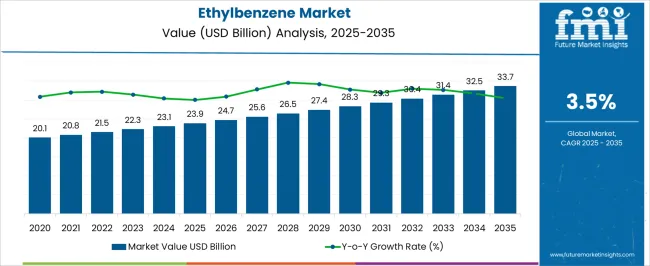

The Ethylbenzene Market is estimated to be valued at USD 23.9 billion in 2025 and is projected to reach USD 33.7 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

| Metric | Value |

|---|---|

| Ethylbenzene Market Estimated Value in (2025 E) | USD 23.9 billion |

| Ethylbenzene Market Forecast Value in (2035 F) | USD 33.7 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

The ethylbenzene market is progressing steadily, driven by its extensive use as an intermediate in the production of styrene and its derivative products. Industry publications and petrochemical company updates have highlighted ethylbenzene’s strong demand in sectors where styrene-based polymers are indispensable, such as construction, automotive, and packaging.

The gasoline sector has also contributed significantly, where ethylbenzene is used as a blending component to enhance octane levels. Rising urbanization and industrialization have fueled the demand for styrene-derived materials including polystyrene and ABS resins, which are widely applied in infrastructure development and consumer goods.

Energy market reports indicate that while environmental concerns and regulations are encouraging producers to optimize refining and blending processes, ethylbenzene continues to hold an established position in petrochemical and fuel applications. Future growth of the market is expected to be supported by construction sector expansion in emerging economies, as well as by technological innovations in catalysts and refining processes that improve ethylbenzene production efficiency.

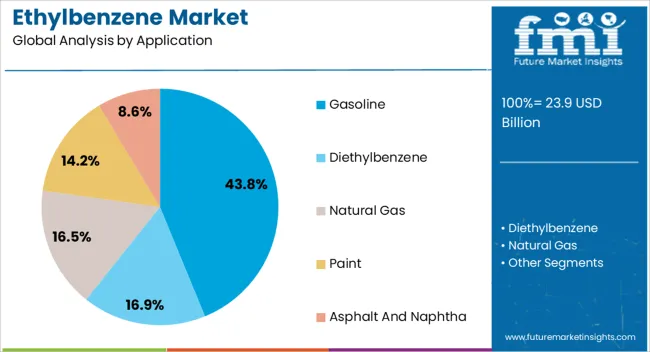

The Gasoline segment is projected to hold 43.8% of the ethylbenzene market revenue in 2025, maintaining its position as the leading application area. Growth of this segment has been driven by ethylbenzene’s effectiveness as a high-octane blending component, which supports the performance of gasoline in meeting fuel quality standards.

Refining industry sources have noted that ethylbenzene enhances combustion efficiency, reduces engine knocking, and contributes to maintaining emission compliance. The wide availability of feedstocks for ethylbenzene production and integration with refining operations have made its use in gasoline blending cost-effective and scalable.

Regulatory frameworks aimed at improving fuel efficiency have further supported demand for high-performance blending components. Although alternative fuel adoption is gradually expanding, the consistent global reliance on gasoline-powered vehicles ensures that ethylbenzene retains a significant role in the fuel sector. This entrenched utility in refining practices is expected to sustain the segment’s leadership.

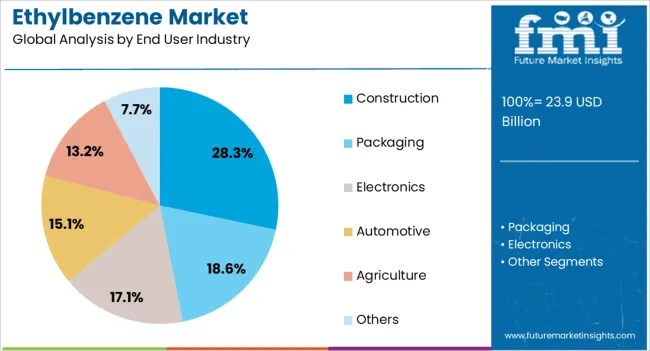

The Construction segment is expected to account for 28.3% of the ethylbenzene market revenue in 2025, establishing itself as the largest end-user industry. Growth of this segment has been influenced by the widespread use of styrene-based polymers derived from ethylbenzene in insulation materials, coatings, adhesives, and structural plastics.

Expanding urban development and infrastructure investments have accelerated the demand for durable and cost-effective building materials. Industry updates have reported that lightweight polystyrene foams and ABS resins are increasingly being adopted in construction projects to improve energy efficiency and design flexibility.

The segment has also gained from regulatory emphasis on energy conservation, where styrene-derived insulation materials are applied extensively in residential and commercial buildings. As construction activity intensifies in emerging economies and modernization efforts continue in developed markets, the Construction segment is projected to sustain its position as a key driver of ethylbenzene consumption.

Ethylbenzene’s use in the petrochemical sector is well-established. However, aside from its use for the making of styrene, there are a few niche segments where the compound’s use is going from strength to strength.

With the construction industry on the rise, in both the Western hemisphere as well as in developing Asian nations such as Japan and India, the need for paints is felt on a more pronounced basis.

The organic compound is also used in making paint, thus finding application through the product in realms such as construction, arts and crafts, and more. Similarly, the compound is also seeing progress in sales due to its use in making ink.

The production and distribution of natural gas are attaining priority status for many governments due to sustainability measures. With the organic compound used in the extraction of natural gas, its use in the sector is growing.

Organizations in the sector also have to contend with a growing number of restraining factors, however. Exposure to the material can lead to throat irritation, dizziness, and other adverse effects. Thus, its use is being restricted. Several companies are now rejecting the use of the compound in their products. The International Agency for Research on Cancer (IARC) has also put down the organic compound as a possible carcinogen.

Stringent government measures regulating the use of chemical materials like ethylbenzene also serve to act as a roadblock to production and ultimately, sales.

Gasoline is the segment where the organic compound is applied predominantly. Packaging is an industry where the use of the organic compound is proliferating immensely.

The application of ethylbenzene for gasoline is in line to take up 43.8% of the industry share in 2025.

One of the notable uses of the organic compound is as an anti-knock agent. With consumers desiring vehicles’ engines to run as smoothly as possible, the demand for anti-knock agents is skyrocketing and thus the compound’s application for gasoline is getting propelled. The sheer number of vehicles running on the road also spells positive things for the compound’s use in this segment.

| Attributes | Details |

|---|---|

| Top Application | Gasoline |

| Industry Share (2025) | 43.8% |

Ethylbenzene’s use in the packaging sector is estimated to make up 28.3% of the industry share in 2025.

The organic compound is significantly used in the making of styrene. Styrene forms an important part of polystyrene. Polystyrene packaging is seeing widespread acceptance due to a myriad of factors. The lightweight nature of polystyrene is a prominent reason it is being increasingly accepted in the packaging realm. The diversity offered by the material, with it being able to be molded into any shape or size, is another factor for its surging use.

| Attributes | Details |

|---|---|

| Top End User Industry | Packaging |

| Industry Share (2025) | 28.3% |

Governments in the Asia Pacific concentrating on natural gas production is seeing ethylbenzene become more common in the industries of the region. Non-abating sales of automobiles in North America are helping the organic compound gain more of a foothold in the region. Europe is also an area to watch in the sector due to its thriving manufacturing facilities.

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 5.2% |

| China | 3.9% |

| United States | 2% |

| Spain | 2.6% |

| United Kingdom | 1.4% |

The CAGR of the market for the forecast period in India is anticipated to be 5.2%.

Courtesy of government encouragement, the manufacturing landscape of India is being painted with a pretty brush. Both public and private players are finding a plethora of opportunities, which is creating an environment for the compound to thrive.

However, there are also downsides. Concerns regarding air pollution is seeing a significant number of the population regarding the product with disdain. As such, players have to navigate India carefully.

China’s petrochemical sector is picking up steam as it goes along. The country’s petrochemical ecosystem is claimed to be the one acquiring the most revenue in the world. The revenue of the petrochemical sector from China is claimed to be above 45 percent. Thus, the environment is just right for the organic compound to grow in the country, with an estimated CAGR of 3.9% over the forecast period.

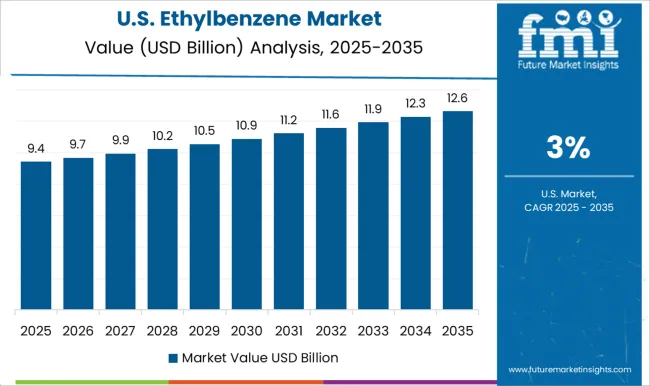

The United States is set to see the sector expand at a steady progression, with a CAGR of 2% over the projected period. As farming practices increasingly embrace the use of pesticides and insecticides, the organic compound’s application on farms is getting more common.

The United States is placed second in terms of pesticide consumption, behind Brazil. The country is also placed second in terms of paint exports, behind Germany. Thus, paint and ink manufacture is another avenue through which the industry is growing in the United States.

The market is still in the nascent stages when it comes to Spain. However, that just means there is a significant growth opportunity for players in the country, with a CAGR of 2.6% suggested through 2035. Foreign players can tackle the country for geographic expansion. The path is laid out for them as several manufacturing giants are expanding their facilities in Spain, increasing production capabilities.

As Spain’s production faculties for the organic compound are still limited, there is scope for exporters to pump it into the country. Spain is also a significant producer of inks and thus players can look towards that sector to enhance their growth prospects in the country.

The United Kingdom is set to see market growth happen at a CAGR of 1.4% over the coming decade.

Despite environmental concerns getting more and more prominent, plastic production in the United Kingdom is not slowing down. As such, polystyrene, and in turn styrene, is seeing increasing production levels in the nation. Thus, the organic compound is being required more in the packaging sector of the United Kingdom.

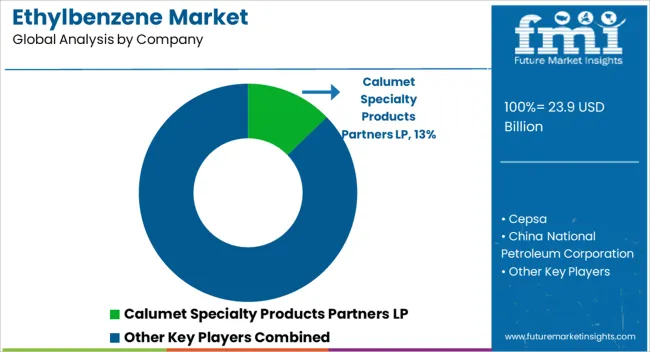

The industry is varied, with no companies establishing a monopoly over it. This fragmented nature of the market is helpful for new entrants and small-scale enterprises.

One of the prominent players in the sector, Cepsa Chemicals, is invested in expanding its existing production facilities. Another prominent company, Chevron Phillips Chemical Company focuses its energy on producing styrene. Meanwhile, Honeywell International Inc. strives to refine its compound to be as pure as possible.

Recent Developments in the Ethylbenzene Market

Key companies in the industry include Cepsa Chemicals, Deten Quimica S.A., Chevron Phillips Chemical Company, Honeywell International Inc., Huntsman International LLC., Reliance Industries Limited, Jingtung Petrochemical Corp., Ltd., SASOL, PT Unggul Indah Cahaya Tbk, Desmet Ballestra, Farabi Petrochemicals Co., S.B.K HOLDING, Indian Oil Corporation Ltd., Qatar Petroleum, JXTG Nippon Oil & Energy Corporation, and ISU Chemical.

Based on application, the ethylbenzene market can be segmented into the following segments: Gasoline, Diethylbenzene, Natural Gas, Paint, and Asphalt and Naphtha.

Based on the end-user industry, the ethylbenzene market can be segmented into the following segments: Packaging, Electronics, Construction, Automotive, Agriculture, and Others.

The sector has been analyzed with the following regions covered: North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East and Africa.

The global ethylbenzene market is estimated to be valued at USD 23.9 billion in 2025.

The market size for the ethylbenzene market is projected to reach USD 33.7 billion by 2035.

The ethylbenzene market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in ethylbenzene market are gasoline, diethylbenzene, natural gas, paint and asphalt and naphtha.

In terms of end user industry, construction segment to command 28.3% share in the ethylbenzene market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA