon Inc., CEVA Inc., FotoNation Inc., LG Corporation, Light Labs Inc., Nikon Corporation, Nvidia Corporation, ON Semiconductor Corporation, Pelican Imaging Corporation, Qualcomm Technologies Inc., Samsung Electronics Co. Ltd., and Sony Group Corporation |

| Additional Attributes | Dollar sales by device type (smartphone, machine-vision, standalone cameras) and component (camera modules vs software), demand dynamics across AR/VR and image enhancement applications, regional adoption trends (North America, APAC), innovation in multi-frame HDR and depth mapping, environmental impact of data processing energy use. |

The global computational photography market is estimated to be valued at USD 16.8 billion in 2025.

The market size for the computational photography market is projected to reach USD 49.9 billion by 2035.

The computational photography market is expected to grow at a 11.5% CAGR between 2025 and 2035.

The key product types in computational photography market are smartphone cameras, standalone cameras and machine vision cameras.

In terms of offering, camera modules segment to command 48.2% share in the computational photography market in 2025.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA