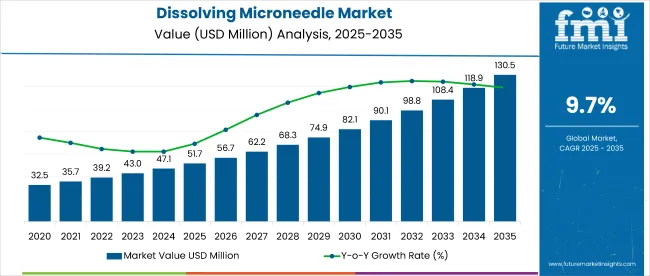

The global dissolving microneedle market is projected to grow from USD 51.7 million in 2025 to USD 130.4 million by 2035, registering a promising CAGR of 9.6%. This surge in demand reflects the rising consumer preference for non-invasive, pain-free dermatological solutions. In 2024, the aesthetic and skincare industries have played a pivotal role in accelerating product commercialization, particularly across wrinkle reduction and anti-aging applications.

Dissolving microneedles are composed of biocompatible materials that safely dissolve into the skin after delivering active compounds. Unlike traditional injectables, they eliminate sharps waste and reduce the risk of infections. By 2025, regulatory frameworks have become more supportive, particularly in the USA. Japan, and South Korea, where dissolving microneedle patches are being approved for both cosmetic and pharmaceutical use cases.

In 2024 and early 2025, product launches focused on wrinkle treatment and skin rejuvenation kits that include dissolving microneedle patches infused with hyaluronic acid, peptides, and retinol. Brands are increasingly targeting millennials and Gen Z with at-home kits designed for convenience and daily skincare routines. The trend is especially prominent in East Asia, where innovation in delivery systems and consumer education has resulted in faster market penetration.

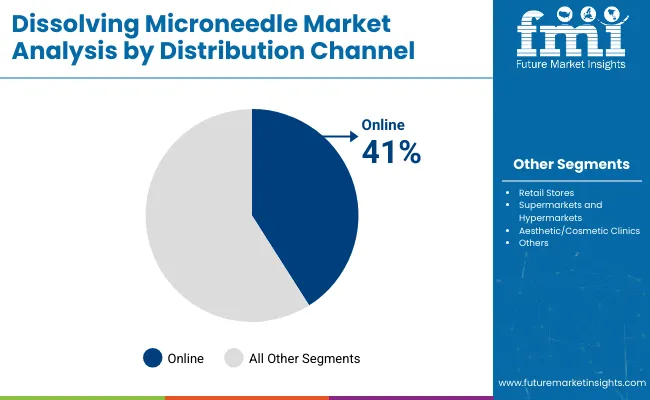

Online distribution has emerged as a key sales channel, driven by influencer marketing, skincare subscription models, and global e-commerce access. Leading beauty-tech brands are leveraging direct-to-consumer platforms to introduce dissolving microneedle products bundled with serums and personalized regimens.

The momentum is evident through sustained investment in bio-dissolvable materials, dermatology trials, and patent filings across Europe and Asia-Pacific. As consumers continue seeking minimal-discomfort alternatives to cosmetic injections, the dissolving microneedle market is poised to expand its footprint not just in skincare, but also in drug delivery and vaccine administration in the coming decade.

| Attributes | Details |

|---|---|

| Dissolving Microneedle Market Size (2025) | USD 51.7 million |

| Dissolving Microneedle Market Forecasted Size (2035) | USD 130.4 million |

| Projected Value CAGR (2025 to 2035) | 9.6% |

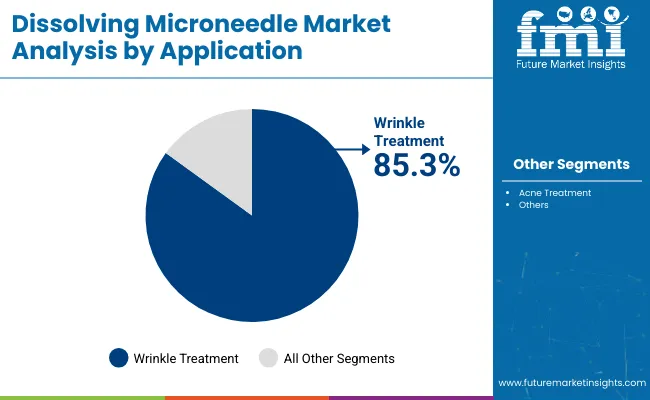

By application, wrinkle treatment holds the dominant position with an 85.3% market share in 2024. This category remains the primary driver of dissolving microneedle adoption, especially among consumers aged 30 and above. These microneedle patches are designed to deliver anti-aging actives directly into the dermal layer without discomfort or downtime.

In 2025, major beauty brands are emphasizing this application in product launches, bundling wrinkle-specific patches with collagen boosters and under-eye serums. Their easy usability and visible results have made them popular for at-home self-care, especially in Asia and North America. Other applications-such as scar reduction, acne treatment, and hyperpigmentation-are gradually gaining momentum, but remain secondary in market share.

Dermatology clinics and medispas are also adopting microneedles for combination treatments. However, over-the-counter availability and the convenience of at-home wrinkle kits continue to dominate the sales landscape. With increasing R&D focused on multi-functional formulations, wrinkle treatment is expected to retain its lead as the most lucrative and innovation-rich segment in the dissolving microneedle space.

By distribution channel, online stores accounted for 41.0% of the market in 2024 and are expected to maintain momentum through 2035. Digital retail platforms are driving most of the dissolving microneedle sales, supported by influencer marketing, social media engagement, and global logistics reach.

In 2025, skincare brands are offering customized kits via their own websites, marketplaces, and subscription-based delivery. These platforms provide direct consumer feedback, rapid trials, and targeted promotion, especially among younger demographics. Retail pharmacies, assumed to hold around 35% market share, remain important but face limitations in stocking variety and user education.

Clinics and dermatology offices contribute to the remaining share, typically through bundled procedures or targeted in-office sales. In emerging markets, online platforms offer wider access to premium skincare tools not always available in physical retail. As e-commerce ecosystems become more sophisticated and skincare becomes more personalized, online channels are likely to retain their leadership position—driven by convenience, product variety, and digitally native consumer behavior.

Dissolving microneedles are increasingly gaining attention in the field of diagnostics and real-time patient monitoring, especially due to their painless application and biocompatibility. Researchers are leveraging these microneedle arrays to access interstitial fluid (ISF), which contains a wide range of physiological biomarkers comparable to blood. Unlike conventional blood sampling, this method does not require venipuncture, making it suitable for continuous, non-invasive monitoring in clinical and home settings.

Governments across key markets have started formalizing regulations for dissolving microneedles to ensure safe, effective, and standardized use in both cosmetic and pharmaceutical applications. These regulations vary by region but generally assess product safety, material composition, skin penetration depth, and whether the device delivers active ingredients.

| Attributes | Details |

|---|---|

| Trends |

|

| Opportunities |

|

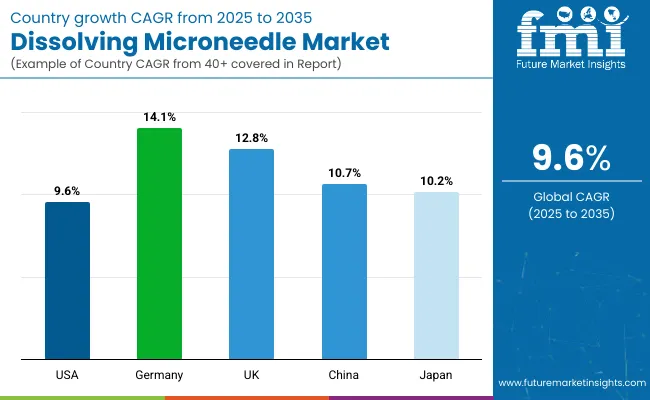

The scope of dissolving microneedles is lucrative in Europe, owing to inflating discretionary income and a high degree of willingness for cosmetic treatments. Two important places where demand and sales of dissolving microneedles are predicted to be high are Germany and the United Kingdom. Meanwhile, North America is expected to register a comparatively lower demand for dissolving microneedles.

Consumption of this instrument is predicted to expand on account of the rising concentration of manufacturers, amplified marketing, and increasing desire to undergo minimally invasive aesthetic procedures, and continuous advancements.

The promising growth of dissolving microneedle business in the Asia Pacific is predicted to propel investors and stakeholders to increase their stake in this region. The significant influence of the West is predicted to be a key catalyst for the sales of dissolving microneedles for aesthetic purposes. Additionally, increasing the use of these needles for the transdermal delivery of several drugs is predicted to advance the regional market.

| Country | Forecasted CAGR (2025 to 2035) |

|---|---|

| The United States | 9.6% |

| Germany | 14.1% |

| The United Kingdom | 12.8% |

| China | 10.7% |

| Japan | 10.2% |

The United States dissolving microneedle market is expected to lead in North America by a substantial market share. As per the latest estimates by FMI analysts, the market in the United States is projected to register a promising 9.6% CAGR through 2035. Following factors back this growth:

Germany is a notable market for dissolving microneedles in Europe. The country is estimated by FMI analysts to record an impressive CAGR of 14.1% through 2035. Key factors that are driving this growth are:

Consumption of dissolving microneedles in the United Kingdom is predicted to shoot up at a CAGR of 12.8% through 2035. Given below are some of the salient growth factors:

The dissolving microneedle market in China is expected to surge at a compounded rate of 10.7% through 2035. The adoption of dissolving microneedles is driven by:

In Japan, the consumption of dissolving microneedles is projected to increase at a CAGR of 10.2%. The market is supported by following factors:

Several strategies have been devised to help businesses and manufacturers bump up their position in the dissolving microneedle industry. Some of these strategies have been outlined below:

Recent Developments in the Dissolving Microneedle Market

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 51.7 million |

| Projected Market Size (2035) | USD 130.4 million |

| CAGR (2025 to 2035) | 9.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value; Thousand units for volume |

| Applications Analyzed (Segment 1) | Wrinkle Treatment, Acne Treatment |

| Distribution Channels Analyzed (Segment 2) | Retail Stores, Supermarkets and Hypermarkets, Online Stores, Aesthetic/Cosmetic Clinics |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players Influencing the Market | CosMED Pharmaceutical Co. Ltd., Micron Biomedical, Inc., Raphas Co. Ltd., Nissha Co. Ltd., Micropoint Technologies, Small Lab, Vice Reversa, NINGBO CHIMED TECHNOLOGY CO., LTD, Vaxess Technologies, Inc., QuadMedicine |

| Additional Attributes | Growth in aesthetic and non-invasive skincare, Increased consumer preference for home-based treatments, Rising popularity of online skincare retail |

| Customization and Pricing | Customization and Pricing Available on Request |

The dissolving microneedle industry is estimated to be valued at USD 51.7 million in 2025.

The dissolving microneedle market size is forecast to surpass USD 130.4 million by 2035.

The CAGR of the dissolving microneedle industry is projected to be around 9.6% through 2035.

CosMED Pharmaceutical Co.Ltd., Micron Biomedical, Inc., and Raphas Co., Ltd are dissolving microneedle industry leaders.

Europe is expected to make a significant contribution to the overall market growth.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Unit Pack) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 4: Global Market Volume (Unit Pack) Forecast by Application, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 6: Global Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 10: North America Market Volume (Unit Pack) Forecast by Application, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 12: North America Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 16: Latin America Market Volume (Unit Pack) Forecast by Application, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 18: Latin America Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 22: Western Europe Market Volume (Unit Pack) Forecast by Application, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: Western Europe Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 28: Eastern Europe Market Volume (Unit Pack) Forecast by Application, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 30: Eastern Europe Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Unit Pack) Forecast by Application, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 40: East Asia Market Volume (Unit Pack) Forecast by Application, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 42: East Asia Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Unit Pack) Forecast by Application, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Unit Pack) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 9: Global Market Volume (Unit Pack) Analysis by Application, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 13: Global Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 16: Global Market Attractiveness by Application, 2024 to 2034

Figure 17: Global Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 27: North America Market Volume (Unit Pack) Analysis by Application, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 31: North America Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 34: North America Market Attractiveness by Application, 2024 to 2034

Figure 35: North America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 45: Latin America Market Volume (Unit Pack) Analysis by Application, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 49: Latin America Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 53: Latin America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 63: Western Europe Market Volume (Unit Pack) Analysis by Application, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 67: Western Europe Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Unit Pack) Analysis by Application, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Unit Pack) Analysis by Application, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 117: East Asia Market Volume (Unit Pack) Analysis by Application, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 121: East Asia Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 125: East Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Unit Pack) Analysis by Application, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Microneedle Drug Delivery Systems Market Report - Growth & Forecast 2025 to 2035

Botulinum Toxin-coated Microneedles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA