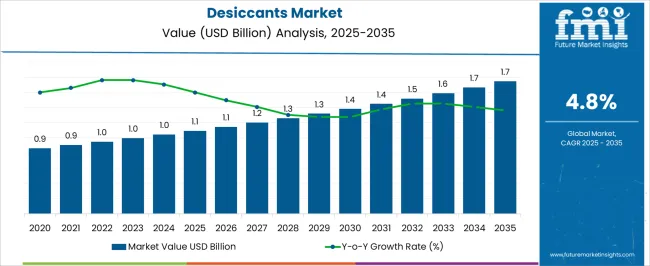

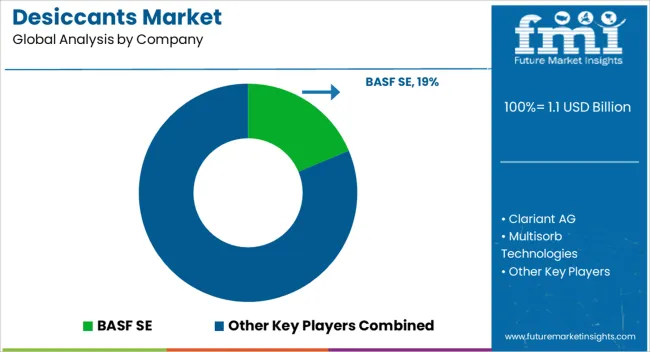

The desiccants market, valued at USD 1.1 billion in 2025 and forecasted to reach USD 1.7 billion by 2035 at a CAGR of 4.8%, demonstrates characteristics of a moderately mature industry positioned in the steady growth phase of the market maturity curve. The adoption lifecycle indicates that desiccants have moved past the introduction and early adoption stages due to their long-established role in moisture control across pharmaceuticals, food packaging, electronics, and industrial applications.

The market trajectory shows consistent but not exponential growth, suggesting reliance on incremental innovations and expanded applications rather than disruptive breakthroughs. During the forecast period, the industry is expected to remain within the late growth to early maturity stage, where adoption broadens in emerging sectors such as renewable energy storage, advanced coatings, and high-precision electronics. Traditional uses in food and drug preservation continue to dominate, indicating saturation in mature markets like North America and Europe. However, Asia-Pacific and Latin America exhibit rising adoption, especially where industrialization and packaged goods demand expand steadily. The lifecycle suggests that the market is unlikely to enter rapid exponential growth but will sustain moderate advancement driven by regulatory standards for product preservation and technology-driven efficiency improvements. Thus, the desiccants sector represents a stable, efficiency-oriented market progressing along a mature adoption curve with regional expansion opportunities.

| Metric | Value |

|---|---|

| Desiccants Market Estimated Value in (2025 E) | USD 1.1 billion |

| Desiccants Market Forecast Value in (2035 F) | USD 1.7 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The desiccants market represents an important segment of the global moisture control and packaging protection industry, reflecting its role in preserving product quality across sectors. Within the broader packaging materials industry, it accounts for about 4.7%, driven by demand in pharmaceuticals, food, and electronics. In the industrial drying and storage sector, desiccants hold nearly 5.5%, supporting efficient moisture management. Across the chemical absorbents and adsorbents industry, it contributes around 3.8%, emphasizing use in air drying, gas purification, and liquid filtration.

Within the logistics and shipping protection market, it secures 3.2%, highlighting the growing reliance on humidity control during transportation. In the overall specialty chemicals landscape, desiccants represent 2.9%, showcasing their strategic importance in quality preservation and operational reliability. Recent developments in the desiccants market have highlighted material innovation and sustainable production practices. Advancements in silica gel, molecular sieves, and activated clay have enhanced efficiency, reusability, and cost-effectiveness. A growing trend involves the integration of eco-friendly desiccants made from renewable and biodegradable sources, supporting green supply chain initiatives.

Pharmaceutical and food sectors are adopting advanced sachet, packet, and canister formats to ensure extended shelf life and compliance with safety regulations. The electronics industry is driving innovation in compact desiccant solutions for semiconductors and precision equipment. Digital tracking and smart packaging solutions are also emerging, enabling real-time monitoring of humidity conditions.

The desiccants market is expanding steadily as industries prioritize moisture control to enhance product longevity, maintain quality, and meet regulatory standards. Rising demand across pharmaceuticals, electronics, and food packaging sectors is driving the adoption of desiccants in manufacturing, storage, and logistics environments.

Growth in global trade, particularly for sensitive products requiring dry conditions, has underscored the need for reliable moisture-absorbing materials. Additionally, sustainability pressures are prompting the development of reusable and eco-friendly desiccant solutions.

Technological innovations in desiccant packaging formats and integration into smart logistics systems are further enhancing the market’s appeal. The market is positioned for continued growth as end-user industries expand their global footprint and seek higher shelf stability, with customized desiccant solutions playing an increasingly strategic role in supply chain efficiency.

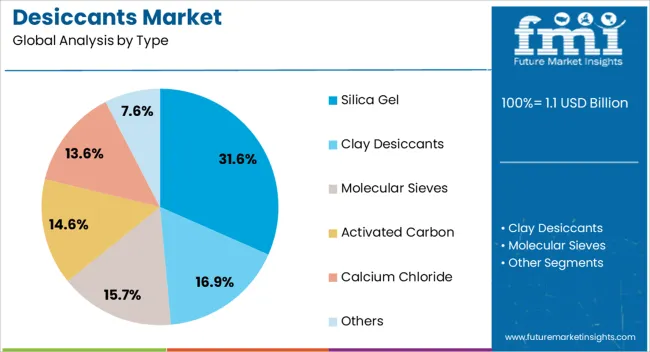

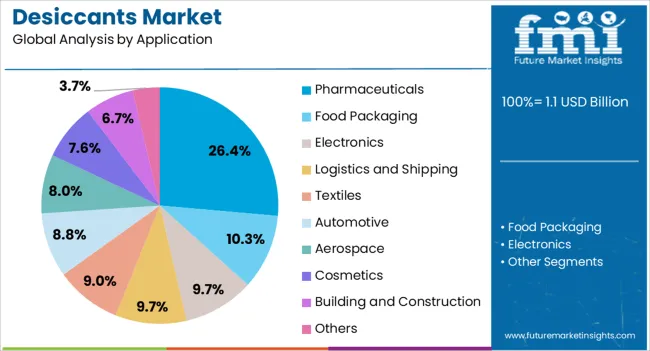

The desiccants market is segmented by type, application, and geographic regions. By type, desiccants market is divided into Silica Gel, Clay Desiccants, Molecular Sieves, Activated Carbon, Calcium Chloride, and Others. In terms of application, desiccants market is classified into Pharmaceuticals, Food Packaging, Electronics, Logistics and Shipping, Textiles, Automotive, Aerospace, Cosmetics, Building and Construction, and Others. Regionally, the desiccants industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The silica gel segment holds a leading 31.6% share in the desiccant type category, favored for its high adsorption capacity, non-corrosive nature, and thermal stability. Silica gel is widely used in applications requiring precise humidity control, including pharmaceuticals, food products, electronics, and optical instruments.

Its popularity is reinforced by its reusability and cost-effectiveness, making it suitable for both consumer and industrial applications. The segment benefits from continuous advancements in indicator technology and packet design, enhancing usability and safety.

The inert chemical structure of silica gel allows compatibility with sensitive products, particularly in sterile or contamination-averse environments. As industries demand more effective and environmentally conscious moisture control, the silica gel segment is expected to maintain its dominant position by offering versatile, scalable, and regulatory-compliant solutions

The pharmaceuticals segment commands a significant 26% share of the desiccants market by application, driven by stringent regulatory requirements for product stability and shelf-life assurance. Desiccants play a crucial role in protecting pharmaceutical formulations from moisture-induced degradation, particularly in tablets, capsules, and diagnostic kits.

The growing complexity of pharmaceutical supply chains and global distribution models further necessitates the use of desiccants to ensure product integrity during transit and storage. Innovation in desiccant canisters, stoppers, and films tailored for moisture-sensitive drug packaging has contributed to the growth of this segment.

Moreover, rising production of biologics and high-potency drugs underscores the need for enhanced moisture control solutions. The segment is expected to expand as pharmaceutical companies invest in advanced packaging technologies and prioritize compliance with evolving quality and safety standards.

The market has expanded as industries increasingly rely on moisture control solutions to preserve product quality, extend shelf life, and ensure safety. Desiccants such as silica gel, activated alumina, zeolites, clay, and calcium chloride are widely applied in pharmaceuticals, food packaging, electronics, and industrial processes. Their ability to absorb and maintain dryness in controlled environments has made them indispensable across multiple sectors. Global trade of packaged goods, rising pharmaceutical output, and expanding electronics manufacturing have driven significant demand.

Desiccants play a vital role in pharmaceutical and healthcare industries by ensuring product stability and safety. They are extensively used in packaging for tablets, capsules, diagnostic kits, and medical devices to prevent moisture-induced degradation. Regulations regarding drug stability have made desiccant inclusion mandatory in several therapeutic segments. Controlled release of moisture absorption through unit packs, canisters, and sachets enables precise protection. The increasing demand for biologics, generics, and sensitive formulations has heightened the requirement for reliable moisture protection. Healthcare packaging advancements now integrate desiccants directly into closures and containers, offering enhanced performance. With rising investments in drug development and stringent regulatory frameworks, the pharmaceutical sector remains one of the most influential drivers of global desiccant consumption.

In the food and beverage sector, desiccants are crucial for extending shelf life and preventing spoilage. Packaged snacks, dried foods, coffee, and confectionery often incorporate desiccant sachets to maintain freshness and prevent clumping. Moisture control also helps preserve texture, aroma, and taste, which are critical for consumer satisfaction. The global increase in packaged and processed food consumption has amplified the need for reliable desiccant solutions. Advanced food-grade desiccants are designed to comply with stringent safety standards, ensuring that they do not contaminate or react with edible products. Growing e-commerce food distribution and long-distance exports have further increased demand for efficient moisture control, solidifying the role of desiccants in global food preservation.

Electronics manufacturing requires precise humidity control to protect semiconductors, circuit boards, and optical components from corrosion and malfunction. Desiccants are widely used in sealed electronic packaging, storage units, and transport cases. Industrial applications also include gas drying, air separation, petrochemicals, and environmental testing equipment. Customized desiccant systems are being engineered for heavy-duty use, providing thermal stability and long-lasting moisture absorption. The rapid expansion of semiconductor and electronics production in Asia Pacific has reinforced regional demand. Meanwhile, industries dependent on precision equipment, such as aerospace and defense, increasingly employ desiccants for operational reliability. This integration demonstrates how desiccants remain critical for protecting high-value components and ensuring process efficiency.

Growing attention toward sustainability has influenced desiccant material innovation. Manufacturers are exploring bio-based, regenerable, and recyclable desiccants to meet environmental standards. Regenerable silica gel and zeolite-based desiccants enable multiple cycles of use, thereby reducing waste. Additionally, sustainable packaging solutions increasingly integrate natural clay desiccants, which offer both effectiveness and eco-friendliness.

Advances in smart desiccant technology, including humidity indicators and self-regulating systems, are enhancing efficiency and usability. These innovations address regulatory pressures and consumer expectations for green products. As industries prioritize low-carbon operations, demand for eco-friendly desiccant materials is projected to expand. This transition underscores the market’s shift toward sustainable practices without compromising moisture control efficiency.

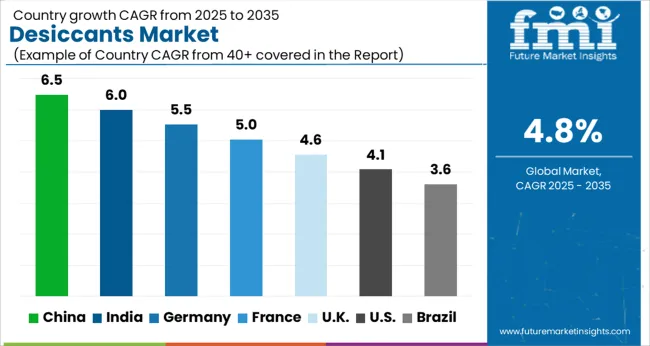

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

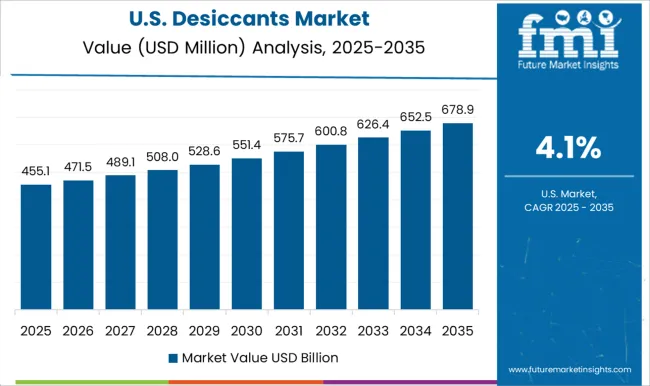

| USA | 4.1% |

| Brazil | 3.6% |

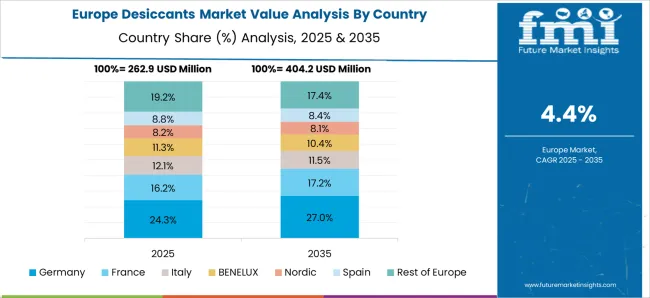

The market is projected to grow at a CAGR of 4.8% from 2025 to 2035, influenced by expanding applications in packaging, pharmaceuticals, and electronics. China records 6.5%, driven by strong manufacturing capacity and large-scale adoption across industries. India follows with 6.0%, supported by increasing pharmaceutical and food sector utilization. Germany stands at 5.5%, where advanced industrial demand and strict quality standards play a major role. The UK posts 4.6%, reflecting growing use in packaged goods and healthcare. The USA reaches 4.1%, with consistent applications in electronics and logistics. These variations illustrate how industrial strength and sectoral needs define country-wise demand for desiccants. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is recording a CAGR of 6.5%, supported by strong demand from packaging, pharmaceuticals, electronics, and food sectors. The large-scale manufacturing ecosystem has enabled consistent supply of silica gel, activated alumina, and molecular sieves. Growth is also being driven by the need for efficient moisture control in bulk exports, where desiccants play a critical role in protecting sensitive products. Innovation is taking place in eco-friendly and biodegradable desiccant formulations, as manufacturers respond to global environmental requirements. Partnerships with logistics and food processing companies ensure consistent adoption across industries, while domestic chemical producers continue to expand production capacities.

India is expanding at a CAGR of 6.0%, fueled by strong use in pharmaceuticals, food packaging, and agrochemicals. The pharmaceutical industry, one of the largest globally, significantly contributes to rising demand for silica gel and clay-based desiccants to protect drug formulations. Growth in packaged food consumption and the need for longer shelf life are also creating consistent opportunities. Local manufacturing capabilities are scaling up, with several medium-sized producers investing in customized desiccant solutions for niche applications. Export markets in the Middle East and Africa are increasingly reliant on Indian suppliers due to cost-effective yet reliable product quality.

Germany is projected to grow at a CAGR of 5.5%, with expansion centered around automotive, electronics, and healthcare industries. German manufacturers prioritize high-quality desiccants with advanced adsorption capacities and regulatory compliance. Sustainability remains a key theme, with investments in reusable and recyclable desiccants gaining momentum. The German logistics sector also uses container desiccants extensively to safeguard machinery and precision tools during exports. Research collaborations between universities and manufacturers further advance innovation in molecular sieve and silica-based desiccant technologies. The market benefits from strong industrial expertise and established trade networks within Europe.

The United Kingdom is growing at a CAGR of 4.6%, supported by pharmaceutical exports, food packaging, and logistics. UK pharmaceutical firms use desiccants extensively to maintain the stability of drug formulations under varying climates during shipping. Food packaging companies increasingly deploy eco-friendly desiccant sachets to ensure moisture-free preservation. With the growth of online retail and international shipments, desiccant demand has expanded in the logistics sector. Emphasis is being placed on adopting biodegradable and regulatory-compliant solutions, catering to both domestic and EU market requirements. This positions the UK as a niche innovator despite smaller production volumes.

The United States is expanding at a CAGR of 4.1%, with pharmaceuticals, electronics, and food storage as primary consumers. The US pharmaceutical industry demands high-grade desiccants to ensure product stability during global distribution. Electronics manufacturing, especially semiconductors and sensors, also requires moisture-control solutions, creating steady growth. Demand for container desiccants has increased in exports to Asia and Europe, where stringent shipment conditions prevail. US companies are investing in advanced desiccant canisters, bags, and sachets with improved absorption rates and compliance with FDA and EPA regulations. Sustainability-driven innovation remains central, with a shift toward recyclable packaging.

The market is highly competitive, with leading multinational companies and regional specialists actively shaping growth through innovation and diversified offerings. BASF SE, Clariant AG, W. R. Grace & Co., Dow Chemical Company, and Mitsubishi Chemical Corporation dominate the market with extensive product portfolios, strong manufacturing capabilities, and well-established supply chains that serve industries such as pharmaceuticals, food packaging, and electronics.

Their investments in advanced adsorbent materials and eco-friendly desiccant technologies position them as key players. Specialized companies including Multisorb Technologies, CSP Technologies, Sanner GmbH, and Absortech Group strengthen their presence by focusing on tailored packaging solutions, moisture-sensitive product protection, and regulatory compliance in healthcare and food safety sectors. Regional and niche participants like Desiccare, Inc., Sorbead India, Capitol Scientific, Inc., IMPAK Corporation, AGM Container Controls, Inc., and Interra Global Corporation drive competition through customized solutions, cost efficiency, and distribution flexibility. Strategic emphasis on sustainability, digital monitoring of humidity control, and material innovations is expected to define competitive advantages in this evolving market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Type | Silica Gel, Clay Desiccants, Molecular Sieves, Activated Carbon, Calcium Chloride, and Others |

| Application | Pharmaceuticals, Food Packaging, Electronics, Logistics and Shipping, Textiles, Automotive, Aerospace, Cosmetics, Building and Construction, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Clariant AG, Multisorb Technologies, W. R. Grace & Co., Dow Chemical Company, Mitsubishi Chemical Corporation, CSP Technologies, Desiccare, Inc., Absortech Group, Sanner GmbH, Sorbead India, Capitol Scientific, Inc., IMPAK Corporation, AGM Container Controls, Inc., and Interra Global Corporation |

| Additional Attributes | Dollar sales by desiccant type and application, demand dynamics across food packaging, pharmaceuticals, and industrial sectors, regional trends in moisture control adoption, innovation in adsorption capacity, regeneration methods, and eco-friendly formulations, environmental impact of material sourcing and disposal, and emerging use cases in electronics protection, healthcare packaging, and renewable energy systems. |

The global desiccants market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the desiccants market is projected to reach USD 1.7 billion by 2035.

The desiccants market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in desiccants market are silica gel, clay desiccants, molecular sieves, activated carbon, calcium chloride and others.

In terms of application, pharmaceuticals segment to command 26.4% share in the desiccants market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA