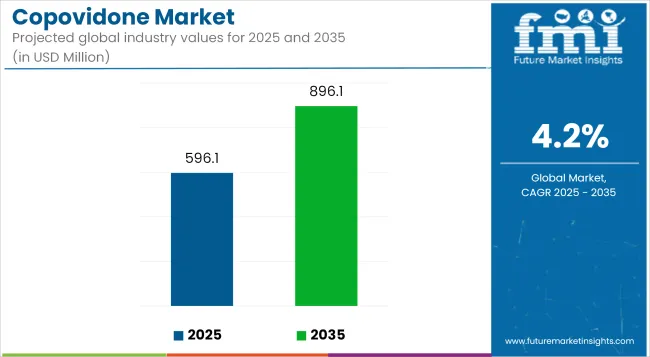

The copovidone market is anticipated to reach USD 896.1 million by 2035, up from USD 596.1 million in 2025, growing at a CAGR of 4.2%. This progress is being propelled by copovidone’s rising utility in pharmaceutical formulations, particularly in oral drug delivery systems. Known for its solubility, binding strength, and film-forming properties, it continues to gain preference among formulation scientists aiming to improve drug stability and bioavailability. The product’s multifunctional role has made it indispensable in excipient innovation, particularly for challenging drug compounds.

A steady momentum has been observed across the pharmaceutical sector, particularly within oral solid dosage manufacturing, where copovidone’s functional superiority continues to be utilized. Its growing inclusion in hot-melt extrusion and spray drying techniques for poorly soluble drugs has solidified its relevance in advanced drug formulation strategies.

Demand has also been reinforced by its compatibility with other excipients, low hygroscopicity, and superior plasticity. However, growth has not been unchallenged. Pricing pressures due to volatility in raw material supply, coupled with regulatory complexities across regions, have marginally restrained expansion in some secondary markets.

A parallel trend is unfolding in nutraceuticals and functional food supplements, where copovidone’s film-coating and dispersion-enhancing characteristics are being increasingly acknowledged. Furthermore, formulation innovations demanding sustained-release profiles and solvent-free manufacturing have extended its application footprint.

Copovidone demand is expected to intensify across emerging economies, driven by growing pharmaceutical manufacturing capacity and preference for polymer-based solubilizers. By 2035, the oral drug delivery segment is anticipated to remain dominant, supported by the consistent pipeline of poorly water-soluble APIs requiring copovidone-enabled solubilization. Meanwhile, direct compression tablets and capsule formulations are likely to benefit from increased investment in patient-centric dosage forms.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025E) | USD 596.1 million |

| Projected Industry Value (2035F) | USD 896.1 million |

| Value-based CAGR (2025 to 2035) | 4.2% |

Industrial formulators are expected to continue prioritizing copovidone due to its processability, stability, and regulatory acceptance across key markets such as the USA, Europe, and select APAC countries. The competitive landscape will likely see further alignment with sustainability goals and production scalability, as formulators demand higher-quality copovidone grades that adhere to pharmacopoeial standards.

Market consolidation is also expected among regional excipient suppliers to cater to the escalating volume demand in high-growth therapeutic areas. With these dynamics, the copovidone market is forecast to remain an integral part of the formulation toolkit for the next generation of oral and specialty drugs.

Pediatric drug formulations are expected to contribute over 8.6% of copovidone demand in 2025, expanding steadily as regulatory bodies emphasize age-appropriate dosage forms. The European Medicines Agency (EMA) and USA FDA’s Pediatric Study Plans have accelerated pharmaceutical investment in child-specific drug formats, necessitating excipients like copovidone that support flexible dosing, palatability, and dispersibility.

Copovidone’s excellent binding properties and ability to form taste-masked coatings without compromising solubility make it ideal for chewables, orodispersible tablets, and mini-tablets. Companies such as Grünenthal and Neuraxpharm are already incorporating copovidone in pediatric neurotherapeutics and analgesics, benefitting from its film-forming efficiency at low concentrations.

As the industry shifts toward excipient innovation that enhances compliance and therapeutic outcomes in children, copovidone's low toxicity profile and regulatory recognition under USP/NF and Ph. Eur. monographs strengthen its adoption. Furthermore, the increased use of copovidone in granulation techniques for multiparticulate systems adds to its functional appeal.

Suppliers are responding with child-safe, allergen-free copovidone grades that align with ICH Q3D elemental impurity limits and global pediatric excipient guidelines. As pediatric APIs continue to face solubility and stability challenges, copovidone’s value as a versatile excipient is likely to see substantial growth across pediatric-focused CDMOs and specialty formulation hubs.

Nutraceuticals utilizing soft granule formats represent an emerging application area where copovidone is projected to grow at a share exceeding 16.1% by 2035. While traditionally dominated by effervescent and direct compression tablets, the sector’s move toward user-friendly granules-particularly for vitamins, joint health, and botanical blends-has created demand for excipients with optimal flowability and wet granulation behavior.

Copovidone’s rapid dissolution and compatibility with natural actives, such as turmeric and ashwagandha extracts, make it an ideal binder and stabilizer in granule systems. In the EU, companies like Aenova Group and Ayanda are leveraging copovidone to improve the dispersibility and palatability of granulated nutraceutical blends for senior and adolescent consumers.

Additionally, Asia-based nutraceutical formulators in Japan and South Korea are integrating copovidone into stick packs and reconstitutable formats to enhance convenience without compromising bioavailability. Importantly, the use of copovidone in food-grade formats must comply with EU Regulation No 1333/2008 and JECFA monographs, which has led to increased certification demand (e.g., TSE/BSE-free, non-GMO status).

As soft granules and sachets evolve as dominant dosage formats in personalized nutrition, copovidone’s safety profile and multifunctionality will continue to drive its selection among premium supplement developers targeting on-the-go, rehydratable nutrition solutions.

Growing Pharmaceutical Applications

Copovidone brought into the pharmaceutical industry originally functions among skincare products and hair treatments as essential stabilizing and film-forming agent. The functionality of hair gels and sprays improves through copovidone application because it delivers flexible hold and protects against humidity but in skincare it provides better texture and enhances both spreading and sunscreens' resistance to water.

Nanhang Industrial the company provides the versatile excipient copovidone which serves for skincare as well as haircare formulations. Nanhang Industrial applies copovidone to create formulations which strengthen hair gels as well as improve spreadability in serums and mousses and add extra protection to sunscreens.

American specialty chemicals company Ashland applies the film-forming and binding and stabilizing abilities of copovidone to improve the performance of haircare and skincare products. The pharmaceutical industry once relied on copovidone but now this ingredient plays a vital role in forming flexible yet durable hair products including gels and sprays.

The cosmetic industry employs copovidone to enhance the texture of creams and sunscreens as well as improve their spreadability and make them resistant to water.

Excipient Evolution - Copovidone in Skincare & Haircare

The pharmaceutical industry seeks Copovidone for its uses as a binding element and film-forming agent and stabilizing component for tablets and capsules. The compatibility and effectiveness of oral drug production has elevated copovidone to its position as a fundamental excipient that enhances medicine stability and bioavailability as well as performance levels.

Merck KGaA produces copovidone as a principal excipient for pharmaceutical formulations and markets Kollidon® which strengthens drug stability and consistency during oral dosing. The pharmaceutical properties of Kollidon® copovidone used as binder and film-former and stabilizer enhance tablet and capsule formulations to deliver drugs reliably through effective drug delivery systems.

Merck KGaA produces pharmaceutical excipients of superior quality which enable powerful medication development within the industry.

The pharmaceutical manufacturer BASF SE creates Polyplasdone® which serves as a copovidone substance for pharmaceutical applications. The pharmaceutical substance Kollidon® copovidone functions simultaneously as binding and disintegrating and stabilizing agent to make tablets and capsules work more efficiently.

The drug delivery systems benefit from Polyplasdone® which provides reliable drug performance for oral medical treatments.

Increased R&D Investments

The market for copovidone experiences rising research and development investments which focus on improving its functional capabilities as an excipient material. Pharmaceutical formulation optimization requires companies to enhance both solubility and stability performance of copovidone to reach its maximum potential.

The research dedicated to copovidone aims to improve its pharmaceutical performance for better bioavailability of drugs while enhancing their delivery and absorption potential. Research developments strengthen the performance of copovidone in applications that need stable tablets and capsules alongside controlled drug delivery systems.

The companies Merck KGaA and BASF SE through their brands Kollidon® and Polyplasdone® dedicate resources to ongoing research initiatives that aim to create copovidone-excipients with better features for pharmaceutical applications.

A variety of industries are utilizing existing research and development initiatives to expand the usage spectrum of copovidone for cosmetics and personal care sectors. Science-based work on upgraded copovidone formulations aims to boost its capacities for film-patterning and binding as well as stabilizing capacity to strengthen its potential in skincare and haircare product development.

Through its R&D activities Ashland seeks to optimize the functional performance of copovidone so it can be used across multiple commercial sectors.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 4.2% |

| H2(2024 to 2034) | 5.1% |

| H1(2025 to 2035) | 5.2% |

| H2(2025 to 2035) | 6.0% |

The Copovidone market is expected to grow steadily with notable half-yearly compound annual growth rates (CAGR). From 2025 to 2035, H1 shows a growth rate of 4.2%, while H2 is slightly higher at 5.1%. Moving to the 2025 to 2035 period, H1 is projected to grow at 5.2%, indicating a positive trend. In H2 growth for the same period is slightly higher at 6.0%.

The copovidone market exhibits strong competition according to three distinct revenue sections. The top three market revenue contributors belong to Tier 1 which includes Ashland and BASF SE and Boai NKY Pharmaceuticals Ltd among them.

These companies control extensive shares because they possess extensive product collections built upon strong distribution networks across the world in pharmaceuticals together with food and cosmetics businesses. The pharmaceutical market showcases Ashland and BASF SE with their top-quality copovidone drug formulation products and Boai NKY Pharmaceuticals Ltd with PVP and derivative solutions for multiple industrial uses.

Nanhang Industrial coupled with Merck KGaA and Huangshan Bonsun Pharmaceuticals Co., Ltd form the second tier of companies that generate 30% of industry revenue. The sector of the market is dominated by medium-sized pharmaceutical and specialty chemical firms who operate at a scale slightly below Tier 1 companies.

The remaining 20% of market companies categorized as Tier 3 are made up of Hangzhou Motto Science & Technology Co., Ltd. and Shanghai Yuking Water Soluble Material Tech Co., Ltd. The manufacturers in this category supply copovidone specifically for pharmaceutical applications as well as adhesives and personal care production.

The sector continues evolving through constant research efforts that shape upcoming developments mainly in drug delivery methods as well as excipient innovations.

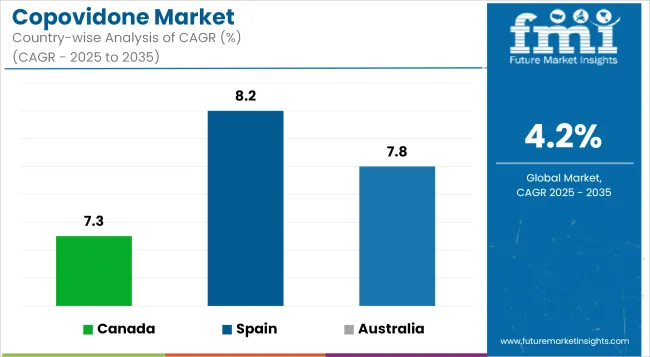

The following table shows the estimated growth rates of the top three territories. Canada, Spain and Australia are few attractive countries to look upon.

| Country | CAGR,2025 to 2035 |

|---|---|

| Canada | 7.3% |

| Spain | 8.2% |

| Australia | 7.8% |

The Canadian market for copovidone is expanding because forecasts show a compound annual growth rate (CAGR) of 7.3%. The pharmaceutical and nutraceutical industries are leading the increasing demand for copovidone because the polymer functions both as a stabilizer and an ingredient in drug formulations.

The pharmaceutical sector uses copovidone in two main roles: medication stabilization and tablet binding yet manufacturers also employ it for cosmetic emulsion processes. Health Canada maintains strict regulatory standards which uphold product safety throughout the supported market.

The industry keeps expanding because of growing interest in innovative drug delivery systems and clean-label products within the cosmetic industry. Markets see growth expansion because consumers choose personalized medicine sustainable release drugs organic cosmetic components yet raw material price volatility and regulatory screening presents ongoing difficulties.

The Spain copovidone advertise proper to grow at a CAGR of 8.2%, indicating the important growth of the European pharmaceutical manufacturing. Driven apiece increasing demand for generics and the increasing need for persuasive excipients in drug formulations, copovidone is generally secondhand as a binder in the result of spoken dimensional dosage forms, specifically tablets.

The demand is helped for one expanding healthcare subdivision and a rise in drug production, as Spain continues to devote effort to something economical answers in the pharmaceutical manufacturing. However, stock exchange faces challenges on account of accurate regulatory flags for drug excipients, that may limit the effort of new advertise performers.

With technological progresses and growing endorsement of generics, the market is balanced for constant progress.

The Australian copovidone market will demonstrate a compound annual growth rate (CAGR) of 7.8% due to rising requirements for advanced drugs and generic pharmaceuticals along with growing nutraceuticals and cosmeceutical business segments.

The Therapeutic Goods Administration of Australia serves as regulator of pharmaceutical excipients including copovidone which operates under International Council for Harmonisation (ICH) standards as well as guidelines from United States Pharmacopeia (USP) and European Pharmacopoeia (Ph. Eur.).

The pharmaceutical industry can obtain steady access to compliant copovidone through TGA efforts to implement Good Manufacturing Practice (GMP) standards and validate international quality certification programs. The alignment of Australian regulations with worldwide standards simplifies regulatory processing for domestic drug producers while guaranteeing both safety and effectiveness of medicines sold to consumers who meet international standards.

The copovidone market maintains average competitive levels while BASF SE Ashland Global Holdings Inc. JRS Pharma and Shin-Etsu Chemical Co. Ltd. hold control over the industry. These corporations primarily work to improve drug dissolution and bio accessibility properties of pharmaceutical formulations so copovidone stands as a critical component in these medicines.

The Industry features multiple barriers to entry because of rigorous FDA and EMA regulatory license requirements that restrict new company participation. The competitive position of businesses depends heavily on research and development (R&D) because companies dedicate funds to enhance product performance to align with changing pharmaceutical requirements and standards.

The pharmaceutical excipients market's leading sectors exist between North America and Europe due to their robust regulatory systems coupled with their active pharmaceutical excipients producers. Asia Pacific market demonstrates rapid expansion because Indian and Chinese generic drug manufacturers benefit from competitive advantages stemming from economical production costs.

The local competition intensifies as regional manufacturers supply cheaper versions of global pharmaceutical products to the market .Industry strategic alliances alongside mergers and acquisitions serve to shape the business because leading pharmaceutical manufacturers pursue Sector expansion and distribution network strengthening in emerging economies.

The global industry is estimated at a value of USD 596.1 million in 2025.

The global demand for copovidone Market is forecasted to surpass USD 896.1 million by the year 2035.

The industry is projected to grow at a forecast CAGR 4.2 % from 2025 to 2035.

The global copovidone market is expected to be dominated by the pharmaceutical industry over forecast period 2022 to 2032.

Nanhang Industrial, Merck KGaA, Boai NKY Pharmaceuticals Ltd., BASF SE, Huangshan Bonsun Pharmaceuticals Co., Ltd., Ashland, Hangzhou Motto Science & Technology Co. Ltd., Shanghai Yuking Water Soluble Material Tech Co. Ltd., others are some of the leading players in the prominent copovidone Industry.

The North America, Latin America, Europe, East Asia, Oceania, Middle east and Africa are the prominent countries driving the demand for Copovidone Industry.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA