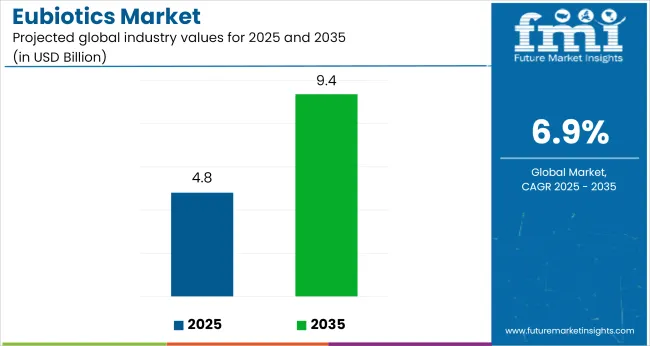

The global eubiotics market is projected to grow from USD 4.8 billion in 2025 to USD 9.4 billion by 2035, registering a CAGR of 6.9%. The market expansion is being driven by rising demand for natural feed additives, regulatory restrictions on antibiotic use, and increasing awareness of livestock health and productivity.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.8 billion |

| Industry Value (2035F) | USD 9.4 billion |

| CAGR (2025 to 2035) | 6.9% |

Growing adoption of eubiotics across poultry, swine, and ruminant sectors is supporting overall market growth, while innovation in spore-forming probiotics and encapsulation technologies is enhancing efficiency and uptake.

The market holds a 100% share in the animal feed additives market due to its core nature as feed additives. It commands around 21% in the feed additives market, highlighting its role in gut health and productivity. Its share in the broader animal nutrition market is about 4%, driven by its inclusion in nutrition programs. In the global feed market, eubiotics hold a modest 1.3% share. However, their share in the entire food and agriculture market remains below 0.02%, signifying a niche but critical segment for livestock productivity and safety.

Government regulations impacting the market focus on antibiotic bans, food safety, and animal welfare. The European Union’s ban on antibiotic growth promoters (AGPs), FDA Guidance for Industry #213 in the USA, and India’s FSSAI feed additive guidelines promote safer and natural alternatives in livestock production. Such regulations are fuelling demand for prebiotics, probiotics, and organic acids to maintain gut health, improve feed conversion ratios, and ensure safe and sustainable meat and dairy production.

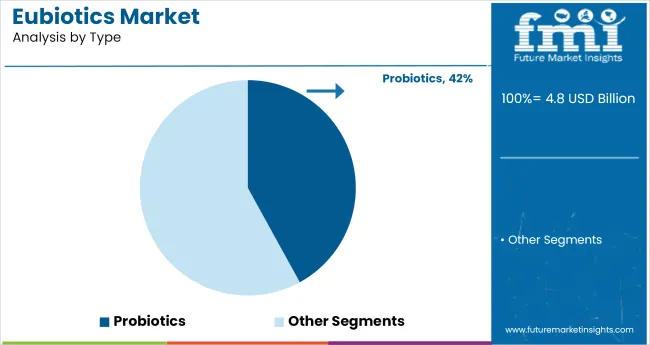

Germany is projected to be the fastest-growing market, expanding at a CAGR of 11.5% from 2025 to 2035. Probiotics will lead the type segment with a 42% share, while dry will dominate the form segment with a 68% share. The USA and France markets are also expected to grow steadily at CAGRs of 8.5% and 9.1%, respectively.

The eubiotics market is segmented by type, form, function, livestock, and region. By type, the market is divided into probiotics, prebiotics, organic acid, essential oil, and enzymes. In terms of form, the market is bifurcated into dry and liquid. Based on function, the market is segmented into nutrition & gut health, yield, and immunity.

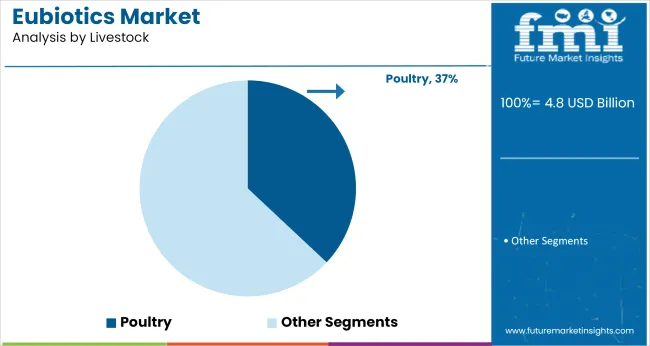

By livestock, the market is segmented into cattle, poultry, swine, aquaculture, and others (sheep, goat, equine, pet food). Regionally, the market is classified into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa.

Probiotics are projected to dominate the type segment, capturing 42% of the global eubiotics market share by 2035. Their widespread application in animal feed enhances gut health, immunity, and overall productivity, driven by rising demand for natural feed additives amid global antibiotic restrictions.

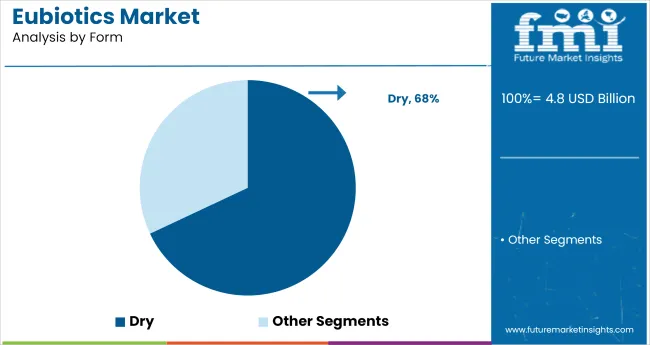

Dry is projected to hold the leading position in the form segment, capturing 68% of the market share by 2035. This dominance is due to their superior stability, extended shelf life, and ease of formulation integration in large-scale feed production systems globally.

The nutrition and gut health function segment is expected to dominate, capturing 35% of the global market share by 2035.

Poultry is projected to dominate the livestock segment, holding 37% of the market share by 2035.

The global eubiotics market is experiencing steady growth, driven by the increasing demand for natural feed additives and sustainable animal farming practices. Eubiotics play a crucial role in enhancing animal health, productivity, and compliance with antibiotic-free regulations.

Recent Trends in the Eubiotics Market

Challenges in the Eubiotics Market

Germany leads the eubiotics market with the highest CAGR at 11.5%, driven by strict EU antibiotic reduction mandates and sustainability policies. France follows with 9.1% CAGR, supported by strong regulatory backing for antibiotic-free meat. The USA market grows at 8.5% CAGR, underpinned by feed efficiency and productivity gains in livestock.

Japan records 7.2% CAGR, driven by precision livestock farming and encapsulated probiotics. The UK shows the slowest growth at 8.4% CAGR, limited by post-Brexit regulatory delays. Europe remains dominant, with Germany significantly exceeding the global average in eubiotics adoption and market expansion.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan eubiotics revenue is growing at a CAGR of 7.2% from 2025 to 2035. Growth is driven by antibiotic-free livestock policies and high-value meat exports to Asia. As a technology-driven OECD economy, Japan prioritizes feed additives enhancing gut health and feed conversion, integrated into precision livestock farming.

The sales of eubiotics in Germany are expected to expand at 11.5% CAGR during the forecast period, strongly exceeding the global average due to regulatory enforcement. EU antibiotic reduction targets, sustainability mandates, and integrated feed additive programs are pushing adoption. Key applications include poultry, swine, and dairy feed.

The French eubiotics market is projected to grow at a 9.1% CAGR during the forecast period, supported by regulatory backing and consumer preference for antibiotic-free meat. Demand is driven by national food safety programs, animal welfare regulations, and sustainability initiatives.

The USA eubiotics market is projected to grow at 8.5% CAGR from 2025 to 2035., USA demand is driven by productivity gains, feed efficiency, and animal welfare mandates in meat production.

The UK eubiotics revenue is projected to grow at a CAGR of 8.4% from 2025 to 2035. Growth is supported by livestock health regulations in poultry and swine sectors. Post-Brexit regulatory divergence has slowed new product registrations.

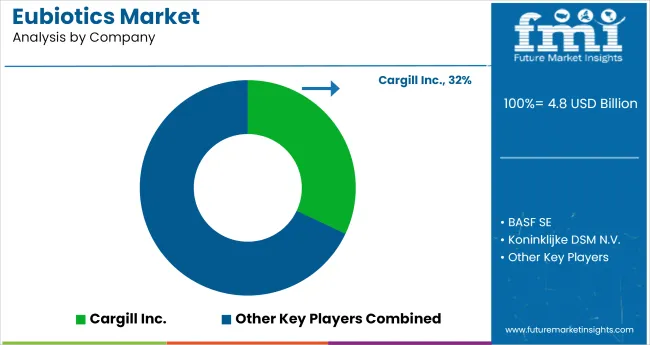

The market is moderately consolidated, with leading players like Cargill Inc., BASF SE, Koninklijke DSM N.V., Novozymes, and Beneo Group dominating the industry. These companies provide advanced, efficient eubiotic solutions catering to livestock sectors such as poultry, swine, cattle, and aquaculture.

Cargill Inc. focuses on integrated feed additive solutions and nutrition programs, while BASF SE specializes in high-purity organic acids and feed enzymes. Koninklijke DSM N.V. delivers innovative probiotic and prebiotic solutions enhancing animal health and productivity.

Novozymes offers enzyme-based eubiotics for improved feed conversion efficiency, and Beneo Group is known for its prebiotic fibre solutions promoting gut health. Other key players like Lesaffre Group, Kemin Industries, Inc., Novus International, Inc., and Chr. Hansen Holding A/S contribute by providing specialized, science-backed eubiotics for diverse livestock applications globally.

Recent Eubiotics Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 4.8 billion |

| Projected Market Size (2035) | USD 9.4 billion |

| CAGR (2025 to 2035) | 6.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/volume in units |

| Type Analyzed | Probiotics, Prebiotics, Organic Acid, Essential Oil, and Enzymes |

| Form Analyzed | Dry and Liquid |

| Function Analyzed | Nutrition and Gut Health, Yield, and Immunity |

| Livestock Analyzed | Cattle, Poultry, Swine, Aquaculture, and Others (Sheep, Goat, Equine, Pet Food) |

| Key Growth Region | North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | Cargill Inc., BASF SE, Koninklijke DSM N.V., Novozymes, Beneo Group, Lesaffre Group, Kemin Industries, Inc., Novus International, Inc., and Chr. Hansen Holding A/S |

| Additional Attributes | Dollar sales by equipment type, share by power, regional demand growth, policy influence, automation trends, competitive benchmarking |

Based on type, the sector is divided into probiotics, prebiotics, organic acid, essential oil, and enzymes.

The eubiotics market segmentation includes dry and liquid based on the form.

In terms of function, the industry is categorized into nutrition and gut health, yield, and immunity.

By livestock, the industry is segmented into cattle, poultry, swine, aquaculture, and others.

Analysis has been carried out in key countries of North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

The market is valued at USD 4.8 billion in 2025.

The market is forecasted to reach USD 9.4 billion by 2035, reflecting a CAGR of 7.0%.

Probiotics will lead the type segment, accounting for 42% of the global market share in 2035.

Dry form will dominate the form segment with a 68% market share in 2035.

Germany is projected to grow at the fastest rate, with a CAGR of 11.5% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA