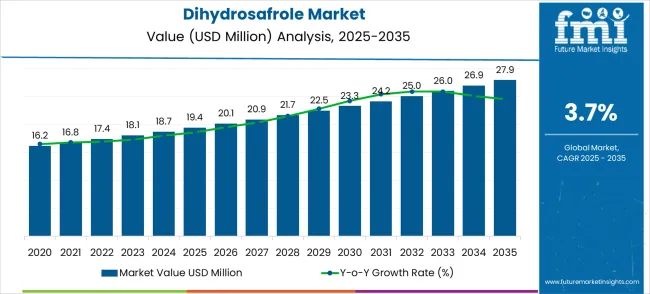

The dihydrosafrole market is projected to grow steadily from USD 19.4 million in 2025 to USD 27.9 million by 2035, reflecting a forecast CAGR of 3.7%. Year-on-year analysis reveals consistent incremental growth, with the market expected to increase to USD 20.1 million in 2026, USD 20.9 million in 2027, and USD 21.7 million in 2028. The trend continues with USD 22.5 million in 2029, USD 23.3 million in 2030, and USD 24.2 million in 2031, highlighting stable expansion without significant volatility. Annual growth percentages indicate a balanced rise in market value, which points to steady demand across various applications including fragrances, flavoring agents, and chemical intermediates. This predictable progression is supported by sustained industrial requirements and a preference for high-purity dihydrosafrole in specialty formulations, which positions the market as a reliable contributor within the global flavor and fragrance ingredients sector.

Further growth is projected with the dihydrosafrole market reaching USD 25.0 million in 2032, USD 26.0 million in 2033, USD 26.9 million in 2034, and ultimately USD 27.9 million by 2035. This steady upward trajectory reflects moderate acceleration driven by expanding adoption in niche industrial applications and consistent regulatory approvals that favor its controlled usage. The market demonstrates a low-risk growth profile, as demand is influenced more by production consistency and quality specifications than by fluctuating consumer trends. Incremental year-on-year increases allow for better forecasting and planning for manufacturers, distributors, and formulators in related industries. Overall, the dihydrosafrole market exhibits a stable growth pattern characterized by measured expansion, providing a strong outlook for investors and participants seeking long-term, predictable returns within the flavor, fragrance, and chemical intermediates markets.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 19.4 million |

| Market Forecast Value (2035) | USD 27.9 million |

| Forecast CAGR (2025-2035) | 3.7% |

The dihydrosafrole market holds a notable position within the essential oils market, accounting for about 5% of the total market share, as it is used in natural fragrance formulations. In the fragrance ingredients market, it captures approximately 7%, owing to its role in imparting floral and sweet notes in perfumes. Within the chemical intermediates market, the share is about 6%, driven by its use as an intermediate in the production of other chemical compounds. The flavor and fragrance industry contributes around 4%, reflecting its essential role in aromatic formulations for consumer products. Lastly, in the natural aromatic chemicals market, the dihydrosafrole market holds approximately 3%, highlighting its importance in the production of natural extracts. These figures show how dihydrosafrole plays a critical role in multiple industries that rely on aromatic and chemical applications.

Market expansion is being supported by the increasing demand for specialty chemical intermediates across pharmaceutical and fragrance industries, creating opportunities for high-value chemical synthesis applications. Modern pharmaceutical and fragrance manufacturing requires precise chemical intermediates with consistent quality and purity levels to ensure product efficacy and regulatory compliance. The versatile chemical properties of dihydrosafrole make it an essential intermediate in sophisticated pharmaceutical synthesis and specialty fragrance production where molecular precision and quality consistency are critical.

The growing emphasis on pharmaceutical quality and regulatory compliance is driving demand for ultra-high purity dihydrosafrole from certified manufacturers with proven track records of pharmaceutical-grade production capabilities. Chemical manufacturers are increasingly investing in advanced purification technologies and quality assurance systems that deliver superior product consistency while meeting stringent pharmaceutical and fragrance industry standards. Regulatory requirements and industry certifications are establishing quality benchmarks that favor precision-manufactured dihydrosafrole with verified purity levels and comprehensive documentation.

The specialty chemical industry's focus on advanced synthesis applications is creating substantial demand for reliable chemical intermediates capable of supporting complex pharmaceutical and fragrance manufacturing processes. The agricultural chemical sector continues to drive innovation in pesticide synergist applications while maintaining cost-effectiveness, leading to development of specialized dihydrosafrole formulations with enhanced chemical stability and improved application performance characteristics.

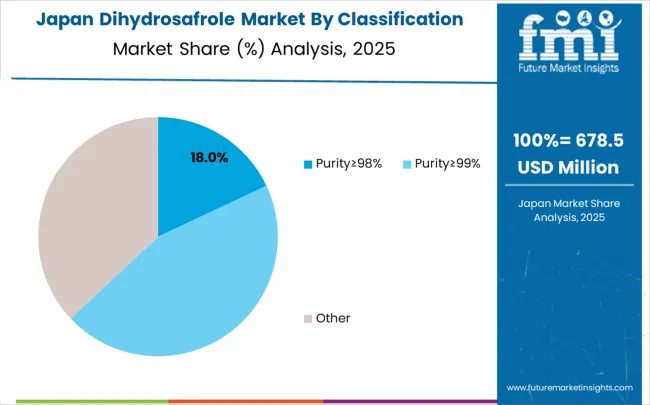

The market is segmented by purity level, application, and region. By purity level, the market is divided into Purity≥98%, Purity≥99%, and other configurations. Based on application, the market is categorized into fragrances, pesticide synergist, pharmaceutical intermediate, and other applications. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Purity≥99% configurations are projected to account for 45% of the dihydrosafrole market in 2025. This leading share is supported by the increasing demand for ultra-high purity intermediates in pharmaceutical applications and growing quality requirements in specialty chemical synthesis. Ultra-high purity dihydrosafrole provides superior chemical consistency and enhanced reaction reliability, making it the preferred choice for pharmaceutical intermediate production, advanced fragrance synthesis, and specialized chemical applications. The segment benefits from advanced purification technologies that have achieved exceptional purity levels while maintaining cost-effectiveness for pharmaceutical-grade applications.

Modern Purity≥99% dihydrosafrole incorporates sophisticated distillation processes and enhanced purification techniques that maximize chemical purity while ensuring consistent molecular characteristics across production batches. These innovations have significantly improved pharmaceutical application performance while reducing impurity-related synthesis complications that can affect final product quality and regulatory compliance. The pharmaceutical industry particularly drives demand for ultra-pure solutions, as these applications require absolute chemical consistency and superior quality characteristics to meet FDA and international regulatory standards.

Additionally, the specialty fragrance market increasingly adopts Purity≥99% dihydrosafrole to ensure consistent olfactory properties and enhance product quality in premium fragrance formulations. The growing emphasis on pharmaceutical-grade chemical intermediates creates opportunities for specialized ultra-high purity dihydrosafrole formulations designed for advanced pharmaceutical synthesis applications.

Pharmaceutical intermediate applications are expected to represent 42% of dihydrosafrole demand in 2025. This dominant share reflects the critical role of dihydrosafrole in pharmaceutical synthesis processes and growing demand for specialized chemical intermediates in drug development and manufacturing. Pharmaceutical manufacturers require ultra-high quality dihydrosafrole capable of supporting complex synthesis reactions while maintaining strict quality control and regulatory compliance standards. The segment benefits from continuous innovation in pharmaceutical chemistry that utilizes dihydrosafrole's unique molecular properties for advanced drug synthesis applications.

The pharmaceutical industry drives significant demand for pharmaceutical-grade dihydrosafrole that provides exceptional chemical purity and consistent reaction characteristics for drug manufacturing processes. These applications require dihydrosafrole with superior quality specifications and comprehensive documentation to ensure regulatory compliance and product safety. The segment benefits from growing pharmaceutical industry investment in specialty intermediate development and increasing demand for complex pharmaceutical synthesis capabilities.

Drug development and specialty pharmaceutical manufacturing contribute substantially to market growth as pharmaceutical companies implement dihydrosafrole in innovative synthesis pathways and specialized pharmaceutical applications. The growing adoption of advanced pharmaceutical chemistry creates opportunities for specialized dihydrosafrole applications designed for cutting-edge drug development and pharmaceutical research. Additionally, the trend toward personalized medicine and specialty pharmaceuticals drives demand for unique chemical intermediates like dihydrosafrole that enable advanced pharmaceutical synthesis capabilities.

The dihydrosafrole market is advancing steadily due to increasing specialty chemical demand and growing recognition of dihydrosafrole's importance across pharmaceutical and chemical synthesis applications. However, the market faces challenges including regulatory compliance requirements, need for specialized manufacturing expertise, and varying quality specifications across different industrial applications. Quality certifications and regulatory standards continue to influence production practices and market development patterns.

The growing adoption of sophisticated purification processes and enhanced quality control systems is enabling significant purity improvements while maintaining pharmaceutical-grade quality standards in dihydrosafrole production. Advanced analytical techniques provide better quality assurance and superior batch consistency, enabling reliable pharmaceutical applications and enhanced customer confidence. These technologies are particularly valuable for pharmaceutical intermediate applications that require maximum chemical purity and regulatory compliance documentation.

Modern dihydrosafrole manufacturers are developing specialized formulations tailored to specific industry requirements, including pharmaceutical-grade intermediates with enhanced purity, fragrance applications with optimized olfactory characteristics, and agricultural chemical formulations with improved stability and performance. Advanced formulation techniques enable precise optimization of chemical properties for targeted applications while maintaining manufacturing scalability and regulatory compliance.

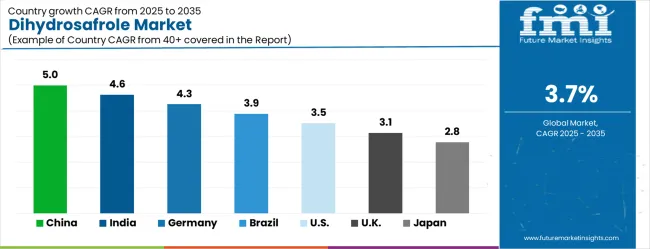

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.0% |

| India | 4.6% |

| Germany | 4.3% |

| Brazil | 3.9% |

| United States | 3.5% |

| United Kingdom | 3.1% |

| Japan | 2.8% |

The dihydrosafrole market is growing moderately, with China leading at a 5.0% CAGR through 2035, driven by expanding specialty chemical manufacturing capabilities and growing pharmaceutical intermediate production. India follows at 4.6%, supported by increasing chemical industry development and expanding pharmaceutical manufacturing infrastructure. Germany records strong growth at 4.3%, emphasizing pharmaceutical industry excellence and advanced chemical synthesis technologies. Brazil grows steadily at 3.9%, developing specialty chemical production capabilities and pharmaceutical industry expansion. The United States shows solid growth at 3.5%, focusing on pharmaceutical innovation and specialty chemical development. The United Kingdom maintains moderate expansion at 3.1%, supported by pharmaceutical industry advancement. Japan demonstrates stable growth at 2.8%, emphasizing quality excellence and precision chemical manufacturing.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

The dihydrosafrole market in China is projected to exhibit the highest growth rate with a CAGR of 5.0% through 2035, driven by the country's expanding specialty chemical manufacturing capabilities and rapidly growing pharmaceutical intermediate production infrastructure. The extensive chemical processing facilities and increasing investment in advanced purification technologies are creating substantial opportunities for high-quality dihydrosafrole production. Major chemical manufacturers are establishing comprehensive production capabilities to support both domestic pharmaceutical industry demand and international export markets while meeting global quality standards.

Specialty chemical manufacturing expansion and pharmaceutical industry development are supporting widespread adoption of advanced dihydrosafrole production technologies across commercial manufacturing operations, driving demand for sophisticated purification equipment and quality control systems. Export market development and pharmaceutical-grade quality certification programs are creating significant opportunities for Chinese dihydrosafrole producers in global specialty chemical supply chains requiring consistent quality and competitive pricing.

The dihydrosafrole market in India is expanding at a CAGR of 4.6%, supported by the country's increasing chemical industry development and expanding pharmaceutical manufacturing infrastructure under government industrial initiatives. The growing specialty chemical production capabilities and increasing investment in modern chemical synthesis technologies are driving substantial dihydrosafrole production potential. Manufacturing facilities are leveraging cost advantages while adopting international quality standards to meet pharmaceutical and specialty chemical market requirements.

Chemical industry development and pharmaceutical manufacturing expansion are creating opportunities for high-quality dihydrosafrole production across diverse specialty chemical categories requiring advanced synthesis capabilities and quality assurance systems. International pharmaceutical market access and quality certification achievements are driving investments in pharmaceutical-grade dihydrosafrole production technologies throughout major chemical manufacturing regions and processing facilities.

The dihydrosafrole market in Germany is projected to grow at a CAGR of 4.3%, supported by the country's leadership in pharmaceutical industry development and advanced chemical synthesis technology applications. German pharmaceutical and chemical companies are implementing sophisticated dihydrosafrole processing systems that meet stringent quality standards and pharmaceutical industry requirements. The market is characterized by focus on innovation, advanced purification technologies, and compliance with comprehensive pharmaceutical quality regulations.

Pharmaceutical industry investments are prioritizing advanced dihydrosafrole processing technologies that demonstrate superior purity levels and pharmaceutical compliance while meeting German pharmaceutical quality and regulatory standards for drug manufacturing applications. Innovation programs and pharmaceutical technology development initiatives are driving adoption of precision-engineered chemical synthesis systems that support optimal dihydrosafrole quality and enhanced pharmaceutical application performance.

The dihydrosafrole market in Brazil is growing at a CAGR of 3.9%, driven by developing specialty chemical production capabilities and expanding pharmaceutical industry infrastructure across chemical manufacturing sectors. The growing investment in modern chemical processing infrastructure and increasing focus on pharmaceutical intermediate production are creating opportunities for dihydrosafrole manufacturing development. Processing facilities are adopting advanced technologies to support growing domestic pharmaceutical and export market requirements while maintaining cost competitiveness.

Specialty chemical production development and pharmaceutical industry expansion are facilitating adoption of effective dihydrosafrole manufacturing systems capable of meeting diverse quality requirements and pharmaceutical specifications across industrial applications. Regional chemical manufacturing capability enhancement and pharmaceutical market development are creating demand for standardized dihydrosafrole products that meet pharmaceutical industry specifications and quality requirements.

The dihydrosafrole market in the United States is expanding at a CAGR of 3.5%, driven by the country's pharmaceutical innovation leadership and increasing emphasis on specialty chemical intermediate development. The sophisticated pharmaceutical industry ecosystem and focus on advanced drug development create consistent demand for high-quality dihydrosafrole solutions. The market benefits from pharmaceutical research expansion and specialty chemical innovation across multiple pharmaceutical and chemical industry segments.

Pharmaceutical innovation programs and specialty chemical development initiatives are driving adoption of premium dihydrosafrole solutions that offer superior chemical consistency and pharmaceutical compliance for advanced drug manufacturing applications. Research and development investments and pharmaceutical technology advancement are supporting demand for specialized dihydrosafrole formulations that meet stringent pharmaceutical quality requirements and innovation standards.

The dihydrosafrole market in the United Kingdom is projected to grow at a CAGR of 3.1%, supported by ongoing pharmaceutical industry advancement and increasing emphasis on specialty chemical intermediate quality in pharmaceutical manufacturing. Pharmaceutical companies are investing in high-quality dihydrosafrole solutions that provide consistent chemical characteristics and meet regulatory compliance requirements for pharmaceutical applications. The market is characterized by focus on pharmaceutical quality, regulatory compliance, and advanced chemical synthesis across pharmaceutical manufacturing applications.

Pharmaceutical industry advancement and specialty chemical quality programs are supporting adoption of verified dihydrosafrole solutions that meet contemporary pharmaceutical and regulatory standards for drug manufacturing applications. Quality enhancement initiatives and pharmaceutical compliance programs are creating demand for specialized dihydrosafrole applications that provide superior chemical consistency and pharmaceutical-grade quality verification.

The dihydrosafrole market in Japan is expanding at a CAGR of 2.8%, driven by the country's emphasis on quality excellence and precision chemical manufacturing development. Japanese chemical and pharmaceutical companies are developing advanced dihydrosafrole formulations that incorporate precision synthesis and quality optimization principles. The market benefits from focus on chemical purity, manufacturing precision, and continuous improvement in specialty chemical production techniques.

Quality excellence programs and precision manufacturing initiatives are driving advancement of premium dihydrosafrole applications that demonstrate superior chemical characteristics and production reliability. Chemical manufacturing excellence programs and quality advancement initiatives are supporting adoption of precision-formulated dihydrosafrole solutions that optimize chemical consistency and ensure reliable performance in demanding pharmaceutical and specialty chemical applications.

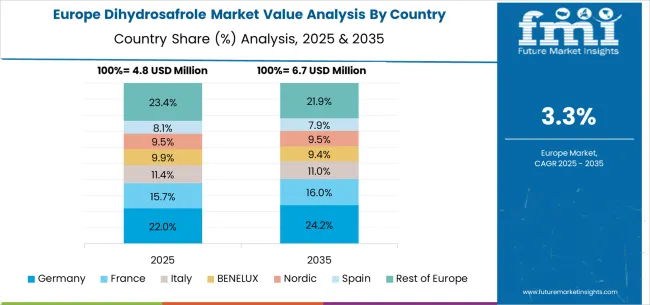

The dihydrosafrole market in Europe is projected to grow from USD 6.1 million in 2025 to USD 8.4 million by 2035, registering a CAGR of 3.2% over the forecast period. Germany is expected to maintain its leadership with a 28.7% share in 2025, supported by its advanced pharmaceutical industry and specialty chemical manufacturing excellence. The United Kingdom follows with 19.3% market share, driven by pharmaceutical industry advancement and specialty chemical quality development. France holds 17.2% of the European market, benefiting from pharmaceutical industry expansion and chemical synthesis technology advancement. Italy and Spain collectively represent 20.1% of regional demand, with growing focus on pharmaceutical intermediate production and specialty chemical applications. The Rest of Europe region accounts for 14.7% of the market, supported by pharmaceutical development in Eastern European countries and Nordic chemical industry advancement.

The dihydrosafrole market is defined by competition among established specialty chemical manufacturers, pharmaceutical intermediate producers, and advanced chemical synthesis companies. Companies are investing in enhanced purification technologies, product innovation, quality assurance systems, and regulatory compliance capabilities to deliver reliable, pure, and cost-effective dihydrosafrole solutions. Strategic partnerships, technological advancement, and geographic expansion are central to strengthening product portfolios and market presence.

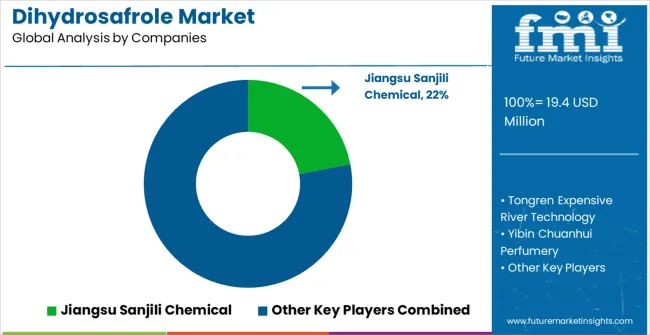

Jiangsu Sanjili Chemical, operating regionally, offers comprehensive dihydrosafrole solutions with focus on specialty chemical applications, quality consistency, and technical support services. Tongren Expensive River Technology, specialized manufacturer, provides advanced chemical intermediate systems with emphasis on purification quality and pharmaceutical-grade formulations. Yibin Chuanhui Perfumery delivers specialized dihydrosafrole products with focus on fragrance applications and olfactory optimization. Jiangxi Spice Chemical Industrial offers comprehensive specialty chemical solutions with standardized procedures and regional manufacturing support.

Penta Manufacturing provides advanced chemical intermediate capabilities with emphasis on pharmaceutical applications and technical expertise. These companies offer specialized dihydrosafrole expertise, regional production capabilities, and technical support across global and regional specialty chemical industry networks.

The dihydrosafrole market underpins pharmaceutical synthesis excellence, specialty chemical innovation, chemical intermediate quality, and advanced chemical manufacturing capabilities. With growing pharmaceutical industry demand, specialty chemical requirements, and regulatory compliance standards, the sector faces pressure to balance chemical purity, production reliability, and regulatory compliance. Coordinated contributions from governments, industry bodies, OEMs/technology integrators, suppliers, and investors will accelerate the transition toward pharmaceutical-grade, high-quality, and application-optimized dihydrosafrole solutions.

Technology Investment: Channel capital toward next-generation synthesis equipment, automated quality control systems, and pharmaceutical-grade production processes for improved efficiency and regulatory compliance.

| Item | Value |

|---|---|

| Quantitative Units | USD 19.4 million |

| Purity Level | Purity≥98%, Purity≥99%, Other |

| Application | Fragrances, Pesticide Synergist, Pharmaceutical Intermediate, Other |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and other 40+ countries |

| Key Companies Profiled | Jiangsu Sanjili Chemical, Tongren Expensive River Technology, Yibin Chuanhui Perfumery, Jiangxi Spice Chemical Industrial, Penta Manufacturing |

The global dihydrosafrole market is estimated to be valued at USD 19.4 million in 2025.

The market size for the dihydrosafrole market is projected to reach USD 27.9 million by 2035.

The dihydrosafrole market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in dihydrosafrole market are purity≥98%, purity≥99% and other.

In terms of application, fragrances segment to command 0.0% share in the dihydrosafrole market in 2025.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA