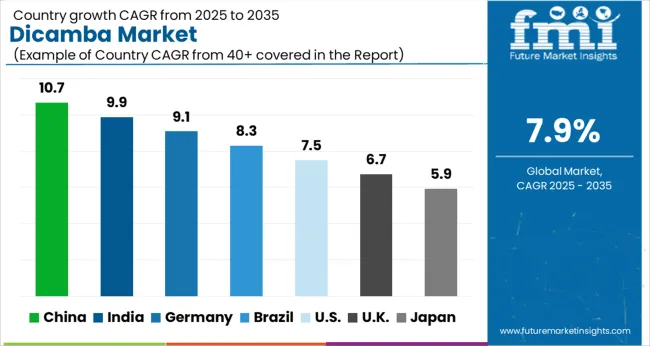

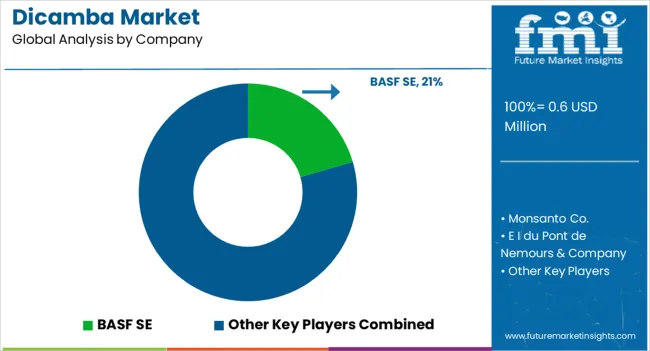

The Dicamba Market is estimated to be valued at USD 0.6 million in 2025 and is projected to reach USD 1.3 million by 2035, registering a compound annual growth rate (CAGR) of 7.9% over the forecast period.

| Metric | Value |

|---|---|

| Dicamba Market Estimated Value in (2025 E) | USD 0.6 million |

| Dicamba Market Forecast Value in (2035 F) | USD 1.3 million |

| Forecast CAGR (2025 to 2035) | 7.9% |

The dicamba market is expanding steadily due to increasing demand for effective herbicides that address resistant weed species and enhance crop yield. The current market landscape is defined by the widespread adoption of dicamba formulations in large-scale farming operations, where efficiency and crop protection remain critical.

Rising global agricultural activities, driven by population growth and the need for higher food output, are reinforcing market demand. Regulatory frameworks aimed at sustainable agriculture and improved crop protection strategies are further supporting adoption, despite ongoing scrutiny related to environmental impact and drift issues.

Producers are focusing on refining application technologies and developing improved formulations to mitigate risks while maximizing effectiveness The future outlook highlights continued reliance on dicamba as part of integrated weed management strategies, with technological innovation, targeted application, and expanding usage in emerging agricultural regions expected to strengthen its market penetration and revenue contribution over the coming decade.

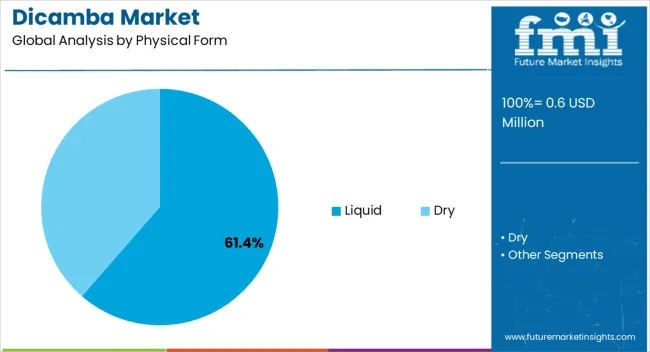

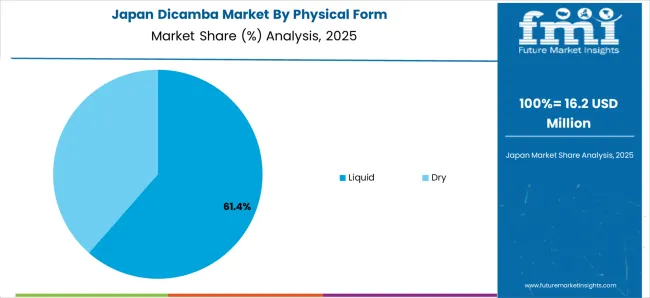

The liquid segment, holding 61.4% of the physical form category, has been leading due to its ease of application and compatibility with modern spraying equipment. Adoption has been reinforced by its ability to deliver consistent coverage across large agricultural fields, ensuring effective weed control.

Liquid formulations have benefited from advances in adjuvants and surfactants that improve performance and reduce volatility, which has strengthened grower confidence in the product. Distribution efficiency and storage convenience have also contributed to higher adoption rates in both developed and emerging farming markets.

Continued innovation in formulation stability and drift-reduction technologies is expected to further sustain liquid dicamba’s leadership position, ensuring it remains the preferred choice for growers aiming to optimize weed management while meeting regulatory standards and environmental considerations.

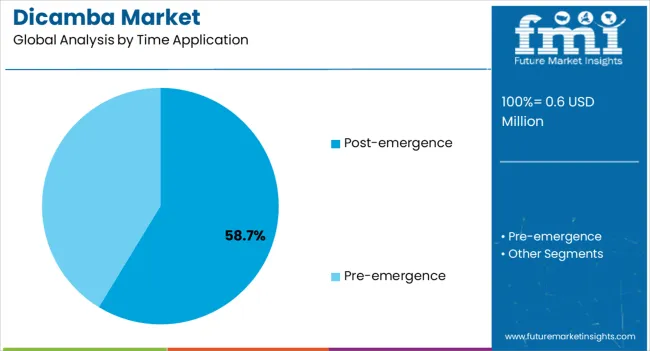

The post-emergence segment, representing 58.7% of the time application category, has established dominance due to its proven effectiveness in managing resistant broadleaf weeds during critical crop growth stages. Its adoption has been supported by the ability to provide targeted control, reducing competition for nutrients and enhancing overall crop productivity.

Post-emergence application has been favored by farmers seeking flexibility in weed management practices, as it allows treatment after weed identification and crop establishment. Advancements in precision spraying and application techniques have improved efficacy while reducing off-target impact, bolstering regulatory compliance and environmental safety.

With the rising need for adaptable and effective weed management solutions, the post-emergence segment is expected to maintain its strong market position and contribute significantly to the overall growth of the dicamba market.

Regulatory Scrutiny:Increasing regulation scrutiny may decline the demand for dicamba among farmers in various countries. The growing concerns about off-target drift and increasing adoption of organic farming may decline the global market growth.

Legal Issues:The increasing legal disputes and lawsuits against the use of dicamba in may cause a decline in market growth. These legal factors may face challenges among manufacturers and increase the prices of dicamba. Due to higher costs, farmers who are not prepared to buy these chemicals may also restrain the market growth.

Alternative Methods:Farmers are shifting towards alternative methods such as natural farming, cover cropping, and other cultivation methods that may decline the uses of dicamba.

Import-export Restrictions:The restriction of dicamba trade among various regions may affect the market growth among international borders.

The global market grew at a steady historical growth, with a valuation of USD 0.6 million in 2025. The increasing farmer's demand for resistant unwanted plants is raising the adoption of dicamba for enhanced crop protection, and production is surging the market revenue. Key companies are introducing new and unique formulas to reduce off-target drift and reduce volatility.

The key players are emerging legal battles related to dicamba products that damage farmers' crops, and landowners are seeking compensation for their losses. On the other side, they are invested heavily in research and development activities to improve dicamba formulations to reduce risks and damage to crops. Rising incidences of crop damage have a heavy impact on the country's economy, as the agriculture sector covers a relevant share in uplifting the country's GDP.

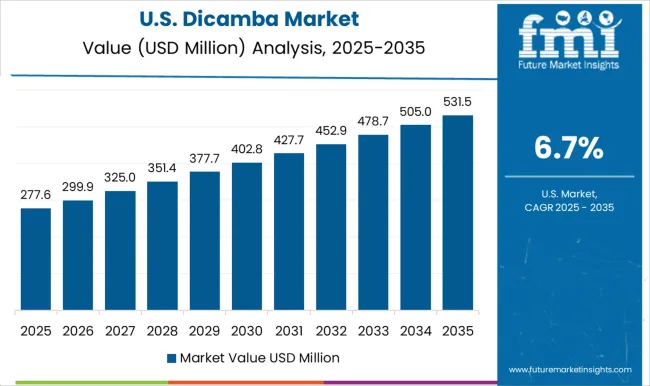

The United States market is estimated to capture a CAGR of 8.80% during the forecast period. Rising advanced farming technologies and farming practices are gaining vast popularity in the agriculture sector, increasing the adoption of dicamba in the country. The growing widespread of genetically modified crops such as cotton and soybeans is increasing the adoption of dicamba-related products for fertilization, which is driving the market growth.

Key companies are focusing on developing low-volatility formulations with smart technologies and investing vastly in research activities. These companies are making strategies to take action on developing herbicides that maintain the quality of crops without damaging them and are expanding the United States dicamba market growth.

The United Kingdom market is anticipated to secure a CAGR of 7.20% through 2035. The increasing demand fordicamba weed control solutionswith strict regulations is surging the United Kingdom's dicamba market size. Key players are approving their herbicides by the European Union Regulations to offer safe and registered dicamba to farmers for crop protection.

Increasing farmers' demand for advanced, safe, and authorized dicamba-related products may surge the market revenue in the country. Key players are focused on farmers' expectations related to their crop's production and safety and are offering new technical farming solutions that significantly boost the market growth in the country.

The market in Canada is anticipated to capture a CAGR of 7.70% over the forecast period. The increasing cultivation of a wide range of crops is significantly raising the demand for dicamba among farmers. Agriculture professionals are focused on environmental impact and developing low-hazardous dicamba with standardized regulations that enhance crop quality and production.

Canada's dicamba marketis propelled by changing weather conditions; temperatures and rainfall are surging the demand for herbicide products such as dicamba. Key companies are looking for collaboration with international companies to manage their strategies and plans with innovative ideas to expand the market in the country.

The market in China is estimated to capture a CAGR of 8.60% through 2035. Increasing agriculture practices with advanced technologies are raising crop production and enhancing their quality, accelerating the demand for dicamba among farmers. Farmers prefer dicamba for specific crops such as wheat and cotton to improve their production and reduce the uncertain growing of plants nearby them.

China is vast in the agriculture sector and produces a wide range of crops such as corn, wheat, and rice with the adoption of dicamba. Farmers in China exporting a wide range of products among various countries due to better crop production in the country are significantly increasing the China dicamba market size. China authorities are ensuring crop safety and production by imposing strict regulations on developing dicamba products to minimize environmental impacts.

The Japanese market is estimated to register a CAGR of 4.30% over the forecast period. The increasing cultivation of a variety of crops with strict regulations is increasing the adoption of dicamba. Japan is vast in technology and is developing advanced solutions to increase crop production, offering suitable and specific dicamba-related products to meet farmers' desires.

Japan's dicamba marketis significantly growing by expanding the agriculture sector, improving sustainability, and focusing ondicamba weed control solutions. Key companies are focusing on effective weed control solutions to enhance crop quality and production in the country. They are choosing minimal environmental impact strategies in the country, increasing the demand for dicamba.

| Top Application | Agriculture |

|---|---|

| Market Share in 2025 | 85.6% |

Based on application, the agriculture sector accounts for a share of 85.6% of the global dicamba market. The increasing demand for crop protection and the reduction of unwanted plants and bushes are expanding the adoption of dicamba. Farmers are making efforts to protect their crops from climate changes, root damage, and other conditions that are surging the demand for dicamba.

The rising demand for dicamba for adequate crop protection and control weeds in the agriculture practices. Farmers are producing high-yield crops by adopting dicamba-related products with sustainable options. They prefer lower doses of dicamba products to maintain environmental regulations. The global agriculture industry is widely accepting dicamba products, which are crucial in capturing vast revenue.

The global dicamba market is fragmented by several major players, significantly boosting vast revenue. These players are investing their million-dollar amount in research and development activities to expand the market reach. Key players are adopting various marketing strategies to advance the global market, including collaborations, product launches, partnerships, and agreements.

Key players are focusing on developing cost-effective and durable products that satisfy end users' requirements. Manufacturers are focused on developing low-hazardous chemicals to reduce crop damage and enhance their productivity. They are experimenting with new formulations to develop eco-friendly products that enhance crop production.

Top Two Players in the Global Dicamba Market

Recent Developments in the Global Dicamba Market

The global dicamba market is estimated to be valued at USD 0.6 million in 2025.

The market size for the dicamba market is projected to reach USD 1.3 million by 2035.

The dicamba market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in dicamba market are liquid and dry.

In terms of time application, Post-emergence segment to command 58.7% share in the dicamba market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA