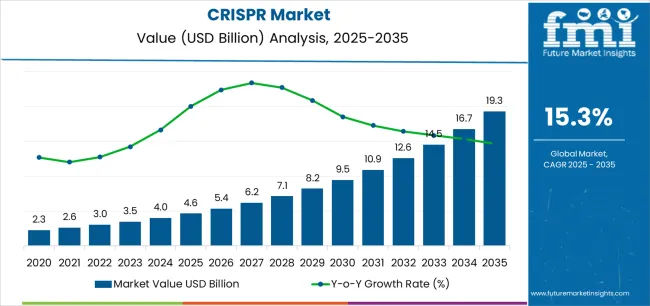

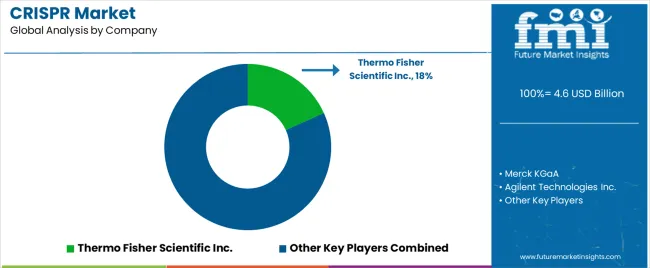

The CRISPR Market is estimated to be valued at USD 4.6 billion in 2025 and is projected to reach USD 19.3 billion by 2035, registering a compound annual growth rate (CAGR) of 15.3% over the forecast period.

The CRISPR market is expanding rapidly as gene-editing technologies revolutionize biomedical research, agriculture, and therapeutic development. The ability of CRISPR systems to introduce precise genetic modifications with high efficiency has positioned them as a key tool in next-generation biotechnology applications.

Increasing R&D investments by academic institutions, biopharmaceutical companies, and government organizations have accelerated technological advancement and commercialization. The market is witnessing growing integration of CRISPR in drug discovery, functional genomics, and diagnostic development.

Regulatory support and collaborations among research entities are further driving innovation. As gene therapies advance toward clinical maturity, CRISPR is anticipated to play a pivotal role in developing targeted, cost-effective, and scalable solutions, ensuring strong long-term growth potential..

| Metric | Value |

|---|---|

| CRISPR Market Estimated Value in (2025 E) | USD 4.6 billion |

| CRISPR Market Forecast Value in (2035 F) | USD 19.3 billion |

| Forecast CAGR (2025 to 2035) | 15.3% |

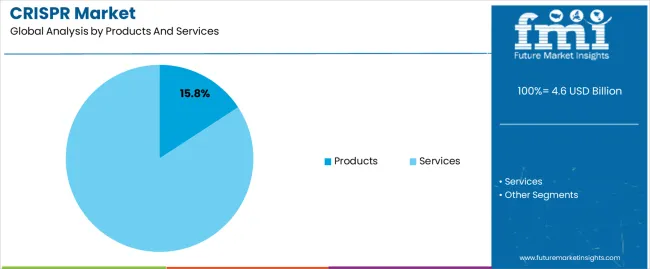

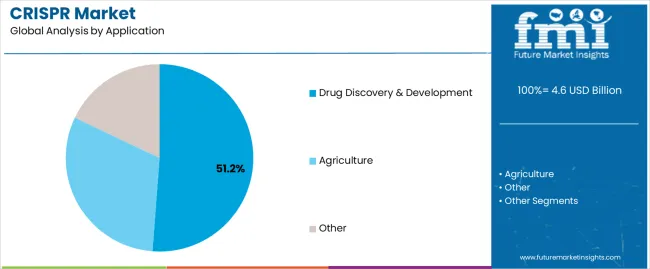

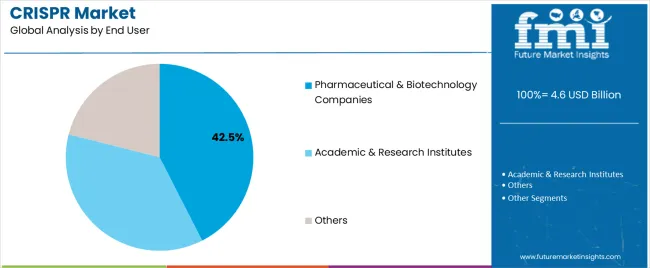

The market is segmented by Products And Services, Application, and End User and region. By Products And Services, the market is divided into Products and Services. In terms of Application, the market is classified into Drug Discovery & Development, Agriculture, and Other. Based on End User, the market is segmented into Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

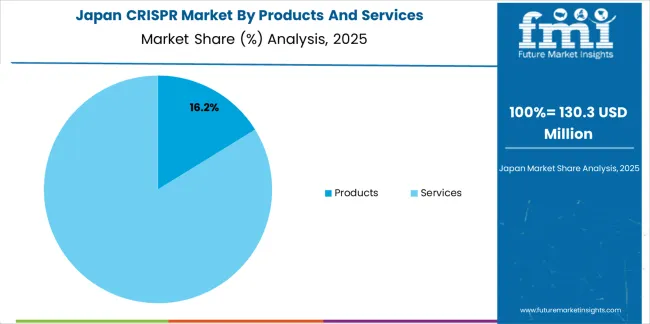

The products segment represents approximately 15.80% share of the products and services category, driven by the commercialization of CRISPR-based tools, reagents, and kits for research and clinical applications. The availability of ready-to-use CRISPR products has reduced technical barriers for researchers, enabling broader adoption in laboratories worldwide.

Growth is also supported by the continuous refinement of CRISPR-Cas9 and emerging variants like Cas12 and Cas13, which expand editing precision and applicability. The increasing adoption of off-the-shelf editing solutions by biotechnology companies has further stimulated demand.

As the research-to-commercial transition accelerates, the products segment is expected to gain momentum, supported by strong manufacturing capabilities and global distribution networks..

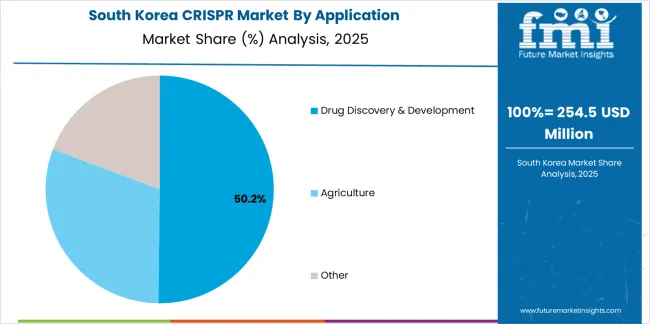

The drug discovery & development segment leads the application category with approximately 51.20% share, reflecting the growing use of CRISPR technologies in identifying, validating, and optimizing therapeutic targets. This segment benefits from the efficiency of CRISPR in modeling diseases and screening compounds in genetically modified cell lines.

Pharmaceutical and biotechnology companies utilize CRISPR to accelerate preclinical research and enhance success rates in early-stage drug pipelines. The segment’s growth is further reinforced by strategic collaborations aimed at integrating CRISPR platforms with AI-driven discovery tools.

With a strong focus on precision medicine and rapid therapeutic innovation, this segment is expected to maintain its dominance over the long term..

The pharmaceutical & biotechnology companies segment holds approximately 42.50% share in the end-user category, driven by the industry’s direct engagement in therapeutic gene editing and biologics research. Organizations in this segment leverage CRISPR technologies to develop cell therapies, genomic medicines, and bioprocess optimization strategies.

Increased partnerships between CRISPR technology providers and major drug developers have accelerated clinical translation. With growing regulatory clarity and patent licensing frameworks, adoption is expected to rise further.

This segment’s leadership is underpinned by strong capital investment and a strategic focus on commercializing genome-editing-based therapies..

The global demand for the CRISPR market was estimated to reach a valuation of USD 2.3 billion in 2020, according to a report from Future Market Insights (FMI). From 2020 to 2025, the CRISPR market witnesses significant growth, registering a CAGR of 18.9%.

| Historical CAGR from 2020 to 2025 | 18.9% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 16.1% |

The ground-breaking gene editing technology CRISPR-X was announced by researchers in 2025. CRISPR-X makes it possible to precisely target many genes at once. It provides exceptional precision with few off-target impacts.

This breakthrough might have revolutionary effects on clinical applications and genetic studies during the forecast period. Some important factors that will boost the market growth through 2035 are:

The market is expanding due to the growing need for CRISPR based treatments to address unmet medical needs, particularly in cancer and rare genetic diseases.

The accuracy and adaptability of CRISPR provide exciting opportunities for the development of tailored therapies for diseases that were previously incurable.

With growing awareness of genetic illnesses and advances in genome editing technology, stakeholders are stepping up efforts to bring CRISPR medicines to market. This is anticipated to push research funding, clinical trials, and regulatory clearances to address the urgent patient needs globally.

Another key driver of the CRISPR industry is the growing use of gene editing technologies beyond healthcare, notably in agriculture as well as biotechnology. CRISPR provides accurate and effective tools for bioengineering, livestock breeding, and agricultural enhancement.

Improving sustainability, food security, and industrial processes is under growing strain as the global population rises and environmental problems endure.

This encourages funding for CRISPR research and commercialization, creating opportunities for development and innovation in a variety of industries besides the healthcare industry.

Regulatory Obstacles and Ethical Issues to Impede the Market Growth

Regulatory obstacles, ethical issues, and intellectual property conflicts all impede market expansion for CRISPR technology. Research and commercialization efforts are limited by uncertain regulatory frameworks and growing ethical issues regarding gene editing.

Continuous disagreements about patent rights and license terms impede innovation and cooperation by causing ambiguity. Unlocking the full potential of CRISPR technology and promoting sustainable market growth require addressing these obstacles with clear rules, moral standards, and equitable dispute resolution procedures.

This section focuses on providing detailed analysis of two particular market segments for CRISPR, the top products and services and the dominant application. The two main segments discussed below are CRISPR kits & enzymes and drug discovery and development.

| Products and Services | CRISPR kits & Enzymes |

|---|---|

| CAGR from 2025 to 2035 | 15.8% |

During the forecast period, the CRISPR kits & enzymes segment is likely to garner a 15.8% CAGR. The need for CRISPR kits and enzymes is expected to rise as a result of growing research projects in a number of industries, including biotechnology, agriculture, and healthcare. These kits make gene editing experiments more accessible to scientists, encouraging research and experimentation.

Personalized medicine and agricultural enhancement are also gaining popularity, which increases the demand for effective gene editing techniques. The demand for CRISPR kits and enzymes is expected to soar in the global market to enable a wide range of applications and developments.

| Application Type | Drug Discovery & Development |

|---|---|

| Market Share in 2025 | 51.2% |

In 2025, the drug discovery & development segment is likely to acquire a 51.2% global market share. CRISPR is critical in drug discovery and development due to its capacity to precisely modify disease-related genes, allowing for faster target selection and confirmation.

CRISPR speeds up the drug development process by making it easier to create disease models for drug screening through effective genome editing.

CRISPR opens up new possibilities for customized therapy by potentially fixing mutations that cause illness in patient cells. CRISPR, thus, becomes a game-changing tool for redefining medication development approaches for a range of illnesses.

This section will go into detail on the CRISPR markets in a few key countries, including the United States, the United Kingdom, China, Japan, and South Korea. This part will focus on the primary factors that are driving up demand in these countries for CRISPR.

| Country | CAGR |

|---|---|

| The United States | 16.3% |

| The United Kingdom | 16.9% |

| China | 16.5% |

| Japan | 17.2% |

| South Korea | 17.6% |

The United States CRISPR ecosystem is anticipated to gain a CAGR of 16.3% through 2035. Demand for CRISPR-based medicines is driven by rising investment in genetic therapies and precision medicine, which promotes improvements in illness management and individualized healthcare.

Growing concerns about food security and sustainability drive demand for CRISPR-enabled crop enhancements that boost yields, nutrient density, and disease resistance in agricultural goods.

The market in the United Kingdom is expected to expand with a 16.9% CAGR through 2035. Reputable academic and scientific organizations in the United Kingdom encourage CRISPR technology innovation, drawing talent and funding for ground-breaking developments in gene editing research and applications.

The advanced regulatory environment in the United Kingdom facilitates the ethical and appropriate application of CRISPR technology. It offers direction and clarity for research and commercialization endeavors, hence stimulating industry development and investment.

The CRISPR ecosystem in China is anticipated to develop with a 16.5% CAGR from 2025 to 2035. Significant government support and funding for biotechnology research and innovation, particularly CRISPR technology, drives progress and positions the country as a global leader in the industry.

The need for CRISPR-based treatments is fueled by China's emphasis on tackling health issues like cancer and genetic disorders, which has resulted in large investments and advancements in the field.

The CRISPR industry in Japan is anticipated to reach a 17.2% CAGR from 2025 to 2035. CRISPR-based medicines for customized medicine and targeted treatments are becoming more popular in Japan due to its focus on healthcare innovation and tackling common ailments like cancer and genetic abnormalities.

The regulatory landscape in Japan is favorable for novel medical technologies, which makes it easier to develop and market CRISPR-based therapies. This promotes investment and industry expansion.

The CRISPR ecosystem in South Korea is likely to evolve with a 17.6% CAGR during the forecast period. South Korea is at the forefront of stem cell research, and using CRISPR technology improves the accuracy and efficiency of gene editing in stem cells, increasing regenerative medicine as well as therapeutic applications.

The need for CRISPR technology is boosted by the strategic focus of the South Korean government on developing the biotech sector, which propels research and development and commercialization activities in the nation's booming biotech industry.

Significant players in the global CRISPR market, such as Editas Medicine, Intellia Therapeutics, and CRISPR Therapeutics, are fostering competition and innovation. These companies are actively working to improve the safety and effectiveness characteristics of CRISPR-based treatments for a range of genetic illnesses and diseases.

By conducting basic research and working with business partners, research institutes and academic centers also significantly contribute to the advancement of CRISPR technology.

Authorities like the FDA and EMA are keeping a careful eye on advances to make sure they are used safely and ethically. Key companies in the dynamic CRISPR market are characterized by their pursuit of rigorous research, strategic alliances, and regulatory compliance. The key players in this market include:

Significant advancements in the CRISPR market are being made by key market participants, and these include:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 16.1% from 2025 to 2035 |

| Market Value in 2025 | USD 4 billion |

| Market Value in 2035 | USD 17.8 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Products and Services, Application, End User, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Thermo Fisher Scientific Inc.; Merck KGaA; Agilent Technologies Inc.; Genscript Biotech Corporation; CRISPR Therapeutics AG; Editas Medicine; Intellia Therapeutics Inc.; Beam Therapeutics Inc.; Caribou Biosciences Inc.; Lonza Group Ltd. |

| Customization Scope | Available on Request |

The global CRISPR market is estimated to be valued at USD 4.6 billion in 2025.

The market size for the CRISPR market is projected to reach USD 19.3 billion by 2035.

The CRISPR market is expected to grow at a 15.3% CAGR between 2025 and 2035.

The key product types in CRISPR market are products, _crispr kits & enzymes, _crispr libraries, _other products, services, _grna design & vector construction, _cell line engineering, _screening services and _other services.

In terms of application, drug discovery & development segment to command 51.2% share in the CRISPR market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

CRISPR-based Gene Editing Market Size and Share Forecast Outlook 2025 to 2035

CRISPR and Cas Gene Market Report – Growth, Trends & Future Outlook 2025 to 2035

CRISPR Genomic Cure Market

Veterinary CRISPR-Based Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA