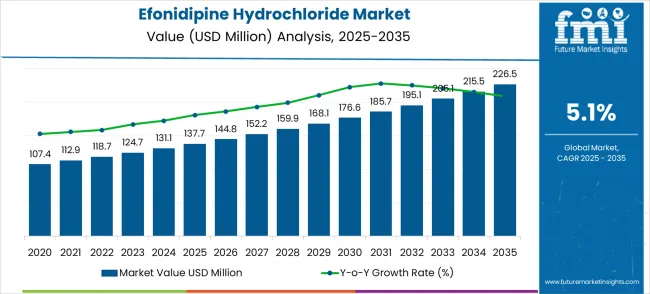

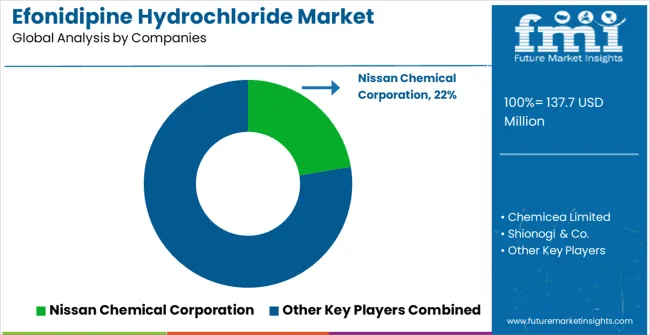

The efonidipine hydrochloride market, valued at USD 137.7 million in 2025, is projected to reach USD 226.5 million by 2035, reflecting a CAGR of 5.1%. The market growth exhibits a moderate, steady increase over the forecast period, with gradual annual increments. From 2021 to 2025, the market progresses from USD 107.4 million to USD 137.7 million, with intermediate annual values of USD 112.9 million, 118.7 million, 124.7 million, and 131.1 million. This phase marks consistent growth as the demand for efonidipine hydrochloride, primarily used in hypertension treatment, steadily increases.

From 2026 to 2030, the market continues its smooth upward trajectory, advancing from USD 137.7 million to USD 168.1 million, with intermediate increments of USD 144.8 million, 152.2 million, 159.9 million, and 168.1 million. This period shows growth, driven by rising awareness of hypertension, improved healthcare infrastructure, and expanded product availability in emerging markets. From 2031 to 2035, the market reaches USD 226.5 million, with steady increases through USD 176.6 million, 185.7 million, 195.1 million, 205.1 million, and 215.5 million. The final phase represents a consistent rise, fueled by increased adoption of efonidipine hydrochloride and ongoing clinical developments, ensuring the market continues its steady upward momentum.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 137.7 million |

| Forecast Value in (2035F) | USD 226.5 million |

| Forecast CAGR (2025 to 2035) | 5.1% |

The pharmaceuticals industry holds the largest share of the market, accounting for 60-65%, as efonidipine hydrochloride is widely prescribed for managing high blood pressure, particularly in patients who are resistant to other treatments. The hospitals and clinics segment contributes 20-25%, where Efonidipine Hydrochloride is frequently administered for hypertension management, often as part of combination therapies for patients with comorbidities like diabetes and chronic kidney disease. Retail pharmacies account for 10-12%, providing a significant channel for distribution as patients increasingly obtain their prescriptions from these outlets, benefiting from the rise in outpatient and home-based care for hypertension.

The research and development segment contributes around 5-8%, with pharmaceutical companies exploring the development of novel formulations or combination therapies to enhance the drug's effectiveness in treating hypertension and cardiovascular conditions.The online pharmacies sector, though smaller at 2-3%, is gradually increasing as more patients turn to online platforms for the convenience and accessibility of prescription fulfillment.

The efonidipine hydrochloride market is poised for steady growth, advancing from USD 137.7M (2025) to USD 226.5M (2035) at a 5.1% CAGR. The expansion is driven by the rising prevalence of hypertension and cardiovascular diseases, growing demand for renal-protective antihypertensives, and the increasing integration of personalized medicine and combination therapies in cardiovascular care.

Asia-Pacific (China, India, Japan) will dominate growth, supported by large patient populations and healthcare infrastructure upgrades, while North America and Europe will adoption through evidence-based medicine and clinical guidelines.

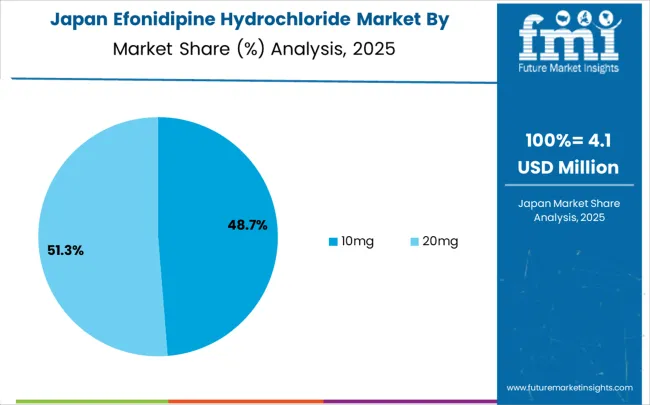

Key opportunity pathways center around dosage optimization (10mg dominance), renal function protection therapies, combination drug innovation, and regional expansion into emerging cardiovascular care markets.

Market expansion is being supported by the increasing global prevalence of hypertension and cardiovascular diseases, and the corresponding need for effective antihypertensive medications that can provide comprehensive cardiovascular protection while supporting renal function preservation across various patient populations and clinical conditions. Modern healthcare providers and cardiovascular specialists are increasingly focused on implementing therapeutic solutions that can achieve optimal blood pressure control, prevent cardiovascular complications, and provide comprehensive patient care in complex cardiovascular disease management. Efonidipine hydrochloride's proven ability to deliver dual-channel calcium antagonist activity, provide renal protective effects, and support cardiovascular health makes it an essential medication for contemporary cardiovascular therapeutics and patient care strategies.

The growing focus on preventive cardiovascular care and renal function preservation is driving demand for efonidipine hydrochloride that can support comprehensive disease management, prevent target organ damage, and enable personalized treatment approaches. Healthcare providers' preference for medications that combine cardiovascular efficacy with renal protective properties and favorable safety profiles is creating opportunities for innovative efonidipine hydrochloride implementations. The rising influence of evidence-based treatment guidelines and personalized medicine approaches is also contributing to increased adoption of efonidipine hydrochloride, which can provide targeted therapeutic benefits without compromising patient safety or treatment tolerability.

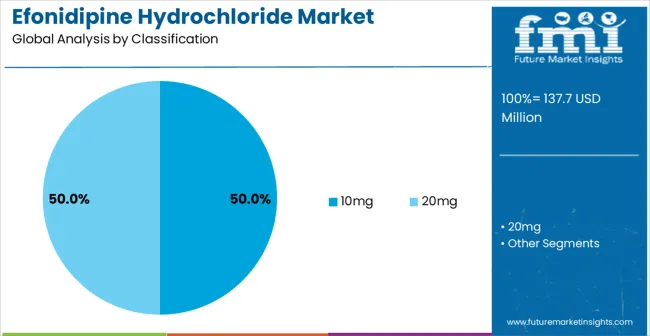

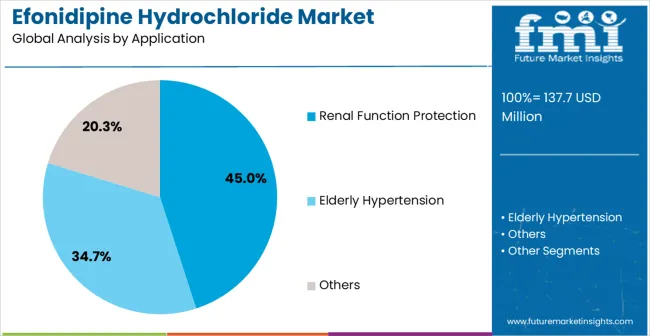

The market is segmented by dosage, application, and region. By dosage, the market is divided into 10mg, 20mg, and others. Based on application, the market is categorized into renal function protection, elderly hypertension, and others. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

The 10mg segment is projected to maintain its leading position in the efonidipine hydrochloride market in 2025, capturing 50% of the market share. Cardiovascular specialists and healthcare providers increasingly favor the 10mg dosage for its optimal therapeutic efficacy, balanced safety profile, and versatility across various patient populations and cardiovascular conditions. The 10mg strength offers proven clinical effectiveness in blood pressure control and cardiovascular protection, addressing the therapeutic needs of diverse patient care scenarios. Healthcare provider investments in 10mg treatment protocols continue to enhance adoption among cardiologists and primary care physicians. With a focus on consistent therapeutic outcomes, this dosage strength remains central to comprehensive cardiovascular treatment strategies.

The renal function protection application segment is projected to represent the largest share of efonidipine hydrochloride demand in 2025, accounting for 45% of the market. Efonidipine hydrochloride is preferred for its dual-channel calcium antagonist mechanism, which provides comprehensive cardiovascular benefits while effectively preserving kidney function. This makes it the preferred choice for renal protection in cardiovascular-renal medicine. Healthcare providers favor this application due to its ability to deliver both blood pressure control and organ protection, improving patient outcomes in cardiovascular and nephrology practices. The segment is further supported by continuous advancements in cardiovascular-renal research and clinical evidence demonstrating enhanced renal protection and improved cardiovascular outcomes.

The efonidipine hydrochloride market is advancing steadily due to the increasing prevalence of hypertension and cardiovascular diseases, and growing adoption of dual-channel calcium antagonists that provide enhanced cardiovascular protection and renal function preservation across diverse patient populations. However, the market faces challenges, including competition from alternative antihypertensive medications, regulatory requirements for pharmaceutical approval and market access, and the need for clinical evidence generation in specialized patient populations. Innovation in pharmaceutical formulations and combination therapy development continues to influence product development and market expansion patterns.

The growing adoption of personalized medicine approaches and precision cardiovascular therapy is enabling healthcare providers to achieve superior patient outcomes, targeted therapeutic interventions, and individualized treatment protocols based on specific patient characteristics and cardiovascular risk factors. Personalized medicine systems provide improved therapeutic effectiveness while allowing more precise medication selection and consistent outcomes across various patient populations and cardiovascular conditions. Manufacturers are increasingly recognizing the competitive advantages of personalized medicine capabilities for clinical differentiation and therapeutic optimization.

Modern efonidipine hydrochloride applications are incorporating combination therapy strategies and multi-target treatment approaches to enhance cardiovascular protection, optimize blood pressure control, and enable comprehensive disease management for complex cardiovascular conditions. These advanced therapeutic strategies improve clinical effectiveness while enabling new applications, including fixed-dose combinations and synergistic treatment protocols. Advanced combination therapy integration also allows healthcare providers to support comprehensive patient management and cardiovascular protection beyond traditional monotherapy approaches.

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| Brazil | 5.4% |

| USA | 4.8% |

| UK | 4.3% |

| Japan | 3.8% |

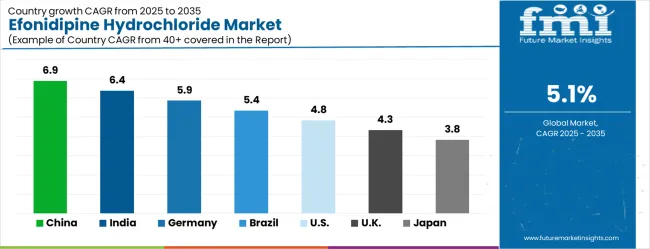

The efonidipine hydrochloride market is experiencing solid growth globally, with China leading at a 6.9% CAGR through 2035, driven by the expanding healthcare infrastructure, growing prevalence of cardiovascular diseases, and significant investment in pharmaceutical development and cardiovascular medicine advancement. India follows at 6.4%, supported by large patient populations, increasing healthcare access, and growing adoption of advanced cardiovascular therapeutics. Germany shows growth at 5.9%, underscoring clinical excellence and evidence-based cardiovascular medicine practices. Brazil records 5.4%, focusing on healthcare infrastructure development and cardiovascular disease management improvement. The USA demonstrates 4.8% growth, supported by advanced healthcare systems and a focus on specialized cardiovascular therapeutics. The UK exhibits 4.3% growth, underscoring clinical guidelines and comprehensive cardiovascular care. Japan shows 3.8% growth, supported by advanced pharmaceutical research and specialized cardiovascular medicine.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

The efonidipine hydrochloride market in China is projected to grow at a CAGR of 6.9% from 2025 to 2035. The market growth is largely driven by the increasing prevalence of hypertension and related cardiovascular diseases in the country. As China’s aging population continues to rise, the demand for antihypertensive drugs, including efonidipine hydrochloride, is expected to expand significantly. The market is also supported by the growing healthcare infrastructure, which ensures wider availability of specialized medications. The rapid advancements in pharmaceutical research and development are contributing to the accessibility and affordability of such medications. With a focus on improving healthcare access in both urban and rural areas, China is well-positioned to witness continued growth in the antihypertensive drug market, particularly for calcium channel blockers like efonidipine hydrochloride.

The efonidipine hydrochloride market in India is expected to grow at a CAGR of 6.4% from 2025 to 2035. As the country faces a rising prevalence of hypertension and related conditions, the demand for effective antihypertensive drugs like efonidipine hydrochloride is steadily increasing. India’s rapidly growing healthcare sector, alongside rising awareness of cardiovascular disease management, is also contributing to market growth. The availability of affordable healthcare, coupled with government programs to improve access to treatment for chronic diseases, has spurred the adoption of efonidipine hydrochloride. The growing middle class with access to better healthcare services is helping to boost the demand for advanced medications. With increasing numbers of individuals seeking treatment for hypertension, the market for efonidipine hydrochloride is expected to continue expanding.

The efonidipine hydrochloride market in Germany is projected to expand at a CAGR of 5.9% from 2025 to 2035. The market’s growth is driven by the increasing recognition of hypertension as a major risk factor for cardiovascular diseases. As the country has a well-established healthcare system, efonidipine hydrochloride is widely prescribed for patients with hypertension and other related cardiovascular conditions. Germany’s aging population is a key factor in the growing demand for antihypertensive drugs. The government’s strong focus on managing chronic diseases and promoting preventive healthcare further supports market growth. German pharmaceutical industry is focused on advancing innovative treatments, which is leading to more accessible and effective therapies for hypertension. The continuous advancements in medical research and the availability of high-quality generic versions of efonidipine hydrochloride will continue to enhance the market's growth potential.

The efonidipine hydrochloride market in Brazil is expected to expand at a CAGR of 5.4% from 2025 to 2035. The market growth in Brazil is being driven by the high incidence of childhood malnutrition, which drives demand for enteral feeding solutions. Government and NGO programs focused on improving child health are also contributing to this growth. Brazil's healthcare system continues to develop, more children are receiving specialized care, including enteral nutrition. With increasing awareness of the importance of proper nutrition in childhood diseases, including malnutrition and gastrointestinal issues, is also expected to further boost the market. Brazil’s pharmaceutical market is benefiting from an expanding network of distributors, making efonidipine hydrochloride more readily available.

The efonidipine hydrochloride market in the USA is anticipated to grow at a CAGR of 4.8% from 2025 to 2035. The growth is largely fueled by the high prevalence of hypertension and cardiovascular diseases, which are major health concerns in the country. As a leader in pharmaceutical research and healthcare technology, the USA is home to numerous advancements in medical treatments, including the development and use of efonidipine hydrochloride. With a growing focus on managing chronic diseases, including hypertension, more patients are turning to medications like efonidipine hydrochloride for effective treatment. Access to healthcare through insurance and a robust pharmaceutical distribution network is expected to further drive market growth.

The efonidipine hydrochloride market in the UK is expanding at a CAGR of 4.3% from 2025 to 2035. The market is driven by the increasing number of individuals diagnosed with hypertension and other cardiovascular diseases. The UK’s healthcare system, known for its focus on preventive care, is expected to see growing demand for antihypertensive medications like efonidipine hydrochloride. With advancements in medical research and treatment options, patients in the UK have access to more effective therapies for managing blood pressure. The government’s healthcare policies aimed at improving access to essential medicines are supporting the expansion of the market.

The efonidipine hydrochloride market in Japan is growing at a CAGR of 3.8% from 2025 to 2035. The aging population in Japan is a significant factor in the increasing demand for hypertension treatments. With more elderly individuals suffering from chronic diseases, including high blood pressure, the demand for antihypertensive medications like efonidipine hydrochloride is expected to rise. Japan’s well-established healthcare infrastructure ensures that these treatments are widely available and accessible. Japan’s strong pharmaceutical industry is continuously improving the availability and affordability of such drugs, contributing to market growth.

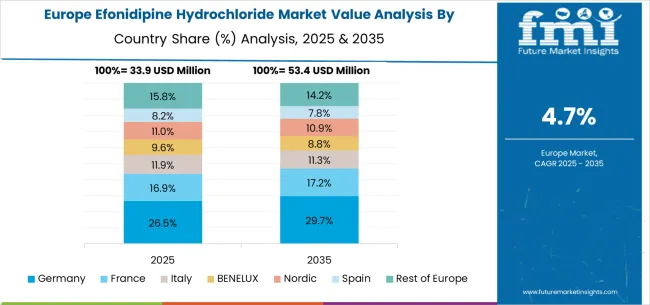

The efonidipine hydrochloride market in Europe is projected to grow from USD 33.9 million in 2025 to USD 53.4 million by 2035, registering a CAGR of 4.7% over the forecast period. Germany is expected to remain the largest national market with 26.5% share in 2025, rising to 29.7% by 2035, supported by its strong healthcare infrastructure, advanced cardiovascular treatment protocols, and growing elderly population driving demand for antihypertensive therapies. The United Kingdom follows with 16.9% in 2025, edging up to 17.2% by 2035 as healthcare accessibility and pharmaceutical adoption continue to expand. France accounts for 11.9% in 2025, easing slightly to 11.0% by 2035, reflecting steady modernization in cardiovascular care.

Italy holds 9.6% in 2025, moderating to 8.8% by 2035, while Spain represents 11.6% in 2025, remaining steady at 11.3% by 2035, supported by investments in healthcare access and treatment affordability. BENELUX countries contribute 8.2% in 2025, easing to 7.8% by 2035, while the Nordic region accounts for 8.8% in 2025, softening to 8.3% by 2035, reflecting mature adoption of advanced cardiovascular medicines. The rest of Europe (Eastern Europe and other emerging markets) collectively accounts for 15.8% in 2025, moderating to 14.2% by 2035, driven by expanding pharmaceutical availability and improvements in regional healthcare infrastructure.

The efonidipine hydrochloride market is characterized by competition among established pharmaceutical manufacturers, specialized cardiovascular medicine companies, and integrated therapeutic solution providers. Companies are investing in advanced pharmaceutical research, clinical evidence development, regulatory compliance, and comprehensive product portfolios to deliver safe, effective, and clinically proven efonidipine hydrochloride solutions. Innovation in pharmaceutical formulations, combination therapies, and personalized medicine approaches is central to strengthening market position and competitive advantage.

Nissan Chemical Corporation leads the market with comprehensive pharmaceutical solutions, offering advanced efonidipine hydrochloride products with a focus on clinical efficacy and therapeutic innovation. Chemicea Limited provides specialized pharmaceutical products with an focus on quality manufacturing and regulatory compliance. Shionogi & Co. delivers innovative pharmaceutical solutions with a focus on cardiovascular therapeutics and clinical effectiveness. SimSon Pharma Limited specializes in pharmaceutical development and manufacturing with focus on therapeutic quality and clinical outcomes. BioCrick focuses on pharmaceutical research and specialized therapeutic applications. JOINHUB offers comprehensive pharmaceutical solutions with focus on therapeutic innovation and market development.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 137.7 million |

| Dosage | 10mg, 20mg |

| Application | Renal Function Protection, Elderly Hypertension, Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, the United States, the United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Nissan Chemical Corporation, Chemicea Limited, Shionogi & Co., SimSon Pharma Limited, BioCrick, and JOINHUB |

| Additional Attributes | Dollar sales by dosage and application category, regional demand trends, competitive landscape, technological advancements in pharmaceutical formulations, clinical research development, personalized medicine innovation, and therapeutic effectiveness optimization |

The global efonidipine hydrochloride market is estimated to be valued at USD 137.7 million in 2025.

The market size for the efonidipine hydrochloride market is projected to reach USD 226.5 million by 2035.

The efonidipine hydrochloride market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in efonidipine hydrochloride market are 10mg and 20mg.

In terms of application, renal function protection segment to command 45.0% share in the efonidipine hydrochloride market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

L-Lysine Hydrochloride (HCL) Market Insights – Demand & Forecast 2025-2035

Palonosetron Hydrochloride Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA