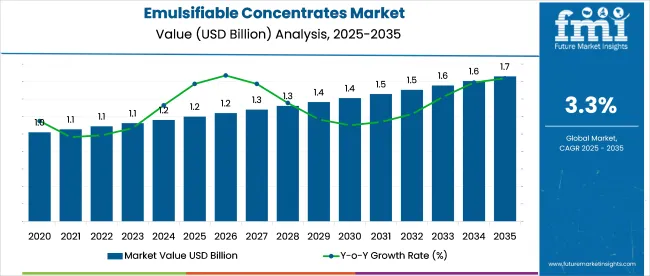

The emulsifiable concentrates market is expected grow from USD 1.2 billion in 2025 and reach approximately USD 1.7 billion by 2035, expanding at a CAGR of around 3.3%.

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 1.2 billion |

| Market Size (2035) | USD 1.7 billion |

| CAGR (2025 to 2035) | 3.3% |

Growth is being propelled by the versatility of oil-soluble active ingredients and emulsifiers in agricultural and nonagricultural applications, such as foliar sprays and seed treatments.

It is argued that advanced surfactant chemistries and compliance with evolving environmental regulations will distinguish premium formulations. However, it is suggested that formulation complexity and solvent risk may hinder adoption unless solvent free formulations or green emulsifiers are prioritized. Industry consolidation is expected, as leading agrochemical firms integrate EC expertise to streamline their crop-protection portfolios.

In July 2024, Sipcam Agro announced a major expansion of its manufacturing plant in Waynesboro, Mississippi, focused on producing fungicide and insecticide formulations, including emulsifiable concentrates (ECs) and suspension concentrates (SCs). The investment aims to boost production integration, enhance toll manufacturing capabilities, and meet growing demand for high-quality agrochemical formulations in the USA industry.

The facility will feature high-capacity milling systems to support advanced crop protection products. Commenting on the expansion, Brent Marek, CEO & COO of Sipcam Agro USA, stated, “I am very excited about this project, which will increase Sipcam’s production integration in fungicides and insecticides and offer customers additional tolling capabilities. The new plant will have high-capacity mills capable of making the highest quality SCs needed by the market.”

The industry holds a specialized share within its parent markets. In the pesticides and agrochemicals market, it accounts for approximately 15-18%, as emulsifiable concentrates are commonly used for pesticide formulations. Within the chemical market, the share is around 2-3%, as emulsifiable concentrates represent a niche segment of chemical products.

In the agricultural equipment market, the share is approximately 5-7%, driven by their use in combination with spraying equipment. In the fertilizers and plant nutrition market, emulsifiable concentrates contribute about 2-4%, used to enhance nutrient delivery. In the industrial chemicals market, their share is around 1-2%, used in various industrial applications.

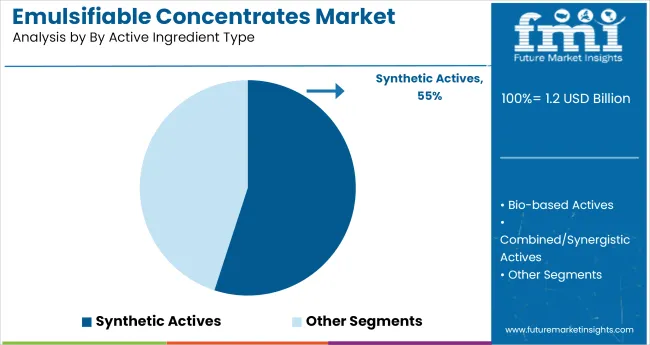

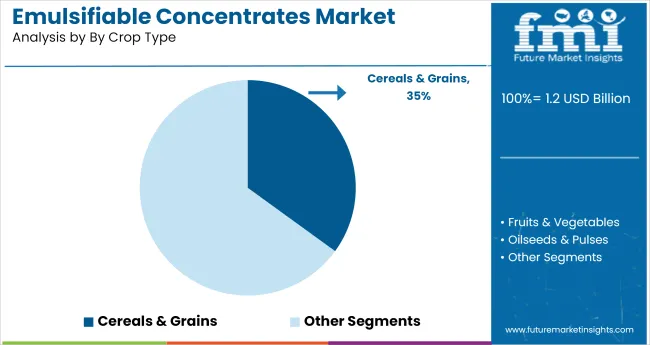

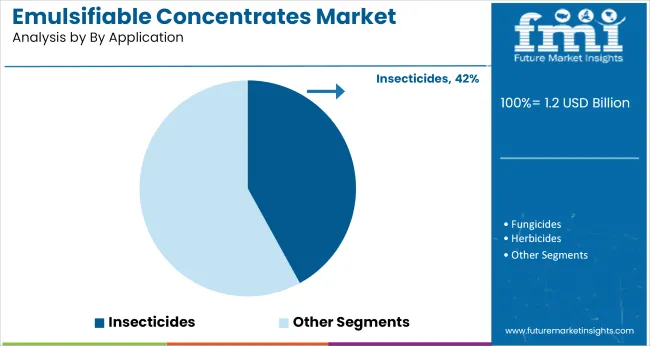

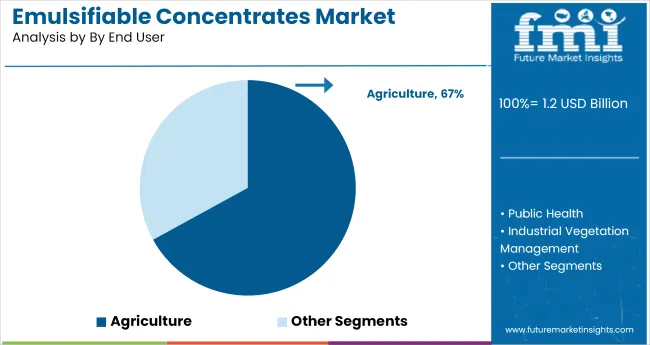

The industry in 2025 is expected to see synthetic actives leading the active ingredient type segment with 55%, cereals & grains dominating the crop type segment with 35%, insecticides holding the largest application share at 42%, and agriculture representing 67% of the end-user industry.

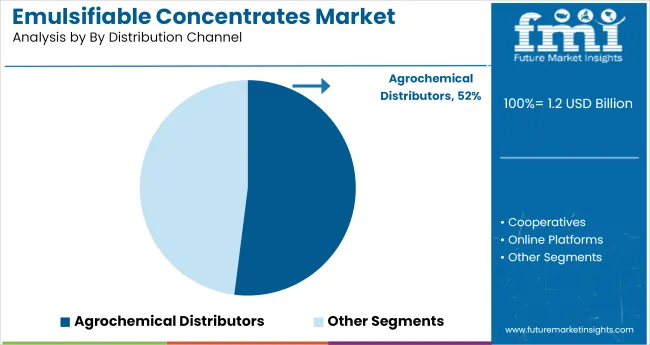

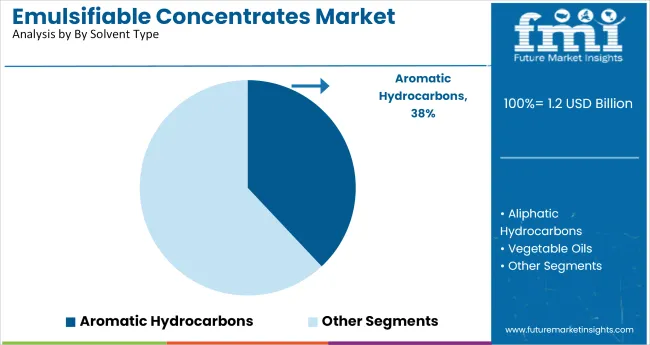

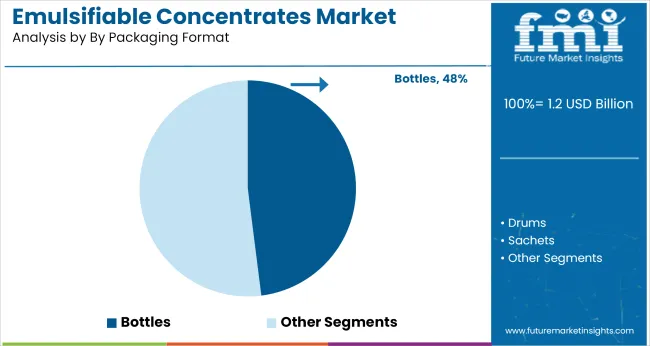

Agrochemical distributors will lead distribution channels with 52%, while aromatic hydrocarbons will dominate the solvent type segment with 38%. Bottles in various sizes will account for 48% of the packaging format.

Synthetic actives are expected to account for 55% of the industry share in 2025. These actives are widely used in various emulsifiable concentrates due to their efficacy and cost-effectiveness in controlling pests, diseases, and weeds in agricultural settings.

Synthetic active ingredients, such as organophosphates and pyrethroids, offer high potency, long-lasting effects, and broad-spectrum activity. The strong demand for effective and reliable crop protection products in both commercial farming and home gardening applications is driving the continued dominance of synthetic actives in the industry.

Cereals & grains are expected to capture 35% of the crop type segment in 2025, making it the dominant crop category for emulsifiable concentrate applications. The high demand for cereals and grains like wheat, rice, and corn globally, along with the need for effective crop protection against pests and diseases, contributes to the dominance of this segment.

Emulsifiable concentrates, particularly insecticides and herbicides, are widely used to maintain crop yields and ensure the health of cereal and grain crops. As global food demand rises, the need for these products in cereals and grains continues to grow.

Insecticides are projected to hold 42% of the industry share in 2025, driven by the growing need to control insect pests that damage crops and reduce yields. Insecticides, such as pyrethroids and neonicotinoids, are widely used to protect various crops from insect infestation.

The increasing prevalence of pests, coupled with the rise in organic farming and the need for sustainable pest control, further reinforces insecticides’ dominant position in the industry. The growing agricultural focus on integrated pest management (IPM) strategies continues to drive the demand for effective insecticides.

Agriculture is expected to capture 67% of the industry share in 2025. Agriculture remains the primary end-user for emulsifiable concentrates, driven by the need for high-performance crop protection solutions. The increasing focus on enhancing crop yields, managing pest resistance, and improving food security is pushing the demand for emulsifiable concentrates in agricultural settings.

As farmers continue to prioritize efficient pest management and crop protection, the agriculture sector will remain the largest consumer of emulsifiable concentrates in the industry.

Agrochemical distributors are projected to hold 52% of the industry share in 2025, becoming the dominant distribution channel for emulsifiable concentrates. These distributors play a crucial role in ensuring the availability of emulsifiable concentrates to farmers and agricultural enterprises.

They supply a range of crop protection products through various retail outlets, including farm supply stores and online platforms. As demand for crop protection solutions increases, agrochemical distributors continue to strengthen their industry position by providing a wide variety of products and ensuring timely delivery to agricultural end-users.

Aromatic hydrocarbons are expected to capture 38% of the solvent type segment in 2025. These solvents are essential in the formulation of emulsifiable concentrates due to their ability to dissolve both water and oil-based components, ensuring proper dispersion and effectiveness in agricultural applications.

Aromatic hydrocarbons offer superior solubility and stability, making them the solvent of choice for many agricultural chemical products. Their widespread use in the formulation of herbicides, insecticides, and fungicides continues to drive their dominance in the industry.

Bottles in various sizes are expected to account for 48% of the packaging format industry share in 2025. Bottles are widely used for emulsifiable concentrates due to their convenience, ease of handling, and ability to preserve product stability.

Packaging in bottles allows for precise dosing, ensuring the efficient use of the product, whether for commercial or home use. The growing demand for small-scale and large-scale agricultural applications drives the adoption of different bottle sizes, from less than 1 liter to more than 5 liters.

The emulsifiable concentrates (EC) industry is experiencing growth due to their effectiveness and ease of application in pest control. However, challenges such as environmental concerns, regulatory restrictions, and the development of pest resistance are limiting broader adoption.

High Efficacy and Cost-Effectiveness Drive Adoption

Emulsifiable concentrates are gaining popularity in pest control applications due to their high efficacy and cost-effectiveness. These formulations allow for the active ingredient to be easily mixed with water, ensuring uniform distribution and effective pest management. Their versatility in various applications, including agriculture, public health, and residential pest control, contributes to their widespread use. Additionally, EC formulations often require less agitation during application, making them convenient for users.

Environmental and Regulatory Challenges Impact Growth

Despite their advantages, emulsifiable concentrates face challenges related to environmental concerns and regulatory restrictions. The use of certain solvents in EC formulations can lead to environmental pollution if not managed properly. Additionally, stringent regulations regarding pesticide residues and environmental impact assessments can delay product approvals and limit industry access. These factors necessitate ongoing research and development to create safer and more environmentally friendly EC formulations.

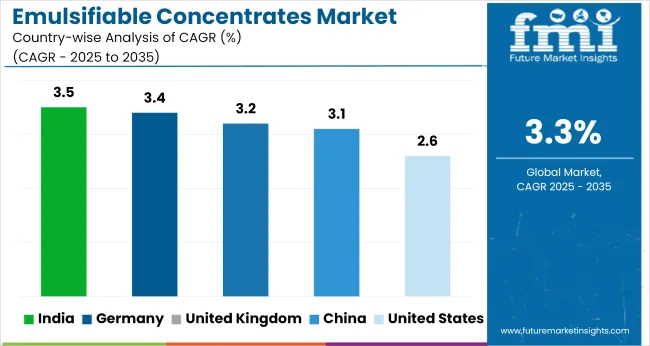

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 2.6% |

| United Kingdom | 3.2% |

| China | 3.1% |

| India | 3.5% |

| Germany | 3.4% |

Global industry demand is projected to rise at a 3.3% CAGR from 2025 to 2035. Of the five profiled countries out of 40 covered, India leads at 3.5%, followed by Germany at 3.4%, and the United Kingdom at 3.2%, while China posts 3.1% and the United States records 2.6%.

These rates translate to a growth premium of +6% for India, -3% for China, and -7% for the United States versus the baseline, while Germany and the United Kingdom show moderate growth. Divergence reflects local catalysts: increasing demand for agricultural chemicals in India, strong industry stability in Germany and the United Kingdom, and slower growth in more mature industries like the United States and China.

The industry in the United States is expected to grow at a CAGR of 2.6% from 2025 to 2035. Growth remains dependent on large-scale crop protection programs, primarily in corn, cotton, and soybean cultivation. Emulsifiable formulations are being integrated into integrated pest management systems where low-volume, high-efficiency delivery is prioritized.

Domestic agrochemical manufacturers continue to reformulate legacy active ingredients into ECs with improved solvency and field stability. Regulatory mandates on surfactant types and VOC content have influenced R&D in adjuvant chemistry. Distribution across cooperatives and agro-dealer networks supports national coverage for seasonal demand spikes.

The industry in the United Kingdom is forecast to grow at a CAGR of 3.2% between 2025 and 2035. This is shaped by restrictions on synthetic pesticide formulations and rising demand for bio-based ECs. Adoption is highest in fruit and vegetable sectors, particularly in Scotland and southern England, where protected cultivation requires precise crop protection delivery.

Brexit-related changes in agrochemical import protocols have led to regional blending and repackaging operations. Demand for tank-mix compatible ECs is increasing among agronomists working in fragmented, small-scale farms across the UK

The industry in China is projected to expand at a CAGR of 3.1% from 2025 to 2035. Demand is concentrated in rice, citrus, and cotton production zones. Regulatory enforcement on formulation toxicity and residual content has intensified reformulation activities. Domestic companies are deploying solvent-free or modified solvent ECs, especially in provinces with stricter environmental policies.

Imports of active ingredients for ECs are channeled into licensed contract formulation facilities. Agrochemical e-commerce channels are boosting EC sales in secondary cities.

The industry in India is forecast to grow at a CAGR of 3.5% between 2025 and 2035, the fastest among the countries analyzed. ECs are preferred in pulses, cotton, and oilseed crops due to their ease of mixing and rapid pest knockdown. Manufacturers are increasingly replacing solvent carriers with bio-derived hydrocarbons to meet safety compliance.

Sales through krishikendras and rural input shops remain dominant, with private firms supporting training initiatives to increase correct EC usage. Blended EC packs with multiple actives are favored by smallholder farmers seeking broader pest coverage.

The industry in Germany is expected to grow at a CAGR of 3.4% from 2025 to 2035. Use is concentrated in vineyards, horticulture, and oilseed farms. Reformulated ECs with biodegradable solvents are being tested under EU Green Deal compliance standards.

German cooperatives and ag-retail chains prefer ECs that offer tank-mix flexibility with micronutrient foliar sprays. Technical service providers offer on-field compatibility testing to reduce formulation errors. Consumer awareness and regulatory strictness have made synthetic solvent-based ECs less acceptable in retail agriculture.

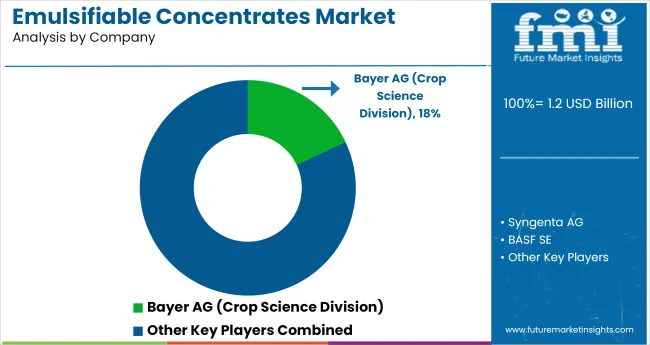

Leading Company - Bayer AG

Industry Share - 18%

In the industry, leading firms like BASF, Syngenta, Bayer, Corteva, and UPL have focused on expanding formulation compatibility, crop-specific efficacy, and regulatory compliance to gain distributor loyalty. Concentrates tailored for cereals, fruits, and pulses are being scaled through backward-integrated sourcing of actives such as organophosphates and pyrethroids.

India-based UPL has deepened its ASEAN footprint by offering localized emulsions through cooperatives and private-label tie-ups. In Europe, Corteva and Bayer emphasize traceability and residue control, aligning products with farm-input standards. Online procurement remains limited, but direct-to-farm pilots have emerged in the USA and Vietnam. Product innovation is being constrained by label restrictions, pushing suppliers to emphasize formulation agility over novel molecule development.

Recent Industry Developments

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 1.2 billion |

| Industry Value (2035) | USD 1.7 billion |

| Forecast CAGR (2025 to 2035) | 3.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and kilotons for volume |

| Active Ingredient Type Segmentation | Synthetic Actives (Organophosphates, Pyrethroids, Neonicotinoids, Carbamates), Bio-based Actives (Neem Oil, Pyrethrins, Essential Oils, Fatty Acids), Combined/Synergistic Actives |

| Crop Type Segmentation | Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, Turf & Ornamentals, Plantation Crops |

| Application Segmentation | Insecticides, Fungicides, Herbicides, Acaricides, Nematicides |

| End-User Segmentation | Agriculture, Public Health, Industrial Vegetation Management, Animal Health |

| Distribution Channel Segmentation | Agrochemical Distributors, Cooperatives, Online Platforms, Direct-to-Farm |

| Solvent Type Segmentation | Aromatic Hydrocarbons, Aliphatic Hydrocarbons, Vegetable Oils, Alcohols, Others (Esters, Glycols) |

| Packaging Format Segmentation | Bottles (less than 1L, 1-5L, and above 5L), Drums, Sachets |

| Regions Covered | North America, Latin America, Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Leading Players | BASF SE, Syngenta AG (a subsidiary of ChemChina), Bayer AG (Crop Science Division), Corteva Agriscience, UPL Ltd. |

| Additional Attributes | Dollar sales by active ingredient type, crop type, application, and packaging format, increasing demand for eco-friendly and bio-based formulations, expanding distribution channels, and regional variations in agrochemical adoption. |

Segmentation includes synthetic actives such as organophosphates, pyrethroids, neonicotinoids, and carbamates; bio-based actives such as neem oil, pyrethrins, essential oils, and fatty acids; and combined/synergistic actives.

Crop-based categories comprise cereals & grains, fruits & vegetables, oilseeds & pulses, turf & ornamentals, and plantation crops.

Applications include insecticides, fungicides, herbicides, acaricides, and nematicides.

End-user segmentation includes agriculture, public health, industrial vegetation management, and animal health.

Distribution channels include agrochemical distributors, cooperatives, online platforms, and direct-to-farm.

Solvent types covered are aromatic hydrocarbons, aliphatic hydrocarbons, vegetable oils, alcohols, and others such as esters and glycols.

Packaging options include Bottles (less than 1L, 1-5L, and above 5L), Drums, and Sachets.

Regional segmentation includes North America, Latin America, Europe, South Asia & Pacific, East Asia, and Middle East & Africa.

The projected industry size of the industry in 2025 is USD 1.2 billion.

The industry value in 2035 is USD 1.7 billion, with a CAGR of 3.3%.

The agriculture segment leads the industry with a 67% industry share.

India is projected to have the highest CAGR in the industry with a growth rate of 3.5% from 2025 to 2035.

The leading company in the industry is Bayer AG, with an 18% industry share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Emulsifiable Metalworking Fluid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA